Fill Out Your Florida Child Support Calculator Form

The Florida Child Support Calculator form, known formally as the Child Support Guidelines Worksheet, is a crucial tool for parents navigating the complexities of family law and child support arrangements. This form must be completed whenever child support is requested, ensuring that the financial contributions of both parents are adequately documented and considered. By using this worksheet, parents can provide the necessary information about their incomes, which is then used to calculate a guideline amount for support based on various factors. The worksheet provides detailed instructions on when and how to use the form, emphasizing the importance of accuracy when disclosing financial data. It also outlines necessary steps such as filing the worksheet with the clerk of court and serving it to the other party. Additionally, the form includes a comprehensive chart that adjusts support amounts according to the combined income of the parents and the number of children involved. This structured approach not only promotes transparency but also helps to ensure that both parties adhere to the same standard when discussing financial obligations. Those considering a deviation from the calculated amount can find further guidance in the attached motion to deviate from guidelines. Understanding the nuances of this form can be instrumental in reaching a fair and reasonable child support arrangement, ultimately promoting the well-being of the children involved.

Florida Child Support Calculator Example

INSTRUCTIONS FOR FLORIDA FAMILY LAW RULES OF PROCEDURE FORM

12.902(e), CHILD SUPPORT GUIDELINES WORKSHEET (09/12)

When should this form be used?

You should complete this worksheet if child support is being requested in your case. If you know the

income of the other party, this worksheet should accompany your financial affidavit. If you do not k o the other party’s income, this form must be completed after the other party files his or her

financial affidavit, and serves a copy on you.

This form should be typed or printed in black ink. You should file the original with the clerk of the circuit court in the county where your case is filed and keep a copy for your records.

What should I do next?

A copy of this form must be served on the other party in your case. Service must be in accordance with Florida Rule of Judicial Administration 2.516.

Where can I look for more information?

Before proceedi g, you should read Ge eral I for atio for

Special notes...

If you want to keep your address confidential because you are the victim of sexual battery, aggravated child abuse, aggravated stalking, harassment, aggravated battery or domestic violence, do not enter the address, telephone, and fax information at the bottom of this form. Instead, file Request for Confidential Filing of Address, Florida Supreme Court Approved Family Law Form 12.980(h).

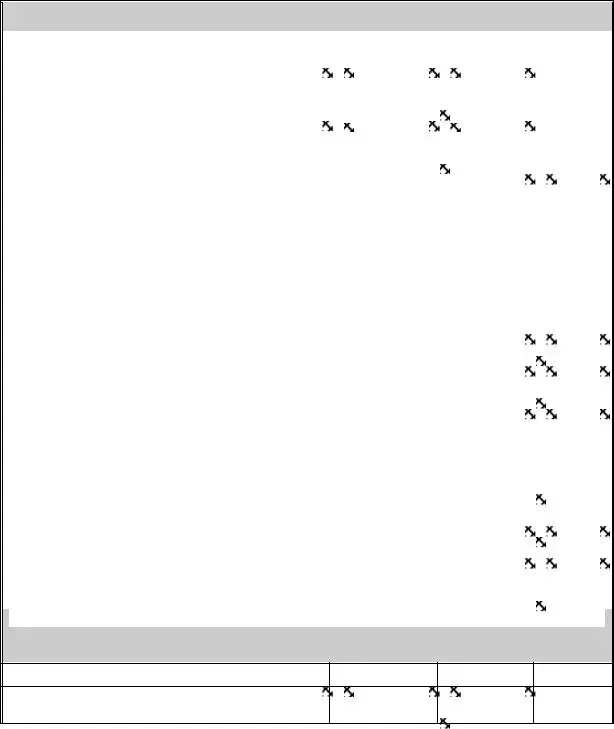

The chart below contains the guideline amounts that you should use when calculating child support. This amount is based on the number of children and the combined income of the parents, and it is divided between the parents in direct proportion to their income or earning capacity. From time to time, some of the amounts in the child support guidelines chart will change. Be sure you have the most recent version of the chart before using it.

Because the guidelines are based on monthly amounts, it may be necessary to convert some income and expense figures from other frequencies to monthly. You should do this as follows:

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

If payment is twice per month |

Payment amount |

x |

2 |

= |

Monthly amount |

If payment is every two weeks |

Payment amount |

x |

26 |

= |

Yearly amount due |

|

Yearly amount |

÷ |

12 |

= |

Monthly amount |

If payment is weekly |

Weekly amount |

x |

52 |

= |

Yearly amount due |

|

Yearly amount |

÷ |

12 |

= |

Monthly amount |

If you or the other parent request that the court award an amount that is different than the guideline amount, you must also complete and attach a Motion to Deviate from Child Support Guidelines, Florida Supreme Court Approved Family Law Form 12.943.

Remember, a person who is NOT an attorney is called a nonlawyer. If a nonlawyer helps you fill out these forms, that person must give you a copy of a Disclosure from Nonlawyer, Florida Family Law Rules of Procedure Form 12.900(a), before he or she helps you. A nonlawyer helping you fill out these forms also must put his or her name, address, and telephone number on the bottom of the last page of every form he or she helps you complete.

