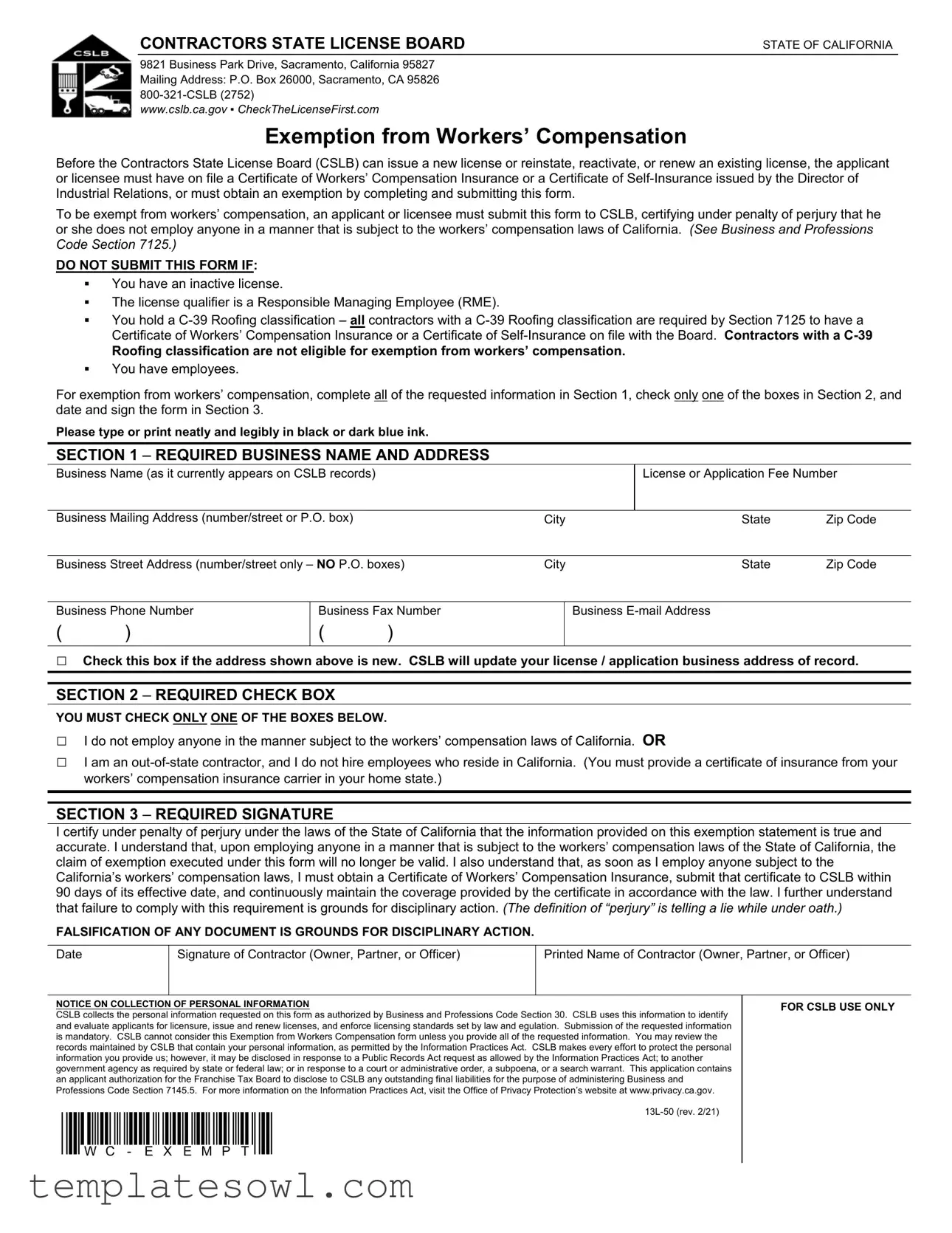

Fill Out Your 13L 50 Form

The 13L 50 form is an important document for contractors in California, specifically designed to address the exemption from workers' compensation requirements. Before the Contractors State License Board (CSLB) can issue or renew a contractor’s license, it is essential for applicants to demonstrate their eligibility for this exemption by submitting the 13L 50 form. This form requires individuals to certify, under penalty of perjury, that they do not employ anyone who is subject to California's workers' compensation laws. Specific criteria must be met for the exemption to apply; for instance, the form cannot be submitted if the applicant holds an inactive license, is classified as a C-39 roofing contractor, or currently employs individuals in a way that necessitates workers' compensation coverage. The form is divided into several sections, which collect key business information, require the selection of an exemption reason, and mandate a signature from the contractor. It's crucial for applicants to fill out the form meticulously and ensure that any changes to contact information are updated in CSLB records. Understanding the correct use of the 13L 50 form is vital for maintaining compliance with California regulations and avoiding any potential disciplinary actions that may arise from falsification or failure to adhere to the requirements laid out in this document.

13L 50 Example

CONTRACTORS STATE LICENSE BOARD |

STATE OF CALIFORNIA |

9821 Business Park Drive, Sacramento, California 95827 |

|

Mailing Address: P.O. Box 26000, Sacramento, CA 95826 |

|

|

|

www.cslb.ca.gov ▪ CheckTheLicenseFirst.com |

|

Exemption from Workers’ Compensation

Before the Contractors State License Board (CSLB) can issue a new license or reinstate, reactivate, or renew an existing license, the applicant or licensee must have on file a Certificate of Workers’ Compensation Insurance or a Certificate of

To be exempt from workers’ compensation, an applicant or licensee must submit this form to CSLB, certifying under penalty of perjury that he or she does not employ anyone in a manner that is subject to the workers’ compensation laws of California. (See Business and Professions Code Section 7125.)

