Fill Out Your 14653 Form

The Form 14653, issued by the Internal Revenue Service (IRS), serves a vital role in the tax landscape for U.S. citizens living abroad. This form is specifically designed for individuals participating in the Streamlined Foreign Offshore Procedures, allowing them to rectify past noncompliance regarding income reporting, tax payments, and required information returns, including the Foreign Bank and Financial Accounts Report (FBAR). Completing Form 14653 necessitates the careful detailing of taxpayer identification information and financial data for the past three years, as well as an acknowledgment of the eligibility criteria, including proof of physical presence outside the United States. It's important to note that both individual circumstances and joint certifications require clear narratives explaining any failures in compliance, emphasizing both the reasons for the oversight and the steps taken to correct it. Additionally, taxpayers must confirm that any amended returns may extend beyond standard assessment periods, thereby ensuring transparency with the IRS. The form ultimately fosters a pathway for individuals seeking to clear discrepancies while underscoring the necessity for accurate and honest reporting to avoid civil or criminal repercussions.

14653 Example

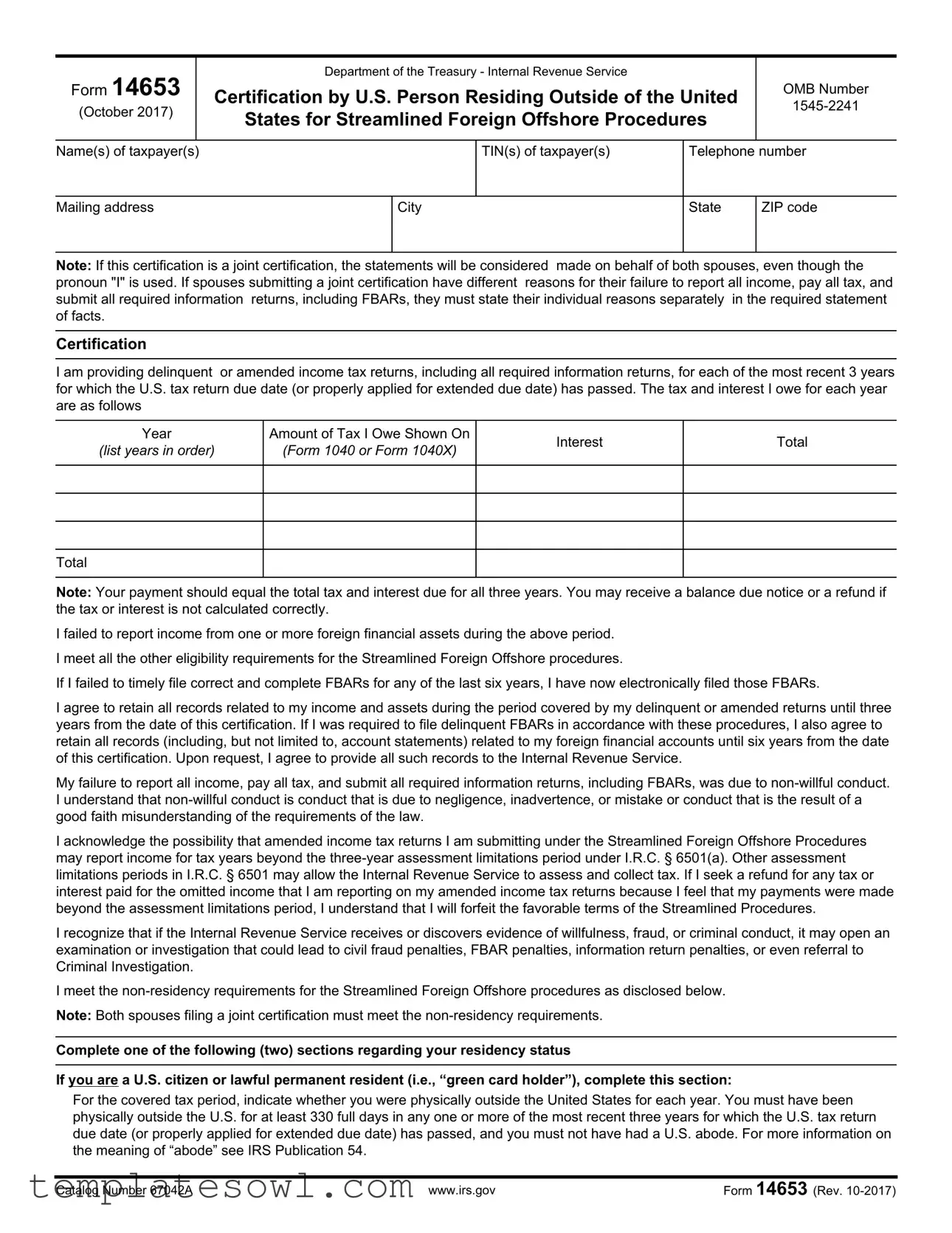

Form 14653

(October 2017)

Department of the Treasury - Internal Revenue Service

Certification by U.S. Person Residing Outside of the United

States for Streamlined Foreign Offshore Procedures

OMB Number

Name(s) of taxpayer(s)

TIN(s) of taxpayer(s)

Telephone number

Mailing address

City

State

ZIP code

Note: If this certification is a joint certification, the statements will be considered made on behalf of both spouses, even though the pronoun "I" is used. If spouses submitting a joint certification have different reasons for their failure to report all income, pay all tax, and submit all required information returns, including FBARs, they must state their individual reasons separately in the required statement of facts.

Certification

I am providing delinquent or amended income tax returns, including all required information returns, for each of the most recent 3 years for which the U.S. tax return due date (or properly applied for extended due date) has passed. The tax and interest I owe for each year are as follows

Year

