Fill Out Your Florida Lottery Claim Form

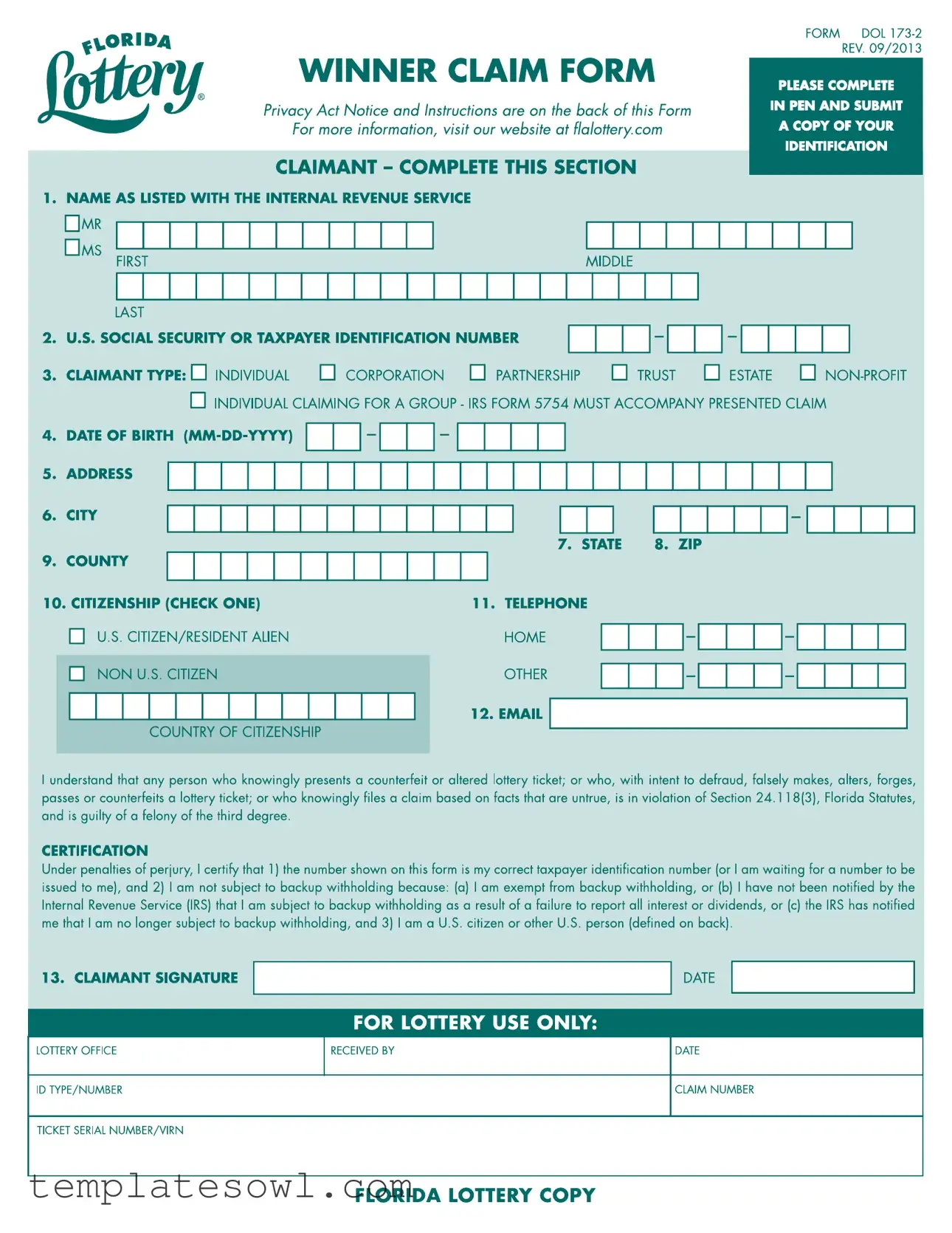

The Florida Lottery Claim form is an essential document for anyone who has won a lottery prize of $600 or more. This form, identified as DOL 173-2, must be filled out completely and accurately in order to facilitate the claim process. It requires the winner's name, as registered with the Internal Revenue Service, and includes options for various claimant types, such as individuals, corporations, or trusts. Additionally, claimants must provide their Social Security or Taxpayer Identification number, verifying their identity and eligibility for the prize. A date of birth entry, citizenship status, and an email address are also needed, along with a signature that certifies the information provided is true and accurate. Privacy regulations dictate that personal information, including Social Security numbers, may be collected for tax reporting and verification purposes. The form also advises claimants on how to maintain their lottery ticket safely and outlines the specific steps to claim different game prizes. Instructions detail submission methods, including in-person claims at retail locations or lottery offices, and guidelines for claiming larger prizes through certified mailing, all of which are vital to successfully redeeming lottery winnings.

