Fill Out Your Forethought Life Insurance Claim Form

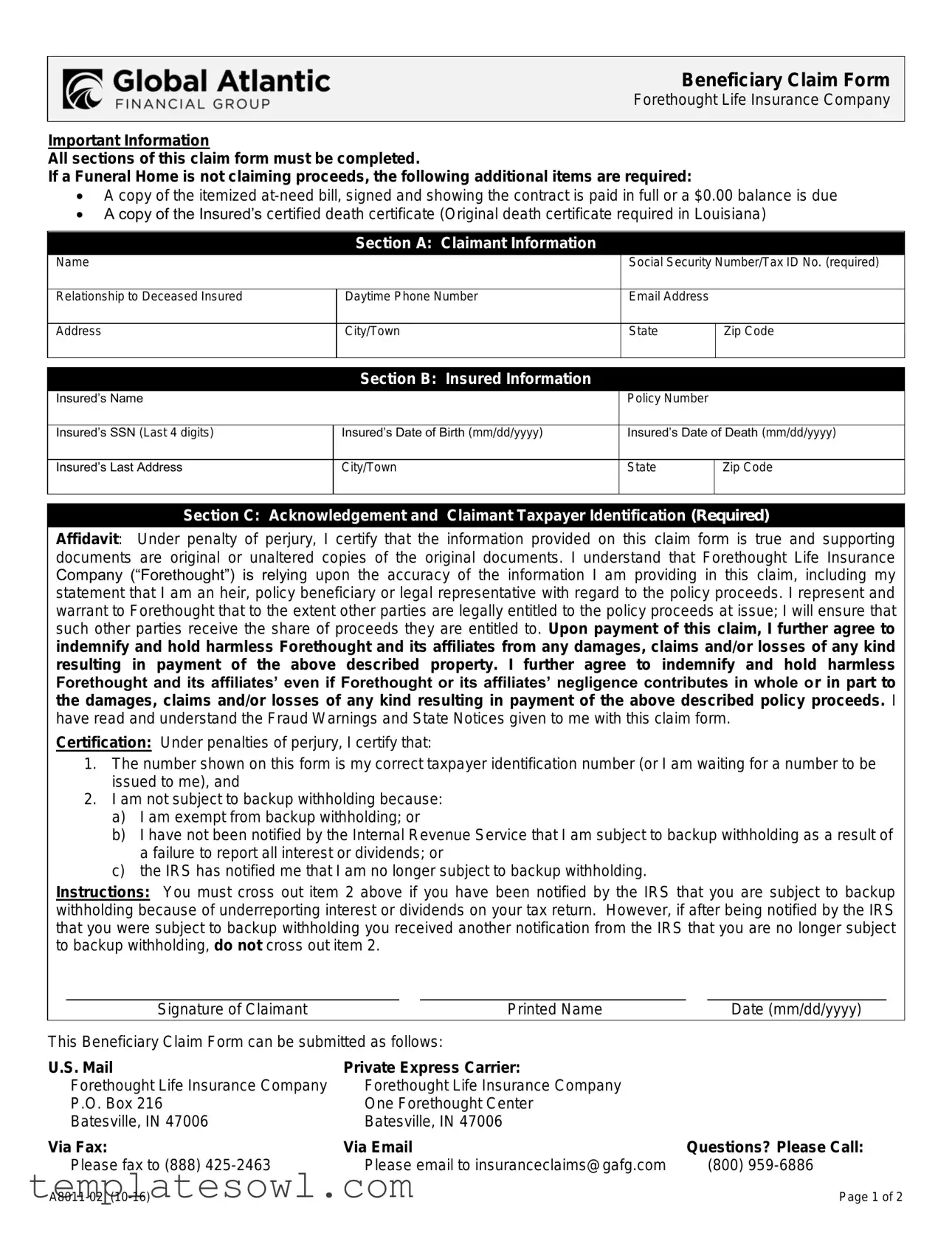

The Forethought Life Insurance Claim form is a key document for beneficiaries seeking to claim benefits after the death of the insured. Completing this form accurately is essential, as all sections must be filled out for the claim to be processed. One important aspect you need to be aware of is the requirement for additional documents if a funeral home is not involved. This includes an itemized at-need bill and a certified death certificate that may vary by state. The form has distinct sections for claimant and insured information, including essential details like personal identifiers and contact information. Claimants must also sign an affidavit, certifying that all information is truthful and complete. This helps to maintain the integrity of the claims process. Additionally, there are specific instructions regarding taxpayer identification and potential penalties for false information, reinforcing the importance of honesty throughout the process. For those needing assistance, guidance is offered via fax, email, or phone, ensuring that help is readily available as needed.

Forethought Life Insurance Claim Example

Beneficiary Claim Form

Forethought Life Insurance Company

Important Information

All sections of this claim form must be completed.

If a Funeral Home is not claiming proceeds, the following additional items are required:

A copy of the itemized

A copy of the Insured’s certified death certificate (Original death certificate required in Louisiana)

Section A: Claimant Information

Name |

|

Social Security Number/Tax ID No. (required) |

|

|

|

|

|

Relationship to Deceased Insured |

Daytime Phone Number |

Email Address |

|

|

|

|

|

Address |

City/Town |

State |

Zip Code |

|

|

|

|

Section B: Insured Information

Insured’s Name |

|

Policy Number |

|

|

|

|

|

Insured’s SSN (Last 4 digits) |

Insured’s Date of Birth (mm/dd/yyyy) |

Insured’s Date of Death (mm/dd/yyyy) |

|

|

|

|

|

Insured’s Last Address |

City/Town |

State |

Zip Code |

|

|

|

|

