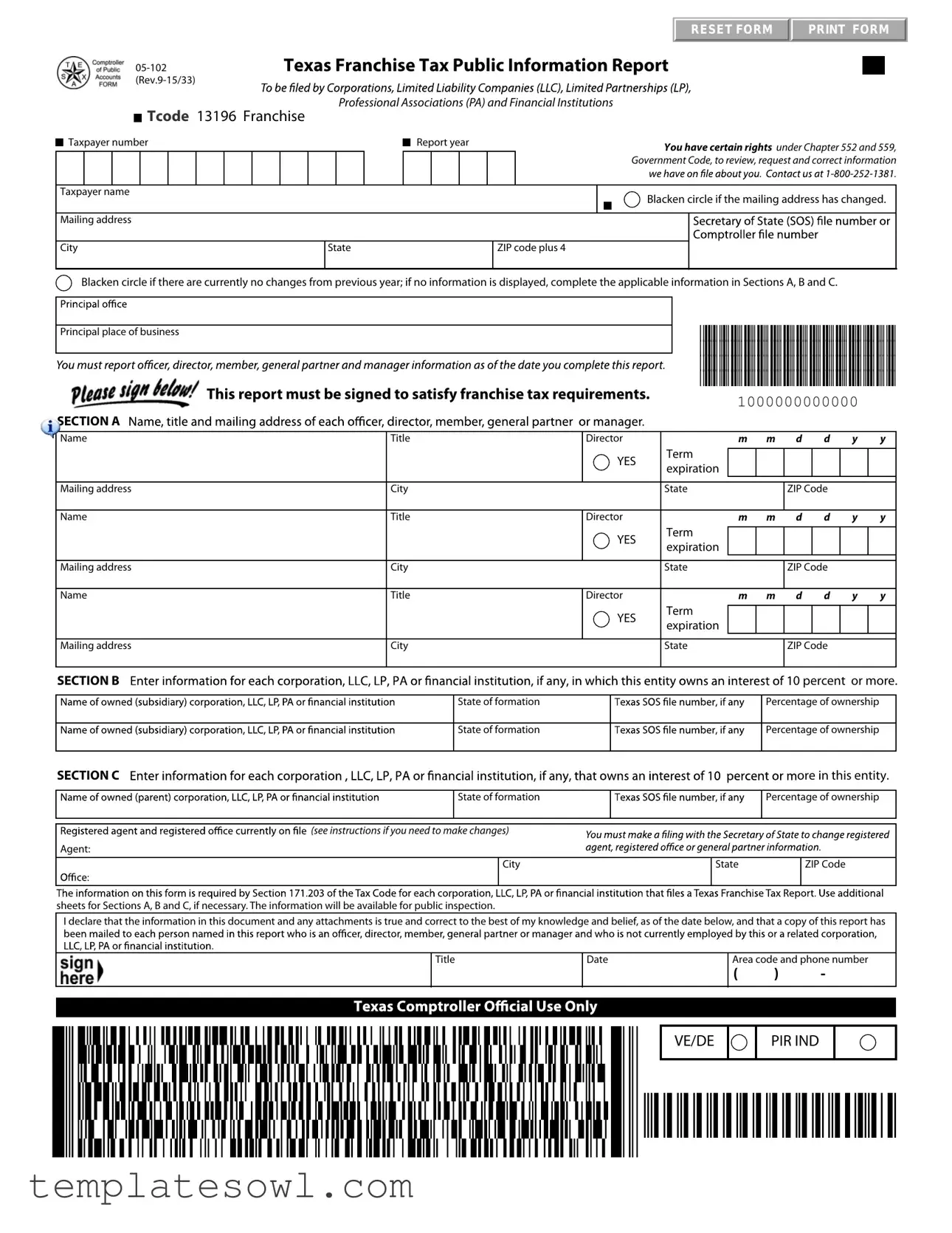

Fill Out Your 05 102 Texas Form

The 05-102 Texas Franchise Tax Public Information Report is a vital document for certain businesses operating in Texas, particularly Professional Associations and Financial Institutions. This form is essential for compliance with state regulations, ensuring that governance and transparency are maintained within these entities. It requires the reporting of various pieces of information, including the taxpayer's name, mailing address, and principal place of business. Importantly, businesses must confirm if there have been any changes to their contact information from the previous year or, if applicable, indicate that there are none. Sections A, B, and C provide additional details regarding the officers of the entity, including their titles, terms, and states of formation, as well as the percentage of ownership held by different individuals or entities. Accurate and truthful reporting is crucial, as the information submitted is open to public inspection, and there are rights under Chapter 552 and 559 of the Government Code to review or correct information if needed. This form must be signed to meet franchise tax requirements, adding an essential layer of accountability for organizations completing it.