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

CHILD SUPPORT GUIDELINES CHART

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

800.00 |

190 |

211 |

213 |

216 |

218 |

220 |

|

850.00 |

202 |

257 |

259 |

262 |

265 |

268 |

|

900.00 |

213 |

302 |

305 |

309 |

312 |

315 |

|

950.00 |

224 |

347 |

351 |

355 |

359 |

363 |

|

1000.00 |

235 |

365 |

397 |

402 |

406 |

410 |

|

1050.00 |

246 |

382 |

443 |

448 |

453 |

458 |

|

1100.00 |

258 |

400 |

489 |

495 |

500 |

505 |

|

1150.00 |

269 |

417 |

522 |

541 |

547 |

553 |

|

1200.00 |

280 |

435 |

544 |

588 |

594 |

600 |

|

1250.00 |

290 |

451 |

565 |

634 |

641 |

648 |

|

1300.00 |

300 |

467 |

584 |

659 |

688 |

695 |

|

1350.00 |

310 |

482 |

603 |

681 |

735 |

743 |

|

1400.00 |

320 |

498 |

623 |

702 |

765 |

790 |

|

1450.00 |

330 |

513 |

642 |

724 |

789 |

838 |

|

1500.00 |

340 |

529 |

662 |

746 |

813 |

869 |

|

1550.00 |

350 |

544 |

681 |

768 |

836 |

895 |

|

1600.00 |

360 |

560 |

701 |

790 |

860 |

920 |

|

1650.00 |

370 |

575 |

720 |

812 |

884 |

945 |

|

1700.00 |

380 |

591 |

740 |

833 |

907 |

971 |

|

1750.00 |

390 |

606 |

759 |

855 |

931 |

996 |

|

1800.00 |

400 |

622 |

779 |

877 |

955 |

1022 |

|

1850.00 |

410 |

638 |

798 |

900 |

979 |

1048 |

|

1900.00 |

421 |

654 |

818 |

923 |

1004 |

1074 |

|

1950.00 |

431 |

670 |

839 |

946 |

1029 |

1101 |

|

2000.00 |

442 |

686 |

859 |

968 |

1054 |

1128 |

|

2050.00 |

452 |

702 |

879 |

991 |

1079 |

1154 |

|

2100.00 |

463 |

718 |

899 |

1014 |

1104 |

1181 |

|

2150.00 |

473 |

734 |

919 |

1037 |

1129 |

1207 |

|

2200.00 |

484 |

751 |

940 |

1060 |

1154 |

1234 |

|

2250.00 |

494 |

767 |

960 |

1082 |

1179 |

1261 |

|

2300.00 |

505 |

783 |

980 |

1105 |

1204 |

1287 |

|

2350.00 |

515 |

799 |

1000 |

1128 |

1229 |

1314 |

|

2400.00 |

526 |

815 |

1020 |

1151 |

1254 |

1340 |

|

2450.00 |

536 |

831 |

1041 |

1174 |

1279 |

1367 |

|

2500.00 |

547 |

847 |

1061 |

1196 |

1304 |

1394 |

|

2550.00 |

557 |

864 |

1081 |

1219 |

1329 |

1420 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

2600.00 |

568 |

880 |

1101 |

1242 |

1354 |

1447 |

|

2650.00 |

578 |

896 |

1121 |

1265 |

1379 |

1473 |

|

2700.00 |

588 |

912 |

1141 |

1287 |

1403 |

1500 |

|

2750.00 |

597 |

927 |

1160 |

1308 |

1426 |

1524 |

|

2800.00 |

607 |

941 |

1178 |

1328 |

1448 |

1549 |

|

2850.00 |

616 |

956 |

1197 |

1349 |

1471 |

1573 |

|

2900.00 |

626 |

971 |

1215 |

1370 |

1494 |

1598 |

|

2950.00 |

635 |

986 |

1234 |

1391 |

1517 |

1622 |

|

3000.00 |

644 |

1001 |

1252 |

1412 |

1540 |

1647 |

|

3050.00 |

654 |

1016 |

1271 |

1433 |

1563 |

1671 |

|

3100.00 |

663 |

1031 |

1289 |

1453 |

1586 |

1695 |

|

3150.00 |

673 |

1045 |

1308 |

1474 |

1608 |

1720 |

|

3200.00 |

682 |

1060 |

1327 |

1495 |

1631 |

1744 |

|

3250.00 |

691 |

1075 |

1345 |

1516 |

1654 |

1769 |

|

3300.00 |

701 |

1090 |

1364 |

1537 |

1677 |

1793 |

|

3350.00 |

