Fill Out Your 104Pn Form

The Colorado Department of Revenue utilizes Form 104PN to assist individuals who have lived in multiple states throughout the tax year. This form is specifically designed for part-year residents and nonresidents, allowing them to accurately apportion their income and calculate their Colorado tax liability. Individuals must complete the 104PN after filling out the main Colorado Individual Income Tax Form, known as the DR 0104. The form accounts for income earned while a resident of Colorado and provides detailed instructions for reporting various types of income, including wages, dividends, and unemployment benefits. Each taxpayer is required to identify their residency status, which informs the calculation of their taxable income in Colorado. Additionally, the 104PN outlines necessary adjustments to gross income and computes the final Colorado tax owed based on a percentage derived from the taxpayer’s total income and applicable tax rates. Understanding the components of this form is essential for ensuring compliance and accuracy in Colorado tax reporting.

104Pn Example

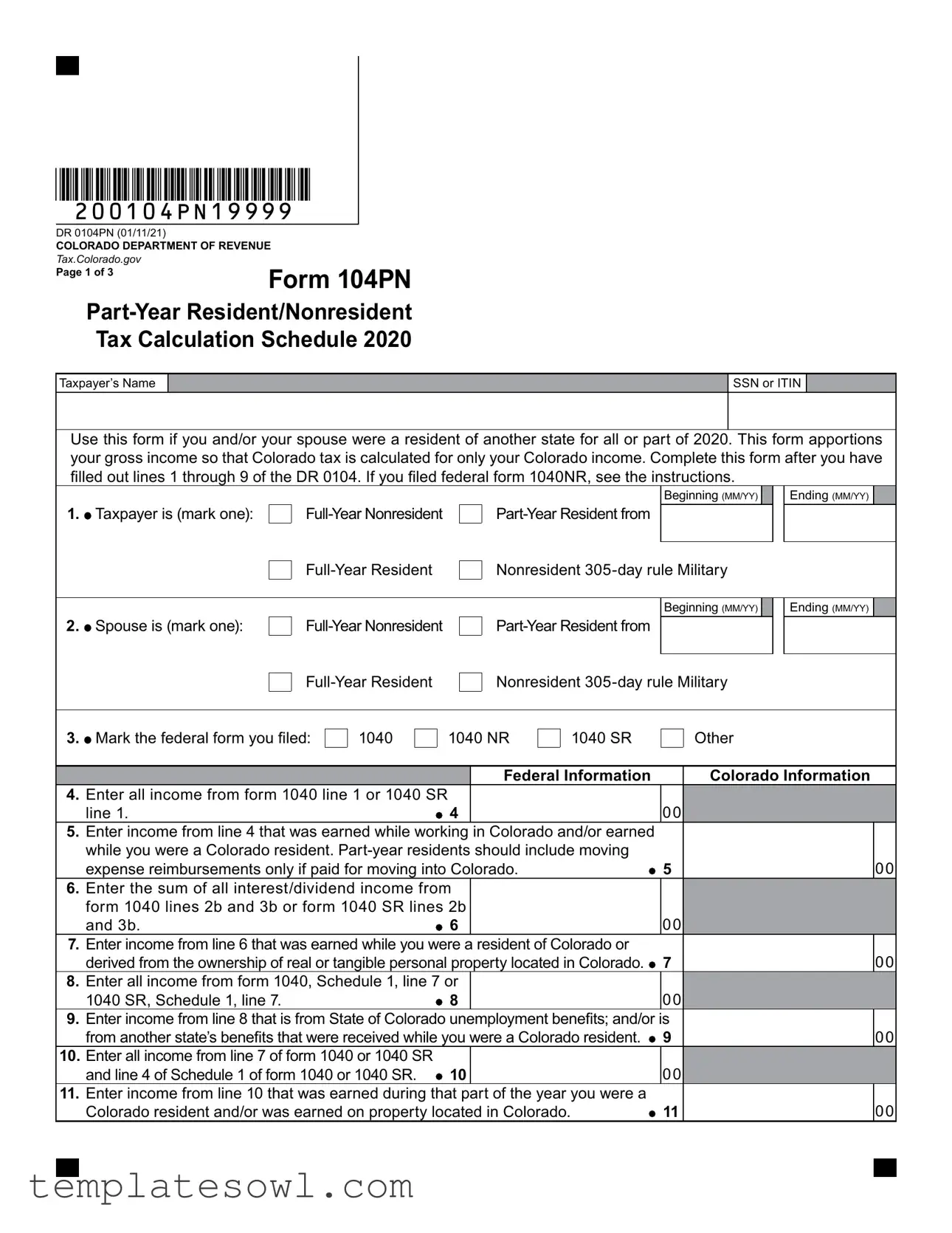

*200104PN19999*

DR 0104PN (01/11/21)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 1 of 3

Form 104PN

Taxpayer’s Name

SSN or ITIN

Use this form if you and/or your spouse were a resident of another state for all or part of 2020. This form apportions

your gross income so that Colorado tax is calculated for only your Colorado income. Complete this form after you have filled out lines 1 through 9 of the DR 0104. If you filed federal form 1040NR, see the instructions.

