Fill Out Your 14950 Form

The completion of Form 14950 is a crucial step for taxpayers seeking to verify their eligibility for the Premium Tax Credit (PTC), a significant benefit designed to make health insurance more affordable. This form, issued by the Internal Revenue Service, requires taxpayers to provide specific documentation ensuring they purchased health insurance through a Health Insurance Marketplace. It covers essential details such as the taxpayer's name, taxpayer identification number, and the relevant tax period. One of the primary tasks when filing this form is to gather and submit various supporting documents, which may include Form 8962, the Health Insurance Marketplace Statement, and records of premium payments. Important conditions that impact eligibility—such as household income relative to the Federal Poverty Line—must also be understood and documented, particularly for those who may have received Advanced Premium Tax Credits. Failing to provide the correct documentation or not filing the necessary forms can lead to repayment of the advanced credits received, highlighting the importance of meticulous record-keeping. Understanding the requirements of Form 14950 is vital for taxpayers to navigate the complexities of health insurance coverage and tax credits effectively.

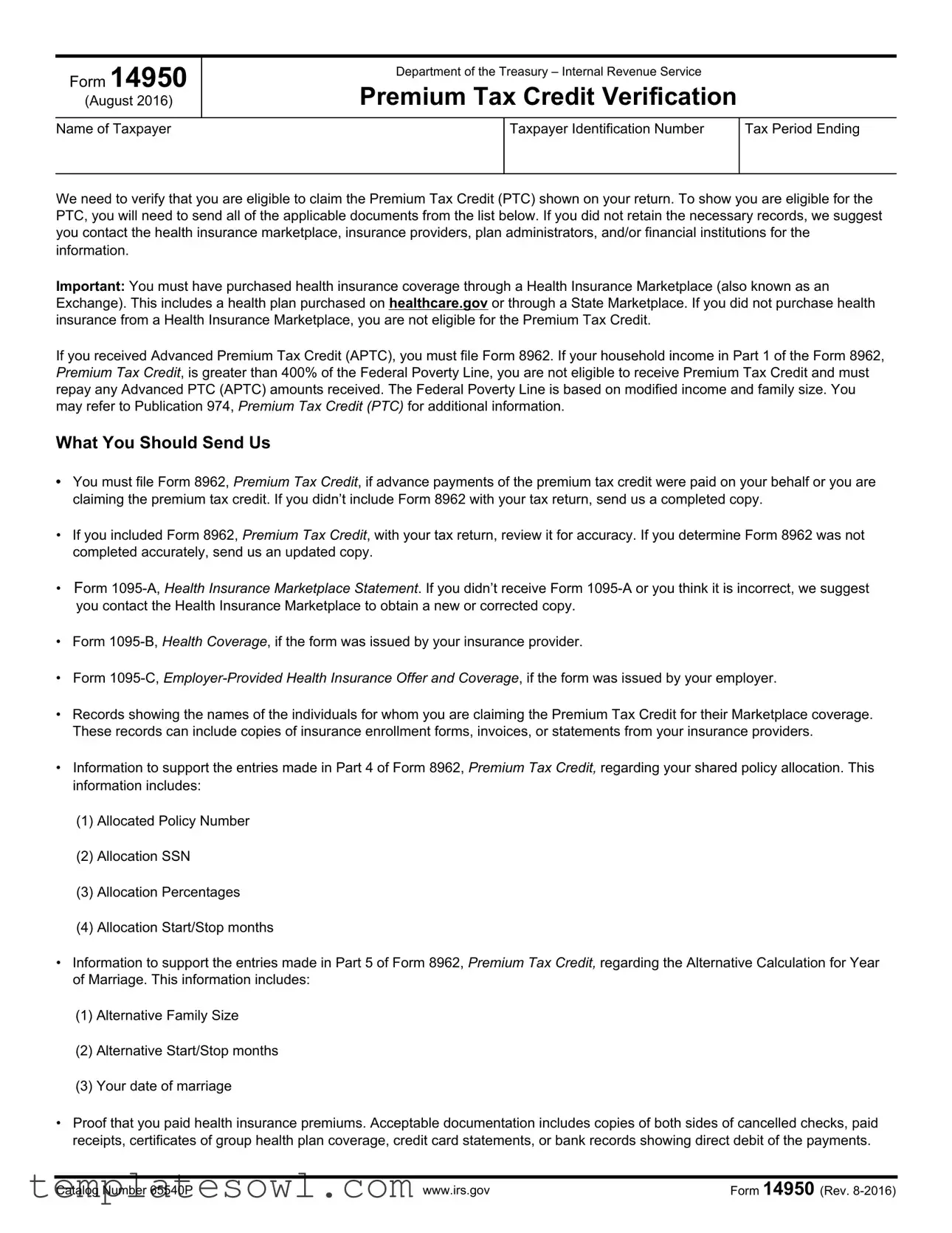

14950 Example

Form 14950 |

Department of the Treasury – Internal Revenue Service |

|

|

|

|

||

(August 2016) |

Premium Tax Credit Verification |

|

|

|

|

|

|

Name of Taxpayer |

|

Taxpayer Identification Number |

Tax Period Ending |

|

|

|

|

We need to verify that you are eligible to claim the Premium Tax Credit (PTC) shown on your return. To show you are eligible for the PTC, you will need to send all of the applicable documents from the list below. If you did not retain the necessary records, we suggest you contact the health insurance marketplace, insurance providers, plan administrators, and/or financial institutions for the information.

Important: You must have purchased health insurance coverage through a Health Insurance Marketplace (also known as an Exchange). This includes a health plan purchased on healthcare.gov or through a State Marketplace. If you did not purchase health insurance from a Health Insurance Marketplace, you are not eligible for the Premium Tax Credit.

If you received Advanced Premium Tax Credit (APTC), you must file Form 8962. If your household income in Part 1 of the Form 8962, Premium Tax Credit, is greater than 400% of the Federal Poverty Line, you are not eligible to receive Premium Tax Credit and must repay any Advanced PTC (APTC) amounts received. The Federal Poverty Line is based on modified income and family size. You may refer to Publication 974, Premium Tax Credit (PTC) for additional information.

What You Should Send Us

