Fill Out Your 14 03 0595 Form

The 14 03 0595 form, often referred to as the Appraisal Update and/or Completion Report, plays a vital role in real estate transactions by providing lenders and clients with crucial updates related to property appraisals. This form allows appraisers to check whether the value of a property has declined since the original appraisal, ensuring that lenders can make informed decisions during mortgage finance transactions. Essential information, including the property address, legal description, original appraised value, and contract details, must be meticulously documented. The appraiser is required to perform a thorough exterior inspection and analyze current market data to assess any changes in value. Additionally, this form serves as a certification of completion, confirming that all necessary improvements stated in the original appraisal have been completed. By thoroughly outlining both the intended use and the scope of work, the form lays down a clear framework for appraisal updates, fostering transparency in the appraisal process. It emphasizes the appraiser’s and supervisory appraiser's responsibilities, reinforcing accountability in reporting. Understanding the intricacies of the 14 03 0595 form aids stakeholders in navigating the complexities of property valuation in today’s market.

14 03 0595 Example

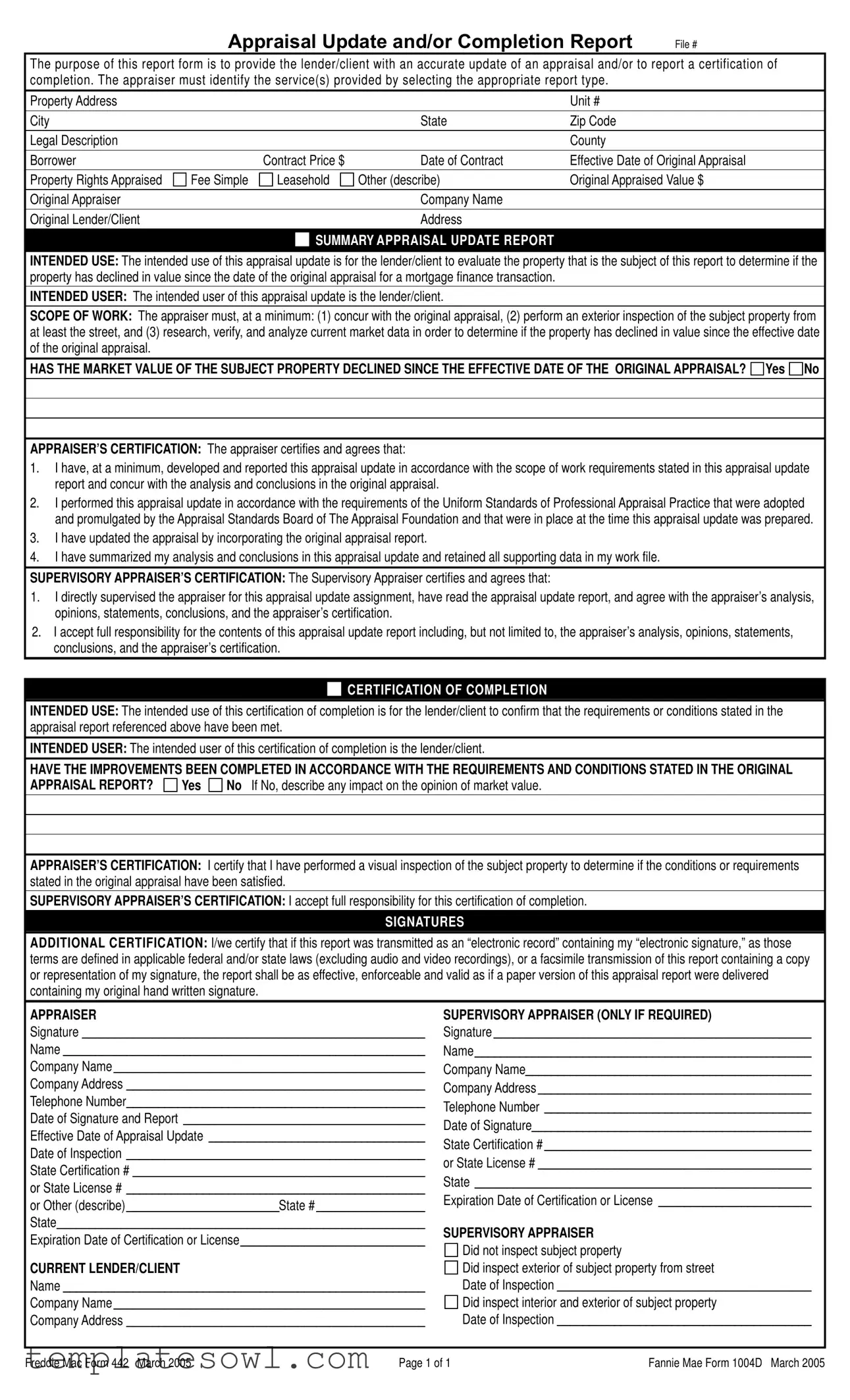

Appraisal Update and/or Completion Report

File #

The purpose of this report form is to provide the lender/client with an accurate update of an appraisal and/or to report a certification of completion. The appraiser must identify the service(s) provided by selecting the appropriate report type.

|

Property Address |

|

|

|

Unit # |

|

|

|

|

|

|

|

City |

|

|

State |

Zip Code |

|

|

|

|

|

|

|

Legal Description |

|

|

|

County |

|

|

|

|

|

|

|

Borrower |

|

Contract Price $ |

Date of Contract |

Effective Date of Original Appraisal |

|

|

|

|

|

|

|

Property Rights Appraised |

Fee Simple |

Leasehold |

Other (describe) |

Original Appraised Value $ |

|

|

|

|

|

|

|

Original Appraiser |

|

|

Company Name |

|

|

|

|

|

|

|

|

Original Lender/Client |

|

|

Address |

|

SUMMARY APPRAISAL UPDATE REPORT

INTENDED USE: The intended use of this appraisal update is for the lender/client to evaluate the property that is the subject of this report to determine if the property has declined in value since the date of the original appraisal for a mortgage finance transaction.

INTENDED USER: The intended user of this appraisal update is the lender/client.

SCOPE OF WORK: The appraiser must, at a minimum: (1) concur with the original appraisal, (2) perform an exterior inspection of the subject property from at least the street, and (3) research, verify, and analyze current market data in order to determine if the property has declined in value since the effective date of the original appraisal.

