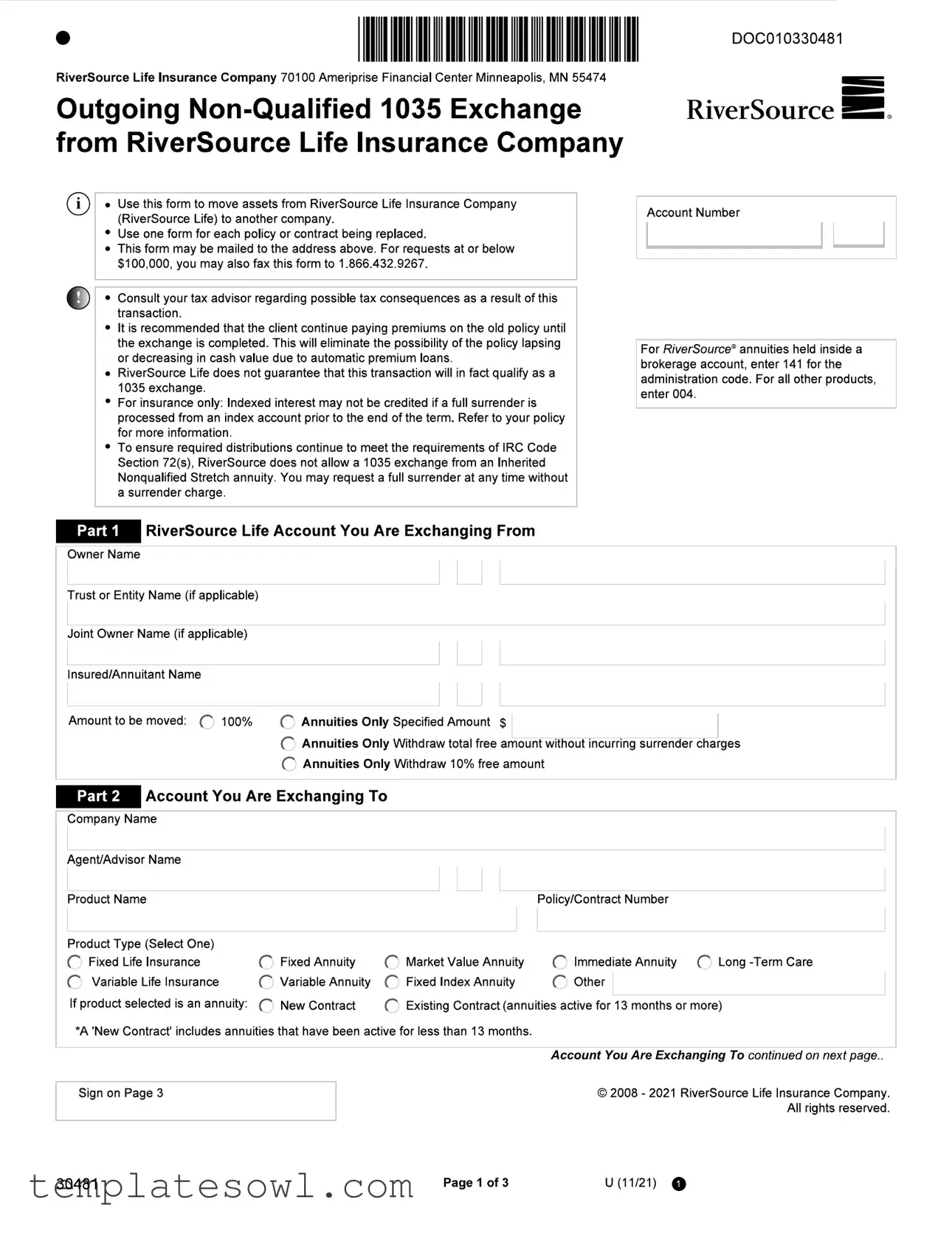

Fill Out Your 1035 Exchange Form

The 1035 Exchange form serves as a crucial instrument for policyholders seeking to transfer assets between insurance products without incurring immediate tax consequences. This particular form, offered by RiverSource Life Insurance Company, enables the exchange of various policies, such as annuities and life insurance, directly to another company. Completing the form requires careful attention to detail, as each policy or contract being replaced necessitates a separate form submission. Individuals must provide information about both the outgoing account and the new account, including the names of owners and any advisors involved. There are specific guidelines about submission methods: forms can be mailed or, for transactions under $100,000, faxed for quicker processing. Given the potential implications of a 1035 Exchange on policy value and tax obligations, consulting a tax advisor is recommended prior to proceeding with the transaction. Further, maintaining premium payments on the existing policy during the exchange process is advised to prevent any lapse in coverage. This form also highlights that certain restrictions may apply, particularly regarding inherited annuities and existing contracts for over 13 months. Understanding these key aspects is essential for policyholders intending to navigate their financial landscape effectively.

