Fill Out Your Florida Commercial Contract Form

The Florida Commercial Contract form plays a vital role in transactions involving the sale of commercial real estate in Florida. It lays out the fundamental elements of the agreement between the buyer and the seller, ensuring that both parties understand their commitments. The form identifies the parties involved and details the property being purchased, including its legal description. One critical component is the purchase price, which must be explicitly defined, along with details regarding deposits that will be held in escrow. Furthermore, the contract specifies timelines for acceptance and various critical deadlines, including the closing date and location. It also addresses financing obligations, outlining the buyer’s responsibilities concerning acquiring third-party financing. The form emphasizes the importance of due diligence, allowing the buyer to investigate the property’s condition and suitability thoroughly. Additionally, it outlines the process for title transfer and the warranty under which the seller will deliver the property. Other clauses cover essential aspects such as property condition, default terms, and risk of loss, ensuring a clear understanding of what happens if certain conditions are not met. By systematically addressing these components, the Florida Commercial Contract form serves as a comprehensive guide that facilitates a smooth transaction while protecting the interests of both parties involved.

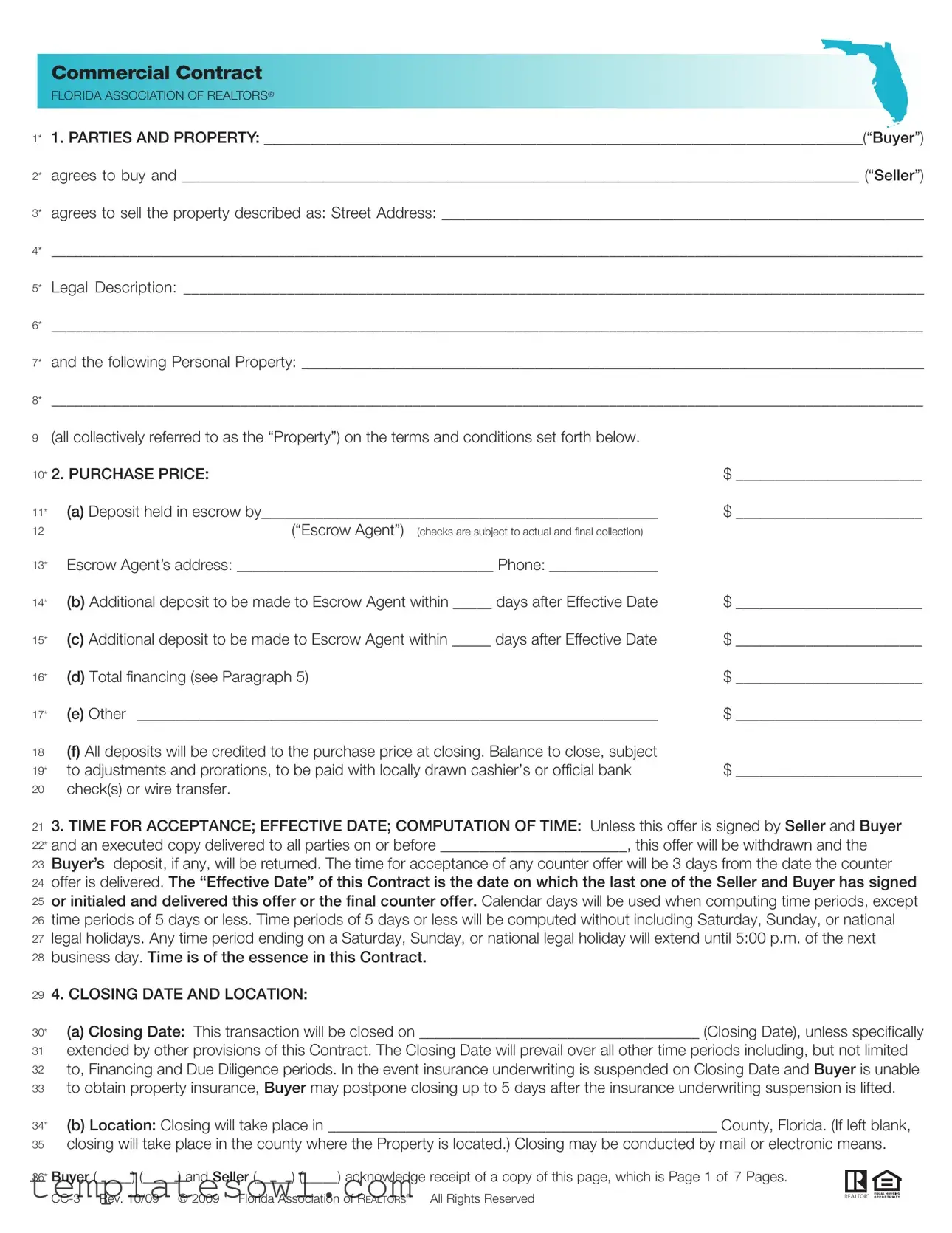

Florida Commercial Contract Example

COMMERCIAL CONTRACT

FLORIDA ASSOCIATION OF REALTORS®

1* 1. PARTIES AND PROPERTY: _____________________________________________________________________________(“Buyer”)

2* agrees to buy and _______________________________________________________________________________________ (“Seller”)

3* agrees to sell the property described as: Street Address: ______________________________________________________________

4* _______________________________________________________________________________________________________________

5* Legal Description: _____________________________________________________________________________________________

6* _______________________________________________________________________________________________________________

7* and the following Personal Property: ________________________________________________________________________________

8* _______________________________________________________________________________________________________________

9(all collectively referred to as the “Property”) on the terms and conditions set forth below.

