Fill Out Your 1028 Form

Understanding Form 1028 is essential for organizations in the agricultural sector that wish to apply for exemption recognition as cooperatives under Section 521 of the Internal Revenue Code. This form primarily serves farmers, fruit growers, and other similar associations, and it plays a crucial role in ensuring that these entities can operate under favorable federal tax conditions. The form itself consists of multiple parts that gather specific information regarding the organization’s identity, structure, activities, and financial data. Organizations must provide details such as their legal name, employer identification number, and comprehensive descriptions of their operations. They also need to disclose their stock structure, governance rules, and financial activities, including how they intend to allocate dividends to members. By completing this form accurately, associations can signify their commitment to functioning in accordance with cooperative principles and can take advantage of certain tax benefits afforded to exempt organizations. Furthermore, additional documentation and supporting materials may be required to accompany the submission, underscoring the importance of thoroughness and compliance in the application process.

1028 Example

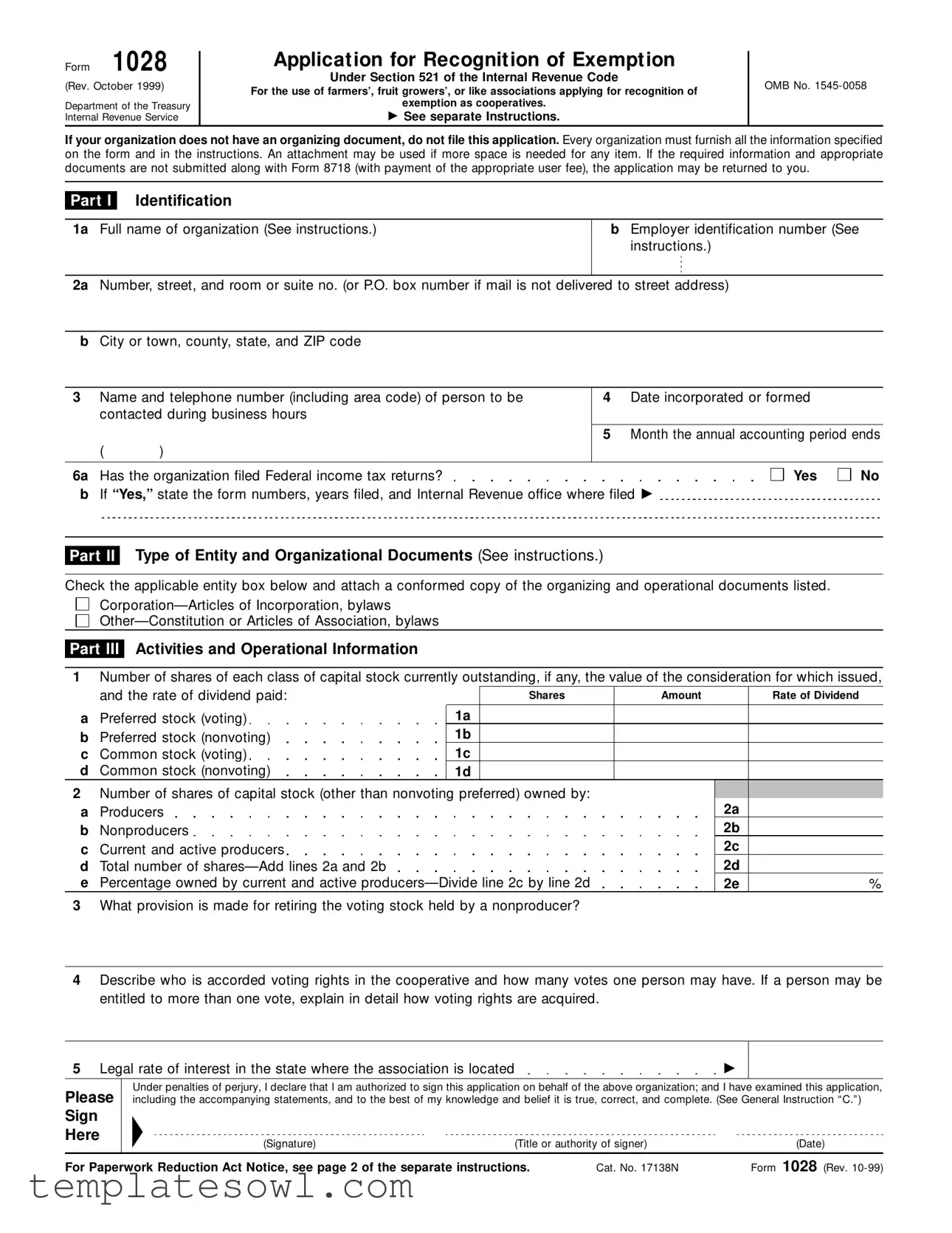

Form 1 0 2 8

(Rev. October 1999)

Department of the Treasury Internal Revenue Service

Application for Recognition of Exemption

Under Section 521 of the Internal Revenue Code

For the use of farmers’, fruit growers’, or like associations applying for recognition of

exemption as cooperatives.

