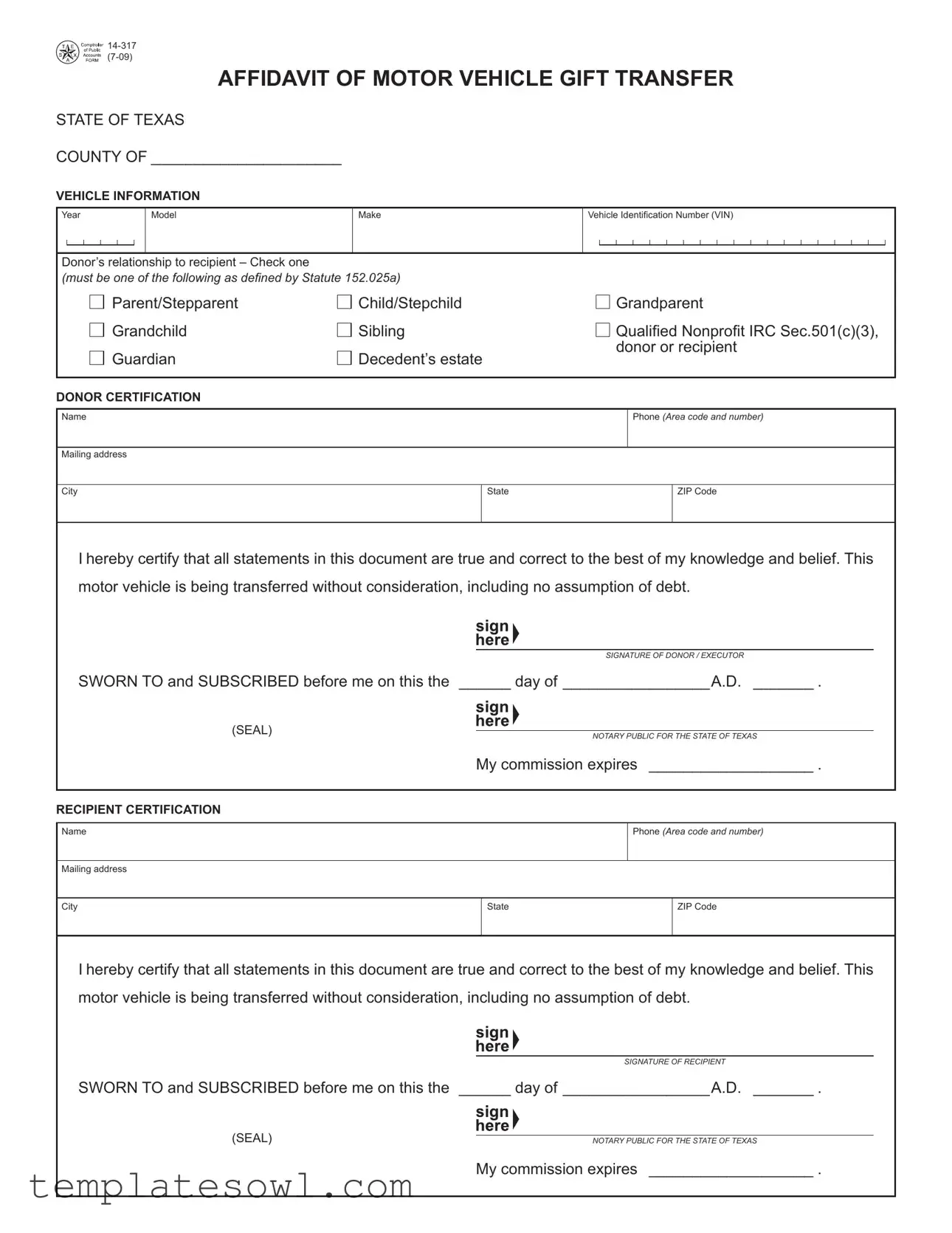

Fill Out Your 14 317 Form

The 14-317 form, officially known as the Affidavit of Motor Vehicle Gift Transfer, serves an essential purpose in the state of Texas. It is utilized when an individual wishes to gift a motor vehicle to another person without any exchange of money or assumption of debt. The form captures crucial details about the vehicle, including its year, model, and Vehicle Identification Number (VIN), which ensures clarity in the transfer process. Additionally, it requires information about the donor and recipient, such as their names, addresses, and phone numbers. An important aspect of the form is the relationship between the donor and recipient—categories such as parent, child, grandparent, and sibling are clearly defined to comply with legal requirements. Both parties must provide certifications affirming the accuracy of the information, as well as their understanding that the transfer is taking place without any financial considerations. To finalize the process, notarization is also necessary, providing an extra layer of verification and legitimacy. This form not only facilitates a gift transfer but also helps avoid potential disputes and ensures compliance with state regulations.