DO NOT SUBMIT THIS FORM IF:

You have an inactive license.

The license qualifier is a Responsible Managing Employee (RME).

You hold a

Roofing classification are not eligible for exemption from workers’ compensation.

You have employees.

For exemption from workers’ compensation, complete all of the requested information in Section 1, check only one of the boxes in Section 2, and date and sign the form in Section 3.

Please type or print neatly and legibly in black or dark blue ink.

SECTION 1 – REQUIRED BUSINESS NAME AND ADDRESS

Business Name (as it currently appears on CSLB records) |

|

Business Mailing Address (number/street or P.O. box) |

City |

License or Application Fee Number

State |

Zip Code |

Business Street Address (number/street only – NO P.O. boxes) |

City |

State |

Zip Code |

||||

|

|

|

|

|

|

||

Business Phone Number |

Business Fax Number |

|

|

Business |

|

||

( |

) |

( |

) |

|

|

|

|

□Check this box if the address shown above is new. CSLB will update your license / application business address of record.

SECTION 2 – REQUIRED CHECK BOX

YOU MUST CHECK ONLY ONE OF THE BOXES BELOW.

□I do not employ anyone in the manner subject to the workers’ compensation laws of California. OR

□I am an

SECTION 3 – REQUIRED SIGNATURE

I certify under penalty of perjury under the laws of the State of California that the information provided on this exemption statement is true and accurate. I understand that, upon employing anyone in a manner that is subject to the workers’ compensation laws of the State of California, the claim of exemption executed under this form will no longer be valid. I also understand that, as soon as I employ anyone subject to the California’s workers’ compensation laws, I must obtain a Certificate of Workers’ Compensation Insurance, submit that certificate to CSLB within 90 days of its effective date, and continuously maintain the coverage provided by the certificate in accordance with the law. I further understand that failure to comply with this requirement is grounds for disciplinary action. (The definition of “perjury” is telling a lie while under oath.)

FALSIFICATION OF ANY DOCUMENT IS GROUNDS FOR DISCIPLINARY ACTION.