710 |

1105 |

1382 |

1558 |

1700 |

1818 |

|

3400.00 |

720 |

1120 |

1401 |

1579 |

1723 |

1842 |

|

3450.00 |

729 |

1135 |

1419 |

1599 |

1745 |

1867 |

|

3500.00 |

738 |

1149 |

1438 |

1620 |

1768 |

1891 |

|

3550.00 |

748 |

1164 |

1456 |

1641 |

1791 |

1915 |

|

3600.00 |

757 |

1179 |

1475 |

1662 |

1814 |

1940 |

|

3650.00 |

767 |

1194 |

1493 |

1683 |

1837 |

1964 |

|

3700.00 |

776 |

1208 |

1503 |

1702 |

1857 |

1987 |

|

3750.00 |

784 |

1221 |

1520 |

1721 |

1878 |

2009 |

|

3800.00 |

793 |

1234 |

1536 |

1740 |

1899 |

2031 |

|

3850.00 |

802 |

1248 |

1553 |

1759 |

1920 |

2053 |

|

3900.00 |

811 |

1261 |

1570 |

1778 |

1940 |

2075 |

|

3950.00 |

819 |

1275 |

1587 |

1797 |

1961 |

2097 |

|

4000.00 |

828 |

1288 |

1603 |

1816 |

1982 |

2119 |

|

4050.00 |

837 |

1302 |

1620 |

1835 |

2002 |

2141 |

|

4100.00 |

846 |

1315 |

1637 |

1854 |

2023 |

2163 |

|

4150.00 |

854 |

1329 |

1654 |

1873 |

2044 |

2185 |

|

4200.00 |

863 |

1342 |

1670 |

1892 |

2064 |

2207 |

|

4250.00 |

872 |

1355 |

1687 |

1911 |

2085 |

2229 |

|

4300.00 |

881 |

1369 |

1704 |

1930 |

2106 |

2251 |

|

4350.00 |

889 |

1382 |

1721 |

1949 |

2127 |

2273 |

|

4400.00 |

898 |

1396 |

1737 |

1968 |

2147 |

2295 |

|

4450.00 |

907 |

1409 |

1754 |

1987 |

2168 |

2317 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

4500.00 |

916 |

1423 |

1771 |

2006 |

2189 |

2339 |

|

4550.00 |

924 |

1436 |

1788 |

2024 |

2209 |

2361 |

|

4600.00 |

933 |

1450 |

1804 |

2043 |

2230 |

2384 |

|

4650.00 |

942 |

1463 |

1821 |

2062 |

2251 |

2406 |

|

4700.00 |

951 |

1477 |

1838 |

2081 |

2271 |

2428 |

|

4750.00 |

959 |

1490 |

1855 |

2100 |

2292 |

2450 |

|

4800.00 |

968 |

1503 |

1871 |

2119 |

2313 |

2472 |

|

4850.00 |

977 |

1517 |

1888 |

2138 |

2334 |

2494 |

|

4900.00 |

986 |

1530 |

1905 |

2157 |

2354 |

2516 |

|

4950.00 |

993 |

1542 |

1927 |

2174 |

2372 |

2535 |

|

5000.00 |

1000 |

1551 |

1939 |

2188 |

2387 |

2551 |

|

5050.00 |

1006 |

1561 |

1952 |

2202 |

2402 |

2567 |

|

5100.00 |

1013 |

1571 |

1964 |

2215 |

2417 |

2583 |

|

5150.00 |

1019 |

1580 |

1976 |

2229 |

2432 |

2599 |

|

5200.00 |

1025 |

1590 |

1988 |

2243 |

2447 |

2615 |

|

5250.00 |

1032 |

1599 |

2000 |

2256 |

2462 |

2631 |

|

5300.00 |

1038 |

1609 |

2012 |

2270 |

2477 |

2647 |

|

5350.00 |

1045 |

1619 |

2024 |

2283 |

2492 |

2663 |

|

5400.00 |

1051 |

1628 |

2037 |

2297 |

2507 |

2679 |

|

5450.00 |

1057 |

1638 |

2049 |

2311 |

2522 |

2695 |

|

5500.00 |

1064 |

1647 |

2061 |

2324 |

2537 |

2711 |

|

5550.00 |

1070 |

1657 |

2073 |

2338 |

2552 |

2727 |

|

5600.00 |

1077 |

1667 |

2085 |

2352 |

2567 |

2743 |

|

5650.00 |

1083 |

1676 |

2097 |

2365 |

2582 |

2759 |

|

5700.00 |

1089 |

1686 |

2109 |

2379 |

2597 |

2775 |

|

5750.00 |

1096 |

1695 |

2122 |

2393 |

2612 |

2791 |

|

5800.00 |

1102 |

1705 |

2134 |

2406 |

2627 |

2807 |

|

5850.00 |

1107 |

1713 |

2144 |

2418 |

2639 |

2820 |

|

5900.00 |