1. Taxpayer is (mark one):

Taxpayer is (mark one):

Beginning (MM/YY)

Ending (MM/YY)

Nonresident

2. Spouse is (mark one):

Spouse is (mark one):

Beginning (MM/YY)

Nonresident

Ending (MM/YY)

3. Mark the federal form you filed:

Mark the federal form you filed:

1040

1040 NR

1040 SR

Other

Federal Information |

Colorado Information |

4.Enter all income from form 1040 line 1 or 1040 SR

line 1. |

4 |

00 |

5.Enter income from line 4 that was earned while working in Colorado and/or earned while you were a Colorado resident.

expense reimbursements only if paid for moving into Colorado. |

5 |

00 |

6.Enter the sum of all interest/dividend income from form 1040 lines 2b and 3b or form 1040 SR lines 2b

and 3b. |

6 |

00 |

7.Enter income from line 6 that was earned while you were a resident of Colorado or

derived from the ownership of real or tangible personal property located in Colorado. 7 |

00 |

8.Enter all income from form 1040, Schedule 1, line 7 or

1040 SR, Schedule 1, line 7. |

8 |

00 |

9.Enter income from line 8 that is from State of Colorado unemployment benefits; and/or is

from another state’s benefits that were received while you were a Colorado resident. 9 |

00 |

10.Enter all income from line 7 of form 1040 or 1040 SR

and line 4 of Schedule 1 of form 1040 or 1040 SR. |

10 |

00 |

11.Enter income from line 10 that was earned during that part of the year you were a