1035 Exchange Example

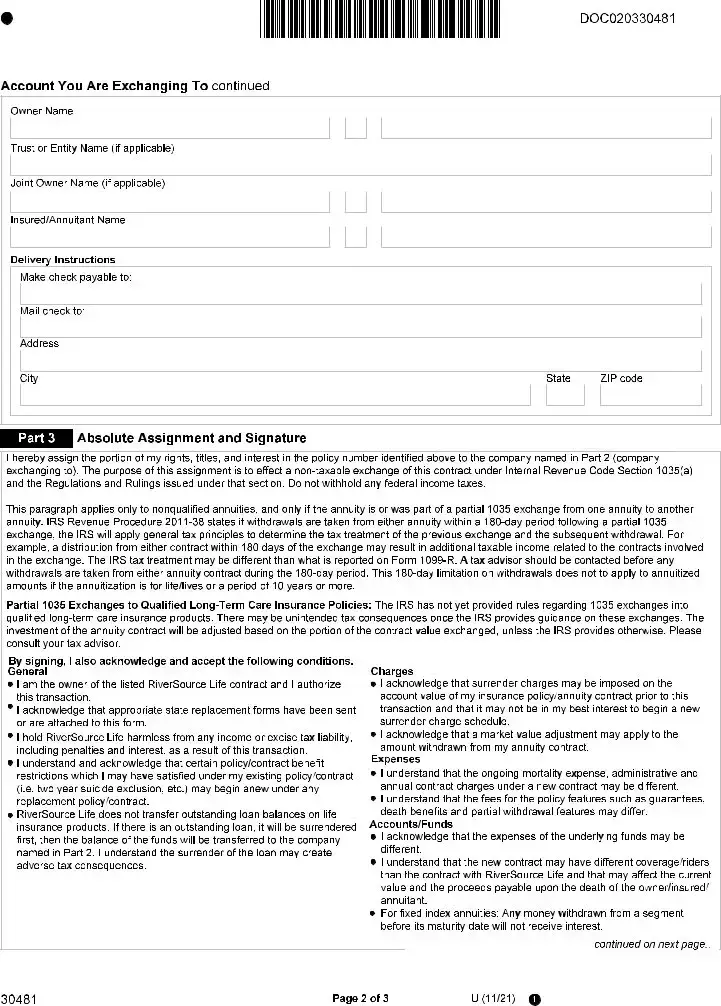

Account You Are Exchanging To

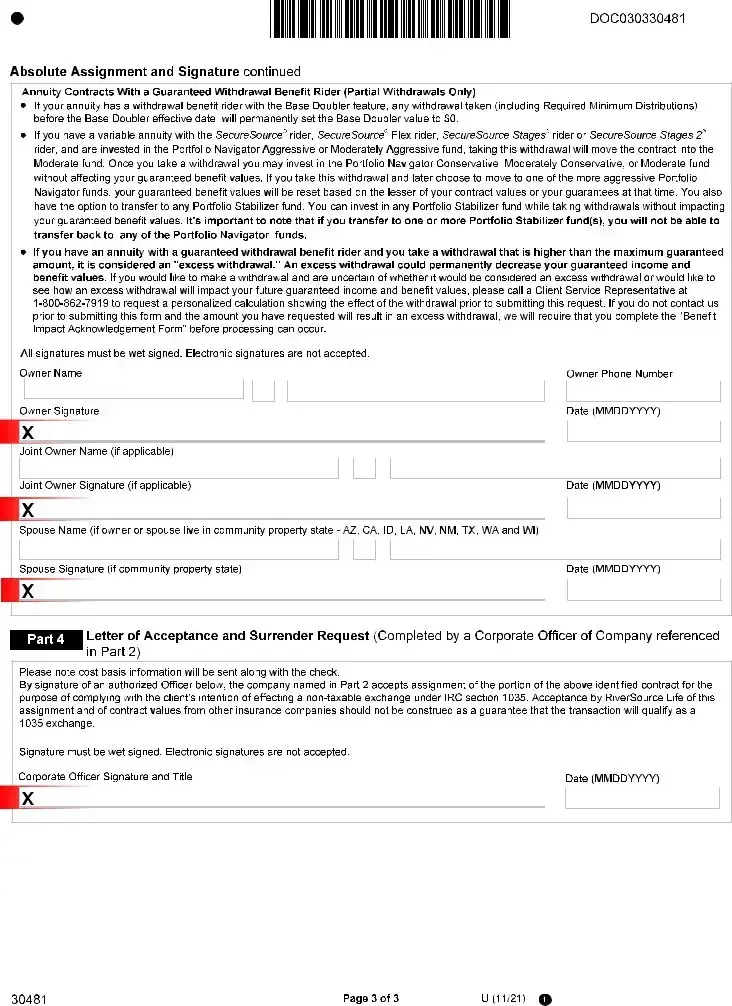

Absolute Assignment and Signature |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The 1035 Exchange form is used to transfer assets from RiverSource Life Insurance Company to another insurance or financial company. |

| Submission Methods | This form can be mailed or faxed. For amounts at or below $100,000, it may be sent to the specified fax number: 1.866.432.9267. |

| Tax Consultation | It is advisable to consult a tax advisor before proceeding with a 1035 Exchange to understand potential tax implications. |

| State-Specific Requirements | Each state may have different regulations governing the 1035 Exchange process. It is essential to check local laws for compliance. |

Guidelines on Utilizing 1035 Exchange

Filling out the 1035 Exchange form is an important step in transferring assets from RiverSource Life Insurance Company to another company. Proper completion of this form ensures that the exchange process runs smoothly. To begin, gather all necessary information related to your current and new accounts. This will help streamline your experience.

- Complete Part 1 by entering your personal details as the owner of the existing account. Include your name, trust or entity name if applicable, and joint owner name if there is one.

- Specify the insured or annuitant name in the designated area.

- Indicate the amount you wish to transfer. You can choose to move 100% of the funds, specify a certain amount, or withdraw free amounts without incurring surrender charges.

- Proceed to Part 2, providing information about the account you are exchanging to. Start with the company name, and include your agent or advisor's name.

- Fill in the product name and type. Select one option from the list, which includes Fixed Life Insurance, Fixed Annuity, Variable Life Insurance, and Variable Annuity.

- If you selected an annuity product, complete the relevant sections regarding the new contract policy or contract number.

- Indicate whether the annuity is a market value annuity, fixed index annuity, immediate annuity, long-term care, or another existing contract.

- Review all information entered to ensure accuracy, then sign the form at the bottom of Page 3, where indicated.

- Submit the completed form via mail or fax as instructed on the form.

