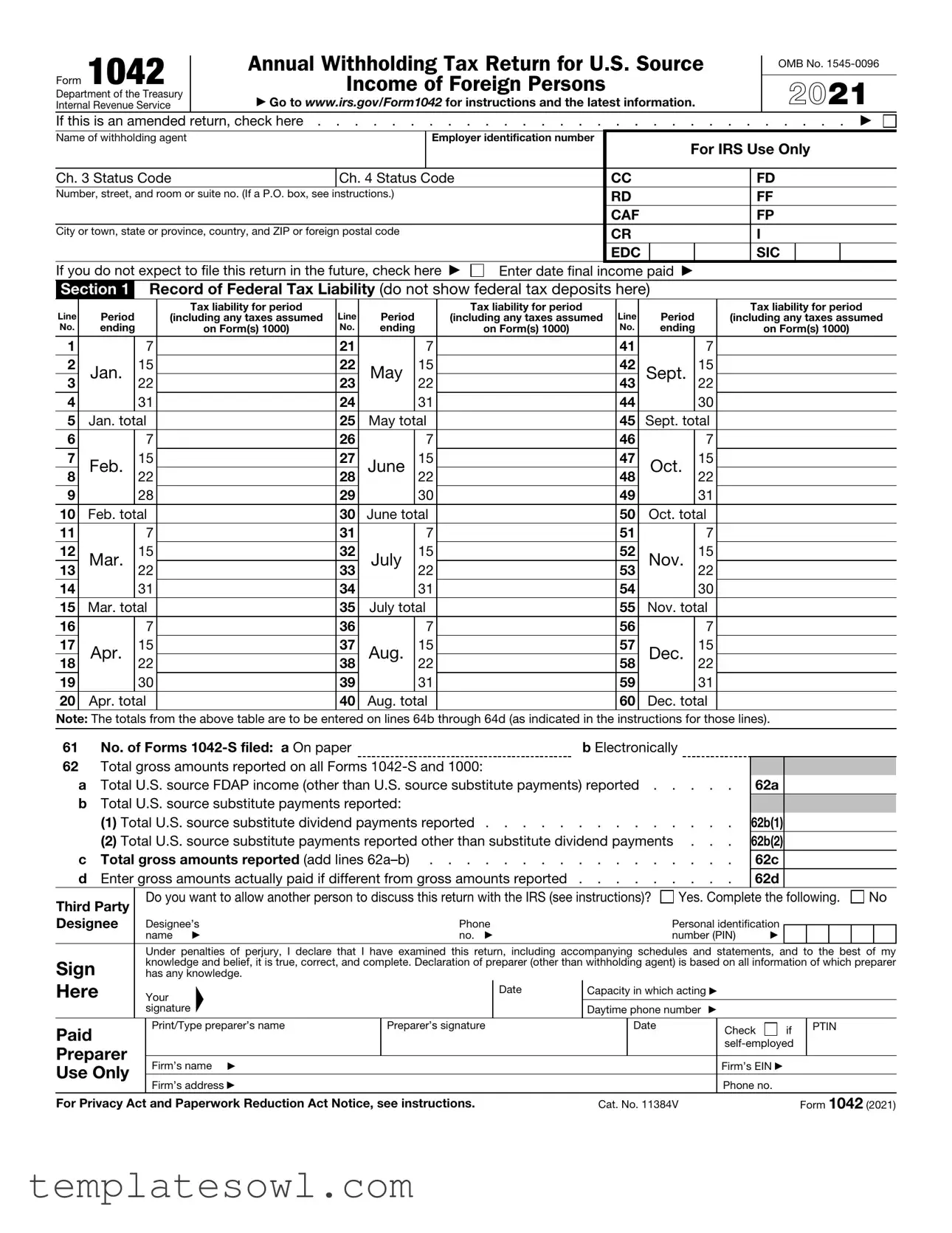

Fill Out Your 1042 Form

The 1042 Form, formally known as the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, plays a crucial role in the tax obligations of U.S. entities making payments to foreign individuals or entities. This form is mainly utilized by withholding agents—those responsible for ensuring that the appropriate amount of federal income tax is withheld from specific payments made to foreign persons. A significant aspect of the 1042 Form is its purpose to report U.S. source fixed, determinable, annual, or periodic (FDAP) income. This includes, but is not limited to, dividends, interest, rents, and royalties. The form requires detailed information, such as the withholding agent's name and employer identification number, along with a review of tax liabilities over specific periods throughout the year. In addition, it tracks the total amounts reported on related Forms 1042-S, which detail the income payments made. It’s essential for withholding agents to accurately complete this form, as it assists the IRS in tracking tax withheld or tax owed, ensuring compliance with U.S. tax laws. Other noteworthy features include the ability for an agent to file an amended return and to designate a third party who is permitted to discuss the return with the IRS. Ultimately, the completion and submission of the 1042 Form are vital for both compliance and for accurately reflecting the tax responsibilities associated with payments to foreign entities.

1042 Example

Form 1042 |

Annual Withholding Tax Return for U.S. Source |

|

|

|

OMB No. |

||||||||||||||||||

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

Income of Foreign Persons |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Department of the Treasury |

|

|

|

|

|

|

|

|

|

|

2021 |

||||||||||||

Internal Revenue Service |

▶ Go to www.irs.gov/Form1042 for instructions and the latest information. |

|

|

|

|

||||||||||||||||||

If this is an amended |

return, check here |

. . . |

. |

. |

. . . . . . ▶ |

||||||||||||||||||

Name of withholding agent |

|

|

|

|

Employer identification number |

|

|

|

|

For IRS Use Only |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ch. 3 Status Code |

