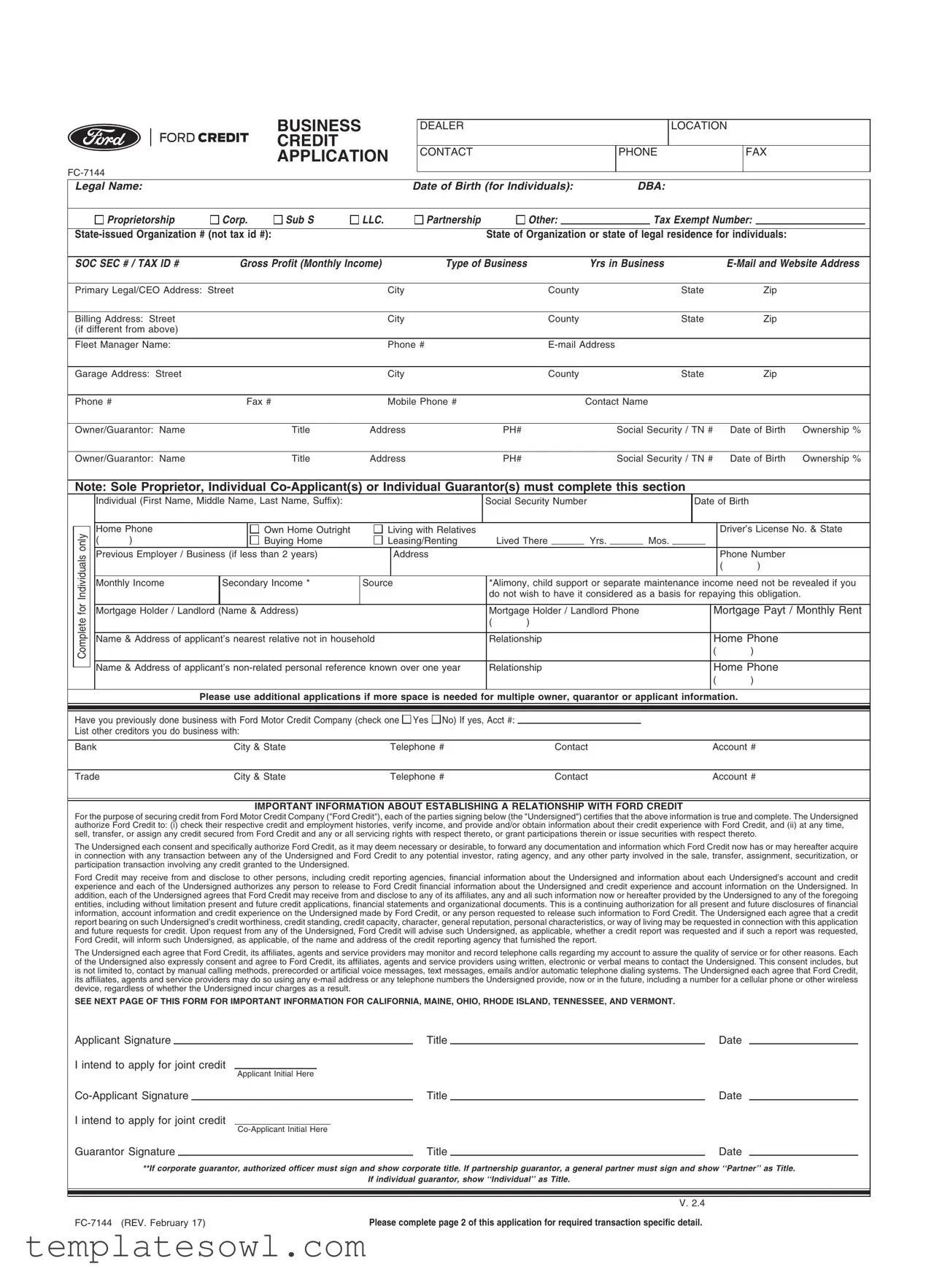

Fill Out Your Ford Business Credit Application Form

The Ford Business Credit Application form is a key document for those looking to establish credit with Ford Motor Credit Company. This form captures essential information about the business and its owners, including the legal name, type of business entity, and contact details. Applicants must provide financial information, such as monthly income and tax identification numbers. It also requests ownership details of the guarantors, along with their social security numbers and addresses. The application delves deeper by asking about personal references and previous experiences with Ford Credit. Additionally, important authorizations concerning credit history checks and the sharing of financial information are included. The form outlines required documentation for establishing credit and emphasizes the obligation for insurance on financed vehicles. Whether the need is for a single vehicle or a fleet, this form lays the groundwork for a financial relationship with Ford, ensuring all parties understand their commitments and the necessary steps to secure funding.

