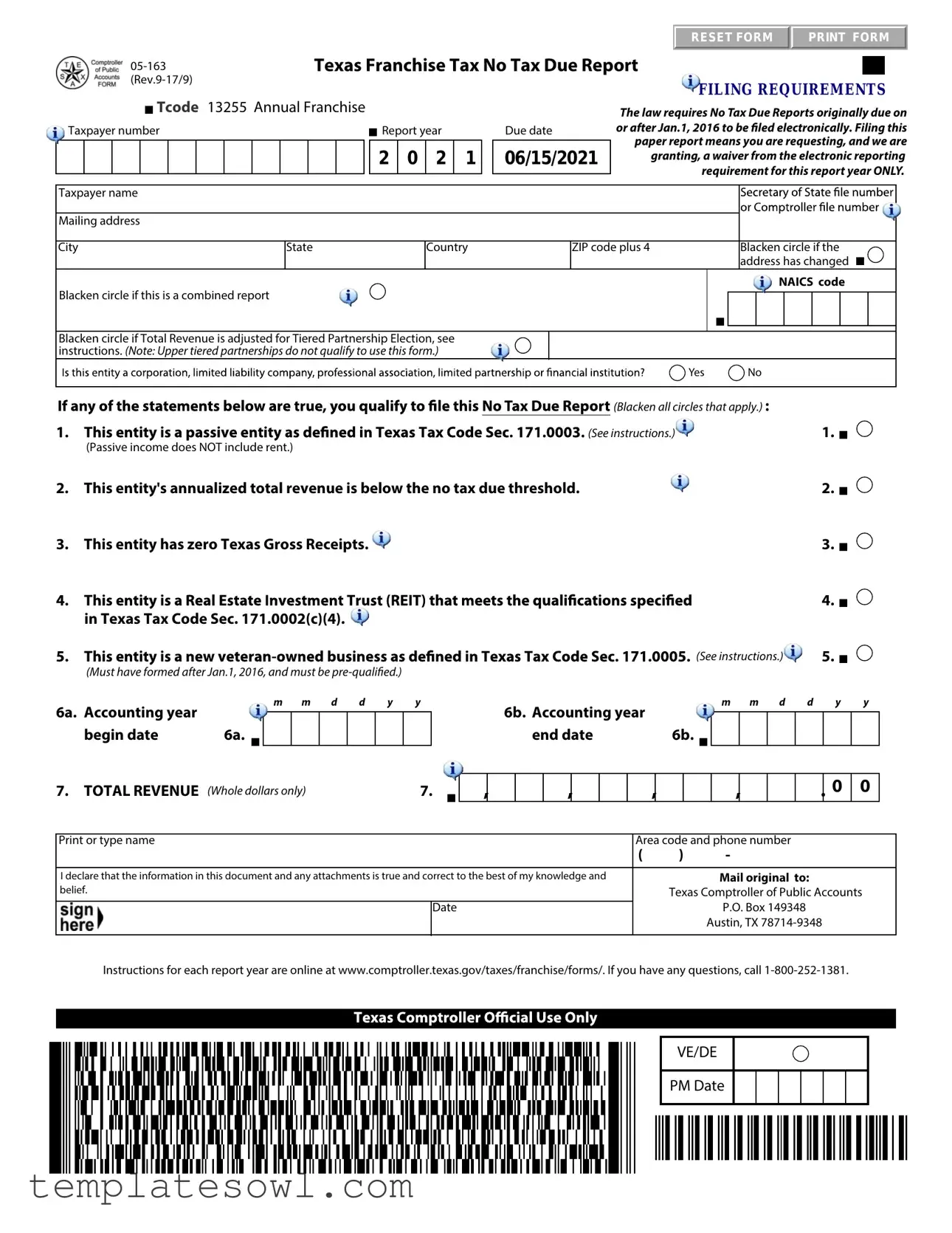

Fill Out Your 05 163 Form

The 05-163 form, commonly known as the Texas Franchise Tax No Tax Due Report, serves a crucial role for businesses operating in Texas. Designed for entities with annualized total revenue below a specified threshold, it simplifies the reporting process for those who owe no tax. It is important to note that, since January 1, 2016, the law mandates the electronic submission of these reports, unless a specific waiver has been granted for a particular reporting year. The form gathers essential information from the taxpayer, including business name, mailing address, and applicable codes such as the North American Industry Classification System (NAICS). Additionally, it enables entities to indicate changes in address or status, such as combined reporting or adjustments related to tiered partnerships. To ensure accuracy, taxpayers must affirm the correctness of their submissions while providing the necessary financial details, including total revenue in whole dollars. Ultimately, this form not only streamlines compliance but also helps businesses confirm their status within the Texas tax system.