Section C: Acknowledgement and Claimant Taxpayer Identification (Required)

Affidavit: Under penalty of perjury, I certify that the information provided on this claim form is true and supporting documents are original or unaltered copies of the original documents. I understand that Forethought Life Insurance Company (“Forethought”) is relying upon the accuracy of the information I am providing in this claim, including my statement that I am an heir, policy beneficiary or legal representative with regard to the policy proceeds. I represent and warrant to Forethought that to the extent other parties are legally entitled to the policy proceeds at issue; I will ensure that such other parties receive the share of proceeds they are entitled to. Upon payment of this claim, I further agree to indemnify and hold harmless Forethought and its affiliates from any damages, claims and/or losses of any kind resulting in payment of the above described property. I further agree to indemnify and hold harmless Forethought and its affiliates’ even if Forethought or its affiliates’ negligence contributes in whole or in part to the damages, claims and/or losses of any kind resulting in payment of the above described policy proceeds. I have read and understand the Fraud Warnings and State Notices given to me with this claim form.

Certification: Under penalties of perjury, I certify that:

1.The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

2.I am not subject to backup withholding because:

a)I am exempt from backup withholding; or

b)I have not been notified by the Internal Revenue Service that I am subject to backup withholding as a result of a failure to report all interest or dividends; or

c)the IRS has notified me that I am no longer subject to backup withholding.

Instructions: You must cross out item 2 above if you have been notified by the IRS that you are subject to backup withholding because of underreporting interest or dividends on your tax return. However, if after being notified by the IRS that you were subject to backup withholding you received another notification from the IRS that you are no longer subject to backup withholding, do not cross out item 2.