10* 2. PURCHASE PRICE: |

$ ________________________ |

|

11* |

(a) Deposit held in escrow by___________________________________________________ |

$ ________________________ |

12 |

(“Escrow Agent”) (checks are subject to actual and final collection) |

|

13* |

Escrow Agent’s address: _________________________________ Phone: ______________ |

|

14* |

(b) Additional deposit to be made to Escrow Agent within _____ days after Effective Date |

$ ________________________ |

15* |

(c) Additional deposit to be made to Escrow Agent within _____ days after Effective Date |

$ ________________________ |

16* |

(d) Total financing (see Paragraph 5) |

$ ________________________ |

17* |

(e) Other ___________________________________________________________________ |

$ ________________________ |

18(f) All deposits will be credited to the purchase price at closing. Balance to close, subject

19* to adjustments and prorations, to be paid with locally drawn cashier’s or official bank |

$ ________________________ |

20check(s) or wire transfer.

213. TIME FOR ACCEPTANCE; EFFECTIVE DATE; COMPUTATION OF TIME: Unless this offer is signed by Seller and Buyer

22* and an executed copy delivered to all parties on or before ________________________, this offer will be withdrawn and the

23Buyer’s deposit, if any, will be returned. The time for acceptance of any counter offer will be 3 days from the date the counter

24offer is delivered. The “Effective Date” of this Contract is the date on which the last one of the Seller and Buyer has signed

25or initialed and delivered this offer or the final counter offer. Calendar days will be used when computing time periods, except

26time periods of 5 days or less. Time periods of 5 days or less will be computed without including Saturday, Sunday, or national

27legal holidays. Any time period ending on a Saturday, Sunday, or national legal holiday will extend until 5:00 p.m. of the next

28business day. Time is of the essence in this Contract.

294. CLOSING DATE AND LOCATION:

30*

31

32

33

34*

35

(a)Closing Date: This transaction will be closed on ____________________________________ (Closing Date), unless specifically extended by other provisions of this Contract. The Closing Date will prevail over all other time periods including, but not limited to, Financing and Due Diligence periods. In the event insurance underwriting is suspended on Closing Date and Buyer is unable to obtain property insurance, Buyer may postpone closing up to 5 days after the insurance underwriting suspension is lifted.

(b)Location: Closing will take place in __________________________________________________ County, Florida. (If left blank, closing will take place in the county where the Property is located.) Closing may be conducted by mail or electronic means.

36* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 1 of 7 Pages.

375. THIRD PARTY FINANCING:

38*

39*

40*

41*

42*

43

44*

45

46

47

48

49*

50

51

52

53

54

55

56

57

58

59*

60*

61

62*

63*

64*

65

66*

67

68*

69*

70*

71

72

73*

74

75

76

77

78

79

80

81*

82

83

84

85

86

87

88*

89*

90*

BUYER’S OBLIGATION: Within ______ days (5 days if left blank) after Effective Date, Buyer will apply for third party financing in an

amount not to exceed ______% of the purchase price or $ ______________________, with a fixed interest rate not to exceed ______%

per year or with an initial variable interest rate not to exceed ______%, with points or commitment or loan fees not to exceed ______%

of the principal amount, for a term of ______ years, and amortized over ______ years, with additional terms as follows: _____________

__________________________________________________________________________________________________________________.

Buyer will timely provide any and all credit, employment, financial and other information reasonably required by any lender. Buyer will use good faith and reasonable diligence to (i) obtain Loan Approval within _____ days (45 days if left blank) from Effective Date

(Loan Approval Date), (ii) satisfy terms and conditions of the Loan Approval, and (iii) close the loan. Buyer will keep Seller and Broker fully informed about loan application status and authorizes the mortgage broker and lender to disclose all such information to Seller and Broker. Buyer will notify Seller immediately upon obtaining financing or being rejected by a lender. CANCELATION: If Buyer, after using good faith and reasonable diligence, fails to obtain Loan Approval by Loan Approval Date, Buyer may within ______ days (3 days if left blank) deliver written notice to Seller stating Buyer either waives this financing

contingency or cancels this Contract. If Buyer does neither, then Seller may cancel this Contract by delivering written notice to Buyer at any time thereafter. Unless this financing contingency has been waived, this Contract shall remain subject to the satisfaction, by closing, of those conditions of Loan Approval related to the Property.

DEPOSIT(S) (for purposes of Paragraph 5 only): If Buyer has used good faith and reasonable diligence but does not obtain Loan Approval by Loan Approval Date and thereafter either party elects to cancel this Contract as set forth above or the lender fails or refuses to close on or before the Closing Date without fault on Buyer’s part, the Deposit(s) shall be returned to Buyer, whereupon both parties will be released from all further obligations under this Contract, except for obligations stated herein as surviving the termination of this Contract. If neither party elects to terminate this Contract as set forth above or Buyer fails to use good faith or reasonable diligence as set forth above, Seller will be entitled to retain the Deposit(s) if the transaction does not close.

6.TITLE: Seller has the legal capacity to and will convey marketable title to the Property by o statutory warranty deed

o other ________________________________________, free of liens, easements and encumbrances of record or known to Seller,

but subject to property taxes for the year of closing; covenants, restrictions and public utility easements of record; existing zoning and governmental regulations; and (list any other matters to which title will be subject) ______________________________________

________________________________________________________________________________________________________________

____________________________________________________________________________________________________________;

provided there exists at closing no violation of the foregoing and none of them prevents Buyer’s intended use of the Property as

_______________________________________________________________________________________________________________.

(a)Evidence of Title: The party who pays the premium for the title insurance policy will select the closing agent and pay for the title search and closing services. Seller will, at (check one) o Seller’s o Buyer’s expense and within _____ days o after Effective Date o or at least _____ days before Closing Date deliver to Buyer (check one)

o (i.) a title insurance commitment by a Florida licensed title insurer and, upon Buyer recording the deed, an owner’s policy in the amount of the purchase price for fee simple title subject only to exceptions stated above. If Buyer is paying for the evidence of title and Seller has an owner’s policy, Seller will deliver a copy to Buyer within 15 days after Effective Date.

o (ii.) an abstract of title, prepared or brought current by an existing abstract firm or certified as correct by an existing firm. However, if such an abstract is not available to Seller, then a prior owner’s title policy acceptable to the proposed insurer as a base for reissuance of coverage may be used. The prior policy will include copies of all policy exceptions and an update in a format acceptable to Buyer from the policy effective date and certified to Buyer or Buyer’s closing agent together with copies of all documents recited in the prior policy and in the update. If such an abstract or prior policy is not available to Seller then (i.) above will be the evidence of title.