Ford Business Credit Application Example

BUSINESS

CREDIT

APPLICATION

DEALER

CONTACT

LOCATION

PHONE |

FAX |

|

|

|

Legal Name: |

|

|

|

|

|

Date of Birth (for Individuals): |

|

DBA: |

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

Proprietorship |

|

Corp. |

Sub S |

LLC. |

Partnership |

|

|

|

Other: |

|

|

|

|

|

|

Tax Exempt Number: |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State of Organization or state of legal residence for individuals: |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

SOC SEC # / TAX ID # |

|

Gross Profit (Monthly Income) |

Type of Business |

Yrs in Business |

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

Primary Legal/CEO Address: Street |

|

City |

|

|

|

|

County |

|

|

|

|

|

|

State |

|

Zip |

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Billing Address: Street |

|

|

|

City |

|

|

|

|

County |

|

|

|

|

|

|

State |

|

Zip |

|

|

|||||||||||

|

(if different from above) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Fleet Manager Name: |

|

|

|

Phone # |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Garage Address: Street |

|

|

|

City |

|

|

|

|

County |

|

|

|

|

|

|

State |

|

Zip |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

Phone # |

|

Fax # |

Mobile Phone # |

|

|

|

|

|

|

Contact Name |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Owner/Guarantor: Name |

|

|

Title |

Address |

|

|

|

PH# |

|

Social Security / TN # |

Date of Birth |

Ownership % |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

Owner/Guarantor: Name |

|

|

Title |

Address |

|

|

|

PH# |

|

Social Security / TN # |

Date of Birth |

Ownership % |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

Note: Sole Proprietor, Individual |

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

Individual (First Name, Middle Name, Last Name, Suffix): |

|

|

|

Social Security Number |

|

|

|

|

|

|

|

Date of Birth |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

only |

|

Home Phone |

|

|

Own Home Outright |

Living with Relatives |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Driver’s License No. & State |

|||||||

|

|

( |

) |

|

|

Buying Home |

Leasing/Renting |

|

|

Lived There |

|

|

|

Yrs. |

|

|

|

Mos. |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Individuals |

|

Previous Employer / Business (if less than 2 years) |

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone Number |

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

do not wish to have it considered as a basis for repaying this obligation. |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|||||||

|

|

|

Monthly Income |

|

Secondary Income * |

Source |

|

|

*Alimony, child support or separate maintenance income need not be revealed if you |

|||||||||||||||||||||||

|

for |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

Mortgage Holder / Landlord (Name & Address) |

|

|

|

|

Mortgage Holder / Landlord Phone |

|

|

|

|

|

Mortgage Payt / Monthly Rent |

|||||||||||||||||||

|

Complete |

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name & Address of applicant’s nearest relative not in household |

|

|

Relationship |

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

Name & Address of applicant’s |

|

Relationship |

|

|

|

|

|

|

|

|

|

Home Phone |

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

|

) |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

Please use additional applications if more space is needed for multiple owner, quarantor or applicant information. |

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Have you previously done business with Ford Motor Credit Company (check one |

Yes No) If yes, Acct #: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

List other creditors you do business with: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Bank |

|

|

City & State |

|

Telephone # |

|

|

|

|

Contact |

|

|

|

|

|

|

|

|

|

Account # |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

Trade |

|

|

City & State |

|

Telephone # |

|

|

|

|

Contact |

|

|

|

|

|

|

|

|

|

Account # |

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

IMPORTANT INFORMATION ABOUT ESTABLISHING A RELATIONSHIP WITH FORD CREDIT |

|

|

|

|

|||||||||||||||||||||

For the purpose of securing credit from Ford Motor Credit Company ("Ford Credit"), each of the parties signing below (the "Undersigned") certifies that the above information is true and complete. The Undersigned authorize Ford Credit to: (i) check their respective credit and employment histories, verify income, and provide and/or obtain information about their credit experience with Ford Credit, and (ii) at any time, sell, transfer, or assign any credit secured from Ford Credit and any or all servicing rights with respect thereto, or grant participations therein or issue securities with respect thereto.

