Fill Out Your 0009001 Form

When navigating the intricate world of life insurance, understanding the various forms associated with policies is essential. One such important document is the 0009001 form, widely known as the Beneficiary Change Form. This form allows policyholders to formally designate or change beneficiaries on their life insurance policy, assuring that the intended individuals receive the benefits after the insured’s passing. Completing the 0009001 form requires attention to detail, as it requests not only the names of the primary and contingent beneficiaries but also critical identification information such as Social Security numbers and dates of birth. Furthermore, policy owners must affirm specific statements concerning the funding of the policy, ensuring compliance with company regulations. This affirmation attests to the accuracy and truthfulness of the information provided, a key part of establishing the legitimacy of the changes being made. With a clear and concise structure, the form also emphasizes the necessity of signatures from both the policy owner and, in certain states, possibly the spouse, along with a witness, ensuring that all parties involved consent to the changes. Understanding the nuances of the 0009001 form is critical for anyone wishing to secure their loved ones’ financial future effectively.

0009001 Example

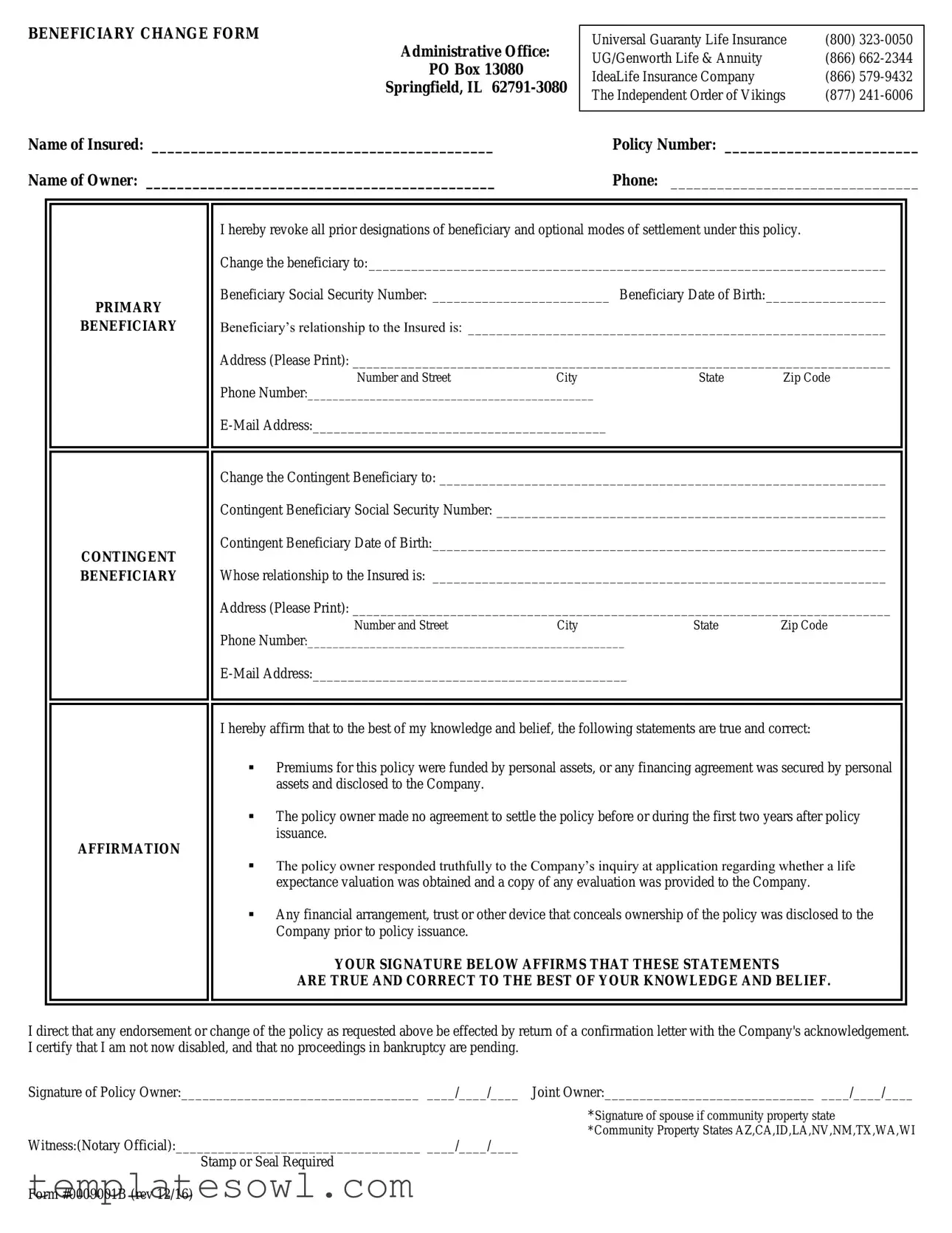

BENEFICIARY CHANGE FORM

Administrative Office:

PO Box 13080

Springfield, IL

Name of Insured: ____________________________________________

Name of Owner: _____________________________________________

Universal Guaranty Life Insurance |

(800) |

UG/Genworth Life & Annuity |

(866) |

IdeaLife Insurance Company |

(866) |

The Independent Order of Vikings |

(877) |

|

|

Policy Number: _________________________

Phone: ________________________________

PRIMARY

BENEFICIARY

I hereby revoke all prior designations of beneficiary and optional modes of settlement under this policy.

Change the beneficiary to:_________________________________________________________________________

Beneficiary Social Security Number: _________________________ Beneficiary Date of Birth:_________________

Beneficiary’s relationship to the Insured is: ___________________________________________________________