▶See separate Instructions.

OMB No.

If your organization does not have an organizing document, do not file this application. Every organization must furnish all the information specified on the form and in the instructions. An attachment may be used if more space is needed for any item. If the required information and appropriate documents are not submitted along with Form 8718 (with payment of the appropriate user fee), the application may be returned to you.

Part I Identification

1a Full name of organization (See instructions.)

bEmployer identification number (See instructions.)

2a Number, street, and room or suite no. (or P.O. box number if mail is not delivered to street address)

b City or town, county, state, and ZIP code

3Name and telephone number (including area code) of person to be contacted during business hours

( )

4Date incorporated or formed

5Month the annual accounting period ends

6a Has the organization filed Federal income tax returns?

b If “Yes,” state the form numbers, years filed, and Internal Revenue office where filed ▶

Yes

No

Part II Type of Entity and Organizational Documents (See instructions.)

Check the applicable entity box below and attach a conformed copy of the organizing and operational documents listed.

Part III Activities and Operational Information

1Number of shares of each class of capital stock currently outstanding, if any, the value of the consideration for which issued,

|

and the rate of dividend paid: |

|

Shares |

Amount |

Rate of Dividend |

|

a |

Preferred stock (voting) |

1a |

|

|

|

|

b |

Preferred stock (nonvoting) |

1b |

|

|

|

|

c |

Common stock (voting) |

1c |

|

|

|

|

d |

Common stock (nonvoting) |

1d |

|

|

|

|

2 |

Number of shares of capital stock (other than nonvoting preferred) owned by: |

|

|

|

||

a |

Producers |

|

|

|

2a |

|

b |

Nonproducers |

|

|

|

2b |

|

c |

Current and active producers |

|

|

|

2c |

|

d |

Total number of |

|

|

|

2d |

|

e |

Percentage owned by current and active |

|

2e |

% |

||

3What provision is made for retiring the voting stock held by a nonproducer?

4Describe who is accorded voting rights in the cooperative and how many votes one person may have. If a person may be entitled to more than one vote, explain in detail how voting rights are acquired.

5 Legal rate of interest in the state where the association is located |

▶ |

Please

Sign

Here

Under penalties of perjury, I declare that I am authorized to sign this application on behalf of the above organization; and I have examined this application, including the accompanying statements, and to the best of my knowledge and belief it is true, correct, and complete. (See General Instruction “C.”)

▶

(Signature)(Title or authority of signer)(Date)

