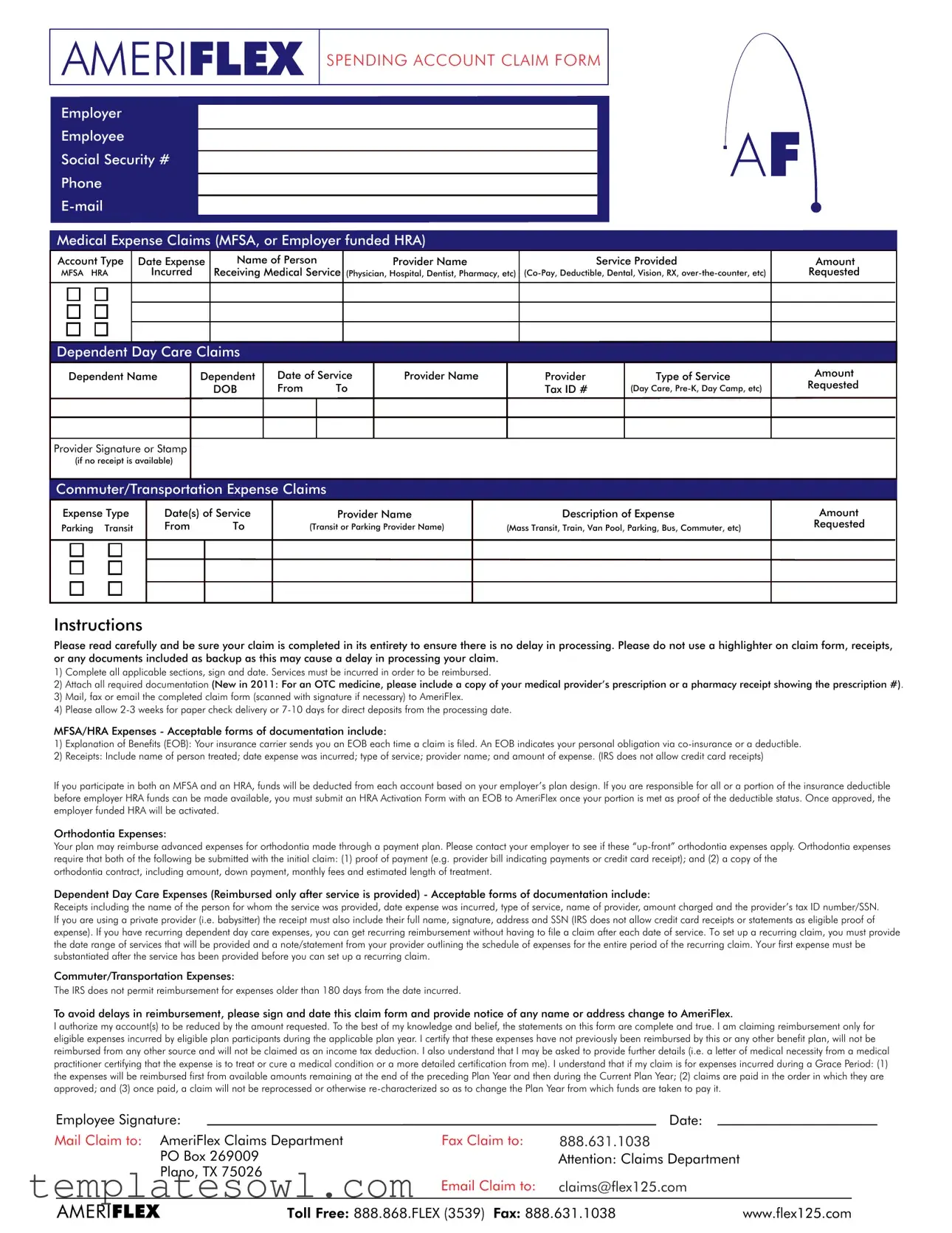

Fill Out Your Flex125 Claim Form

Efficiently navigating healthcare and dependent care expenses can be complex, but the Flex125 Claim Form simplifies this process for participants in healthcare flexible spending accounts (MFSA) and employer-funded health reimbursement arrangements (HRA). This form allows employees to file claims for various eligible medical and dependent care costs, ensuring they have access to the reimbursement they deserve. Required information includes personal details such as the employee's social security number and contact information, along with specifics about medical expenses, dependent childcare claims, and commuter costs. Each section of the form demands precise documentation, which may include receipts, provider information, and descriptions of services provided. Completing the form accurately is crucial to avoid delays in processing claims. With clear instructions and a straightforward submission process, participants can submit their claims via mail, fax, or email. Timely reimbursement hinges on attention to detail, as the IRS stipulates that claims for commuter expenses cannot be over 180 days old. Understanding these requirements allows employees to maximize their benefits while ensuring compliance with IRS regulations.

