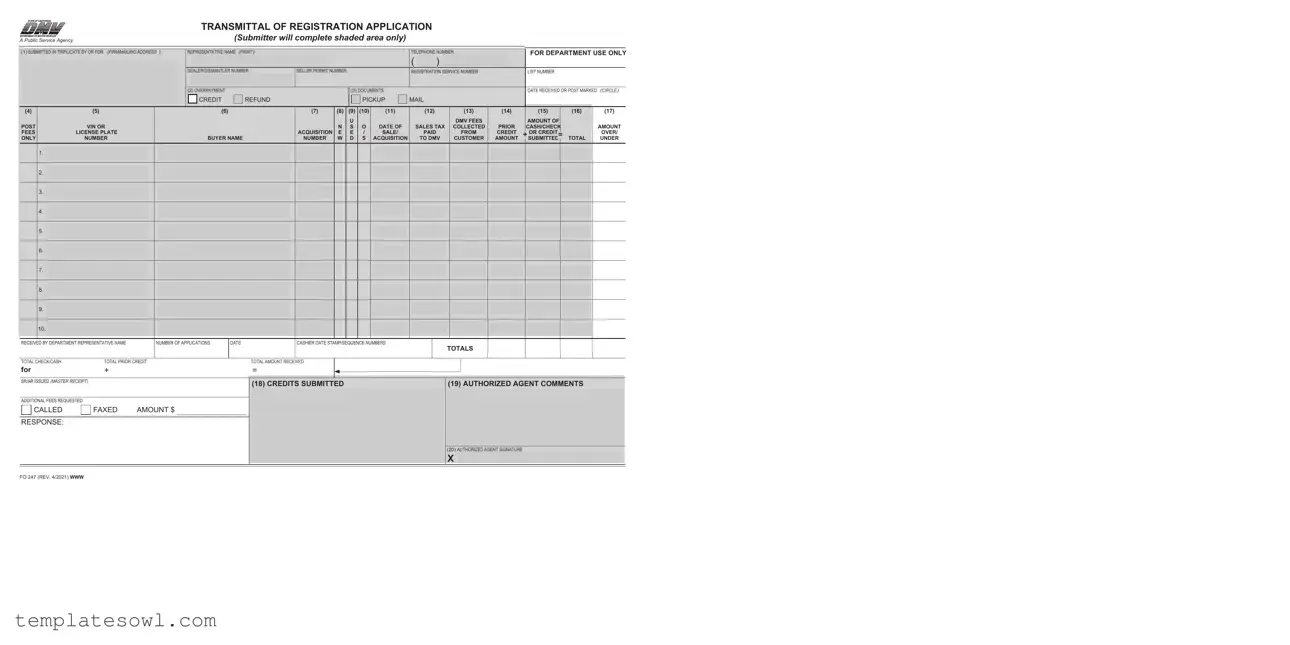

Fill Out Your Fo247 Form

The Fo247 form serves as a crucial tool for those engaged in the vehicle registration process, primarily benefiting dealers and dismantlers but also providing utility for individuals or companies submitting multiple registrations. Designed to streamline the submission of registration applications, the form ensures that all necessary documentation and fees are accounted for and appropriately processed. It requires submitters to detail their firm name, mailing address, and other essential identifiers like the dealer or dismantler number. The form also addresses various financial aspects, including guidelines for handling overpayments and tips for calculating applicable fees or penalties. For instance, when submitting payments, any fractional dollar amounts under fifty cents are to be disregarded, while amounts fifty cents or higher must be rounded up. Timeliness is key; applications submitted beyond specific deadlines may incur administrative service fees. The careful completion of the Fo247 form not only assists in adhering to deadlines but also helps prevent penalties associated with late submissions—making it indispensable for those navigating the sometimes-complex world of vehicle registration.

Fo247 Example

TRANSMITTAL OF REGISTRATION APPLICATION

A Public Service Agency |

|

|

|

|

|

(Submitter will complete shaded area only) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FOR DEPARTMENT USE ONLY |

