Fill Out Your 13Veri Form

The 2012-2013 Verification Worksheet, known as the 13Veri form, is crucial for independent students seeking federal financial aid. After submission of the Free Application for Federal Student Aid (FAFSA), some applicants are selected for a review process called verification. This process ensures that the information provided on the FAFSA is accurate and complete. The form requests essential details, including personal information, household composition, and income verification. Students must identify all household members and confirm their income, either through the IRS Data Retrieval Tool or by submitting a tax return transcript. The form also covers supplemental assistance received, such as SNAP benefits or child support payments. Completing and submitting this form promptly is critical; delays in processing can hinder access to much-needed financial aid. Each applicant must ensure that all statements are truthful to avoid serious penalties. The 13Veri form serves as a vital checkpoint in the financial aid process, ensuring that students can confidently proceed on their educational journeys.

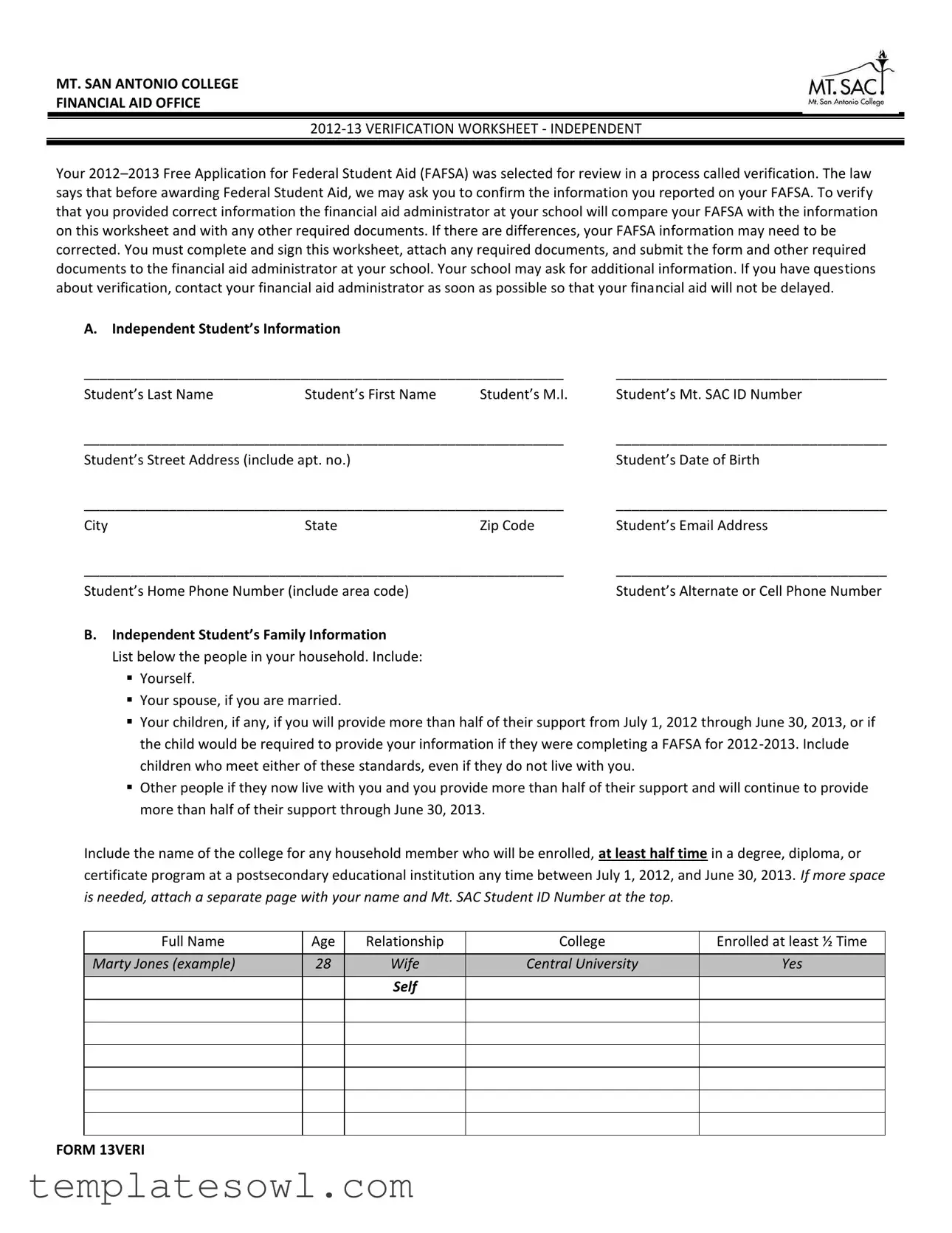

13Veri Example

MT. SAN ANTONIO COLLEGE

FINANCIAL AID OFFICE

Your

A.Indepe de t Stude t’s I for atio

______________________________________________________________ |

___________________________________ |

||||

Stude |

t’s Last Na e |

Stude t’s First Na e |

Stude t’s M.I. |

Stude |

t’s Mt. SAC ID Number |

______________________________________________________________ |

___________________________________ |

||||

Stude |

t’s Street Address i |

lude apt. o. |

|

Stude |

t’s Date of Birth |

______________________________________________________________ |

___________________________________ |

||||

City |

|

State |

Zip Code |

Stude |

t’s E ail Address |

______________________________________________________________ |

___________________________________ |

||||

Stude |

t’s Ho e Pho e Nu |

er i lude area ode |

|

Stude |

t’s Alter ate or Cell Pho e Nu er |

B.Indepe de t Stude t’s Fa il I for atio

List below the people in your household. Include:

Yourself.

Your spouse, if you are married.