05 102 Texas Example

RESET FORM |

PRINT FORM |

|

|

Texas Franchise Tax Public Information Report

Tcode 13196 Franchise

Tcode 13196 Franchise

Professional Associations (PA) and Financial Institutions

|

Taxpayer number |

|

|

|

|

|

|

|

|

|

|

Report year |

|

|

|

|

|

You have certain rights under Chapter 552 and 559, |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Government Code, to review, request and correct information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Taxpayer name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blacken circle if the mailing address has changed. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mailing address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City |

|

|

|

|

|

|

State |

|

|

|

|

|

|

ZIP code plus 4 |

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Blacken circle if there are currently no changes from previous year; if no information is displayed, complete the applicable information in Sections A, B and C.

Principal place of business

This report must be signed to satisfy franchise tax requirements.

This report must be signed to satisfy franchise tax requirements.

*1000000000015*

*1000000000015*

*1000000000015*

*1000000000015*

1000000000000

SECTION A

Name

Mailing address

Name

Mailing address

Name

Mailing address

Title |

|

Director |

|

m |

m |

|

d |

d |

y |

y |

|

|

YES |

Term |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||

Title |

|

Director |

Term |

m |

m |

|

d |

d |

y |

y |

|

|

|||||||||

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

||||

Title |

|

Director |

Term |

m |

m |

|

d |

d |

y |

y |

|

|

|||||||||

|

|

YES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

expiration |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

|

State |

|

|

|

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B |

|

0 percent or more. |

|

|

|

|

|

|

State of formation |

|

Percentage of ownership |

|

|

|

|

|

State of formation |

|

Percentage of ownership |

|

|

|

|

SECTION C |

|

ore in this entity. |

|

State of formation

Percentage of ownership

(see instructions if you need to make changes)

Agent:

City

State

ZIP Code

sheets for Sections A, B and C, if necessary. The information will be available for public inspection.

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and belief, as of the date below, and that a copy of this report has

Title

Date

Area code and phone number

( ) -

VE/DE

PIR IND

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The 05-102 Texas form is the Public Information Report required for certain entities like Franchise Professional Associations and Financial Institutions to disclose specific information for franchise tax requirements. |

| Governing Laws | This form is governed by Texas Tax Code Section 171, which requires entities to report information annually for franchise tax compliance. |

| Filing Requirements | Entities must complete and sign the report. The required sections must be filled out with accurate information to satisfy state regulations. |

| Public Inspection | The information provided in this report will be available for public inspection, ensuring transparency in business operations. |

| Rights to Review | Under Chapters 552 and 559 of the Texas Government Code, taxpayers have rights to review, request, and correct their information submitted on this form. |

| Mailing Address Updates | Taxpayers are required to update their mailing address if it has changed since the last filing by indicating this on the form. |

Guidelines on Utilizing 05 102 Texas

Before filling out the Texas 05-102 form, it’s essential to gather all necessary information regarding your business. This includes your taxpayer number, report year, business name and address, and details of your directors and ownership percentages. Once you have this information ready, follow the steps below to complete the form accurately.

- Start by entering your taxpayer number in the designated space at the top of the form.

- Fill in the report year for which you are submitting the information.

- Provide the taxpayer name and check the box if the mailing address has changed.

- Complete the mailing address, including city, state, and ZIP code.

- If there are no changes from the previous year, mark the box indicating this. If necessary, fill in all applicable information in Sections A, B, and C.

- In Section A, list the names, mailing addresses, titles, and term expiration dates of your directors. Include the relevant information for each director.

- In Section B, indicate the state of formation and percentage of ownership for each entity involved.

- In Section C, if applicable, specify any additional owners along with their state of formation and ownership percentages.

- Sign and date the form to certify that the information provided is accurate to the best of your knowledge.

- Finally, include your area code and phone number for contact purposes, located at the end of the form.

After completing these steps, you will have filled out the form correctly. Be sure to keep a copy for your records before submitting it to the appropriate Texas state agency.