•You must file Form 8962, Premium Tax Credit, if advance payments of the premium tax credit were paid on your behalf or you are claiming the premium tax credit. If you didn’t include Form 8962 with your tax return, send us a completed copy.

•If you included Form 8962, Premium Tax Credit, with your tax return, review it for accuracy. If you determine Form 8962 was not completed accurately, send us an updated copy.

•Form

•Form

•Form

•Records showing the names of the individuals for whom you are claiming the Premium Tax Credit for their Marketplace coverage. These records can include copies of insurance enrollment forms, invoices, or statements from your insurance providers.

•Information to support the entries made in Part 4 of Form 8962, Premium Tax Credit, regarding your shared policy allocation. This information includes:

(1)Allocated Policy Number

(2)Allocation SSN

(3)Allocation Percentages

(4)Allocation Start/Stop months

•Information to support the entries made in Part 5 of Form 8962, Premium Tax Credit, regarding the Alternative Calculation for Year of Marriage. This information includes:

(1)Alternative Family Size

(2)Alternative Start/Stop months

(3)Your date of marriage

•Proof that you paid health insurance premiums. Acceptable documentation includes copies of both sides of cancelled checks, paid receipts, certificates of group health plan coverage, credit card statements, or bank records showing direct debit of the payments.

Catalog Number 65540P |

www.irs.gov |

Form 14950 (Rev. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | Form 14950 is used by the IRS to verify eligibility for the Premium Tax Credit (PTC). |

| Required Submissions | Taxpayers must submit relevant documents to verify eligibility for the PTC. |

| Health Insurance Marketplace Requirement | Eligibility for PTC requires that health insurance be purchased through a Health Insurance Marketplace. |

| Advance Premium Tax Credit | If APTC was received, Form 8962 must be filed with the tax return. |

| Income Limitations | Household income exceeding 400% of the Federal Poverty Line disqualifies taxpayers from receiving the PTC. |

| Essential Documents | Documents include Form 1095-A, 1095-B, 1095-C, and evidence of premium payments. |

| Shared Policy Allocation | Information regarding shared policy allocation is needed to complete Form 8962 accurately. |

| Documentation Standards | Accepted proof of premium payments includes receipts, canceled checks, and bank statements. |

Guidelines on Utilizing 14950

Following these steps will help ensure that the 14950 form is completed accurately. This form relates to verifying eligibility for the Premium Tax Credit (PTC). You must provide specific information and documentation to support your eligibility claim. Please gather all necessary records and be prepared to submit additional support as required.