Your children, if any, if you will provide more than half of their support from July 1, 2012 through June 30, 2013, or if the child would be required to provide your information if they were completing a FAFSA for

Other people if they now live with you and you provide more than half of their support and will continue to provide more than half of their support through June 30, 2013.

Include the name of the college for any household member who will be enrolled, at least half time in a degree, diploma, or certificate program at a postsecondary educational institution any time between July 1, 2012, and June 30, 2013. If more space is needed, attach a separate page with your name and Mt. SAC Student ID Number at the top.

|

Full Name |

Age |

Relationship |

|

College |

Enrolled at least ½ Time |

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Marty Jones (example) |

|

|

28 |

|

|

Wife |

|

|

Central University |

|

|

Yes |

|

|

|

|

|

|

|

|

Self |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 13VERI

Stude t’s Na e: ______________________________________________ Mt. SAC ID #: __________________________

C. Indepe de t Stude t’s I co e I for atio to Be Verified

1.TAX RETURN

Instructions: Complete this section if you, the student, filed or will file a 2011 income tax return with the IRS. The best way

to verify income is by using the IRS Data Retrieval Tool that is part of FAFSA on the Web. If you have not already used the tool, go to FAFSA.gov, log in to your FAF“A e o d, sele t Make FAF“A Co e tio s, a d a igate to the Fi a ial

Information section of the form. From there, follow the instructions to determine if you are eligible to use the IRS Data Retrieval Tool to transfer 2011 IRS income tax information into your FAFSA. It takes up to two weeks for IRS income information to be available for the IRS Data Retrieval Tool for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers. If you need more information about when, or how to use the IRS Data Retrieval Tool see your financial aid administrator.

Check the box that applies:

I, the student, have used the IRS Data Retrieval Tool in FAFSA on the Web to transfer y a d, if arried, y spouse’s 2011 IRS income information into my FAFSA, either on the initial FAFSA or when making a correction to the FAFSA. Your school will use the IRS information that was transferred in the verification process.