What You Should Know About This Form

What is the purpose of the 05-102 Texas Franchise Tax Public Information Report?

This form serves as a crucial document that provides information about a business entity's compliance with franchise tax regulations in Texas. It allows taxpayers to disclose necessary details about their organization, including ownership percentages, addresses, and principal business locations. Completing this report demonstrates a commitment to transparency, ensuring that state authorities have an accurate record of the organization and its key individuals. The information provided is accessible for public inspection, reinforcing accountability.

Who needs to complete the 05-102 form?

Any business entity that operates in Texas and is subject to franchise tax must fill out the 05-102 form. This includes professional associations and financial institutions. If your business has undergone any changes, such as a new mailing address or changes in ownership, it is important to update this information in the report. Filing the form helps maintain compliance with state tax laws and fosters trust in the business community.

What happens if I do not file the 05-102 form on time?

Failing to submit the 05-102 form by the due date can lead to penalties and potential legal repercussions for the organization. In Texas, late filings may result in fines or interest accrual. Moreover, an overdue report can impact the entity's good standing status, making it more difficult to secure contracts or funding. Ensuring timely submission helps mitigate these risks and keeps the organization in good standing with state authorities.

Can I make changes to the information provided in the 05-102 form after submission?

Yes, changes to the information can be made after submission if necessary. If updates are needed regarding ownership percentages, mailing addresses, or key personnel, it is advisable to file an amendment or a new report, depending on the specific situation. The Texas Government Code allows individuals to review, request, and correct their information, safeguarding accuracy and integrity in the public records.

Common mistakes

Filling out the Texas Franchise Tax Public Information Report, Form 05-102, can be a straightforward task if approached with care. However, many individuals make common mistakes that can lead to complications. One common error involves the failure to provide an updated mailing address. It is crucial to blacken the circle if any changes have occurred since the last filing. Missing this detail could result in important communications being sent to the wrong location, which may delay the processing of the report.

Another frequent mistake occurs when taxpayers neglect to check for completeness in Sections A, B, and C. If there are no changes compared to the previous year, individuals must still complete the applicable sections as required. Leaving sections blank or assuming that previous entries remain valid can lead to discrepancies, making the report incomplete. All sections must accurately reflect the current situation to comply with the reporting requirements.

Signature errors are yet another issue that arises during the process. It is imperative that the report is signed properly to fulfill franchise tax obligations. Failure to sign or dating the document incorrectly can invalidate the report. This oversight might not only cause delays but could also lead to penalties if the report is considered non-compliant.

Lastly, individuals should be aware of the importance of accurately reporting ownership percentages in Section B and Section C. Miscalculating or misrepresenting ownership stakes can have serious implications for how a business is classified under Texas law. It is important to ensure that these details are precise and verifiable. By taking the time to carefully complete each part of the form, taxpayers can help safeguard their compliance and maintain good standing with state regulations.

Documents used along the form

The Texas Franchise Tax Public Information Report, commonly referred to as the 05-102 form, is an essential document that Texas businesses must submit. This form provides critical information about the business, including its ownership and management structure. While the 05-102 form is significant, there are several other forms and documents that are often used in conjunction with it. The following is a list of related forms and their brief descriptions.

- Texas Franchise Tax Annual Report (Form 05-167): This form is required for businesses to report their franchise tax due to the state. It includes financial information and details about revenue to determine the tax obligations.

- Certificate of Formation (Form 201): This document is necessary for the creation of a new business entity in Texas. It outlines the entity’s structure, management, and purpose, serving as the official paperwork that establishes the business.

- Bylaws for Corporations: Although not submitted to the state, this document outlines the rules and regulations governing the internal management of a corporation. It guides operations and procedures, ensuring compliance with state laws and corporate governance.

- Texas Application for Sales and Use Tax Permit (Form 01-339): Businesses that sell taxable items or services must complete this application. It registers the business for collecting state sales tax and provides essential compliance for sales tax purposes.

- Texas Employer Identification Number (EIN) Application (Form SS-4): This form, required by the IRS, helps businesses obtain an Employer Identification Number. It is critical for tax purposes, hiring employees, and opening a business bank account.

These forms play various roles in ensuring that a business operates legally and complies with state and federal regulations. Understanding the relationship between these documents can simplify the process of setting up and maintaining a business in Texas.

