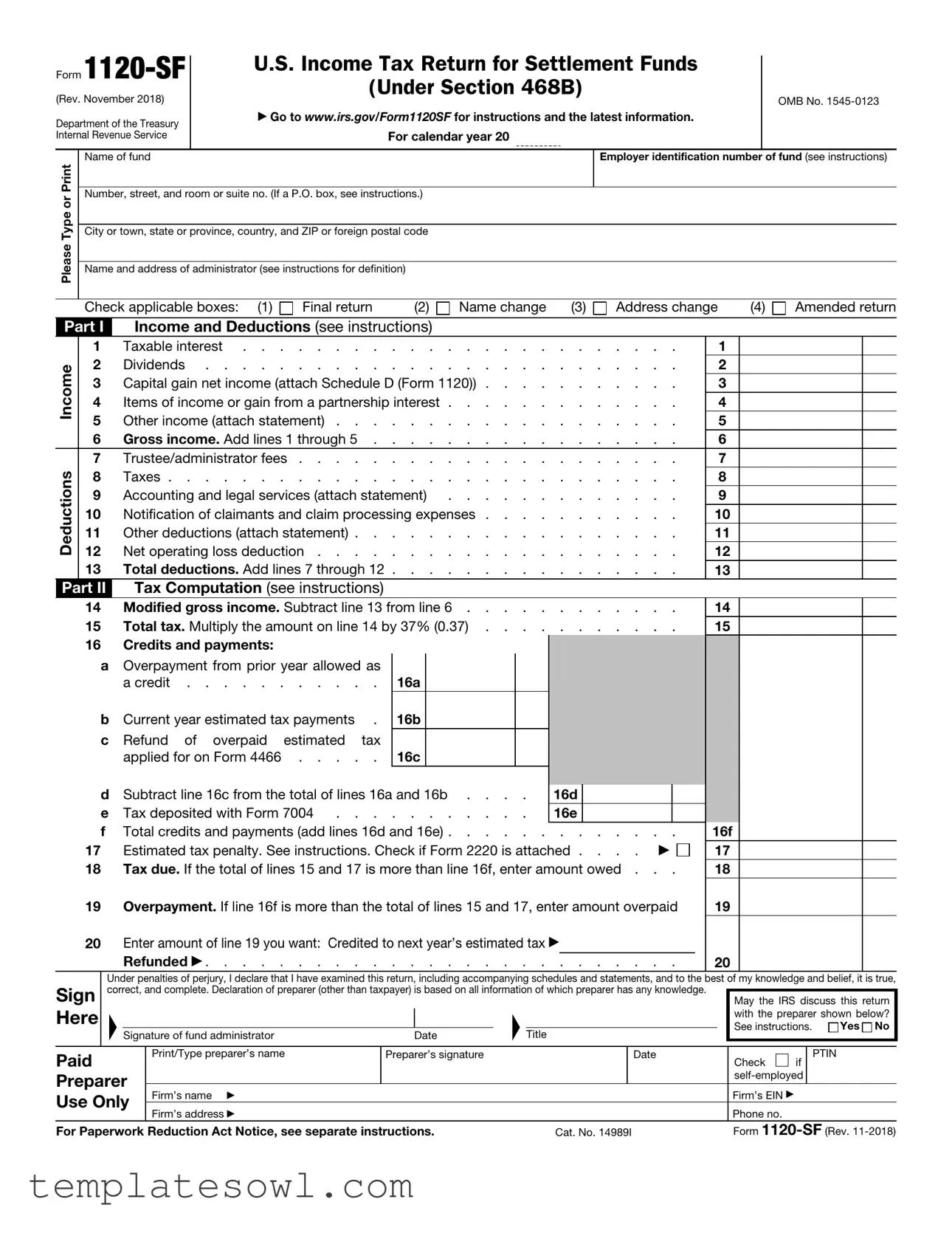

Fill Out Your 1120 Sf Form

Form 1120-SF, the U.S. Income Tax Return for Settlement Funds, is specifically designed to address the taxation of settlement funds under Section 468B of the Internal Revenue Code. This form must be filed annually by funds that are created to hold money for the benefit of claimants in a settlement or similar arrangement. Unlike other tax forms, Form 1120-SF focuses on the nuances of income accumulation and distribution within these unique funds. The form requires details such as the fund's income sources, deductions, and the calculation of tax obligations. It includes sections for reporting taxable interests, dividends, and capital gains, along with necessary deductions related to fund expenses. Part II computes the total tax owed based on the modified gross income, while additional sections capture important information about fund assets and liabilities. It is crucial for fund administrators to complete this form accurately to comply with IRS requirements and avoid potential penalties. Therefore, understanding the intricacies of Form 1120-SF is essential for effective fund management, ensuring all income and deductions are appropriately accounted for.