|

Ch. 4 Status Code |

|

CC |

|

|

|

|

|

FD |

|||||||||||||

Number, street, and room or suite no. (If a P.O. box, see instructions.) |

|

|

|

|

RD |

|

|

|

|

|

FF |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

CAF |

|

|

|

|

|

FP |

|||||

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

CR |

|

|

|

|

|

I |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

EDC |

|

|

|

|

|

SIC |

|

|

|||

If you do not expect to file this return in the future, check here ▶ |

Enter date final |

income |

paid ▶ |

|

|

|

|

|

|

|

|||||||||||||

Section 1 |

Record of Federal Tax Liability (do not show federal tax deposits here) |

|

|

|

|

|

|

|

|||||||||||||||

Line |

|

Period |

|

|

Tax liability for period |

Line |

Period |

|

|

|

Tax liability for period |

|

Line |

|

|

Period |

|

|

|

Tax liability for period |

|||

|

|

(including any taxes assumed |

|

|

(including any taxes assumed |

|

|

|

|

(including any taxes assumed |

|||||||||||||

No. |

|

ending |

|

|

on Form(s) 1000) |

No. |

ending |

|

|

|

on Form(s) 1000) |

|

No. |

|

|

ending |

|

|

|

|

on Form(s) 1000) |

||

1 |

|

|

7 |

|

|

21 |

|

7 |

|

|

|

41 |

|

|

|

7 |

|

|

|

|

|

|

|

2 |

|

Jan. |

15 |

|

|

22 |

May |

15 |

|

|

|

42 |

|

Sept. |

15 |

|

|

|

|

|

|

||

3 |

|

22 |

|

|

23 |

22 |

|

|

|

43 |

|

22 |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

4 |

|

|

31 |

|

|

24 |

|

31 |

|

|

|

44 |

|

|

|

30 |

|

|

|

|

|

|

|

5 |

|

Jan. total |

|

|

25 |

May total |

|

|

|

45 |

|

Sept. total |

|

|

|

|

|

|

|||||

6 |

|

|

7 |

|

|

26 |

|

7 |

|

|

|

46 |

|

|

|

7 |

|

|

|

|

|

|

|

7 |

|

Feb. |

15 |

|

|

27 |

June |

15 |

|

|

|

47 |

|

|

Oct. |

15 |

|

|

|

|

|

|

|

8 |

|

22 |

|

|

28 |

22 |

|

|

|

48 |

|

|

22 |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

9 |

|

|

28 |

|

|

29 |

|

30 |

|

|

|

49 |

|

|

|

31 |

|

|

|

|

|

|

|

10 |

|

Feb. total |

|

|

30 |

June total |

|

|

|

50 |

|

Oct. total |

|

|

|

|

|

|

|||||

11 |

|

|

7 |

|

|

31 |

|

7 |

|

|

|

51 |

|

|

|

7 |

|

|

|

|

|

|

|

12 |

|

Mar. |

15 |

|

|

32 |

July |

15 |

|

|

|

52 |

|

Nov. |

15 |

|

|

|

|

|

|

||

13 |

|

22 |

|

|

33 |

22 |

|

|

|

53 |

|

22 |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