Similar forms

- Texas Partnership Information Form: Similar to the 05-102 form, this document requires details about the partners and their ownership percentages within a partnership, ensuring transparency in state registrations.

- Texas Corporations Public Information Report: Like the 05-102 form, this report includes the corporation's basic information, including names and addresses of directors, ensuring public access to corporate details.

- Texas LLC Annual Report: This document also requires reporting information about members and managers within a Limited Liability Company, paralleling the aspects of ownership disclosure found in the 05-102 form.

- Texas Franchises Tax Report: Similar in that it requires specific information about the entity's business structure and owners, this report primarily focuses on tax obligations and financial disclosures.

- Texas Nonprofit Organization Report: This document shares the same purpose of public transparency, detailing the organization's structure, similar to the information required in the 05-102.

- Texas Foreign Entity Registration Form: Like the 05-102, this form requires information about an out-of-state entity doing business in Texas, including ownership and principal addresses.

- Texas Limited Partnership Certificate: This document, similar in function to the 05-102, mandates reporting pertinent details about partners and their roles, emphasizing ownership and management structures.

Dos and Don'ts

When filling out the Texas Franchise Tax Public Information Report (05 102), it is crucial to get it right to avoid issues down the line. Here are five things to do and not do while completing this form:

- Do double-check all entries for accuracy to ensure that the taxpayer name, address, and other details are correct.

- Do blacken the circle if there are no changes from the previous year, as this indicates continuity in your reporting.

- Do sign the report. An unsigned report will not satisfy the franchise tax requirements.

- Do include all required sections, such as A, B, and C, even if it means filling out additional sheets.

- Do declare the accuracy of the information provided. Your declaration asserts the truthfulness of the details.

- Don't skip over the Principal Place of Business section. This information is necessary for identifying your business location.

- Don't overlook state requirements. Make sure to acknowledge the state of formation and percentage of ownership information.

- Don't forget to use the most recent version of the form. Using outdated versions can lead to submission issues.

- Don't leave any fields blank unless explicitly stated that they are optional. Missing information can cause delays.

- Don't wait until the last minute to file. Timely submissions ensure compliance and avoid late fees.

Misconceptions

The 05 102 Texas form, also known as the Texas Franchise Tax Public Information Report, is often misunderstood. Below is a list of common misconceptions about this form, accompanied by clarifications that provide a better understanding.

- Misconception 1: The form is only for large corporations.

- Misconception 2: Filing the form is optional.

- Misconception 3: There is no need to update information annually.

- Misconception 4: Only the owner needs to sign the form.

- Misconception 5: The form can be filed online without any issues.

- Misconception 6: Changes to the business structure don’t need to be reported.

- Misconception 7: The information on the form is confidential.

In reality, this form applies to various business structures, including professional associations and financial institutions, regardless of size.

On the contrary, submitting the 05 102 form is mandatory for compliance with franchise tax regulations in Texas.

This is incorrect. Businesses must file an updated report each year to ensure that their information remains accurate and current.

All directors listed in the report must sign it to verify that the information provided is true and correct.

Some businesses may experience technical difficulties when attempting to file online. It's crucial to confirm that the submission was successful and keep records of confirmation.

Any significant changes, such as changes in ownership or management, should be reported in the relevant sections of the form.

Actually, the information provided in the 05 102 form is available for public inspection, making transparency vital for compliance.

Key takeaways

When filling out the 05 102 Texas Franchise Tax Public Information Report, keep the following key takeaways in mind:

- Accuracy is crucial: Ensure all information is correct and reflects the current status of the entity.

- Signature requirement: This report must be signed to meet franchise tax obligations.

- Address changes: If the mailing address has changed, mark the appropriate circle to indicate this.

- No changes: If there are no changes from the previous year, blacken the circle to indicate this status.

- Ownership details: Clearly state the percentage of ownership for each entity and its state of formation in Section B.

- Public inspection: All submitted information will be available for public review.

- Multiple directors: Use additional sheets for listing multiple directors in Section A if necessary.

- Stay compliant: Review your rights under Chapter 552 and 559 of the Government Code to request corrections if needed.

Browse Other Templates

Free Backround Check - Applicants can provide several forms of contact information for verification.

Who Owns Mr Cooper - Understand the importance of eligibility criteria in your application success.

Tiaa Revenue - Participating in the Custom Portfolio Service may affect how funds are rolled over.