(b)Title Examination: Buyer will, within 15 days from receipt of the evidence of title deliver written notice to Seller of title defects. Title will be deemed acceptable to Buyer if (1) Buyer fails to deliver proper notice of defects or (2) Buyer delivers proper written notice and Seller cures the defects within _____ days from receipt of the notice (“Curative Period”). If the defects are cured within the Curative Period, closing will occur within 10 days from receipt by Buyer of notice of such curing. Seller may elect not to cure defects if Seller reasonably believes any defect cannot be cured within the Curative Period. If the defects are not cured within the Curative Period, Buyer will have 10 days from receipt of notice of Seller’s inability to cure the defects to elect whether to terminate this Contract or accept title subject to existing defects and close the transaction without reduction in purchase price.

(c)Survey: (check applicable provisions below)

o Seller will, within _____ days from Effective Date, deliver to Buyer copies of prior surveys, plans, specifications, and engineering documents, if any, and the following documents relevant to this transaction: _______________________________

______________________________________________________________________________, prepared for Seller or in Seller’s

91* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 2 of 7 Pages.

92

93

94*

95

96*

97*

possession, which show all currently existing structures. In the event this transaction does not close, all documents provided by Seller will be returned to Seller within 10 days from the date this Contract is terminated.

o Buyer will, at o Seller’s o Buyer’s expense and within the time period allowed to deliver and examine title evidence, obtain a current certified survey of the Property from a registered surveyor. If the survey reveals encroachments on the Property or that the improvements encroach on the lands of another, o Buyer will accept the Property with existing encroachments o such encroachments will constitute a title defect to be cured within the Curative Period.

98(d) Ingress and Egress: Seller warrants that the Property presently has ingress and egress.

997. PROPERTY CONDITION: Seller will deliver the Property to Buyer at the time agreed in its present “as is” condition, ordinary

100wear and tear excepted, and will maintain the landscaping and grounds in a comparable condition. Seller makes no warranties

101other than marketability of title. By accepting the Property “as is,” Buyer waives all claims against Seller for any defects in the

102Property. (Check (a) or (b))

103*

104*

105

106

107

108

109

110

111

112

113

114

115

116

117

118

119

120

121

122

123

124

125

o (a) As Is: Buyer has inspected the Property or waives any right to inspect and accepts the Property in its “as is” condition.

o (b) Due Diligence Period: Buyer will, at Buyer’s expense and within _______ days from Effective Date (“Due Diligence

Period”), determine whether the Property is suitable, in Buyer’s sole and absolute discretion, for Buyer’s intended use and development of the Property as specified in Paragraph 6. During the Due Diligence Period, Buyer may conduct any tests, analyses, surveys and investigations (“Inspections”) which Buyer deems necessary to determine to Buyer’s satisfaction the Property’s engineering, architectural, environmental properties; zoning and zoning restrictions; flood zone designation and restrictions; subdivision regulations; soil and grade; availability of access to public roads, water, and other utilities; consistency with local, state and regional growth management and comprehensive land use plans; availability of permits, government approvals and licenses; compliance with American with Disabilities Act; absence of asbestos, soil and ground water contamination; and other inspections that Buyer deems appropriate to determine the suitability of the Property for Buyer’s intended use and development. Buyer will deliver written notice to Seller prior to the expiration of the Due Diligence Period of Buyer’s determination of whether or not the Property is acceptable. Buyer’s failure to comply with this notice requirement will constitute acceptance of the Property in its present “as is” condition. Seller grants to Buyer, its agents, contractors and assigns, the right to enter the Property at any time during the Due Diligence Period for the purpose of conducting Inspections; provided, however, that Buyer, its agents, contractors and assigns enter the Property and conduct Inspections at their own risk. Buyer will indemnify and hold Seller harmless from losses, damages, costs, claims and expenses of any nature, including attorneys’ fees at all levels, and from liability to any person, arising from the conduct of any and all inspections or any work authorized by Buyer. Buyer will not engage in any activity that could result in a mechanic’s lien being filed against the Property without Seller’s prior written consent. In the event this transaction does not close, (1) Buyer will repair all damages to the Property resulting from the Inspections and return the Property to the condition it was in prior to conduct of the Inspections, and

(2)Buyer will, at Buyer’s expense, release to Seller all reports and other work generated as a result of the Inspections. Should Buyer deliver timely notice that the Property is not acceptable, Seller agrees that Buyer’s deposit will be immediately returned to Buyer and the Contract terminated.

126(c)

127conduct a final

128Property is on the premises.

1298. OPERATION OF PROPERTY DURING CONTRACT PERIOD: Seller will continue to operate the Property and any business

130conducted on the Property in the manner operated prior to Contract and will take no action that would adversely impact the

131Property, tenants, lenders or business, if any. Any changes, such as renting vacant space, that materially affect the Property or

132* Buyer’s intended use of the Property will be permitted o only with Buyer’s consent o without Buyer’s consent.

1339. CLOSING PROCEDURE:

134(a) Possession and Occupancy: Seller will deliver possession and occupancy of the Property to Buyer at closing. Seller will

135provide keys, remote controls, and any security/access codes necessary to operate all locks, mailboxes, and security systems.

136(b) Costs: Buyer will pay buyer’s attorneys’ fees, taxes and recording fees on notes, mortgages and financing statements and

137recording fees for the deed. Seller will pay seller’s attorneys’ fees, taxes on the deed and recording fees for documents needed

138to cure title defects. If Seller is obligated to discharge any encumbrance at or prior to closing and fails to do so, Buyer may use

139purchase proceeds to satisfy the encumbrances.

140(c) Documents: Seller will provide the deed; bill of sale; mechanic’s lien affidavit; originals of those assignable service and

141maintenance contracts that will be assumed by Buyer after the Closing Date and letters to each service contractor from Seller

142* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 3 of 7 Pages.