Florida Lottery Claim Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Essential Information | The Florida Lottery Winner Claim Form (Form DOL 173-2) is essential for claiming lottery prizes, especially those valued at $600 or more. |

| Identification Requirement | When claiming a prize of $600 or more, the claimant must submit a copy of an acceptable form of identification along with the completed claim form. |

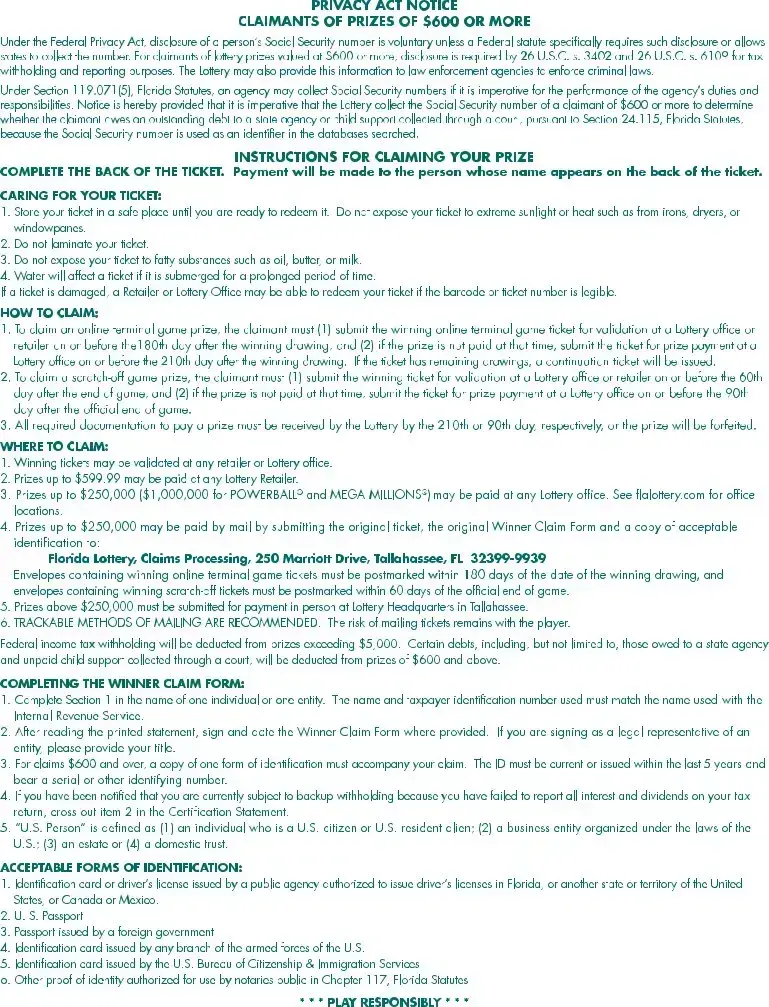

| Submission Deadline | For online terminal game prizes, claims must be submitted within 180 days after the winning drawing. Scratch-off game prizes must be claimed within 60 to 90 days depending on the game. |

| Tax Obligations | Winnings over $5,000 are subject to federal income tax withholding. Additionally, certain debts can be deducted from prizes of $600 and above, including child support debts. |

| Governing Laws | The claim process is governed by several Florida Statutes, including Sections 24.115 and 119.071(5), which outline the requirements for prize claims and the collection of Social Security numbers. |

