Fill Out Your 13B 2 Form

The 13B 2 form is a critical document required in California for contractors who are acting as qualifying individuals. This form serves as a bond that ensures compliance with state regulations under the Business and Professions Code. It is important for the Principal, who is typically the qualifying individual, to file this bond for both personal and business protection. The bond guarantees the payment of $12,500, confirming the Principal’s commitment to adhering to industry standards and lawful practices. This obligation is not merely a formality; it is a safeguard for consumers and the state, providing a recourse in case of any violations related to the contractor's activities. The bonding process involves both the Principal and a Surety, which is a licensed corporation that agrees to back the bond legally. By signing this form, the Principal acknowledges their responsibilities and the potential risks involved. The bond remains active for the duration of the contractor's license, demonstrating an ongoing commitment to uphold the laws governing the profession. Importantly, the bond includes stipulations about the claims process, outlining timelines for bringing actions against it, thereby ensuring that all parties involved are aware of their rights and obligations.

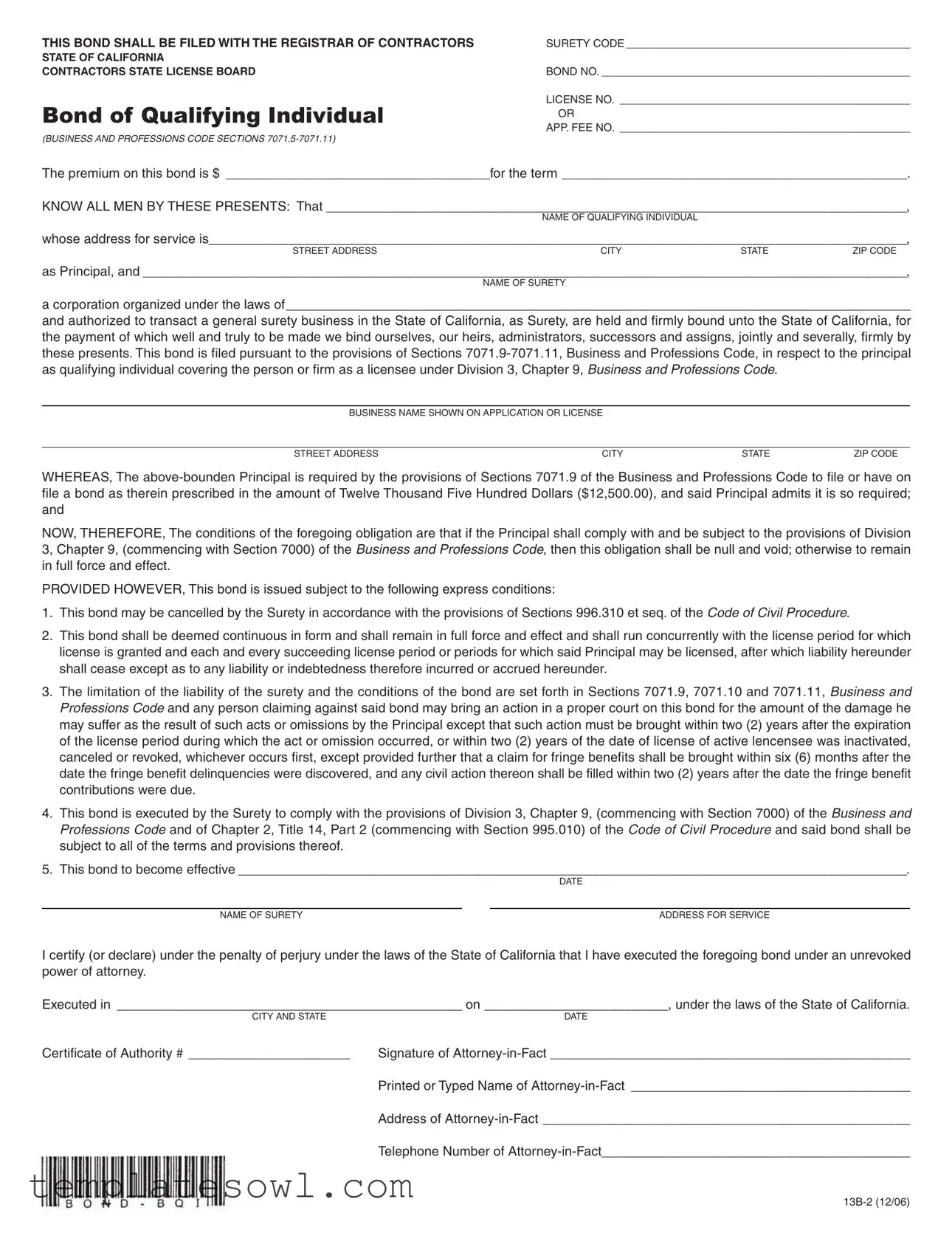

13B 2 Example

THIS BOND SHALL BE FILED WITH THE REGISTRAR OF CONTRACTORS |

SURETY CODE _______________________________________________ |

|

STATE OF CALIFORNIA |

|

|

CONTRACTORS STATE LICENSE BOARD |

BOND NO. ___________________________________________________ |

|

Bond of Qualifying Individual |

LICENSE NO. ________________________________________________ |

|

OR |

||

|

||

|

APP. FEE NO. ________________________________________________ |

|

(BUSINESS AND PROFESSIONS CODE SECTIONS |

|

The premium on this bond is $ ____________________________________for the term _______________________________________________.

KNOW ALL MEN BY THESE PRESENTS: That _______________________________________________________________________________,

NAME OF QUALIFYING INDIVIDUAL

whose address for service is_______________________________________________________________________________________________,

STREET ADDRESSCITYSTATEZIP CODE

as Principal, and ________________________________________________________________________________________________________,

NAME OF SURETY

a corporation organized under the laws of_____________________________________________________________________________________