- Begin by downloading and printing the 14950 form from the IRS website.

- Fill in your name as the taxpayer in the designated space.

- Enter your Taxpayer Identification Number (TIN) in the appropriate box.

- Indicate the tax period ending date accurately.

- Compile and attach Form 8962 if you received Advance Premium Tax Credit or are claiming the PTC.

- If you already submitted Form 8962 with your tax return, review it for accuracy. If corrections are needed, complete a new Form 8962 and attach it.

- Attach Form 1095-A, Health Insurance Marketplace Statement. If missing or incorrect, contact the Health Insurance Marketplace for a new form.

- Include Form 1095-B, Health Coverage, if provided by your insurance provider.

- Include Form 1095-C, Employer-Provided Health Insurance Offer and Coverage, if issued by your employer.

- Gather records for the individuals you’re claiming Premium Tax Credit for. This may include insurance enrollment forms, invoices, or statements from insurance providers.

- Prepare information for Part 4 of Form 8962 including the allocated policy number, allocation SSN, allocation percentages, and allocation start/stop months.

- Collect the required information for Part 5 of Form 8962 regarding the Alternative Calculation for Year of Marriage, including alternative family size, alternative start/stop months, and your marriage date.

- Provide proof of paid health insurance premiums. Acceptable documentation can comprise copies of cancelled checks, paid receipts, group health plan coverage certificates, credit card statements, or bank records showing direct debits.

- Review all completed sections and documents to ensure they are accurate and complete before submission.

After you've filled out the form, gather the necessary attachments. Double-check each document to make sure everything is accurate and complete. Then, submit your form and supporting documents to the IRS for review. Confirm that you keep a copy for your records as proof of submission.

What You Should Know About This Form

What is Form 14950 and why is it important?

Form 14950, issued by the Department of the Treasury's Internal Revenue Service, serves as a request for verification of eligibility for the Premium Tax Credit (PTC). Taxpayers who have reported a PTC on their tax returns need to ensure their eligibility, as this credit can significantly reduce the cost of health insurance purchased from a Health Insurance Marketplace. Failing to provide the necessary documentation can lead to repayment of tax credits and adjustments to your tax return.

Who needs to submit Form 14950?

Any taxpayer who claimed the Premium Tax Credit on their tax return may be required to submit Form 14950. This form is particularly necessary if the IRS requests further substantiation of the information provided on your return. It is crucial for anyone who purchased health insurance through a Health Insurance Marketplace and received an Advanced Premium Tax Credit (APTC) to verify their eligibility with the required documentation.

What documents do I need to provide with Form 14950?

You will need to submit several specific documents along with Form 14950. These include Form 8962, which details your PTC claims, and Form 1095-A, the Health Insurance Marketplace Statement. Depending on your situation, you might also need Form 1095-B or Form 1095-C if they pertain to your health coverage. Make sure to gather records showing the names of individuals for whom you are claiming the PTC, along with proof of paid health insurance premiums such as bank statements, receipts, or cancelled checks.

What should I do if I did not keep my records?

If you didn’t retain necessary documents, don’t panic. Start by contacting the Health Insurance Marketplace or your health insurance provider to obtain replacement documents. They should be able to assist you in retrieving your Form 1095-A, as well as any other relevant forms. Keep in mind that having accurate information is essential to prevent issues with your tax return.

What if my income exceeds 400% of the Federal Poverty Line?

If your household income exceeds 400% of the Federal Poverty Line, you are not eligible for the Premium Tax Credit. Consequently, if you received the Advanced Premium Tax Credit (APTC), you would be required to repay those amounts. This situation emphasizes the importance of accurately calculating and reporting your income on Form 8962, as it directly influences your eligibility for the PTC.

Where can I find more information about the Premium Tax Credit?