Date

Signature of Contractor (Owner, Partner, or Officer)

Printed Name of Contractor (Owner, Partner, or Officer)

NOTICE ON COLLECTION OF PERSONAL INFORMATION

CSLB collects the personal information requested on this form as authorized by Business and Professions Code Section 30. CSLB uses this information to identify and evaluate applicants for licensure, issue and renew licenses, and enforce licensing standards set by law and egulation. Submission of the requested information is mandatory. CSLB cannot consider this Exemption from Workers Compensation form unless you provide all of the requested information. You may review the records maintained by CSLB that contain your personal information, as permitted by the Information Practices Act. CSLB makes every effort to protect the personal information you provide us; however, it may be disclosed in response to a Public Records Act request as allowed by the Information Practices Act; to another government agency as required by state or federal law; or in response to a court or administrative order, a subpoena, or a search warrant. This application contains an applicant authorization for the Franchise Tax Board to disclose to CSLB any outstanding final liabilities for the purpose of administering Business and Professions Code Section 7145.5. For more information on the Information Practices Act, visit the Office of Privacy Protection’s website at www.privacy.ca.gov.

FOR CSLB USE ONLY

Form Characteristics

| Fact Name | Description |

|---|---|

| Governing Authority | The form is governed under the Business and Professions Code Section 7125 in California. |

| Purpose | The 13L 50 form is used to request an exemption from workers’ compensation requirements. |

| Eligibility | Only applicants or licensees who do not employ anyone subject to California’s workers’ compensation laws can use this form. |

| Prohibition | Contractors with a C-39 Roofing classification cannot apply for this exemption. |

| Signature Requirement | Applicants must certify the accuracy of their statements under penalty of perjury. |

| Submission Instructions | Completed forms must be submitted to the Contractors State License Board (CSLB) for consideration. |

| Contact Information | CSLB can be reached at 800-321-CSLB (2752) or via their website at www.cslb.ca.gov. |

| Record Maintenance | CSLB collects personal information as mandated by the law and maintains this information for licensing purposes. |

| Disciplinary Actions | Falsification of any document related to this form can lead to disciplinary actions by CSLB. |

Guidelines on Utilizing 13L 50

Completing the 13L 50 form requires careful attention to detail. This form must be filled out correctly in order to apply for an exemption from workers' compensation insurance. Once completed, it will be submitted to the Contractors State License Board (CSLB) for processing. Below are the steps to guide you through filling out the form.

- Gather your information. Before starting the form, collect all necessary details including your business name, addresses, and contact information.

- Fill out Section 1. Input your business name as it currently appears on CSLB records. Then, provide your business mailing address, city, state, and zip code.

- List your business street address. Ensure you include only the street address without using a P.O. box. Include the city, state, and zip code.

- Provide contact details. Enter the business phone number, fax number, and email address. If your address has changed, check the appropriate box.

- Proceed to Section 2. You must choose only one option by checking the appropriate box regarding your employment status. Make sure to read each option carefully.

- Complete Section 3. Sign and date the form, certifying that the information is truthful and complete. You must include the printed name of the contractor or business owner.

Ensure that you type or print all responses in black or dark blue ink for clarity. Once completed, review the form for accuracy before submitting it to CSLB.

What You Should Know About This Form

What is the purpose of the 13L 50 form?

The 13L 50 form is used to apply for an exemption from workers' compensation requirements in California. If you are a contractor and do not employ anyone in a way that falls under the state's workers' compensation laws, you can fill out this form to certify your exemption. This is necessary for obtaining or renewing your contractor’s license with the Contractors State License Board (CSLB).

Who needs to complete the 13L 50 form?

What are the consequences of providing false information on the 13L 50 form?

Providing false information can lead to serious consequences. If you submit the 13L 50 form and it is discovered that you have employed someone subject to workers' compensation laws in California, your exemption will be invalidated. You may face disciplinary action from the CSLB, which could affect your licensing status.

What should I do if my employment status changes after submitting the form?

If your employment status changes and you start hiring employees subject to California's workers' compensation laws, you must obtain a Certificate of Workers’ Compensation Insurance. This certificate needs to be submitted to CSLB within 90 days of its effective date. It's important to maintain this coverage continuously to avoid disciplinary actions.

What information do I need to provide on the 13L 50 form?