For Paperwork Reduction Act Notice, see page 2 of the separate instructions. |

Cat. No. 17138N |

Form 1028 (Rev. |

Form 1028 (Rev. |

Page 2 |

|

|

|

|

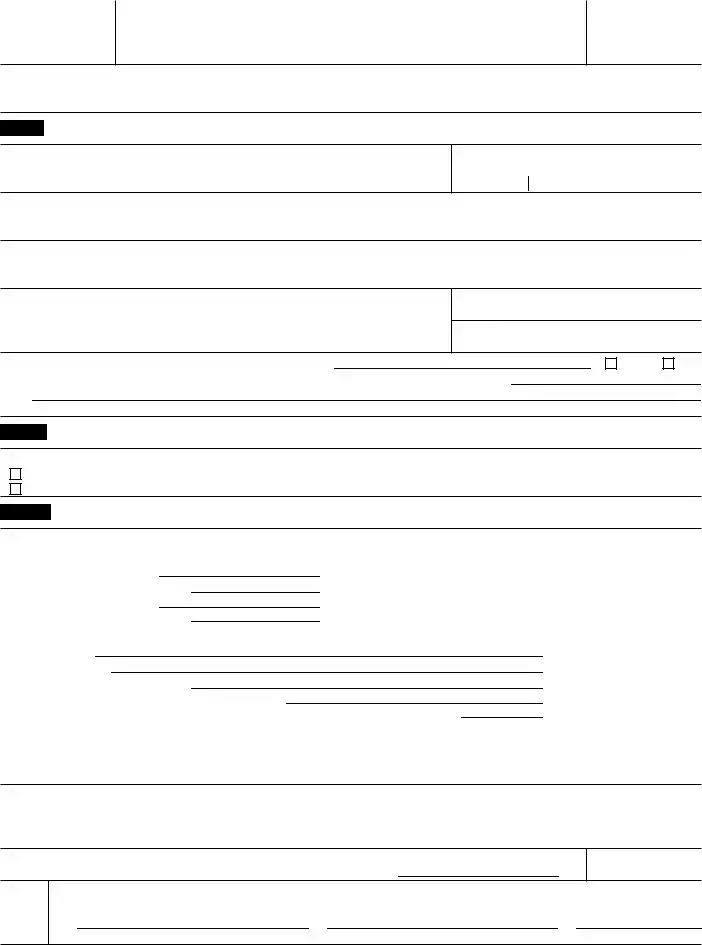

Part III |

Activities and Operational Information ( Continued) |

|

|

|

|

6If the association issues any nonvoting preferred stock, explain whether the owners, upon dissolution or liquidation, may participate in the profits of the association beyond fixed dividends.

7a Does state law require the accumulation and maintenance of reserves?

b If “Yes,” state the names and purposes of the reserves and enter the amount of each:

Yes |

No |

Amount

8a Does the association maintain or plan to maintain any reserve or reserves other than those required by state law?

b If “Yes,” state the names and purposes of the reserves and enter the amount of each:

Yes |

No |

Amount

9 |

Does the association deal or plan to deal with both members and nonmembers? |

Yes |

No |

10a |

Does the association pay or plan to pay patronage dividends? |

Yes |

No |

b |

If “Yes,” are they paid or will they be paid to all patrons, both member and nonmember, on the same basis? |

Yes |

No |

11a |

Is the allocation of patronage dividends based on an obligation in existence before the cooperative |

|

|

|

received the amounts allocated? |

Yes |

No |

bIf “Yes,” is the obligation in:

Organizing document (specify) ▶

Bylaws

12Explain all of the activities in which the association is or will be engaged.

13Explain how distribution is or will be made of the proceeds of products marketed for members and nonmembers. Also, if the organization operates on a basis of allocated units (i.e., functional, departmental, etc.), explain how losses are or will be treated.

14 Explain how the association charges for supplies and equipment bought for members and nonmembers.

Form 1028 (Rev.

Form 1028 (Rev. |

Page 3 |

|

|

|

|

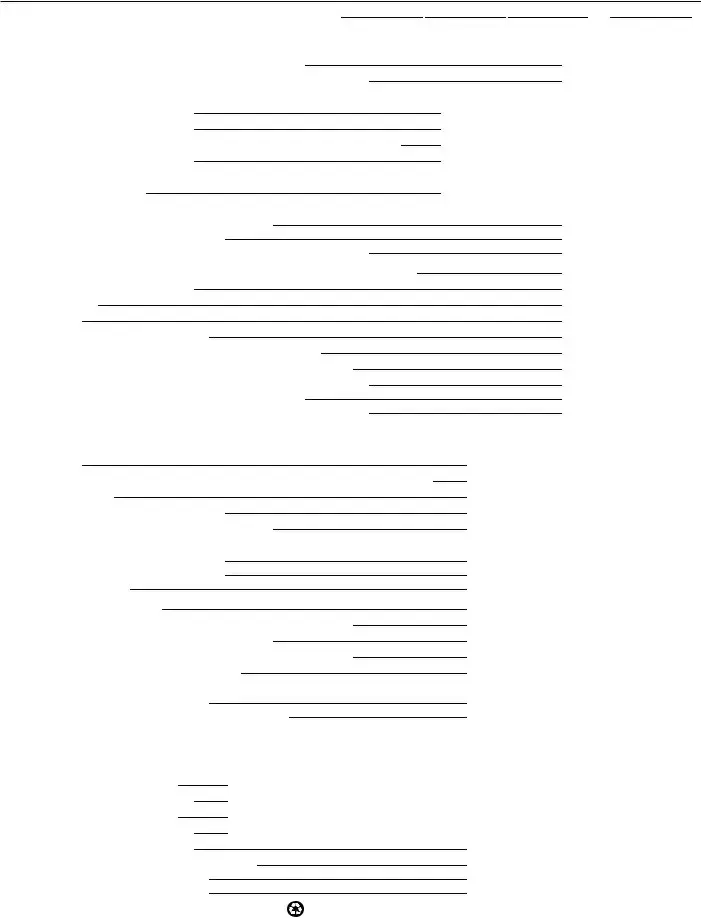

Part III |

Activities and Operational Information ( Continued) |

|

|

|

|

15 Explain the requirements for membership in the association.

16Federated cooperatives only:

aAre all the association’s member cooperatives exempt under section 521?

bIf “No,” do the nonexempt member cooperatives have the same annual accounting period as the association’s?

Yes

Yes

No

No

cIf “No,” to 16b, check the method below that the association used, or will use, to provide a common or comparable unit of time for analyzing and evaluating its operations and those of its members.