1120 Sf Example

Form |

|

|

U.S. Income Tax Return for Settlement Funds |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

(Rev. November 2018) |

|

|

|

(Under Section 468B) |

|

|

|

|

|

|

|

|

|

|

OMB No. |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

Department of the Treasury |

|

|

▶ Go to www.irs.gov/Form1120SF for instructions and the latest information. |

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

Internal Revenue Service |

|

|

|

|

|

For calendar year 20 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Name of fund |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer identification number |

of fund (see instructions) |

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Number, street, and room or suite no. (If a P.O. box, see instructions.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

or |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City or town, state or province, country, and ZIP or foreign postal code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

Please |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and address of administrator (see instructions for definition) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Check applicable boxes: |

(1) |

Final return |

(2) |

Name change |

(3) |

Address change |

(4) |

|

Amended return |

|||||||||||||||||||||||||||

Part I |

|

|

Income and Deductions (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

1 |

|

|

Taxable interest |

1 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Income |

2 |

|

|

Dividends |

2 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

3 |

|

|

Capital gain net income (attach Schedule D (Form 1120)) |

3 |

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

|

4 |

|

|

Items of income or gain from a partnership interest |

4 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

5 |

|

|

Other income (attach statement) |

5 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

6 |

|

|

Gross income. Add lines 1 through 5 |

6 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

7 |

|

|

Trustee/administrator fees |

7 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

Deductions |

8 |

|

|

Taxes |

8 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

12 |

|

|

Net operating loss deduction |

12 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

9 |

|

|

Accounting and legal services (attach statement) |

9 |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

10 |

|

|

Notification of claimants and claim processing expenses |

10 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

11 |

|

|

Other deductions (attach statement) |

11 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

13 |

|

|

Total deductions. Add lines 7 through 12 |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

13 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||

Part II |

|

|

Tax Computation (see instructions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

14 |

|

|

Modified gross income. Subtract line 13 from line 6 |

14 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

15 |

|

|

Total tax. Multiply the amount on line 14 by 37% (0.37) |

15 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

16 |

|

|

Credits and payments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

a |

|

Overpayment from prior year allowed as |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

a credit |

|

16a |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

b |

|

Current year estimated tax payments . |

|

16b |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

c |

|

Refund of overpaid estimated tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

applied for on Form 4466 |

|

16c |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d |

|

Subtract line 16c from the total of lines 16a and 16b . . . . |

16d |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

e |

|

Tax deposited with Form 7004 . . . |

. . . . . . . . |

16e |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

f |

|

Total credits and payments (add lines 16d and 16e) |

16f |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

17 |

|

|

Estimated tax penalty. See instructions. Check if Form 2220 is attached . |

. . . ▶ |

17 |

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

18 |

|

|

Tax due. If the total of lines 15 and 17 is more than line 16f, enter amount owed . . . |

18 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

19 |

|

|

Overpayment. If line 16f is more than the total of lines 15 and 17, enter amount overpaid |

19 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

20 |

|

|

Enter amount of line 19 you want: Credited to next year’s estimated tax ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

Refunded ▶ |

. . . . . . . |

|

20 |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

Under penalties of perjury, I declare that I have examined this return, including accompanying schedules and statements, and to the |

best of |

my knowledge and belief, it |

is true, |

||||||||||||||||||||||||||||||||

Sign |

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. |

|

|

|

|

|

|

||||||||||||||||||||||||||||||

|

|

|

May the IRS discuss this return |

||||||||||||||||||||||||||||||||||

Here |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

with the preparer shown below? |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See instructions. |