(list years in order)

Amount of Tax I Owe Shown On

(Form 1040 or Form 1040X)

Interest

Total

Total

Note: Your payment should equal the total tax and interest due for all three years. You may receive a balance due notice or a refund if the tax or interest is not calculated correctly.

I failed to report income from one or more foreign financial assets during the above period.

I meet all the other eligibility requirements for the Streamlined Foreign Offshore procedures.

If I failed to timely file correct and complete FBARs for any of the last six years, I have now electronically filed those FBARs.

I agree to retain all records related to my income and assets during the period covered by my delinquent or amended returns until three years from the date of this certification. If I was required to file delinquent FBARs in accordance with these procedures, I also agree to retain all records (including, but not limited to, account statements) related to my foreign financial accounts until six years from the date of this certification. Upon request, I agree to provide all such records to the Internal Revenue Service.

My failure to report all income, pay all tax, and submit all required information returns, including FBARs, was due to

I acknowledge the possibility that amended income tax returns I am submitting under the Streamlined Foreign Offshore Procedures may report income for tax years beyond the

I recognize that if the Internal Revenue Service receives or discovers evidence of willfulness, fraud, or criminal conduct, it may open an examination or investigation that could lead to civil fraud penalties, FBAR penalties, information return penalties, or even referral to Criminal Investigation.

I meet the

Note: Both spouses filing a joint certification must meet the

Complete one of the following (two) sections regarding your residency status

If you are a U.S. citizen or lawful permanent resident (i.e., “green card holder”), complete this section:

For the covered tax period, indicate whether you were physically outside the United States for each year. You must have been physically outside the U.S. for at least 330 full days in any one or more of the most recent three years for which the U.S. tax return due date (or properly applied for extended due date) has passed, and you must not have had a U.S. abode. For more information on the meaning of “abode” see IRS Publication 54.