Colorado resident and/or was earned on property located in Colorado. |

11 |

00 |

|

|

|

|

|

|

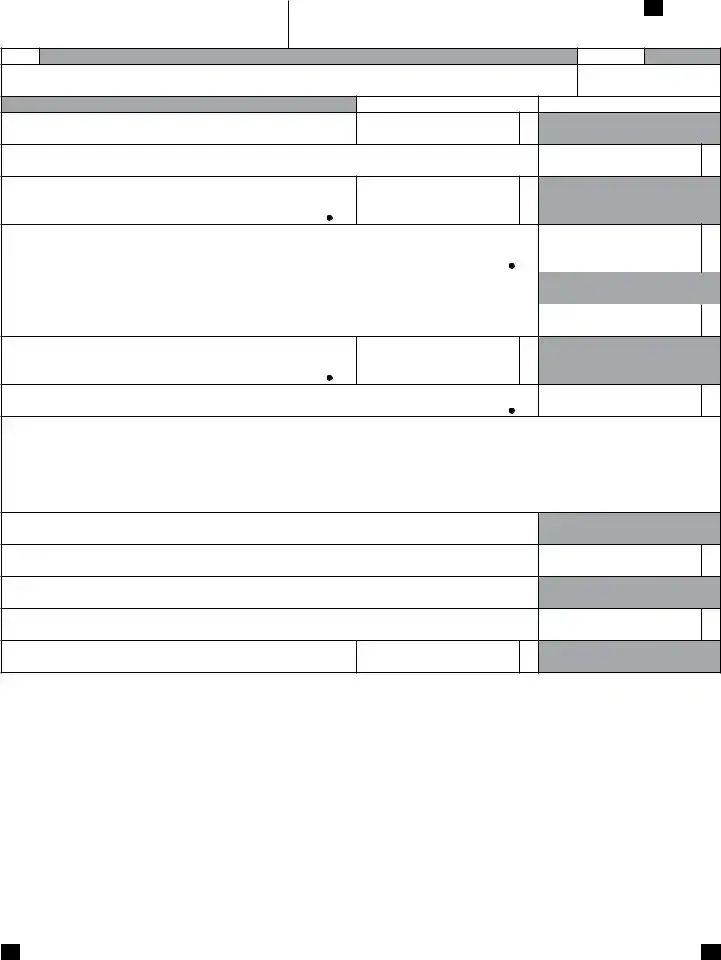

*200104PN29999*

DR 0104PN (01/11/21)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 2 of 3

Name

SSN or ITIN

Federal Information |

Colorado Information |

12.Enter the sum of all income from form 1040 lines 4b,

5b and 6b or 1040 SR lines 4b, 5b and 6b. |

12 |

00 |

13.Enter income from line 12 that was received during that part of the year you were a

Colorado resident. |

13 |

00 |

14.Enter the sum of all business and farm income from form 1040, Schedule 1, lines 3 and 6 or 1040 SR,

Schedule 1, lines 3 and 6. |

14 |

00 |

15.Enter income from line 14 that was earned during that part of the year you were a

Colorado resident and/or was earned from Colorado sources. |

15 |

00 |

16.Enter all Schedule E income from form 1040,

Schedule 1, line 5 or 1040 SR, Schedule 1, line 5. 16 |

00 |

17.Enter income from line 16 that was earned from Colorado sources; and/or rent and

royalty income received or credited to your account during the part of the year you were a Colorado resident; and/or partnership/S corporation/fiduciary income that is

taxable to Colorado during the tax year. |

17 |

00 |

18.Enter the sum of all other income from form 1040, Schedule 1, lines 1, 2a and 8 or 1040 SR, Schedule 1,

lines 1, 2a and 8. |

18 |

00 |

List Type

19.Enter income from line 18 that was earned during that part of the year you were a

Colorado resident and/or was derived from Colorado sources. |

19 |

List Type

00

20.Total Income. Enter amount from form 1040, line 9 or

1040 SR, line 9. |

20 |

00 |

21.Total Colorado Income. Enter the total from the Colorado column, lines 5, 7, 9, 11,

13, 15, 17 and 19. |

|

21 |

|

22. Enter all federal adjustments from form 1040, line 10c or |

|

00 |

|

1040 SR, line 10c. |

22 |

|

|

List Type

00

23. Enter adjustments from line 22 as follows |

23 |

|

List Type |

|

|

|

|

|

00

•Educator expenses, IRA deduction, business expenses of reservists, performing artists and

•Student loan interest deduction, alimony, and tuition and fees deduction are allowed in the Colorado to federal total income ratio (line 21 / line 20).

•Penalty paid on early withdrawals made while a Colorado resident.

•Moving expenses for members of the Armed Forces.

For treatment of other adjustments reported on federal form 1040, line 10c or 1040 SR, line 10c, see the Colorado Individual Income Tax Guide and/or the Income Tax Topics:

