Fill Out Your Florida Lawyers Support Form

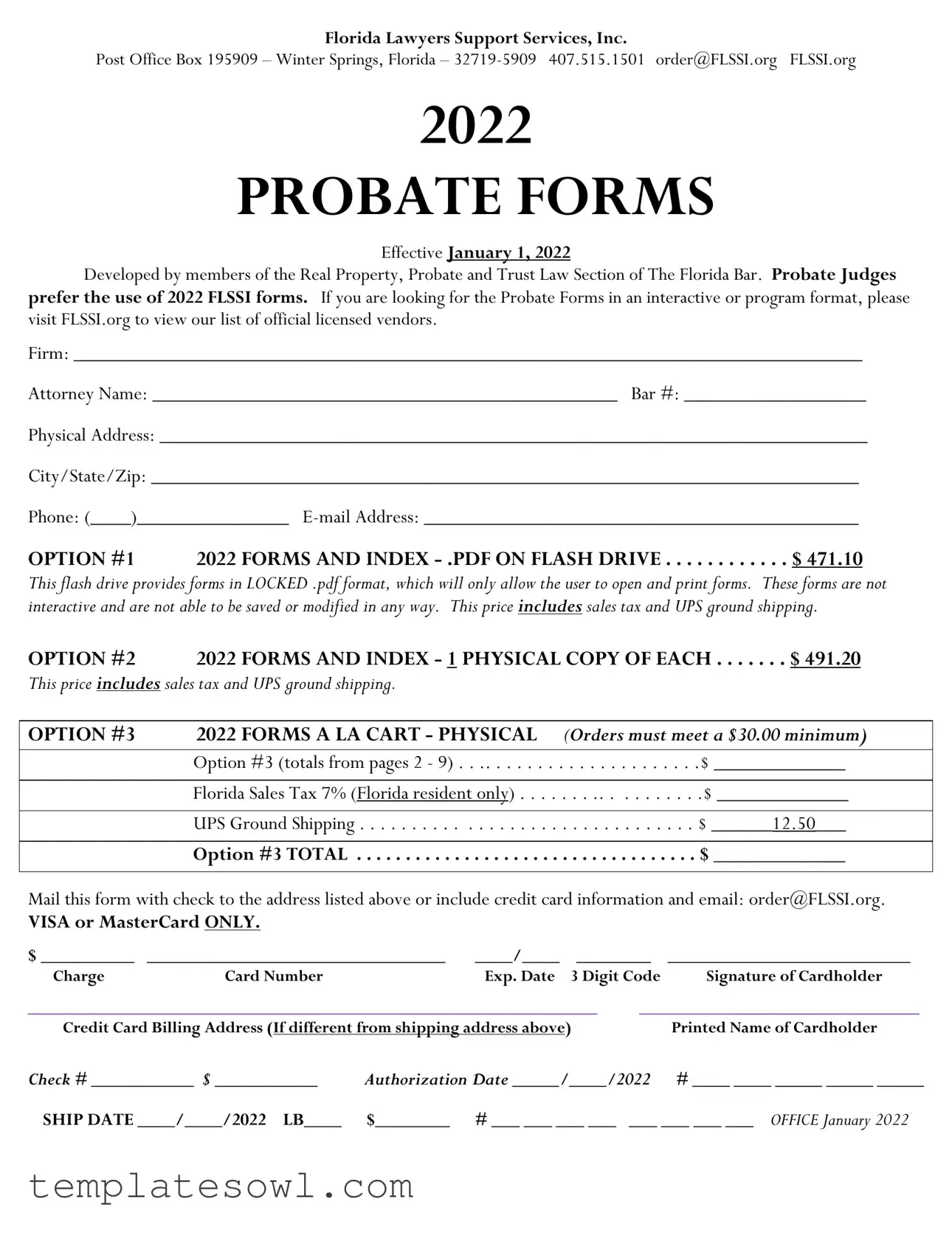

The Florida Lawyers Support form serves as a vital resource for legal professionals involved in probate law. Developed by the Real Property, Probate and Trust Law Section of The Florida Bar, these forms have been standardized to enhance workflow, ensure compliance, and meet the preferences of probate judges across Florida. Effective January 1, 2022, the forms were designed to cater to a range of probate-related scenarios, from the initiation of probate proceedings to notifications required throughout the legal process. They come in various formats, including a flash drive with non-interactive locked PDF files, physical copies, and the option to order forms individually. Additionally, the form includes pricing details along with shipping and tax provisions, providing clear and concise information for attorneys to make their selections. By streamlining the transition into probate court matters, the Florida Lawyers Support form not only simplifies the preparation of necessary documentation but also emphasizes the importance of utilizing up-to-date forms to support case outcomes.

Florida Lawyers Support Example

Florida Lawyers Support Services, Inc.

Post Office Box 195909 – Winter Springs, Florida –

2022

PROBATE FORMS

Effective January 1, 2022

Developed by members of the Real Property, Probate and Trust Law Section of The Florida Bar. Probate Judges prefer the use of 2022 FLSSI forms. If you are looking for the Probate Forms in an interactive or program format, please visit FLSSI.org to view our list of official licensed vendors.

Firm: ______________________________________________________________________________

Attorney Name: ______________________________________________ Bar #: __________________

Physical Address: ______________________________________________________________________

City/State/Zip: ______________________________________________________________________

