Fill Out Your Form

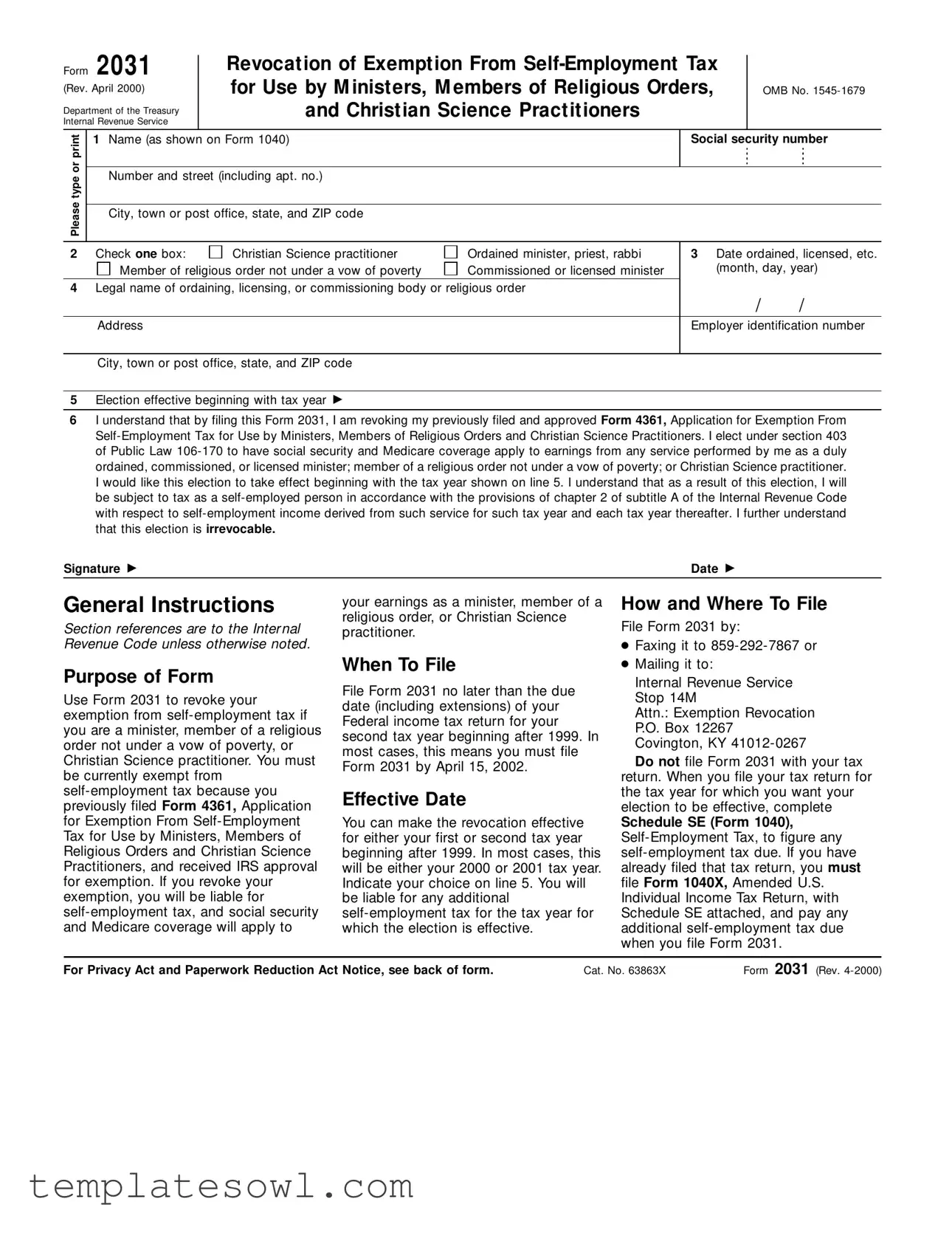

Form 2031, officially titled "Revocation of Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders, and Christian Science Practitioners," serves an essential purpose for certain religious figures. It allows individuals, who previously applied for and received exemption from self-employment tax using Form 4361, to revoke that exemption. This process is particularly relevant for ordained ministers, members of religious orders not under a vow of poverty, and Christian Science practitioners. By submitting Form 2031, these individuals can opt back into self-employment tax coverage, thereby becoming liable for self-employment tax on their earnings while gaining access to social security and Medicare benefits. The form requests information such as the individual's name, social security number, and details about their religious organization. It also requires a clear indication of the desired effective tax year for this revocation. Timing is crucial; the form must be filed no later than the due date of the individual's federal income tax return for the second tax year beginning after 1999, which would generally be by April 15, 2002. Detailed guidelines ensure that those submitting the form know exactly how to proceed and where to send it, thus facilitating a smooth transition back to being subject to self-employment tax.