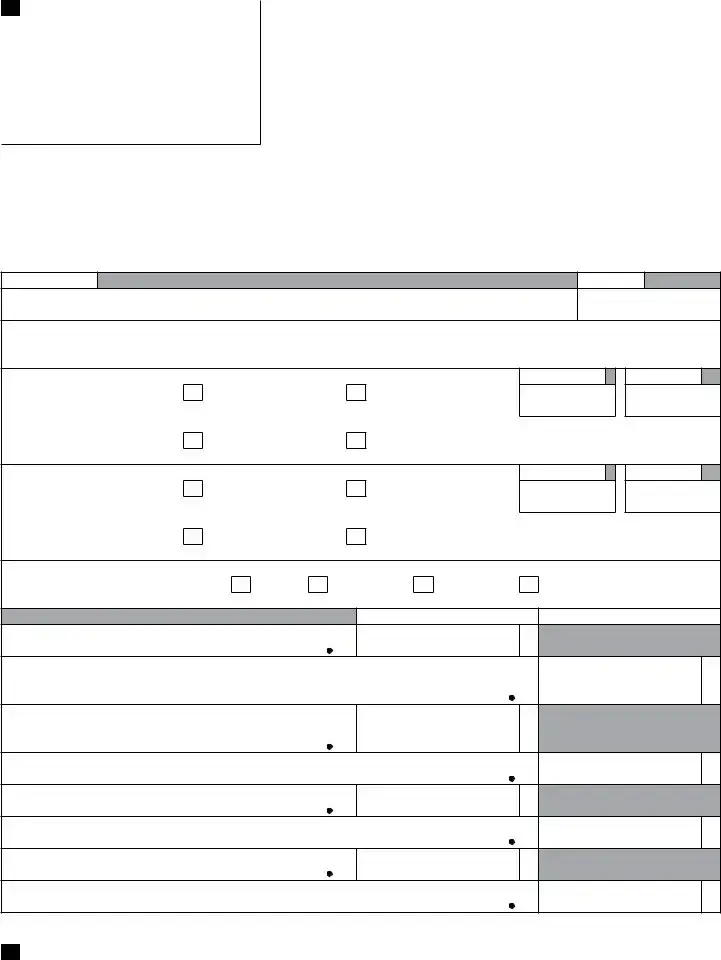

*200104PN39999*

DR 0104PN (01/11/21)

COLORADO DEPARTMENT OF REVENUE

Tax.Colorado.gov

Page 3 of 3

Name

SSN or ITIN

Federal Information |

Colorado Information |

24.Adjusted Gross Income. Enter amount from form 1040

line 11 or 1040 SR line 11. |

24 |

00 |

25.Colorado Adjusted Gross Income. Subtract the amount on line 23 of Form 104PN

from the amount on line 21 of Form 104PN. |

25 |

00 |

26.Additions to Adjusted Gross Income. Enter the sum of lines 3, 4, 5, and 6 of Colorado Form 104 excluding

any charitable contribution adjustments. |

26 |

00 |

27.Additions to Colorado Adjusted Gross Income. Enter any amount from line 26 that is from

|

a Colorado resident.* |

|

27 |

00 |

|

28. |

Total of lines 24 and 26 |

28 |

|

00 |

|

29. |

Total of lines 25 and 27 |

|

29 |

00 |

|

30.Subtractions from Adjusted Gross Income. Enter the amount from line 8 of Colorado Form 104 excluding

any qualifying charitable contributions. |

30 |

00 |

31.Subtractions from Colorado Adjusted Gross Income.

Enter any amount from line 30 as follows: |

31 |

00 |

•The state income tax refund subtraction to the extent included on line 19 above

•The federal interest subtraction to the extent included on line 7 above

•The pension/annuity subtraction and the PERA or DPS retirement subtraction to the extent included on line 13 above

•The Colorado capital gain subtraction to the extent included on line 20 above

For treatment of other subtractions, see the Individual Income Tax Guide and/or the Income Tax

|

Topics: |

|

|

|

32. |

Modified Adjusted Gross Income. Subtract line 30 |

|

|

|

|

from line 28. |

32 |

|

00 |

33. |

Modified Colorado Adjusted Gross Income. Subtract line 31 from line 29. |

33 |

||

34. |

Divide line 33 by line 32. Round to four significant digits, |

|

|

|

|

e.g. xxx.xxxx |

34 |

|

% |

35. |

Tax from the tax table based on income reported on the DR 0104 line 9 |

35 |

||

36.Apportioned tax. Multiply line 35 by the percentage on

line 34. Enter here and on DR 0104 line 10. |

36 |

00 |

00

00

*See the Individual Income Tax Guide and/or the Income Tax Topics:

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Identification | The 104PN form is officially titled the Part-Year Resident/Nonresident Tax Calculation Schedule. |

| Filing Requirement | Taxpayers must use this form if they were a resident of another state for any part of the tax year. |

| Governing Authority | This form is governed by the laws of the State of Colorado, as administered by the Colorado Department of Revenue. |

| Income Apportionment | The form allows taxpayers to apportion their income, ensuring Colorado tax is calculated only on income earned in Colorado. |

| Federal Forms | Taxpayers must indicate which federal tax form they filed, such as 1040, 1040NR, or 1040SR, as part of the process. |

| Part-Year Resident Definition | A part-year resident is someone who lived in Colorado for part of the tax year and earned income during that time. |

| Information Lines | The form contains specific lines that require taxpayers to enter various types of income, such as wages, dividends, and capital gains. |

| Adjusted Gross Income Calculation | Taxpayers must calculate both federal and Colorado adjusted gross income on this form to determine tax liability accurately. |

| Taxable Income | Income earned while a resident and from Colorado sources is generally subject to Colorado state income tax. |

| Final Submission | The completed 104PN form must be submitted alongside or after the DR 0104 form for proper filing. |