14 317 Example

AFFIDAVIT OF MOTOR VEHICLE GIFT TRANSFER

STATE OF TEXAS

COUNTY OF ______________________

VEHICLE INFORMATION

Year

Model

Make

Vehicle Identiication Number (VIN)

Donor’s relationship to recipient – Check one

(must be one of the following as deined by Statute 152.025a)

Parent/Stepparent |

Child/Stepchild |

Grandparent |

Grandchild |

Sibling |

Qualiied Nonproit IRC Sec.501(c)(3), |

Guardian |

Decedent’s estate |

donor or recipient |

|

DONOR CERTIFICATION

Name

Phone (AREA CODE AND NUMBER)

Mailing address

City

State

ZIP Code

Ihereby certify that all statements in this document are true and correct to the best of my knowledge and belief. This motor vehicle is being transferred without consideration, including no assumption of debt.

|

SIGNATURE OF DONOR / EXECUTOR |

|

SWORN TO and SUBSCRIBED before me on this the ______ day of _________________A.D. _______ . |

|

|

(SEAL) |

|

|

NOTARY PUBLIC FOR THE STATE OF TEXAS |

|

|

|

|

|

|

My commission expires ___________________ . |

|

|

|

|

RECIPIENT CERTIFICATION |

|

|

Name

Phone (AREA CODE AND NUMBER)

Mailing address

City

State

ZIP Code

Ihereby certify that all statements in this document are true and correct to the best of my knowledge and belief. This motor vehicle is being transferred without consideration, including no assumption of debt.

SIGNATURE OF RECIPIENT

SWORN TO and SUBSCRIBED before me on this the ______ day of _________________A.D. _______ .

(SEAL) |

NOTARY PUBLIC FOR THE STATE OF TEXAS |

My commission expires ___________________ .

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 14-317 form is used to declare the transfer of a motor vehicle as a gift from one individual to another without any payment involved. |

| Applicable Law | This form is governed by Texas law, specifically under Statute 152.025a, which defines the acceptable relationships between the donor and the recipient. |

| Required Information | The form requires details such as the vehicle's year, model, make, and VIN, along with the donor's and recipient's personal information. |

| Donor's Certification | The donor must certify that all information provided is true and that the vehicle is being transferred without consideration or debt assumption. |

| Notary Requirement | Both donor and recipient must sign the form in the presence of a notary public, who will validate the signatures and information provided. |

Guidelines on Utilizing 14 317

Filling out Form 14-317 is a straightforward process that requires specific information. Once you have gathered the necessary details, follow the steps below to complete the form accurately.

- Start by entering the county in Texas where the transfer is taking place.

- Fill in the vehicle informationb> section with the following:

- Year: Indicate the year of the vehicle.

- Model: Specify the model of the vehicle.

- Make: Enter the make (brand) of the vehicle.

- Vehicle Identification Number (VIN): Provide the VIN for the vehicle.

- Identify the relationship between the donor and the recipient by checking one of the listed options:

- Parent/Stepparent

- Child/Stepchild

- Grandparent

- Grandchild

- Sibling

- Qualified Nonprofit IRC Sec. 501(c)(3)

- Guardian

- Decedent’s estate donor or recipient

- In the donor certification section, enter the following information:

- Name: Write the full name of the donor.

- Phone Number: Provide the area code and phone number of the donor.

- Mailing Address: Complete the mailing address, including city, state, and ZIP code.

- Have the donor sign the form where indicated.

- Leave space for the notary to fill in the date, seal, and commission expiration date.

- In the recipient certification section, enter the following:

- Name: Write the full name of the recipient.

- Phone Number: Provide the area code and phone number of the recipient.

- Mailing Address: Complete the mailing address, including city, state, and ZIP code.

- Have the recipient sign the form where indicated.

- Leave space for the notary to fill in the date, seal, and commission expiration date.

What You Should Know About This Form

What is the purpose of the 14-317 form?

The 14-317 form, also known as the Affidavit of Motor Vehicle Gift Transfer, is utilized to document the transfer of a motor vehicle as a gift. In Texas, this form is useful for establishing that the vehicle is being transferred without any consideration, meaning there is no payment involved in the transfer. It is important for both the donor and recipient to affirm that no debts are assumed in the process, ensuring a clear understanding of the transaction.

