Fill Out Your Florida Proof Loss Form

The Florida Proof of Loss form is a critical document for those filing claims under an insurance policy. It outlines essential information regarding the loss, detailing the policy number, date of loss, and any relevant claims associated with the event. Insured individuals must provide a sworn statement, confirming the accuracy and completeness of the information submitted. This form includes data such as the cause of loss, amount of insurance, and actual cash value of the property involved at the time of the incident. Furthermore, it requires disclosure of any mortgages or liens on the property. Any discrepancies, omissions, or misleading information can lead to severe legal consequences, underscoring the importance of honesty and precision when completing the form. The notarization process at the end of the document further emphasizes its legal weight, ensuring that the information presented is verified and trustworthy. Understanding the nuances of the Florida Proof of Loss form can significantly impact the success of an insurance claim, making it imperative for claimants to approach this task diligently.

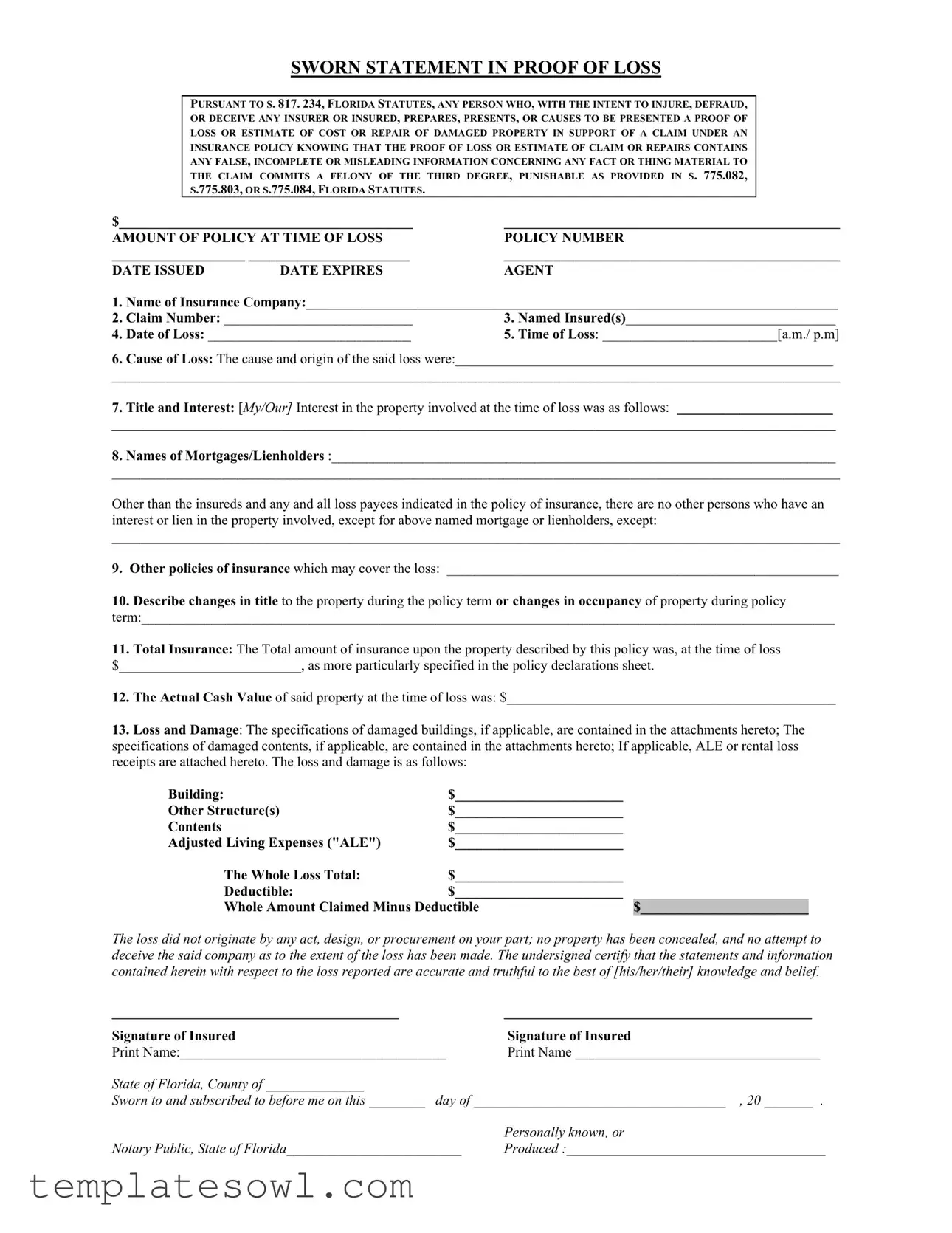

Florida Proof Loss Example

SWORN STATEMENT IN PROOF OF LOSS

PURSUANT TO S. 817. 234, FLORIDA STATUTES, ANY PERSON WHO, WITH THE INTENT TO INJURE, DEFRAUD, OR DECEIVE ANY INSURER OR INSURED, PREPARES, PRESENTS, OR CAUSES TO BE PRESENTED A PROOF OF LOSS OR ESTIMATE OF COST OR REPAIR OF DAMAGED PROPERTY IN SUPPORT OF A CLAIM UNDER AN INSURANCE POLICY KNOWING THAT THE PROOF OF LOSS OR ESTIMATE OF CLAIM OR REPAIRS CONTAINS ANY FALSE, INCOMPLETE OR MISLEADING INFORMATION CONCERNING ANY FACT OR THING MATERIAL TO THE CLAIM COMMITS A FELONY OF THE THIRD DEGREE, PUNISHABLE AS PROVIDED IN S. 775.082, S.775.803, OR S.775.084, FLORIDA STATUTES.

$__________________________________________ |

________________________________________________ |

|

AMOUNT OF POLICY AT TIME OF LOSS |

POLICY NUMBER |

|

___________________ _______________________ |

________________________________________________ |

|

DATE ISSUED |

DATE EXPIRES |

AGENT |

1.Name of Insurance Company:____________________________________________________________________________

2. |

Claim Number: ___________________________ |

3. |

Named Insured(s)______________________________ |

4. |

Date of Loss: _____________________________ |

5. |

Time of Loss: _________________________[a.m./ p.m] |

6.Cause of Loss: The cause and origin of the said loss were:______________________________________________________