Flex125 Claim Example

AMERIFLEX

SPENDING ACCOUNT CLAIM FORM

Employer

Employee

Social Security #

Phone

Medical Expense Claims (MFSA, or Employer funded HRA)

Account Type

MFSA HRA

Date Expense

Incurred

Name of Person

Receiving Medical Service

Provider Name

(Physician, Hospital, Dentist, Pharmacy, etc)

Service Provided

Amount Requested

Dependent Day Care Claims

Dependent Name

Dependent

DOB

Date of Service

From To

Provider Name

Provider Tax ID #

Type of Service

(Day Care,

Amount Requested

Provider Signature or Stamp

(if no receipt is available)

Commuter/Transportation Expense Claims

Expense Type

Parking Transit

Date(s) of Service

From To

Provider Name

(Transit or Parking Provider Name)

Description of Expense

(Mass Transit, Train, Van Pool, Parking, Bus, Commuter, etc)

Amount Requested

Instructions

Please read carefully and be sure your claim is completed in its entirety to ensure there is no delay in processing. Please do not use a highlighter on claim form, receipts, or any documents included as backup as this may cause a delay in processing your claim.

1)Complete all applicable sections, sign and date. Services must be incurred in order to be reimbursed.

2)Attach all required documentation (New in 2011: For an OTC medicine, please include a copy of your medical provider’s prescription or a pharmacy receipt showing the prescription #).

3)Mail, fax or email the completed claim form (scanned with signature if necessary) to AmeriFlex.

4)Please allow

MFSA/HRA Expenses - Acceptable forms of documentation include:

1)Explanation of Benefits (EOB): Your insurance carrier sends you an EOB each time a claim is filed. An EOB indicates your personal obligation via

2)Receipts: Include name of person treated; date expense was incurred; type of service; provider name; and amount of expense. (IRS does not allow credit card receipts)

If you participate in both an MFSA and an HRA, funds will be deducted from each account based on your employer’s plan design. If you are responsible for all or a portion of the insurance deductible before employer HRA funds can be made available, you must submit an HRA Activation Form with an EOB to AmeriFlex once your portion is met as proof of the deductible status. Once approved, the employer funded HRA will be activated.

Orthodontia Expenses:

Your plan may reimburse advanced expenses for orthodontia made through a payment plan. Please contact your employer to see if these

orthodontia contract, including amount, down payment, monthly fees and estimated length of treatment.

Dependent Day Care Expenses (Reimbursed only after service is provided) - Acceptable forms of documentation include:

Receipts including the name of the person for whom the service was provided, date expense was incurred, type of service, name of provider, amount charged and the provider’s tax ID number/SSN. If you are using a private provider (i.e. babysitter) the receipt must also include their full name, signature, address and SSN (IRS does not allow credit card receipts or statements as eligible proof of expense). If you have recurring dependent day care expenses, you can get recurring reimbursement without having to file a claim after each date of service. To set up a recurring claim, you must provide the date range of services that will be provided and a note/statement from your provider outlining the schedule of expenses for the entire period of the recurring claim. Your first expense must be substantiated after the service has been provided before you can set up a recurring claim.

Commuter/Transportation Expenses:

The IRS does not permit reimbursement for expenses older than 180 days from the date incurred.

To avoid delays in reimbursement, please sign and date this claim form and provide notice of any name or address change to AmeriFlex.

I authorize my account(s) to be reduced by the amount requested. To the best of my knowledge and belief, the statements on this form are complete and true. I am claiming reimbursement only for eligible expenses incurred by eligible plan participants during the applicable plan year. I certify that these expenses have not previously been reimbursed by this or any other benefit plan, will not be reimbursed from any other source and will not be claimed as an income tax deduction. I also understand that I may be asked to provide further details (i.e. a letter of medical necessity from a medical practitioner certifying that the expense is to treat or cure a medical condition or a more detailed certification from me). I understand that if my claim is for expenses incurred during a Grace Period: (1) the expenses will be reimbursed first from available amounts remaining at the end of the preceding Plan Year and then during the Current Plan Year; (2) claims are paid in the order in which they are approved; and (3) once paid, a claim will not be reprocessed or otherwise

