Fill Out Your 114A Form

The 114A form serves as a crucial document for individuals or entities looking to authorize a third party to file a Report of Foreign Bank and Financial Accounts (FBAR) on their behalf. Created by the Financial Crimes Enforcement Network (FinCEN), this form records the authorization for electronic filing while ensuring compliance with legal requirements. It requires information from both the account owner and the designated preparer, focusing on details like names, taxpayer identification numbers (TINs), and signatures. Notably, the form emphasizes the account owner’s responsibility to ensure the accuracy of account information submitted for the filing year, even when utilizing a preparer's services. Specifically, if the account is jointly owned by spouses, both must provide their information and signatures, creating a comprehensive record of authorization. Importantly, individuals must retain the completed form for their records, as it is not submitted to FinCEN unless specifically requested. Understanding this form’s structure and requirements is essential for maintaining compliance with federal regulations regarding foreign bank accounts.

114A Example

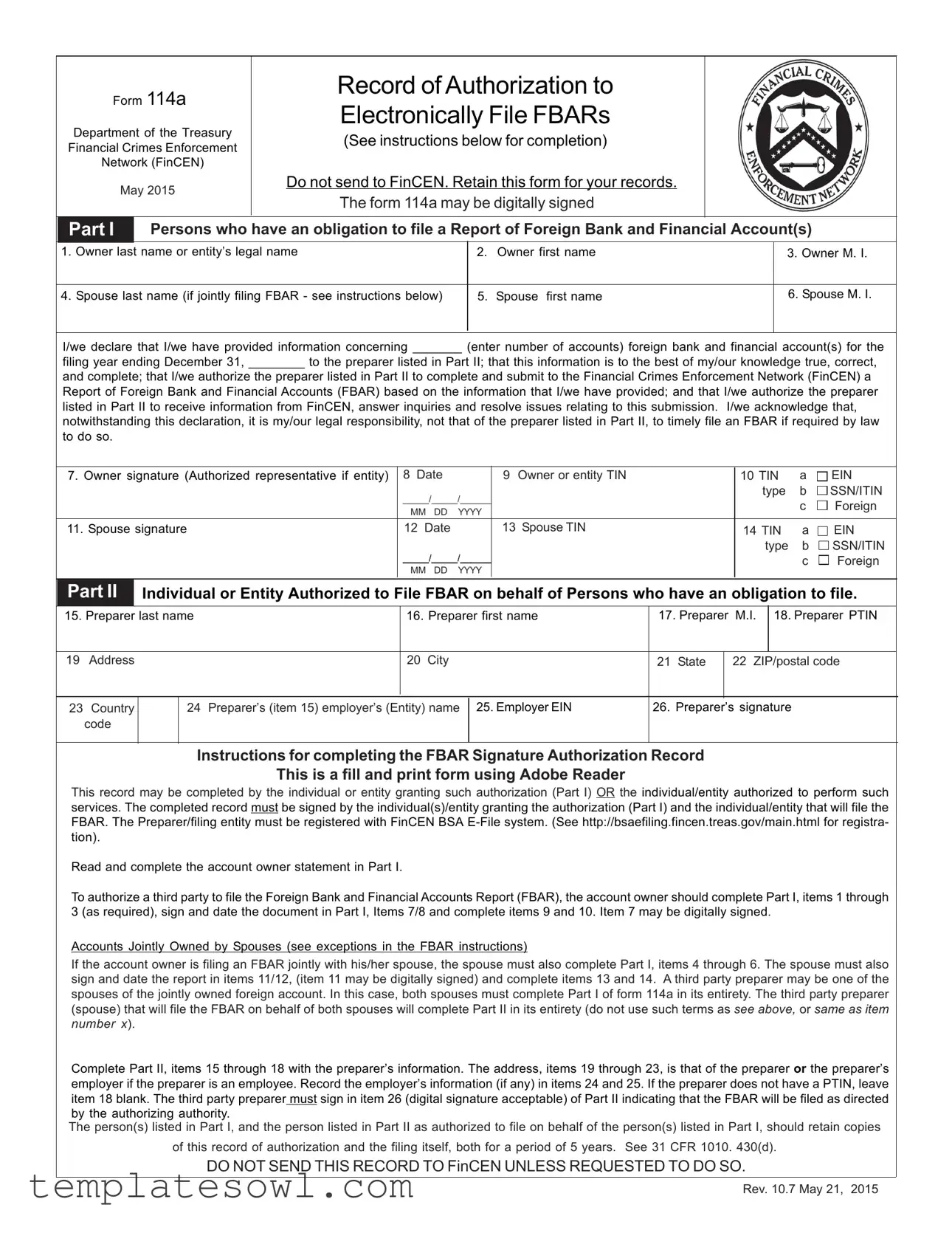

Form 114a

Department of the Treasury

Financial Crimes Enforcement

Network (FinCEN)