The Undersigned each consent and specifically authorize Ford Credit, as it may deem necessary or desirable, to forward any documentation and information which Ford Credit now has or may hereafter acquire in connection with any transaction between any of the Undersigned and Ford Credit to any potential investor, rating agency, and any other party involved in the sale, transfer, assignment, securitization, or participation transaction involving any credit granted to the Undersigned.

Ford Credit may receive from and disclose to other persons, including credit reporting agencies, financial information about the Undersigned and information about each Undersigned’s account and credit experience and each of the Undersigned authorizes any person to release to Ford Credit financial information about the Undersigned and credit experience and account information on the Undersigned. In addition, each of the Undersigned agrees that Ford Credit may receive from and disclose to any of its affiliates, any and all such information now or hereafter provided by the Undersigned to any of the foregoing entities, including without limitation present and future credit applications, financial statements and organizational documents. This is a continuing authorization for all present and future disclosures of financial information, account information and credit experience on the Undersigned made by Ford Credit, or any person requested to release such information to Ford Credit. The Undersigned each agree that a credit report bearing on such Undersigned’s credit worthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or way of living may be requested in connection with this application and future requests for credit. Upon request from any of the Undersigned, Ford Credit will advise such Undersigned, as applicable, whether a credit report was requested and if such a report was requested, Ford Credit, will inform such Undersigned, as applicable, of the name and address of the credit reporting agency that furnished the report.

The Undersigned each agree that Ford Credit, its affiliates, agents and service providers may monitor and record telephone calls regarding my account to assure the quality of service or for other reasons. Each of the Undersigned also expressly consent and agree to Ford Credit, its affiliates, agents and service providers using written, electronic or verbal means to contact the Undersigned. This consent includes, but is not limited to, contact by manual calling methods, prerecorded or artificial voice messages, text messages, emails and/or automatic telephone dialing systems. The Undersigned each agree that Ford Credit, its affiliates, agents and service providers may do so using any

SEE NEXT PAGE OF THIS FORM FOR IMPORTANT INFORMATION FOR CALIFORNIA, MAINE, OHIO, RHODE ISLAND, TENNESSEE, AND VERMONT.

Applicant Signature |

|

|

|

|

|

|

Title |

|

Date |

|

|

I intend to apply for joint credit |

|

|

|

|

|

|

|

|

|||

|

|

|

|

Applicant Initial Here |

|

|

|

||||

|

|

|

|

Title |

|

Date |

|

|

|||

I intend to apply for joint credit |

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|||||

Guarantor Signature |

|

|

|

|

Title |

|

Date |

|

|

||

**If corporate guarantor, authorized officer must sign and show corporate title. If partnership guarantor, a general partner must sign and show ‘‘Partner’’ as Title. |

|

||||||||||

|

|

|

|

|

|

If individual guarantor, show ‘‘Individual’’ as Title. |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

V. 2.4 |

|

|

|

|

|

Please complete page 2 of this application for required transaction specific detail. |

|

|

|

||||||

BUSINESS CREDIT APPLICATION - PAGE 2

VEHICLE INFORMATION - (All of the below information is tentative and subject to the terms and conditions of the applicable approval letter. Use additional application for multiple vehicles.)