Catalog Number 67042A |

www.irs.gov |

Form 14653 (Rev. |

Page of

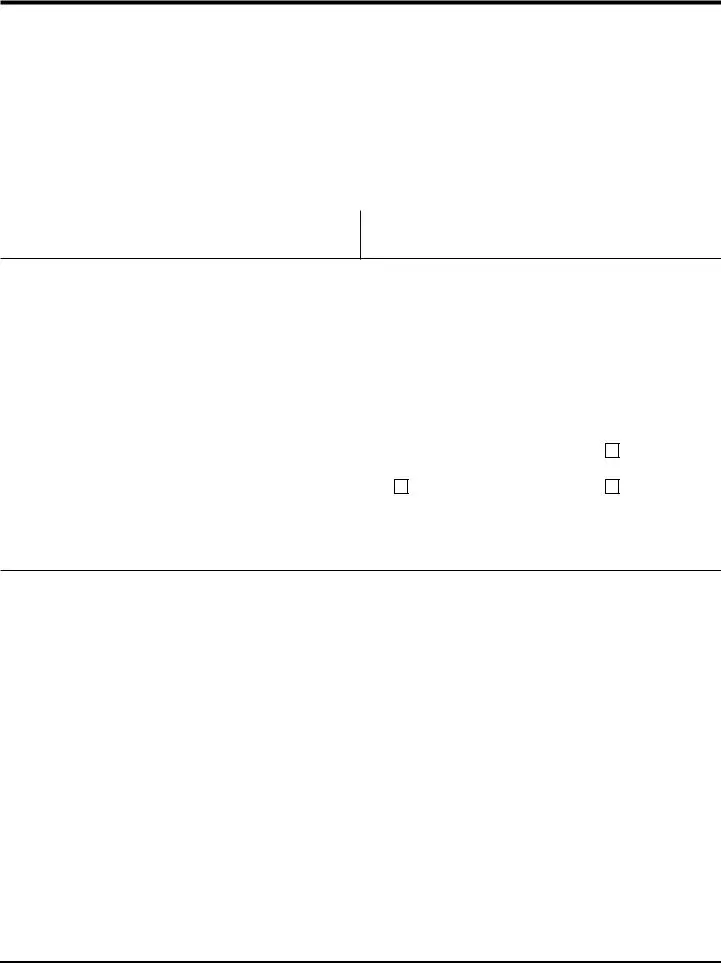

I was physically outside the United States for at least 330 full days (answer Yes or No for each year)

Year

Yes

No

Both spouses filing a joint certification must meet the

If you are not a U.S. citizen or lawful permanent resident, complete this section:

If you are not a U.S. citizen or a lawful permanent resident, please attach to this certification your computation showing that you did not meet the substantial presence test under I.R.C. sec. 7701(b)(3). Your computation must disclose the number of days you were present in the U.S. for the three years included in your Streamlined Foreign Offshore Procedures submission and the previous two years. If you do not attach a complete computation showing that you did not meet the substantial presence test, your submission will be considered incomplete and your submission will not qualify for the Streamlined Foreign Offshore Procedures.

Both spouses filing a joint certification must meet the

Note: You must provide specific facts on this form or on a signed attachment explaining your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Any submission that does not contain a narrative statement of facts will be considered incomplete and will not qualify for the streamlined penalty relief.

Provide specific reasons for your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Include the whole story including favorable and unfavorable facts. Specific reasons, whether favorable or unfavorable to you, should include your personal background, financial background, and anything else you believe is relevant to your failure to report all income, pay all tax, and submit all required information returns, including FBARs. Additionally, explain the source of funds in all of your foreign financial accounts/assets. For example, explain whether you inherited the account/asset, whether you opened it while residing in a foreign country, or whether you had a business reason to open or use it. And explain your contacts with the account/asset including withdrawals, deposits, and investment/ management decisions. Provide a complete story about your foreign financial account/asset. If you relied on a professional advisor, provide the name, address, and telephone number of the advisor and a summary of the advice. If married taxpayers submitting a joint certification have different reasons, provide the individual reasons for each spouse separately in the statement of facts. The field below will automatically expand to accommodate your statement of facts.

Catalog Number 67042A |

www.irs.gov |

Form 14653 (Rev. |

Page of

Under penalties of perjury, I declare that I have examined this certification and all accompanying schedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete.

Signature of Taxpayer |

Name of Taxpayer |

Date |

|

|

|

Signature of Taxpayer (if joint certification) |

Name of Taxpayer (if joint certification) |

Date |

|

|

|

For Estates Only

Signature of Fiduciary |

Date |

|

|

Title of Fiduciary (e.g., executor or administrator)

Name of Fiduciary

For Paid Preparer Use Only (the signature of taxpayer(s) or fiduciary is required even if this form is signed by a paid preparer)

Signature of Preparer |

Name of Preparer |

|

|

Date |

|

|

|

|

|

Firm’s name |

|

|

|

Firm’s EIN |

|

|

|

|

|

Firm’s address |

City |

|

State |

ZIP code |

|

|

|

|

|

Telephone number |

PTIN |

|

|

Check if |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this form with the IRS |