May 2015

Record of Authorization to

Electronically File FBARs

(See instructions below for completion)

Do not send to FinCEN. Retain this form for your records. The form 114a may be digitally signed

Part I

Persons who have an obligation to file a Report of Foreign Bank and Financial Account(s)

1. Owner last name or entity’s legal name

2. Owner first name

3. Owner M. I.

4. Spouse last name (if jointly filing FBAR - see instructions below)

5. Spouse first name

6. Spouse M. I.

I/we declare that I/we have provided information concerning _______ (enter number of accounts) foreign bank and financial account(s) for the

filing year ending December 31, ________ to the preparer listed in Part II; that this information is to the best of my/our knowledge true, correct,

and complete; that I/we authorize the preparer listed in Part II to complete and submit to the Financial Crimes Enforcement Network (FinCEN) a Report of Foreign Bank and Financial Accounts (FBAR) based on the information that I/we have provided; and that I/we authorize the preparer listed in Part II to receive information from FinCEN, answer inquiries and resolve issues relating to this submission. I/we acknowledge that, notwithstanding this declaration, it is my/our legal responsibility, not that of the preparer listed in Part II, to timely file an FBAR if required by law to do so.

7. Owner signature (Authorized representative if entity) |

8 Date |

|

9 Owner or entity TIN |

10 TIN |

a |

EIN |

|

_____/_____/______ |

|

type |

b |

SSN/ITIN |

|

|

|

|

c |

Foreign |

||

|

MM DD |

YYYY |

|

|

||

|

|

|

|

|

||

11. Spouse signature |

12 Date |

|

13 Spouse TIN |

14 TIN |

a |

EIN |

|

|

|

|

type |

b |

SSN/ITIN |

|

_____/_____/______ |

|

|

c |

Foreign |

|

|

MM DD |

YYYY |

|

|

||

|

|

|

|

|

||

Part II

Individual or Entity Authorized to File FBAR on behalf of Persons who have an obligation to file.

15. Preparer last name |

|

16. Preparer first name |

17. Preparer |

M.I. |

18. Preparer PTIN |

|||||

|

|

|

|

|

|

|

|

|

|

|

19 |

Address |

|

|

|

20 City |

21 State |

|

22 ZIP/postal code |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

23 |

Country |

|

24 |

Preparer’s (item 15) employer’s (Entity) name |

25. Employer EIN |

26. Preparer’s signature |

||||

|

code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Instructions for completing the FBAR Signature Authorization Record

This is a fill and print form using Adobe Reader

This record may be completed by the individual or entity granting such authorization (Part I) OR the individual/entity authorized to perform such services. The completed record must be signed by the individual(s)/entity granting the authorization (Part I) and the individual/entity that will file the FBAR. The Preparer/filing entity must be registered with FinCEN BSA

Read and complete the account owner statement in Part I.

To authorize a third party to file the Foreign Bank and Financial Accounts Report (FBAR), the account owner should complete Part I, items 1 through 3 (as required), sign and date the document in Part I, Items 7/8 and complete items 9 and 10. Item 7 may be digitally signed.

Accounts Jointly Owned by Spouses (see exceptions in the FBAR instructions)

If the account owner is filing an FBAR jointly with his/her spouse, the spouse must also complete Part I, items 4 through 6. The spouse must also sign and date the report in items 11/12, (item 11 may be digitally signed) and complete items 13 and 14. A third party preparer may be one of the spouses of the jointly owned foreign account. In this case, both spouses must complete Part I of form 114a in its entirety. The third party preparer (spouse) that will file the FBAR on behalf of both spouses will complete Part II in its entirety (do not use such terms as SEE ABOVE, or SAME AS ITEM NUMBER X).