Note: Methods listed below do not apply to the filing of retur ns or the manner in which operating results are reported by a federated cooperative and its members.

1.

2.

3.

Method

Method

17 |

Value of agricultural products marketed or handled |

Current tax |

|

3 prior tax years |

|

|

|

|

|||

|

for: (See instructions.) |

year |

|

|

|

|

|

|

|

||

|

|

(a) From |

(b) |

(c) |

(d) |

*a |

Members— |

to |

|

|

|

1.Actually produced by members

2.Not actually produced by members but marketed by them through the association

bNonmembers—

1.Actually produced by nonmembers

2.Not actually produced by nonmembers but marketed by them through the association

cNonproducers (purchased from nonproducers for marketing by the association)

18Value of supplies and equipment purchased for or sold to: (See instructions.)

*a Members who were producers

bNonmembers who were producers

cMembers and nonmembers who were not producers

19Amount of business done with the United States Government or any of its agencies

20 |

Does the association plan to do business with the United States Government or any of its agencies in the future? |

Yes |

No |

21a |

Were all of the net earnings (after payment of dividends, if any, on capital stock) for the years shown on |

|

|

|

lines |

Yes |

No |

b |

If “No,” were undistributed net earnings apportioned on the records to all patrons on a patronage basis? |

Yes |

No |

22a |

Has the organization operated in a manner consistent with the information given since the date formed? |

Yes |

No |

bIf “No,” state the changes that have occurred and dates of the changes.

*If it is necessary to own one or more shares of stock in order to become a member, include on lines 17a and 18a only the amount of business transacted with persons actually owning the required number of shares.

Form 1028 (Rev.

Form 1028 (Rev. |

Page 4 |

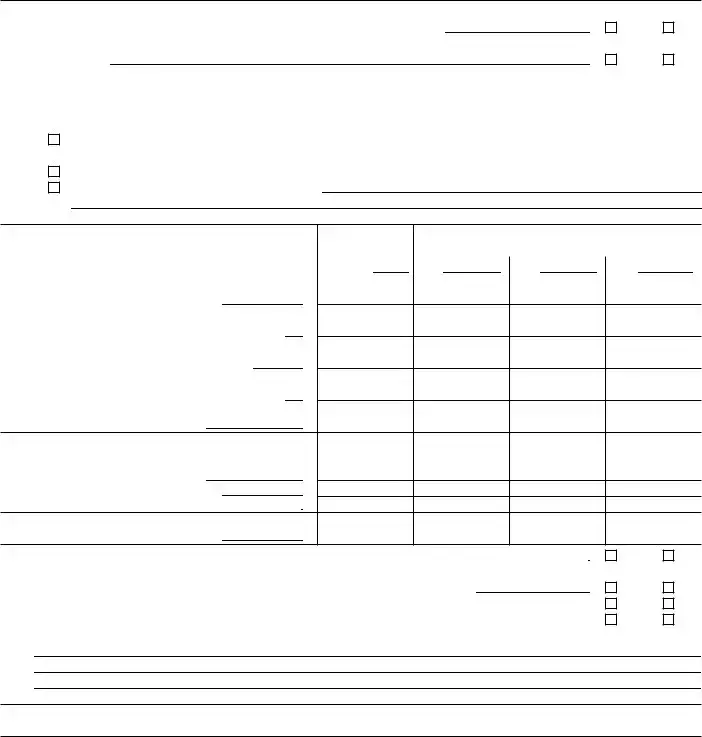

|

Part IV |

Financial Data (See instructions.) |

|

Complete the Statement of Receipts and Expenditures and Balance Sheets for the current year and for each of the three immediately preceding years that the organization was in existence.

Statement of Receipts and Expenditures, for period ending |

|

|

|

|

|

|

|

, |

|

. |

|||||||

|

(If you prepare a statement of receipts and expenditures that is more descriptive and detailed than the statement below, you |