14 |

|

|

31 |

|

|

34 |

|

31 |

|

|

|

54 |

|

|

|

30 |

|

|

|

|

|

|

|

15 |

|

Mar. total |

|

|

35 |

July total |

|

|

|

55 |

|

Nov. total |

|

|

|

|

|

|

|||||

16 |

|

|

7 |

|

|

36 |

|

7 |

|

|

|

56 |

|

|

|

7 |

|

|

|

|

|

|

|

17 |

|

Apr. |

15 |

|

|

37 |

Aug. |

15 |

|

|

|

57 |

|

Dec. |

15 |

|

|

|

|

|

|

||

18 |

|

22 |

|

|

38 |

22 |

|

|

|

58 |

|

22 |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

19 |

|

|

30 |

|

|

39 |

|

31 |

|

|

|

59 |

|

|

|

31 |

|

|

|

|

|

|

|

20 |

|

Apr. total |

|

|

40 |

Aug. total |

|

|

|

60 |

|

Dec. total |

|

|

|

|

|

|

|||||

Note: The totals from the above table are to be entered on lines 64b through 64d (as indicated in the instructions for those lines). |

|||||||||||||||||||||||

61 |

|

No. of Forms |

|

|

|

|

b Electronically |

|

|

|

|

|

|

|

|||||||||

62 Total gross amounts reported on all Forms |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

a Total U.S. source FDAP income (other than U.S. source substitute payments) reported |

. . . |

. |

. |

|

62a |

|||||||||||||||||

|

b Total U.S. source substitute payments reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

(1) Total U.S. source substitute dividend payments reported |

. . . |

. |

. |

|

62b(1) |

||||||||||||||||

|

|

(2) Total U.S. source substitute payments reported other than substitute dividend payments . |

. |

. |

|

62b(2) |

|||||||||||||||||

|

c |

Total gross amounts reported (add lines |

. . . |

. |

. |

|

62c |

||||||||||||||||

dEnter gross amounts actually paid if different from gross amounts reported . . . . . . . . . 62d

Third Party |

Do you want to allow another person to discuss this return with the IRS (see instructions)? |

Yes. Complete the following. |

No |

||||||

|

|

|

|

|

|

|

|

|

|

Designee |

Designee’s |

Phone |

Personal identification |

|

|

|

|

|

|

|

name ▶ |

no. ▶ |

number (PIN) |

▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than withholding agent) is based on all information of which preparer has any knowledge.

Your |

▲ |

Date |

|

||

signature |

|

|

|

|

|

Paid |

Print/Type preparer’s name |

Preparer’s signature |

|

|

|

Preparer |

Firm’s name ▶ |

|

Use Only |

|

|

Firm’s address ▶ |

|

|

|

|

For Privacy Act and Paperwork Reduction Act Notice, see instructions.