Guidelines on Utilizing 104Pn

Completing the 104PN form requires careful attention to detail. By following these steps sequentially, individuals can accurately report their income as it pertains to Colorado tax requirements. Ensure that any federal forms or documents are readily available, as this will assist in providing the necessary information on the 104PN.

- Start by writing your name and SSN or ITIN at the top of the form.

- Indicate your residency status by marking one box for the taxpayer: Full-Year Nonresident, Part-Year Resident from Beginning (MM/YY), Full-Year Resident, Nonresident 305-day rule, or Military.

- If applicable, indicate your spouse's residency status by marking one box: Full-Year Nonresident, Full-Year Resident, Part-Year Resident from (MM/YY), Nonresident 305-day rule, or Military.

- Mark the federal form you filed: 1040, 1040 NR, 1040 SR, or Other.

- Enter all income from form 1040 line 1 or 1040 SR line 1 on line 4.

- On line 5, enter the income from line 4 earned in Colorado and/or while you were a Colorado resident.

- Input the sum of all interest/dividend income from form 1040 lines 2b and 3b (or form 1040 SR lines 2b and 3b) on line 6.

- Record the income from line 6 that was earned as a Colorado resident or from property located in Colorado on line 7.

- From form 1040, Schedule 1, line 7 (or 1040 SR, Schedule 1, line 7), enter all income on line 8.

- On line 9, document income from line 8 that is from Colorado unemployment benefits or from benefits received while residing in Colorado.

- On line 10, enter all income from line 7 of form 1040 or 1040 SR and line 4 of Schedule 1 of form 1040 or 1040 SR.

- For line 11, document income from line 10 earned while you were a Colorado resident and/or earned on Colorado property.

- On line 12, enter the sum of all income from form 1040 lines 4b, 5b, and 6b (or 1040 SR lines 4b, 5b, and 6b).

- Document income from line 12 received during the Colorado residency period on line 13.

- Enter total business and farm income from form 1040, Schedule 1, lines 3 and 6 (or 1040 SR, Schedule 1, lines 3 and 6) on line 14.

- On line 15, input income from line 14 earned during your Colorado residency or from Colorado sources.

- From form 1040, Schedule 1, line 5 (or 1040 SR, Schedule 1, line 5), enter all Schedule E income on line 16.

- Record income from line 16 that was earned from Colorado sources on line 17.

- Enter the sum of all other income from form 1040, Schedule 1, lines 1, 2a, and 8 (or 1040 SR, Schedule 1, lines 1, 2a, and 8) on line 18.

- On line 19, document income from line 18 that was earned as a Colorado resident or derived from Colorado sources.

- Calculate total income. Enter this amount from form 1040, line 9 (or 1040 SR, line 9) on line 20.

- Input your total Colorado income from lines 5, 7, 9, 11, 13, 15, 17, and 19 on line 21.

- Enter all federal adjustments from form 1040, line 10c (or 1040 SR, line 10c) on line 22.

- Document adjustments from line 22 as detailed instructions dictate on line 23.

- Enter your adjusted gross income from form 1040 line 11 (or 1040 SR line 11) on line 24.

- Calculate Colorado adjusted gross income by subtracting line 23 from line 21, and enter the result on line 25.

- Input any additions to adjusted gross income from form 104 excluding charitable contribution adjustments on line 26.

- Record additions to Colorado adjusted gross income from non-Colorado state or local bond interest on line 27.

- Add lines 24 and 26 together, and enter this total on line 28.

- Add lines 25 and 27 together, and enter this total on line 29.

- Input any subtractions from adjusted gross income from line 8 of Colorado Form 104 on line 30.