||||||||||||||||

|

may submit that statement instead of this one.) |

|

|

|

|

|

|

|

|

|

|

||||||

|

|

1 |

Gross dues and assessments from members |

|

|

|

|

|

|

|

1 |

|

|

||||

|

|

2 |

Gross dues and assessments from affiliated organizations |

|

|

|

|

|

|

|

2 |

|

|

||||

|

|

3a |

Gross amount derived from activities related to organization’s exempt |

|

3a |

|

|

|

|

|

|

||||||

|

|

|

purpose (attach schedule) |

|

|

|

|

|

|

|

|

|

|

|

|

||

Receipts |

|

b Less cost of goods sold |

|

|

|

|

|

|

3b |

( |

|

) |

3c |

|

|

||

|

4a |

Gross amount from other business activities (attach schedule) |

|

|

4a |

|

|

|

|

|

|

||||||

|

b |

Less cost of goods sold |

|

|

|

|

|

|

4b |

( |

|

) |

4c |

|

|

||

|

5a |

Gross amount received from sale of assets, excluding inventory items |

|

|

|

|

|

|

|

|

|||||||

|

|

|

(attach schedule) |

|

|

|

|

|

|

5a |

|

|

|

|

|

|

|

|

|

b Less cost or other basis and sales expense of assets sold (attach schedule) |

|

5b |

( |

|

) |

5c |

|

|

|||||||

|

|

6 |

Interest, dividends, rents and royalties |

|

|

|

|

|

|

|

6 |

|

|

||||

|

|

7 |

Other receipts (attach schedule) |

|

|

|

|

|

|

|

|

|

|

7 |

|

|

|

|

|

8 |

Total |

|

|

|

|

|

|

|

8 |

|

|

||||

|

|

9 |

Compensation of officers, directors, and trustees (attach schedule) |

|

|

|

|

|

|

9 |

|

|

|||||

|

|

10 |

Other salaries and wages |

|

|

|

|

|

|

|

|

|

|

10 |

|

|

|

Expenditures |

|

11 |

Interest |

|

|

|

|

|

|

|

|

|

|

11 |

|

|

|

|

12 |

Rent |

|

|

|

|

|

|

|

|

|

|

12 |

|

|

||

|

13 |

Depreciation and depletion |

|

|

|

|

|

|

|

|

|

|

13 |

|

|

||

|

14 |

Dues and assessments to affiliated organizations |

|

|

|

|

|

|

|

14 |

|

|

|||||

|

15 |

Other expenditures (see |

|

|

|

|

|

|

|

15 |

|

|

|||||

|

16 |

Patronage dividends (see |

|

|

|

|

|

|

|

16 |

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

17 |

Total |

|

|

|

|

|

|

|

17 |

|

|

||||

|

|

18 |

Excess of receipts over expenditures (line 8 less line 17) |

|

|

|

|

|

|

|

18 |

|

|

||||

Balance Sheets |

|

|

|

|

|

Enter |

|

|

Beginning date |

|

Ending date |

||||||

|

|

|

|

|

dates ▶ |

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

19 |

Cash |

|

|

|

|

|

|

|

19 |

|

|

|

|

|

|

|

|

20 |

Trade notes and accounts receivable (less allowance for bad debts) |

|

|

|

20 |

|

|

|

|

|

|||||

|

|

21 |

Inventories |

|

|

|

|

|

|

|

21 |

|

|

|

|

|

|

Assets |

|

22 |

Investments (attach schedule) |

|

|

|

|

|

|

|

22 |

|

|

|

|

|

|

|

23 |

Other current assets (attach schedule) |

|

|

|

|

23 |

|

|

|

|

|

|||||

|

24 |

Depreciable and depletable assets (less accumulated depreciation/depletion) |

24 |

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|||||||||||

|

|

25 |

Land (net of any amortization) |

|

|

|

|

|

|

|

25 |

|

|

|

|

|

|

|

|

26 |

Other assets (attach schedule) |

|

|

|

|

|

|

|

26 |

|

|

|

|

|

|

|

|

27 |

Total assets |

|

|

|

|

|

|

|

27 |

|

|

|

|

|

|

|

|

28 |

Accounts payable |

|

|

|

|

|

|

|

28 |

|

|

|

|

|

|

|

|

29 |

Mortgages, notes, bonds payable in less than one year |

|

|

|

|

29 |

|

|

|

|

|

||||

|

|

30 |

Other current liabilities (attach schedule) |

|

|

|

|

30 |

|

|

|

|

|

||||

|

|

31 |

Mortgages, notes, bonds payable in one year or more |

|

|

|

|

31 |

|

|

|

|

|

||||

|

|

32 |

Other liabilities (attach schedule) |

|

|

|

|

|

|

|

32 |

|

|

|

|

|

|

Capital |

|

33 |

Patronage dividends allocated in noncash form, other than capital stock and |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