HAS THE MARKET VALUE OF THE SUBJECT PROPERTY DECLINED SINCE THE EFFECTIVE DATE OF THE ORIGINAL APPRAISAL?

YES

NO

APPRAISER’S CERTIFICATION: The appraiser certifies and agrees that:

1.I have, at a minimum, developed and reported this appraisal update in accordance with the scope of work requirements stated in this appraisal update report and concur with the analysis and conclusions in the original appraisal.

2.I performed this appraisal update in accordance with the requirements of the Uniform Standards of Professional Appraisal Practice that were adopted and promulgated by the Appraisal Standards Board of The Appraisal Foundation and that were in place at the time this appraisal update was prepared.

3.I have updated the appraisal by incorporating the original appraisal report.

4.I have summarized my analysis and conclusions in this appraisal update and retained all supporting data in my work file.

SUPERVISORY APPRAISER’S CERTIFICATION: The Supervisory Appraiser certifies and agrees that:

1.I directly supervised the appraiser for this appraisal update assignment, have read the appraisal update report, and agree with the appraiser’s analysis, opinions, statements, conclusions, and the appraiser’s certification.

2.I accept full responsibility for the contents of this appraisal update report including, but not limited to, the appraiser’s analysis, opinions, statements, conclusions, and the appraiser’s certification.

CERTIFICATION OF COMPLETION

INTENDED USE: The intended use of this certification of completion is for the lender/client to confirm that the requirements or conditions stated in the appraisal report referenced above have been met.

INTENDED USER: The intended user of this certification of completion is the lender/client.

HAVE THE IMPROVEMENTS BEEN COMPLETED IN ACCORDANCE WITH THE REQUIREMENTS AND CONDITIONS STATED IN THE ORIGINAL

APPRAISAL REPORT? |

YES |

NO If No, describe any impact on the opinion of market value. |

APPRAISER’S CERTIFICATION: I certify that I have performed a visual inspection of the subject property to determine if the conditions or requirements stated in the original appraisal have been satisfied.

SUPERVISORY APPRAISER’S CERTIFICATION: I accept full responsibility for this certification of completion.

SIGNATURES

ADDITIONAL CERTIFICATION: I/we certify that if this report was transmitted as an “electronic record” containing my “electronic signature,” as those terms are defined in applicable federal and/or state laws (excluding audio and video recordings), or a facsimile transmission of this report containing a copy or representation of my signature, the report shall be as effective, enforceable and valid as if a paper version of this appraisal report were delivered containing my original hand written signature.