Yes No |

||||||

|

|

|

▲Signature of fund administrator |

|

|

|

|

Date |

|

▲Title |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Paid |

|

|

|

Print/Type preparer’s name |

|

|

Preparer’s signature |

|

|

|

|

Date |

|

|

|

Check |

if |

|

PTIN |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Preparer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Firm’s name ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Firm’s EIN ▶ |

|

|

|

|

||||||||||

Use Only |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

Firm’s address ▶ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Phone no. |

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

For Paperwork Reduction Act Notice, see separate instructions. |

|

|

|

|

Cat. No. 14989I |

|

|

|

Form |

||||||||||||||||||||||||||||

Form |

|

|

|

Page 2 |

|||

|

Balance Sheets |

|

|

|

|

|

|

Schedule L |

|

|

(a) Beginning of year |

(b) End of year |

|||

|

|

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

1 |

Cash |

|

1 |

|

|

|

|

2 |

U.S. Government obligations |

|

2 |

|

|

|

|

3 |

State and local government obligations |

|

3 |

|

|

|

|

4 |

Other investments (attach statement) |

|

4 |

|

|

|

|

5 |

Other assets (attach statement) |

|

5 |

|

|

|

|

6 |

Total assets. Add lines 1 through 5 |

|

6 |

|

|

|

|

|

|

Liabilities and Fund Balance |

|

|

|

|

|

7 |

Liabilities |

|

7 |

|

|

|

|

8 |

Fund balance |

|

8 |

|

|

|

|

9 |

Total. Add lines 7 and 8 |

|

9 |

|

|

|

|

Additional Information |

|

|

|

Yes |

No |

||

|

|

|

|||||

1a Enter the amount of cash and the fair market value of property, valued at the date of the transfer, |

|

|

|||||

|

transferred to the fund during the tax year |

. . . . . . . . . $ |

|

|

|||

bFor transfers of property included on line 1a, attach a copy of each qualified appraisal and the statements received from a transferor under Regulations sections

c |

Were amounts transferred to the fund during the tax year by a person other than a transferor? . |

. . . . . |

▶ |

|

2 |

Enter the amount of |

$ |

|

|

3a |

Were direct and indirect distributions made to claimants during the tax year? |

. . . . . |

▶ |

|

b |

If “Yes,” enter the amount of the total distributions |

$ |

|

|

4a |

Did the fund make any distributions (including deemed distributions) to a transferor or related party during the tax |

|||

|

year? |

. . . . . |

▶ |

|

b If “Yes,” enter the amount of the total distributions and attach a statement showing the name, |

$ |

|

|

|

|

identifying number, and the amount of distributions to each transferor or related party . . . |

|

|

|

5a |

Check the type of liability (or liabilities) for which the fund was established. |

|

|

|

|

Tort |

|

|

|

Breach of Contract

Violation of Law

CERCLA

Other

bIf “Other” is checked, enter the percent (by value) of the assets of the fund that are allocated to the

“Other” liability . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

% |

|

Attach a statement describing the type of liability (or liabilities). |

|

|

6If the fund was established by a court order, enter the Court Order Number under which the fund was established . . . . . . . . . . . . . . . . . . . . . . . . . . .

Form

Form Characteristics

| Fact Name | Fact Details |

|---|---|

| Form Title | Form 1120-SF is officially titled "U.S. Income Tax Return for Settlement Funds." |

| Governing Law | This form is governed under Internal Revenue Code Section 468B. |

| IRS OMB Number | The form has been assigned OMB No. 1545-0123 by the Office of Management and Budget. |

| Last Revision Date | The most recent revision for Form 1120-SF occurred in November 2018. |

| Purpose | Form 1120-SF is used to report income, deductions, and tax liability for settlement funds, ensuring compliance with federal tax regulations. |

| Who Must File | Settlement funds established under Section 468B must file this form, regardless of whether they owe taxes. |

| Filing Deadline | The filing deadline is the 15th day of the fourth month after the end of the tax year for which the return is being filed. |

| Key Components | Essential sections include income, deductions, and tax computation, along with a balance sheet showing assets and liabilities. |

| Estimated Tax Penalty | If applicable, filers must include any estimated tax penalty, which can arise from underpayment of the estimated tax. |

| Statement Requirement | Attachments are necessary for certain items, such as a statement for other deductions and qualified appraisals of property. |

Guidelines on Utilizing 1120 Sf

Filling out Form 1120-SF is essential for settlement funds to report their income and expenses accurately. Completing this form allows the Internal Revenue Service to assess the fund's tax obligations. Below are the steps to guide you through the process of filling out the form correctly.