1111 |

1721 |

2155 |

2429 |

2651 |

2833 |

|

5950.00 |

1116 |

1729 |

2165 |

2440 |

2663 |

2847 |

|

6000.00 |

1121 |

1737 |

2175 |

2451 |

2676 |

2860 |

|

6050.00 |

1126 |

1746 |

2185 |

2462 |

2688 |

2874 |

|

6100.00 |

1131 |

1754 |

2196 |

2473 |

2700 |

2887 |

|

6150.00 |

1136 |

1762 |

2206 |

2484 |

2712 |

2900 |

|

6200.00 |

1141 |

1770 |

2216 |

2495 |

2724 |

2914 |

|

6250.00 |

1145 |

1778 |

2227 |

2506 |

2737 |

2927 |

|

6300.00 |

1150 |

1786 |

2237 |

2517 |

2749 |

2941 |

|

6350.00 |

1155 |

1795 |

2247 |

2529 |

2761 |

2954 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

6400.00 |

1160 |

1803 |

2258 |

2540 |

2773 |

2967 |

|

6450.00 |

1165 |

1811 |

2268 |

2551 |

2785 |

2981 |

|

6500.00 |

1170 |

1819 |

2278 |

2562 |

2798 |

2994 |

|

6550.00 |

1175 |

1827 |

2288 |

2573 |

2810 |

3008 |

|

6600.00 |

1179 |

1835 |

2299 |

2584 |

2822 |

3021 |

|

6650.00 |

1184 |

1843 |

2309 |

2595 |

2834 |

3034 |

|

6700.00 |

1189 |

1850 |

2317 |

2604 |

2845 |

3045 |

|

6750.00 |

1193 |

1856 |

2325 |

2613 |

2854 |

3055 |

|

6800.00 |

1196 |

1862 |

2332 |

2621 |

2863 |

3064 |

|

6850.00 |

1200 |

1868 |

2340 |

2630 |

2872 |

3074 |

|

6900.00 |

1204 |

1873 |

2347 |

2639 |

2882 |

3084 |

|

6950.00 |

1208 |

1879 |

2355 |

2647 |

2891 |

3094 |

|

7000.00 |

1212 |

1885 |

2362 |

2656 |

2900 |

3103 |

|

7050.00 |

1216 |

1891 |

2370 |

2664 |

2909 |

3113 |

|

7100.00 |

1220 |

1897 |

2378 |

2673 |

2919 |

3123 |

|

7150.00 |

1224 |

1903 |

2385 |

2681 |

2928 |

3133 |

|

7200.00 |

1228 |

1909 |

2393 |

2690 |

2937 |

3142 |

|

7250.00 |

1232 |

1915 |

2400 |

2698 |

2946 |

3152 |

|

7300.00 |

1235 |

1921 |

2408 |

2707 |

2956 |

3162 |

|

7350.00 |

1239 |

1927 |

2415 |

2716 |

2965 |

3172 |

|

7400.00 |

1243 |

1933 |

2423 |

2724 |

2974 |

3181 |

|

7450.00 |

1247 |

1939 |

2430 |

2733 |

2983 |

3191 |

|

7500.00 |

1251 |

1945 |

2438 |

2741 |

2993 |

3201 |

|

7550.00 |

1255 |

1951 |

2446 |

2750 |

3002 |

3211 |

|

7600.00 |

1259 |

1957 |

2453 |

2758 |

3011 |

3220 |

|

7650.00 |

1263 |

1963 |

2461 |

2767 |

3020 |

3230 |

|

7700.00 |

1267 |

1969 |

2468 |

2775 |

3030 |

3240 |

|

7750.00 |

1271 |

1975 |

2476 |

2784 |

3039 |

3250 |

|

7800.00 |

1274 |

1981 |

2483 |

2792 |

3048 |

3259 |

|

7850.00 |

1278 |

1987 |

2491 |

2801 |

3057 |

3269 |

|

7900.00 |

1282 |

1992 |

2498 |

2810 |

3067 |

3279 |

|

7950.00 |

1286 |

1998 |

2506 |

2818 |

3076 |

3289 |

|

8000.00 |

1290 |

2004 |

2513 |

2827 |

3085 |

3298 |

|

8050.00 |

1294 |

2010 |

2521 |

2835 |

3094 |

3308 |

|

8100.00 |

1298 |

2016 |

2529 |

2844 |

3104 |

3318 |

|

8150.00 |

1302 |

2022 |

2536 |

2852 |

3113 |

3328 |

|

8200.00 |

1306 |

2028 |

2544 |

2861 |

3122 |

3337 |

|

8250.00 |

1310 |

2034 |

2551 |

2869 |

3131 |

3347 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Combined |

One |

Two |

Three |

Four |

Five |

Six |

|

Monthly |

Child |

Children |

Children |