For additional details regarding the Premium Tax Credit, including income thresholds and eligibility requirements, you can refer to IRS Publication 974. This resource provides comprehensive information about the credit, helps clarify the calculation process, and guides you in gathering the documentation necessary for compliance. It’s a valuable tool for taxpayers looking to fully understand their rights and responsibilities concerning health insurance tax credits.

Common mistakes

When filling out Form 14950, it's easy to make mistakes that could delay your Premium Tax Credit verification. One common error is not submitting Form 8962. If you received advance Premium Tax Credit (APTC) or claimed the Premium Tax Credit, this form is essential. Omitting it could lead to issues with your tax return. Always double-check that you’re including it.

Another frequent mistake is failing to provide accurate information on Form 8962 itself. If you included this form with your tax return, verify that all entries are correct. Errors in household income or family size can result in denial of the credit or an obligation to repay APTC amounts. It’s vital to review this form carefully before submission.

Moreover, neglecting to attach Form 1095-A, the Health Insurance Marketplace Statement, can pose significant problems. If you haven’t received it or believe it's incorrect, reaching out to the Health Insurance Marketplace for a new copy is necessary. This form plays a crucial role in determining your eligibility for the Premium Tax Credit.

Many people also overlook supporting documents related to their claimed Premium Tax Credit. Records demonstrating who is covered under your health plan and proof of premium payments should be included. Without these documents, such as invoices or bank statements, the IRS won’t have sufficient information to process your claim.

Lastly, individuals often forget to provide the necessary information for Part 4 and Part 5 of Form 8962. This section requires details about shared policy allocation and the Alternative Calculation for Year of Marriage. Carefully gather all relevant information and documentation to prevent any delays or complications in your Premium Tax Credit verification.

Documents used along the form

When submitting the Form 14950 to verify eligibility for the Premium Tax Credit, several other documents may be necessary to complete the process effectively. These forms provide essential information needed to support your claim and ensure compliance with the regulations. Below is a list of commonly required forms and documents associated with the Form 14950.

- Form 8962: This form is used to calculate the Premium Tax Credit and reconcile any advance payments made on your behalf. You need to submit it if you received or are claiming the Premium Tax Credit.

- Form 1095-A: This form, issued by the Health Insurance Marketplace, provides information about your health coverage and any Premium Tax Credit amounts. It is crucial for completing Form 8962.

- Form 1095-B: This document shows proof of your health coverage, issued by your insurance provider. It is important for verifying insurance enrollment.

- Form 1095-C: Issued by your employer, this form outlines the health insurance offered and coverage provided. It may be needed to confirm eligibility for certain credits.

- Enrollment Records: Include documents that show the names of individuals claiming the Premium Tax Credit. This can consist of enrollment forms, invoices, or statements from your insurance providers.

- Shared Policy Allocation Information: Documentation supporting the entries in Part 4 of Form 8962. This includes details like allocated policy numbers and percentages.

- Alternative Calculation Information: Required if you are using the alternative calculation for the year of marriage in Part 5 of Form 8962. This includes your alternative family size and marriage date.

- Premium Payment Proof: Provide evidence of premium payments through canceled checks, bank statements, or receipts. This documentation demonstrates payment compliance.

Each document plays a pivotal role in validating your eligibility for the Premium Tax Credit. Gathering and submitting these forms accurately can significantly contribute to a smoother process and a favorable outcome.

Similar forms

The 14950 form, used for verifying eligibility for the Premium Tax Credit, shares similarities with several other documents. Here’s a list of those documents along with their connection to Form 14950:

- Form 8962: This form is essential for claiming the Premium Tax Credit itself. It outlines required information about your premium tax credits and is necessary whether you received advance payments or not.

- Form 1095-A: Known as the Health Insurance Marketplace Statement, this form provides vital details about your health insurance coverage. It is often needed to complete Form 8962 accurately.

- Form 1095-B: This document, issued by your insurance provider, offers proof of health coverage. It supports your claims related to health insurance premium payments.

- Form 1095-C: If you receive this form from your employer, it indicates your employer's health insurance offer. It may help prove your eligibility for tax credits.

- Insurance Enrollment Records: These can include copies of enrollment forms or invoices. They help demonstrate who is covered under which plan, supporting your claim for the Premium Tax Credit.

