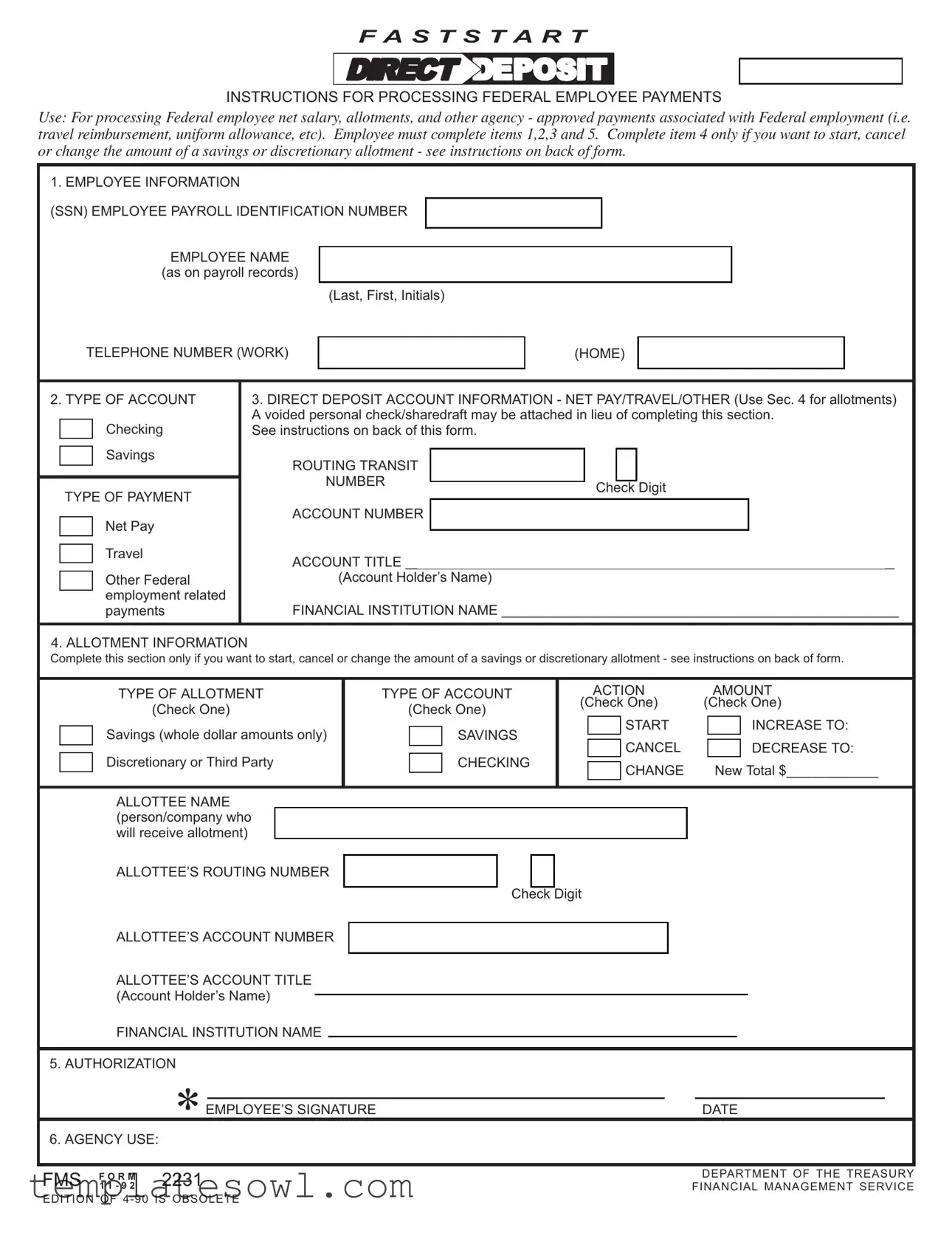

Fill Out Your Fms 2231 Form

The FMS 2231 form is essential for federal employees who wish to manage their payment processes efficiently. This standardized document allows employees to set up direct deposit for their net salary and various agency-approved payments, including travel reimbursements and uniform allowances. To complete the form, employees must provide essential personal information, including their Social Security Number and payroll identification. Different types of accounts can be selected, with options for checking or savings. Furthermore, the form contains sections dedicated to detailing account information and allotments. Employees seeking to start, modify, or cancel discretionary allotments will find specific instructions within the document, ensuring they have the tools to direct their finances. Additionally, the form includes a Privacy Act Statement, emphasizing the confidentiality of the information collected and its role in processing payments from federal agencies to financial institutions. Overall, the FMS 2231 form is a straightforward yet critical tool for federal employees to control their payment arrangements.

Fms 2231 Example

F A S T S T A R T

DIRECT

DEPOSIT

INSTRUCTIONS FOR PROCESSING FEDERAL EMPLOYEE PAYMENTS

Use: For processing Federal employee net salary, allotments, and other agency - approved payments associated with Federal employment (i.e. travel reimbursement, uniform allowance, etc). Employee must complete items 1,2,3 and 5. Complete item 4 only if you want to start, cancel or change the amount of a savings or discretionary allotment - see instructions on back of form.

1. EMPLOYEE INFORMATION

(SSN) EMPLOYEE PAYROLL IDENTIFICATION NUMBER

EMPLOYEE NAME

(as on payroll records)

(Last, First, Initials)

TELEPHONE NUMBER (WORK)

(HOME)

2. TYPE OF ACCOUNT

Checking

Savings

TYPE OF PAYMENT

Net Pay

Travel

Other Federal employment related payments

3.DIRECT DEPOSIT ACCOUNT INFORMATION - NET PAY/TRAVEL/OTHER (Use Sec. 4 for allotments) A voided personal check/sharedraft may be attached in lieu of completing this section.

See instructions on back of this form.

ROUTING TRANSIT |

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

|

Check Digit |

|||

|

|

|

|||

ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

ACCOUNT TITLE ________________________________________________________________