Completing the 1035 Exchange form accurately is essential for a seamless asset transfer. Once submitted, you will receive confirmation from the new company regarding the status of your exchange. Maintain communication with your financial advisor or agent throughout the process to address any questions or concerns.

What You Should Know About This Form

What is a 1035 Exchange?

A 1035 Exchange is a provision in the Internal Revenue Code that allows policyholders to transfer funds from one life insurance or annuity contract to another without incurring immediate tax liabilities. Essentially, it allows you to switch products while deferring any taxes that would typically arise from cashing in the old policy or contract.

Who can use the 1035 Exchange form?

Anyone holding a life insurance policy or annuity may utilize the 1035 Exchange form to transfer their assets to another insurer or product. However, it’s crucial to consult your tax advisor beforehand to ensure that the exchange meets your specific needs and to understand any potential tax implications.

How many forms do I need to complete for multiple policies?

You will need to fill out a separate 1035 Exchange form for each policy or contract you wish to transfer. This ensures that each transaction is accurately processed and recorded. Each form is specific to its respective policy, making tracking easier for both you and the financial institutions involved.

What happens if I don't continue paying premiums on my old policy?

If you stop paying premiums on your old policy before the exchange is completed, you risk having that policy lapse. Gaps in premium payments could reduce its cash value or even lead to a complete loss of the policy. To avoid this, it’s recommended to keep paying premiums until the exchange process is finalized.

Can I request a partial transfer using the 1035 Exchange?

Yes, the 1035 Exchange form allows you to specify how much you'd like to move. You can choose to transfer the entire amount or a specified portion as long as it aligns with your other financial goals and any current contract rules. Remember, for annuities, specific withdrawal amounts may be available without incurring surrender charges.

Is it guaranteed that my transaction qualifies for a 1035 Exchange?

No, RiverSource Life does not guarantee that all transactions will qualify for a 1035 Exchange. Each request may be evaluated based on the specific policies involved and their compliance with IRS regulations. Ensure that you meet all the eligibility criteria before submitting your request.