Capacity in which acting ▶

Daytime phone number |

▶ |

|

|

|

||

|

Date |

|

Check |

if |

|

PTIN |

|

|

|

||||

|

|

|

|

|

||

|

|

|

|

|

||

|

|

|

Firm’s EIN ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone no. |

|

|

|

Cat. No. 11384V |

|

|

|

Form 1042 (2021) |

||

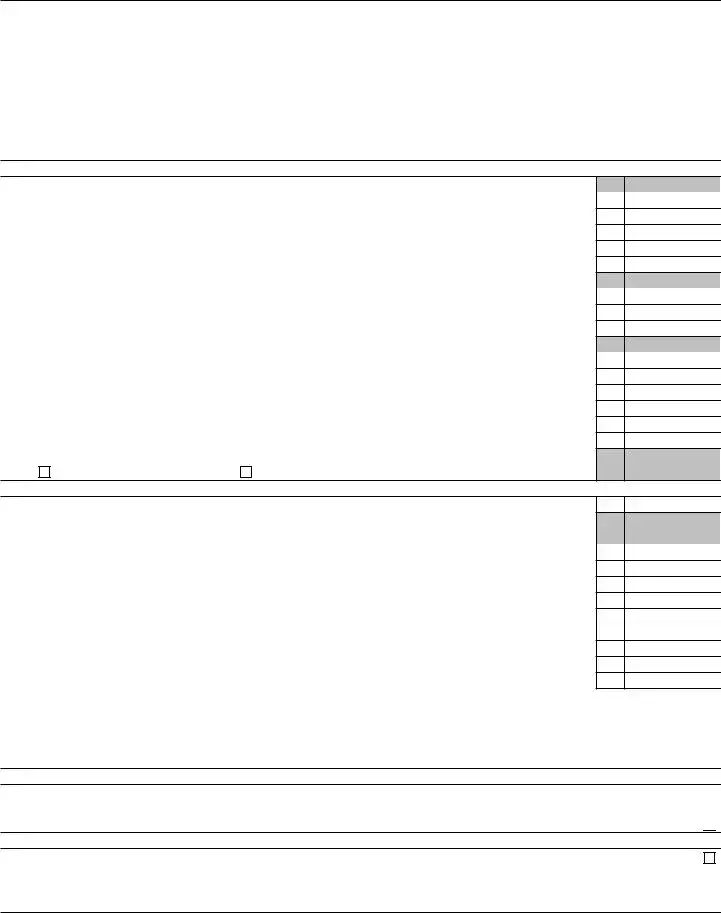

Form 1042 (2021) |

Page 2 |

63Total tax reported as withheld or paid by withholding agent on all Forms

a Tax withheld by withholding agent . . . . . . . . . . . . . . . . . . . . . .

bTax withheld by other withholding agents:

(1) |

For payments other than substitute dividends |

(2) |

For substitute dividends |

cAdjustments to withholding:

(1) |

Adjustments to overwithholding |

(2) |

Adjustments to underwithholding |

d Tax paid by withholding agent . . . . . . . . . . . . . . . . . . . . . . . .

eTotal tax reported as withheld or paid (add lines

Computation of Tax Due or Overpayment

|

|

|

63a |

|

|

|

|

|

63b(1) |

|

|

63b(2) |

|

|

|

|

|

63c(1) |

( |

) |

63c(2) |

|

|

63d |

|

|

63e |

|

|

|

|

|

64Total net tax liability

a |

Adjustments to total net tax liability |

b |

Total net tax liability under chapter 3 |

c |

Total net tax liability under chapter 4 |

d |

Excise tax on specified federal procurement payments (total payments made x 2% (0.02)) . . . . |

e |

Total net tax liability (add lines |

65Total paid by electronic funds transfer (or with a request for extension of time to file):

a |

Total paid during calendar year |

b |

Total paid during subsequent year |

66 |

Enter overpayment applied as credit from 2020 Form 1042 |

67Credit for amounts withheld by other withholding agents:

a |

For payments other than substitute dividend payments |

b |

For substitute dividend payments |

68 |

Total payments. Add lines 65 through 67 |

69If line 64e is larger than line 68, enter balance due here . . . . . . . . . . . . . . . .