Yes (complete information below) |

No |

||

|

|

|

|

|

Designee’s name |

|

|

Telephone number |

|

|

|

|

|

|

Privacy Act and Paperwork Reduction Notice

We ask for the information on this certification by U.S. person residing in the United States for streamlined domestic offshore procedures to carry out the Internal Revenue laws of the United States. Our authority to ask for information is sections 6001, 6109, 7801, 7803 and the regulations thereunder. This information will be used to determine and collect the correct amount of tax under the terms of the streamlined filing compliance program. You are not required to apply for participation in the streamlined filing compliance program. If you choose to apply, however, you are required to provide all the information requested on the streamlined certification. You are not required to provide the information requested on a document that is subject to the Paperwork Reduction Act unless the document displays a valid OMB control number. Books or records relating to a document or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103. Section 6103, however, allows or requires the Internal Revenue Service to disclose or give this information to others as described in the Internal Revenue Code. For example, we may disclose this information to the Department of Justice to enforce the tax laws, both civil and criminal, and to cities, states, the District of Columbia, and U.S. commonwealths or possessions to carry out their tax laws. We may also disclose this information to other countries under a tax treaty, to federal and state agencies to enforce federal nontax criminal laws, or to federal law enforcement and intelligence agencies to combat terrorism. Failure to provide this information may delay or prevent processing your application. Providing false information may subject you to penalties. The time needed to complete and submit the streamlined certification will vary depending on individual circumstances. The estimated average time is: 8 hours

Catalog Number 67042A |

www.irs.gov |

Form 14653 (Rev. |

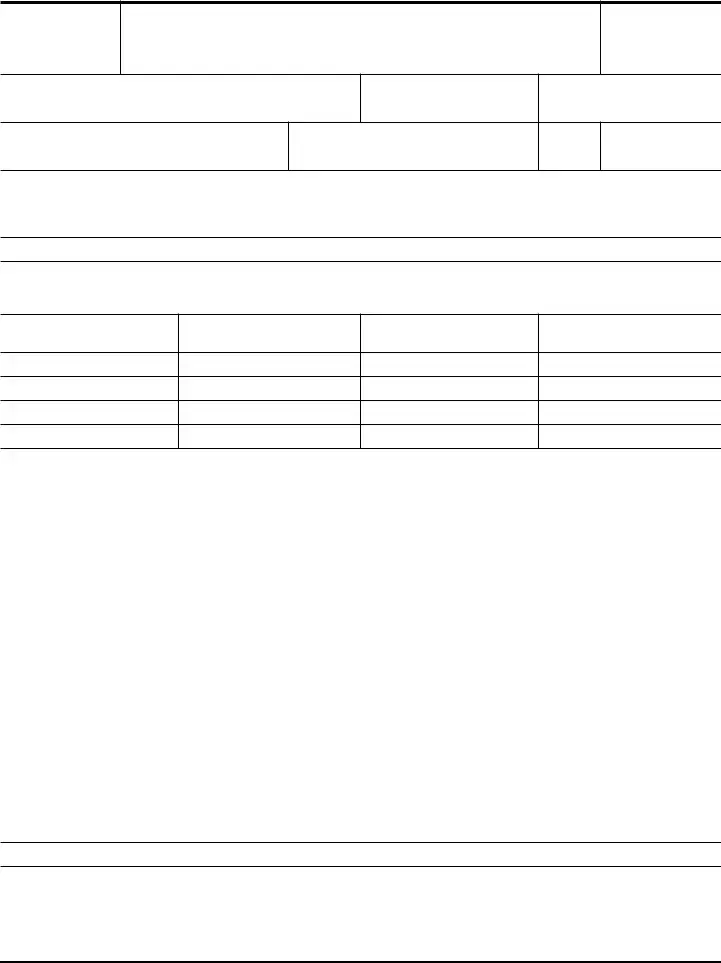

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Form Title | Certification by U.S. Person Residing Outside of the United States for Streamlined Foreign Offshore Procedures. |

| Publication Date | The form has a publication date of October 2017. |

| OMB Number | The form is assigned OMB Number 1545-2241. |

| Eligibility Requirements | Taxpayers must meet specific eligibility requirements to use the Streamlined Foreign Offshore Procedures, including providing delinquent or amended tax returns for the past three years. |