(Account Holder’s Name)

FINANCIAL INSTITUTION NAME ____________________________________________________

4. ALLOTMENT INFORMATION

Complete this section only if you want to start, cancel or change the amount of a savings or discretionary allotment - see instructions on back of form.

|

|

TYPE OF ALLOTMENT |

|

TYPE OF ACCOUNT |

|

ACTION |

|

|

|

AMOUNT |

|||||||||||||||||||||

|

|

|

(Check One) |

|

|

(Check One) |

|||||||||||||||||||||||||

|

|

(Check One) |

|

(Check One) |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

Savings (whole dollar amounts only) |

|

|

|

SAVINGS |

|

|

START |

|

|

|

|

|

|

|

INCREASE TO: |

||||||||||||||

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

CANCEL |

|

|

|

|

|

|

|

DECREASE TO: |

||||||||||||||||

|

|

Discretionary or Third Party |

|

|

|

CHECKING |

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

CHANGE |

|

|

|

New Total $____________ |

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOTTEE NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

(person/company who |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

will receive allotment) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

ALLOTTEE’S ROUTING NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Digit |

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

ALLOTTEE’S ACCOUNT NUMBER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

ALLOTTEE’S ACCOUNT TITLE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

(Account Holder’s Name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

FINANCIAL INSTITUTION NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. AUTHORIZATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EMPLOYEE’S SIGNATURE |

DATE |

6. AGENCY USE: |

|

|

|

|

|

|

|

FMS |

F O R M |

2231 |

D E PA RT M E N T O F T H E T R E A S U RY |

1 1 - 9 2 |

F I N A N C I A L M A N A G E M E N T S E RV I C E |

||

|

|

|

|

E D I T I O N O F 4 - 9 0 I S O B S O L E T E

PRIVACY ACT STATEMENT

The collection of the information you are requested to provide on this form is authorized under 31 CFR 209 and/or 210. The information is confidential and is needed to prove entitlement to payments. The information will be used to process payment data from the Federal agency to the financial institution and/or its agent.