I, the student, am unable or choose not to use the IRS Data Retrieval Tool in FAFSA on the Web, and I will submit to the

school my 2011 IRS Tax Return Transcript(s) or a photocopy of |

sig ed |

IRS Federal I |

co |

e Ta Retur |

( |

4 ’s |

|||||||||

with all Schedules). To obtain an IRS tax return transcript, go to www.IRS.gov a d |

li k o |

the |

O de |

a Retu |

o |

|

|||||||||

A |

ou |

t T a s |

ipt |

li |

k, o |

all |

e uest the |

IR“ ta |

etu |

t a |

s |

ipt |

a d ot the |

IR“ |

|

ta |

a |

ou t t a |

s |

ipt. |

You |

ill eed ou “o ial “e u it Nu |

e , date of |

i th, a |

d the add ess on file with the IRS |

||||||

(normally this will be the address used when the 2011 IRS tax return was filed). It takes up to two weeks for IRS income information to be available for electronic IRS tax return filers, and up to eight weeks for paper IRS tax return filers.

Check here if a 2011 IRS Tax Return Transcript(s) or a photocopy of your signed 2011 IRS Federal Income Tax Return is attached to this worksheet. Verification cannot be completed until the 2011 IRS Tax Return Transcript or a photocopy of the signed 2011 Income Tax Return is submitted to your school.

2.TAX RETURN

Check the box that applies:

The student |

a |

d, if arried, the stude t’s spouse was not employed and had no income earned from work in 2011. |

The student |

a |

d/or the stude t’s spouse if arried was employed in 2011 and has listed below the names of all |

employers, including the amount earned from each employer in 2011. List every employer even if they did not issue an

IRS

|

E ployer’s Na |

e |

2011 Amount Earned |

|

“uz ’s Auto Bod “hop |

e a ple |

$2,000.00(example) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM 13VERI

Stude |

t’s Na e: ______________________________________________ Mt. SAC ID #: __________________________ |

|||

D. I depe de t Stude |

t’s Other I |

for |

atio to Be Verified |

|

1. Co |

plete this se tio |

if so eo |

e i |

the stude t’s household listed i Se tio B re ei ed e efits fro the Supple e tal |

Nutrition Assistance Program or SNAP (formerly known as food stamps) any time during the 2010 or 2011 calendar years.

One of the persons listed in Section B of this worksheet received SNAP benefits in 2010 or 2011. If asked by my school, I will provide documentation of the receipt of SNAP benefits during 2010 and/or 2011.

2. Complete this section if you or your spouse, if married, paid child support in 2011.

Either I, or if married, my spouse who is listed in Section B of this worksheet, paid child support in 2011. I have indicated below the name of the person who paid the child support, the name of the person to whom the child support was paid, the names of the children for whom child support was paid, and the total annual amount of child support that was paid in 2011 for each child. If asked by my school, I will provide documentation of the payment of child support. If you need more space, attach a separate page that includes your name and Mt. SAC ID Number at the top.

|

Name of Person Who Paid |

|

Name of Person to Whom Child |

Name of Child for Whom |

Amount of Child |

|

Child Support |

|

Support was Paid |

Support Was Paid |

Support Paid in 2011 |

|

|

|

|

|

|

|

Marty Jones (example) |

|

Chris Smith |

Terry Jones |

$6,000.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

E.Certification and Signature

I certify that all information reported on this

worksheet is complete and correct. The student must

sig this orksheet. If arried, the spouse’s sig ature is optional

_________________________________________________

Stude t’s Sig ature

_________________________________________________

Spouse’s Sig ature

WARNING: If you purposely give false or misleading information on this worksheet, you may be fined, be sentenced to jail, or both.

RETURN TO:

Mt. San Antonio College

1100 N. Grand Avenue

Walnut, CA 91789

_________________________________

Date

_________________________________

Date

Do not mail this worksheet to the U.S. Department of Education.

Submit this worksheet to the financial aid administrator at your school.

You should make a copy of this worksheet for your records.