Children |

Children |

Children |

|

Available |

|||||||

|

|

|

|

|

|

||

Income |

|

|

|

|

|

|

|

8300.00 |

1313 |

2040 |

2559 |

2878 |

3141 |

3357 |

|

8350.00 |

1317 |

2046 |

2566 |

2887 |

3150 |

3367 |

|

8400.00 |

1321 |

2052 |

2574 |

2895 |

3159 |

3376 |

|

8450.00 |

1325 |

2058 |

2581 |

2904 |

3168 |

3386 |

|

8500.00 |

1329 |

2064 |

2589 |

2912 |

3178 |

3396 |

|

8550.00 |

1333 |

2070 |

2597 |

2921 |

3187 |

3406 |

|

8600.00 |

1337 |

2076 |

2604 |

2929 |

3196 |

3415 |

|

8650.00 |

1341 |

2082 |

2612 |

2938 |

3205 |

3425 |

|

8700.00 |

1345 |

2088 |

2619 |

2946 |

3215 |

3435 |

|

8750.00 |

1349 |

2094 |

2627 |

2955 |

3224 |

3445 |

|

8800.00 |

1352 |

2100 |

2634 |

2963 |

3233 |

3454 |

|

8850.00 |

1356 |

2106 |

2642 |

2972 |

3242 |

3464 |

|

8900.00 |

1360 |

2111 |

2649 |

2981 |

3252 |

3474 |

|

8950.00 |

1364 |

2117 |

2657 |

2989 |

3261 |

3484 |

|

9000.00 |

1368 |

2123 |

2664 |

2998 |

3270 |

3493 |

|

9050.00 |

1372 |

2129 |

2672 |

3006 |

3279 |

3503 |

|

9100.00 |

1376 |

2135 |

2680 |

3015 |

3289 |

3513 |

|

9150.00 |

1380 |

2141 |

2687 |

3023 |

3298 |

3523 |

|

9200.00 |

1384 |

2147 |

2695 |

3032 |

3307 |

3532 |

|

9250.00 |

1388 |

2153 |

2702 |

3040 |

3316 |

3542 |

|

9300.00 |

1391 |

2159 |

2710 |

3049 |

3326 |

3552 |

|

9350.00 |

1395 |

2165 |

2717 |

3058 |

3335 |

3562 |

|

9400.00 |

1399 |

2171 |

2725 |

3066 |

3344 |

3571 |

|

9450.00 |

1403 |

2177 |

2732 |

3075 |

3353 |

3581 |

|

9500.00 |

1407 |

2183 |

2740 |

3083 |

3363 |

3591 |

|

9550.00 |

1411 |

2189 |

2748 |

3092 |

3372 |

3601 |

|

9600.00 |

1415 |

2195 |

2755 |

3100 |

3381 |

3610 |

|

9650.00 |

1419 |

2201 |

2763 |

3109 |

3390 |

3620 |

|

9700.00 |

1422 |

2206 |

2767 |

3115 |

3396 |

3628 |

|

9750.00 |

1425 |

2210 |

2772 |

3121 |

3402 |

3634 |

|

9800.00 |

1427 |

2213 |

2776 |

3126 |

3408 |

3641 |

|

9850.00 |

1430 |

2217 |

2781 |

3132 |

3414 |

3647 |

|

9900.00 |

1432 |

2221 |

2786 |

3137 |

3420 |

3653 |

|

9950.00 |

1435 |

2225 |

2791 |

3143 |

3426 |

3659 |

|

10000.00 |

1437 |

2228 |

2795 |

3148 |

3432 |

3666 |

Instructions for Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

IN THE CIRCUIT COURT OF THE |

|

|

|

|

JUDICIAL CIRCUIT, |

||

IN AND FOR |

|

|

COUNTY, FLORIDA |

||||

|

|

|

Case No.: |

|

|||

|

|

|

Division: |

||||

|

, |

|

|

|

|

|

|

Petitioner, |

|

|

|

|

|

||

and |

|

|

|

|

|

||

|

, |

|

|

|

|

|

|

Respondent. |

|

|

|

|

|

||

NOTICE OF FILING CHILD SUPPORT GUIDELINES WORKSHEET

PLEASE TAKE NOTICE, that {name} |

_______, is filing his/her |

|

|

|

|

Child Support Guidelines Worksheet attached and labeled Exhibit 1.

CERTIFICATE OF SERVICE

I certify that a copy of this Notice of Filing with the Child Support Guidelines Worksheet was

[check all used]: ( ) |

) mailed ( ) faxed ( ) hand delivered to the person(s) listed |

||

below on {date} |

|

__________. |

|

|

|

|

|

Other party or his/her attorney:

Name: _____________________________

Address: ____________________________

City, State, Zip: _______________________

Fax Number: _________________________

Signature of Party or his/her Attorney

Printed Name: _________________________

Address: ____________________________

City, State, Zip: _______________________

Fax Number: _________________________

Florida Bar Number: ____________________

Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

CHILD SUPPORT GUIDELINES WORKSHEET

|

|

|

|

A. FATHER |

B. MOTHER |

TOTAL |

|

|

|

|

|

|

|

|

1. Present Net Monthly Income |

|

|

|

|

|

|

Enter the amount from line 27, Section I of |

|

|

|

||

|

Florida Family Law Rules of Procedure Form |

|

|

|

||

|

12.902(b) or (c), Financial Affidavit. |

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Basic Monthly Obligation |

|

|

|

|

|

|

There is (are) {number}_____ minor child(ren) |

|

|

|

||

|

common to the parties. |

|

|

|

|

|

|

Using the total amount from line 1, enter the |

|

|

|

||

|

appropriate amount from the child support |

|

|

|

||

|

guidelines chart. |

|

|

|

|

|

|

|

|

|

|

|

|

|

3. Percent of Financial Responsibility |

|

% |

% |

|

|

|

Divide the amount on line 1A by the total |

|

|

|

||

|

a |

ou t o li e 1 to get Father’s per e |

tage of |

|

|

|

|

financial responsibility. Enter answer on line 3A. |

|

|

|

||

|

Divide the amount on line 1B by the total |

|

|

|

||

|

a |

ou t o li e 1 to get Mother’s per e |

tage of |

|

|

|

|

financial responsibility. Enter answer on line 3B. |

|

|

|

||

|

|

|

|

|

|

|

|

4. Share of Basic Monthly Obligation |

|

|

|

|

|

|

Multiply the number on line 2 by the |

|

|

|

|

|

|

per e tage o li e 3A to get Father’s share |

|

|

|

||

|

of basic obligation. Enter answer on line 4A. |

|

|

|

||

|

Multiply the number on line 2 by the |

|

|

|

|

|

|

per e tage o li e 3B to get Mother’s share |

|

|

|

||

|

of basic obligation. Enter answer on line 4B. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Additional Support — Health Insurance, Child Care & Other |

|

|||

|

|

|

|

|

|

|

|

5. a. 100% of Monthly Child Care Costs |

|

|

|

|

|

|

|

[Child care costs should not exceed the level |

|

|

|

|

|

|

required to provide quality care from a |

|

|

|

|

|

|

licensed source. See section 61.30(7), Florida |

|

|

|

|

|

|

Statutes, for more information.] |

|

|

|

|

|

|

|

|

|

|

|

|

b. |

Total Mo thly Child re ’s Health Insurance |

|

|

|

|

|

|

Cost |

|

|

|

|

|

|

[This is only amounts actually paid for |

|

|

|

|

|

|

health insurance on the child(ren).] |

|

|

|

|

|

|

|

|

|

|

|

Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

CHILD SUPPORT GUIDELINES WORKSHEET

|

|

|

|

|

A. FATHER |

B. MOTHER |

TOTAL |

|

|

|

|

|

|

|

|

|

|

|

|

c. |

Total Mo thly Child re ’s No |

o ered |

|

|

|

|

|

|

|

Medical, Dental and Prescription |

|

|

|

|

|

|

|

|

Medication Costs |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. |

Total Monthly Child Care & Health Costs |

|

|

|

|

|

|

|

|

[Add lines 5a + 5b +5c]. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

Additional Support Payments |

|

|

|

|

|

||

|

|

Multiply the number on line 5d by the |

|

|

|

|

||

|

|

per e tage o li e 3A to deter i |

e the Father’s |

|

|

|

|

|

|

|

share. Enter answer on line 6A. Multiply the |

|

|

|

|

||

|

|

number on line 5d by the percentage on line 3B |

|

|

|

|

||

|

|

to deter i e the Mother’s share. |

|

|

|

|

|

|

|

|

Enter answer on line 6B. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Statutory Adjustments/Credits |

|

|

|

||

7. |

a. Monthly child care payments actually made |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

b. |

Monthly health insurance payments actually |

|

|

|

|

|

|

|

|

made |

|

|

|

|

|

|

|

c. |

Other payments/credits actually made for |

|

|

|

|

|

|

|

|

any noncovered medical, dental and |

|

|

|

|

|

|

|

|

prescription medication expenses of the |

|

|

|

|

|

|

|

|

child(ren) not ordered to be separately paid |

|

|

|

|

|

|

|

|

on a percentage basis. |

|

|

|

|

|

|

|

|

(See section 61.30 (8), Florida Statutes) |

|

|

|

|

|

|

8. Total Support Payments actually made |

|

|

|

|

|||

|

|

(Add 7a though 7c) |

|

|

|

|

|

|

|

9. MINIMUM CHILD SUPPORT OBLIGATION FOR |

|

|

|

|

|||

|

|

EACH PARENT |

|

|

|

|

|

|

|

|

[Line 4 plus line 6; minus line 8] |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

Substantial |

|

|||||

|

|

|

|

|

|

|

|

|

percent of the overnights in the year (73 overnights in the year), complete Nos. 10 through 21

A. FATHER |

B. MOTHER |

TOTAL |

10. Basic Monthly Obligation x 150% [Multiply line 2 by 1.5]

Florida Family Law Rules of Procedure Form 12.902(e), Child Support Guidelines Worksheet (09/12)

Form Characteristics

| Fact Name | Description |

|---|---|

| Use of the Form | This form is to be completed when child support is requested in a case. |

| Income Knowledge | If you know the other party's income, include this worksheet with your financial affidavit. |

| Filing Instructions | The original form should be filed with the clerk of the circuit court where your case is located. |

| Service Requirement | A copy of the completed form must be served to the other party as per Florida Rule of Judicial Administration 2.516. |

| Confidentiality | If you need to keep your address confidential, do not include it and file a Request for Confidential Filing of Address. |

| Child Support Guidelines | The guidelines for child support payments are based on the parents' combined income and the number of children. |

| Income Conversion | Income and expenses may need to be converted to a monthly basis using specific calculations. |

| Deviation from Guidelines | If the court is asked to award an amount different from the guidelines, a Motion to Deviate must be filed. |

| Nonlawyer Assistance | Any nonlawyer helping you must provide a Disclosure from Nonlawyer and must sign the forms they assist with. |

| Governing Laws | This form adheres to the Florida Family Law Rules of Procedure and Section 61.30 of the Florida Statutes. |

Guidelines on Utilizing Florida Child Support Calculator

Getting ready to fill out the Florida Child Support Calculator form is a crucial step in ensuring child support obligations are calculated accurately. Once completed, this form will help establish the child support amount based on both parents’ incomes. It’s important to carefully follow each step to make sure all the necessary information is included.