Qty |

N/U |

Year |

Make / Model |

|

GVW |

|

Serial / VIN # |

|

Total CAP Cost |

|

Residual % |

|

|

Est. Payment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installed equipment, body uplifts or |

|

|

|

|

Total cost of body uplifts / |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Qty |

N/U |

Year |

Make / Model |

|

GVW |

|

Serial / VIN # |

|

Total CAP Cost |

|

Residual % |

|

|

Est. Payment |

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Installed equipment, body uplifts or |

|

|

|

|

Total cost of body uplifts / |

|

|

||||||||

|

|

|

|

|

|

|

|

||||||||

Trade Detail: QTY: |

Year |

Make / Model |

|

VIN # |

Dealer Allowance |

Leinholder |

Payoff Amount |

||||||||

Will the vehicles be:

Used in Hazardous Material Transportation: |

Yes |

No |

Used in People Moving Services: |

Yes |

No |

Used in |

Yes |

No |

Part of a |

Yes |

No |

NOTE SPECIFIC PROGRAM OR OTHER DETAIL:

Terms:

#of Months

#of Adv. Pmts.

Circle Skip Months:

J F M A M J J A S O N D

Other:

Cash Price |

$ |

Net Trade |

- |

|

|

Cash Down |

- |

|

|

FET |

+ |

Other Up Front Tax |

+ |

|

|

Tags & Title |

+ |

Cap Cost |

$ |

|

|

Est. Payment |

$ |

California Disclosure

Applicant, if married, may apply for a separate account.

Maine Resident

If your credit application is approved and you finance the purchase of your motor vehicle through Creditor, you will be required to insure the vehicle against loss or damage. Creditor requires collision coverage and comprehensive coverage or fire and theft coverage. In addition, if this application is for a lease, Creditor will also require you to obtain liability insurance.

You have the option to select an agent or broker of your choice, whether or not affiliated with Creditor. Obtaining insurance from a particular agent or broker does not affect credit decisions by Creditor, unless the insurance product selected violates the terms of your contract for the purchase or lease of the motor vehicle.

Ohio Disclosure

The Ohio laws against discrimination require that all creditors make credit equally available to all creditworthy customers and that credit reporting agencies maintain separate credit histories on each individual upon request. The Ohio Civil Rights Commission administers compliance with this law.

Rhode Island Resident

A Credit Report may be requested in connection with this application for credit. Vehicle insurance may be obtained from a person of your choice.

Tennessee Resident

You must maintain insurance during the term of the contract. You must give the Creditor evidence of this insurance. The amount and type of insurance must be acceptable to the Creditor. YOU MAY CHOOSE THE PERSON THROUGH WHOM ANY INSURANCE IS OBTAINED.

Vermont Resident

By signing this credit application, Applicant consents to your obtaining a credit report for the purposes of evaluating this application and to obtain subsequent credit reports, in connection with this transaction, for the purpose of reviewing the account, taking collection action on the account or for any other legitimate purpose associated with the account.

Form Characteristics

| Fact Name | Details |

|---|---|

| Legal Structure | The applicant must specify their business type: Proprietorship, Corporation, LLC, or other formats. |

| Tax Identification | The form requires a Tax ID number and a State-issued Organization number (not a tax ID number). |

| Personal Information | Individuals applying must provide their Social Security number and date of birth. |

| Business Information | The applicant needs to indicate the type of business and years in operation. |

| Prior Relationship | The form inquires whether the applicant has previously done business with Ford Motor Credit Company. |

| State-Specific Disclosures | Residents from states like California, Ohio, and Tennessee must acknowledge specific disclosures regarding credit and insurance requirements. |

| Authorization | By signing the application, the undersigned authorizes Ford Credit to verify credit and employment histories, and share information with affiliates. |

Guidelines on Utilizing Ford Business Credit Application

Completing the Ford Business Credit Application can be a crucial step in securing financing for your business needs. It’s essential to provide accurate and comprehensive information, as this can affect your credit approval process. Below are straightforward steps to help you navigate filling out the application form successfully.

- Begin with the Legal Name of your business and your DBA (Doing Business As) name if applicable. Fill in your Date of Birth if you are applying as an individual.

- Indicate your business structure by selecting from the options provided: Proprietorship, Corp, Sub S, LLC, Partnership, or Other.

- If applicable, enter your Tax Exempt Number and State-issued Organization Number (not your tax ID).

- Specify your State of Organization or state of legal residence. Provide your business's TAX ID # or SOC SEC #.

- Fill in your Gross Profit as your Monthly Income and the type of business you operate.

- Include the Years in Business along with your Email and Website Address.

- Next, enter the Primary Legal/CEO Address, followed by the Billing Address if it differs from the primary.