| Non-Willful Conduct | The form requires the taxpayer to attest that their failure to report was due to non-willful conduct, which may include negligence or misunderstanding of tax requirements. |

| Retention of Records | Taxpayers must retain records related to their income and assets for three years after certification, and records related to FBARs for six years. |

| Joint Certification | If married taxpayers file jointly, both must meet the non-residency requirements as outlined in the form. |

| Assessment Limitations | Amended returns may report income beyond the three-year assessment limitations under I.R.C. § 6501(a). |

| Consequences of Willfulness | If evidence of willfulness or fraud is discovered, the Internal Revenue Service may conduct an examination which could result in penalties. |

| Time to Complete | The estimated average time to complete the form is approximately 8 hours. |

Guidelines on Utilizing 14653

Once you've prepared to fill out Form 14653, it's important to follow the steps carefully. This form is a crucial part of the process for U.S. Persons living outside the United States to certify their eligibility for the Streamlined Foreign Offshore Procedures. By providing the correct information, you can help ensure smoother processing of your submission.

- Begin by entering your name(s) in the designated field at the top of the form.

- Fill in the Taxpayer Identification Number (TIN) for each taxpayer.

- Provide a telephone number where you can be reached.

- Complete your mailing address, including the city, state, and ZIP code.

- Indicate whether this certification is joint by checking the appropriate box.

- In the certification section, confirm that you are submitting delinquent or amended income tax returns for the past three years.

- List the years for which you are filing returns along with the corresponding tax amount owed.

- Calculate the total amount of taxes and interest due and enter the total in the specified area.

- Confirm that you failed to report income from foreign financial assets during the stated period and affirm that you meet all eligibility requirements.

- If applicable, indicate whether you have electronically filed any outstanding FBARs (Foreign Bank Account Reports).

- Acknowledge your agreement to retain records related to your income and assets as specified.

- Confirm that your failure to report income and pay taxes was due to non-willful conduct.

- Complete the residency status section based on your status as a U.S. citizen or lawful permanent resident or not.

- If required, attach your computation showing you did not meet the substantial presence test if you're not a U.S. citizen.

- Provide a narrative statement explaining your reasons for failing to report income and pay taxes, including specific personal and financial background.

- If applicable, identify any professional advisors you relied upon and summarize the advice received.

- Sign and date the form in the designated areas. Ensure both taxpayers sign if it’s a joint certification.

- If a paid preparer is involved, ensure their information is filled out and signed correctly.

What You Should Know About This Form

What is Form 14653?

Form 14653 is a certification used by U.S. persons residing outside of the United States to participate in the Streamlined Foreign Offshore Procedures. This form allows taxpayers to resolve their non-compliance with U.S. tax obligations, including income tax returns and FBAR reporting, in cases of non-willfulness. It is crucial for individuals who may have unintentionally failed to report income or file returns due to misunderstanding or negligence.

Who needs to use Form 14653?

U.S. citizens and lawful permanent residents who have resided outside the United States and have failed to report income from foreign financial assets may need to file Form 14653. The form specifically addresses cases of non-willful conduct, making it suitable for those who did not intentionally evade their tax responsibilities. Additionally, both spouses must meet the residency requirements if filing jointly.

What information must be included in the certification?

The certification requires personal details such as the taxpayer's name, taxpayer identification number (TIN), and contact information. It also necessitates the submission of delinquent or amended income tax returns for the last three years, details regarding any unpaid taxes and interest, and an explanation of the reasons for the failure to report. The taxpayer must include specific facts on their financial background and any foreign accounts, as well as information if professional advice was sought.

What are the residency requirements for Form 14653?

To qualify, a U.S. citizen or lawful permanent resident must have been physically outside the U.S. for at least 330 full days during any one of the past three tax years for which the tax return due date has passed. Additionally, they must not have had a U.S. abode during that period. For non-citizens, a calculation must be attached showing that they do not meet the substantial presence test.

Can multiple taxpayers submit a joint certification?

Yes, spouses can submit a joint certification via Form 14653. However, both spouses must independently satisfy the non-residency requirements. If there are differing circumstances or reasons for non-compliance between the spouses, each must provide their individual reasons separately within the submission.

What are the consequences of inaccurate information on Form 14653?