|||||||||

(1) SUBMITTED IN TRIPLICATE BY OR FOR (FIRM/MAILING ADDRESS ) |

|

REPRESENTATIVE NAME (PRINT ) |

|

|

|

|

|

|

|

TELEPHONE |

NUMBER |

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

DEALER/DISMANTLER NUMBER |

SELLER PERMIT NUMBER |

|

|

|

|

REGISTRATION SERVICE NUMBER |

|

|

|

LIST NUMBER |

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) OVERPAYMENT |

|

|

|

|

|

|

(3) DOCUMENTS |

|

|

|

|

|

|

|

|

|

DATE RECEIVED OR POST MARKED |

(CIRCLE ) |

|

|||||||

|

|

|

|

|

|

CREDIT |

REFUND |

|

|

|

|

|

PICKUP |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(4) |

(5) |

|

(6) |

|

|

(7) |

|

(8) |

(9) |

(10) |

(11) |

|

(12) |

|

(13) |

(14) |

|

(15) |

|

|

(16) |

(17) |

|

|||||||

POST |

VIN OR |

|

|

|

|

|

|

|

N |

|

U |

O |

DATE OF |

|

SALES TAX |

DMV FEES |

PRIOR |

|

AMOUNT OF |

|

|

AMOUNT |

||||||||

|

|

|

|

|

|

|

|

S |

|

COLLECTED |

|

CASH/CHECK |

|

|

||||||||||||||||

FEES |

LICENSE PLATE |

|

|

|

|

|

ACQUISITION |

E |

|

E |

/ |

SALE/ |

|

|

PAID |

FROM |

CREDIT |

+ |

OR CREDIT |

= |

|

OVER/ |

||||||||

ONLY |

NUMBER |

|

|

BUYER NAME |

NUMBER |

W |

|

D |

S |

ACQUISITION |

|

|

TO DMV |

CUSTOMER |

AMOUNT |

|

SUBMITTED |

|

TOTAL |

UNDER |

||||||||||

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RECEIVED BY DEPARTMENT REPRESENTATIVE NAME |

|

NUMBER OF APPLICATIONS |

DATE |

|

|

|

CASHIER DATE STAMP/SEQUENCE NUMBERS |

|

|

TOTALS |

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

TOTAL CHECK/CASH |

TOTAL PRIOR CREDIT |

|

|

TOTAL AMOUNT RECEIVED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

for |

+ |

|

|

|

|

|

|

= |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SR/AR ISSUED (MASTER RECEIPT) |

|

|

|

|

|

|

|

|

(18) CREDITS SUBMITTED |

|

|

(19) AUTHORIZED AGENT COMMENTS |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADDITIONAL FEES REQUESTED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

CALLED |

FAXED |

AMOUNT $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RESPONSE: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(20) AUTHORIZED AGENT SIGNATURE |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FO 247 (REV. 4/2021) WWW |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

GENERAL INFORMATION

This form is designed for use by dealers/dismantlers but may also be used by individuals or companies submitting multiple registration applications.

In computing any fees or penalties due whether on a proration or otherwise, disregard a fraction of a dollar unless it exceeds fifty cents ($0.49). In this case, round the fee up to the next dollar.

Example: (If fee and/or penalty is $5.50, submit $6.00.) (If fee and/or penalty is $5.49, submit $5.00.)

Please do not submit odd cents.

It is not necessary to enter .00 in the money columns to indicate cents.

Applications not submitted to the Department in a timely manner are subject to the following Administrative Service Fees (ASF)/ Investigative Service Fee (ISF).

Submitted after 20/30 days from date of sale (ASF) |

$5.00 |

Submitted after 40/50 days from date of sale |

$25.00 |

In addition, whichever is appropriate: |

|

Submitted after 20 days from date the |

|

department first returned the application (ASF) |

$25.00 |

Submitted after 5 days from acquiring the vehicle (ISF) |

$15.00 |

Sacramento Headquarters will bill for any ASF/ISF due. The dealer/ dismantler or

PREPARE AN ORIGINAL AND TWO (2) COPIES

Original: Retained by the Department.

Copy: Returned to submitter with documents due after the applications have been processed.

Copy: If ISF fees are due, this copy will be forwarded by the field office to:

ASF/ISF Unit

P.O. Box 932366, M/S L224

Sacramento, CA

An application for vehicle registration is considered to be received

by the Department only when it is accompanied by all necessary documents properly completed and the required fees. Penalties may accrue on applications submitted to the Department without fees.

PROCEDURE TO COMPLETE THIS FORM

(Submitter will complete the shaded area only.)

1.As the submitter, enter your firm name, mailing address, dealer/dismantler number, Registration Service number, or Seller Permit Number, if applicable. Print the representative’s name and telephone number. Note: Seller’s Permit Number is a

2.Indicate choice of refund or credit media for overpayment.

3.Indicate choice of pickup or mail for documents.

4.Enter “X” if the item is for Posting Fees Only.

5.Enter the Vehicle Identification number (VIN) or the California license plate number presently on the vehicle. Note: When completing this form, group all “used” vehicle transactions together, all “new” vehicles together, and all “out of state (O/S)” vehicles together.

6.Enter the buyer’s name.