INSTRUCTIONS FOR PROCESSING FASTSTART AUTHORIZATION

PURPOSE

You may use this form to provide instructions for processing your net salary. You may also use this for to provide instructions for processing allotments and other agency - approved payments associated with your Federal employment.

1.EMPLOYEE INFORMATION (always complete this section)

2.TYPE OF ACCOUNT/PAYMENT (Put an “X” in the appropriate space to indicate a checking or savings account and type of payment.)

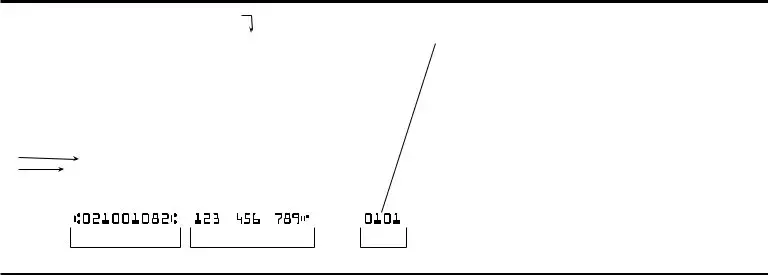

3.DIRECT DEPOSIT ACCOUNT INFORMATION

ROUTING TRANSIT NUMBER (your financial institution’s

ACCOUNT TITLE (the depositor’s name on the account to which payments are to be directed) FINANCIAL INSTITUTION NAME (the name of the institution to which payments are to be directed)

The Routing Transit Number (RTN) can be obtained from the financial institution or found on the bottom of a check.

|

|

3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF DEPOSITOR |

101 |

|||

|

|

STREET ADDRESS |

|

|

|

|

|

|

CITY, STATE |

|

|

|

|

|

|

|

|

___________ _______ |

|

|

|

|

|

|

19 |

|

|

|

PAY TO THE |

|

|

|

|

|

|

ORDER OF: _______________________________________________$ |

|

|

|||

|

___________________________________________________________DOLLARS |

|||||

4 |

NAME OF YOUR BANK |

|

|

|

|

|

5 |

Payable Through Another Bank |

|

|

|

|

|

|

For _____________________________ |

____________________________ |

|

|||

|

|

|

|

|

|

|

|

ROUTING NUMBER |

ACCOUNT NUMBER |

CHECK NUMBER |

|||

|

1 |

2 |

|

|

|

|

1.ROUTING TRANSIT NUMBER - Here you would put “021001082”

2.ACCOUNT NUMBER - Here you would put

appears on the check or card.

appears on the check or card.

3.ACCOUNT TITLE (must include employee name)

4.FINANCIAL INSTITUTION NAME

5.If your check or sharedraft includes “payable through“ under the bank name, contact the finan- cial institution to help obtain the correct Routing Transit Number for Direct Deposit processing.

4. ALLOTMENT INFORMATION ALLOTMENT TYPE

SAVINGS (If this option is checked, this will allow the specified allotment to be credited to an account owned by the payee.)

Savings allotments are limited to two. Savings allotments must be in whole dollar amounts (no cents). The dollar amount of allotments may not exceed the pay due an employee per pay period.

DISCRETIONARY OR THIRD PARTY (If this option is checked, this will allow the specified allotment to be credited to an account not owned

by the payee.) Certain restrictions may apply as to the kind of allotments your agency will allow. Check with your agency to determine what kinds of allotments it will allow. ANY CHANGES TO THE ALLOTMENT INFORMATION FURNISHED ON THIS REQUEST MUST BE MADE USING A NEW FASTSTART FORM.

TYPE OF ACCOUNT (Put an “X” in the appropriate space to indicate a checking or savings account.) ACTION (Put an “X” in the appropriate space to indicate start/cancel/change.)

AMOUNT (Put an “X” in the appropriate space to indicate if an allotment is an increase, decrease and always indicate $ amount.)