- Begin by printing the fund's name in the designated area.

- Enter the employer identification number (EIN) of the fund accurately.

- Provide the complete address of the fund, including the street, city, state, and ZIP code.

- List the administrator's name and address as requested.

- Check the applicable boxes to indicate if this is a final return, name change, address change, or amended return.

- In Part I, report all sources of income, including taxable interest, dividends, capital gains, and any other income. Add all income sources together in line 6 for gross income.

- Proceed to list the deductions, including trustee fees, taxes, legal services, claim processing expenses, and other deductions. Total these on line 13.

- Calculate modified gross income by subtracting total deductions from gross income in line 14.

- Compute total tax on line 15 by multiplying the modified gross income by 37%.

- Enter credits and payments in section 16, indicating any overpayments from previous years and current estimates.

- Determine if there is an estimated tax penalty in line 17. If so, check the box if Form 2220 is attached.

- Calculate tax due or overpayment on lines 18 and 19, respectively.

- In line 20, indicate how you want the overpayment allocated—either credited to next year’s estimated tax or refunded.

- Sign and date the form. If completed by a preparer, include their information and signature as well.

- In Schedule L, provide information on the fund's balance sheets for assets and liabilities at the beginning and end of the year.

- Answer any additional questions as necessary, including information about funds transferred and distributions made throughout the year.

What You Should Know About This Form

What is Form 1120-SF?

Form 1120-SF is the U.S. Income Tax Return for Settlement Funds, specifically designed for entities established under Section 468B of the Internal Revenue Code. This form is used by settlement funds to report their income, deductions, and taxes owed to the IRS. It was last revised in November 2018.

Who needs to file Form 1120-SF?

Any administrator of a settlement fund that qualifies under Section 468B must file Form 1120-SF. This includes funds created to settle claims related to personal injury, wrongful death, and other civil actions. If your fund fits this description, it is essential to comply with this filing requirement.

When is Form 1120-SF due?

Form 1120-SF is typically due on the 15th day of the third month after the end of the fund's tax year. For most funds that operate on a calendar year, this means the due date is March 15. However, if the due date falls on a weekend or holiday, the filing deadline is extended to the next business day.

What information is required to complete Form 1120-SF?

To fill out Form 1120-SF, you will need to provide details about the fund including its name, employer identification number (EIN), and the address. Additionally, you must report various types of income like taxable interest, dividends, and any capital gains. You'll also need to list deductions and compute the total tax liability.

What happens if the form is not filed on time?

If Form 1120-SF is not filed by the due date, the IRS may impose penalties. These penalties can accumulate quickly, leading to significant financial consequences for the fund. It's vital to file on time or seek an extension if necessary. An extension will give you additional time but will still require a payment of any estimated tax due.

Can I amend Form 1120-SF after it’s filed?

Yes, it is possible to amend Form 1120-SF if you discover an error or need to make changes after it has been filed. You would check the box for "Amended return" on the form and submit the completed form along with any relevant documentation to the IRS. Ensure that the amendment is submitted as soon as possible to avoid complications.

Who can help with the completion of Form 1120-SF?

It is advisable to seek assistance from professionals who are experienced in tax preparation, especially those familiar with settlement funds. Legal and tax advisors can guide you through the specifics of the form, ensuring that all income and deductions are properly reported and compliant with IRS regulations.

Where can I find instructions for Form 1120-SF?

Detailed instructions for completing Form 1120-SF are available on the IRS website at www.irs.gov/Form1120SF. It is important to review these instructions carefully to ensure accurate and complete submission of the form.

Common mistakes

Filling out Form 1120-SF can be a daunting task, and mistakes can lead to delays and complications. One common error is failing to check the relevant boxes for the return's status. Showing whether the return is final, amended, or involves a name change is crucial. Omitting this information might result in the IRS questioning the submission.

Another frequent mistake is underreporting or incorrectly categorizing income. Each line item in Part I requires diligent attention. For instance, taxable interest and dividends might seem straightforward, but many overlook other forms of income, leading to discrepancies that trigger audits.