33 |

|

|

|

|

|

|||

|

34 |

|

|

|

|

34 |

|

|

|

|

|

||||||

and |

|

35 |

Capital stock (enter numbers at |

|

|

|

Number of shares |

|

|

|

|

|

|

||||

|

|

Number of |

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

end of year): |

|

|

Issued for |

|

Issued as |

|

|

|

|

|

|||||

|

|

|

shareholders |

|

|

|

|

|

|

|

|||||||

Liabilities |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

money |

patronage benefits |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

a Voting preferred stock |

|

35a |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

b Nonvoting preferred stock |

|

35b |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

c Voting common stock |

|

35c |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

d Nonvoting common stock |

|

35d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

36 |

|

|

|

|

|

|

|

36 |

|

|

|

|

|

||

|

|

37 |

Retained earnings (attach schedule) |

|

|

|

|

|

|

|

37 |

|

|

|

|

|

|

|

|

38 |

Less cost of treasury stock |

|

|

|

|

|

|

|

38 |

( |

|

) |

( |

) |

|

|

|

39 |

Total liabilities and capital |

|

|

|

|

|

|

|

39 |

|

|

|

|

|

|

Form 1028 (Rev.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The Form 1028 serves as an application for recognition of exemption under Section 521 of the Internal Revenue Code, specifically for cooperatives formed by farmers and similar associations. |

| Governing Law | This form is governed by the Internal Revenue Code, particularly Section 521. |

| Filing Requirements | Organizations must provide all information required on the form and in its instructions. An attachment is allowed if more space is needed. |

| User Fee | Submission of Form 8718 along with the appropriate user fee is mandatory; failure to do so may result in return of the application. |

| Organizational Document | If the organization lacks an organizing document, it must not file Form 1028. |

| Contact Information | Filing entities must include the name and phone number of a contact person available during business hours. |

| Tax Returns | The form requires organizations to disclose whether they have filed federal income tax returns, including details of any forms used. |

| Voting Rights | Detail must be provided regarding who is granted voting rights within the cooperative and the number of votes each individual may hold. |

| Membership Requirements | The form requires a clear explanation of what is necessary to become a member of the cooperative. |

Guidelines on Utilizing 1028

Before filling out Form 1028, gather all necessary information and supporting documents. Make sure you are ready to provide a complete and accurate application. Missing information could cause delays or lead to your application being returned. Follow the steps below to ensure a smooth submission process.

- Part I - Identification: Fill in the organization's full name and employer identification number (EIN).

- Provide the physical address of the organization, including city, state, and ZIP code.

- Enter the contact information of the person available during business hours.

- Specify the date the organization was incorporated or formed.

- Indicate the month the annual accounting period ends.

- Answer whether the organization has filed federal income tax returns, and if yes, provide details about the forms, years filed, and the IRS office where filed.

- Part II - Type of Entity: Check the applicable entity type and attach the required organizing documents.

- Part III - Activities and Operational Information: Complete items regarding shares of stock and ownership percentages. Provide details about voting rights and any provisions for retiring voting stock. Include legal rates of interest in your state.

- Detail all activities the association is currently engaged in or plans to engage in.

- Explain how proceeds of marketed products are distributed and how charges for supplies are made.

- If applicable, provide information concerning reserves and patronage dividends.

- For federated cooperatives, answer questions regarding member cooperatives' exemptions and accounting periods.

- Enter the value of agricultural products marketed and handled for the current and prior tax years, along with any business done with government agencies.

- Part IV - Financial Data: Complete the statement of receipts and expenditures for the current year and for the preceding three years. Fill out the balance sheets as needed, providing details on cash, investments, liabilities, and capital.

Once you’ve completed the form, check all information for accuracy and ensure you have attached any necessary supporting documents. Sign the application and date it before submitting it to the appropriate IRS office.

What You Should Know About This Form

What is Form 1028?

Form 1028 is an application for recognition of exemption under Section 521 of the Internal Revenue Code. It is specifically designed for farmers’, fruit growers’, or similar associations that are seeking to apply for exemption as cooperatives. The form requires detailed information about the organization, including its structure, activities, and financial data.

Who should file Form 1028?

This form should be filed by organizations wishing to be recognized as cooperatives for tax exemption purposes. It's suitable for entities that have an organizing document, as applications without such documents will not be accepted. If your organization is involved in agricultural activities and structured as a cooperative, Form 1028 needs to be considered.

What information is required when completing Form 1028?

When completing Form 1028, applicants must provide comprehensive details. This includes the full name of the organization, its employer identification number, contact information, incorporation date, and the nature of its capital stock. Additionally, information on operational activities, financial data, and the organizational structure must be included. Clear instructions accompany the form to guide the applicant on required disclosures.

What happens if Form 1028 is not completed correctly?

If the required information or appropriate documents are not submitted with the completed Form 1028, it may be returned to the applicant. Incomplete submissions can significantly delay the application process, and ultimately, hinder the organization’s ability to secure tax-exempt status. It's crucial to ensure all details are accurate and complete before submission.

Are there fees associated with filing Form 1028?

Yes, filing Form 1028 requires the payment of a user fee. This fee must be submitted along with Form 8718, which is the user fee transmittal form. The amount of the fee can vary, so applicants should check the most current IRS guidelines to ensure payment is sent correctly with their application.