What types of products can I exchange using this form?

You can exchange various types of financial products, including fixed life insurance, fixed and variable annuities, and long-term care insurance. However, if you are dealing with an inherited nonqualified stretch annuity, note that RiverSource does not permit a 1035 exchange for that specific product.

What if I have more questions about the 1035 Exchange process?

If you have further questions about the 1035 Exchange process, it’s advisable to reach out directly to your insurance agent, financial advisor, or tax consultant. They can provide personalized assistance and clarity based on your unique situation, making the process smoother and more informative.

Common mistakes

When completing the 1035 Exchange form, individuals often overlook critical details that can lead to complications. One common mistake is failing to use separate forms for each policy or contract being replaced. Each transaction requires its own documentation, and combining multiple exchanges into one form can result in processing delays or even rejections.

Another frequent error involves the incorrect filling of account numbers. Every account needs its unique identifier, and omitting or miswriting an account number can lead to assets being lost in transit. Ensuring accuracy in this section is essential for a smooth transfer process.

Many people neglect to consult with a tax advisor before initiating the exchange. Tax implications can be complex, and understanding them beforehand can prevent unexpected tax liabilities arising from the transaction. Failing to seek this guidance can leave individuals vulnerable to unforeseen financial consequences.

Also, it is crucial to continue paying premiums on the old policy until the exchange is completed. Some individuals mistakenly stop payments too soon, risking policy lapse or diminished cash value due to automatic premium loans. This oversight can significantly impact financial security.

Choosing the wrong product type is another mistake. Applicants often select a product type that does not match their intentions or financial goals. For instance, selecting a variable annuity when a fixed annuity is desired can lead to misalignment with personal financial strategies.

Moreover, individuals sometimes misunderstand the guidelines regarding existing contracts. A new contract includes those active for less than 13 months. As a result, many fail to provide essential information about their existing annuities, complicating the exchange process.

Inadequate completion of the agent or advisor details can also cause problems. Missing or incorrect information in this section can lead to miscommunication and delays. It is important to ensure that this information is accurate, as it directly affects who will oversee the transaction.

Lastly, signatures must be carefully executed. Some participants forget to sign the form or obtain the necessary signatures from co-owners or entities involved. This omission can halt the process entirely, forcing individuals to restart their efforts. Attention to detail, patience, and thoroughness are key when filling out the 1035 Exchange form to avoid these common mistakes.

Documents used along the form

A 1035 Exchange is a helpful way to transfer assets from one insurance or annuity policy to another without incurring immediate tax consequences. However, this process often requires other forms and documents to ensure everything is completed smoothly. Here is a list of documents that are commonly used alongside the 1035 Exchange form:

- Account Transfer Request Form: This document formally requests the transfer of funds from the current insurer to the new insurer. It helps streamline communication between the involved parties.

- Client Authorization Form: This form grants permission for the transfer. It protects the rights of all parties and confirms the client is aware of the process.

- Statement of Need: This document outlines the client's reasons for the exchange. It may be necessary to demonstrate that the new product aligns better with their financial goals.

- Current Policy Document: A copy of the existing policy is often required. This verifies the terms and balances of the policy being exchanged.

- New Policy Application: If the exchange involves a new policy, a completed application is needed to initiate coverage with the new insurance provider.

- Tax Consequences Disclosure: This document outlines any potential tax implications related to the exchange. Understanding these implications is critical for informed decision-making.

- Beneficiary Designation Form: This form may need to be filled out for the new policy, specifying who will receive benefits in the event of the policyholder's death.

- Financial Suitability Questionnaire: This document assesses whether the new policy meets the client's needs and financial situation. It helps ensure the client's investment matches their profile.

- Proof of Identity: Some providers may require identification documents to verify the identity of the person requesting the exchange. This helps prevent fraud and secure the transaction.

- Notarized Affidavit: In certain cases, a notarized statement may be needed to verify information provided in the application or other documents.

Gathering these forms and documents can help ensure a smooth transition during the 1035 Exchange process. Proper preparation helps reduce stress and promotes a successful completion of the exchange.

Similar forms

- 1031 Exchange: Like the 1035 Exchange, a 1031 Exchange allows for the deferral of taxes when swapping one investment property for another. Here, investment properties are exchanged rather than insurance policies or annuities, but both transactions aim to minimize tax burdens during financial transitions.

- Transfer Request Form for Retirement Accounts: This document facilitates the transfer of funds from one retirement account to another, similar to how the 1035 Exchange enables the transfer of insurance policies or annuities. Both forms require specific details about the accounts involved and aim to maintain the tax-advantaged status of the funds being transferred.