Example

Form 2 0 3 1

(Rev. April 2000)

Department of the Treasury Internal Revenue Service

Revocation of Exemption From

OMB No.

Please type or print

1Name (as shown on Form 1040)

Number and street (including apt. no.)

City, town or post office, state, and ZIP code

Social security number

2 |

Check one box: |

Christian Science practitioner |

Ordained minister, priest, rabbi |

3 Date ordained, licensed, etc. |

|

|

Member of religious order not under a vow of poverty |

Commissioned or licensed minister |

(month, day, year) |

||

4 |

Legal name of ordaining, licensing, or commissioning body or religious order |

|

|

||

|

|

|

|

/ |

/ |

|

Address |

|

|

Employer identification number |

|

|

|

|

|

|

|

City, town or post office, state, and ZIP code

5Election effective beginning with tax year

6I understand that by filing this Form 2031, I am revoking my previously filed and approved Form 4361, Application for Exemption From

Signature |

Date |

General Instructions

SECTION REFERENCES ARE TO THE INTER NAL REVENUE CODE UNLESS OTHERWISE NOTED.

Purpose of Form

Use Form 2031 to revoke your exemption from

your earnings as a minister, member of a religious order, or Christian Science practitioner.

When To File

File Form 2031 no later than the due date (including extensions) of your Federal income tax return for your second tax year beginning after 1999. In most cases, this means you must file Form 2031 by April 15, 2002.

Effective Date

You can make the revocation effective for either your first or second tax year beginning after 1999. In most cases, this will be either your 2000 or 2001 tax year. Indicate your choice on line 5. You will be liable for any additional

How and Where To File

File Form 2031 by:

●Faxing it to

●Mailing it to:

Internal Revenue Service Stop 14M

Attn.: Exemption Revocation P.O. Box 12267 Covington, KY

Do not file Form 2031 with your tax return. When you file your tax return for the tax year for which you want your election to be effective, complete

Schedule SE (Form 1040),

For Privacy Act and Paperwork Reduction Act Notice, see back of form. |

Cat. No. 63863X |

Form 2031 (Rev. |

Form 2031 (Rev. |

Page 2 |

Specific Instructions

Enter your social security number as it appears on your social security card.

Line 3

Enter the date you were duly ordained, commissioned, or licensed as a minister of a church; the date you became a member of a religious order; or the date you began practice as a Christian Science practitioner. Members of religious orders who have taken a vow of poverty are not eligible to file this form.

Line 4

If you are a minister or belong to a religious order, enter the legal name, address, and employer identification number (EIN) of the denomination that ordained, commissioned, or licensed you, or the order to which you belong. You can obtain the EIN from the ordaining, licensing, or commissioning body or religious order.

Line 5

Enter the first tax year you want your election to be effective. If the first tax year is not a calendar year, enter the beginning and ending dates of that year. See Effective Date on page 1.

Line 6

Be sure to read line 6 carefully and sign and date the form. The IRS will date stamp and return a copy to you for your records.

Privacy Act and Paperwork Reduction Act Notice. Section 403 of Public Law

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law.

Generally, tax returns and return information are confidential, as stated in section 6103. However, section 6103 allows or requires the IRS to disclose such information to others. Routine disclosures of information on this form

include giving it to the Department of Justice for civil and criminal litigation, to the Social Security Administration for the administration of social security programs, and to cities, states, the District of Columbia, and U.S. commonwealths and possessions for use in the administration of their taxes.

Please keep this notice with your records. It may help you if we ask you for other information. If you have any questions about the rules for filing and giving information, please call or visit any Internal Revenue Service office.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated average time is:

Learning about the |

|

law or the form |

11 min. |

Preparing the form |

11 min. |

Copying, assembling, and |

|

sending the form to the IRS |

14 min. |

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. You can write to the Tax Forms Committee, Western Area Distribution Center, Rancho Cordova, CA

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | This form is used to revoke an exemption from self-employment tax for ministers, members of religious orders not under a vow of poverty, and Christian Science practitioners. |

| Governing Law | Section 403 of Public Law 106-170 outlines the rules for revoking the exemption from social security and Medicare coverage. |

| Filing Deadline | The form must be filed no later than the due date of your Federal income tax return for the second tax year beginning after 1999, typically by April 15, 2002. |

| Effective Date | You can choose to make the revocation effective for either your first or second tax year beginning after 1999, usually for the 2000 or 2001 tax year. |

| Signature Requirement | The form must be signed and dated by the applicant to ensure its validity and to maintain compliance with IRS regulations. |

Guidelines on Utilizing

Completing Form 2031 involves several critical steps to ensure accurate information is provided. After you fill out the form, submit it according to the provided instructions to the IRS. It's essential to pay close attention to each section for a smooth process.