Phone: (____)_______________

OPTION #1 2022 FORMS AND INDEX

This flash drive provides forms in LOCKED .pdf format, which will only allow the user to open and print forms. These forms are not interactive and are not able to be saved or modified in any way. This price includes sales tax and UPS ground shipping.

OPTION #2 |

2022 FORMS AND INDEX - 1 PHYSICAL COPY OF EACH |

$ 491.20 |

||

This price includes sales tax and UPS ground shipping. |

|

|

|

|

|

|

|

||

OPTION #3 |

2022 FORMS A LA CART - PHYSICAL |

(Orders must meet a $30.00 minimum) |

||

|

Option #3 (totals from pages 2 - 9) . |

. .. . . . . . . |

. . . . . . . . . . . . . .$ _____________ |

|

|

|

|

||

|

Florida Sales Tax 7% (Florida resident only) . . . . |

. . . .. . . . . . . . . .$ _____________ |

||

|

|

|

||

|

UPS Ground Shipping |

. . . . . . . . . . . . . . . . . . . . . . $ ______12.50___ |

||

|

|

|

|

|

|

Option #3 TOTAL |

. . . . . . . . . . |

. . . . . . . . . . . . . . $ _____________ |

|

|

|

|

|

|

Mail this form with check to the address listed above or include credit card information and email: order@FLSSI.org.

VISA or MasterCard ONLY.

$ __________ |

________________________________ |

____/____ |

________ |

__________________________ |

||

Charge |

Card Number |

|

Exp. Date |

3 Digit Code |

Signature of Cardholder |

|

_____________________________________________________________ |

______________________________ |

|||||

Credit Card Billing Address (If different from shipping address above) |

|

Printed Name of Cardholder |

||||

Check # ___________ $ ___________ |

Authorization Date _____/____/2022 |

# ____ ____ _____ _____ _____ |

||||

SHIP DATE ____/____/2022 LB____ |

$________ |

# ___ ___ ___ ___ |

___ ___ ___ ___ OFFICE January 2022 |

|||

INDEX of all probate forms; includes rule and statutory references pertaining to each form.