Address (Please Print): _____________________________________________________________________________

Number and StreetCityStateZip Code Phone Number:______________________________________________

CONTINGENT BENEFICIARY

Change the Contingent Beneficiary to: _______________________________________________________________

Contingent Beneficiary Social Security Number: _______________________________________________________

Contingent Beneficiary Date of Birth:________________________________________________________________

Whose relationship to the Insured is: ________________________________________________________________

Address (Please Print): _____________________________________________________________________________

Number and StreetCityStateZip Code Phone Number:___________________________________________________

AFFIRMATION

I hereby affirm that to the best of my knowledge and belief, the following statements are true and correct:

Premiums for this policy were funded by personal assets, or any financing agreement was secured by personal assets and disclosed to the Company.

The policy owner made no agreement to settle the policy before or during the first two years after policy issuance.

The policy owner responded truthfully to the Company’s inquiry at application regarding whether a life expectance valuation was obtained and a copy of any evaluation was provided to the Company.

Any financial arrangement, trust or other device that conceals ownership of the policy was disclosed to the Company prior to policy issuance.

YOUR SIGNATURE BELOW AFFIRMS THAT THESE STATEMENTS

ARE TRUE AND CORRECT TO THE BEST OF YOUR KNOWLEDGE AND BELIEF.

I direct that any endorsement or change of the policy as requested above be effected by return of a confirmation letter with the Company's acknowledgement. I certify that I am not now disabled, and that no proceedings in bankruptcy are pending.

Signature of Policy Owner:__________________________________ ____/____/____ Joint Owner:______________________________ ____/____/____

*Signature of spouse if community property state

*Community Property States AZ,CA,ID,LA,NV,NM,TX,WA,WI

Witness:(Notary Official):___________________________________ ____/____/____

Stamp or Seal Required

Form #0009001B (rev 12/16)