FORM 13VERI

Form Characteristics

| Fact Name | Description |

|---|---|

| Institution | This form is used by Mt. San Antonio College. |

| Academic Year | The form pertains to the 2012-13 academic year. |

| Purpose | It is for verifying the information provided on the FAFSA. |

| Verification Requirement | If selected for verification, students must respond promptly to avoid delays in aid. |

| Required Information | Students must provide personal, household, and income information. |

| IRS Data Retrieval Tool | Students can verify income via the IRS Data Retrieval Tool when completing the FAFSA. |

| TAX Return Filers | Students who filed taxes must check specific boxes and provide necessary documents. |

| Non-filers | Students who did not file taxes must list employment details for 2011. |

| Certification Requirement | The student must sign the form to certify its accuracy before submission. |

Guidelines on Utilizing 13Veri

After gathering the necessary information, it's time to complete the 13Veri form accurately to ensure your financial aid process moves smoothly. Pay close attention to each section, as missing details can delay your aid. Here’s how to fill out the form.

- Section A: Student’s Information - Fill in your last name, first name, middle initial, Mt. SAC ID number, street address (including apartment number), date of birth, city, state, zip code, email address, home phone number (with area code), and an alternate or cell phone number.

- Section B: Independent Student’s Family Information

- List yourself.

- Include your spouse, if married.

- List your children, if you provide more than half of their support from July 1, 2012, through June 30, 2013.

- Add other people living with you whom you support more than half, along with the name of the college if they’re enrolled at least half-time.

- Section C: Independent Student’s Income Information to Be Verified

- If you filed a 2011 IRS tax return, check the appropriate box to indicate whether you used the IRS Data Retrieval Tool or will submit your IRS Tax Return Transcript.

- If you did not file a tax return, check the relevant box indicating whether you had no income or list all employers and amounts earned.

- Section D: Independent Student’s Other Information to Be Verified

- Indicate if anyone in your household received SNAP benefits in 2010 or 2011.

- If you or your spouse paid child support in 2011, provide the necessary details, including the names and amounts paid.

- Section E: Certification and Signature - Sign and date the form. If married, your spouse’s signature is optional.

Once you have completed all the required sections, double-check your entries for accuracy. Organize and attach any additional documentation required, then submit this form to the financial aid administrator at Mt. San Antonio College. Keep a copy for your records, as it may be useful for future reference.

What You Should Know About This Form

What is the purpose of the 13Veri form?

The 13Veri form is a verification worksheet specifically designed for students who have submitted a FAFSA (Free Application for Federal Student Aid) for the 2012-2013 academic year and have been selected for verification. The form provides the financial aid office with the necessary information to confirm the accuracy of the data reported in the FAFSA. It is vital as it helps determine the student's eligibility for federal aid, ensuring that the information used to calculate their financial aid package is accurate and complete.

Who needs to fill out the 13Veri form?

Any independent student whose FAFSA has been selected for verification must complete the 13Veri form. If you are married, your spouse’s information will also need to be included. It's important to provide complete and accurate information about your household members, income, and other relevant financial details to ensure proper evaluation for financial aid. If you fail to submit this form correctly, your financial aid could be delayed or adjusted based on inaccurate information.

What documents do I need to attach when submitting the 13Veri form?

When you submit the 13Veri form, you may need to attach several documents. If you filed a 2011 IRS tax return, it’s advisable to include a copy of your signed tax return or an IRS Tax Return Transcript. If you were a non-filer, you'll need to provide proof of income or a statement detailing any work you had in 2011. Additionally, if you or someone in your household received SNAP benefits in the previous years, documentation of that must also be included. Always check with your financial aid administrator for any specific documentation they require, as this can vary by institution.

What happens if I don’t submit the 13Veri form?

If you do not submit the 13Veri form, or if it is incomplete, your school will likely delay the processing of your financial aid application. This means that you may not receive your financial aid funds on time, which can affect your ability to register for classes, pay tuition, and meet other financial obligations. It's crucial to act promptly and ensure all required information and documents are submitted correctly to avoid any interruptions in your financial aid process.