Who can complete the 14-317 form?

This form must be completed by both the donor (the person gifting the vehicle) and the recipient (the person receiving the vehicle). Additionally, the relationship between the donor and the recipient must fall within specific categories defined by Texas statute, including parent, child, grandparent, grandchild, sibling, qualified nonprofit under IRC Sec. 501(c)(3), guardian, or a decedent's estate donor or recipient.

What information is required on the form?

The 14-317 form requires several key pieces of information. The vehicle’s year, model, make, and VIN (Vehicle Identification Number) must be documented. Furthermore, the names, phone numbers, and mailing addresses of both the donor and recipient are needed. Each party must also certify the truthfulness of the information provided, and both must sign in the presence of a notary public to finalize the affidavit.

Is it necessary to have the form notarized?

Yes, notarization is a critical step in completing the 14-317 form. Both the donor and the recipient must sign the form in front of a notary public. This requirement adds an additional layer of verification to the document, ensuring that the signatures are valid and that the declarations made by both parties are officially recognized.

Common mistakes

Filling out the 14-317 form can seem straightforward, but many make critical errors that can lead to delays or complications. One common mistake is leaving the Vehicle Identification Number (VIN) blank. The VIN is essential for identifying the vehicle, and without it, the form cannot be processed.

Another frequent error occurs when people do not check a relationship box. This form requires the donor to specify their relationship to the recipient. Each relationship type, such as parent or sibling, has specific legal implications. Failing to check one limits the ability to comply with state requirements.

People often neglect to provide complete contact information. Missing a phone number or mailing address can cause significant issues. Authorities need this information to reach out if there are questions or additional requirements regarding the gift transfer.

Signature problems can also arise. Some individuals forget to sign the form, while others fail to ensure that both the donor and recipient sign where required. A signature is a declaration of truthfulness and intent, and without it, the form is incomplete.

Notary errors are another hurdle. Some individuals may overlook the notary requirement entirely, while others might forget to date the notary section. Both the donor and recipient must appear in front of a notary public to validate their signatures properly.

Misunderstanding the "consideration" phrase also leads to confusion. The form states the vehicle is being transferred without consideration. Some may mistakenly indicate otherwise, which can trigger legal issues concerning the nature of the transfer.

Another common mistake involves providing incorrect vehicle information. If the year, make, or model of the vehicle is misstated, it creates a mismatch that could lead to complications during vehicle registration or title transfer.

Lastly, people often neglect to file the form in a timely manner. There is a specific timeframe for the gift transfer process in Texas. Delaying submission can result in penalties or complications with ownership transfer. Ensuring each aspect of the form is filled out accurately and completely is essential for a smooth transfer experience.

Documents used along the form

The 14-317 form, known as the Affidavit of Motor Vehicle Gift Transfer, is essential for reporting the transfer of a vehicle as a gift. It ensures that the transaction is documented legally and can help clarify the relationship between the donor and recipient. Below are other forms and documents that are often utilized in conjunction with the 14-317 form.

- Application for Texas Title: This form is required to apply for a new title after the gift transfer. It verifies ownership and legal acknowledgment of the vehicle's new owner.

- Bill of Sale: While not always necessary, a bill of sale acts as proof of the transaction. It details the vehicle's condition and the agreed-upon terms, even if the vehicle is a gift.

- Vehicle Registration Application: This document registers the vehicle under the new owner's name with the Department of Motor Vehicles (DMV). It is necessary to ensure the vehicle is legally on the road.

- Notice of Transfer of Vehicle Ownership: Often required by state law, this notice informs the DMV about the change in ownership. It may prevent any future liabilities related to the vehicle.

- Odometer Disclosure Statement: This statement confirms the vehicle’s mileage at the time of the transfer. Federal and state laws require this documentation to prevent fraud in vehicle sales.

- Affidavit of Relationship: In cases where the relationship between donor and recipient may not be immediately clear, this affidavit helps establish the connection, providing necessary context for the transaction.

Utilizing these documents alongside the 14-317 form can streamline the vehicle transfer process. It also helps to ensure that all necessary details are accurately recorded, promoting clarity and legal compliance.

Similar forms

The Form 14-317, known as the Affidavit of Motor Vehicle Gift Transfer, shares similarities with several other documents within the realm of vehicle transfers and gifts. Below is a list of ten such documents, along with a brief explanation of how they relate to Form 14-317.

- Title Transfer Form: This form is used to officially transfer the title of a vehicle from one party to another, similar to how the 14-317 serves as documentation for a no-cost transfer.