Common mistakes

Completing Form 1028, which is essential for farmers’ and similar associations applying for exemption recognition as cooperatives, is a delicate task that requires attention to detail. One of the common mistakes is providing incomplete information in the identification section. It is vital to ensure that all requested details, such as the full name and employer identification number, are filled out completely. Missing or inaccurate information can lead to delays or rejection of the application.

Another frequent mistake involves failing to provide the necessary organizational documents. Applicants often overlook the requirement to attach a conformed copy of important documents like Articles of Incorporation or bylaws. Submitting the application without these attachments makes it likely that the IRS will return the application for missing information.

Some individuals also misunderstand the significance of the annual accounting period. Incorrectly reporting the month the organization’s accounting year ends can introduce confusion regarding fiscal matters. Such discrepancies, while seemingly minor, can complicate the application process.

Providing insufficient details regarding the types of capital stock can hinder the application, too. Applicants often fail to describe the nature of the shares accurately, such as the number of shares currently outstanding and the rates of dividends paid. Complete clarity in this section is crucial for the reviewers to understand the financial structure of the organization.

Another area where mistakes occur is in the financial data section. Many applicants either miscalculate or omit essential financial figures. For instance, failing to accurately report total receipts or expenditures can lead to serious implications for the accuracy of the application. The IRS relies on these figures to evaluate the financial health of the organization.

Inadequate descriptions of operational activities can also pose a problem. When applicants do not provide thorough explanations of how the cooperative operates, it leaves the IRS with unanswered questions, potentially leading to rejection. Transparency about business activities is key to demonstrating compliance with exemption requirements.

A common error is neglecting to update the IRS on changes that have occurred in the organization since its formation. If the organization has not operated consistently with the originally provided information, disclosing these changes becomes essential. Failing to do so invites further scrutiny and possible complications.

Another oversight often occurs with patronage dividends. Applicants sometimes do not clarify whether all patrons, members, and nonmembers receive these dividends on the same basis. This ambiguity can create confusion and may impact the cooperative's eligibility for exemption.

Additionally, many forms are submitted without a proper signature from an authorized representative. The application must include a signature affirming its accuracy and completeness. This step, while simple, is critical. Omitting it can lead to unnecessary processing delays.

Finally, some applicants misunderstand or overlook the IRS's requirement for reserves. State laws may mandate the accumulation of reserves, but applicants sometimes forget to specify the names and purposes of these reserves in their applications. This oversight could suggest a lack of compliance with state regulations, which can reflect poorly on the organization’s credibility.

Documents used along the form

When applying for recognition of exemption under Section 521 of the Internal Revenue Code using Form 1028, certain other documents may be necessary to ensure a complete and streamlined application process. These documents support the application by supplying additional detailed information required by the Internal Revenue Service. Here are some common forms and documents that may accompany Form 1028:

- Form 8718: This form is used to pay the user fee for the submission of Form 1028. Ensuring that this fee is paid is crucial for processing the application.

- Articles of Incorporation: This document outlines the basic structure of the organization, including its purpose and governance. It officially establishes the existence of the entity in the state.

- Bylaws: Bylaws provide detailed rules about the internal governance of the organization. They may include information on membership requirements, voting rights, and procedural guidelines for meetings.

- Constitution or Articles of Association: Similar to Articles of Incorporation, these documents may explain the organization’s purpose and the framework governing its operations, particularly for non-corporate entities.

- Financial Statements: Recent financial statements, including balance sheets and income statements, are typically required to demonstrate the financial health and operations of the organization.

- Statements of Receipts and Expenditures: These statements detail the income and expenses of the organization, providing insight into its operational efficiency and how funds are managed.

- Tax Returns: Any previous tax returns filed by the organization may need to accompany the application to establish a history of compliance with tax regulations.

- Membership Lists: A list detailing current members of the organization may be required. This shows the cooperative nature of the organization and its alignment with cooperative principles.

- Resolutions: If applicable, resolutions passed by the board or members formally documenting decisions made by the organization may need to be included.

- Patronage Dividend Policy: Documentation outlining how patronage dividends are determined and distributed is essential for verifying compliance with cooperative tax regulations.

Having these documents ready and submitted alongside Form 1028 can facilitate a smoother process with the IRS. It is important to ensure completeness and accuracy in each submission. Seeking guidance on these documents and understanding their significance can contribute greatly to the successful recognition of the organization's tax-exempt status.

Similar forms

-

Form 990: This form is used by tax-exempt organizations to provide information about their financial activities and governance. Like Form 1028, it requires organizations to disclose their operational details, though it is aimed at securing different types of tax exemption recognition. Both forms necessitate complete transparency regarding financial information and organizational practices.