Signature of Claimant |

|

Printed Name |

|

Date (mm/dd/yyyy) |

This Beneficiary Claim Form can be submitted as follows:

U.S. Mail |

Private Express Carrier: |

Forethought Life Insurance Company |

Forethought Life Insurance Company |

P.O. Box 216 |

One Forethought Center |

Batesville, IN 47006 |

Batesville, IN 47006 |

Via Fax: |

Via Email |

Questions? Please Call: |

Please fax to (888) |

Please email to insuranceclaims@gafg.com |

(800) |

Page 1 of 2 |

Beneficiary Claim Form

Forethought Life Insurance Company

Fraud Warnings & State Notices

California Residents – Reg. 789.8

The sale or liquidation of any asset in order to buy insurance, either life insurance or an annuity contract, may have tax consequences. Terminating any life insurance policy or annuity contract may have early withdrawal penalties or other costs or penalties, as well as tax consequences. You may wish to consult independent legal or financial advice before the sale or liquidation of any asset and before the purchase of any life insurance or annuity contract.

Colorado Residents

It is unlawful to knowingly provide false, incomplete, or misleading facts or information to an insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agent of any insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Department of Regulatory Agencies.

District of Columbia Residents

Warning: It is a crime to provide false or misleading information to an insurer for the purpose of defrauding the insurer or any other person. Penalties include imprisonment and/or fines. In addition, an insurer may deny insurance benefits, if false information materially related to a claim was provided by the applicant.

Hawaii, North Dakota, Pennsylvania Residents

Any person who knowingly and with intent to injure, defraud or deceive any insurance company, submits an application for insurance containing any materially false, incomplete, or misleading information, or conceals for the purpose of misleading, any material fact, is guilty of insurance fraud, which is a crime and in certain states, a felony. Penalties may include imprisonment, fine, denial of benefits, or civil damages.

Kansas Residents

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance may be guilty of insurance fraud as determined by a court of law and may be subject to fines and confinement in prison

Kentucky Residents

Any person who knowingly and with intent to defraud any insurance company or other person files a statement of claim containing any materially false information or conceals, for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime.

Maine and Tennessee Residents

It is a crime to knowingly provide false, incomplete or misleading information to an insurance company for the purpose of defrauding the company. Penalties may include imprisonment, fines or a denial of insurance benefits.

Massachusetts, New Mexico, Louisiana and Rhode Island Residents

Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

New Jersey Residents

Any person who includes any false or misleading information on an application for an insurance policy is subject to criminal and civil penalties.

Virginia Residents

Any person who, with the intent to defraud or knowing that he is facilitating a fraud against an insurer, submits an application or files a claim containing a false or deceptive statement may have violated the state law.

All Other States

Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Page 2 of 2 |

Form Characteristics

| Fact Name | Details |

|---|---|

| Claim Form Requirement | All sections of the Forethought Life Insurance Claim form must be completed for processing. |

| Funeral Home Documentation | If a Funeral Home is not claiming proceeds, an itemized at-need bill and a certified death certificate are required. |

| Death Certificate Specifics | In Louisiana, an original death certificate is necessary for the claim process. |

| Claimant Information Section | Section A collects claimant’s details, including name, Social Security Number, and relationship to the deceased. |

| Insured Information Section | Section B gathers information about the insured, including their name, policy number, and date of death. |

| Taxpayer Identification Requirement | A Taxpayer Identification Number is mandatory for certification on the claim form. |

| Fraud Warnings | The form includes state-specific fraud warnings to inform claimants of potential legal penalties for dishonest claims. |

| Submission Methods | The claim form can be submitted via U.S. Mail, fax, or email to speed up the processing time. |

| State Governing Laws | Each state has its own governing laws regarding insurance claims, such as penalties for fraud, which are outlined on the form. |

| Indemnity Agreement | Claimants agree to indemnify Forethought against any losses resulting from payment of the claim, ensuring legal protection for the company. |

Guidelines on Utilizing Forethought Life Insurance Claim

Filling out the Forethought Life Insurance Claim form is an important step in securing the benefits owed to you as a beneficiary. Whether you are familiar with the claims process or this is your first time, following these steps can help ensure that your submission is complete and accurate. Having all necessary information ready will make the process smoother.

- Complete Claimant Information: Fill out your name, Social Security number (or Tax ID), relationship to the deceased, daytime phone number, email address, and your full address including city, state, and zip code.