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Beneficiary Change Form |

| Form Number | 0009001 |

| Administrative Office | PO Box 13080, Springfield, IL 62791-3080 |

| Contact Information | Phone numbers for multiple insurance companies provided, including Universal Guaranty Life Insurance and IdeaLife Insurance Company. |

| Primary Beneficiary Declaration | The form allows the policy owner to revoke prior beneficiary designations and specify a new primary beneficiary. |

| Contingent Beneficiary | Policy owners can also designate a contingent beneficiary on this form. |

| Acknowledgment Requirement | A signature from the policy owner is required to affirm the accuracy of provided statements. |

| Community Property States | Additional signatures may be needed in community property states: AZ, CA, ID, LA, NV, NM, TX, WA, WI. |

Guidelines on Utilizing 0009001

After gathering the necessary information, you can begin filling out the 0009001 form. This form is used to designate primary and contingent beneficiaries for a life insurance policy and includes an affirmation section that the owner must complete. Accurate completion is important for ensuring that the changes are processed correctly.

- Enter the name of the insured in the designated space labeled "Name of Insured."

- Fill in the name of the owner in the space labeled "Name of Owner."

- Provide the policy number in the section marked "Policy Number."

- Insert a phone number in the "Phone" section.

- For the primary beneficiary, write the name of the individual in the section "Change the beneficiary to."

- Input the primary beneficiary's Social Security Number in the designated field.

- Enter the primary beneficiary's date of birth in the corresponding space.

- Describe the relationship of the primary beneficiary to the insured.

- Fill out the address for the primary beneficiary, including the number and street, city, state, and zip code.

- Provide the primary beneficiary's phone number and email address.

- Next, for the contingent beneficiary, write the individual’s name in "Change the Contingent Beneficiary to."

- Fill in the contingent beneficiary's Social Security Number in the appropriate area.

- Enter the contingent beneficiary's date of birth in the space provided.

- Describe the relationship of the contingent beneficiary to the insured.

- Complete the address for the contingent beneficiary, including the number and street, city, state, and zip code.

- Provide the contingent beneficiary's phone number and email address.

- Read the affirmation statements carefully. Ensure that all statements are true and correct.

- Sign the form in the section labeled "Signature of Policy Owner" and include the date.

- If applicable, have the joint owner sign in the "Joint Owner" section and include the date.

- If in a community property state, ensure that the spouse signs where indicated.

- Lastly, have a witness (notary official) sign and date the form, and ensure that their stamp or seal is included.

What You Should Know About This Form

What is the purpose of the 0009001 form?

The 0009001 form, also known as the Beneficiary Change Form, is used to officially designate or change beneficiaries for a life insurance policy. By completing this form, policy owners can revoke previous beneficiary designations and specify new primary and contingent beneficiaries. Ensuring that your beneficiary designations align with your current wishes is crucial for effective estate planning.

Who should complete the 0009001 form?

Any individual who holds a life insurance policy and wishes to modify their beneficiary designations should complete the 0009001 form. This includes the policy owner, who may be the insured individual or someone else. It is also necessary for joint owners or spouses in community property states to provide their signatures, underscoring the importance of mutual agreement in such situations.

What information is required to fill out the form?

The 0009001 form requires several pieces of critical information. You will need to provide the names of both the insured and the owner of the policy, along with the policy number. Additionally, details for both primary and contingent beneficiaries must be completed. This includes each beneficiary's full name, Social Security number, date of birth, relationship to the insured, and their contact information such as address, phone number, and email address.

Is there a need for notarization or a witness signature?

How will I know if my changes have been processed?

Once the 0009001 form is submitted, the insurance company will effect the requested changes and send a confirmation letter back to the policy owner. This notification serves as official acknowledgment that the beneficiary designations have been updated in accordance with the instructions provided in the form. It is essential to keep this confirmation for your records.

What should I do if I have questions about filling out the form?

If you have questions while completing the 0009001 form, it is advisable to contact your insurance company directly using the customer service numbers provided on the form. They can guide you through the process and ensure you understand every section. Seeking assistance can help prevent any errors that might delay the processing of your beneficiary changes.