Complete Part II, items 15 through 18 with the preparer’s information. The address, items 19 through 23, is that of the preparer or the preparer’s employer if the preparer is an employee. Record the employer’s information (if any) in items 24 and 25. If the preparer does not have a PTIN, leave item 18 blank. The third party preparer must sign in item 26 (digital signature acceptable) of Part II indicating that the FBAR will be filed as directed by the authorizing authority.

The person(s) listed in Part I, and the person listed in Part II as authorized to file on behalf of the person(s) listed in Part I, should retain copies

of this record of authorization and the filing itself, both for a period of 5 years. See 31 CFR 1010. 430(d).

DO NOT SEND THIS RECORD TO FinCEN UNLESS REQUESTED TO DO SO.

Rev. 10.7 May 21, 2015

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | Form 114A is used to authorize a third party to file a Foreign Bank and Financial Accounts Report (FBAR) on behalf of the account owner. |

| Retention Requirement | This form should be kept for the record and not submitted to FinCEN unless requested. |

| Signature Digitalization | Owners can digitally sign this form, making the authorization process more efficient. |

| File Completion | The form must be filled out completely by both the account owner and the authorized preparer. |

| Legal Obligation | Despite authorizing a preparer, the account owner remains legally responsible for timely filing the FBAR if required. |

| Spousal Joint Ownership | If accounts are jointly owned, both spouses must fill out the required sections of Part I before an FBAR can be filed jointly. |

| Preparer Registration | The preparer must be registered with FinCEN's BSA E-File system before submitting the FBAR. |

| Record Keeping Duration | Both the authorization record and the FBAR should be retained for a minimum of five years, as per 31 CFR 1010.430(d). |

| Governing Law | Form 114A operates under the Bank Secrecy Act and the regulatory provisions set forth by FinCEN. |

Guidelines on Utilizing 114A

After completing the 114A form, retain a copy for your records. This document authorizes a third party to file the Report of Foreign Bank and Financial Accounts (FBAR) on your behalf. It is important to make sure all information is accurate before submitting it to your preparer.

- Fill out Part I: Enter the Owner's last name, first name, and middle initial.

- If applying jointly with a spouse, include the spouse's last name, first name, and middle initial.

- Declare the number of foreign bank and financial accounts by entering the appropriate number.

- Sign and date the Owner's signature and provide the date.

- Input the Owner's Tax Identification Number (TIN), including the type (EIN, SSN/ITIN, or Foreign).

- If applicable, have the spouse sign, date, and provide their TIN.

- Fill out Part II: Enter the Preparer's last name, first name, and middle initial.

- Provide the Preparer's PTIN and complete their address information.

- Record the employer's information of the Preparer, including their EIN if necessary.

- The Preparer must sign and date the form, indicating their commitment to file as directed.

What You Should Know About This Form

What is Form 114A?

Form 114A is a document provided by the Financial Crimes Enforcement Network (FinCEN) that allows individuals or entities to authorize a third party to electronically file the Report of Foreign Bank and Financial Accounts (FBAR) on their behalf. This form is crucial for those who have foreign bank accounts and need to comply with federal reporting requirements.

Who needs to file Form 114A?

Individuals or entities with an obligation to file an FBAR must complete Form 114A if they wish to grant authorization to a preparer for filing. This includes anyone who owns or jointly owns foreign bank accounts that meet the filing criteria set by the IRS.

Can I sign Form 114A electronically?

Yes, Form 114A allows for digital signatures. This makes it easier for both account owners and preparers to complete and submit the necessary authorizations without needing to print and physically sign the form.

What information do I need to provide on Form 114A?

When filling out Form 114A, you will need to provide specific information including the names and TINs (Taxpayer Identification Numbers) of both the account owner and, if applicable, their spouse. Additionally, you must disclose the preparer’s information and the number of foreign accounts you’re reporting.

Is there a deadline for submitting Form 114A?

Form 114A does not need to be submitted to FinCEN itself; however, it is essential to have it prepared and signed before the FBAR deadline. The FBAR is typically due by April 15 of each year, with an automatic extension available until October 15.

What should I do with Form 114A once completed?

Once you have completed Form 114A and signed it, keep it for your records. You do not need to send it to FinCEN unless specifically requested to do so. It’s wise to retain this document together with any filed FBARs for at least five years.

Can one spouse authorize the other to file the FBAR?

Yes, if foreign accounts are jointly owned by spouses, one spouse can authorize the other to file the FBAR on their behalf by using Form 114A. Both spouses must complete the required sections of Part I, and the authorized spouse will complete Part II.