Guidelines on Utilizing Florida Lottery Claim

To successfully fill out the Florida Lottery Claim Form, follow these clear steps to ensure that your claim is processed without delay. Once you have the form completed, you will be ready to submit your claim to the appropriate lottery office or retailer.

- Enter your full name as listed with the Internal Revenue Service, selecting the appropriate title (Mr. or Ms.) at the top of the form.

- Provide your Social Security Number or Taxpayer Identification Number in the specified fields.

- Select the claimant type from the options provided: Individual, Corporation, Partnership, Trust, or Non-Profit. If you are claiming for a group, include IRS Form 5754 with your claim.

- Fill in your date of birth in the format MM-DD-YYYY.

- State your country of citizenship and email address.

- Review the certification statement. By signing this, you confirm the accuracy of your information and your eligibility for the claim.

- Sign and date the form in the provided space.

- Attach a current copy of your identification that meets the requirements (ID issued within the last 5 years with an identifying number).

Double-check all entries for accuracy before submission. Send the completed form, along with your ticket and ID, to the specified Florida Lottery address. Timely submission of these documents is crucial for processing your claim smoothly.

What You Should Know About This Form

What is the process for submitting a Florida Lottery Claim form?

To submit a Florida Lottery Claim form, you need to follow several steps. First, make sure that the back of your winning lottery ticket is completed. Payment will only be made to the person whose name appears on that back. Next, you’ll need to fill out the claim form completely in pen, providing accurate information, including your taxpayer identification number. Remember, if your prize is $600 or more, you must attach a current copy of your identification. After you’ve prepared the form and documentation, decide whether to submit your claim in person at a Lottery office or by mail. If you choose to mail it, the envelope must be postmarked within the required timeframe based on your type of ticket. Don’t forget to maintain copies of all documents sent for your records!

What forms of identification are acceptable when claiming a lottery prize?

You will need to provide a form of identification when you claim a lottery prize of $600 or more. Acceptable forms include a driver’s license or identification card issued by any public agency in Florida or other U.S. states, U.S. passports, and military identification cards, among others. It’s important that the ID you submit is current—or issued within the last five years—and includes a serial or identifying number. This requirement helps ensure your identity is verified correctly.

What happens if my ticket is damaged?

If your lottery ticket is damaged, you may still be able to redeem it, provided that the barcode or ticket number is legible. It’s advisable to visit a Retailer or a Lottery office for validation. They will assess the condition of the ticket and determine if you can claim your prize. To prevent damage, always store your ticket in a safe place, away from sunlight, heat, and moisture. Taking good care of your ticket can help avoid these situations altogether.

What are the deadlines for claiming lottery prizes?

The deadlines for claiming lottery prizes vary based on the type of game. For online terminal game prizes, you must submit your winning ticket within 180 days after the winning drawing. For scratch-off games, the timeline is shorter; you have 60 days after the end of the game to validate your ticket and another 90 days to complete your claim for payment. Failing to meet these deadlines means you risk forfeiting your prize, as all necessary documentation must be received by the Lottery within these timeframes. Make sure to keep track of these dates to ensure you don’t miss out!

Common mistakes

Submitting a Florida Lottery Claim Form can seem straightforward, but many people make common errors that can delay their prize payment. One significant mistake is failing to complete the name section accurately. The name must match exactly as listed with the IRS. If the name on the ticket doesn't align with the claim form or taxpayer identification number, the claim may be rejected, and verification could be time-consuming.

Another frequent pitfall is neglecting to include the required identification. For claims over $600, the form must be accompanied by a copy of acceptable identification. Many individuals overlook this step, thinking the ticket itself is sufficient. Submitting without proper ID can lead to rejection, causing further delays in receiving funds.