A third error pertains to deductions. Some filers mistakenly believe all expenses incurred by the fund are deductible without proper documentation. It’s essential to properly categorize each expense and attach necessary statements. Inadequate substantiation of deductions can raise red flags.

Calculating the total tax due is where some individuals trip up. The formula is clear, but it’s vital to ensure that all lines are accurately completed before computation. Missed or incorrectly transcribed numbers can skew the final tax liability and result in either underpayment or overpayment.

Additionally, failing to review for mathematical errors is another mistake. Basic arithmetic mistakes can lead to incorrect totals on crucial lines, such as the total tax or total deductions. Double-checking calculations is a simple yet effective way to avoid this pitfall.

People also sometimes neglect to sign the form. Even if all the information is accurate, a missing signature can render the form invalid. The IRS requires a declaration of the accuracy, which implies a signature is necessary.

Some filers forget to include information regarding prior year overpayments or estimated tax credits. Omitting this information can lead to confusion regarding tax liability. It’s essential to include all credits and payments on the schedule to avoid misleading results.

Another common issue arises from incomplete attachments. Schedules and statements that support various inputs, such as deductions and distributions, must accompany the return. Simply putting “See attached” isn't enough; the corresponding documents need to be provided.

Lastly, many filers overlook the importance of keeping copies for their records. After submission, it's crucial to retain a copy of the completed form and all attachments in case of future audits or inquiries. This oversight can complicate matters if the IRS ever questions any detail on the return.

Documents used along the form

When filing Form 1120-SF for Settlement Funds, several other forms and documents are commonly used to support the tax return. Each document serves a specific purpose to ensure compliance with tax regulations and to accurately report income, deductions, and other essential information.

- Schedule D (Form 1120): Used for reporting capital gains and losses. Attach this schedule if the fund has capital gain net income to report.

- Form 4466: This form is for requesting a refund of overpaid estimated taxes. It helps to ensure the proper handling of overpayments from previous years.

- Form 7004: This is used to apply for an automatic extension of time to file certain business income tax returns, including Form 1120-SF. If more time is needed to prepare the return, this form must be submitted.

- Form 2220: If the fund is subject to an estimated tax penalty, this form should be attached. It determines whether a penalty applies due to underpayment of estimated tax.

- Qualified Appraisal Documents: If the fund includes donated property, qualified appraisal documents are necessary. These support the fair market value claimed on the return.

- Statement of Income and Expenses: This document summarizes the fund’s income and expenses during the tax year. It provides insight into the fund's financial activity.

- Distribution Statements: These are essential if distributions were made to claimants or transferors. A statement detailing the amounts and parties involved must be attached when applicable.

- Additional Information Statements: Use these to provide any necessary explanations or scenarios relevant to the fund, especially regarding taxes and compliance.

These documents work together with Form 1120-SF to give a comprehensive view of the fund’s financial activities. Ensuring that all relevant forms and statements are filed accurately can help avoid complications with tax filings and provide clarity to the IRS.

Similar forms

- Form 1120: This is the standard U.S. corporate income tax return used by C corporations. Like Form 1120-SF, it summarizes income, deductions, and tax liability, but it applies to different types of entities.

- Form 1065: This form is used for partnerships to report income, deductions, and other financial information. While Form 1120-SF reports on settlement funds, Form 1065 focuses on partnerships.

- Form 1041: This is the tax form for estates and trusts to report income, deductions, and tax obligations. Like Form 1120-SF, it deals with the financial activity of an entity, but applies to trusts and estates instead.

- Form W-2: This form is used to report wages paid to employees. Both forms involve reporting financial information, but Form W-2 focuses on individual income whereas Form 1120-SF pertains to fund income.

- Form 990: Nonprofits use this form to provide information on their income and expenditures to the IRS. Similar to Form 1120-SF, it summarizes financial data, but is specifically for tax-exempt organizations.

- Form 941: Employers use this form to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It is different in purpose but shares a focus on reporting financial liabilities.

- Form 1065-B: This form is for electing large partnerships to report their income. Like Form 1120-SF, it deals with partnership tax situations but applies to larger entities.

- Form 4506-T: This is a request for tax return information. While not a tax return itself, it is related to the financial documentation process that includes forms like the 1120-SF.