Employee Signature: |

|

Date: |

|

|

|

|

Mail Claim to: |

AmeriFlex Claims Department |

Fax Claim to: |

888.631.1038 |

|

|

|

|

PO Box 269009 |

|

Attention: Claims Department |

|

|

|

|

Plano, TX 75026 |

|

|

|

|

|

|

|

Email Claim to: |

claims@flex125.com |

|

|

|

|

|

|

|

|||

AMERIFLEX |

TOLL FREE: 888.868.FLEX (3539) FAX: 888.631.1038 |

www.flex125.com |

||||

Form Characteristics

| Fact Name | Description |

|---|---|

| Claim Types | The Flex125 Claim Form allows for reimbursement of Medical Expenses, Dependent Day Care expenses, and Commuter/Transportation expenses. |

| Documentation Requirements | Each claim must be accompanied by proper documentation. This includes receipts or Explanation of Benefits (EOB) for medical expenses and detailed service information for dependent care. |

| Submission Methods | Claims can be submitted via mail, fax, or email. When emailing, scanned signatures may be required to ensure authenticity. |

| Reimbursement Timelines | After submitting a claim, allow 2-3 weeks for paper checks and 7-10 days for direct deposits. |

| IRS Compliance | Reimbursements for commuter expenses are not allowed for claims older than 180 days. This is in accordance with IRS regulations. |

| Grace Period Rules | For claims incurred during a Grace Period, funds will first be drawn from the previous Plan Year. Each claim is processed in the order it is approved. |

Guidelines on Utilizing Flex125 Claim

Completing the Flex125 Claim form is a straightforward process that ensures timely reimbursement for eligible expenses. Following the steps carefully will help facilitate processing, minimizing delays. Once filled out, you will need to submit the claim form along with any necessary documentation to AmeriFlex. Keep in mind the importance of taking your time to ensure accuracy in your submission.

- Fill out the personal information section, including your employer details, name, Social Security number, phone number, and email address.

- Indicate the type of account you are claiming from, selecting either MFSA or HRA, and provide the date the expense was incurred.

- If applicable, enter the name of the person receiving the medical service and the name of the service provider. Specify the service provided and enter the amount you are claiming.

- For Dependent Day Care claims, enter the dependent’s name and date of birth, along with the service dates and provider information, including the provider's tax ID number. Specify the type of service and the amount requested.

- If there are no receipts available, obtain and attach a signature or stamp from the provider to validate the claim.

- For Commuter/Transportation claims, specify the expense type (e.g., parking or transit), the date range of service, and the provider name. Describe the nature of the expense and enter the amount being claimed.

- Sign and date the form to certify that all information is complete and accurate, acknowledging that you are claiming reimbursement only for eligible expenses incurred.

- Attach all required documentation. This may include receipts, EOB forms, or additional documentation, depending on the type of expenses claimed.

- Submit the completed claim form by mailing, faxing, or emailing it to AmeriFlex. Ensure that documents are scanned clearly if being emailed.

After submitting the claim form, allow for 2-3 weeks for paper checks or 7-10 days for direct deposits to process. Patience is encouraged during this time, and you may reach out to AmeriFlex for any inquiries regarding your claim status.

What You Should Know About This Form

What is the Flex125 Claim form?

The Flex125 Claim form is a document used by employees to request reimbursement for eligible expenses incurred under the AmeriFlex Spending Account program. This program includes Medical Flexible Spending Accounts (MFSA), Health Reimbursement Arrangements (HRA), and other benefits associated with dependent day care and commuter expenses. Completing the form accurately is essential for timely reimbursement.

How do I complete the Flex125 Claim form?

To complete the Flex125 Claim form, first make sure you fill out all applicable sections. You'll need to include your personal information, details about the medical services or expenses incurred, and any relevant provider information. Additionally, gather and attach all required documentation, such as receipts or Explanation of Benefits (EOB). Ensure you sign and date the form before submitting it.

What types of expenses can I claim with this form?

You can claim various types of expenses, including qualified medical expenses (like co-pays and deductibles), dependent day care costs, and transportation-related expenses. It's important that these expenses have been incurred during the applicable plan year and comply with IRS guidelines.

What documentation do I need to attach to the claim form?

Documentation required depends on the type of claim. For medical expenses, you need EOBs, receipts detailing service provider information, and the costs incurred. For dependent day care claims, receipts must contain the provider's tax identification number or Social Security number, as well as the necessary details of the service provided. Commuter claims require receipts showing the expense type and provider information.