APPRAISER |

SUPERVISORY APPRAISER (ONLY IF REQUIRED) |

|

Signature ______________________________________________________ |

Signature __________________________________________________ |

|

Name _________________________________________________________ |

Name _____________________________________________________ |

|

Company Name _________________________________________________ |

Company Name_____________________________________________ |

|

Company Address _______________________________________________ |

Company Address ___________________________________________ |

|

Telephone Number_______________________________________________ |

||

Telephone Number __________________________________________ |

||

Date of Signature and Report ______________________________________ |

||

Date of Signature____________________________________________ |

||

Effective Date of Appraisal Update __________________________________ |

||

State Certification # __________________________________________ |

||

Date of Inspection _______________________________________________ |

||

or State License # ___________________________________________ |

||

State Certification # ______________________________________________ |

||

State _____________________________________________________ |

||

or State License # _______________________________________________ |

||

Expiration Date of Certification or License ________________________ |

||

or Other (describe) ________________________State # _________________ |

||

|

||

State__________________________________________________________ |

SUPERVISORY APPRAISER |

|

Expiration Date of Certification or License _____________________________ |

||

Did not inspect subject property |

||

|

||

CURRENT LENDER/CLIENT |

Did inspect exterior of subject property from street |

|

Name _________________________________________________________ |

Date of Inspection ________________________________________ |

|

Company Name _________________________________________________ |

Did inspect interior and exterior of subject property |

|

Company Address _______________________________________________ |

Date of Inspection ________________________________________ |

Freddie Mac Form 442 March 2005 |

Page 1 of 1 |

Fannie Mae Form 1004D March 2005 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | This form is designed for lenders or clients to receive an updated appraisal or a certification of completion regarding the property. |

| Intended Users | The lender or client is the intended user of the appraisal update and certification of completion. |

| Scope of Work | The appraiser must perform an exterior inspection and analyze current market data, at a minimum, to ascertain any value decline since the original appraisal. |

| Certification Requirements | The appraiser must certify that they followed the Uniform Standards of Professional Appraisal Practice (USPAP) guidelines. |

| Market Value Analysis | The report requires answering if the market value of the property has declined since the original appraisal. |

| Governing Laws | The form is subject to state-specific appraisal regulations, as referenced in the USPAP and each state’s appraisal licensing requirements. |

| Signatures | Both the appraiser and supervisory appraiser must sign the form, affirming their responsibilities for the content and accuracy. |

Guidelines on Utilizing 14 03 0595

After gathering all necessary information, you are ready to fill out Form 14 03 0595. It's important to ensure accuracy and clarity throughout the process. This form requires specific details related to the property and appraisal, so take your time to provide the required information accurately.

- Begin by entering the File Number at the top of the form.

- Fill in the Property Address, including the unit number, city, state, and zip code.

- Include the Legal Description of the property.

- Specify the County where the property is located.

- Enter the Borrower details, including their name and contact information.

- List the Contract Price and the Date of Contract.

- Provide the Effective Date of Original Appraisal.

- Indicate the Property Rights Appraised by selecting one of the options: Fee Simple, Leasehold, or Other (describe).

- Input the Original Appraised Value.

- Include the Original Appraiser's Name and Company Name.

- Fill in the Original Lender/Client's Name and Address.

- Confirm the Intended Use of the appraisal update.

- Identify the Intended User as the lender/client.

- Below, answer the question regarding whether the market value of the subject property has declined since the effective date of the original appraisal by selecting YES or NO.

- Complete the Appraiser’s Certification by confirming that all necessary steps in the appraisal update process were followed.

- Have the Supervisory Appraiser’s Certification filled in, acknowledging their supervision of the appraisal.

- Indicate if the improvements have been completed according to the original appraisal report’s requirements and conditions.

- If indicated NO, provide a description of any impacts on the opinion of market value.

- Both the appraiser and supervisory appraiser must sign and date the form, entering their names and company details.

- Finish by entering the State Certification or License Numbers for both the appraiser and supervisory appraiser, along with their expiration dates.

With all sections complete, carefully review the form for accuracy before submission. Ensure compliance with all required standards to avoid any issues down the line.

What You Should Know About This Form

What is the purpose of the 14 03 0595 form?

The 14 03 0595 form is used to provide lenders or clients with an updated appraisal report or to certify the completion of property improvements. This report includes an analysis to determine whether the property's value has declined since the original appraisal. It also confirms that any conditions outlined in the previous appraisal report have been addressed.