ALLOTTEE’S ROUTING NUMBER: Enter person’s/company financial institution

ALLOTTEE’S ACCOUNT NUMBER: Enter the account number to which the allotment payment will be deposited.

ALLOTTEE’S ACCOUNT NUMBER: Enter account holder’s name on the account at the financial institution.

FINANCIAL INSTITUTION NAME: Enter the name of the financial institution to which the payment should be sent.

5.AUTHORIZATION

Sign and date the request form after you have carefully read the instructions and Privacy Act Statement.

6.AGENCY USE (This space is reserved for agency use.)

CHANGES AND CANCELLATIONS - Contact your agency for instructions.

Form Characteristics

| Fact Name | Description |

|---|---|

| Use of the Form | The FMS 2231 form is designed for processing direct deposit instructions for federal employee payments, including net salary, travel reimbursements, and other agency-approved payments. |

| Required Sections | Employees must complete sections 1, 2, 3, and 5 of the form. Section 4 is only necessary if the employee wishes to start, cancel, or modify an allotment. |

| Routing Information | Submit a valid 9-digit Routing Transit Number and account number for successful direct deposit processing. This information can be obtained from the financial institution or found on a check. |

| Legal Authority | The collection of information for this form is authorized under 31 CFR 209 and/or 210, ensuring confidentiality and proper processing of payment data. |

Guidelines on Utilizing Fms 2231

Completing the FMS 2231 form is a straightforward process that allows federal employees to set up direct deposit for their payments. After filling out the form, it should be submitted to the designated agency for processing. Be sure to have all necessary information ready before you begin. Following these steps can help ensure your form is completed accurately and submitted without delay.

- Employee Information: Fill in your Social Security Number (SSN), employee payroll identification number, full name (as it appears in payroll records), and your work and home telephone numbers.

- Type of Account/Payment: Indicate whether your account is a checking or savings account. Also, specify the type of payment you wish to set up: net pay, travel reimbursement, or other payments related to federal employment.

- Direct Deposit Account Information: Provide the routing transit number (RTN) of your financial institution, your account number, account holder’s name, and the name of the financial institution. You may attach a voided check instead of filling in these details.

- Allotment Information: Complete this section only if you want to handle savings or discretionary allotments. Specify the type of allotment, the account type, the action you wish to take (start, cancel, change), and the amount. Include the allottee's name, routing number, account number, account title, and financial institution name if applicable.

- Authorization: Sign and date the form to show you understand and agree to the conditions for direct deposit and allotments.

What You Should Know About This Form

What is the FMS 2231 form used for?

The FMS 2231 form is designed for processing direct deposit instructions related to federal employee payments. This includes net salaries, allotments, and other agency-approved payments such as travel reimbursements or uniform allowances. Employees must complete key sections of the form to ensure proper compensation and benefits.

Who should complete the FMS 2231 form?

Any federal employee who wants to establish or modify their direct deposit information should complete the FMS 2231 form. This includes those wishing to start, cancel, or change any allotments or payments associated with their federal employment. It's vital for employees to provide accurate information to avoid payment delays.

What information is required on the FMS 2231 form?

To complete the form, employees must provide their employee information, including Social Security number, payroll identification number, name, and contact details. They also need to indicate the type of account (checking or savings) and provide direct deposit account information, such as the routing transit number, account number, and account title. Additionally, for allotments, employees should fill in details like the amount and the allottee's information.

Can I attach a voided check to the FMS 2231 form?

Yes, you can attach a voided personal check or sharedraft in place of filling out the direct deposit account information section. This can simplify the process and help ensure that the correct account details are used for your payments. Just make sure the attached check clearly shows your account information.

What do I do if I need to make changes to my allotment information?

If you need to change any information related to your allotment, you must submit a new FMS 2231 form. It's important to note that using a previous form for changes is not allowed. For specific instructions on how to make these changes, you should contact your agency directly.