- Provide Insured Information: Enter the insured’s name, policy number, last four digits of the insured's Social Security Number, date of birth, date of death, and last address including city, state, and zip code.

- Acknowledge and Certify: Read and sign the affidavit and certification sections. Ensure that you accurately declare your taxpayer identification number and status regarding backup withholding.

- Gather Supporting Documents: If you are not claiming proceeds through a funeral home, attach an itemized at-need bill showing it is paid in full and a certified copy of the death certificate. In Louisiana, submit the original death certificate.

- Sign and Date: Make sure to provide your signature, printed name, and the date at the bottom of the form.

- Submit the Form: You may send the completed claim form via U.S. Mail, private express carrier, fax, or email using the details provided on the form.

By following these steps carefully, you can increase your chances of a prompt processing of your claim. If any questions arise during the process, don’t hesitate to reach out to the provided contact number for assistance.

What You Should Know About This Form

What information is required to complete the Forethought Life Insurance Claim form?

To successfully complete the form, all sections must be filled out. Key details include the claimant's information, the insured’s information, and an acknowledgment section. For claimants not associated with a funeral home, an itemized at-need bill and a certified death certificate are also needed. Additional documents may be requested depending on the case.

What is the purpose of Section A in the claim form?

Section A gathers essential details about the claimant. This includes the name, Social Security Number or Tax ID, relationship to the deceased, and contact information. Providing this information ensures that Forethought Life Insurance Company can contact the right individual regarding the claim.

What should I do if I do not have the death certificate?

If you do not possess a certified death certificate, it is crucial to obtain one. An original death certificate is necessary for submitting the claim, especially in Louisiana where specific regulations apply. Without this document, the claim may be delayed or rejected.

How do I submit the completed claim form?

The completed claim form can be sent in several ways. You may use U.S. Mail or a Private Express Carrier to send it to Forethought Life Insurance Company's P.O. Box. Alternatively, you can fax the form to (888) 425-2463 or email it to insuranceclaims@gafg.com. Ensure that you retain a copy for your records.

What type of identification is needed for the claimant?

The claimant must provide their Social Security Number or Tax ID in Section A of the form. This information is crucial for verifying the claimant's identity and ensuring that the benefit payment is processed correctly.

What does the acknowledgment section mean?

The acknowledgment section requires the claimant to certify that all information provided is accurate and true. Additionally, it establishes that they understand the legal implications of the claim, including their obligation to indemnify Forethought in case of any future disputes regarding the claim.

Are there any penalties for providing false information on the claim form?

Yes, providing false or misleading information can lead to serious legal consequences. Depending on the state, penalties may include imprisonment, fines, or denial of benefits. It is essential to ensure that all information submitted is accurate and truthful.

What if I have additional questions about the claim process?

If you have further questions, you can contact Forethought Life Insurance Company directly by calling (800) 959-6886. They can provide guidance and address any concerns regarding your claim.

Common mistakes

When filling out the Forethought Life Insurance Claim form, individuals often make critical mistakes that can delay or disrupt the claims process. Understanding these common missteps can significantly improve the chances of a smooth claim experience. Here are six mistakes to watch for.

One significant error involves failing to complete all sections of the claim form. Each part of the form is essential, and missing information can lead to delays. Ensure that personal details such as your name, relationship to the deceased, and contact information are accurately provided. Verify that the details about the insured, including their name, policy number, and date of birth, are also complete.

Another common mistake is neglecting to submit supporting documentation. If the Funeral Home is not handling the claim, additional documents are required, such as a signed itemized at-need bill showing payment in full and a certified death certificate. Omitting these documents will hinder the processing time and may require resubmission of the claim.

Many claimants forget to include the last four digits of the insured’s Social Security number. This information is mandatory. Without it, the claim may remain stagnant while the insurance company requests the missing details. It’s crucial to double-check that nothing is overlooked before submission.