________________________________________________________________________________________________________

7.Title and Interest: [My/Our] Interest in the property involved at the time of loss was as follows: ____________________

_____________________________________________________________________________________________

8.Names of Mortgages/Lienholders :________________________________________________________________________

________________________________________________________________________________________________________

Other than the insureds and any and all loss payees indicated in the policy of insurance, there are no other persons who have an interest or lien in the property involved, except for above named mortgage or lienholders, except:

________________________________________________________________________________________________________

9.Other policies of insurance which may cover the loss: ________________________________________________________

10.Describe changes in title to the property during the policy term or changes in occupancy of property during policy

term:___________________________________________________________________________________________________

11.Total Insurance: The Total amount of insurance upon the property described by this policy was, at the time of loss $__________________________, as more particularly specified in the policy declarations sheet.

12.The Actual Cash Value of said property at the time of loss was: $_______________________________________________

13.Loss and Damage: The specifications of damaged buildings, if applicable, are contained in the attachments hereto; The specifications of damaged contents, if applicable, are contained in the attachments hereto; If applicable, ALE or rental loss receipts are attached hereto. The loss and damage is as follows:

Building: |

$________________________ |

|

Other Structure(s) |

$________________________ |

|

Contents |

$________________________ |

|

Adjusted Living Expenses ("ALE") |

$________________________ |

|

The Whole Loss Total: |

$________________________ |

|

Deductible: |

$________________________ |

|

Whole Amount Claimed Minus Deductible |

$________________________ |

|

The loss did not originate by any act, design, or procurement on your part; no property has been concealed, and no attempt to deceive the said company as to the extent of the loss has been made. The undersigned certify that the statements and information contained herein with respect to the loss reported are accurate and truthful to the best of [his/her/their] knowledge and belief.