05 163 Example

RESET FORM PRINT FORM

|

|

|

|

|

Texas Franchise Tax No Tax Due Report |

|

|

||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FILING REQUIREMENTS |

|||||||

|

|

|

|

|

|

|

Tcode 13255 AnnualFranchise |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

The law requires No Tax Due Reports originally due on |

|||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

Taxpayer number |

|

|

|

|

|

|

|

|

Report year |

Due date |

or after Jan.1, 2016 to be led electronically. Filing this |

||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

paper report means you are requesting, and we are |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

0 |

2 |

1 |

|

06/15/2021 |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

granting, a waiver from the electronic reporting |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

requirement for this report year ONLY. |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Taxpayer name |

|

|

|

|

Mailing address |

|

|

|

|

City |

State |

Country |

ZIP code plus 4 |

Blacken circle if the |

|

|

|

|

address has changed |

NAICS code

Blacken circle if this is a combined report

Blacken circle if Total Revenue is adjusted for Tiered Partnership Election, see instructions. (Note: Upper tiered partnerships do not qualify to use this form.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

|

|

No |

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Blacken all circles that apply.) : |

|

|

|

|

|

|

||||||||||

|

(Passive income does NOT include rent.) |

|

|

|

|

|

|

|

|

|

(See instructions.) |

|

|

|

|

|

1. |

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

2. This entity's annualized total revenue is below the no tax due threshold. |

|

|

|

|

|

|

|

|

|

|

|

2. |

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3. |

This entity has zero Texas Gross Receipts. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

in Texas Tax Code Sec. 171.0002(c)(4). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4. |

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

(Must have formed after Jan.1, 2016, and must be |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(See instructions.) |

5. |

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

6a. Accounting year |

|

|

|

m m d d y |

y |

|

6b. Accounting year |

|

|

|

|

m m d d |

|

y |

|

y |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6b. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

begin date |

6a. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

end date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

7. |

TOTAL REVENUE (Whole dollars only) |

7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

0 |

|

0 |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Print or type name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Area code and phone number |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

( |

) |

|

|

- |

|

|

|

|

|

|

|

|

|

|

I declare that the information in this document and any attachments is true and correct to the best of my knowledge and |

|

|

|

|

|

|

|

Mail original to: |

|

|

|

|

|

|

|||||||||||||||||||||||

belief. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Texas Comptroller of Public Accounts |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

P.O. Box 149348 |

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Austin, TX |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for each report year are online at www.comptroller.texas.gov/taxes/franchise/forms/. If you have any questions, call

VE/DE

PM Date

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Purpose | The 05-163 form is used to report no tax due for Texas Franchise Tax. |

| Filing Requirement | No Tax Due Reports must be filed electronically if originally due on or after January 1, 2016. |

| Waiver Request | Filing a paper report requests a waiver from electronic filing for that specific report year. |

| Governing Law | This form is governed by Texas Tax Code Section 171.0002(c)(4). |

| Total Revenue Threshold | The entity's annualized total revenue must be below the no tax due threshold to qualify. |

| Zero Gross Receipts | The form can be filed if the entity has zero Texas Gross Receipts. |

| Post-Formation Requirement | Entities formed after January 1, 2016, and pre-qualified can use this form. |

| Submission Information | Mail the original form to the Texas Comptroller of Public Accounts at the designated address. |

Guidelines on Utilizing 05 163

After completing the 05-163 form, it must be submitted to the Texas Comptroller of Public Accounts by the specified deadline. Ensure that all information is accurate to avoid potential issues. Below are the steps to fill out the form:

- Gather the necessary information: your Taxpayer number, entity's name, mailing address, and NAICS code.

- Check if your address has changed and mark the appropriate circle if applicable.

- Indicate whether this is a combined report by marking the corresponding circle.

- Determine if your Total Revenue is adjusted for Tiered Partnership Election and mark the appropriate circle.

- Indicate your entity's annualized total revenue and check both conditions to confirm eligibility for the no tax due report.

- Provide the accounting year begin and end dates in the specified format (mm/dd/yyyy).

- Fill in the Total Revenue in whole dollars only.

- Print or type your name and include your area code and phone number.

- Sign the form, declaring that all information is true and correct.

- Mail the original form to the Texas Comptroller of Public Accounts at the provided address.

What You Should Know About This Form

What is the purpose of the Texas Franchise Tax No Tax Due Report (Form 05-163)?