Some individuals also mistakenly leave out the signature or the date at the end of the claim form. This step is vital, as both the certification of the information and acknowledgment of the terms depend on the claimant’s signature. An unsigned form can be deemed invalid, necessitating a complete resubmission.

Another frequent oversight is the misunderstanding of the taxpayer identification requirements. Ensure that the taxpayer identification number you include is correct. If you have been notified by the IRS regarding backup withholding, it is necessary that the relevant part of the certification is properly addressed. Ignoring this can lead to further complications.

Lastly, it is not uncommon for claimants to overlook checking for accuracy before sending the claim. Tiny errors such as misspellings, incorrect dates, or inaccurate amounts can lead to delays. Reviewing the completed form thoroughly can prevent frustrations and speed up the claim process.

Taking the time to carefully fill out the Forethought Life Insurance Claim form and avoiding these common mistakes can save significant time and effort. It’s a straightforward process, but attention to detail is imperative for a successful outcome.

Documents used along the form

When filing a Forethought Life Insurance Claim, several other documents may accompany the claim form to ensure a smooth process. Having the correct forms can make a significant difference in expediting the claim. Below are a few key documents that are often required.

- Itemized At-Need Bill: This document serves as proof of expenses incurred for funeral services. It must show a $0.00 balance or indicate that the contract is paid in full. A complete billing statement helps validate the claim and ensures that funds are released to cover these costs.

- Certified Death Certificate: A certified copy of the deceased's death certificate is essential for processing the claim. This official document verifies the passing of the insured individual. Note that certain states, like Louisiana, require the original death certificate for submission.

- Proof of Identity: Some claimants may be asked to provide a form of identification, such as a driver's license or passport. This helps confirm the identity of the claimant and their relationship to the deceased.

- Affidavit of Relationship: If there is any doubt about the relationship between the claimant and the deceased, an affidavit may be required. This document provides a sworn statement confirming the nature of that relationship, ensuring that the claim is valid.

Submitting these documents along with your Forethought Life Insurance Claim Form can help facilitate a quicker and more efficient claims process. Make sure to double-check that all required items are completed to avoid delays.

Similar forms

- Life Insurance Policy Application: Just like the Forethought Life Insurance Claim form, this document requires the applicant to provide personal information such as their name, Social Security number, and relationship to the insured. Both documents also involve an affirmation of the truthfulness of the information provided.

- Health Insurance Claim Form: Similar to the life insurance claim form, the health insurance claim form must be completed with accurate details about the insured person and the nature of the claims made. Both forms also often require signatures to certify that the statement is truthful.

- Funeral Benefit Claim Form: This form shares similarities with the Forethought Life Insurance Claim form in that it also requests documentation confirming the deceased’s death and the relationship of the claimant to the deceased. Affidavits may be necessary in both cases.

- Disability Insurance Claim Form: In this form, individuals must provide personal details and describe how and why they are unable to work, similar to the claims process for life insurance where the claimant explains their relationship to the deceased and justifies the claim.

- Beneficiary Designation Form: Also requiring an accurate identification of pertinent parties, this form specifies who is entitled to receive benefits, akin to the details sought in the Forethought Life Insurance Claim form about beneficiaries of the policy.

- Accidental Death and Dismemberment Claim Form: Much like the life insurance claim form, this document needs information about the insured individual and the circumstances surrounding the claim, requiring specifics to support eligibility for benefits.

- Withdrawal Request Form for Retirement Accounts: This form requires personal and financial details, akin to the insurance claim process, where the claimant must verify their identity and the nature of their relationship to the account holder.

- Health Savings Account (HSA) Claim Form: Similar to the Forethought Life Insurance Claim form, the HSA claim form requires substantiation of expenses and relationship, asking for proof of eligibility before providing benefits.

- Long-Term Care Insurance Claim Form: Both documents necessitate a thorough understanding of the insured's status and the suitability of the claim, often demanding signatures assuring the accuracy of all provided information.