- Change of Beneficiary Form: While primarily for changing the recipient of the policy benefits, this form shares similarities with the 1035 Exchange in that both require clear identification of the involved parties and serve to update important information regarding financial products.

- Loan Application for Life Insurance Policy: Both documents require policyholder information and contribute to the management of financial products. While the 1035 Exchange moves the policy, a loan application enables the borrowing against it, making each form essential for financial strategies involving insurance.

- Policy Surrender Form: This form allows policyholders to surrender their life insurance or annuity contract for cash value. While a 1035 Exchange transfers a policy to another company, a surrender form terminates the contract. Both involve careful consideration of the policy's status and associated values.

- Contract Replacement Form: This form helps policyholders to replace their existing insurance policy with a new one, similar to the purpose of the 1035 Exchange. Both documents highlight the process of shifting insurance interests, ensuring that all necessary steps and participant details are recorded to facilitate a smooth transition.

Dos and Don'ts

When filling out the 1035 Exchange form, it is crucial to follow specific guidelines to ensure a smooth process. Here are five key recommendations:

- Do use one form for each policy or contract being replaced to avoid confusion.

- Do ensure that you continue to pay premiums on the old policy until the exchange is completed to prevent lapsing.

- Do consult with a tax advisor about potential tax consequences related to the exchange.

- Don’t fax the form if the total exchange request exceeds $100,000. Instead, mail it to the designated address.

- Don’t assume that the transaction will qualify for brokerage account treatment without confirming eligibility.

Adhering to these guidelines can help prevent errors and ensure that your 1035 Exchange goes as planned. Taking these steps can safeguard your financial interests and keep your insurance coverage intact.

Misconceptions

Misconceptions about the 1035 Exchange Form

- It is only for life insurance policies. Many people think a 1035 Exchange is limited to life insurance. In reality, it can also apply to certain types of annuities and long-term care policies.

- It guarantees tax-free transactions. While it is designed for tax-deferred exchanges, it doesn't guarantee that there won't be tax implications. Always consult with a tax advisor before proceeding.

- Only the policy owner can initiate the exchange. Although the policy owner typically makes the request, other authorized individuals can act on their behalf, provided proper documentation is in place.

- The old policy can be canceled at any time. Some believe that they can just cancel their old policy after submitting the 1035 Exchange. It's crucial to continue paying premiums until the new policy is in place to avoid lapsing or decreasing cash value.

- There is no limit on the amount that can be exchanged. While there is generally no maximum limit, some companies might impose restrictions on large exchanges, particularly for accounts over $100,000.

- You only need to submit one form for multiple policies. Each policy or contract requires its own 1035 Exchange form. Submitting one form for multiple policies can lead to complications and delays.

- The exchange process is quick and hassle-free. While the idea of a quick transaction is appealing, the process can take time and often involves several steps. Patience is key.

- All products will be eligible for a 1035 Exchange. Not all financial products qualify for an exchange. Specific rules regarding eligibility apply, especially for inherited annuities.

- It's advisable to switch policies every few years. Frequent exchanges may not always be advantageous. It’s vital to carefully consider the long-term implications before making a switch.

Key takeaways

The 1035 Exchange form is an essential document for moving assets between insurance contracts. Understanding how to complete and use it wisely can make a significant difference in your financial future.

- One form per policy: Use a separate form for each policy or contract you are replacing. This ensures clarity and accuracy in the process.

- Mail or fax options: You can mail the completed form to RiverSource Life Insurance Company or fax it for requests at or below $100,000. This flexibility can expedite your exchange.

- Consult a tax advisor: It is crucial to speak with a tax advisor regarding potential tax implications before initiating the exchange. They can provide personalized advice based on your circumstances.

- Continue premium payments: Keep paying premiums on your old policy until the exchange is finalized. This can help prevent any lapses or decreases in cash value.

- Be aware of restrictions: Certain policies may not qualify for a 1035 exchange, especially inherited nonqualified stretch annuities. Always check the specifics of your situation.

Filling out the 1035 Exchange form correctly is vital to ensuring a smooth transition of your assets. Approach the process with care and seek assistance if needed.

Browse Other Templates

Virginia Medicaid Income Limits 2024 Calculator - Using the DMAS 225 can enhance the understanding and management of a patient’s care and eligibility for services.

Abc Liquor License Application - It inquires about any previous employment with the Commonwealth of Pennsylvania.