The Texas Franchise Tax No Tax Due Report is a form that allows certain businesses to report that they owe no franchise tax for a given year. This form helps businesses demonstrate compliance with Texas tax laws when their annual revenue falls below a specific threshold. Filing this report is necessary to maintain good standing with the Texas Comptroller of Public Accounts and can facilitate the renewal of business licenses and other legal requirements.

Who is required to file the Form 05-163?

How do I file the Form 05-163?

This form must be filed electronically if the report is for a year after January 1, 2016. However, if you are submitting a paper report, you must request a waiver from the electronic filing requirement for that specific report year. To file, complete the required sections of the form and mail the original to the Texas Comptroller of Public Accounts at the specified address. Ensure all information is accurate to avoid any penalties.

What should I do if my address has changed since the last report?

If your business address has changed, you must indicate this on the Form 05-163 by blackening the appropriate circle. Providing up-to-date information is crucial for maintaining accurate records with the Texas Comptroller. Failure to notify the authorities of an address change can lead to missed communications regarding tax filings and obligations, which could result in penalties or fines.

Common mistakes

Filling out the 05-163 form can seem straightforward, but many individuals make common mistakes that can lead to delays or complications. One significant error is failing to file electronically. Since January 1, 2016, the law mandates that No Tax Due Reports be submitted electronically. Those who submit a paper form are effectively requesting a waiver. This can create confusion and potential issues down the line.

Another mistake involves inaccurate reporting of total revenue. It’s crucial to ensure that the revenue figures provided are whole dollars only. Submitting incorrect amounts not only may lead to rejection of the form but could also raise questions about the entity’s eligibility for the no tax due status.

Some people overlook the importance of identifying changes in address. If there has been a change in the mailing address, it must be clearly indicated by blackening the appropriate circle. Failing to update the address can result in miscommunication and delays in receiving important notifications or documents.

It’s also common to misunderstand the NAICS code requirement. The NAICS code must accurately reflect the type of business entity. If an incorrect code is provided, it can lead to compliance issues and misinterpretation by the Texas Comptroller's office.

A frequent oversight is not declaring all relevant information about the taxpayer's status. It is essential to check all applicable boxes, particularly regarding whether the entity has zero Texas Gross Receipts or if it is a combined report. Incomplete information can cause unnecessary complications in processing the report.

Finally, remember to sign and date the form. This appears simple, yet many forget this step, which is vital for the validation of the filing. A missing signature can delay processing and create significant frustration down the line.

Documents used along the form

When filing the Texas Franchise Tax No Tax Due Report (Form 05-163), there are several other documents that often accompany it to ensure compliance and thoroughness. Each of these forms serves a unique purpose in the tax filing process. Here's a closer look at five commonly used forms:

- Texas Franchise Tax Report (Form 05-162): This report is required for businesses whose total revenue exceeds the no tax due threshold. It provides detailed information about the business's earnings and tax obligations for the reporting period.

- Form 05-167, Texas Franchise Tax Extension Request: This form allows a business to request an extension for filing its franchise tax report. It must be submitted with appropriate documentation before the due date of the original report to avoid late penalties.

- Form 05-159, Texas Franchise Tax E-File Notice: This document notifies taxpayers of the requirement to file electronically. It aims to inform and ensure compliance with the electronic filing rules established by the Texas Comptroller's office.

- Form 05-160, Texas Franchise Tax Account Status: This form provides verification of a business's current franchise tax standing. It helps businesses confirm whether they are compliant or if there are any outstanding issues.

- NAICS Code Documentation: Businesses must provide documentation supporting their North American Industry Classification System (NAICS) code. This code categorizes the entity’s industry for statistical and tax purposes.

Each of these documents plays a significant role in the overall process of ensuring that businesses meet their tax obligations accurately and timely. Understanding their function can make the filing experience much smoother and more manageable.

Similar forms

Form 05-102: Texas Franchise Tax Report - This form is required for businesses that owe franchise taxes. Unlike the 05-163, which indicates no tax is due, Form 05-102 requires detailed financial information about the business’s revenue, expenses, and tax obligations. It’s a comprehensive report essential for assessing which taxes need to be paid.

Form 05-158: Texas Franchise Tax Extension Request - Similar in nature to the 05-163, this document allows businesses to request an extension for filing their franchise tax report. Unlike the No Tax Due Report, this form does not provide an exemption from tax reporting, but it gives businesses extra time to prepare their full financial disclosures.

Form 05-166: Texas Franchise Tax Election to Use the EZ Computation - This form allows entities to opt for a simplified tax calculation method, akin to the no tax due area of the 05-163. Both forms help streamline the filing process, but the 05-166 specifically addresses how to calculate the tax owed for eligible smaller businesses.