7.Enter the Acquisition Number for the transaction.

8.Enter “X” if transaction is for a new vehicle

9.Enter “X” if transaction is for a used vehicle.

10.Enter “X” if vehicle will be registered O/S.

11.Enter the date of sale/acquisition for each transaction.

12.Enter the amount of sales tax collected based on the actual selling price of the vehicle. Note: Sales tax collected on other charges related to the vehicle (including, but not limited to the document fees, smog certification fees, and mandatory warranties) must be reported directly to CDTFA on monthly sales and use tax returns.

13.Enter the amount of DMV fees collected from the customer.

14.Enter the prior credit amount, if any.

15.Enter the amount of cash/check or credit submitted.

16.Total for columns 14 plus 15.

17.To Completed by DMV personnel.

18.Indicate credits submitted; Bundle credit information, Z96, or write “none”.

19.Authorized agent’s comments.

20.Authorized agent’s signature.

NOTICE TO DEALERS

In the “Amount of Refund” column shown on the attached Bundle Listing sheet, the Department will indicate excess fees paid DMV. Refund of Excess Fees by Dealer (CVC §11713.4). If a purchaser of a vehicle pays the dealer an amount for the licensing or transfer of title of the vehicle, which amount is in excess of the actual fees due for such licensing or transfer, or which amount is in excess of the amount which has been paid, prior to the sale, by the dealer to the state in order to avoid penalties that would have accrued because of the late payment of such fees, the dealer shall return such excess amount to the purchaser, whether or not such purchaser requests the return of the excess amount.

FO 247 (REV. 4/2021) WWW

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The FO247 form is used for the transmittal of multiple vehicle registration applications, primarily by dealers and dismantlers. |

| Governing Law | This form is governed by California Vehicle Code (CVC) §11713.4 regarding excess fees paid by purchasers. |

| Submission Format | The form must be submitted in triplicate, meaning three copies are required: original for the department, one for the submitter, and one for ASF/ISF purposes if applicable. |

| Fee Handling | Applications should not include odd cents; they should round up to the nearest dollar if the fee exceeds fifty cents. |

| Overpayment Handling | Submitters can choose to receive a credit or a refund for any overpayment made on the application. |

| Timely Submission Fees | Late submissions incur administrative service fees: $5.00 if late 20/30 days, $25.00 if late 40/50 days. |

| Required Information | Submitters must provide the dealer/dismantler number, seller permit number, and vehicle identification number (VIN) among other details. |

| Authorized Agent | The form requires the signature of an authorized agent, affirming the submitted information's accuracy. |

Guidelines on Utilizing Fo247

Completing the Fo247 form is a straightforward process once you have the necessary information at hand. Follow the steps outlined below to ensure that all required sections are filled out accurately and completely.

- Enter your firm name, mailing address, dealer/dismantler number, registration service number, and seller permit number if applicable. Print the representative's name and provide the telephone number.

- Select your choice for refund or credit media for any overpayment.

- Indicate whether you prefer to pick up or receive documents by mail.

- If applicable, enter an "X" for Posting Fees Only.

- Input the Vehicle Identification Number (VIN) or the current California license plate number.

- Provide the buyer's name for the transaction.

- Fill in the Acquisition Number associated with this transaction.

- If the transaction is for a new vehicle, enter an "X".

- If the transaction is for a used vehicle, enter an "X".

- For vehicles being registered out of state, input an "X".

- Enter the date of sale or acquisition for each transaction.

- Document the amount of sales tax collected based on the actual selling price of the vehicle.

- Record the DMV fees collected from the customer.

- Fill in any prior credit amount, if applicable.

- Enter the total amount of cash/check or credit submitted.

- Add the totals for prior credit (if any) and the amount submitted together.

- This part should be completed by DMV personnel.

- Indicate credits submitted; provide details or note “none”.

- Include any comments from the authorized agent.

- Obtain the authorized agent's signature to finalize the submission.

What You Should Know About This Form

What is the FO247 form used for?

The FO247 form is primarily used by vehicle dealers and dismantlers to submit multiple registration applications. It may also be utilized by individuals or companies submitting several applications in one go. The form ensures that all necessary information, fees, and documents are properly organized for the Department's processing.

How do I complete the FO247 form?

To complete the FO247 form, start by filling in your firm's name, mailing address, dealer or dismantler number, and any relevant registration service or seller permit numbers. It’s essential to print the representative's name and telephone number clearly. Follow the instructions carefully, populating each required field with accurate data, including the vehicle identification number, buyer's name, and sales tax amount.

What happens if I submit the application late?