Providing false information on Form 14653 can lead to serious penalties. If the IRS discovers evidence of willfulness, fraud, or criminal conduct during the review process, it may initiate an investigation. This could result in additional civil penalties, FBAR penalties, or even referral for criminal investigation. It is essential to ensure all submitted information is truthful and complete to avoid these potential consequences.

Common mistakes

Filing Form 14653 correctly is crucial for U.S. taxpayers residing abroad who seek to participate in the Streamlined Foreign Offshore Procedures. However, many individuals make common mistakes during the submission process. One prevalent error is failing to provide a complete narrative statement of facts. This statement is vital and should explain the reasons behind the failure to report income, pay taxes, and submit required information returns.

Another frequent mistake involves incorrect calculations of taxes owed and interest. It is essential to ensure that the amounts listed on the form accurately reflect the tax liabilities and interest due for each of the previous three years. Discrepancies in these calculations can lead to delays or denials of the streamlined procedures. An often overlooked section is the requirement for documentation related to foreign financial accounts; failing to include necessary records can result in an incomplete submission.

People also misinterpret the non-residency requirements. Both spouses submitting a joint certification must meet these criteria. If one spouse does not qualify, it may jeopardize the application for both individuals. Additionally, incorrect answers about being physically outside of the United States can lead to disqualification. Taxpayers must be meticulous in ensuring that their residency status is clearly defined.

Another mistake often seen involves lack of thoroughness in detailing the source of funds in foreign accounts. Providing a vague or incomplete explanation can diminish the credibility of the submission. It is crucial to clarify whether the funds originated from an inheritance, business dealings, or other legitimate sources.

Moreover, many taxpayers forget to attach the necessary computations to demonstrate the substantial presence test. If applicable, this attachment needs to prove that the individual did not meet the requirements set forth in the Internal Revenue Code. Omitting this information will likely result in the submission being considered incomplete.

In some instances, individuals incorrectly assume that they can rely solely on a paid preparer's guidance without reviewing the form themselves. While utilizing a preparer is helpful, taxpayers have a responsibility to ensure that all information submitted is accurate. Lastly, not retaining documentation as outlined in the form is a significant oversight. Taxpayers are required to keep records for several years, and failure to do so might complicate future inquiries or audits by the IRS.

Documents used along the form

The Form 14653 is crucial for U.S. citizens living abroad seeking to rectify past tax reporting issues under the Streamlined Foreign Offshore Procedures. To optimize your compliance process, several other forms and documents often accompany the 14653. Each of these plays a specific role in ensuring proper tax reporting and eligibility for streamlined procedures.

- Form 1040: This is the standard U.S. Individual Income Tax Return form. Taxpayers report their annual income, deductions, and credits here to calculate their federal tax obligation for the year.

- Form 1040X: This form is used to amend a previously filed tax return. Taxpayers use it to correct errors or update information on their original Form 1040 submission.

- FBAR (FinCEN Form 114): If you have foreign bank accounts with an aggregate value exceeding $10,000 at any time during the calendar year, you must file this form to report those accounts.

- Form 8938: This is used to report specified foreign financial assets if the total value exceeds certain thresholds. Compliance with Form 8938 is necessary to avoid penalties.

- IRS Publication 54: It provides guidelines on the taxation of U.S. citizens living abroad. This publication aids taxpayers in understanding their residency status and filing obligations.

- Statement of Facts: This essential narrative outlines the reasons for any prior failures to report income or file returns. Providing a complete and accurate statement supports your eligibility for streamlined procedures.

- Foreign Tax Credit Form (Form 1116): This form allows taxpayers to claim a credit for taxes paid to foreign governments on income earned overseas, reducing U.S. tax liability.

- Form W-7: If you need an ITIN (Individual Taxpayer Identification Number) for a dependent or to comply with filing obligations, this form is required to apply for one.

- Form 8854: This form is for expatriates who give up their U.S. citizenship. It helps determine if any exit taxes are applicable based on the expatriate's assets.

Collectively, these forms support taxpayers in achieving compliance and clarifying their tax obligations while reaping the benefits of streamlined procedures. Each serves a unique purpose but works harmoniously with Form 14653 to address tax reporting issues effectively.

Similar forms

- Form 1040: This is the standard individual income tax return form. Like Form 14653, it requires taxpayers to report income, deductions, and tax liabilities for the relevant tax years.