Common mistakes

Filling out the FMS 2231 form can be straightforward, but several common mistakes can lead to delays in processing your direct deposit. A significant error involves not completing the employee information section accurately. It is crucial to ensure your Social Security Number (SSN), payroll identification number, and name match exactly how they appear in payroll records. Any discrepancies may result in processing issues.

Another frequent mistake is failing to indicate the correct type of account. You must select whether your account is a checking or savings account. Omitting this detail can confuse your financial institution, leading to potential misdirection of funds. Always double-check this section.

Inaccurate routing transit numbers are also a common pitfall. This 9-digit number must be correct because it's how your bank identifies where to send your funds. Individuals sometimes use an old number or a number from a different account. To avoid this, refer to a recent check or contact your bank for the correct routing number.

People often miss the requirement to fill out the account title properly. The account title should match the name of the account holder. If you list a different name, the bank may refuse to process your direct deposit. Ensure clarity by writing the name as it appears on the account.

Some applicants neglect to specify the type of payment. Not indicating whether the deposit is for net pay, travel reimbursement, or another federal employment-related payment can stall processing. Complete this section clearly to ensure your employer knows where to direct your funds.

Another error involves incomplete authorization signatures. Failing to sign or date the form can result in immediate rejection. It is essential to read the instructions carefully and ensure that your signature is present and dated.

Finally, individuals frequently overlook the instructions for allotments. If you’re choosing to start, cancel, or change an allotment amount, it's essential to complete that section thoroughly. Mistakes here can lead to funds being sent to the wrong account or not being disbursed at all. Always review this section to ensure clarity and accuracy.

Documents used along the form

The FMS 2231 form plays a crucial role in facilitating the direct deposit process for federal employees. To ensure comprehensive processing and proper management of payments, several other documents may be required alongside the FMS 2231 form. Below is a list of such forms, each serving a distinct purpose in this context.

- FMS Form 1510: This form allows federal employees to request a change in their direct deposit information, enabling them to modify account details without starting a new FMS 2231 form.

- SF 1199A: This form functions as a direct deposit sign-up form for individuals who receive federal payments, such as pension benefits or Social Security, facilitating their enrollment in direct deposit.

- Payroll Change Request Form: Often used within agencies, this form requests adjustments to an employee's salary, classification, or other payroll-related changes, ensuring accurate payment processing.

- Leave Request Form: While primarily for leave purposes, this form can affect payroll processing. It documents employee leave and ensures accurate compensation during periods of absence.

- W-4 Form: This is a tax withholding form that employees complete to indicate their tax situation to their employer. Accurate withholding is essential for proper payroll calculations.

- Tax Filing Affidavit: If applicable, this document may be necessary for confirming an employee’s filing status or other tax-related issues that could impact net pay.

- Agency-Specific Allotment Form: Certain agencies may require this form to process specific allotments beyond the standard provisions set forth in the FMS 2231.

- Financial Institution Authorization Form: This document allows a financial institution to initiate ACH transactions, which is essential for the direct deposit process.

In conclusion, while the FMS 2231 form is essential for processing federal employee payments, these accompanying documents help streamline the overall payroll process. Each one plays a vital role in ensuring that employees receive their payments accurately and efficiently.

Similar forms

- Form W-4: Similar to the FMS 2231 form, the W-4 form is used by employees to direct how much federal income tax should be withheld from their paychecks. Both documents ensure accurate processing of financial information related to employment.

- Direct Deposit Authorization Form: Like the FMS 2231, this form specifies banking information and authorizes the transfer of funds directly into an employee’s account. Both are focused on facilitating timely and accurate payments.

- Form SF-1199A: This form is used by federal employees to set up direct deposit for retirement benefits. Similar to the FMS 2231, it collects necessary banking details to ensure proper payment delivery.

- Form 1099-MISC: Although utilized differently, both forms deal with payments related to federal employment. The 1099-MISC provides information on various income types, while the FMS 2231 handles the disbursement of payments.