70a |

Enter overpayment attributable to overwithholding on U.S. source income of foreign persons . . . |

b |

Enter overpayment attributable to excise tax on specified federal procurement payments . . . . |

71Apply overpayment (sum of lines 70a and 70b) to (check one):

Credit on 2022 Form 1042 or |

Refund |

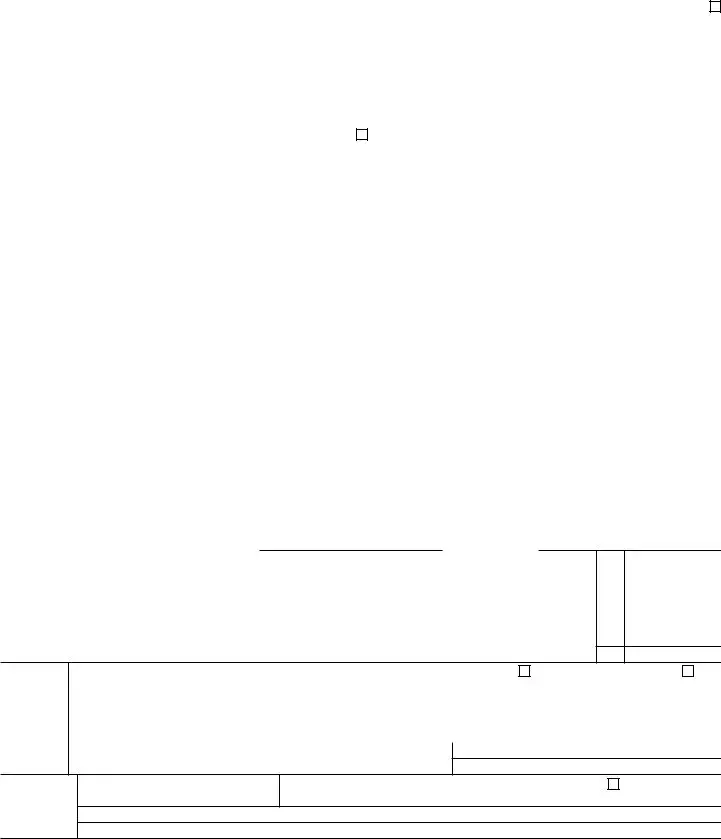

Section 2 Reconciliation of Payments of U.S. Source FDAP Income

64a

64b

64c

64d

64e

65a

65b

66

67a

67b

68

69

70a

70b

1 Total U.S. source FDAP income required to be withheld upon under chapter 4 . . . . . . . .

2Total U.S. source FDAP income required to be reported under chapter 4 but not required to be withheld upon under chapter 4 because:

aAmount of income paid to recipients whose chapter 4 status established no withholding is required .

b |

Amount of excluded nonfinancial payments |

c |

Amount of income paid with respect to grandfathered obligations |

dAmount of income effectively connected with the conduct of a trade or business in the U.S. . . .

eTotal U.S. source FDAP income required to be reported under chapter 4 but not required to be

|

withheld upon under chapter 4 (add lines |

3 |

Total U.S. source FDAP income reportable under chapter 4 (add lines 1 and 2e) |

4 |

Total U.S. source FDAP income reported on all Forms |

5 |

Total variance, subtract line 3 from line 4; if amount other than zero, provide explanation on line 6 . . |

6 |

|

|

|

|

|

|

|

1

2a

2b

2c

2d

2e

3

4

5

Section 3 Potential Section 871(m) Transactions

Check here if any payments (including gross proceeds) were made by the withholding agent under a potential section 871(m) transaction, including a notional principal contract or other derivatives contract that references (in whole or in part) a U.S. stock or other underlying security. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Section 4 Dividend Equivalent Payments by a Qualified Derivatives Dealer (QDD)

Check here if any payments were made by a QDD . . . . . . . . . . . . . . . . . . . . . . . . . . .