- Shared Policy Allocation Info: Required for Part 4 of Form 8962, this includes information such as the policy number and allocation percentages. It's important to validate shared policy situations.

- Alternative Calculation Info: This relates to Part 5 of Form 8962 and includes details necessary when calculating credits for those who married during the year.

- Proof of Premium Payments: Acceptable forms of proof such as canceled checks or bank statements confirm that health insurance premiums were paid, aligning with the requirements of the Premium Tax Credit.

- Health Insurance Marketplace Communication: Any correspondence regarding your health coverage with the Marketplace provides necessary context and proof of your eligibility status.

Dos and Don'ts

When filling out the 14950 form, consider the following do's and don'ts:

- Do ensure you file Form 8962 if you are claiming the Premium Tax Credit or if advance payments were made on your behalf.

- Do review Form 8962 for accuracy if you included it with your tax return.

- Do provide Form 1095-A, Health Insurance Marketplace Statement, if applicable.

- Do keep records that list the individuals for whom you are claiming the Premium Tax Credit.

- Don't submit the form without attaching all required documents.

- Don't ignore the need for accurate information regarding shared policy allocations on Form 8962.

- Don't overlook the proof of premium payments; they are necessary for your eligibility.

- Don't forget to contact the Health Insurance Marketplace if you encounter issues with Form 1095-A.

Misconceptions

Understanding the 14950 form can be challenging, and there are several misconceptions that may lead to confusion. Here is a list of ten common misunderstandings about this form and their clarifications:

- Only low-income individuals can file Form 14950. This form can be used by anyone who qualifies for the Premium Tax Credit, regardless of income, as long as they meet the necessary criteria.

- You do not need to report your health coverage if it was through your employer. You still need to provide necessary information from Forms 1095-B or 1095-C to verify your eligibility.

- If you didn't apply for Advanced Premium Tax Credit, you cannot use Form 14950. This is incorrect. You can still claim the Premium Tax Credit even if you didn't receive advance payments.

- Submitting Form 14950 is optional for everyone. If you are claiming the Premium Tax Credit and did not include Form 8962, you must submit Form 14950 to complete your application.

- You can send in any document proving your health insurance. Only specific documents listed in the instructions are acceptable for verifying your eligibility for the Premium Tax Credit.

- Once you submit Form 14950, you will definitely receive the Premium Tax Credit. Submission of the form does not guarantee the credit; your eligibility will be determined after review.

- You can ignore Form 8962 if there were no advance payments made on your behalf. It is still necessary to file Form 8962, whether or not advance payments were received.

- Form 14950 is only for individuals filing their taxes. This form can also apply to families when claiming the Premium Tax Credit for multiple policyholders.

- Forms 1095-A, 1095-B, and 1095-C are all the same. These forms serve different purposes and must be submitted according to your coverage situation.

- You can submit the documents later if you filed your tax return without them. Timely submission is crucial for processing; it is recommended to send the documents with the initial submission.

Addressing these misconceptions can ease the anxiety surrounding the completion and submission of Form 14950. Being well-informed helps ensure that you meet all requirements for the Premium Tax Credit.

Key takeaways

Eligibility Requirement: To claim the Premium Tax Credit, you must have purchased health insurance through a Health Insurance Marketplace. This includes plans from healthcare.gov or state exchanges. If you did not purchase insurance from these platforms, you are not eligible for the credit.

Documentation Needed: Gather all relevant documents before submitting the Form 14950. This includes your Form 8962 and Form 1095-A, as well as any correspondence from your insurance provider.

Updates and Corrections: If you find inaccuracies in the Form 8962 that you filed with your tax return, you must send an updated copy to ensure that the IRS has the correct information.

Advanced Premium Tax Credit (APTC): If you received APTC, filing Form 8962 is necessary. Make sure to check the income details in your 8962 closely; exceeding 400% of the Federal Poverty Line may result in having to repay any APTC received.

Proof of Payments: Provide documentation of your health insurance premium payments. Acceptable forms of proof include canceled checks, receipts, or bank statements that show direct payments to your insurance provider.

Browse Other Templates

What Alarms - Ensure you list the correct alarm location, including the street address and zip code.

Florida Vehicle Title Replacement - Gather all required documentation before submitting the application to expedite processing.