#______@ $25.00 each

I.GENERAL PROBATE RELATED FORMS

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#_____@ $2.50 each

#______@ $5.00 each

#_____@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#_____@ $2.50 each

#_____@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

2

#______@ $2.50 each

#______@ $2.50 each

II.FORMS FOR ABBREVIATED PROBATE PROCEEDINGS

#______@ $7.50 each

– single petitioner)

#______@ $10.00 each

#______@ $10.00 each

– single petitioner)

#______@ $10.00 each

–multiple petitioners))

#______@ $10.00 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#_____@ $2.50 each

#_____@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

3

#______@ $5.00 each

III.OPENING FORMAL ADMINISTRATION

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

4

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

Nonresident

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

5

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

6

#______@ $2.50 each

#______@ $2.50 each

#_______@ $5.00 each

#______@ $2.50 each

IV. SPECIAL PROCEEDINGS

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $7.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

7

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

V.CLOSING ADMINISTRATION

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $17.50 each

#______@ $5.00 each

8

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $7.50 each

Certificate of Distribution of Real Property (corporate

representatives)

#______@ $5.00 each

#______@ $5.00 each

#______@ $5.00 each

#______@ $2.50 each

#______@ $2.50 each

#______@ $5.00 each

#______@ $2.50 each

9

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | The form is governed by Florida Statutes Chapters 731 through 735, covering probate, trust administration, and related procedures. |

| Form Provider | Florida Lawyers Support Services, Inc. (FLSSI) developed the form with contributions from the Real Property, Probate, and Trust Law Section of The Florida Bar. |

| Effective Date | The forms are effective as of January 1, 2022, ensuring compliance with the most recent legal standards. |

| Preferred Usage | Probate judges in Florida prefer the utilization of 2022 FLSSI forms for handling probate-related matters. |

| Form Options | Three options for obtaining forms exist: a PDF on flash drive, a physical copy of each form, or à la carte purchasing of physical forms. |

| Shipping Details | All prices include Florida sales tax and UPS ground shipping, which streamlines the ordering process for users. |

| Contact Information | For orders, individuals can reach FLSSI at 407.515.1501 or order@FLSSI.org for assistance and inquiries. |

Guidelines on Utilizing Florida Lawyers Support

Once you have completed the Florida Lawyers Support form, make sure to double-check your information. This form is crucial for ordering probate forms, and accuracy is essential. After filling it out, you will submit it via mail or email along with the required payment.

- Fill in your firm’s name at the top of the form.

- Provide the attorney's name and bar number.

- Enter your physical address, city, state, and zip code.

- Write your phone number and email address in the designated areas.

- Select one of the three options for ordering the forms and write the corresponding total in the blank spaces.

- If you chose Option #3, list the quantities of specific forms you wish to order and calculate the total, including sales tax if applicable.

- Fill in the credit card information if you choose to pay via card. Ensure you include the charge card number, expiration date, and the 3-digit code.

- Sign the form to authorize the transaction.

- Provide the credit card billing address if it differs from your shipping address.

- If paying by check, indicate the check number and the total amount there.

- Complete the authorization date and ship date fields.

- Mail the completed form along with payment to the address listed on the form.

What You Should Know About This Form

What is the Florida Lawyers Support form?

The Florida Lawyers Support form is a document designed to facilitate the ordering of probate forms through Florida Lawyers Support Services, Inc. It is particularly beneficial for legal professionals needing standardized probate forms to comply with Florida laws. The form includes options for obtaining these documents either as a PDF on a flash drive or in physical format.

Who should use the Florida Lawyers Support form?

This form is intended for attorneys and legal firms operating in Florida who require access to probate forms for their practice. It is particularly useful for those who prefer or are required to use the updated 2022 forms as recommended by probate judges in the state.

What are the available options for ordering forms?

There are several options available through the Florida Lawyers Support form. Users can choose from:

- Option #1: A flash drive containing locked PDF formats of all forms for $471.10.

- Option #2: One physical copy of each form for $491.20.

- Option #3: Individual physical forms, with a minimum order total of $30.00.

What payment methods are accepted?

The form allows for payment via check or credit card. If opting to pay by credit card, only Visa and MasterCard are accepted, and the cardholder must provide the credit card number, expiration date, and the security code.

Are the forms interactive?

The forms provided on the flash drive (Option #1) are in a locked PDF format. This means they can be printed, but they cannot be modified or saved as editable documents. If an interactive format is required, individuals are encouraged to visit the designated website for licensed vendors.