You will need to provide your business name, mailing address, contact information, and details about your employment status. Specifically, you must check one of the boxes indicating whether you do not employ anyone or if you are an out-of-state contractor without California employees. Additionally, you will need to sign and date the form, certifying the information is accurate and truthful.

Common mistakes

Filling out the 13L 50 form can seem daunting, but avoiding common mistakes can make the process smoother. One frequent error is failing to submit this form when it's necessary. For example, if you currently have employees or hold a C-39 Roofing classification, you cannot claim exemption from workers’ compensation. Ignoring these requirements can lead to complications with the Contractors State License Board (CSLB).

Another common mistake occurs in Section 1, which asks for crucial business information. Many applicants neglect to ensure that the business name matches exactly with the CSLB records. If this detail is off, it might create confusion and delay the processing of your application. Always double-check this information for accuracy.

In Section 2, applicants must check only one box. Checking more than one misrepresents your status and can result in the rejection of your application. Make sure to carefully read each option and verify that the box you select aligns with your circumstances.

Legibility is also critical. Applicants often rush through the form and submit it without ensuring neat handwriting. Remember, it’s essential to print using black or dark blue ink. Illegibility can cause administrative delays or misunderstandings, potentially jeopardizing your application.

Don’t overlook Section 3, which requires your signature and printed name. Some individuals forget to sign the form or fail to date it, leading to unnecessary delays in the approval process. Ensure you complete this section thoroughly to avoid setbacks.

Another stumbling block is understanding the penalties for falsification. Many people overlook the legal implications of providing inaccurate information. Remember, signing under penalty of perjury is serious. Providing false statements can result in disciplinary action. Therefore, it's vital to be honest and accurate when certifying your employment status.

Staying informed about the certification from your insurance carrier is also essential. If you claim exemption as an out-of-state contractor, be ready to provide certification of insurance from your workers’ compensation carrier in your home state. Many applicants forget this step, which can complicate the exemption process.

Finally, some individuals fail to include their current contact information, such as phone numbers and email addresses. If you provide outdated or incorrect contact details, you may not receive crucial communication from the CSLB about your application. Keeping this information up to date is vital for the continued flow of communication.

By familiarizing yourself with these common pitfalls ahead of time, you can navigate the 13L 50 form with confidence. Take a moment to review each section carefully, ensuring all requirements are met, and avoid common mistakes that could hinder your application process.

Documents used along the form

The 13L 50 form, titled "Exemption from Workers’ Compensation," is essential for contractors seeking to certify that they do not employ anyone subject to California's workers' compensation laws. It is crucial to accompany this form with several other documents or forms to ensure complete compliance with state regulations. Below are forms that you may commonly encounter alongside the 13L 50 form.

- Certificate of Workers’ Compensation Insurance: This document provides proof that a contractor has an active workers' compensation insurance policy. It is required unless a contractor qualifies for the exemption.

- Certificate of Self-Insurance: A declaration from the Director of Industrial Relations confirming that a contractor is authorized to self-insure their workers’ compensation liabilities.

- Application for Contractor's License (CLS-200): This application is necessary for any new contractors wishing to obtain a license from the Contractors State License Board. It includes personal, business, and financial information.

- Responsible Managing Employee (RME) Application: Required for contractors who wish to designate a qualified individual as the RME, this form ensures that the individual meets the necessary licensing criteria.

- Franchise Tax Board Authorization: This form allows the Contractors State License Board to access information related to any outstanding tax liabilities of the applicant, which is important in the review process for granting a license.

Completing the 13L 50 form is just one step in the licensing process, and submitting it alongside the necessary documents is critical to avoid delays or complications. Ensure you gather all required forms to streamline your application and remain compliant with the regulations established by the Contractors State License Board.

Similar forms

The 13L 50 form, which serves as a request for exemption from workers’ compensation, shares similarities with various other documents used in similar contexts. Understanding these similarities can help clarify the purpose and requirements of the 13L 50 form. The following list outlines six documents that are comparable to the 13L 50 form, detailing how they align with its intentions and functions.