Common mistakes

Filling out the 0009001 form can seem straightforward, but many people make common mistakes that can lead to delays or issues with processing. One major error is not providing complete information. When entering details about the beneficiaries, it's crucial to ensure that all required fields are filled out completely. Missing a beneficiary's name, social security number, or date of birth can cause problems down the line.

Another mistake involves incorrect relationship descriptions. It's important to precisely describe each beneficiary's relationship to the insured. Vague terms like "relative" or "friend" can create confusion. Instead, using specific terms like "sibling" or "partner" is much more helpful for the processing team.

Many people overlook the need for proper signatures. When multiple owners are involved, all necessary signatures must be provided. This includes any joint owners, and in community property states, even a spouse may need to sign. Missing a signature can derail the entire process.

Data entry errors also rank high on the list of mistakes. Simple typos in names, addresses, or phone numbers can result in significant issues. It's wise to double-check everything. Providing accurate contact information ensures that confirmation letters reach the right person.

Failing to affirm the statements required at the bottom of the form is another frequent oversight. All policy owners must affirm the truthfulness of the statements listed. Neglecting this step could lead to complications regarding the policy.

People sometimes forget to include a witness or a notary, depending on specific state requirements. This step is not just a formality; it may be necessary to validate the form. Ensure a witness is present or, when required, have the document notarized.

Lastly, neglecting to keep a copy of the filled form is a common misstep. It’s vital to maintain a record for personal reference. In case any issues emerge during the approval process, having that copy can make resolving problems much easier.

Documents used along the form

The following forms and documents are commonly utilized alongside the 0009001 form, which is a Beneficiary Change Form. Each document serves a unique purpose in the process of managing life insurance policies.

- Policy Application Form: This document is filled out when applying for a life insurance policy. It provides essential information about the insured, beneficiaries, and policy owner, setting the foundation for the insurance contract.

- Insurance Policy Document: This is the official document that outlines the terms of the insurance policy, including coverage details, premiums, and conditions. It serves as proof of the insurance agreement.

- Beneficiary Designation Form: Similar to the 0009001 form, this document specifically lists the beneficiaries of the policy. It is primarily used when creating a new designation or altering an existing one.

- Change of Ownership Form: This form is used to transfer ownership of the insurance policy from one person to another. It requires the current owner’s consent and may include additional information for the new owner.

- Claim Form: This document is required when a beneficiary submits a claim for benefits after the insured has passed. It includes necessary information to process the claim and obtain the death benefit.

- Disclosure Statement: This statement explains the policy's features, fees, and any potential risks involved. It ensures that the policyholder understands the terms and conditions fully.

Utilizing these forms can contribute to a smoother process in managing life insurance policies and beneficiaries. Each serves its role in ensuring clarity and compliance with insurance requirements.

Similar forms

-

Beneficiary Designation Form: Similar to the 0009001 form, this document allows policyholders to designate primary and contingent beneficiaries for their insurance policies. Both forms revoke previous beneficiary designations and require detailed information about the new beneficiaries, including their names, relationships, and social security numbers.

-

Trustee Certification Form: This document is used to establish a trust and designate a trustee to manage assets, much like the 0009001 form designates beneficiaries. Both forms require verification of the beneficiary's or trustee's identity and their relationship to the deceased or insured.

-

Power of Attorney Form: This legal instrument permits an individual to act on behalf of another in legal or financial matters. Similar to the 0009001 form, it requires the signatures of both the principal and the agent to confirm their agreement.

-

Last Will and Testament: A will outlines how an individual's assets will be distributed upon their death. The 0009001 form similarly identifies beneficiaries but focuses exclusively on insurance policies rather than the entirety of an estate.

-

Insurance Application Form: This form is used when applying for an insurance policy. Like the 0009001 form, it collects essential personal information, such as the applicant's name and contact details, and often incorporates beneficiary designations as well.