and authorized to transact a general surety business in the State of California, as Surety, are held and firmly bound unto the State of California, for the payment of which well and truly to be made we bind ourselves, our heirs, administrators, successors and assigns, jointly and severally, firmly by these presents. This bond is filed pursuant to the provisions of Sections

BUSINESS NAME SHOWN ON APPLICATION OR LICENSE

STREET ADDRESS |

CITY |

STATE |

ZIP CODE |

WHEREAS, The

NOW, THEREFORE, The conditions of the foregoing obligation are that if the Principal shall comply with and be subject to the provisions of Division 3, Chapter 9, (commencing with Section 7000) of the Business and Professions Code, then this obligation shall be null and void; otherwise to remain in full force and effect.

PROVIDED HOWEVER, This bond is issued subject to the following express conditions:

1.This bond may be cancelled by the Surety in accordance with the provisions of Sections 996.310 et seq. of the Code of Civil Procedure.

2.This bond shall be deemed continuous in form and shall remain in full force and effect and shall run concurrently with the license period for which license is granted and each and every succeeding license period or periods for which said Principal may be licensed, after which liability hereunder shall cease except as to any liability or indebtedness therefore incurred or accrued hereunder.

3.The limitation of the liability of the surety and the conditions of the bond are set forth in Sections 7071.9, 7071.10 and 7071.11, Business and Professions Code and any person claiming against said bond may bring an action in a proper court on this bond for the amount of the damage he may suffer as the result of such acts or omissions by the Principal except that such action must be brought within two (2) years after the expiration of the license period during which the act or omission occurred, or within two (2) years of the date of license of active lencensee was inactivated, canceled or revoked, whichever occurs first, except provided further that a claim for fringe benefits shall be brought within six (6) months after the date the fringe benefit delinquencies were discovered, and any civil action thereon shall be filled within two (2) years after the date the fringe benefit contributions were due.

4.This bond is executed by the Surety to comply with the provisions of Division 3, Chapter 9, (commencing with Section 7000) of the Business and Professions Code and of Chapter 2, Title 14, Part 2 (commencing with Section 995.010) of the Code of Civil Procedure and said bond shall be subject to all of the terms and provisions thereof.