143advising each of them of the sale of the Property and, if applicable, the transfer of its contract, and any assignable warranties or

144guarantees received or held by Seller from any manufacturer, contractor, subcontractor, or material supplier in connection with

145the Property; current copies of the condominium documents, if applicable; assignments of leases, updated rent roll; tenant and

146lender estoppel letters; assignments of permits and licenses; corrective instruments; and letters notifying tenants of the change

147in ownership/rental agent. If any tenant refuses to execute an estoppel letter, Seller will certify that information regarding the

148tenant’s lease is correct. If Seller is a corporation, Seller will deliver a resolution of its Board of Directors authorizing the sale

149and delivery of the deed and certification by the corporate Secretary certifying the resolution and setting forth facts showing the

150conveyance conforms to the requirements of local law. Seller will transfer security deposits to Buyer. Buyer will provide the

151closing statement, mortgages and notes, security agreements, and financing statements.

152(d) Taxes and Prorations: Real estates taxes, personal property taxes on any tangible personal property, bond payments

153assumed by Buyer, interest, rents, association dues, insurance premiums acceptable to Buyer, and operating expenses will be

154prorated through the day before closing. If the amount of taxes for the current year cannot be ascertained, rates for the previous

155year will be used with due allowance being made for improvements and exemptions. Any tax proration based on an estimate

156will, at request of either party, be readjusted upon receipt of current year’s tax bill; this provision will survive closing.

157(e) Special Assessment Liens: Certified, confirmed, and ratified special assessment liens as of the Closing Date will be paid

158by Seller. If a certified, confirmed, or ratified special assessment is payable in installments, Seller will pay all installments due

159and payable on or before the Closing Date, with any installment for any period extending beyond the Closing Date prorated,

160and Buyer will assume all installments that become due and payable after the Closing Date. Buyer will be responsible for all

161assessments of any kind which become due and owing after Closing Date, unless an improvement is substantially completed as

162of Closing Date. If an improvement is substantially completed as of the Closing Date but has not resulted in a lien before closing,

163Seller will pay the amount of the last estimate of the assessment.

164(f) Foreign Investment In Real Property Tax Act (FIRPTA): If Seller is a “foreign person” as defined by FIRPTA, Seller and

165Buyer agree to comply with Section 1445 of the Internal Revenue Code. Seller and Buyer will complete, execute, and deliver

166as directed any instrument, affidavit, or statement reasonably necessary to comply with the FIRPTA requirements, including

167delivery of their respective federal taxpayer identification numbers or Social Security Numbers to the closing agent. If Buyer

168does not pay sufficient cash at closing to meet the withholding requirement, Seller will deliver to Buyer at closing the additional

169cash necessary to satisfy the requirement.

17010. ESCROW AGENT: Seller and Buyer authorize Escrow Agent (Agent) to receive, deposit, and hold funds and other property

171in escrow and, subject to collection, disburse them in accordance with the terms of this Contract. The parties agree that Agent

172will not be liable to any person for misdelivery of escrowed items to Seller or Buyer, unless the misdelivery is due to Agent’s willful

173breach of this Contract or gross negligence. If Agent has doubt as to Agent’s duties or obligations under this Contract, Agent may,

174at Agent’s option, (a) hold the escrowed items until the parties mutually agree to its disbursement or until a court of competent

175jurisdiction or arbitrator determines the rights of the parties or (b) deposit the escrowed items with the clerk of the court having

176jurisdiction over the matter and file an action in interpleader. Upon notifying the parties of such action, Agent will be released from

177all liability except for the duty to account for items previously delivered out of escrow. If Agent is a licensed real estate broker,

178Agent will comply with Chapter 475, Florida Statutes. In any suit in which Agent interpleads the escrowed items or is made a party

179because of acting as Agent hereunder, Agent will recover reasonable attorney’s fees and costs incurred, with these amounts to be

180paid from and out of the escrowed items and charged and awarded as court costs in favor of the prevailing party.

181

182

183*

184

11.CURE PERIOD: Prior to any claim for default being made, a party will have an opportunity to cure any alleged default. If a party fails to comply with any provision of this Contract, the other party will deliver written notice to the

18512. RETURN OF DEPOSIT: Unless otherwise specified in the Contract, in the event any condition of this Contract is not met

186and Buyer has timely given any required notice regarding the condition having not been met, Buyer’s deposit will be returned in

187accordance with applicable Florida laws and regulations.

18813. DEFAULT:

189(a) In the event the sale is not closed due to any default or failure on the part of Seller other than failure to make the title

190marketable after diligent effort, Buyer may either (1) receive a refund of Buyer’s deposit(s) or (2) seek specific performance. If

191Buyer elects a deposit refund, Seller will be liable to Broker for the full amount of the brokerage fee.

192(b) In the event the sale is not closed due to any default or failure on the part of Buyer, Seller may either (1) retain all deposit(s)

193paid or agreed to be paid by Buyer as agreed upon liquidated damages, consideration for the execution of this Contract, and

194* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 4 of 7 Pages.

195in full settlement of any claims, upon which this Contract will terminate or (2) seek specific performance. If Seller retains the

196deposit, Seller will pay the Brokers named in Paragraph 20 fifty percent of all forfeited deposits retained by Seller (to be split

197equally among the Brokers) up to the full amount of the brokerage fee.

19814. ATTORNEY’S FEES AND COSTS: In any claim or controversy arising out of or relating to this Contract, the prevailing party,

199which for purposes of this provision will include Buyer, Seller and Broker, will be awarded reasonable attorneys’ fees, costs, and

200expenses.

20115. NOTICES: All notices will be in writing and may be delivered by mail, personal delivery, or electronic means. Parties agree to

202send all notices to addresses specified on the signature page(s). Any notice, document, or item given by or delivered to an attorney

203or real estate licensee (including a transaction broker) representing a party will be as effective as if given by or delivered to that party.

20416. DISCLOSURES:

205(a) Commercial Real Estate Sales Commission Lien Act: The Florida Commercial Real Estate Sales Commission Lien Act

206provides that when a broker has earned a commission by performing licensed services under a brokerage agreement with you,

207the broker may claim a lien against your net sales proceeds for the broker’s commission. The broker’s lien rights under the act

208cannot be waived before the commission is earned.