Who is the intended user of the 14 03 0595 form?

The intended user of this form is the lender or client. They rely on the appraisal update to make informed decisions regarding the subject property, especially for mortgage finance transactions. The form is designed to convey essential information about the property's current market value and condition since the original appraisal.

What are the basic requirements for the appraiser when filling out this form?

The appraiser must ensure the form meets several key requirements. At a minimum, they should verify the original appraisal conclusions and conduct an exterior inspection of the property from the street. They also need to research current market data to determine if there has been a decline in value since the original appraisal date.

How does the appraisal update impact the analysis of market value?

The appraisal update assesses whether the market value of the property has declined since the original appraisal date. If the appraiser finds that the value has dropped, this information directly impacts financing decisions and may influence the terms of any mortgage or purchase agreement. Additionally, it keeps the lender informed about the property's current status and any potential risks.

What should be included in the Appraiser's and Supervisory Appraiser's certification section?

The certification section includes statements where the appraiser affirms that they have adhered to the required appraisal standards and conducted a thorough analysis of the property. The supervisory appraiser also certifies their supervision of the process, taking responsibility for the conclusions and data presented in the report. Together, these certifications ensure accountability and professional integrity in the appraisal process.

Common mistakes

When completing Form 14 03 0595, individuals often overlook critical details. One common mistake is failing to accurately fill out the property address. Missing or incorrect information in this section can lead to delays or complications in the appraisal process. The lender needs precise details to ensure that the correct property is being evaluated. Double-checking the address before submitting the form is essential to avoid potential issues.

Another frequent error involves the appraisal value and related dates. People sometimes enter outdated or incorrect figures. The original appraised value, contract price, and effective dates must all be accurate. Discrepancies can raise red flags and result in further scrutiny from the lender. Careful review of these entries before submission can help mitigate this risk.

Additionally, many individuals forget to thoroughly read the entire certification section. The responsibilities outlined for both the appraiser and the supervisory appraiser are critical. If these sections are not properly acknowledged and signed, the completion report might not be deemed valid. It's vital to ensure all necessary signatures are obtained and that both parties understand their obligations.

Lastly, some appraisers neglect the requirement for a visual inspection confirmation. Without verifying whether improvements have complied with the original appraisal’s conditions, the integrity of the report is compromised. Therefore, it's crucial to document this inspection clearly on the form. Confirming all elements of the appraisal update fosters confidence in the final report.

Documents used along the form

When completing the Appraisal Update and/or Completion Report (Form 14 03 0595), several other documents may be required to support the appraisal process or provide necessary information. These forms help to ensure that all aspects of the appraisal are properly documented and verified.

- Freddie Mac Form 442: This form is used to provide a valuation report for existing properties and includes detailed information about the property in question. It acts as confirmation that the appraiser has properly assessed the home and can help lenders in making informed decisions.

- Fannie Mae Form 1004D: This is a form used to report on the completion of work or to update a previous appraisal. It verifies whether the property improvements have been completed according to the original appraisal conditions.

- Original Appraisal Report: This report contains the initial assessment of the property, including its value and the methodology used by the appraiser. It serves as a foundational document referenced in the update and completion reports.

- Market Data Analysis Report: This document includes research and verification of current market conditions that could affect the property’s value. It supports the appraisal update by providing context around any changes in the local real estate market.

Collectively, these forms complement the Appraisal Update and/or Completion Report, providing essential information for lenders and ensuring that the appraisal is thorough and precise. Always check with relevant parties to confirm which documents are necessary for your specific situation.

Similar forms

-

Fannie Mae Form 1004D: Like the 14 03 0595 form, this document is used to provide updates on property appraisals. Specifically, it offers an appraisal update or a completion certification, ensuring that lenders have the necessary information to evaluate property value and condition.

-

Freddie Mac Form 442: This form serves a similar purpose as the 14 03 0595, focusing on the completion of improvements to a property. It is essential for lenders to verify that the conditions stated in the original appraisal have been satisfied, which aligns with the completion certification aspect of the 14 03 0595.

-

Form 1004MC: This document provides a market conditions addendum to the appraisal report. It complements the 14 03 0595 by analyzing market data, helping lenders understand whether the property has declined in value since the original appraisal.