How do I send my completed order?

Once the form is completed, it can be mailed with a check to the address provided in the form. If using a credit card, individuals may also email the form to the designated email address. Ensure all relevant payment information is accurately filled out to avoid processing delays.

Is there a sales tax for these orders?

Yes, a 7% sales tax applies for residents of Florida. This tax is added to the total when ordering physical forms or the flash drive.

Can I purchase individual forms?

Yes, under Option #3, individuals may order forms on an a la carte basis. However, the total order must meet a minimum of $30.00. Prices for each individual form vary, and a specific table is provided in the form for reference.

Where can I find more information about the forms and services offered?

For additional details and an extensive list of all available forms, individuals can visit the official website: FLSSI.org. This site provides the necessary resources for attorneys looking to stay updated on the available probate forms and services.

Common mistakes

Completing the Florida Lawyers Support form can be straightforward, but several common mistakes can hinder the process. First and foremost, many individuals fail to provide a complete and accurate physical address. An incomplete address may lead to delays in processing and delivery of the necessary documents.

Another frequent error involves the lack of necessary contact information. People sometimes overlook including their current phone number or email address. Without these, communication regarding the order may become challenging, leading to missed updates or important information.

Using the wrong payment method is another common mistake. The form explicitly states that only Visa or MasterCard are accepted. Some may mistakenly assume they can use other forms of payment, like American Express or Discover, which will not be processed.

An additional oversight is failing to double-check the charge card information. Incorrect card numbers or expiration dates can result in denied transactions. This can be easily avoided by verifying all details before submission.

Many users also neglect to sign the form. The signature of the cardholder is required for payment authorization. Without it, the order will not be processed, resulting in unnecessary delays.

When calculating totals for options selected, people sometimes miscalculate, which can lead to incorrect payments. It is crucial to tally all selections accurately and ensure that sales tax and shipping costs are included.

Submitting the form without the required minimum order amount for itemized selections is another common error. For example, option #3 requires a $30.00 minimum. Orders falling below this amount will not be processed.

Some individuals fail to verify that they are ordering the correct forms. With many options available, not reviewing the specific form codes can lead to ordering the wrong documents. This mistake can unnecessarily complicate the probate process.

Lastly, forgetting to provide a credit card billing address when it differs from the shipping address can lead to payment processing issues. This information is essential to prevent potential fraud and ensure the transaction is successful.

By being mindful of these common errors, individuals can smoothly navigate the process of completing the Florida Lawyers Support form, ensuring their orders are processed efficiently and accurately.

Documents used along the form

The Florida Lawyers Support form is part of a broader set of documents that facilitate probate proceedings in Florida. Understanding these companion forms can streamline your legal process, making it easier to navigate the complexities of probate law. Below is a list of additional forms that are commonly used alongside the Florida Lawyers Support form.

- Petition for Summary Administration: This document allows for a simplified probate process when the estate qualifies, particularly for smaller estates. It expedites the distribution of assets to heirs.

- Order Admitting Will to Probate: This form officially acknowledges a will as valid and prepares the estate for formal administration, allowing the designated personal representative to act.

- Notice to Creditors: This notice informs any potential creditors of the probate proceedings, allowing them to make claims against the estate if applicable. Timely notifications are crucial to address any outstanding debts.

- Waiver of Notice: This form allows interested parties to waive their right to receive formal notifications regarding probate proceedings, which can simplify and speed up the process.

- Final Accounting: This essential document summarizes the financial transactions of the estate and outlines how assets have been distributed. It ensures transparency and helps obtain court approval for the final settlement of the estate.

Utilizing these forms with the Florida Lawyers Support can help ensure that your probate process runs smoothly and efficiently. It is always advisable to consult with a legal professional if you have specific questions regarding your situation.

Similar forms

- Uniform Probate Code (UPC): Like the Florida Lawyers Support form, the UPC provides a standardized framework for probate procedures across various jurisdictions. Both documents aim to streamline the probate process, making it more efficient for those navigating estate issues.