If applications are submitted late, various Administrative Service Fees (ASF) or Investigative Service Fees (ISF) may apply. For instance, if the application is submitted after 20 or 30 days from the sale date, a fee of $5.00 may be charged. If the delay extends to 40 or 50 days, the fee increases to $25.00. Additional fees may also apply if there are subsequent delays after the department returns the application.

Can I submit the FO247 form digitally?

The form is intended to be submitted in triplicate, meaning it must be printed out and physically submitted to the appropriate agency. However, depending on local regulations or updates to the process, it’s worth checking if electronic submissions are now allowed or being phased in.

What should I do if there is an overpayment?

If there has been an overpayment, the form allows you to indicate your choice for a credit refund. Clearly state whether you prefer to receive the refund by pickup or via mail. Adhering to the instructions on the form regarding overpayments will ensure correct processing by the department.

What documents must accompany the FO247 form?

Along with the FO247 form, all necessary documents pertinent to the registration applications must be included. This comprises copies of any required licenses, previous registration documents, and proof of any taxes paid. Without these, the application may not be considered complete, which can lead to delays or penalties.

How can fees and penalties be calculated on the FO247 form?

When calculating fees or penalties, disregard any fraction of a dollar unless it amounts to fifty cents ($0.49) or more. In these cases, round up to the next dollar. For example, if a fee totals $5.50, submit $6.00; if it totals $5.49, submit $5.00. This clear guidance simplifies the fee submission process for all users of the form.

Common mistakes

When filling out the FO247 form, individuals often make common mistakes that can lead to delays or complications. Understanding these mistakes can help ensure a smoother process when submitting vehicle registration applications.

One frequent error involves incomplete or inaccurate entries in the shaded areas. Submitters should provide all required information, including firm name, mailing address, and dealer or dismantler numbers. Omitting information or entering incorrect numbers can lead to processing delays.

Another mistake is neglecting the proper grouping of vehicle transactions. It is essential to categorize transactions as new, used, or out of state. By failing to do so, the application may be rejected or require additional clarification from the Department.

Some submitters forget to indicate the choice for refunds or credit media when there is overpayment. This oversight can significantly prolong the refund process. Always select the appropriate option to avoid unnecessary complications.

Additionally, applicants often miscalculate the amounts for sales tax and DMV fees. The sales tax collected must reflect the actual selling price. Misrepresentation of these figures may result in penalties or an inaccurate assessment of fees owed.

Many people also forget to check the appropriate boxes to specify the type of vehicle registration. Indicating whether the vehicle is new, used, or will be registered out of state is crucial. Neglecting to do so may cause delays in processing the application.

The dates associated with the sale or acquisition often go unchecked or incorrectly filled out. Accurate date entries communicate when the transaction took place, which is vital for compliance with time-sensitive fees.

Some submitters mistakenly fail to submit the required number of copies. The FO247 form must be accompanied by the original and two copies. Without this, the Department may not process the application efficiently.

Further complicating matters, submitters may overlook the additional fees that can arise due to late submissions. Understanding the Administrative Service Fees and their applicable timeframes can help prevent costly mistakes.

Lastly, the authorized agent's signature is often missing or improperly completed. Signatures validate the information and indicate that the application has been thoroughly reviewed. An unsigned form will typically be returned, causing unnecessary delays.

By avoiding these common mistakes, individuals can significantly improve the chances of a successful and timely vehicle registration process.

Documents used along the form

When completing the Fo247 form, other documents may also be necessary. These documents support the registration process and help ensure that all relevant information is submitted accurately. Here are some common forms and documents you might encounter:

- Application for Title or Registration (Form REG 343) - This form is used to apply for a title for a vehicle or registration. It collects basic information about the vehicle and the owner.

- Vehicle Transfer Form (Form REG 262) - This document is required when ownership of a vehicle is transferred. It includes details about the buyer, seller, and the vehicle.

- Bill of Sale - A bill of sale outlines the transaction details for a vehicle purchase. It serves as a receipt and includes the vehicle's description, sale price, and signatures from both parties.

- Smog Certification - This document verifies that a vehicle meets state emissions standards. It is necessary for certain vehicles before registration is finalized.

- Statement of Facts (Form REG 256) - This form allows individuals to clarify specific details regarding a vehicle's history or the circumstances surrounding its registration.

- Proof of Insurance - Documentation showing that the vehicle has adequate insurance coverage, which is often required for registration.

- Power of Attorney (Form REG 260) - This document allows one person to act on behalf of another in vehicle-related matters. It is often needed if someone is completing registration for someone else.