What happens if I authorize a preparer to file and they make an error?

While you may authorize a preparer to file the FBAR for you, you remain legally responsible for ensuring that the filing is accurate and timely. If any issues arise, it is your responsibility to address them, even if they stem from the preparer's actions.

Common mistakes

Filling out Form 114A correctly is crucial for compliance with foreign bank account reporting requirements. However, many individuals make common mistakes that can lead to complications. One misstep is providing incorrect names. It's essential that the names match exactly with official documents. Any discrepancies can raise questions and potentially delay processing.

Another frequent error involves signing and dating the form. All required signatures must be present. It’s equally important to ensure the dates reflect the accurate filing timeline. Missing signatures or inaccurate dates can result in unnecessary delays in the filing process or even penalties.

A lack of attention to detail often leads to errors in tax identification numbers (TIN). Individuals must provide the correct TIN, whether it’s an EIN or a Social Security number. Incorrect or missing TINs can lead to a rejection of the submission or additional inquiries from FinCEN.

Many filers also neglect to include information about their preparer. Properly completing Part II is just as important as Part I. Omitting details like the preparer's name and PTIN can create confusion about who is authorized to file, complicating the process further.

Another mistake involves assumptions about joint accounts. If a couple holds joint accounts, both spouses need to complete specific sections of the form. Often, one spouse believes that only one signature is necessary, but this can lead to complications if both spouses are co-owners.

Lastly, many individuals do not retain a copy of the authorization record or the form itself. Keeping these records is vital for future reference and compliance checks. Failure to do so can cause significant issues if FinCEN later requests proof of filing.

Documents used along the form

The Form 114A serves as a crucial component in the process of filing a Report of Foreign Bank and Financial Accounts (FBAR). However, it is important to note that several other documents often accompany it, each playing a distinct role. Understanding these forms can streamline the filing process, ensuring compliance with the law.

- Form 114 (FBAR): This is the primary form used to report foreign bank and financial accounts to the Financial Crimes Enforcement Network (FinCEN). All individuals or entities that meet the criteria must file this form by the annual deadline, typically April 15, with an automatic extension until October 15.

- Form 8938 (FATCA): Required under the Foreign Account Tax Compliance Act (FATCA), this form targets specified foreign financial assets for U.S. taxpayers. Taxpayers must file this form if their foreign assets exceed certain thresholds, providing parallel reporting to the FBAR.

- Form W-8BEN: This form is used by non-U.S. persons to certify their foreign status and claim any applicable tax treaty benefits. It is often utilized in conjunction with foreign bank accounts to ensure proper withholding and reporting by U.S. financial institutions.

- Form 1040 (U.S. Individual Income Tax Return): This standard income tax return for individuals may require the inclusion of foreign income, which is relevant for those filing FBARs. It ensures that all income is reported accurately in accordance with U.S. tax laws.

- Form 8865 (Return of U.S. Persons With Respect to Certain Foreign Partnerships): This form is necessary for U.S. persons involved in certain foreign partnerships. Filing this form may be required if an individual has a substantial role or ownership interest in a foreign entity.

In summary, the Form 114A is integral to the authorization process for filing FBARs, but these additional forms are essential for a comprehensive understanding and adherence to reporting requirements related to foreign financial accounts. Familiarity with all these documents can prevent compliance issues and ensure timely submissions.

Similar forms

- Form 1040 (U.S. Individual Income Tax Return): Similar to Form 114A, Form 1040 allows taxpayers to authorize a preparer to file their income tax return. It requires personal information about the taxpayer, including names, social security numbers, and the signature of both the taxpayer and the preparer, indicating consent to submit financial information to the IRS.

- Form 4506-T (Request for Transcript of Tax Return): This form enables taxpayers to authorize the IRS to release their tax information to a third party. Like Form 114A, it involves personal details and requires signatures, demonstrating clear intent for the designated preparer to act on behalf of the taxpayer.

- Form 8821 (Tax Information Authorization): Similar in purpose, Form 8821 allows taxpayers to authorize someone to receive their tax information from the IRS. Just as with Form 114A, this document includes identifying details and must be signed by the taxpayer, ensuring proper authorization for the preparer.