Common mistakes

Filling out the 13Veri form isn’t just a bureaucratic task; it's a crucial step in securing your financial aid. However, many people make common mistakes that can delay their aid or even jeopardize their financial support. Understanding these pitfalls can help ensure a smoother application process.

One mistake often seen is neglecting to double-check personal information. It's essential to ensure that your last name, first name, and Mt. SAC ID number are entered accurately. Even a small typo can lead to complications, including mismatches when the form is processed.

Another frequent error is failing to provide complete information about household members. It's important to list everyone who meets the criteria, including yourself, your spouse, and any children or individuals who rely on your support. Leaving someone out may result in further requests for clarification from the financial aid office.

Many applicants also overlook the IRS Data Retrieval Tool. This tool simplifies the verification process significantly. If you've filed an income tax return, using the tool to transfer your data directly into the FAFSA can prevent numerous issues down the line. Skipping this step could create unnecessary work and delays.

People sometimes make the mistake of not including necessary documentation. Whether it's the IRS tax return transcript or proof of child support payments, missing documents can halt processing. Always check that you’ve attached all required paperwork to your form.

Another common oversight involves income reporting, particularly for those who have not filed a tax return. Applicants must clearly indicate their employment status and accurately report any income earned, even if they did not receive an IRS W-2 form. Incomplete or inaccurate income declarations can lead to complications.

Finally, signing the form is crucial. Many people forget to sign or overlook the spouse’s signature if applicable. A form without the necessary signatures will not be processed, which can cause unwanted delays. Ensuring that every required section is completed and signed can make a significant difference in how quickly your financial aid is processed.

By being aware of these common mistakes, you can take proactive steps to complete the 13Veri form correctly and efficiently. It’s not just about filling out a form; it’s about ensuring that you receive the financial support you deserve.

Documents used along the form

The 2012-2013 Verification Worksheet (13Veri form) is a crucial element in the financial aid process, particularly for independent students. Along with the 13Veri form, several other documents are frequently needed to help verify the information submitted on the Free Application for Federal Student Aid (FAFSA). These documents assist financial aid offices in the examination of any discrepancies in reported financial information.

- IRS Tax Return Transcript: This document summarizes the information reported on a taxpayer's federal income tax return. It is often required to confirm income and tax information as stated on the FAFSA.

- Copy of IRS Federal Income Tax Return: A complete photocopy of a federal tax return including all schedules. It serves as an alternative to the IRS Tax Return Transcript if the latter is unavailable.

- W-2 Forms: These forms detail income earned from each employer during the tax year. They are essential for verifying income for independent students or their spouses.

- Verification of Non-Filing Letter: This letter from the IRS indicates that no tax return was filed. Students may need this if they did not file a tax return for the specified year.

- Child Support Payment Documentation: This includes records or agreements regarding child support payments made during the tax year, helping to authenticate any claimed amounts.

- SNAP Benefit Documentation: Proof of participation in the Supplemental Nutrition Assistance Program (formerly known as food stamps). This may include award letters or benefit statements.

- Documentation for Other Income: This can encompass any additional sources of income not reported on the tax return, such as unemployment benefits, child support, or any other financial assistance received.

- Verification Worksheet for Household Information: If needed, this supplementary worksheet outlines information about other household members contributing to the financial aid process.

These documents collectively ensure accuracy in the information provided, thereby facilitating a fair review of a student's eligibility for financial aid. By systematically compiling and submitting these forms, students can improve the efficiency of the verification process and potentially avert delays in receiving financial assistance.

Similar forms

The 13Veri form is an important document used for financial aid verification. It shares similarities with other documents that are also designed for confirming financial information. Below are six documents that have comparable purposes:

- FAFSA (Free Application for Federal Student Aid): Like the 13Veri form, the FAFSA gathers financial information to assess eligibility for federal aid. Both require personal and financial details, reinforcing the transparency needed for aid distribution.