Incorrectly signing the form is also a prevalent error. Claimants must sign and date the Winner Claim Form in the designated area. If someone is signing on behalf of a business or entity, they need to include their title. Omitting this detail could result in the form being deemed incomplete, which complicates the claims process.

Lastly, people often ignore the backup withholding notice. If you’ve been informed that you are subject to backup withholding, you must cross out item 2 in the Certification Statement. Failing to do so could complicate matters when the Lottery processes your claim. Avoiding these mistakes can help ensure a smoother claiming experience and faster access to your winnings.

Documents used along the form

Claiming a prize from the Florida Lottery can be an exciting experience, but it also requires proper documentation. The Florida Lottery Claim Form is just the beginning. Here’s a list of other important documents and forms you might need to secure your winnings smoothly:

- ID Verification: A government-issued identification card is essential when claiming prizes of $600 or more. Acceptable IDs include a Florida driver’s license, U.S. passport, or military identification.

- IRS Form 5754: If you’re claiming a prize on behalf of a group, this form helps report the identities of all individuals sharing in the prize. It’s a critical step for tax purposes.

- Ticket Receipt: Always keep the receipt or a copy of the ticket as proof of purchase. This can be vital if there’s a dispute regarding the ticket validity.

- W-9 Form: This form may be requested by the Florida Lottery for tax reporting purposes when claiming larger prizes. It ensures your taxpayer information is correct.

- Affidavit of Loss: If your lottery ticket is lost or stolen, this legal document declares that you no longer possess it. It may be required to begin the claim process for lost tickets.

- Bank Verification Form: If you choose to have your prize deposited directly into your bank account, this form provides the necessary banking details to process the transfer.

- Power of Attorney: If someone is claiming a prize on your behalf, you’ll need to provide a Power of Attorney document authorizing them to act in your stead. This ensures a smooth transition during the claim process.

Understanding these documents and having them prepared can make the claiming process much less stressful. Always check the Florida Lottery's website for the most up-to-date information and procedures.

Similar forms

The Florida Lottery Claim Form is an important document for those claiming lottery prizes, but it shares similarities with several other forms. Here’s a look at ten documents that the Florida Lottery Claim Form is similar to, along with an overview of their commonalities.

- W-2 Form: Just like the Florida Lottery Claim Form, the W-2 form requires accurate identification information. It collects data to report earnings to the IRS and ensure people are taxed correctly.

- I-9 Form: This employment eligibility verification form is similar as it requires individuals to provide proof of identity. Both documents aim to ensure that the party involved is valid and eligible for their respective claims or payments.

- Claim Form for Insurance Benefits: When filing for insurance claims, individuals must complete forms that also demand identification and detailed information about the claim, much like the Florida Lottery Claim Form.

- Application for a Driver's License: Similar to the lottery claim form, this application demands personal information, proof of identity, and signature, establishing the identity of the applicant.

- Tax Return Form: Just as the lottery claim process ensures that taxes are calculated, tax returns gather personal and financial information, requiring accurate identification and signatures for submission.

- Passport Application: Both the passport application and the lotto claim form require personal identification details and support documents to verify identity and citizenship status.

- Social Security Card Application: To obtain a Social Security card, individuals must provide identifying information, similar to the Florida Lottery Claim Form's requirements for valid identification.

- Home Lease Agreement: This agreement typically needs identification and personal details of the parties involved, paralleling the requirement for complete and accurate information inherent in the lottery claim form.

- Mortgage Application: Similar to the Florida Lottery Claim Form, a mortgage application requires potential borrowers to submit detailed personal information, financial disclosures, and identification to validate their identity and financial status.

- Voter Registration Form: Much like the lottery claim form, a voter registration form asks for personal information, identification and verification of residency to ensure eligibility for voting.