- Commercial General Liability Claim Form: This form, like the life insurance claim form, involves declaring facts about the incident leading to a claim as well as the identity of the parties involved, ensuring that all necessary details are clearly communicated.

Dos and Don'ts

Things to Do When Filling Out the Forethought Life Insurance Claim Form:

- Complete all sections of the claim form thoroughly.

- Provide a copy of the Insured’s certified death certificate.

- Sign the affidavit to confirm the accuracy of your information.

- Make sure to include your Social Security Number or Tax ID.

- Attach required documents if a Funeral Home is not claiming proceeds.

- Keep copies of all submitted documents for your records.

Things Not to Do When Filling Out the Forethought Life Insurance Claim Form:

- Do not provide incomplete or misleading information.

- Do not forget to cross out the backup withholding item if applicable.

- Do not ignore the fraud warnings included in the form.

- Do not submit documents that are not original or unaltered copies.

- Do not rush through the form; double-check your entries.

- Do not submit the claim without your signature and date.

Misconceptions

Misconception 1: All sections of the Forethought Life Insurance Claim form can be left incomplete.

This is incorrect. It is crucial that all sections of the claim form be fully completed to avoid delays in processing the claim. Incomplete forms can lead to additional requests for information, which can prolong the claim payout process.

Misconception 2: A Funeral Home must always claim proceeds on behalf of the beneficiary.

This misconception is false. If a Funeral Home is not claiming the proceeds, claimants must submit additional documentation, such as an itemized at-need bill and a certified death certificate. The beneficiary can manage the claim independently.

Misconception 3: A copy of the death certificate can be any version, including digital formats.

Contrary to this belief, only original or certified copies of the death certificate are acceptable. In states like Louisiana, the original document is specifically required, which means that digital copies or unofficial formats are not valid.

Misconception 4: Providing the Social Security Number of the deceased is optional.

This is a misunderstanding. The form mandates the inclusion of the Insured's Social Security Number or the last four digits. This information is necessary for proper identification and processing of the claim.

Misconception 5: Once the claim form is submitted, the claimant has no further obligations.

In reality, claimants must certify the accuracy of the information provided under penalties of perjury. Additionally, they agree to indemnify the insurance company, meaning they take responsibility for any claims made against the proceeds. Ongoing communication may also be required during the claim processing stage.

Key takeaways

When filling out and using the Forethought Life Insurance Claim form, it’s essential to follow certain guidelines to ensure a smooth process. Here are some key takeaways:

- Complete All Sections: Ensure that every section of the claim form is filled out completely. Incomplete forms can delay the processing of your claim.

- Required Documents: If a funeral home is not claiming the proceeds, include the itemized at-need bill showing a zero balance and the certified death certificate.

- Claimant Information: Provide accurate details of the claimant, including name, contact information, and relationship to the deceased.

- Insured Information: Fill in the details about the insured, including their name, policy number, and dates of birth and death.

- Accuracy is Crucial: Certify that the information you provide is true. The accuracy of your statements is vital for the claim’s approval.

- Taxpayer Identification: Include your correct taxpayer identification number to avoid delays due to tax-related issues.

- Understand Your Responsibilities: Recognize that you must indemnify Forethought against damages related to the claim once payment is made.

- Submission Methods: You can submit the claim form via U.S. Mail, Private Express Carrier, fax, or email. Make sure to choose a method that works best for you.

- Fraud Warnings: Be aware of the fraud warnings listed on the form, as providing false information can lead to serious legal consequences.

- Contact for Questions: If you have any questions about the claims process, do not hesitate to call the provided customer service number for assistance.

Following these key points will help ensure that your claim form is processed efficiently and correctly.

Browse Other Templates

Psychology Gre Practice Test - Focus on mastering specific content areas such as Biological and Cognitive psychology for better subscores.

Dmv Vision Report - The form must be reviewed carefully to ensure compliance with all instructions provided.