If box is checked, you must:

(1)Attach Schedule Q (Form 1042). See instructions.

(2)Enter the EIN (not the

Form 1042 (2021)

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose of Form | The 1042 Form is used to report annual withholding tax on U.S. source income paid to foreign persons. |

| Who Must File | Withholding agents must file this form when they have withheld income from foreign payees. |

| Deadline | The form is generally due on March 15 following the end of the calendar year in which the income was paid. |

| Filing Requirements | Copy of all Forms 1042-S issued must be attached to the 1042 Form. Reporting is critical for compliance. |

| Penalties for Non-Compliance | Failing to file or pay the correct amount can lead to fines and penalties, which may include interest on unpaid taxes. |

| State-Specific Forms | Check with state tax authorities, as some states have specific forms and procedures governed by their laws and regulations. |

Guidelines on Utilizing 1042

Filling out Form 1042 is a crucial step in reporting withholding taxes for U.S. source income paid to foreign persons. It's important to follow each step carefully to ensure accurate submission. This form requires various information about the withholding agent, the federal tax liability, and the payments made. Below are the specific steps to complete the form.

- Gather necessary information, including your name, the employer identification number, and address.

- Indicate if this is an amended return by checking the appropriate box if applicable.

- Provide the date final income was paid.

- In Section 1, record your federal tax liability. Fill in the periods and the respective tax liabilities for each line accurately.

- Count and list the number of Forms 1042-S filed, distinguishing between those filed on paper and electronically.

- Report the total gross amounts from all Forms 1042-S and 1000, categorizing them by type of income (FDAP, substitute payments, etc.).

- Indicate whether you allow another person to discuss this return with the IRS, and provide their details if applicable.

- Sign and date the form, confirming that the information is accurate and complete.

- Fill in the preparer's information if someone else prepared the form, including their signature and firm details.

- Review all entries before sending to ensure everything is correct to avoid potential delays or penalties.

What You Should Know About This Form

What is Form 1042?

Form 1042 is the Annual Withholding Tax Return for U.S. Source Income paid to Foreign Persons. It is used by withholding agents to report tax liability and payments made on certain U.S. source income paid to non-U.S. residents. This includes fixed or determinable annual or periodical income (FDAP), such as interest, dividends, rents, and royalties. Filing this form is essential to comply with U.S. tax laws governing foreign entities and individuals.

Who needs to file Form 1042?

Withholding agents, which include individuals and entities that make payments to foreign persons, are required to file Form 1042. If U.S. source payments are made to a foreign person, and tax is withheld on those payments, the withholding agent must file this form. This obligation applies to banks, brokers, and organizations that manage investments or payments involving foreign recipients.

How is Form 1042 completed?

To complete Form 1042, the withholding agent must provide basic information including their name, employer identification number (EIN), and address. Additionally, the form requires the reporting of federal tax liability for each applicable period, the number of Forms 1042-S filed, and total gross amounts paid. Each section includes specific calculations that summarize the tax withheld and payments made throughout the year. Review detailed IRS instructions to ensure compliance and accuracy.

When is Form 1042 due?

Form 1042 is due on March 15 of the year following the calendar year for which the income was paid. For instance, if payments were made in 2022, the Form 1042 would need to be filed by March 15, 2023. If the 15th falls on a weekend or legal holiday, the due date shifts to the next business day. If an extension is needed, Form 7004 should be filed to request additional time.

Common mistakes

When completing Form 1042, individuals often encounter pitfalls that can lead to errors and complications. One common mistake is failing to provide accurate identification information. This includes the name of the withholding agent and their employer identification number. A wrong identification number can create delays in processing and may result in penalties.

Another significant error arises from incorrect reporting of tax liabilities. Individuals sometimes miscalculate their total federal tax liability for the periods listed in Section 1 of the form. Such inaccuracies can result in either underpayment or overpayment, both of which could trigger issues with the Internal Revenue Service (IRS) later on.