-

Form 1073: This is a residential appraisal report form catered to condos and co-ops. It shares similarities with the 14 03 0595 by ensuring that the property’s value is accurately updated for lenders, serving those involved in mortgage transactions.

-

Form 71: Known as the Residential Appraisal Report, this document is similar in purpose, as it outlines the appraiser's findings on property value and characteristics. It also includes a standardized format that helps streamline the appraisal process, much like the 14 03 0595.

Dos and Don'ts

When filling out the 14 03 0595 form, it’s crucial to pay attention to detail. A well-structured submission can make a significant difference in the appraisal process. Here’s a guide of what you should and shouldn’t do:

- DO read all the instructions carefully before starting.

- DO accurately identify the property using the correct address and legal description.

- DO ensure that all financial figures, such as original appraised value and contract price, are correct.

- DO perform a thorough inspection of the property, noting any changes since the original appraisal.

- DO check for any discrepancies with the current market data and analyze them carefully.

- DO NOT leave any sections of the form blank unless specifically instructed to do so.

- DO NOT assume values from the original appraisal are still accurate without verifying.

- DO NOT falsify or misrepresent any information on the form.

- DO NOT skip the supervisory appraiser’s certification if required; it’s essential for accuracy.

- DO NOT overlook the importance of signatures; ensure all necessary individuals have signed before submission.

Filling out the form carefully and correctly is essential for the approval of the appraisal update. Everyone involved has a role in ensuring the values presented are accurate and reflect the true status of the property. Don’t take shortcuts; your diligence will pay off in the end.

Misconceptions

Understanding the 14 03 0595 form is essential for both lenders and appraisers. However, several misconceptions can lead to confusion. Here are seven common myths about the form and clarifications to improve understanding.

- Misconception 1: The form is only for updating appraisals.

- Misconception 2: Only appraisers can complete the 14 03 0595 form.

- Misconception 3: Exterior inspections are optional.

- Misconception 4: The appraiser's certification is not important.

- Misconception 5: The form cannot be used for new construction.

- Misconception 6: If the original appraised value hasn’t changed, the update is unnecessary.

- Misconception 7: The 14 03 0595 form allows for electronic signatures only in specific states.

This form not only provides appraisal updates but also serves to certify completion of property enhancements as per the original appraisal requirements.

While appraisers play a key role in filling out the form, the lender or client must also be involved, especially in signing off on the certification of completion.

According to the scope of work outlined in the form, an exterior inspection from at least the street is a mandatory requirement for updating appraisals.

The appraiser’s certification ensures that the update complies with professional standards. This responsibility is crucial for maintaining the credibility of the appraisal process.

This form can be utilized for new construction as long as the necessary conditions and requirements from the original appraisal report have been met and verified.

Even if the market value remains unchanged, completing the form is essential for formal documentation and reassessment, particularly in the context of the lender/client.

The form states that electronic signatures are valid as per federal and state law, making it widely applicable across different jurisdictions, not limited to particular states.

By addressing these misconceptions, all parties can approach the appraisal and certification processes with greater confidence and clarity.

Key takeaways

Understanding how to complete and utilize the 14 03 0595 form is essential for appraisers and lenders alike. This form represents an Appraisal Update and/or Completion Report. Here are some key takeaways to consider:

- The purpose of the form is to provide the lender or client with an accurate update on an appraisal or to certify the completion of improvements.

- Make sure to fill out the property address, unit number, city, state, and zip code accurately. Legal descriptions and county information are also critical.

- Indicate the property rights being appraised, such as Fee Simple or Leasehold.

- The intended use of the appraisal update is mainly for lenders to determine if a property has declined in value since the original appraisal.

- At a minimum, the appraiser must concur with the original appraisal, conduct an exterior inspection, and analyze current market data.

- Be clear when answering the question about whether the property’s market value has declined. A simple "yes" or "no" can have significant implications.

- Both the appraiser and the supervisory appraiser must provide certifications, ensuring accountability and confirming their analyses and conclusions.

- The certification of completion aims to confirm that the improvements have been completed according to the original appraisal's requirements.

- Remember the importance of signatures on the form; they validate the report and confirm its authenticity.

By keeping these takeaways in mind, you can effectively navigate the 14 03 0595 form, ensuring compliance with standards and facilitating smooth transactions.

Browse Other Templates

Us Certificate of Citizenship - The N600 form cannot be submitted online; it's a paper form that must be mailed in.

University of Maryland Global Campus Student Login - Special handling can be requested, if necessary.