- Form 1040X: This is the amendment form for previously filed tax returns. Both this form and Form 14653 allow taxpayers to correct prior omissions or errors in income reporting.

- Form 8938: This form is used to report specified foreign financial assets. Similar to Form 14653, it addresses the reporting of foreign income and financial holdings.

- FBAR (FinCEN Form 114): Required for reporting foreign bank accounts, the FBAR and Form 14653 both focus on compliance regarding foreign financial assets, emphasizing disclosure to the IRS.

- Form W-7: This application is used to obtain an Individual Taxpayer Identification Number (ITIN). It parallels Form 14653 in terms of providing necessary documentation for those who may not have a Social Security number.

- Form 5405: This is the First-Time Homebuyer Credit form. Like Form 14653, it concerns the submission of documentation that may affect tax liabilities related to specific financial situations.

- Form 8854: This form is for expatriates to report on their tax obligations when renouncing U.S. citizenship. Both forms highlight compliance with U.S. tax laws and the necessity of disclosing all income.

- Form 8965: This is the health coverage exemption form. While focusing on health coverage, it similarly requires taxpayers to declare specific information, akin to the income reporting in Form 14653.

Dos and Don'ts

When filling out Form 14653, it is essential to follow specific guidelines to ensure your submission is complete and accurate. Below is a list of things to do and avoid:

- Do: Provide complete and accurate information in each section of the form.

- Do: Disclose all foreign financial accounts and any missing income, along with a detailed explanation.

- Do: Retain all relevant records for the required periods.

- Do: Follow the specific instructions for joint submissions if applicable.

- Don't: Leave any sections of the form blank; incomplete forms may be rejected.

- Don't: Make false statements or misrepresent any facts related to your financial history.

- Don't: Forget to attach necessary computations or documentation if you do not meet residency requirements.

- Don't: Ignore the requirement to explain both favorable and unfavorable circumstances related to your failure to report.

Misconceptions

- Misconception 1: Everyone is eligible to use Form 14653.

- Misconception 2: Filling out this form guarantees no penalties.

- Misconception 3: All past tax returns must be reported in one submission.

- Misconception 4: It's unnecessary to explain why taxes were not reported.

- Misconception 5: Only one spouse needs to meet the requirements for joint submissions.

This form is specifically for U.S. persons residing outside the United States who meet certain eligibility criteria. If a person does not meet the non-residency requirement, they cannot use this form for streamlined procedures.

While Form 14653 is part of the Streamlined Foreign Offshore Procedures designed to reduce penalties, it does not automatically guarantee immunity from penalties. The IRS retains the right to investigate any indication of willfulness or fraud.

Form 14653 requires the submission of delinquent or amended tax returns for the most recent three years. Individuals must only report the years they are eligible for, and provide the required information for those specific years.

The form necessitates a detailed narrative statement that explains the reasons for failing to report all income and comply with tax obligations. A lack of explanation can render the submission incomplete.

When filing jointly, both spouses must meet the non-residency requirements. If one spouse does not meet these criteria, the joint certification will not be accepted.

Key takeaways

Filling out Form 14653 is crucial for U.S. citizens or lawful permanent residents living outside the United States who wish to participate in the Streamlined Foreign Offshore Procedures. Here are some key takeaways that can help navigate this process.

- Eligibility Requirements: To be eligible, taxpayers must have been physically outside the U.S. for at least 330 full days during the past three years and not have a U.S. abode. Failing to satisfy these conditions may result in an incomplete submission.

- Statement of Facts: Providing a detailed narrative explaining the reasons for not reporting income or submitting required returns is essential. Both positive and negative factors should be included, offering a complete picture of the taxpayer's circumstances.

- Tax and Interest Calculations: Ensure accurate reporting of taxes owed and any interest due for the past three years. Payments submitted must align with the total calculated tax and interest.

- Record Retention: Taxpayers must agree to retain all related records for three years after certification and FBAR records for six years. This includes ensuring access to documents upon IRS request.

Browse Other Templates

Mechanic Lien Nc - The report must be submitted to the DMV’s Notice & Storage Unit for processing.

Alabama Child Support Modification Forms - Average monthly income should be based on the last year of employment if applicable.

E10 Form - Understanding the impact on insurance and assets is vital when filing this petition.