209(b) Special Assessment Liens Imposed by Public Body: The Property may be subject to unpaid special assessment lien(s)

210imposed by a public body. (A public body includes a Community Development District.) Such liens, if any, shall be paid as set

211forth in Paragraph 9.(e).

212(c) Radon Gas: Radon is a naturally occurring radioactive gas that, when it has accumulated in a building in sufficient quantities,

213may present health risks to persons who are exposed to it over time. Levels of radon that exceed federal and state guidelines

214have been found in buildings in Florida. Additional information regarding radon and radon testing may be obtained from your

215county public health unit.

216(d)

217553.996, Florida Statutes.

21817. RISK OF LOSS:

219(a) If, after the Effective Date and before closing, the Property is damaged by fire or other casualty, Seller will bear the risk of

220loss and Buyer may cancel this Contract without liability and the deposit(s) will be returned to Buyer. Alternatively, Buyer will

221have the option of purchasing the Property at the agreed upon purchase price and Seller will transfer to Buyer at closing any

222insurance proceeds, or Seller’s claim to any insurance proceeds payable for the damage. Seller will cooperate with and assist

223Buyer in collecting any such proceeds.

224(b) If, after the Effective Date and before closing, any part of the Property is taken in condemnation or under the right of eminent

225domain, or proceedings for such taking will be pending or threatened, Buyer may cancel this Contract without liability and the

226deposit(s) will be returned to Buyer. Alternatively, Buyer will have the option of purchasing what is left of the Property at the

227agreed upon purchase price and Seller will transfer to the Buyer at closing the proceeds of any award, or Seller’s claim to any

228award payable for the taking. Seller will cooperate with and assist Buyer in collecting any such award.

229*

230*

231

18.ASSIGNABILITY; PERSONS BOUND: This Contract may be assigned to a related entity, and otherwise o is not assignable o is assignable. The terms “Buyer,” “Seller” and “Broker” may be singular or plural. This Contract is binding upon Buyer, Seller and their heirs, personal representatives, successors and assigns (if assignment is permitted).

23219. MISCELLANEOUS: The terms of this Contract constitute the entire agreement between Buyer and Seller. Modifications of

233this Contract will not be binding unless in writing, signed and delivered by the party to be bound. Signatures, initials, documents

234referenced in this Contract, counterparts and written modifications communicated electronically or on paper will be acceptable

235for all purposes, including delivery, and will be binding. Handwritten or typewritten terms inserted in or attached to this Contract

236prevail over preprinted terms. If any provision of this Contract is or becomes invalid or unenforceable, all remaining provisions will

237continue to be fully effective. This Contract will be construed under Florida law and will not be recorded in any public records.

238* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 5 of 7 Pages.

23920. BROKERS: Neither Seller nor Buyer has used the services of, or for any other reason owes compensation to, a licensed real

240estate Broker other than:

241* |

(a) Seller’s Broker: ____________________________________________________________________________________________, |

|

242 |

(Company Name) |

(Licensee) |

243* |

______________________________________________________________________________________________________________, |

|

244 |

(Address, Telephone, Fax, |

|

245* |

who o is a single agent o is a transaction broker o has no brokerage relationship and who will be compensated by o Seller |

|

246* |

o Buyer o both parties pursuant to o a listing agreement o other (specify) _____________________________________________ |

|

247* |

______________________________________________________________________________________________________________ |

|

248* |

(b) Buyer’s Broker: ___________________________________________________________________________________________, |

|

249 |

(Company Name) |

(Licensee) |

250* |

______________________________________________________________________________________________________________, |

|

251 |

(Address, Telephone, Fax, |

|

252* |

who o is a single agent o is a transaction broker o has no brokerage relationship and who will be compensated by o Seller’s |

|

253* |

Broker o Seller o Buyer o both parties pursuant to o an MLS offer of compensation o other (specify) |

|

254* |

______________________________________________________________________________________________________________ |

|

255(collectively referred to as “Broker”) in connection with any act relating to the Property, including but not limited to inquiries,

256introductions, consultations, and negotiations resulting in this transaction. Seller and Buyer agree to indemnify and hold Broker

257harmless from and against losses, damages, costs and expenses of any kind, including reasonable attorneys’ fees at all levels,

258and from liability to any person, arising from (1) compensation claimed which is inconsistent with the representation in this

259Paragraph, (2) enforcement action to collect a brokerage fee pursuant to Paragraph 10, (3) any duty accepted by Broker at the

260request of Seller or Buyer, which is beyond the scope of services regulated by Chapter 475, Florida Statutes, as amended, or (4)

261recommendations of or services provided and expenses incurred by any third party whom Broker refers, recommends, or retains

262for or on behalf of Seller or Buyer.

26321. OPTION (Check if any of the following clauses are applicable and are attached as an addendum to this Contract):

(Check if any of the following clauses are applicable and are attached as an addendum to this Contract):