- Document subtractions from Colorado adjusted gross income as specified on line 31.

- Calculate modified adjusted gross income by subtracting line 30 from line 28, and enter the result on line 32.

- Calculate modified Colorado adjusted gross income by subtracting line 31 from line 29, and enter that on line 33.

- Divide line 33 by line 32. Round to four significant digits, and enter that as a percentage on line 34.

- Using the tax table, calculate tax from the income reported on line 9 and enter it on line 35.

- Multiply the amount from line 35 by the percentage on line 34. Enter this on line 36 and on line 10 of the DR 0104 form.

What You Should Know About This Form

What is Form 104PN and who should use it?

Form 104PN is for individuals who were part-year residents or nonresidents of Colorado during the tax year. You must use this form if you or your spouse lived in another state for any part of the year and earned income during that time. It helps determine how much of your income is taxable in Colorado.

How do I complete Form 104PN?

Start with filling out lines 1 through 9 of the DR 0104 form. Once that is done, you can move on to Form 104PN. You will report different types of income, identifying how much of that income was earned while you were a Colorado resident. The form requires you to list income sources separately, so it’s important to gather your information beforehand.

What kind of income should I report on Form 104PN?

You should report all types of income that you received while living in Colorado or income derived from Colorado sources. This includes wages, interest, dividends, and any unemployment benefits linked to your residency in Colorado. Be sure to differentiate between Colorado income and income earned while you were a resident of another state.

How is the Colorado Adjusted Gross Income calculated on Form 104PN?

The Colorado Adjusted Gross Income is calculated by taking your total income taxable in Colorado and making necessary adjustments. You will subtract specific deductions and adjustments from your total Colorado income, which you will determine on the form. This will give you a clearer picture of your taxable income within the state.

What happens if I filed a federal form 1040NR?

If you filed a federal form 1040NR (nonresident), make sure to follow the specific instructions provided for that situation. Your income reporting and tax calculations might differ slightly, and it’s important to adhere to the guidelines set out for nonresidents when filling out the 104PN form.

What is the final step after completing Form 104PN?

After you finish the 104PN, you will need to enter the apportioned tax amount on the DR 0104 form. This is the tax calculated based on your Colorado income, and it should be reported on line 10 of the DR 0104. Make sure to check your figures for accuracy before filing.

Common mistakes

Filling out the 104PN form can be a complex process, and many people make mistakes that could lead to delays, penalties, or an incorrect tax calculation. One common error involves mislabeling their residency status. Whether marking themselves as a full-year resident, full-year nonresident, or part-year resident, taxpayers must ensure that they choose the correct option. This decision has a significant impact on how income is reported and taxed in Colorado. If a person incorrectly indicates their residency status, it could result in owing more tax than necessary or being eligible for refunds that are incorrectly claimed.

Another frequent mistake lies in the calculation of income earned during the time residing in Colorado. When completing lines 5, 7, 11, or other relevant sections, individuals often include all income without separating what was earned while a Colorado resident from that earned elsewhere. Accurately distinguishing Colorado-related income is essential, as incorrect reporting can lead to inaccurate tax liabilities.

Many taxpayers also overlook the necessity of including specific income types. For example, unemployment benefits received while residing in Colorado must be reported on line 9. Failing to include these benefits or misreporting them can result in penalties or adjustments by the Colorado Department of Revenue.

Another common error occurs in documenting federal adjustments to income. Line 22 requires taxpayers to accurately enter all federal adjustments, and mistakes here can precipitate problems with the Colorado adjusted gross income. Each deduction should be properly accounted for and correctly apportioned based on Colorado wages and income.

One serious yet easily avoidable mistake is neglecting to double-check calculations. Arithmetic errors can creep in, resulting in discrepancies that may raise red flags during review. Therefore, reviewing numbers against their sources and ensuring each line aligns with the corresponding tax form can save time and frustration.

In addition, failing to validate the necessity of additional documentation can lead to complications. Taxpayers sometimes overlook the importance of including supporting documents when required. For instance, if claiming specific deductions or credits, individuals should keep copies of all relevant receipts and forms for their records. Without these documents, justifying claims may become difficult if questioned.