- California Probate Forms: Similar to the Florida Lawyers Support form, California's probate forms are designed to facilitate the administration of estates. They serve similar functions, ensuring that legal requirements are met while simplifying the documentation process for users.

- New York SCPA Forms: The Surrogate's Court Procedure Act (SCPA) forms in New York share the same intent as the Florida Lawyers Support form. They outline processes for administering estates and provide necessary documentation tailored to the state’s legal requirements.

- Texas Probate Code Documents: Like the Florida Lawyers Support form, documents issued under the Texas Probate Code provide critical guidelines and templates for managing probate cases. Both sets of documents aim to standardize procedural practices within their respective states.

- Washington State Probate Forms: The Washington probate forms serve a function akin to that of the Florida Lawyers Support form. They provide templates and procedural guidance for those involved in estate administration, emphasizing clarity and compliance with state laws.

Dos and Don'ts

Do's

- Provide complete and accurate information on the form.

- Double-check the attorney's Bar number to ensure it matches official records.

- Include a preferred method of payment, either credit card or check, with required details.

- Sign the form to authorize the order and payment.

- Include the correct shipping address for your order delivery.

- Contact customer service for any questions or clarifications necessary.

Don'ts

- Do not leave any required fields blank.

- Do not attempt to modify any of the forms after downloading.

- Don’t forget to check the application deadline for submitting the form.

- Do not use credit cards other than VISA or MasterCard for payment.

- Do not mail the form without ensuring all information is correct.

- Don't ignore the shipping fees when calculating the total cost.

Misconceptions

- Misconception 1: The Florida Lawyers Support form is not necessary.

- Misconception 2: All forms are available for free online.

- Misconception 3: I can modify the forms as needed.

- Misconception 4: It’s okay to submit outdated forms.

- Misconception 5: I don’t need to pay sales tax if I order online.

- Misconception 6: I can use these forms for any type of legal proceeding.

- Misconception 7: All forms are the same across the United States.

- Misconception 8: The form can be submitted electronically.

- Misconception 9: I don’t need an attorney to use the forms.

Many people believe that any form can be used for probate matters. However, using the correct, approved forms is essential to ensure compliance with Florida law.

While some forms can be found online, the comprehensive set provided by the Florida Lawyers Support is not free. It’s vital to use the correct official forms, which come with a fee.

Users often think they can edit the forms to better fit their needs. However, the forms are locked in PDF format to maintain their integrity and compliance.

Submitting outdated forms can lead to delays and potential legal issues. Always ensure that you're using the most current version, as specified by Florida laws.

Many assume that online orders are exempt from sales tax. In Florida, sales tax applies to purchases, regardless of how they are ordered.

These forms are specifically designed for probate matters. Using them for unrelated legal issues can lead to complications or invalid submissions.

Each state has its own specific rules and forms. The Florida Lawyers Support forms are tailored specifically for Florida's probate laws.

Many people think the forms can be submitted online, but paper submissions via mail are often required, depending on the form type and the court.

While it's true that individuals can represent themselves, seeking legal advice is recommended, especially considering the complexities of probate laws.

Key takeaways

The Florida Lawyers Support form is designed for ordering official probate forms from Florida Lawyers Support Services, Inc.

Two primary options exist for obtaining the forms: a flash drive containing locked PDF files or physical copies of each form.

Orders must include a minimum purchase amount if choosing forms a la carte. The minimum requirement is $30.

Payment can be made by check or credit card (Visa or MasterCard only). If utilizing a credit card, complete all required fields accurately.

Shipping costs, sales tax for Florida residents, and pricing for individual forms should be calculated and included in the total order amount.

Browse Other Templates

Ca Epn - Clear completion of the form assists in a smooth debt resolution process.

Ethiopian Embassy - This form serves as an official request for the power to act on another’s behalf.

Subrogation Rights - This form ultimately aims to support claimants in recovering costs associated with their injuries.