- Form 2848 (Power of Attorney and Declaration of Representative): This form gives a representative the authority to act on behalf of the taxpayer. It shares similarities with Form 114A in that it requires signatures and specific taxpayer information, confirming the representative's authorization to communicate with the IRS about the taxpayer's filings.

- Form W-9 (Request for Taxpayer Identification Number and Certification): Form W-9 requires individuals to provide their taxpayer identification information and to authorize others to use this data for tax reporting purposes. Both Forms 114A and W-9 focus on verifying taxpayer identity and providing consent for financial disclosures.

- Form 1065 (U.S. Return of Partnership Income): In case of partnerships, Form 1065 enables the partnership to authorize a single partner or representative to file the return. Similar to Form 114A, it collects pertinent information about the entity and individuals involved and requires signatures to validate the submission.

Dos and Don'ts

When filling out the 114A form, it is essential to adhere to specific guidelines to ensure accurate and efficient processing. Below are best practices.

- Provide accurate names and identification numbers for both the account owner and spouse, if applicable.

- Sign and date the form to confirm the information is true and complete.

- Retain a copy of the completed form for your records.

- Ensure the preparer is registered with the FinCEN BSA E-File system.

Equally important are the actions to avoid while completing the form. The following points outline what not to do:

- Do not submit the 114A form to FinCEN; it is for your records.

- Avoid incomplete information, particularly regarding account details.

- Do not leave the PTIN field blank unless the preparer does not have one.

- Refrain from using vague terms such as "SEE ABOVE" in any sections.

Misconceptions

Understanding the Form 114A can be challenging, and there are several misconceptions associated with it. Here are nine common myths, along with clarifications to help you navigate the process more easily.

-

Myth: The 114A form must be submitted to FinCEN.

Fact: This form is meant for record-keeping purposes only. You do not need to send it to FinCEN, but you should retain it for your records.

-

Myth: Anyone can prepare and file the FBAR on my behalf.

Fact: The preparer must be registered with the FinCEN BSA E-File system to file on someone’s behalf legally.

-

Myth: Only the account owner can fill out the 114A form.

Fact: An authorized representative can fill it out, but they cannot submit the FBAR without the owner's consent and completion of Part I.

-

Myth: A digital signature is not acceptable on the 114A form.

Fact: Digital signatures are permitted, making the process more convenient for both account owners and preparers.

-

Myth: Only individuals must complete the 114A form.

Fact: Entities, as well as individuals, can fill out this form if they are responsible for filing an FBAR.

-

Myth: If my spouse and I own the account jointly, only one of us needs to sign the 114A form.

Fact: Both spouses must complete and sign the form if they are jointly filing an FBAR.

-

Myth: The 114A form does not need to be filled out for multiple accounts.

Fact: You should declare the number of foreign accounts on the form, and this is essential for accurate record-keeping.

-

Myth: The 114A form is just a formality; it has no real significance.

Fact: This form provides crucial authorization for a third-party preparer to file the FBAR correctly, and failing to fill it out may lead to issues.

-

Myth: Once I complete the 114A form, I don't need to worry about the FBAR filing process.

Fact: Completing the 114A does not relieve the account owner of the legal responsibility to ensure an FBAR is filed on time if required.

Having accurate information regarding the 114A form will help prevent misunderstandings and ensure compliance with the requirements related to foreign accounts.

Key takeaways

Filling out and using Form 114A is crucial for anyone who needs to authorize a third party to file a Foreign Bank and Financial Accounts Report (FBAR). Here are key takeaways to consider:

- Retention Requirement: Keep the completed Form 114A for your records. It should not be sent to FinCEN unless specifically requested.

- Accurate Information: Ensure all information is true and complete. Incorrect details could lead to complications with the FinCEN.

- Digital Signing: The form allows for digital signatures, providing convenience for account owners and authorized preparers.

- Timeliness is Essential: The account owner remains legally responsible for timely filing the FBAR. This obligation cannot be delegated to the preparer.

- Joint Filings: If filing jointly with a spouse, both parties must complete relevant sections of Part I and provide signatures where required.

- Qualified Preparers: Verify that the preparer is registered with the FinCEN BSA E-File system prior to submitting the FBAR.

Browse Other Templates

Volunteer Template - Share emergency procedures that may apply to your situation.

Treatment Plan Examples - Communication training will enhance interpersonal skills and promote effective interaction.

Be12 - The unfilled blanks on the EB-12 can result in additional scrutiny of your claim.