- Provide information about your Fleet Manager, including their Name and Contact Information.

- For the Garage Address, include relevant details such as Street, City, State, and Phone/Fax Numbers.

- List the Owner/Guarantor information, noting multiple owners or guarantors as necessary. Include their names, titles, addresses, phone numbers, social security numbers, dates of birth, and ownership percentages.

- If applicable, complete the section for individual co-applicants or guarantors. Include full names, social security numbers, dates of birth, home phone numbers, and details regarding their living arrangements.

- Fill out details concerning your previous employment if you have been in business for fewer than two years. Include the employer's name, address, and phone number.

- Indicate any Secondary Income sources you wish to declare, if applicable.

- Provide details of your Mortgage Holder or landlord, including contact information.

- Include information about a nearest relative not living with you and a personal reference you’ve known for over a year.

- Answer whether you have previously done business with Ford Motor Credit Company by marking “Yes” or “No”. If “Yes,” provide the account number.

- List other creditors your business works with, mentioning Bank names, contact details, and account numbers for each.

- Finally, ensure all required signatures are included from the applicant, co-applicant, and guarantor, as well as dates and titles.

After completing the form, double-check for any missed information. Each detail serves a purpose in your application, offering insight into your business's financial standing. Gather any additional documents requested by Ford and ensure everything is submitted to facilitate a smoother review process.

What You Should Know About This Form

What information do I need to provide on the Ford Business Credit Application form?

When filling out the Ford Business Credit Application form, you'll need to provide various details about your business and financial situation. This includes your legal name, type of business (like corporation or partnership), tax identification number, and years in business. You’ll also need to share your monthly income, contact information, and the details of any owners or guarantors. The form includes specific sections for those applying as individuals or with co-applicants, so be sure to complete those accurately. If you have done business with Ford Credit before, note down your account number as well.

How will my credit history be checked?

By signing the application, you give permission for Ford Credit to check your credit history and employment background. This includes verifying your income and gathering information from credit reporting agencies. They may also obtain future credit reports to monitor your account and ensure you meet credit conditions. If you're curious about whether a credit report was requested, you can ask Ford Credit. They will provide you with the name and address of the reporting agency if one was used.

What happens after I submit the application?

Once you submit your application, Ford Credit will review it to determine your eligibility for credit. This may involve checking the provided information and assessing your business's financial health. If additional documentation is needed or if there are any questions, a Ford Credit representative may reach out to you. You will receive a notification regarding the approval or denial of your application, along with details about the next steps if your application is accepted.

What should I do if I need help completing the application?

If you need assistance with the Ford Business Credit Application, you're encouraged to contact a Ford Credit representative or your dealership. They can provide guidance on what information is required and address any specific questions about the application process. Additionally, if you have multiple owners or guarantors, it's advisable to use additional applications to ensure all necessary information is accurately captured.

Common mistakes

Completing the Ford Business Credit Application form is a crucial step for businesses seeking credit. However, several common mistakes can jeopardize this process. Understanding these pitfalls will help ensure a smoother application experience.

One frequent oversight occurs when applicants fail to provide a complete legal name. This section is vital, as it must match the official documents of the business entity. Leaving it blank or using an abbreviation can lead to delays, as Ford Motor Credit Company requires clear and verifiable information.

Another common error involves misidentifying the type of business entity. Upon filling out the form, individuals sometimes select the incorrect designation, such as marking "Partnership" instead of "Corporation." This mistake can require additional clarification and documentation, slowing the application process significantly.

Accurate contact information is essential, yet applicants often provide outdated or incorrect phone numbers and email addresses. As Ford Credit may reach out for verification or follow-up questions, ensuring that all contact information is current is imperative to avoid communication lapses.

Income reporting presents another challenge. Some applicants may understate or overlook certain sources of income, which can inadvertently misrepresent their financial situation. Thoroughly reviewing all income details helps prevent discrepancies that could raise red flags during the approval process.

In the section for previous employers, individuals frequently skip listing past jobs, especially if their work history spans less than two years. This omission may prompt the credit department to question their stability and reliability as borrowers, which can adversely affect approval chances.