People frequently overlook the importance of checking the boxes that apply to their situation. For instance, failing to indicate if the form is an amended return or not providing the status code accurately can lead to significant processing errors. This oversight may require additional correspondence with the IRS, consuming valuable time and resources.

Not filing the required Forms 1042-S is another common mistake. Individuals may assume that filing this main form is sufficient, but the IRS requires documentation of U.S. source income, which is reported on Forms 1042-S. Missing these forms can lead to incomplete submissions and may result in compliance issues.

Lastly, some people neglect to follow up on discussions with the IRS regarding their returns. The form includes a section allowing filers to designate another person to discuss the return with the IRS. If this designation is incorrectly completed, it can hinder communication and resolution of any challenges that arise from the filing.

Documents used along the form

The IRS Form 1042 is used primarily for reporting income paid to foreign persons and the amounts withheld for federal taxes on that income. To properly complete and submit this form, individuals and organizations often need to refer to or submit various related documents. Below is a list of additional forms and documents commonly used alongside Form 1042, each serving a distinct purpose.

- Form 1042-S: This form reports income paid to foreign persons and the amount of federal income tax withheld on that income. Each foreign recipient will receive their own Form 1042-S, detailing the income and tax withheld.

- Form W-8BEN: This form is filled out by foreign individuals to certify their foreign status and claim benefits for reduced withholding tax rates under an applicable tax treaty with the U.S.

- Form W-8BEN-E: Similar to Form W-8BEN, but specifically for foreign entities. This form allows organizations to claim foreign status and any tax treaty benefits.

- Form W-8ECI: This form is for foreign persons who receive income effectively connected with a U.S. trade or business. This form indicates the income is not subject to withholding tax.

- Form W-9: U.S. persons use this form to provide their taxpayer identification number (TIN) to a requesting party. This is commonly required for U.S. residents to ensure proper reporting.

- Form 1000: This form is used to report certain types of U.S. source income paid to foreign persons. It includes information about the payments made and tax withheld.

- Form 8833: Used by foreign persons to disclose positions taken under a tax treaty that may contradict the provisions of U.S. tax law, this form is crucial for some income claims.

- Schedule Q (Form 1042): This schedule is filed with Form 1042 when payments are made by a qualified derivatives dealer (QDD). It provides necessary details about the payments related to derivatives.

These forms and documents play a vital role in ensuring compliance with U.S. tax laws when dealing with foreign persons and entities. Understanding their functions can greatly aid in accurately reporting and managing tax withholding obligations. Whether you are a foreign individual receiving U.S. income or a U.S. organization making payments, familiarity with these forms can streamline the tax process considerably.

Similar forms

The IRS Form 1042 is an important document for reporting annual withholding tax on income paid to foreign persons. It shares similarities with several other tax forms. Below is a comparison of Form 1042 with four related documents.

- Form 1042-S: This form is used to report income paid to foreign persons and the tax withheld on that income. While Form 1042 summarizes the withholding for the year, Form 1042-S is filed for each individual payment to foreign persons, detailing the specific amounts and withholding for each payment.

- Form W-2: Employers use Form W-2 to report wages paid to employees and the taxes withheld from those wages. Just as Form 1042 is for foreign recipients, the W-2 is for U.S. employees, documenting income and withholding for the year, along with providing necessary information to the IRS.

- Form 1099: This form is used to report various types of income other than wages, salaries, and tips. Similar to Form 1042, both forms serve to inform the IRS about income payments but are intended for different recipient types: 1099 is typically aimed at U.S. residents, while 1042 focuses on payments to foreign entities.

- Form 8804: This form is utilized to report income tax for partnerships with foreign partners. Much like Form 1042, it is specifically designed for cases involving foreign entities and their tax obligations in the U.S., ensuring transparency and compliance with U.S. tax laws.