- Certificate of Workers’ Compensation Insurance: This document serves as proof that a contractor has secured workers’ compensation coverage, confirming compliance with California’s workers’ compensation laws. In contrast to the 13L 50 form, which requests an exemption, the certificate indicates that the contractor is maintaining necessary insurance for any employees.

- Certificate of Self-Insurance: Similar to the workers’ compensation insurance certificate, this form is filed by businesses that wish to self-insure against workers’ compensation claims. Both documents aim to demonstrate that a business has adequate coverage, though the 13L 50 certifies that no coverage is necessary due to lack of employment.

- Application for Contractor License: Applicants for a contractor's license must submit various forms, including proof of insurance or exemption. Like the 13L 50 form, this application involves confirming compliance with legal requirements and disclosing business information.

- Reciprocal Worker’s Compensation Exemption Form: In some states, contractors who operate out-of-state may file for exemption from workers’ compensation, similar to the process detailed in the 13L 50. This form also requires a certification that no employees are subject to the state's workers' compensation laws.

- Affidavit of Exempt Status: This document is often used by individuals who qualify for specific exemptions regarding various licenses. Like the 13L 50, it includes an affirmation under penalty of perjury, verifying the individual’s exemption status and business operations.

- Employee Business Profile Form: While this may seem distinct, it collects similar data about the business structure and operations. Both forms assess whether a contractor has employees and their associated status under workers’ compensation laws, albeit from different perspectives.

Dos and Don'ts

When filling out the 13L 50 form for exemption from workers' compensation, it’s important to follow clear guidelines. Here are seven dos and don’ts to keep in mind:

- Do ensure you have an active license before submitting the form.

- Do fill out all requested information neatly in black or dark blue ink.

- Do check only one of the boxes in Section 2 to avoid confusion.

- Do sign and date the form in Section 3.

- Don’t submit the form if you have employees.

- Don’t leave any sections blank; completeness is mandatory.

- Don’t use a P.O. box for your business street address.

Misconceptions

Misconceptions about the 13L 50 form can lead to confusion and potential issues. Here are nine common misunderstandings clarified:

- It is for all contractors: Not all contractors qualify to use this form. Certain classifications, like C-39 Roofing, must have workers’ compensation insurance.

- I can submit it if I have employees: This form is specifically for those who do not employ anyone subject to California’s workers’ compensation laws.

- Out-of-state contractors are exempt: Out-of-state contractors must still submit proof of workers’ compensation coverage from their home state. Simply being out-of-state doesn’t grant automatic exemption.

- It’s optional for new applicants: Submission of this form is mandatory for new applicants or for those seeking license reinstatement or renewal, if claiming exemption.

- Filling it out is simple: The form must be filled out accurately, with all requested information. Incomplete forms will not be processed.

- Any business name can be used: The business name provided must match what is on the CSLB records to avoid delays.

- I can backdate my signature: The form must be signed and dated at the time of submission. Backdating is not allowed.

- Submitting it guarantees exemption: The exemption is valid only as long as the applicant does not employ anyone subject to workers’ compensation laws.

- It will not affect my license: Providing false information on the form can lead to serious disciplinary actions affecting licensing status.

Make sure to thoroughly understand your obligations and the requirements to avoid any complications with your licensing.

Key takeaways

Filling out and using the 13L 50 form is an important step for contractors seeking exemption from workers' compensation requirements in California. Here are some key takeaways:

- The form must be submitted to the Contractors State License Board (CSLB) to certify that the applicant does not employ anyone in a manner subject to California workers’ compensation laws.

- Before completing the form, ensure that you meet the eligibility criteria. Certain contractors, such as those with a C-39 Roofing classification, cannot claim this exemption.

- Accurate completion of all required sections is essential. This includes providing your business name, address, and indicating your employment status through the appropriate checkbox.

- Signing the form under penalty of perjury emphasizes the seriousness of providing truthful information. Falsification can lead to disciplinary actions.

Browse Other Templates

Where to Get Pay Stubs - Experience the convenience of ePayStub for managing your finances.

Taxpayers Advocate Phone Number - This form must be submitted to the Franchise Tax Board for consideration.

Point Park Transcripts - Specify the last year you attended Point Park University.