Finally, individuals often miss deadlines or incorrectly assume that filing electronically will prune away all potential problems. While e-filing can streamline the process, it’s vital to ensure that submissions are timely and that all required forms are included. Missing deadlines could incur late fees or affect refunds. Being diligent and organized is key to successfully navigating the 104PN form.

Documents used along the form

When completing the 104PN form, there are several other documents and forms that you may need to reference or submit. These additional forms help ensure that your tax situation is accurately assessed, especially if you are a part-year resident or a nonresident of Colorado. Here’s a brief overview of some commonly associated documents.

- Form 1040: This is the standard individual income tax return form used by U.S. taxpayers. It reports a taxpayer’s adjusted gross income and is the primary form used to calculate federal income tax liabilities.

- Form 1040NR: This form is specifically for nonresident aliens. Individuals who do not meet the green card or substantial presence test must use this form to report their income earned in the U.S.

- Schedule 1 (Form 1040): This schedule is used to report additional income such as unemployment benefits or to claim adjustments to income like educator expenses or student loan interest deductions. It supplements the information provided on the main 1040 form.

- Form DR 0104: This is the Colorado individual income tax return form. All Colorado residents and part-year residents need to complete this form, providing information about their total income and tax liability for the state.

- Form DR 0104AD: This form is used to apply for an extension to file the Colorado income tax return. Taxpayers who need more time to prepare their taxes may file this form to avoid late filing penalties.

Gathering the necessary forms and related documents helps simplify the tax filing process. Understanding what each document entails ensures that residents and nonresidents alike can accurately report their income and fulfill their tax obligations in Colorado.

Similar forms

The 104Pn form, known as the Part-Year Resident/Nonresident Tax Calculation Schedule, is utilized for taxpayers who have lived in Colorado for only part of the year or who were residents of another state. Various other tax documents serve similar purposes for different situations or residency statuses. Below is a detailed comparison of the 104Pn with nine other similar documents:

- Form 1040: This is the main individual income tax form used by residents in the United States. Both forms require reporting of income and deductions, but the 1040 does not specifically address part-year residency.

- Form 1040NR: This form is intended for nonresident aliens. Like the 104Pn, it calculates income tax based only on income from U.S. sources, but it is specifically designed for individuals who are not considered residents for tax purposes.

- Form 1040SR: Meant for seniors over the age of 65, this tax form allows simplified reporting for those who qualify. Both the 1040SR and the 104Pn help taxpayers calculate tax based on specific income situations, but the 104SR is more streamlined for an older demographic.

- Form 1040X: This form is used to amend previously filed tax returns. If a change affects residency status or income reported, both 1040X and 104Pn may be involved in determining an accurate tax liability for Colorado residents or nonresidents.

- State Tax Credit Forms: Often specific to each state, these forms help to claim credits related to state income taxes. They share a purpose with the 104Pn in apportioning income, but focus on the credits available to minimize tax liability.

- Form DR 0104: This is the main Colorado income tax form that calculates tax liability for full-year residents. While the 104Pn focuses on part-year scenarios, both forms engage in comprehensive income reporting and adjust tax liabilities accordingly.

- Schedule C: Used for reporting profit or loss from business, Schedule C is similar to 104Pn in that it forces tax filers to detail income and expenses related to specific activities and may influence how that income is apportioned in part-year residency calculations.

- Schedule E: This form concerns supplemental income and loss, such as rental income. Like the 104Pn, it requires the participant to specify income sources, especially when they originate from Colorado.

- Form 8862: If a taxpayer needs to claim the Earned Income Tax Credit after it has been disallowed previously, this form is necessary. Similar documents often share the requirement to clarify income sources for eligibility, resembling the 104Pn's breakdown of apportioned income.

Each of these forms serves specific functions yet parallels the 104Pn in the meticulous tracking of income and residency status to establish fair tax liability. The common thread uniting them is the fundamental need to accurately report income for tax obligations across varying scenarios within or outside of Colorado.

Dos and Don'ts

When filling out the 104PN form, it's essential to follow specific guidelines for accuracy. Here are nine important do's and don'ts to consider:

- Do ensure you’ve completed lines 1 through 9 of the DR 0104 form before starting the 104PN.

- Do accurately report all income earned while you were a Colorado resident.