5.This bond to become effective ___________________________________________________________________________________________.

DATE

NAME OF SURETY |

ADDRESS FOR SERVICE |

I certify (or declare) under the penalty of perjury under the laws of the State of California that I have executed the foregoing bond under an unrevoked power of attorney.

Executed in _______________________________________________ on _________________________, under the laws of the State of California.

CITY AND STATEDATE

Certificate of Authority # ______________________ |

Signature of |

|

Printed or Typed Name of |

|

Address of |

|

Telephone Number of |

Form Characteristics

| Fact Name | Details |

|---|---|

| Governing Law | This form is governed by the California Business and Professions Code Sections 7071.5-7071.11. |

| Purpose | The bond serves as a guarantee for compliance with the provisions of the California Business and Professions Code. |

| Bond Amount | The required bond amount is Twelve Thousand Five Hundred Dollars ($12,500.00). |

| Principal's Responsibility | The principal must comply with the laws in Division 3, Chapter 9 of the Business and Professions Code. |

| Cancellation Provision | The surety can cancel the bond as outlined in the California Code of Civil Procedure Sections 996.310 et seq. |

| Continuous Coverage | The bond remains in effect concurrently with the license period, unless cancelled. |

| Claim Timeline | Claims against the bond must be initiated within two years of the related event or the license inactivation. |

| Effective Date | The bond becomes effective upon the specified date indicated in the form. |

Guidelines on Utilizing 13B 2

Once you have the 13B 2 form in front of you, it’s time to start filling it out properly. This form is important, and accuracy is key to ensuring it meets regulatory requirements. Below are the steps you'll need to take to complete it. Make sure you have all the necessary information handy.

- Obtain the form: Download or print the 13B 2 form from the appropriate source.

- Fill in the Surety Code: At the top of the form, enter the Surety Code.

- Input the Bond Number: Enter the bond number adjacent to "BOND NO."

- Qualifying Individual's Name: Write the full name of the qualifying individual where it states "NAME OF QUALIFYING INDIVIDUAL."

- Qualifying Individual's Address: Complete the address fields for the qualifying individual, including street address, city, state, and ZIP code.

- Enter Surety Information: Write the name of the surety company that will back this bond in "NAME OF SURETY."

- Organizational Details of Surety: Specify the state under which the surety is organized.

- Bond Premium: Fill in the premium amount for the bond and indicate the term it covers.

- Business Information: Provide the business name, street address, city, state, and ZIP code as shown on the application or license.

- Effective Date: Fill in the date when the bond becomes effective.

- Signature and Authority: The Attorney-in-Fact must sign the form. Ensure their printed name, address, and phone number are included.

- Certificate of Authority: Write the Certificate of Authority number as required.

You’re now ready to submit the completed form to the Registrar of Contractors. Be sure to double-check all information for accuracy before handing it in. Any mistakes might delay processing, so take your time and ensure everything is correct.

What You Should Know About This Form

What is the purpose of the 13B 2 form?

The 13B 2 form is a surety bond required by the State of California for contractors. It ensures that a qualifying individual complies with the legal obligations of their contractor’s license. Should any claims arise due to violations of the law, this bond provides financial protection for affected parties.

Who needs to file the 13B 2 form?

What are the financial requirements for the bond?

The bond must be in the amount of $12,500. This figure must be confirmed on the form and indicates the maximum liability under the bond. The premium for securing this bond varies based on the surety company, and this amount must be stated on the form as well.

How long does the bond remain in effect?

The bond remains effective as long as the contractor's license is active. It is a continuous bond, meaning it automatically renews with each licensing period, unless it is canceled by the surety company. However, claims against the bond must be filed within a specific timeframe after any alleged violations.

Common mistakes

Filling out the 13B 2 form correctly is crucial for compliance with the California Contractors State License Board. One common mistake is failing to provide accurate license or application fee numbers. Applicants often overlook this detail, which can lead to delays in processing or rejection of the bond. Always double-check that these numbers match the official documentation.