264* |

o Arbitration |

o Seller Warranty |

o Existing Mortgage |

265* |

o Section 1031 Exchange |

o Coastal Construction Control Line |

o Buyer’s Attorney Approval |

266* |

o Property Inspection and Repair |

o Flood Area Hazard Zone |

o Seller’s Attorney Approval |

267* |

o Seller Representations |

o Seller Financing |

o Other ___________________________ |

26822. ADDITIONAL TERMS:

269* |

________________________________________________________________________________________________________________ |

270* |

________________________________________________________________________________________________________________ |

271* |

________________________________________________________________________________________________________________ |

272* |

________________________________________________________________________________________________________________ |

273* |

________________________________________________________________________________________________________________ |

274* |

________________________________________________________________________________________________________________ |

275* |

________________________________________________________________________________________________________________ |

276* |

________________________________________________________________________________________________________________ |

277* |

________________________________________________________________________________________________________________ |

278* |

________________________________________________________________________________________________________________ |

279THIS IS INTENDED TO BE A LEGALLY BINDING CONTRACT. IF NOT FULLY UNDERSTOOD, SEEK THE ADVICE

280OF AN ATTORNEY PRIOR TO SIGNING. BROKER ADVISES BUYER AND SELLER TO VERIFY ALL FACTS AND

281REPRESENTATIONS THAT ARE IMPORTANT TO THEM AND TO CONSULT AN APPROPRIATE PROFESSIONAL

282FOR LEGAL ADVICE (FOR EXAMPLE, INTERPRETING CONTRACTS, DETERMINING THE EFFECT OF LAWS ON

283THE PROPERTY AND TRANSACTION, STATUS OF TITLE, FOREIGN INVESTOR REPORTING REQUIREMENTS,

284ETC.) AND FOR TAX, PROPERTY CONDITION, ENVIRONMENTAL AND OTHER ADVICE. BUYER ACKNOWLEDGES

285THAT BROKER DOES NOT OCCUPY THE PROPERTY AND THAT ALL REPRESENTATIONS (ORAL, WRITTEN OR

286OTHERWISE) BY BROKER ARE BASED ON SELLER REPRESENTATIONS OR PUBLIC RECORDS UNLESS BROKER

287INDICATES PERSONAL VERIFICATION OF THE REPRESENTATION. BUYER AGREES TO RELY SOLELY ON SELLER,

288PROFESSIONAL INSPECTORS AND GOVERNMENTAL AGENCIES FOR VERIFICATION OF THE PROPERTY CONDITION,

289SQUARE FOOTAGE AND FACTS THAT MATERIALLY AFFECT PROPERTY VALUE.

290* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 6 of 7 Pages.

291Each person signing this Contract on behalf of a party that is a business entity represents and warrants to the other party that

292such signatory has full power and authority to enter into and perform this Contract in accordance with its terms and each person

293executing this Contract and other documents on behalf of such party has been duly authorized to do so.

294* |

_________________________________________________________ |

Date: ______________________________________________ |

295 |

(Signature of Buyer) |

|

296* |

_________________________________________________________ |

Tax ID No.: _________________________________________ |

297 |

(Typed or Printed Name of Buyer) |

|

298* |

Title: ____________________________________________________ |

Telephone: _________________________________________ |

299* |

_________________________________________________________ |

Date: ______________________________________________ |

300 |

(Signature of Buyer) |

|

301* |

_________________________________________________________ |

Tax ID No.: _________________________________________ |

302 |

(Typed or Printed Name of Buyer) |

|

303* |

Title: ____________________________________________________ |

Telephone: _________________________________________ |

304* |

Buyer’s Address for purpose of notice: _____________________________________________________________________________ |

|

305* |

Facsimile: ________________________________________________ |

|

306* |

_________________________________________________________ |

Date: ______________________________________________ |

307(Signature of Seller)

308* |

_________________________________________________________ |

Tax ID No.: _________________________________________ |

309 |

(Typed or Printed Name of Seller) |

|

310* |

Title: ____________________________________________________ |

Telephone: _________________________________________ |

311* |

_________________________________________________________ |

Date: ______________________________________________ |

312 |

(Signature of Seller) |

|

313* |

_________________________________________________________ |

Tax ID No.: _________________________________________ |

314 |

(Typed or Printed Name of Seller) |

|

315* |

Title: ____________________________________________________ |

Telephone: _________________________________________ |

316* |

Seller’s Address for purpose of notice: ______________________________________________________________________________ |

|

317* |

Facsimile: ________________________________________________ |

|

The Florida Association of REALTORS® makes no representation as to the legal validity or adequacy of any provision of this form in any specific transaction. This standardized form should not be used in complex transactions or with extensive riders or additions. This form is available for use by the entire real estate industry and is not intended to identify the user as a REALTOR®. REALTOR® is a registered collective membership mark which may be used only by real estate licensees who are members of the NATIONAL ASSOCIATION OF REALTORS® and who subscribe to its Code of Ethics.

The copyright laws of the United States (17 U.S. Code) forbid the unauthorized reproduction of this form by any means including facsimile or computerized forms.

318* Buyer (_____) (_____) and Seller (_____) (_____) acknowledge receipt of a copy of this page, which is Page 7 of 7 Pages.

Form Characteristics

| Fact Name | Details |

|---|---|

| Parties Involved | The contract includes a designated "Buyer" and "Seller," who agree to the transfer of property ownership. |

| Property Description | The contract requires a detailed description of the property, including the street address and legal description. |

| Purchase Price | The total purchase price is established, along with details about deposits and financing options. |

| Effective Date | The agreement includes a definition of "Effective Date," which begins upon the last signature on the document. |

| Closing Procedure | Closing details, including the date and location, are specified and allow for adjustments if necessary. |

| Seller's Obligations | Seller is responsible for delivering the property in "as is" condition, while also upholding marketability of title. |

| Buyer's Financing | Buyers must apply for financing within a specified timeframe, with provisions for potential cancellation if financing fails. |

| Title Evidence | Evidence of title will be provided, and defects must be addressed within a specified period. |

| Risk of Loss | The seller bears the risk of loss should the property be damaged before closing, allowing buyers to cancel the contract. |

| Governing Law | This contract is governed by Florida law, ensuring compliance with local regulations and statutes. |

Guidelines on Utilizing Florida Commercial Contract

When you approach the Florida Commercial Contract form, you're stepping into an essential process for formalizing the transfer of a commercial property. Careful attention to detail is paramount for both buyers and sellers. Below are organized steps to ensure that you complete the form accurately and effectively.

- Begin by identifying the Parties involved. Fill in the names of the Buyer and Seller in the designated fields.

- Specify the Property being sold. Provide a complete street address and legal description to describe the property clearly.

- Detail any Personal Property that is included in the sale. This could encompass items such as fixtures, furniture, or other specific equipment.

- Input the Purchase Price at the appropriate line, ensuring it is clear and accurate.

- List the Deposit held in escrow, along with the name and address of the Escrow Agent. Include all relevant deposit amounts and timelines for additional deposits.