_________________________________________ |

____________________________________________ |

Signature of Insured |

Signature of Insured |

Print Name:______________________________________ |

Print Name ___________________________________ |

State of Florida, County of ______________

Sworn to and subscribed to before me on this ________ day of ____________________________________ , 20 _______ .

|

Personally known, or |

Notary Public, State of Florida_________________________ |

Produced :_____________________________________ |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Florida Proof of Loss form serves to document an insured party’s claim following a loss or damage to property. It provides detailed information required by the insurer to process the claim efficiently. |

| Governing Law | This form is governed by Section 817.234 of the Florida Statutes, which outlines the legal implications of submitting false information in a proof of loss. |

| Fraudulent Claims | Submitting false, incomplete, or misleading information on this form constitutes a felony of the third degree. Legal penalties are set forth in Sections 775.082, 775.083, or 775.084 of the Florida Statutes. |

| Information Required | The form requires specific details, including the amount of policy coverage at the time of loss, the date and time of the loss, and the cause of the loss, among others. |

| Sworn Statement | The information provided on the form must be certified as accurate by the insured. A notary public must witness the signing to ensure the statement’s authenticity. |

| Complete Documentation | The form may require supplemental attachments, such as specifications of damaged property and any rental loss receipts, to support the claim fully. |

Guidelines on Utilizing Florida Proof Loss

Filling out the Florida Proof Loss form is an important step in the claims process for any loss covered by your insurance policy. You will provide details about the loss, the property involved, and any relevant insurance information. Make sure all the information you provide is accurate, as incorrect details can complicate your claim.

- Begin by entering the name of your insurance company at the top of the form.

- Next, write your claim number in the designated space.

- List the names of the named insured(s) on the policy.

- Input the date of loss in the prescribed format.

- Specify the time of loss, indicating whether it's a.m. or p.m.

- Describe the cause of loss, detailing what happened leading to the claim.

- Specify your title and interest in the property at the time of the loss.

- List the names of any mortgages or lienholders related to the property.

- If applicable, mention any other policies of insurance that may cover the loss.

- Note any changes in title or occupancy during the policy term.

- Provide the total insurance amount for the property as noted in the policy.

- State the actual cash value of the property at the time of the loss.

- Detail the loss and damage in the specified categories (Buildings, Other Structures, Contents, ALE), filling in the amounts where indicated.

- Confirm the total amount of the loss and the deductible, ensuring all totals are accurately calculated.

- Sign the form as the insured and print your name as required.

- A notary public must complete the section for witnessing your signature. Provide the county and date.

What You Should Know About This Form

What is the Florida Proof Loss form?

The Florida Proof Loss form is a legal document that policyholders must complete and submit to their insurance company after experiencing a loss covered under their insurance policy. This form is designed to provide detailed information about the loss, the insured property, and the amount being claimed. It ensures that the claim is processed efficiently and that the insurance company has all the necessary information to assess the situation accurately.

Who needs to fill out the Proof Loss form?

The Proof Loss form must be filled out by the policyholder, also known as the insured. In cases where multiple individuals are named on the insurance policy, all named insured parties should sign the form to verify the accuracy of the information provided.

What information is required on the form?

The form requires a variety of information, including the name of the insurance company, policy and claim numbers, date and time of the loss, cause of the loss, description of damaged property, and the total amount being claimed. Additionally, details regarding any mortgage or lienholders, changes in title or occupancy, and other applicable insurance policies must also be included.

Why is it important to provide accurate information?

Providing accurate and truthful information is crucial when completing the Proof Loss form. Misrepresenting or omitting details can lead to serious consequences, including denial of the claim or potential legal repercussions. Under Florida law, intentionally deceiving an insurer is considered a felony. Therefore, ensuring that all details are complete and correct protects both the policyholder and the insurer.

What happens if there are changes in the property's title or occupancy?

If there have been changes in the title or occupancy of the property during the policy term, these must be disclosed on the Proof Loss form. This information can affect the validity of the insurance policy and the claim process. Failing to include such changes could result in complications or a denial of the claim.

How is the total amount of the claim calculated?

The total claim amount is calculated by assessing various components of the loss. This includes the costs associated with repairing or replacing damaged buildings, other structures, contents, and any additional living expenses incurred due to the loss. After totaling these amounts, any applicable deductibles are subtracted to arrive at the final claim amount.

What should be done if the actual cash value is less than the claimed amount?

If the actual cash value of the property at the time of loss is less than the total amount being claimed, it is essential to adjust the claim accordingly. The Proof Loss form allows for the declaration of the actual cash value, which can affect the insurance payout. A policyholder should only claim amounts supported by evidence of loss and value at the time of the incident.

Is a notary required for the Proof Loss form?

Yes, the Proof Loss form must be signed in front of a notary public. This adds a layer of verification to the authenticity of the form and the statements made therein. The notary public will need to record the date the document was sworn, ensuring that the process complies with legal requirements.

Where should the completed Proof Loss form be submitted?