Another frequent error involves the bond amount. The required amount is $12,500, as specified in the form, yet applicants sometimes write down incorrect figures. To avoid complications, ensure that the premium amount is correctly filled out and is consistent with the state requirement.

A third common misstep occurs when individuals neglect to fill in the date of the bond’s effectiveness. Leaving this blank can create confusion about when the bond takes effect, which can affect legal standings. It’s important to complete this section accurately to maintain compliance.

Incorrectly stating the name or address of the qualifying individual can lead to significant issues. Applicants should ensure that the name matches exactly as it appears on the official licensing documents. Any inconsistency may result in the bond being deemed invalid, thus hampering business operations.

Additionally, some people provide outdated or incorrect information about the surety company. Including the legal name and correct address of the surety is essential. Always verify this information against official records to avoid problems down the line.

Finally, many applicants fail to have the bond signed by the Attorney-in-Fact. This signature is mandatory to validate the bond. Ensure that the signature is included, and the printed name and contact information of the Attorney-in-Fact are provided to clarify the authority behind the bond.

Documents used along the form

The 13B 2 form is a key document related to contractor licensing in California, specifically for the bond of a qualifying individual. Along with this form, several other documents are often required or useful in the same context. Below is a list of additional forms and documents that you may need.

- Contractor License Application: This form is submitted to the state to apply for a contractor's license. It includes personal and business information to determine eligibility.

- Certificate of Bonding: This certificate confirms that the contractor has a valid bond in place, which is necessary for licensing. It often accompanies the surety bond.

- Surety Bond Agreement: This document outlines the specific terms of the bond agreement between the contractor and the surety company. It details the responsibilities of both parties.

- Proof of Insurance: Contractors must provide proof of general liability insurance to safeguard against potential claims. This document is often required alongside the license application.

- Business License: A separate license issued by local city or county authorities. It permits a business to operate legally within that jurisdiction.

- Tax Identification Number (TIN): This number is issued by the IRS and is essential for tax reporting. Contractors must provide their TIN when applying for a license.

- Financial Statement: This document provides insight into the contractor's financial health. Some licensing boards may require financial statements to assess stability and capability.

By having these additional documents prepared and organized, you can streamline the process of contractor licensing and ensure compliance with all state requirements. Proper documentation helps avoid delays and potential setbacks in your licensing journey.

Similar forms

-

Surety Bond: Similar to the 13B 2 form, a Surety Bond is a contractual agreement that guarantees the principal will fulfill obligations to a third party. It is also commonly used in construction and licensing situations.

-

Performance Bond: This document ensures that a contractor will complete a project according to the contract. It functions in much the same way as a 13B 2 form, providing financial security.

-

License Bond: This bond is required for businesses to obtain a license, similar to the 13B 2 form, which secures compliance with applicable laws and regulations.

-

Contractor License Bond: This specific type of license bond is often required by state agencies. Like the 13B 2, it ensures that contractors adhere to legal standards and financial obligations.

-

Bid Bond: A Bid Bond guarantees that a bidder on a construction project will enter into a contract if selected. It provides assurance similar to the 13B 2 by protecting project owners from defaults.

-

Maintenance Bond: This bond guarantees that any work completed will be maintained for a specified period. This serves a similar purpose of ensuring ongoing compliance, as seen with the 13B 2 form.

-

Payment Bond: This document ensures that a contractor will pay subcontractors and suppliers. Like the 13B 2 form, it protects stakeholders involved in a project.

-

General Liability Insurance Certificate: While not a bond, this certificate provides proof of insurance coverage. It helps establish financial responsibility, paralleling the 13B 2 requirements.

-

Occupational License: An Occupational License is often needed to operate legally. It has similar implications as the 13B 2 in establishing compliance with legal standards.

-

Franchise Agreement: In certain cases, a franchise agreement may also require financial guarantees or bonds. This parallels the compliance aspect seen in the 13B 2 form.