- IRS Tax Return Transcript: This document is used to verify income in a similar way to the 13Veri form. It provides an official record of income and tax filing status, helping financial aid administrators confirm the accuracy of reported figures.

- Verification Worksheet (Dependent Student): This worksheet is tailored for dependent students and serves much the same purpose as the 13Veri form. It verifies financial data and household composition, ensuring correct information is submitted for aid applications.

- Student Aid Report (SAR): Generated after submitting the FAFSA, the SAR summarizes the information provided in the application. Financial aid offices reference the SAR to confirm details, similar to how they use the 13Veri form.

- Cost of Attendance (COA) Documentation: This document outlines the estimated costs for a student attending a school. It complements the 13Veri form by providing context on the financial situation and helping in determining aid eligibility.

- Letter of Eligibility for State Aid: This letter indicates a student's eligibility for state-based support, akin to how the 13Veri form establishes qualifications for federal aid. It ensures that students receive appropriate funding based on verified information.

Dos and Don'ts

Do's and Don'ts When Filling Out the 13Veri Form

- Do read all instructions carefully before starting.

- Do provide accurate and truthful information in all sections.

- Do use the IRS Data Retrieval Tool if you filed a tax return.

- Do attach all required documents to support your claims.

- Don't leave any sections blank unless instructed to do so.

- Don't submit photocopies of tax returns that are not signed.

- Don't enter estimated or guessed income amounts.

- Don't neglect to sign the form where required before submission.

Misconceptions

Misconceptions about the 13Veri form can lead to confusion for students navigating the financial aid verification process. Below are six common misconceptions along with clarifications to help understand the purpose and requirements of the form.

- It’s optional to complete the 13Veri form. Some students believe that they can choose whether to fill out this form. In reality, if your FAFSA is selected for verification, completing this form is required to proceed with your financial aid process.

- Submitting the 13Veri form is enough. Many think that submitting the form alone fulfills all verification requirements. However, it is important to include any additional required documents, such as tax transcripts, to complete the verification process.

- There’s no deadline for submitting the form. Some students assume they can take their time. Each school has specific deadlines for submitting the 13Veri form, and delays could jeopardize financial aid eligibility.

- Corrections to FAFSA are made automatically after submission. This is not true. After you submit the 13Veri form, your financial aid administrator will compare it with your FAFSA. If discrepancies are found, you will be notified to make necessary corrections.

- All income information can be accurately provided without supporting documentation. Some believe they can simply state their income without verification. Providing accurate income details is vital, and official documents like tax transcripts are often required to substantiate the information provided.

- Only the student needs to complete the 13Veri form. It's a misconception that only the student’s information is needed. If the student is married or has dependents, their information must also be included on the form for a comprehensive review.

Key takeaways

Filling out the 13Veri form is a crucial step in the financial aid verification process. Here are key takeaways to consider:

- Verification Process: Your FAFSA has been selected for verification, which means the school needs to confirm the information you provided.

- Submission Requirements: Complete the form accurately, attach required documents, and submit everything to your school’s financial aid administrator.

- IRS Data Retrieval Tool: Using the IRS Data Retrieval Tool is highly recommended for easily transferring your tax information to the FAFSA.

- Tax Return Transcripts: If you cannot use the IRS tool, you must submit a tax return transcript or a signed copy of your tax return.

- Non-Filers Section: If you or your spouse did not file a tax return, complete the non-filers section by indicating income information from employment.

- Household Information: Include yourself, your spouse, and any dependents in your household when filling out the form to accurately reflect your situation.

- Child Support Documentation: If you pay or receive child support, be prepared to provide documentation if requested by your school.

- Accurate Information: Providing false information may lead to serious consequences, including fines or legal action.

Always keep a copy of your completed worksheet for your personal records. This will be beneficial if you need to reference it in the future.

Browse Other Templates

Free Printable Direction to Pay Form - Can prevent disputes regarding repair authorization and costs.

Factory Connection Clothing - Let us know if you've ever been discharged from a job.