- Form 8865: This form is for U.S. persons with certain interests in foreign partnerships. Both forms require reporting of income and deductions, though 8865 deals with international partnerships.

- Form 2220: This form is used to calculate underpayment penalties for estimated tax. It is related to the financial management aspect seen in Form 1120-SF regarding tax calculations.

Dos and Don'ts

Filling out Form 1120-SF can seem overwhelming at first, but following certain best practices can make the process easier. Here are some important dos and don’ts to consider.

- Do read the instructions carefully before starting. Understanding the requirements will save time and errors.

- Do ensure the fund's employer identification number (EIN) is correct. An incorrect EIN can lead to processing delays.

- Do provide accurate figures for income and deductions. Mistakes can result in penalties or audits.

- Do attach all necessary schedules and statements, such as Schedule D for capital gains. Incomplete submissions may be rejected.

- Do double-check the arithmetic. Simple math errors can affect the tax owed or refund due.

- Don’t leave any section blank unless instructed. Each line serves a purpose in the review process.

- Don’t forget to sign and date the form. A missing signature can delay processing.

- Don’t overlook deadlines. Filing late can incur penalties, potentially increasing the total amount owed.

- Don’t submit without keeping a copy for your records. Documentation can be crucial for future reference or in case of an audit.

By following these guidelines, you can navigate the completion of Form 1120-SF more smoothly and efficiently. Always consult with a tax professional if you are uncertain about specific entries or requirements.

Misconceptions

Understanding Form 1120-SF can be challenging, and several misconceptions may lead to confusion among fund administrators. Here are six of the most common misconceptions:

- Form 1120-SF is only for large settlement funds. In reality, this form is applicable to all settlement funds, regardless of their size. Whether a fund is large or small, it must comply with IRS regulations and submit the appropriate tax return.

- Only tax professionals can file Form 1120-SF. While it can be beneficial to consult a tax professional due to the complexities involved, fund administrators can successfully complete and file the form themselves if they understand the requirements and follow the instructions provided by the IRS.

- Form 1120-SF requires complex calculations. Many may think the tax computation is overly complicated, but the form's structure is designed to simplify the process. Most of the calculations are straightforward, involving simple addition and multiplication.

- The form is the same every year. This is not true. Form 1120-SF is subject to updates and revisions by the IRS. It is crucial to use the correct version for the applicable tax year to ensure compliance with any new regulations.

- Filing Form 1120-SF guarantees tax exemption. Filing this form does not guarantee that the fund will be tax-exempt. The nature of the fund’s income and activities will determine its tax obligations, so it is essential to assess eligibility for tax-exempt status based on specific criteria.

- Once filed, the form cannot be amended. This misconception leads many administrators to believe that their only option is to accept any errors made on the initial filing. However, amendments are possible. Fund administrators can file an amended return if they discover any discrepancies after submission, ensuring accurate reporting.

Each of these misconceptions can lead to complications if left unaddressed. Accurate understanding and careful filing are essential to navigate the requirements imposed by the IRS effectively.

Key takeaways

When completing and using Form 1120-SF, the U.S. Income Tax Return for Settlement Funds, there are several important points to keep in mind:

- Identification Information: Clearly provide the name of the fund, its employer identification number, and the address details. Accurate information is essential for proper processing.

- Income Reporting: Summarize all sources of income on Part I, including taxable interest, dividends, and other types of income. Each line item should be accurately completed based on provided income records.

- Deduction Entries: Include all applicable deductions, such as trustee fees and legal services, to ensure the correct calculation of net income.

- Tax Calculation: Calculate total tax by determining modified gross income and applying the appropriate tax rate. This involves subtracting total deductions from gross income.

- Credits and Payments: Properly report any credits from overpayments and current year estimated tax payments to reduce overall tax liabilities.

- Additional Information: Answer all additional questions related to fund distributions and liabilities. This information provides context for the fund’s financial activities during the tax year.

Browse Other Templates

How Can I Enroll My Child in a Different School District - The transfer process is vital for students to maintain their educational continuity as they move districts.

Aap Compliance - Regular assessments of recruitment methods will help identify opportunities for improvement.

Dea Form 41 Example - The agreement must be signed by both parties for it to be valid.