- Indicate the Time for Acceptance by entering a date by which the seller must accept the offer to prevent the offer from being withdrawn.

- Fill in the Closing Date and location details, specifying the county where the closing will take place.

- Complete the Financing Terms, including the details of third-party financing if applicable. Make sure to mention the loan amount, interest rates, and any additional terms.

- Document the status of Title, including the type of deed to be used for conveying ownership and any existing claims or encumbrances against the property.

- Clarify the Property Condition and whether the buyer will accept the property “as is” or if a due diligence period will be observed.

- Specify the Closing Procedure, detailing who will pay for associated costs and which documents will be provided at closing.

- In sections pertaining to Escrow Agent, note the authority of the agent concerning funds and property held in escrow.

- Fill out any provisions regarding Cure Periods, outlining the time frame for addressing any disputes or defaults.

- Clarify terms regarding the Return of Deposit to ensure you understand the conditions under which deposits can be returned.

- Review details under Default clauses; ensure you understand the implications if either party fails to fulfill their obligations.

- Complete sections related to Notices, including how you wish to communicate between parties.

- Finally, provide signatures and dates where required, ensuring all parties have acknowledged receipt of the contract in the allotted spaces.

Once the form is filled out, consider reviewing it with a legal expert to avoid common pitfalls. Accuracy and clarity in every section ensure that all parties' interests are protected and that the transaction proceeds smoothly.

What You Should Know About This Form

What is the purpose of the Florida Commercial Contract form?

The Florida Commercial Contract form serves as a legally binding agreement between a buyer and a seller in the context of commercial real estate transactions. This document outlines the terms and conditions of the sale, including the purchase price, property description, financing details, and timelines for acceptance and closing. It helps to ensure that both parties have a clear understanding of their rights and obligations, thus reducing the potential for disputes during the sale process.

What key information must be included in the contract?

Several critical pieces of information are necessary for a comprehensive contract. The form requires details about the parties involved, including the buyer and seller, the legal description of the property, and the agreed-upon purchase price. It also needs to specify the deposit amounts, the closing date, and any financing arrangements, including the responsibilities of the buyer to secure funding. Moreover, any contingencies, such as inspections or title conditions, should be clearly stated to protect both parties.

How does the contract address financing and what happens if the buyer cannot secure it?

The contract includes a section that outlines the buyer's obligation to seek third-party financing. The buyer must apply for a loan within a specified period and keep the seller informed about the financing status. If the buyer is unable to obtain loan approval by the designated date, they have the option to either waive the financing contingency or cancel the contract. If the contract is canceled under these circumstances, the buyer’s deposit should be returned, provided they acted in good faith throughout the process.

What obligations does the seller have regarding the property's condition?

Sellers must deliver the property in "as is" condition, meaning they are not required to make repairs or improvements. However, they must maintain the property adequately during the contract period. If the buyer requests inspections or tests during the due diligence period, the seller must allow access for those activities. Any defects discovered must be reported by the buyer within a specific timeframe, and the seller may have an opportunity to remedy those defects before closing.

What should parties know about the closing process?

The closing process involves transferring ownership of the property from the seller to the buyer. Key tasks include delivering necessary documents, such as the deed and any relevant contracts, while ensuring that funds are available for the transaction. The closing date is crucial, as it overrides any other timelines set in the contract. If the seller fails to close by the specified date without just cause, the buyer may seek their deposit's return or pursue specific performance, compelling the seller to complete the sale.

Common mistakes

Filling out the Florida Commercial Contract form can seem daunting, and mistakes occur all too easily. One common error is omitting essential details about the properties involved. Each buyer and seller must be clearly defined, including their full names and addresses. If this information is incomplete or incorrect, it can lead to legal complications later.

Another frequent mistake involves miscalculating the purchase price. Buyers should double-check the figures entered, particularly regarding deposits and totals. If the numbers do not add up appropriately, it could delay closing or even derail the transaction altogether.

The timing of acceptance often causes confusion. Parties must ensure that they adhere to the specified time frames for acceptance. If deadlines are not clearly met, the offer may automatically expire. This deadline concerning counteroffers can create misunderstandings if left unchecked.

People sometimes neglect to clarify the closing date and location. Leaving these sections blank or providing vague information can lead to disputes. It is crucial to specify when and where the closing will occur to ensure that both parties are on the same page.

Additionally, failing to document third-party financing obligations can create serious problems. Buyers must list the amount, terms, and conditions related to any financing they will pursue. Incomplete information here can lead to unmet expectations and potential contractual disputes.

Inspections play a critical role in commercial property transactions. Buyers must clearly outline if they intend to conduct any inspections and the timeline for doing so. Skipping this step may result in missed opportunities to uncover critical property issues prior to completing the sale.

Another area of concern is the handling of deposits. Buyers often overlook the risks involved. If a deposit is not properly allocated or if the contract does not clearly state the circumstances under which it can be returned, it may be difficult to retrieve funds later on.

The title examination section is sometimes not completed accurately. Buyers must give appropriate notice regarding any title defects discovered during the review process. Failing to do so can result in an acceptance of the title as it stands, possibly leading to regrets later.

The risks associated with the property are frequently underestimated. Buyers should take note of potential hazards like radon or uncovering ongoing assessments for special taxes. Not acknowledging these risks might lead to surprise costs that could have been planned for ahead of time.

Lastly, parties frequently overlook the assignment clause. It’s important to clarify whether the contract can be assigned to another party. If this aspect is left ambiguous, it may lead to disputes and issues with any future transactions involving the property.

Documents used along the form

When working with the Florida Commercial Contract form, various additional documents may be required to support the transaction. Each of these documents serves a specific purpose in ensuring the process runs smoothly and according to legal requirements. Below is a list of commonly used forms and documents.

- Counter Offer Form: This document is used when either the buyer or seller wishes to change the terms of the original offer. It allows the receiving party to accept, reject, or propose new terms.

- Disclosure Documents: These include various notices and disclosures required by law, such as those related to lead paint, radon gas, and any other potential hazards associated with the property.