- Payment Receipt - This receipt documents payment for registration fees and serves as proof of a transaction with the Department of Motor Vehicles (DMV).

Each of these documents plays a role in ensuring that vehicle registration processes are correctly followed. It is advisable to gather all required forms before submitting your application for smoother processing.

Similar forms

DMV Registration Application: Similar to the Fo247, this application is used for vehicle registration and requires detailed information about the seller, vehicle, and fees. Both documents involve processing fees and may also incur penalties for late submissions.

Sales Tax Payment Form: This form is used to report sales tax collected on vehicle transactions. Like the Fo247, it captures sales tax information along with the transaction details to ensure compliance.

Vehicle Title Application: This document is needed for transferring ownership of a vehicle. It includes buyer and seller information, resembling the Fo247’s requirement for detailed transaction information.

Dealer License Application: Similar to the Fo247, it is filled out by dealers to apply for or renew their dealership licenses. Both documents require specific details about the dealer and their business operations.

Transfer of Title Form: This form facilitates the transfer of ownership between parties. Like the Fo247, it necessitates accurate vehicle and buyer information to prevent issues during processing.

Refund Request Form: Used to request refunds for overpaid fees, this form requires information similar to the Fo247 regarding the amount overpaid and reasons for the refund.

Lease Registration Form: This document registers vehicles under a lease agreement. Both forms collect information on vehicle details, lessee information, and associated fees.

Customs Clearance Form: A document used to clear vehicles imported from other countries. It also contains transaction details and fee structures, akin to the Fo247 requirements.

Compliance Certificate Application: This application is submitted to verify that a vehicle meets state regulations. It gathers similar compliance and transaction information to the Fo247.

Reinstatement Application: Used when a vehicle's registration has lapsed. It collects data on previous registration and fees for reinstatement, paralleling the structure and purpose of the Fo247.

Dos and Don'ts

Do's and Don'ts for Filling Out the FO247 Form

- Do make sure to complete the form accurately, entering all required information, including the firm name, mailing address, and representative's details.

- Don't forget to submit the necessary fees along with the application. Incomplete submissions may lead to penalties.

- Do circle your choice between credit or refund and select how you prefer to receive the documents (pickup or mail).

- Don't enter cents in the money columns. Only round to the nearest dollar as instructed.

- Do group vehicle transactions by type (used, new, or out of state) for clarity.

Misconceptions

Misconceptions about the Fo247 form can lead to unnecessary confusion for users. Below is a list of common misunderstandings along with clarifications.

- The Fo247 form is only for dealers. Many believe this form is exclusively for licensed dealers and dismantlers. However, individuals and companies submitting multiple registration applications can also use it.

- You must submit odd cents on the form. Some people think they should include odd cents in the monetary calculations. In fact, any amount below fifty cents should be disregarded. Only submit whole dollar amounts.

- Late submissions will not incur fees. Another common belief is that applications won’t face penalties unless they are significantly late. In reality, administrative service fees apply after specific time periods, starting as early as 20 days after the date of sale.

- There is no need for multiple copies of the form. It is a misconception that only one copy is necessary. Submitters must prepare an original and two copies for processing by the Department.

- You must always enter the seller’s permit number. Some users think that the seller’s permit number is mandatory for all submissions. This number is only required if applicable, mainly for those who hold a seller’s permit.

- The original application is automatically returned to the submitter. Many participants assume the original form is returned after processing. However, the original is retained by the Department, while a copy is returned.

- Overpayment will not be addressed in the form. Some people believe that the form does not allow for the designation of overpayment. In fact, the Fo247 does have a section specifically for indicating whether a refund or credit is desired for any overpayments.

Key takeaways

Filling out the FO247 form is crucial for anyone involved in multiple vehicle registrations, whether you’re a dealer, dismantler, or an individual. The following key takeaways will help you navigate the process effectively:

- Complete the shaded area accurately: The submitter must fill in their firm name, address, dealer number, and necessary contact information. This information is essential for processing.

- Understand the payment structure: Fees must be calculated correctly. Remember to disregard cents unless they exceed fifty cents, where rounding up is necessary.

- Timeliness is key: Late submissions can incur additional fees. Applications need to be submitted promptly to avoid potential financial penalties.

- Provide comprehensive documentation: Ensure all required documents accompany your application to avoid delays. Incomplete submissions can lead to penalties and further complications.

- Be mindful of credits and refunds: Indicate any overpayments and choose an option for receiving refunds. Proper tracking of credits is essential in the registration process.

Browse Other Templates

California Quit Claim - Information about the decedent must be clearly specified in the deed for validity.

Braums Hiring - Contact information for previous employers is required on the form.