Dos and Don'ts

When filling out the 13B 2 form, it's essential to ensure accuracy and compliance. Here are some important dos and don'ts to guide you:

- Do double-check all information before submission.

- Do clearly write the names and addresses, ensuring legibility.

- Do include the correct bond amount as required by law.

- Do ensure that the signature of the Attorney-in-Fact is included.

- Don't leave any required fields blank; fill in everything accurately.

- Don't provide false or misleading information on the form.

Adhering to these guidelines can help avoid common pitfalls and ensure your bond submission is accepted without issues.

Misconceptions

Understanding the 13B 2 form is crucial for individuals and businesses engaged in contracting in California. However, there are several misconceptions associated with this form that may lead to confusion. Here, we clarify some of these misunderstandings.

- Misconception 1: The 13B 2 form is optional. Many believe that filing this bond is purely a choice. In reality, it is a legal requirement for qualifying individuals under California’s Business and Professions Code.

- Misconception 2: The bond amount is fixed and cannot be changed. The bond amount is typically set at $12,500, but this can vary based on specific circumstances or changes in regulations.

- Misconception 3: The bond protects the contractor solely. This is not accurate. The bond is actually designed to protect consumers from potential misconduct by the contractor, ensuring they have recourse in case of damages.

- Misconception 4: Expiration of the bond means all obligations are extinguished. Although the bond may expire, any claims against it must be made within specific timeframes, as outlined in the bond’s terms.

- Misconception 5: Only one bond is needed for multiple license periods. The bond is generally continuous and covers all subsequent license periods, but this does not eliminate the need for it to be properly maintained and renewed when required.

- Misconception 6: Claims against the bond can be filed anytime. There are strict timelines for filing claims. Individuals must adhere to the two-year limitation from the date of the license expiration or other specified events.

- Misconception 7: The bond cannot be canceled. While the bond is intended to remain in effect for as long as needed, the surety can cancel it following the appropriate legal processes, as stipulated in relevant statutes.

Clarifying these misconceptions can help individuals and businesses better navigate the legal landscape surrounding contractor licensing and bonding in California. Being well-informed is the first step toward ensuring compliance and protecting one’s interests.

Key takeaways

The 13B 2 form is an important legal document for contractors in California. It serves as a bond which ensures compliance with certain regulatory requirements. Here are some key takeaways to consider when filling out and using this form:

- Purpose of the Bond: The 13B 2 form is used to guarantee that the qualifying individual will comply with the state’s regulations regarding contractor licensing.

- Required Information: You must provide accurate details such as the names, license number, and addresses of both the principal and the surety company.

- Bond Amount: The standard bond amount required is $12,500, which is a measure set by state law.

- Effective Date: Clearly state the date when the bond will become effective. This ensures clarity regarding the bond’s validity period.

- Signatures: The form must be signed by an authorized attorney-in-fact from the surety company. This signature indicates that the surety is legally bound by the terms of the bond.

- Continuous Nature: The bond is continuous in form, which means it remains in effect for as long as the principal holds a valid license. However, it can still be canceled under specific conditions.

- Claim Period: Claims against the bond must be made within two years of the licensing period during which the issue occurred, ensuring timely resolution.

- Special Provisions: Be aware that fringe benefit claims have a more stringent timeline—they must be filed within six months after being discovered.

- Legal Compliance: Completing this form accurately is critical, as it exists to enforce compliance with the applicable sections of the Business and Professions Code.

In summary, careful attention to detail when completing the 13B 2 form can prevent legal complications and ensure that all parties understand their obligations under the bond. It not only protects the state but also establishes trust with clients and subcontractors involved in the contracting process.

Browse Other Templates

Banks That Cash Savings Bonds Without an Account - Timeliness of submitting the form is important to ensure effective processing of the request.

Hud 9832 - The HUD 9886 ensures accurate verification of provided household data.

Printable New Employee Forms - The form format is designed for easy completion and clear communication.