Understanding these forms is critical for ensuring accurate reporting and compliance with tax obligations. Each document serves a specific purpose in the broader landscape of tax reporting, fulfilling unique requirements for different categories of payees.

Dos and Don'ts

- Ensure all personal information is accurate, including name and identification number.

- Double-check entries for any calculations related to tax liability.

- Provide the required supporting documentation for any amounts claimed.

- Clearly indicate if this is an amended return by checking the appropriate box.

- Review the latest IRS guidelines to ensure compliance with current requirements.

- Do not forget to sign and date the form before submission.

- Do not leave any fields blank; if a question does not apply, indicate that appropriately.

- Avoid using a P.O. box for the address unless specified in the instructions.

- Do not submit the form without completing all relevant sections, as incomplete submissions may lead to delays.

Misconceptions

- Misconception 1: The 1042 form is only for U.S. citizens.

- Misconception 2: You must always file a 1042 form if you receive any payment from a U.S. source.

- Misconception 3: Filing a 1042 form is optional.

- Misconception 4: If I withhold the right amount of tax, I don’t need to file the form.

- Misconception 5: The 1042 form is the same as the 1040 form.

- Misconception 6: I can file the 1042 form any time during the year.

- Misconception 7: Only large companies need to file the 1042 form.

- Misconception 8: Once I file the 1042 form, I’m done with my tax obligations.

This form is specifically designed for U.S. source income paid to foreign persons. It applies to non-resident aliens and foreign entities, not U.S. citizens.

Not all payments require the filing of this form. The 1042 form is specifically for reporting certain types of income, known as FDAP (Fixed, Determinable, Annual, or Periodical) income.

For those required to file, submitting the 1042 form is mandatory. Failing to do so can lead to penalties and interest on any owed taxes.

Even if the correct amount of tax has been withheld, the form still must be filed to properly document the income and the withholding.

These are two entirely different forms serving distinct purposes. The 1040 is for U.S. residents to report their income, while the 1042 is for reporting payments to foreign entities.

The 1042 form has a specific filing deadline, which typically falls on March 15 of the year following the calendar year in which the income was paid.

Any withholding agent that makes payments to foreign persons may need to file, regardless of their size. This includes individuals and small businesses.

Filing the 1042 form is just one part of the process. If applicable, you may still need to fulfill additional tax obligations, including filing Forms 1042-S for the recipients of the income.

Key takeaways

Filling out and using the 1042 form effectively requires attention to detail and understanding of regulatory requirements.

- The 1042 form is used for reporting annual withholding tax on income paid to foreign persons.

- Ensure the withholding agent's name and Employer Identification Number (EIN) are accurately entered at the top of the form.

- Check the appropriate boxes if filing an amended return or if you do not expect to file again in the future.

- Complete Section 1 to report your federal tax liability for each applicable period.

- Document the total number of Forms 1042-S filed, both on paper and electronically, in the designated area.

- Clearly report gross amounts of U.S. source Fixed, Determinable, Annual, or Periodical (FDAP) income on lines 62a through 62d.

- Use accurate calculations when determining the total tax reported as withheld, as outlined in Section 3.

- If necessary, apply for overpayments derived from withholding on U.S. source income.

- Keep records of all related supporting documentation, as the IRS may request them during audits.

- Before submitting, ensure all signatures are present and that the declaration accurately reflects the information provided.

Browse Other Templates

How Do I Claim on My Pet Insurance - The claim form must be accurately completed to avoid rejection.

ATRRS Modification Request,ATRRS Update Form,ATRRS Change Application,ATRRS Adjustment Form,ATRRS Information Change Request,ATRRS Change Submission,ATRRS Request for Change,ATRRS Enrollment Modification Form,ATRRS Course Change Form,ATRRS Data Revis - Add comments as needed for further clarification.

Do Independent Contractors Charge Sales Tax - Contractors must present this certificate to vendors to claim tax exemption on purchases.