Form 05-167: Texas Franchise Tax Report for Combined Groups - Designed for businesses that are part of a combined group, this form serves a similar purpose to the 05-163 by detailing the tax responsibilities of collective entities. However, it outlines the combined total revenue and tax liabilities rather than confirming no tax is due.

Form 05-175: Texas Franchise Tax No Tax Due Report for Foreign Entities - This document mirrors the purpose of the 05-163 but is specifically for foreign entities doing business in Texas. It confirms that the foreign entity has met the no tax due criteria, providing a streamlined way to file without extensive reporting.

Dos and Don'ts

- Do read the instructions thoroughly before you start filling out the form.

- Don’t ignore the requirement to file electronically if your report is due after January 1, 2016.

- Do ensure that all entered information is accurate, including your total revenue.

- Don’t forget to blacken the circles that apply to your business situation.

- Do provide a clear mailing address, ensuring that all details are current.

- Don’t use an outdated form; make sure you're using the latest version of Form 05-163.

- Do keep a copy of the completed form for your records after submission.

Misconceptions

Understanding the Texas Franchise Tax No Tax Due Report (Form 05-163) can be challenging due to various misconceptions. Here are nine common misunderstandings explained:

- Filing a paper report is always acceptable. Many believe they can file this form on paper indefinitely. However, since January 1, 2016, all No Tax Due Reports must be filed electronically, except for those requesting a waiver for that specific year.

- Zero Texas gross receipts mean no filing is required. Some think that if they have zero Texas gross receipts, they do not need to file. While entities with no revenue may seem exempt, all must still file to maintain good standing.

- Only established businesses need to file. New businesses often think they can skip filing. Even if a business was formed after January 1, 2016, it still needs to file if it meets certain revenue thresholds.

- Filing this form is only necessary for larger businesses. This form applies to any business entity whose total revenue falls below the threshold defined by Texas law, no matter the size.

- Only partnerships can file the No Tax Due Report. This report is applicable to various business entities, including corporations and limited liability companies, not just partnerships.

- Details on the form do not affect my tax liability. Every piece of information provided is crucial. Misrepresentations can lead to penalties or legal issues, even if there is no tax due.

- All revenue types are counted equally. There is confusion about what constitutes total revenue. Passive income does not include certain revenue types, such as rent, so it is essential to understand these distinctions.

- I can file anytime before the deadline. Deadlines must be adhered to strictly. Filing late can incur penalties and affect a business’s status with the state.

- I don’t need to keep a copy of the report. Businesses should retain a copy of their filed report for their records. This helps in future filings and in case of audits.

Clarifying these misconceptions can facilitate smoother compliance with Texas tax laws.

Key takeaways

Filling out the 05-163 form, known as the No Tax Due Report for the Texas Franchise Tax, is an important task for taxpayers who qualify. Here are some key takeaways to keep in mind:

- The form is required to be filed electronically if it is due on or after January 1, 2016. Filing a paper form is only permissible if you are seeking a waiver for that specific year.

- When completing the form, you must provide your taxpayer name, mailing address, city, state, country, and ZIP code. Accuracy is crucial to avoid processing delays.

- You should check all applicable boxes, including changes in your address or if this is a combined report.

- The total annualized revenue must be reported in whole dollars only. Keep in mind that any passive income does not include rent, which can affect your eligibility.

- Ensure to include the NAICS code, which identifies your business type and industry. This information is necessary for compliance and reporting.

- Fill in the accounting year dates accurately. This entails providing both the beginning and end dates of your financial year.

- Some entities, particularly those formed after January 1, 2016, must be pre-qualified to use this form, so verify your entity’s eligibility status.

- Upon completing the form, it is essential to declare the truthfulness of the information provided. Falsification can lead to penalties and legal issues.

- If you have questions while filling out the form, do not hesitate to contact the Texas Comptroller’s office at the provided phone number for assistance.

In summary, careful attention to detail and an understanding of the filing requirements can streamline the process of submitting the 05-163 form. Keeping these points in mind will help ensure compliance with Texas tax laws.

Browse Other Templates

Aetc Form 29b - Driving during late night hours is discouraged due to increased risks.

Active Duty Family Dental Enrollment Form,FMDP Enrollment Application,Tricare Family Member Dental Plan Election,Dental Insurance Enrollment for Family Members,Supplemental Dental Coverage Selection,Dependent Dental Coverage Application,Dental Plan E - Applicants must fill out this form to secure dental coverage for their eligible family members.