-

Form 8718: This form serves as a user fee request for organizations applying for tax-exempt status. Similar to Form 1028, it must be filed alongside the relevant tax-exempt application, ensuring the IRS receives payment for processing. Both forms are integral to the application process for tax-exempt status.

-

Form 1023: This form is specifically designed for 501(c)(3) charitable organizations to apply for tax-exempt status. Like Form 1028, it details the organization's purpose, structure, and financial information. Both forms require comprehensive disclosures about organizational activities and governance.

-

Form 941: Employers use this form to report payroll taxes. Similar to Form 1028, it requires detailed financial data, but focuses on the organization’s tax obligations as an employer rather than its exemption status.

-

Form 1065: Partnerships use this form to report income, deductions, and other information. Like Form 1028, it necessitates sharing financial information and operational data about the organization, steering towards its tax responsibilities as opposed to tax-exempt status.

-

Form 990-EZ: This abbreviated form simplifies reporting for smaller tax-exempt organizations, akin to Form 1028 in that both require transparency in financial reporting. They both aid organizations in communicating their operational and financial data to the IRS.

-

Form 1041: This is used by estates and trusts to report income and deductions. Like Form 1028, it requires information about financial activities, although it differs in context, focusing on fiduciary responsibilities.

-

Form 1120: Corporations file this form to report income, gains, losses, and deductions. While Form 1028 focuses on cooperatives seeking tax exemption, both demand meticulous documentation of financial status and operational details.

-

Form 8832: This form allows entities to elect their federal tax classification. Similar to Form 1028, it involves formal documentation related to an organization's structure and tax classifications.

-

Form 720: Used to report excise taxes, this form, like Form 1028, requires organizations to disclose specific operational and transactional details, though it caters to different tax obligations.

Dos and Don'ts

When filling out Form 1028, it’s important to ensure accuracy and completeness. The following list includes things you should and shouldn't do during this process.

- Do: Read the instructions carefully before you start completing the form.

- Provide the full legal name of your organization as listed in your organizing documents.

- Include your organization’s Employer Identification Number (EIN) where indicated.

- Attach copies of all necessary organizational documents like bylaws and articles of incorporation.

- Ensure all required sections of the form are completed, including activities and financial data.

- Don’t: Skip any questions; every section must be addressed.

- Assume that all information is known; verify or look up details when unsure.

- Forget to sign the form. A signature is required by an authorized person.

- Leave out supporting documentation as incomplete applications can be returned.

- Risk submitting the form without reviewing it for errors or omissions.

Misconceptions

Misconceptions about the Form 1028 can create confusion among those looking to apply for exemption as cooperatives. Below are ten common misconceptions, along with clarifying explanations:

- Form 1028 is only for large organizations. This form is designed for farmers, fruit growers, and similar associations, regardless of size. Small organizations can benefit from filing it as well.

- You do not need any organizational documents to file. Every organization is required to submit their organizing documents along with Form 1028 to validate their application for exemption.

- Filing Form 1028 guarantees tax-exempt status. Approval of tax-exempt status is not automatic. The IRS reviews each application carefully before granting exemptions.

- All cooperatives automatically qualify for exemption. Not every cooperative meets the IRS criteria. Factors such as structure and operations are considered in the review process.

- It is unnecessary to provide comprehensive details about operational activities. The IRS requires specific information about the organization’s activities. Lack of detail may lead to rejection of the application.

- You can submit Form 1028 without the appropriate fees. Failure to pay the required user fee when submitting Form 8718 can result in the application being returned.

- Once filed, there is nothing else to do. Organizations must continue to operate within the guidelines provided by the IRS and may need to provide additional information if requested.

- The IRS does not care about members’ voting rights. Information regarding voting rights must be included, as it is critical in determining the structure and operations of the cooperative.

- Changes in financial data can be omitted after the initial filing. It is essential to maintain accurate records and report any significant changes in financial data to remain compliant.

- All fields in the form must be filled out, regardless of relevance. While all relevant sections must be completed, non-applicable fields or questions can be left blank. Providing only the necessary information is acceptable.

Key takeaways

- Ensure that your organization has an organizing document before filing the 1028 form. Without it, the application cannot be submitted.

- Complete all sections accurately and thoroughly. Missing information may lead to your application being returned.

- Prepare to provide detailed information on your organization’s activities, operational procedures, and membership requirements.

- Review the instructions carefully. There are specific requirements for supporting documents that you must attach to the application.

Browse Other Templates

Gift Deed Form - The form is a crucial legal tool for family members wishing to pass down property without cost.

Ky Divorce Papers - The form assists in formalizing divorce processes in Kentucky.

How to Write a Current Event - Community engagement in urban gardening projects fosters connections among residents while promoting local food production.