The completed Proof Loss form should be submitted directly to the insurance company handling your claim. It's essential to keep a copy for personal records and to confirm that the submission is received. This can help prevent any delays in processing the claim or discrepancies regarding the submission date.

Common mistakes

Filling out the Florida Proof of Loss form is a critical step in the insurance claims process. However, individuals often make common mistakes that can lead to delays or even denials of their claims. Understanding these pitfalls can significantly enhance the accuracy and effectiveness of submitted documents.

One frequent error is failing to provide complete information. Each section of the form must be filled out thoroughly. Omitting details, such as the date of loss or the cause of loss, can raise red flags with the insurance company. Incomplete responses may lead to requests for additional information, causing delays in the claims processing.

Another mistake involves misrepresenting the facts. The form requires an honest disclosure of information, including any prior losses or existing liens on the property. Failing to disclose other insurance policies that could cover the loss can not only complicate the claim but may also raise questions about the integrity of the submission.

The lack of documentation is also a critical mistake. Supporting documents such as repair estimates, photographs of the damage, and receipts for temporary living expenses should be attached. Neglecting to provide sufficient evidence can weaken a claim significantly. An insubstantial submission may lead to denials or requests for further clarification.

Inaccurate valuations of the loss pose another risk. Claimants should carefully assess the actual cash value of the damaged property. Underestimating or overestimating the value can result in financial losses or complications in negotiating the claim. It is recommended to consult with professionals if there is uncertainty about valuation.

People often also forget to sign and date the form appropriately. The signature attests to the truthfulness of the information provided. A missing signature can halt the claim process entirely. Additionally, ensuring that the form is notarized, if required, is essential for compliance with Florida law.

The inclusion of vague descriptions is another common oversight. When outlining the specifics of the damage, clarity is crucial. Ambiguous or overly general language can lead to misunderstandings and may result in the claim being scrutinized further. Clear and detailed descriptions can facilitate a smoother claims process.

Finally, failing to keep copies of submitted forms is a significant oversight. Retaining documentation ensures that claimants have a record of what was sent, which can be valuable in case of disputes or follow-up inquiries. Having copies allows individuals to reference their original submission when communicating with their insurance company.

Understanding these common mistakes can empower individuals to navigate the Florida Proof of Loss form effectively. By avoiding misunderstandings and errors, claimants can improve their chances for a favorable outcome in their insurance claims process.

Documents used along the form

The Florida Proof of Loss form is a crucial document in the insurance claims process, particularly for property damage claims. In addition to this form, several other documents may play significant roles in ensuring a comprehensive and accurate claim submission. Below is a list of commonly used forms that are often required alongside the Florida Proof of Loss form. Each serves a unique purpose in supporting your claim.

- Insurance Policy Declaration Page: This document outlines the terms of your insurance coverage, including the policyholder’s name, coverage limits, deductibles, and the types of coverage in effect at the time of loss. It is usually the first page of your insurance policy and is essential for verifying the coverage you had when the loss occurred.

- Claim Notification Form: Often required to formally notify the insurance company about a loss, this form typically includes information about the incident, the policy number, and the claimant's contact information. Submitting this form promptly is important, as many policies have specific time limits for reporting claims.

- Damage Estimate: This document provides a detailed estimate of the cost to repair or replace the damaged property. It is often prepared by a contractor or a professional appraiser and should include a breakdown of materials and labor costs. Providing a thorough estimate can help substantiating your claim amount.

- Photos of Damages: Visual evidence can be vital in adequately representing the extent of the loss. Photographs should be taken as soon as possible after the incident and should clearly depict all damaged areas and items. Including these images can aid in expediting the claims process.

It is essential to ensure all documentation is complete, accurate, and submitted on time. Having these additional documents prepared can streamline your claim process and potentially lead to a faster resolution. Take care to keep copies of everything submitted, as records can be invaluable in case of any inquiries or disputes later on.

Similar forms

- Sworn Statement: Similar to the Florida Proof Loss form in that both require a formal declaration affirming the truthfulness of the information provided. This document also serves to deter fraudulent claims.

- Insurance Claim Form: This form collects relevant details about an insurance claim, such as the policyholder’s information, the nature of the claim, and the loss's specifics.

- Proof of Loss Document: Like the Florida Proof Loss form, it serves as a formal notification to the insurer regarding the details of a claim, including the amount sought after a loss.

- Statement of Claim: This document outlines the specifics of a claim being made against an insurance policy, highlighting why the claim is justified, akin to the requirements of the Florida Proof Loss form.