Each of these documents shares a common goal: to validate identity and ensure that claims, applications, or registrations are processed fairly and accurately. Understanding these similarities can help people navigate the administrative landscape more effectively.

Dos and Don'ts

7 Things You Should Do When Filling Out the Florida Lottery Claim Form:

- Complete the form in pen to ensure legibility.

- Provide a copy of your identification that is current or issued within the last 5 years.

- Sign and date the Winner Claim Form to certify the information is accurate.

- Ensure your name and taxpayer identification number match what is on file with the IRS.

- Submit your claim to the appropriate address within the required timeframes.

- Keep your winning ticket in a safe place until you are ready to claim the prize.

- Double-check that all required documentation is included with your claim.

7 Things You Shouldn't Do When Filling Out the Florida Lottery Claim Form:

- Do not submit a damaged ticket unless it is still legible.

- Do not laminate your ticket, as this can damage it.

- Do not expose your ticket to extreme heat or sunlight.

- Do not forget to include your correct email and date of birth.

- Do not claim the prize in a name or with an ID that does not match the ticket owner.

- Do not neglect to read the instructions carefully before submitting.

- Do not delay in submitting your claim, as time limits apply.

Misconceptions

There are several misconceptions regarding the Florida Lottery Claim form. Addressing these can help potential claimants navigate the process more effectively.

- Misconception 1: Claiming a prize is the same as cashing a ticket.

- Misconception 2: All winning tickets can be redeemed at any location.

- Misconception 3: You can wait indefinitely to claim your prize.

- Misconception 4: You do not need to provide ID if the prize is small.

- Misconception 5: Completing the form is optional.

- Misconception 6: Only winners need to fill out a Claim form.

- Misconception 7: You can laminate your ticket for protection.

Winning lottery tickets must be validated, and the prize must be claimed through the appropriate form. Simply cashing a ticket at a retailer does not fulfill this requirement for prizes over $599.

While smaller prizes can typically be claimed at retailers, larger prizes require validation and should be claimed at designated Lottery offices or by mail.

Each ticket has specific deadlines by which claims must be submitted. Failure to meet these deadlines results in forfeiture of the prize.

For any claim of $600 or more, a valid form of identification is mandatory. This helps verify the claimant's identity.

Filling out the Claim form accurately is essential. It must be completed and submitted correctly for the claim to be processed.

Individuals claiming prizes on behalf of a group must also complete the appropriate forms and provide additional documentation.

Laminating a lottery ticket can damage it, making it difficult or impossible to validate. Proper care includes storing tickets safely without tampering.

Key takeaways

Filling out and using the Florida Lottery Claim form involves several important steps. Below are key takeaways for efficient completion and submission:

- Complete in Pen: Use a pen to fill out the form. Avoid any alterations or corrections.

- Identification Required: Submit a copy of an acceptable form of identification for claims of $600 or more.

- Claimant Details: Fill out your name exactly as listed with the Internal Revenue Service.

- Claimant Type: Specify whether you are an individual, corporation, partnership, trust, or a nonprofit organization.

- Deadline Awareness: Submit the winning ticket within defined timeframes: 180 days for online games and 60 days for scratch-offs.

- Multiple Claims: For individuals claiming on behalf of a group, IRS Form 5754 must be included with your claim.

- Damaged Tickets: If your ticket is damaged but the barcode or number is legible, a retailer or Lottery office may still validate it.

- Mailing Options: Prizes up to $250,000 can be claimed by mail. Ensure your envelope is postmarked within the specified timelines.

- Certification of Information: Certify your information is accurate. Misrepresenting facts can lead to legal consequences.

- Trackable Mail: For high-value claims, use trackable mailing methods to manage submission risks effectively.

Browse Other Templates

Religious Exemption Form Tn 2023 - By completing this form, you affirm your child's exemption from vaccinations required by the state.

Daycare Forms - The assessment aims to ensure that clients/residents receive appropriate and effective services.

Letter to School for Absence of Child - Increases awareness among schools regarding student health conditions.