In addition, many applicants overlook the requirement for personal references. Including references allows for further verification of the applicant's credibility. Not providing this information can be seen as a lack of preparedness or transparency.

The signing section also holds potential for mistakes. Failing to sign in the designated areas or using incorrect titles can cause significant setbacks. Ford understands that proper documentation is part of a professional application; therefore, clarity in signatures and corresponding titles is necessary.

Lastly, applicants might neglect to disclose previous business dealings with Ford Motor Credit. This part should be checked honestly. If applicants have business history with Ford, it could influence how their application is evaluated, making disclosure essential.

Awareness of these common mistakes can significantly improve the submission process for the Ford Business Credit Application form. Avoiding these errors insists on clarity, accuracy, and diligence, paving the way for a smoother lending experience.

Documents used along the form

When filling out the Ford Business Credit Application form, several other documents may be required or beneficial to streamline the process. Each one serves a specific purpose in verifying the credibility and financial background of the applicant. Below are some commonly used forms and documents that complement the application.

- Personal Financial Statement: This document outlines an individual's or business's financial situation, detailing assets, liabilities, and net worth. It helps lenders assess the financial stability of the applicant.

- Tax Returns: Providing recent tax returns (typically the last two years) allows lenders to review the applicant's income and ensure it aligns with the financial information provided in the application.

- Business Plan: A detailed business plan may be requested, particularly for new businesses. It outlines the business's goals, operational plans, market analysis, and financial projections.

- Credit Report: A copy of the applicant's personal or business credit report offers insight into their credit history and current creditworthiness. This document helps lenders evaluate risk.

- Proof of Identity: Applicants may need to provide a government-issued ID, such as a driver's license or passport, to verify their identity and relevant personal details.

- Ownership Documentation: For businesses, documents like Articles of Incorporation or operating agreements may be required to establish ownership and structure, verifying the legitimacy of the business entity.

- Bank Statements: Recent bank statements help lenders understand the cash flow of the applicant, providing additional context regarding financial stability and spending patterns.

- Lease Agreements: If leasing property or equipment, providing a copy of the lease agreement can offer insights into monthly obligations and overall financial commitments.

- Previous Credit Agreements: Sharing information from any past credit agreements can also be beneficial. This document shows a history of the applicant's relationship with other lenders or financial institutions.

Gathering these documents in advance can facilitate a smoother application process with Ford Business Credit. Each document plays a vital role in assessing the applicant’s qualifications, ultimately aiding in the decision-making process regarding credit approval.

Similar forms

-

Loan Application Form: Similar to the Ford Business Credit Application, a standard loan application also collects essential personal and business information, including income, employment history, and assets. Both forms require consent for credit checks and evaluations of the applicant's financial standing.

-

Credit Card Application: Like the Ford Business Credit Application, credit card applications ask for personal information, monthly income, and existing debts, allowing the institution to assess creditworthiness. Both forms require the applicant's consent for the bank to check credit reports.

-

Business Loan Application: This document, similar to the Ford form, gathers details about the business type, financial history, and personal information of the owners. Both applications assess the ability to repay the loan by verifying financial health through documentation.

-

Retail Credit Application: Retail credit applications focus on collecting personal and employment details to determine credit limits, resembling Ford's process of evaluating a customer's creditworthiness and financial credentials.

-

Lease Application: A lease application, like the Ford Business Credit Application, requires the applicant to provide personal and financial information and often includes consent for background checks to verify the applicant’s leasing viability.

-

Mortgage Application: This application type seeks financial data, employment history, and information about assets, similar to how the Ford Business Credit Application evaluates an applicant's financial situation and credit history for underwriting purposes.

-

Insurance Application: An insurance application requires personal details, including financial strength indicators, much like the Ford application. Both need the applicant's permission to collect information from credit agencies to determine risk factors associated with the applicant.

-

Equipment Financing Application: This document is similar, as it gathers extensive information about the business, including credit history and financials, to assess eligibility and risk, akin to Ford's business credit evaluations.

-

Personal Loan Application: Personal loan applications ask for similar data, such as income and debt levels, to determine lending risk. Both applications require personal information and often grant permission to conduct credit inquiries.