- Loss Assessment Report: This document evaluates the extent of the damage and the value of lost property, comparable to the loss and damage section of the Florida Proof Loss form.

- Declaration Page: Similar in that it summarizes key elements of an insurance policy, including coverage limits, which helps substantiate claims made in the proof of loss.

- Claim Adjustment Report: While conducted by an adjuster, this report reflects the findings regarding a claim, mirroring the need for accurate assessment found in the Florida Proof Loss form.

- Property Damage Evaluation Form: This form details the damages sustained to property, paralleling the detailed descriptions required in the Florida Proof Loss documentation.

- Affidavit of Loss: Like the Florida Proof Loss form, it is a sworn statement that details the loss incurred, reinforcing the commitment to provide truthful information.

Dos and Don'ts

When filling out the Florida Proof Loss form, it is essential to follow specific guidelines to ensure accuracy and compliance with state regulations. Below is a list of things to do and avoid during this process.

- Double-check all entries for accuracy before submission to avoid any discrepancies.

- Provide complete information on all required fields, including names, dates, and policy details.

- Sign the form in the presence of a notary public to validate the submission.

- Attach all necessary documents that support the claim, such as receipts and estimates of loss.

- Review relevant insurance policies to ensure all coverage details are accurately reflected on the form.

- Keep copies of everything you submit for your records and future reference.

- File the form promptly within the time limits set by your insurance policy.

- Do not provide false or misleading information as it can lead to criminal charges.

- Do not omit any relevant details, as incomplete information can result in delays or denial of your claim.

- Avoid submitting the form without a signature or notary verification, as it may not be accepted.

- Do not send the form without reviewing it thoroughly; mistakes can significantly impact your claim.

- Do not ignore deadlines for submission as this can nullify your claim.

- Avoid using vague descriptions for damages; be specific to enhance clarity.

- Refrain from submitting the form via untracked mail to ensure you have proof of submission.

Misconceptions

Understanding the Florida Proof of Loss form can sometimes be confusing. Here are four common misconceptions about this important document:

- It is only for major losses. Many people believe that the Proof of Loss form is only necessary for large claims. In reality, this form is required for any significant loss, regardless of the amount. Always submit it to ensure your claim is processed properly.

- The form guarantees payment from the insurer. Submitting a Proof of Loss form does not guarantee that your claim will be approved or paid. The insurer will still review the details, evaluate the documentation, and determine whether the loss is covered under your policy.

- One submission is enough for all claims. Another misconception is that once the form is submitted, you don’t need to provide any further documentation or information. In fact, the insurer may request additional details or evidence to support your claim, so it’s important to be prepared.

- It doesn’t matter how you fill it out. Some assume that the specifics of the form are insignificant. However, inaccuracies or omissions can affect the outcome of your claim. Complete the form carefully, ensuring all information is accurate and complete.

By dispelling these misconceptions, you can approach the claims process with greater confidence and clarity.

Key takeaways

Filling out and using the Florida Proof of Loss form requires careful attention to detail. Here are key takeaways to consider:

- Understanding the Purpose: The form serves to document a claim for loss under an insurance policy.

- Legal Obligations: Providing false or misleading information on this form can result in serious legal consequences, including felony charges.

- Complete All Sections: Ensure every segment of the form is filled out accurately to avoid delays in processing your claim.

- Document Details: Include details like the date and time of the loss, as well as the cause of the loss, which are critical for the evaluation of the claim.

- Amount of Loss: Clearly state the loss and damage amounts for buildings, contents, and additional living expenses.

- Signature Requirement: The form must be signed by the insured individuals, verifying that the information is truthful to the best of their knowledge.

- Notary Requirement: The form typically requires notarization to confirm identity and the accuracy of the statements made.

- Attention to Insurance Coverage: List any other insurance policies that may also cover the loss, as this could affect claims processing.

- Disclosure of Interests: Identify any mortgages or lienholders with an interest in the property involved at the time of the loss.

- Keep Copies: It is advisable to retain copies of the completed form and any supporting documents for your records and future reference.

Browse Other Templates

998 Offer California - Ensure that all dates and amounts are correctly filled in for clarity.

Arizona Nonresident Filing Requirements - Important dates for refunds and payments are also noted on the form.

Af Imt 220 - Submitting the AF 220 form is voluntary, but failure to provide the necessary information may delay payment processing.