- Do include only the income derived from Colorado sources in your calculations.

- Do take care to mark the correct residency status for both yourself and your spouse.

- Do review all entries for completeness; inconsistent data can lead to delays.

- Don’t underestimate the significance of including moving expense reimbursements only if incurred while moving to Colorado.

- Don’t forget to adhere to the federal form guidelines to avoid discrepancies.

- Don’t skip over line sections that might apply to your specific income type.

- Don’t submit the form without double-checking that all entries are correct and all required documentation is attached.

Filling out tax forms accurately is vital to ensure compliance and avoid potential penalties. Taking the time to follow these guidelines can lead to a smoother filing experience.

Misconceptions

When dealing with the Form 104PN for part-year residents or nonresidents of Colorado, several misconceptions can create confusion. It's essential to understand the details clearly to ensure accurate tax filing. Here are nine common misconceptions, along with explanations to clarify the reality.

- Only residents of Colorado need to file this form. Many believe that Form 104PN is only for individuals who are residents. However, this form is specifically designed for part-year residents or nonresidents who earned income in Colorado while residing in another state.

- This form is only for income earned while living in Colorado. Some think that only income earned directly in Colorado is reportable. In reality, the form also applies to income from sources derived from ownership of property located in Colorado during the time you were a resident.

- Filing federal Form 1040 means you do not need to file Form 104PN. This is incorrect. Even if you filed a federal tax return, if you qualify as a part-year resident or nonresident, you still need to complete the 104PN to ensure accurate Colorado tax calculations.

- All income is taxed equally. Many taxpayers assume that all income is treated the same on the 104PN. However, certain types of income may have specific rules about how they are taxed based on residency status and the timing of income recognition.

- Once you file the 104PN, you don’t have to provide supporting documentation. This misconception leads to potential issues. While the form itself is critical, you must still keep records and documentation for the income reported in case of audits or inquiries from the tax department.

- Colorado income tax withholding covers all tax obligations. Some believe that if Colorado income tax was withheld from their paychecks, they have no further obligations. This is not the case. You must accurately report all income and calculate tax based on the specifics of your residency and income sources.

- Only income from employment needs to be included. A common misunderstanding is that only wages count as taxable income. In fact, other sources such as dividends, rental income, and unemployment benefits also need to be reported if they fall within the taxable period and conditions outlined in the form.

- Filing Form 104PN is optional for part-year residents. Some individuals think they can choose whether to file this form. In truth, if you meet the criteria for part-year residency or nonresident status in Colorado, filing is required to apportion your income for tax purposes.

- Form 104PN can be completed without considering other forms. It is a misconception that the 104PN can be done in isolation. You’ll need various inputs from other federal forms, so ensure you gather all relevant information before completing the 104PN.

By addressing these misconceptions, you can confidently approach your tax responsibilities as a part-year resident or nonresident of Colorado. Understanding the accurate intentions behind the Form 104PN can lead to a smoother tax filing process.

Key takeaways

Here are some important points regarding the 104PN form, which is used for part-year residents and nonresidents in Colorado.

- Purpose: This form helps determine how much income is taxable in Colorado when a taxpayer lived in another state during the year.

- Readiness: Complete lines 1 through 9 of the DR 0104 form before filling out the 104PN form.

- Eligibility: Use this form if you or your spouse were a resident of another state for any part of the tax year.

- Income Reporting: Accurately report income earned while living in Colorado to ensure correct tax calculation.

- Federal Form Reference: Indicate which federal tax form was filed, such as 1040, 1040NR, or 1040SR, to help clarify your tax situation.

- Colorado Source Income: Be sure to include only income derived from Colorado sources when completing the sections concerning various types of income.

- Adjustments: Familiarize yourself with allowed adjustments to income, as these can affect your overall tax liability.

Browse Other Templates

User Access Authorization Form,USCG Direct Access Authorization,Work-Life Management User Request,Coast Guard User Role Application,WIMS User Authorization Document,Direct Access User Credential Form,User Account Access Request,CG-7421G Access Reques - This form is part of the process for users authorized under various Work-Life management roles.

Guard/Reserve Position Form - Highlight any leadership roles you have held in past jobs.

Texas Teacher Retirement - Indicate if a DSS application for assistance has been initiated.