-

Change of Ownership Form: This document allows the original owner of an insurance policy to transfer ownership to another party. The approval and affirmation process within both forms ensures that such changes adhere to company policies and the law.

-

Healthcare Proxy Form: This document designates an individual to make healthcare decisions on behalf of another person. Like the 0009001 form, it requires specific information about both parties and the affirmation of their consent.

-

Community Property Agreement: In certain states, this agreement governs the ownership of property acquired during a marriage. The 0009001 form also includes specific provisions for spouses in community property states, highlighting relationships and signatures that validate the document.

Dos and Don'ts

Filling out the 0009001 form correctly is crucial to ensuring that your beneficiary changes are processed without delays. Here are seven helpful tips on what to do and what to avoid.

- Do read the entire form carefully before filling it out.

- Do provide complete and accurate information for all beneficiaries, including their Social Security numbers and dates of birth.

- Do sign and date the form to affirm the information is true and correct.

- Do ensure that all contact information, such as phone numbers and email addresses, is up to date.

- Don't leave any sections blank. Incomplete forms can lead to processing delays.

- Don't forget to use black or blue ink, as legibility is important for processing.

- Don't submit the form without reviewing it for accuracy one last time.

Adhering to these guidelines will help ensure that your beneficiary change is executed smoothly and according to your wishes. Take the time to verify each detail for peace of mind.

Misconceptions

Misconceptions about the 0009001 form can lead to confusion and errors in the beneficiary designation process. Here are six common misconceptions explained:

- This form is only required for life insurance policies. Many people believe the 0009001 form applies exclusively to life insurance. In reality, it can also be used for certain annuities and other financial products, depending on the issuing company.

- Once a beneficiary is designated, it can't be changed. This is a misconception. The 0009001 form allows policy owners to change beneficiaries at any time, provided they follow the required procedures outlined in the form.

- Contingent beneficiaries are unnecessary. Some individuals dismiss the importance of contingent beneficiaries. However, designating a contingent beneficiary ensures that someone will receive benefits if the primary beneficiary cannot, which offers additional security.

- Social Security numbers aren’t required. Contrary to what some may think, including the Social Security numbers of beneficiaries is often necessary. This helps to verify their identity and ensure that the correct individuals receive any benefits.

- Signing the form is enough; there’s no need for a witness. Many believe that a signature alone suffices for the form's validity. However, the 0009001 form often requires a witness or notary, especially in states with community property laws.

- This form is only relevant when the insured passes away. Some may think the form has no significance until the policyholder's death. In truth, changing beneficiaries can have immediate effects on the distribution of benefits and may be necessary during life events such as marriage, divorce, or birth.

Understanding these misconceptions can help ensure that beneficiaries are accurately designated and that the intended individuals receive their benefits as planned.

Key takeaways

The 0009001 form is designed for changing the beneficiary of a life insurance policy.

Ensure you have the necessary information ready before filling out the form, such as names, Social Security Numbers, and dates of birth.

Indicate whether you are changing the primary or contingent beneficiary by filling out the appropriate sections.

Revocation of any previous beneficiary designations occurs automatically when you fill in the new primary beneficiary.

Verify that all information provided is accurate and truthful, as it affects the validity of the policy.

Signatures are required from the policy owner and, if applicable, the joint owner or spouse in community property states.

A notary’s signature and stamp or seal are also needed to finalize the form in many cases, making it legally binding.

Make sure to send the completed form to the address provided on the form: PO Box 13080 Springfield, IL 62791-3080.

Keep a copy of the submitted form for your records, including any confirmation letter you receive from the insurance company.

If you have further questions, reach out to one of the contact numbers listed for the insurance companies related to your policy.

Browse Other Templates

Firehouse Subs Odessa - Release previous employers from any liability when providing references.

How to Apply for Ignition Interlock License in Pa - The DL-3731 form is used to apply for an ignition interlock license in Pennsylvania.