- Obtain the Florida Child Support Guidelines Worksheet (Form 12.902(e)). Make sure to have a recent version of the form.

- Type or neatly print your information in black ink. Avoid using pencil or any other color.

- Fill in your monthly income. Be thorough and include all sources like salary, bonuses, or investments.

- Input the other parent's monthly income if known. If not, leave this blank for now.

- Provide details about the number of children, noting how many children support is being calculated for. This is key in determining the amount of support.

- Use the child support guidelines chart included in the materials to find the guideline amount based on the combined monthly income and the number of children.

- Include any other relevant expenses, such as health insurance or childcare costs, that may affect the support calculation.

- Once you have filled out all sections, double-check your entries for accuracy and completeness.

- Make a copy of the completed worksheet for your records.

- File the original form with the clerk of the circuit court in the county where your case is filed.

- Serve a copy of the completed worksheet to the other party involved in the case as required by Florida law.

After submitting the form, you’ll want to keep a close eye on any further actions that may be required. This could include court hearings or additional documentation that might be requested by the court or the other party. Stay organized and maintain clear records throughout the process to ensure everything goes smoothly.

What You Should Know About This Form

What is the purpose of the Florida Child Support Calculator form?

The Florida Child Support Calculator form is designed to assist parents in determining the proper amount of child support to be paid based on their combined incomes and the number of children involved. This form is essential when child support is requested and provides a guideline to help ensure that the financial needs of children are met fairly by both parents.

When should I complete this worksheet?

Complete the worksheet if you are requesting child support in your case. If you know the other party’s income, include this worksheet with your financial affidavit. If you are unaware of the other party's income, wait until they file their financial affidavit and serve a copy to you before you complete this form. It is crucial that you file the original with the circuit court and keep a copy for your own records.

How do I serve the completed form to the other party?

A copy of the completed form must be served to the other party involved in your case. Make sure that the service follows the standards set by Florida Rule of Judicial Administration 2.516. This ensures that the other party receives notice of the child support calculations you are proposing.

Where can I find additional resources or information?

For more information, it’s recommended to read the General Information for Self-Represented Litigants section that accompanies these forms. Additionally, you can consult section 61.30 of the Florida Statutes for detailed guidelines on child support calculations and requirements.

What if I need to keep my address confidential?

If you are a victim of domestic violence or similar situations and wish to keep your address confidential, refrain from entering your address and contact information on the form. Instead, file a Request for Confidential Filing of Address using the appropriate Florida Supreme Court Approved Family Law Form 12.980(h).

How do I convert income figures to a monthly amount?

To convert different pay schedules into monthly amounts, use the following methods: For payments received bi-monthly, multiply the amount by 2. For bi-weekly payments, multiply by 26, then divide by 12 to convert to a monthly amount. For weekly payments, multiply by 52 and then divide by 12. This step is necessary to ensure that all income is accurately represented on a monthly basis for the calculation.

Common mistakes

Completing the Florida Child Support Calculator form is essential for ensuring fair support agreements. However, many individuals make mistakes during this process that can affect the outcome. One common error is failing to accurately report income. People often forget to include all sources of income, such as bonuses, overtime, or side jobs. This oversight can lead to an incorrect calculation of support obligations. All income should be disclosed to create a comprehensive picture of financial resources.

Another frequent mistake is not using the most recent guidelines. The Florida child support guidelines can change periodically. Individuals may fill out the calculator using outdated information, which could result in inaccurate support calculations. It's crucial to verify that the child support charts are current before proceeding with the calculations. Always refer to the official website or court resources to obtain the latest version.

Many erroneously believe that they can estimate income based on their past earnings without adjusting for their current situation. This approach disregards changes in employment status, salary fluctuations, or economic conditions. Utilizing outdated income figures can lead to significant discrepancies in support obligations. It is vital to use the most up-to-date financial data for an accurate assessment.

People also often neglect to convert income and expense figures appropriately. Income may be reported weekly, biweekly, or monthly, and failing to convert these figures into a consistent monthly amount can skew calculations. This step is necessary to ensure that each party's financial contributions are proportionately represented. Review the conversion instructions carefully to avoid this pitfall.

Finally, individuals sometimes overlook the requirement to serve the completed form to the other party. After filling out the child support calculator form, the individual must provide a copy to the other parent. Ignoring this step results in non-compliance with legal procedures. Timely service of documents is integral to the legal process and helps ensure that both parties are informed and can participate fully in any discussions or disputes regarding child support.

Documents used along the form

When navigating child support matters in Florida, it's essential to be aware of additional forms and documents that often accompany the Child Support Calculator form. Each of these documents plays a vital role in ensuring that the child support process is thorough and compliant with legal requirements. Understanding these forms can help streamline your experience in addressing child support issues.