- Bill of Sale: A bill of sale records the transaction between a buyer and a seller. While the 14-317 indicates a gift transfer without payment, both documents require signatures from the involved parties.

- Vehicle Donation Receipt: This document is typically used for charitable donations. Like the 14-317, it is used when a vehicle is given without financial consideration, often accompanied by tax deduction benefits.

- Application for Texas Title: This application is necessary for the new owner to obtain a title after receiving a vehicle. The 14-317 must often accompany this application to confirm the transfer's legitimacy.

- Affidavit of Heirship: Used to establish the rights of heirs to a deceased person's property. The 14-317 also serves as an affidavit, confirming a transfer between living parties without financial consideration.

- Power of Attorney for Vehicle Transactions: This document allows one person to act on behalf of another regarding vehicle matters. In situations involving the signing of a 14-317, a power of attorney may be necessary if the donor cannot sign personally.

- Motor Vehicle Gift Tax Exemption Form: This form is often filed to claim an exemption from taxes on a vehicle gift. The 14-317 plays a similar role by indicating that no financial exchange occurred.

- Vehicle Registration Application: This form is required for registering a vehicle in a new owner’s name. The 14-317 serves as a supporting document to verify the change of ownership.

- Notarized Statement of Transfer: A general form stating a transfer has occurred, often notarized for authenticity. Similar to the 14-317, this document serves as proof of transfer but may not specifically state the transfer was a gift.

- Release of Liability: This document relieves the previous owner of responsibility for the vehicle after transfer. The 14-317 also implies that the donor relinquishes ownership without conditions or debts being assumed.

Dos and Don'ts

When filling out the 14-317 form for the affidavit of motor vehicle gift transfer, it's essential to ensure accuracy and compliance. Here’s a list of dos and don'ts to guide you through the process:

- Do make sure all information is accurate, including vehicle details and personal information.

- Do check the correct relationship between the donor and recipient based on the provided options.

- Do use clear and legible handwriting or type the form to ensure readability.

- Do ensure both the donor and recipient sign the form in the appropriate places.

- Do have the signatures notarized to validate the document.

- Don't leave any sections blank; fill in all required fields completely.

- Don't assume that any fields are optional; double-check for completion.

- Don't forget to date the signatures when signing the form.

- Don't submit the form without double-checking your entries for errors.

- Don't provide misleading information, as it could lead to legal issues down the line.

Misconceptions

-

Misconception 1: The form is only for family members.

While most people think this form is limited to family relationships, that's not entirely true. The 14-317 form can also be used for transfers to qualified nonprofit organizations under certain conditions, specifically those recognized under IRC Section 501(c)(3).

-

Misconception 2: A vehicle can be transferred with debt attached.

This is incorrect. The form specifically states that the motor vehicle must be transferred without consideration, meaning no money or debt can be involved in the transaction. Both the donor and recipient must certify this in their respective sections.

-

Misconception 3: The form does not need a notary.

Many believe they can skip the notary requirement. However, the 14-317 form must be sworn to and subscribed before a notary public, ensuring that both parties are confirming the truthfulness of their statements.

-

Misconception 4: This form is only necessary for vehicle registration.

Some think they only need this form when registering the vehicle. In reality, it serves as a formal record of the gift transfer itself, documenting the transaction for both the donor and the recipient.

Key takeaways

Filling out and using the Texas 14-317 form, known as the Affidavit of Motor Vehicle Gift Transfer, is essential for recording a vehicle transfer without consideration. Here are key takeaways to consider:

- Correct Completion is Vital: Ensure all fields are filled accurately. Mistakes can delay the transfer process.

- Donor and Recipient Roles: Clearly define the relationship between the donor and recipient, choosing from the specified categories such as parent, child, sibling, or qualified non-profit.

- No Consideration Policy: The form stipulates that the vehicle is being transferred without any payment or assumption of debt. This is a key point to highlight during the signing.

- Signatures Required: Both the donor and the recipient must sign the form. Each signature should be notarized to validate the authenticity of the declarations.

- Notary Public Involvement: The form requires a notary public to witness the signatures. Be prepared with the necessary identification and details for notarization.

- Retention of Copies: After completion and notarization, both parties should keep copies of the signed form for their records. This can serve as proof of the transaction if needed in the future.

Browse Other Templates

What Is an Unincorporated Nonprofit Association - Filing this form with the Secretary of State is essential for legal recognition.

Proof Approval Form - Document any specific errors you find in the proof.