How long will it take to process my claim?

Once your completed claim form is received, it typically takes 2-3 weeks for paper checks to be delivered and around 7-10 days for direct deposits to process. To speed up this process, ensure that your claim is filled out completely and accurately, along with all necessary supporting documents.

Can I submit a claim for expenses incurred before my coverage started?

No, you cannot submit claims for expenses incurred before the effective date of your coverage or plan year. Make sure to only request reimbursement for expenses that were incurred during the coverage period in which you are enrolled.

What if I have recurring dependent day care expenses?

If you have consistent dependent day care costs, you can set up a recurring reimbursement. To do this, you must show the provider’s statement outlining the schedule of expenses for the entire period and submit proof of your first incurred expense after the service has been provided.

What should I do if I have a name or address change?

Notify AmeriFlex immediately if you have a name or address change. Update your information on the claim form to prevent delays in processing your claims and receiving reimbursements.

How do I submit my completed claim form?

You can submit your completed Flex125 Claim form in several ways: mail it to the AmeriFlex Claims Department, send it via fax to 888.631.1038, or email a scanned copy with your signature to claims@flex125.com. Choose the method that is most convenient for you.

What happens if my claim is incomplete?

If your claim form is incomplete, it may cause delays in processing. AmeriFlex may return it for you to complete the missing sections or provide additional documentation. To avoid this, take the time to complete the form fully and double-check all attached documents before submission.

Common mistakes

When completing the Flex125 Claim form, many individuals encounter challenges that can lead to delays or denials of their claims. One common mistake is failing to fill out all applicable sections. Each section serves a specific purpose, and incomplete information can create confusion and hinder the processing of your claim.

Another frequent error involves neglecting to attach necessary documentation. It's essential to include all required receipts and proofs of payment. For over-the-counter medicines, ensure you provide a prescription or pharmacy receipt. Missing documents can lead to significant delays in reimbursement.

Many people also overlook the details when providing expense information. For instance, the description of the medical services rendered must be clear and precise, including the type of service, provider name, and incurred date. If any of these details are missing or unclear, the claim may be rejected.

A mistake that often goes unnoticed is the use of highlighters on the form or attached documents. Highlighted information can cause issues during the processing of claims. Instead, it is better to use legible handwriting or print clearly to ensure all details are visible to review personnel.

Submitting the claim more than 180 days after the incurred expense can also lead to disqualification. This strict timeline is stipulated by the IRS, and attention to dates is crucial to prevent forfeiting your eligible expenses.

Many claimants fail to read the instructions thoroughly before submitting their claims. Ignoring the specific instructions can result in improperly completed forms, leading to inefficient processing. Each section and piece of documentation is designed to streamline the approval process.

The signature on the form is another critical area that can cause problems. Some individuals forget to sign and date the claim form, which is a necessary step to validate the request. Without a signature, claims will not proceed further.

Individuals also sometimes mix up the types of accounts by not indicating whether the claim is related to MFSA or HRA on the form. This small oversight can significantly delay understanding which funds should be accessed for reimbursement.

Another commonly made mistake is submitting claims for expenses that have already been reimbursed. It is crucial to track your expenses and reimbursement history accurately to avoid filing duplicate claims inadvertently.

Finally, many people do not notice the requirement for recurring claims must be substantiated with an initial claim after the service has been provided. Setting up a recurring claim without this proof can lead to complications and unnecessary delays. By addressing these common mistakes, individuals can ensure their claims are processed efficiently, leading to timely reimbursements.

Documents used along the form

The Flex125 Claim Form is an essential document used for requesting reimbursement for various qualified expenses, including medical services, dependent care, and transportation costs. When submitting this claim form, it’s often necessary to include other supporting documents to ensure timely and correct processing. Here is a list of forms and documents that are frequently used alongside the Flex125 Claim Form:

- Explanation of Benefits (EOB): This document is sent by your insurance provider each time a claim is made. It outlines the services provided, any amounts covered by your insurance, and your financial responsibility, such as deductibles or coinsurance.

- Receipts: To support your claim, you need to provide receipts that detail your medical expenses. These should include the date of service, the service provider's name, the type of service provided, and the amount charged. Remember, credit card receipts are not acceptable.

- HRA Activation Form: If you have reached your insurance deductible and are eligible for employer-funded Health Reimbursement Arrangements (HRA), this form must be submitted along with an EOB as proof to activate those employer funds.