- Financial Affidavit (Form 12.902(b)): This document outlines the financial status of both parties involved. It includes details about income, expenses, assets, and liabilities. Completing this form accurately is crucial as it forms the basis for determining child support obligations.

- Child Support Guidelines Worksheet (Form 12.902(e)): This is the worksheet you fill out to calculate the child support amount based on the parents' combined income and the number of children. It's an essential tool for verifying financial contributions.

- Motion to Deviate from Child Support Guidelines (Form 12.943): If you believe the standard child support amount should be adjusted based on specific circumstances, this form allows you to request a different amount from the court.

- Request for Confidential Filing of Address (Form 12.980(h)): This form is necessary if you need to keep your address confidential due to safety concerns, such as domestic violence. It ensures that your location remains protected.

- Disclosure from Nonlawyer (Form 12.900(a)): If a nonlawyer assists you in completing forms, this document must be provided to disclose the nonlawyer's information and confirm their assistance.

- Summons (Form 12.910): This document notifies the other party of the legal action taken against them. It's essential for ensuring that both parties are aware of the proceedings related to child support.

- Parenting Plan (Form 12.995(a)): This plan outlines the parenting arrangements after separation or divorce. It includes details on custody, visitation schedules, and how decisions about the child will be made.

Familiarizing yourself with these forms can significantly ease the child support process. Each document has its own purpose and importance, helping to ensure that both parents fulfill their responsibilities toward their children. With the right documentation in hand, you can approach your case with confidence and clarity.

Similar forms

- Financial Affidavit (Form 12.901(b)): This document is used to disclose financial information and expenses of both parties, assisting the court in determining child support amounts. Like the Child Support Calculator, the financial affidavit requires accurate income documentation and must be filed with the court.

- Motion to Deviate from Child Support Guidelines (Form 12.943): This form is essential if either party seeks an amount of child support different from the guidelines. It must include reasons for the deviation, similar to how the Child Support Calculator calculates amounts based on specific financial circumstances.

- Request for Confidential Filing of Address (Form 12.980(h)): This document protects the address of individuals in sensitive situations, such as victims of violence. It parallels the Child Support Calculator by ensuring that both parties' privacy is safeguarded during financial and support disclosures.

- Child Support Guidelines Worksheet (Form 12.902(e)): This worksheet directly relates to the Child Support Calculator, as it provides a structured format for entering combined income and calculating expected child support payments, ensuring consistent reporting and calculation methods.

Dos and Don'ts

When filling out the Florida Child Support Calculator form, consider these key recommendations:

- Do complete the form with accurate income information for both parties.

- Don’t leave any sections blank; incomplete forms can delay the process.

- Do double-check the latest child support guidelines chart before calculating amounts.

- Don’t forget to sign and date the form before submitting it.

- Do submit the form as instructed to the clerk of the circuit court.

- Don’t include confidential contact information if you are a victim of domestic violence; use the appropriate confidential form instead.

- Do keep a copy of the completed form for your records.

It is crucial to follow these guidelines carefully to ensure prompt processing of your child support case.

Misconceptions

Misconceptions about the Florida Child Support Calculator form

- Only one parent needs to fill it out. Both parents are usually involved in the process. It’s essential for both parties to provide their financial information.

- The calculator is only for divorced parents. This form can be used by anyone seeking child support, regardless of marital status.

- Child support calculations are set in stone. The calculations provide a guideline, but parents can request adjustments if circumstances change.

- Income must be verified through complex paperwork. While accurate reporting is critical, it does not require complicated documents. Simple financial affidavits typically suffice.

- The form can be completed in any color ink. It specifically states that the worksheet should be typed or printed in black ink only.

- The child support amount is always the same. Amounts vary based on several factors, including the number of children and the parents' combined income.

- Anyone can serve the form to the other party. Service must follow specific rules set forth in Florida Rule of Judicial Administration 2.516, which outlines who can serve the documents.

- The guidelines never change. Child support guideline amounts can change, so it’s important to check for the most current figures each time you use the form.

Key takeaways

Understanding the Florida Child Support Calculator form can greatly ease the process of determining child support obligations. Here are seven key takeaways to keep in mind:

- Complete the worksheet if child support is part of your case. Knowing the other party's income can streamline this process.

- Ensure that the form is filled out neatly, either typed or printed in black ink. Legible submissions help prevent delays.

- File the original worksheet with the clerk of the circuit court and keep a copy for your own records.

- Service of this form to the other party is crucial. Make sure to comply with Florida Rule of Judicial Administration 2.516.

- Stay informed about changes to the child support guidelines chart. Regular updates mean you should verify that you are using the latest version.

- When calculating, convert all income and expenses to a monthly basis for accuracy, using the given formulas for different payment schedules.

- If you wish to deviate from the guideline amounts, don't forget to attach a Motion to Deviate from Child Support Guidelines.

Browse Other Templates

California Corporation - The form requires a signature from a manager of the LLC.

Title and Registration Illinois - Complete the employer section with your job title for added clarity during review.