- Escrow Agreement: This agreement outlines the responsibilities of the escrow agent who will hold funds and documents until all terms of the contract have been met.

- Financing Addendum: This document details the specific financing arrangements agreed upon by both parties. It typically includes information about loan amounts, terms, and conditions.

- Title Insurance Policy: This policy protects the buyer from potential title defects or disputes that may arise after the purchase. It ensures that the title is clear and can be legally transferred.

- Closing Statement: This document summarizes the financial aspects of the real estate transaction, including all closing costs, fees, and distributions of funds to ensure transparency at closing.

- Property Condition Disclosure: This form provides details about the current physical condition of the property. It informs the buyer of any known issues before finalizing the sale.

Using these forms and documents correctly can help facilitate a successful commercial real estate transaction in Florida. It ensures that all parties are clear on their responsibilities and that legal requirements are met.

Similar forms

- Residential Purchase Agreement: This document serves a similar purpose in facilitating the sale of residential real estate. It outlines the parties involved, property details, purchase price, and conditions for closing, similar to how the Florida Commercial Contract does for commercial properties.

- Lease Agreement: Just like the Florida Commercial Contract, a Lease Agreement details the terms of rental between a landlord and tenant. It includes information on parties, property description, and obligations of both parties, ensuring clear understanding and legal protection.

- Real Estate Option Agreement: This document allows a buyer the right to purchase a property within a specified period. It also details terms like price and conditions, mirroring the structure of the Florida Commercial Contract in terms of outlining rights and responsibilities.

- Real Estate Sale and Purchase Contract: Similar to the Florida Commercial Contract, this document is for the sale of real estate. It involves purchase terms, deposits, and obligations of the parties, helping ensure both parties are clear on their commitments.

Dos and Don'ts

- Do complete all required fields accurately. Ensure that information about the buyer, seller, and property is clear and precise.

- Do review all terms and conditions carefully before signing. Understanding each provision will help prevent potential disputes.

- Do ensure any financial details, including deposit amounts and purchase price, are correct and reflect the agreed-upon terms.

- Do seek legal advice if needed. Consulting with an attorney can provide valuable insight into the contract's implications.

- Don't leave any blank fields. Incomplete information can lead to confusion and may affect the agreement's validity.

- Don't rush through the signing process. Taking your time allows for careful consideration of the contract's stipulations.

- Don't ignore contingencies. Make sure to include any financing or inspection contingencies that protect your interests.

- Don't sign the contract unless fully understood. Signing without comprehension can lead to unforeseen obligations and liabilities.

Misconceptions

Misconceptions about the Florida Commercial Contract form can lead to misunderstandings and complications in real estate transactions. Below is a list of ten common misconceptions, along with clarifications for each.

- All Commercial Contracts in Florida are the same. Many believe that any commercial contract will suffice for their needs. However, contracts can differ significantly based on property type, specific terms, and the parties involved.

- The contract automatically guarantees property purchase. Signing the contract does not mean the buyer is guaranteed to purchase the property. Conditions outlined in the contract must still be satisfied.

- Agents are responsible for all contract terms and compliance. Buyers and sellers often think their agents handle every detail. Each party should understand their own responsibilities within the contract.

- A verbal agreement suffices after signing the contract. Any changes to the contract must be documented in writing. Verbal agreements are not legally enforceable in this context.

- The closing date is flexible. While there is a possibility to extend the closing date, it must be done according to the provisions set in the contract and requires mutual agreement.

- Deposits are refundable without conditions. Many assume they can get their deposits back at any time. However, specific conditions regarding refunds are outlined in the contract.

- Inspection is optional and can be waived at any time. Buyers often think they can inspect the property after closing. The contract typically allows for inspections to ensure the property meets their expectations beforehand.

- All repairs and deficiencies are the seller's responsibility. Many buyers feel the seller must fix everything prior to closing. However, contracts often specify that properties are sold “as is,” limiting seller responsibilities.

- The buyer can cancel the contract any time before closing. While buyers can cancel in certain situations, doing so without cause after specific deadlines can have financial repercussions or lead to forfeiture of the deposit.

- Legal advice is unnecessary if using a standard form. Some believe that standard templates eliminate the need for legal counsel. However, each transaction has unique considerations that may require legal input for protection.

Key takeaways

When it comes to completing the Florida Commercial Contract form, understanding the nuances can save you time, money, and potential legal headaches. Here are some essential points to consider:

- Clearly Identify Parties: Ensure that the names and roles of both the buyer and seller are accurately filled out to prevent any confusion later.

- Accurate Property Description: Provide a complete street address and legal description of the property. Ambiguities can lead to disputes.

- Purchase Price Clarity: Include all relevant financial details, such as the purchase price, deposits, and any financing arrangements.

- Effective Date Importance: The contract specifies an "Effective Date" which is critical for timelines and deadlines related to the offer and acceptance.

- Understand Timeframes: Be mindful of the time for acceptance and other specified time periods. Missing deadlines can jeopardize the transaction.

- Third-Party Financing Needs: If financing is involved, the buyer must follow the outlined provisions diligently to secure the necessary funds. Failing to do so can result in cancellation of the contract.

- Title Insurance: Be aware of the requirement for title insurance, which protects against future disputes over property ownership.

- Property Condition Clauses: Evaluate the condition of the property carefully. Accepting it "as is" waives your rights to later claims about its defects.

- Closing Procedures: Know the steps for closing, including responsibilities for payments, documentation, and possession of the property.

Reviewing these key takeaways can enhance your understanding and management of the Florida Commercial Contract form, allowing for a smoother transaction process.

Browse Other Templates

Excusable Neglect Examples - It emphasizes the importance of justice, ensuring that every case is resolved based on its merits.

Ovulation Bbt - Previous employer details, including addresses and hire dates, provide context about stability.

Duplicate Vehicle Registration Request,Replacement Registration Card Application,Lost Plate Replacement Form,Vehicle Registration Update Request,Registration Plate Replacement Application,Weight Class Sticker Replacement Form,Illegible Plate Authoriz - It's advisable to track your application after submission.