- Dependent Care Provider Statement: For dependent day care claims, this statement should outline the schedule of services provided, including the start and end dates. It should also be accompanied by documentation that verifies the service provider’s identity, such as their tax ID or social security number.

Including these documents with your Flex125 Claim Form helps ensure a smoother processing experience. Keeping everything organized allows claims to be reviewed quickly and efficiently, which means you'll receive your reimbursements in a timely manner.

Similar forms

The Flex125 Claim form shares similarities with several other important documents in the realm of healthcare and expense reimbursement. Understanding these documents can aid in effective claims processing and management. Below are five documents that are quite similar to the Flex125 Claim form:

- Health Reimbursement Account (HRA) Claim Form: Like the Flex125 Claim form, the HRA Claim Form is utilized for requesting reimbursements for qualified medical expenses. Both documents require detailed information about the incurred expenses, service providers, and necessary supporting documentation.

- Flexible Spending Account (FSA) Claim Form: The FSA Claim Form is another tool for employees to submit claims for medical expenses. Similar to the Flex125 Claim form, it necessitates proof of the expenses, including the type of service and the provider's information.

- Dependent Care Expense Claim Form: Designed for claiming reimbursement for dependent care expenses, this form closely mirrors the Flex125 Claim form in its structure and requirements. Both documents collect similar data regarding the service provider, the care recipient, and the amount claimed.

- Commuter Benefits Claim Form: This document facilitates claims for transportation expenses associated with commuting. Like the Flex125 Claim form, it requires detailed descriptions of the incurred transportation expenses and the relevant dates, ensuring clarity for reimbursement purposes.

- Explanation of Benefits (EOB): While not a claim submission form itself, an EOB serves as a critical supporting document for both the Flex125 Claim form and related claim forms. An EOB outlines the services provided, reimbursable amounts, and applicable deductibles, helping substantiate claims made by employees.

Dos and Don'ts

When filling out the Flex125 Claim form, follow these guidelines to ensure smooth processing:

- Read the instructions carefully. Make sure you understand each requirement before starting.

- Complete all applicable sections. Missing information can delay your claim.

- Attach required documentation. Include all necessary receipts or proof of payment.

- Sign and date your form. Unsigned forms may be returned for correction.

- Submit your claim promptly. File claims within 180 days from the date that expenses were incurred.

- Do not use a highlighter on any part of the form or supporting documents.

- Do not assume your claim will be processed without providing complete documentation.

Misconceptions

Below are several misconceptions about the Flex125 Claim form that often lead to confusion:

- Only medical expenses are eligible for reimbursement. Many people think this is the case, but the form also covers dependent day care and commuter transportation expenses.

- Highlighters can be used on the form. In reality, using highlighters can cause delays in processing. It is best to avoid highlighting any part of the claim form.

- Claims can be submitted without proper documentation. This is incorrect. All claims must include the necessary receipts or proof of service to ensure they are processed smoothly.

- Claims can be submitted for expenses incurred any time. In fact, for commuter expenses, the IRS only allows claims for expenses incurred within the last 180 days.

- It's okay to submit credit card receipts as proof of expense. Unfortunately, the IRS does not accept these types of receipts as eligible documentation for reimbursement.

- The form can be signed later. The signature is crucial and must be included at the time of submission to validate the claim.

- Recurring payment claims can be filed without initial proof. To set up recurring reimbursement, the first expense must be documented and substantiated after the service has been provided.

Key takeaways

This guide highlights some essential points for successfully filling out and using the Flex125 Claim form.

- Complete All Sections: Fill out each part of the claim form. An incomplete form can cause delays in processing.

- Required Documentation: Always attach the necessary receipts or documents. For over-the-counter medications, a prescription or pharmacy receipt with the prescription number is now required.

- Multiple Filing Methods: You can submit your completed claim via mail, fax, or email. Ensure it's signed if you're emailing the form.

- Processing Times: Expect a 2-3 week wait for paper checks and 7-10 days for direct deposits after the processing date.

- Documentation for Expenses: Acceptable documents for medical expenses include Explanation of Benefits from your insurance or detailed receipts. Avoid using credit card receipts as proof.

- Recurring Claims: If you have ongoing dependent day care expenses, set up a recurring reimbursement claim with specific information including the schedule of services.

- Orthodontia Costs: For orthodontia treatment, submit proof of payment and the orthodontia contract with your initial claim for reimbursement consideration.

Browse Other Templates

Aa 600 - All drivers involved in accidents must submit this report.

Employee Loan Agreement - Expenses must reflect fair pricing in line with Church policies.