-

Merchant Application for Credit Card Processing: Merchant applications seek business and financial data to make credit decisions, mirroring the Ford Business Credit Application in evaluating business credibility and payment capabilities.

Dos and Don'ts

Filling out the Ford Business Credit Application form requires attention to detail and accuracy. Here are nine important do's and don'ts to keep in mind:

- Do provide accurate legal names for your business and any co-applicants.

- Do include your Tax ID number and any state-issued organization number.

- Do specify your type of business accurately (e.g., corporation, partnership).

- Do ensure that you include both billing and primary addresses completely.

- Do list all individuals who hold an ownership stake in the business.

- Don't omit any sources of income, including secondary income.

- Don't use abbreviations or acronyms that might confuse the reviewers.

- Don't forget to sign the application; incomplete submissions will be delayed.

- Don't neglect to inform your references that they may be contacted.

By following these guidelines, you can help facilitate a smoother application process and improve your chances of obtaining credit.

Misconceptions

Misconception 1: Only large businesses can apply for Ford Business Credit.

This is not true. Ford Business Credit is available to businesses of all sizes, including small and medium enterprises. Whether you’re a sole proprietor or part of a larger corporation, you can complete the application if you meet the necessary criteria.

Misconception 2: The Ford Business Credit Application requires extensive financial history.

Many believe they need an extensive financial background to apply. However, while having good credit helps, the application allows applicants to present their current financial situation, including income and business status. Your potential for future business is often taken into account as well.

Misconception 3: Applying for credit will negatively affect your personal credit score.

Some may worry that applying for business credit could harm their personal credit scores. While inquiries can impact your score slightly, when applying for business credit, the primary focus is on the business and its financials. Furthermore, if structured properly, there are ways to limit personal liability.

Misconception 4: The application process is overly complicated and time-consuming.

While any application requires attention to detail, many find the Ford Business Credit Application straightforward. Clear instructions guide you, and all required information is laid out in a user-friendly manner. Proper preparation can make the process quicker and more efficient.

Misconception 5: You must have existing relationships with Ford to apply.

This is a common myth. You don't need to already have a relationship with Ford or its credit division to submit an application. New applicants are welcome, and the company is keen to establish new partnerships with interested businesses.

Misconception 6: Additional loans will always be needed after approval.

Many assume that being approved for Ford Business Credit automatically means a business will need additional loans in the future. While financing options can vary based on needs, successfully obtaining credit may provide enough capital to manage purchases for some time without requiring further loans immediately.

Key takeaways

Filling out the Ford Business Credit Application form is a critical step for individuals and businesses seeking credit. Here are some key takeaways to ensure your application is completed correctly and effectively.

- Accurate Information is Essential: All details in the application must be truthful and comprehensive. Inaccurate information can lead to delays or denial of your application.

- Multiple Applicants Require Full Disclosure: If you're applying with co-applicants or guarantors, ensure that everyone provides their complete information, including personal data and financial history.

- Understand Your Business Structure: Clearly indicate whether you are applying as a sole proprietorship, corporation, partnership, or LLC. Each structure may have different implications for creditworthiness.

- Credit History Disclosure: By signing the application, you're authorizing Ford Credit to check your credit history, which is crucial for assessing your financial reliability.

- Income Verification Matters: Be prepared to provide documentation regarding your gross income and any additional sources. This helps establish your ability to repay the credit sought.

- Vehicle Information is Critical: When listing vehicle details, ensure that all information regarding the year, make, model, and costs is accurate. This data influences financing terms.

- Communication Preferences: The application allows Ford Credit to contact you through various means. Agree to the terms to facilitate ongoing communication regarding your account.

- Stay Informed About Disclosures: Be aware of specific disclosures for your state, as these can affect the terms of insurance and credit evaluation.

Completing the Ford Business Credit Application correctly lays the groundwork for a successful credit relationship. Treat this process thoughtfully and ensure that every section is diligently filled out.

Browse Other Templates

1099 K Meaning - Disputes or inquiries about payments reported on the 1099-K should be directed to the PSE listed on the form.

Incident Form in Hospital - Capture important details like the child's date of birth and the facility they attend.

Da 3645-1 - It assists commanders in understanding the equipment status of their personnel.