- Travel Voucher Form (SF-1164): Employees use this form to request reimbursement for travel expenses. Both documents are linked to federal employment payments, ensuring employees receive the correct amounts owed for their service or expenses.

- Payroll Deduction Authorization Form: This form authorizes deductions for various purposes from an employee’s paycheck, resembling the allocation provisions in the FMS 2231 which allows for savings and discretionary allotments to be managed efficiently.

Dos and Don'ts

When filling out the FMS 2231 form, it is essential to follow specific guidelines to ensure the process goes smoothly. Here are ten things to do and avoid while completing the form:

- Do complete all required fields: employee information, type of account, and direct deposit account information.

- Do provide accurate and current contact information, including telephone numbers for both work and home.

- Do specify the type of payment clearly (Net Pay, Travel, or Other).

- Do use a voided check for direct deposit account information if applicable.

- Do double-check the routing transit number and account number for accuracy.

- Don't leave any required sections blank; incomplete forms may delay processing.

- Don't enter amounts for savings allotments that are not whole dollars.

- Don't assume that previous allotments carry over; always specify new amounts or changes.

- Don't forget to sign and date the form; an unsigned form is invalid.

- Don't hesitate to contact your agency if unsure about any part of the form; assistance is available.

Misconceptions

Many people have misunderstandings about the FMS 2231 form, which is used for processing direct deposits for federal employee payments. Here are some common misconceptions:

- It's only for salary payments. The FMS 2231 form can also be used for other payments related to federal employment, such as travel reimbursements and uniform allowances.

- Only new employees need to fill it out. Current employees may need to use the form to update their payment information or change their allotments.

- The account type must always be checking. You can designate either a checking or savings account on the form, depending on your preference.

- I don't need to provide my Social Security Number. You must provide your Social Security Number on the form to ensure accurate processing of payments.

- It's a one-size-fits-all form. The form allows for both direct deposit of net pay and savings or discretionary allotments, which can vary based on individual needs.

- I can make changes verbally. If you need to change any allotment information, a new form must be submitted; verbal requests are not accepted.

- Only employees can fill it out. While employees must complete the form, they can designate third parties for certain allotments, like a family member or organization.

- Allotments can exceed my salary. Allotment amounts may not exceed your net pay and must be in whole dollar amounts, making it essential to stay within limits.

- The form is optional. If you want direct deposit or allotments, completing this form is necessary. It's not just a recommendation.

- Filling it out guarantees I will receive my payments on time. While it facilitates the process, various factors, such as agency processing times, can affect when payments are actually made.

Understanding these points can help ensure that you use the FMS 2231 form correctly and avoid any processing issues with your payments.

Key takeaways

Filling out the FMS 2231 form correctly is essential for managing your direct deposit and allotments. Here are some important takeaways:

- Complete Essential Sections: Fill out items 1, 2, 3, and 5 to ensure your form is processed. Item 4 is for allotment changes only.

- Account Type Matters: Clearly indicate whether your account is checking or savings. Failure to do so can delay your payments.

- Accurate Routing Numbers: Use the correct 9-digit routing transit number for your financial institution. This is crucial for successful transactions.

- Account Holder's Name: Ensure that the account title matches the name used on your payroll records. This connection is vital for the direct deposit to work.

- Allotment Restrictions: Be aware that your agency may impose specific restrictions regarding the types of allotments allowed.

- Use Whole Dollar Amounts: When specifying savings allotments, use whole dollar amounts without cents or decimals.

- Changes Require a New Form: If you need to make any changes to your allotment information, submit a new FMS 2231 form. Previous submissions won’t be updated automatically.

- Sign and Date: Always sign and date the form. Review all instructions carefully before submitting to ensure compliance with privacy regulations.

Understanding these points will help you navigate the FMS 2231 form more effectively and avoid potential issues with your payments.

Browse Other Templates

Requirements for Open Work Permit in Canada - The application can be submitted at designated issuing officers in Maryland.

Randstad Timesheets - Record total hours in decimal format for clarity.