- Begin by typing or printing your full name as shown on Form 1040 in the designated field.

- Provide your complete address, including the street number, apartment number (if applicable), city, state, and ZIP code.

- Enter your social security number carefully in the relevant space.

- Check one box to indicate your status: Christian Science practitioner, ordained minister, priest, rabbi, or member of a religious order not under a vow of poverty.

- Fill in the date you were ordained, licensed, or otherwise qualified (in month, day, year format).

- Provide the legal name, address, and employer identification number (EIN) of the religious body or order that ordained or licensed you.

- Indicate the tax year you want your election to be effective, following the instructions for line 5.

- Carefully read line 6, then sign and provide the date on which you are signing the form.

Once you complete these steps, submit the form via fax or mail as instructed. Ensure you retain a copy for your records, as the IRS will stamp and return another for your reference.

What You Should Know About This Form

What is Form 2031 used for?

Form 2031 is used by ministers, members of religious orders not under a vow of poverty, and Christian Science practitioners to revoke their exemption from self-employment tax. This form is necessary if you previously applied for and received an exemption using Form 4361. If this exemption is revoked, you will then be responsible for self-employment tax, and social security and Medicare will apply to your earnings from religious services.

When should I file Form 2031?

You must file Form 2031 no later than the due date of your Federal income tax return for the second tax year that begins after 1999. In most cases, this due date is April 15, 2002. This is critical for ensuring that your revocation becomes effective for the appropriate tax year.

How do I indicate the effective date for my revocation?

On line 5 of Form 2031, you need to specify which tax year the revocation takes effect. You can choose either your first or second tax year that begins after 1999, which typically equates to either the 2000 or 2001 tax year. Ensure that you clearly note your preference to avoid any confusion regarding your taxable status.

Where do I submit Form 2031?

Form 2031 should be submitted either by faxing it to 859-292-7867 or mailing it to the IRS at the following address: Internal Revenue Service, Stop 14M, Attn.: Exemption Revocation, P.O. Box 12267, Covington, KY 41012-0267. It is important to remember that you should not file Form 2031 with your tax return. Instead, any self-employment tax liabilities must be calculated using Schedule SE when you file your tax return for the relevant year.

What happens if I change my mind after filing Form 2031?

The election you make by filing Form 2031 is irrevocable. Once you revoke your exemption from self-employment tax, you cannot revert to your prior exempt status. This means that you will be required to pay self-employment taxes for the tax year indicated on the form and for all subsequent years. Make sure you fully understand your decision before submitting the form.

Common mistakes

Filling out Form 2031 can be a straightforward process, but many individuals make common mistakes that can lead to complications. One frequent error is failing to provide a complete social security number. Each applicant must ensure that their number appears exactly as it does on their social security card. Omitting any digits can delay processing and impact future tax obligations.

Another mistake lies in the selection process on line 2. Many individuals neglect to check the appropriate box indicating their status. Whether you are an ordained minister, a commissioned or licensed minister, or a Christian Science practitioner, it is critical to accurately identify yourself on the form. Inaccuracies here can lead to the IRS questioning your eligibility and potentially cause delays in processing.

Line 4 often becomes a source of confusion as well. Applicants must enter the legal name and the employer identification number (EIN) of their ordaining or licensing body. Failing to provide this information or providing incorrect details can hinder the IRS’s ability to verify your status. This verification process is essential in ensuring your application is legitimate and complete.

Another mistake is improperly indicating the effective date on line 5. Applicants might misinterpret which tax year they wish their election to take effect. It is crucial to double-check against the IRS guidelines to ensure the correct year is indicated. Choosing the wrong year may create complications with your tax filing status and obligations.

Lastly, many forget the importance of signing and dating the form. Line 6 requires a signature to validate the revocation of exemption. Neglecting to sign and date the form can lead to it being rejected or processed incorrectly. A simple yet critical step, this oversight can result in significant delays and confusion regarding your self-employment tax obligations. Always ensure that you complete every part of the form before submission, as each piece plays a role in the overall process.

Documents used along the form

When dealing with taxes, especially regarding self-employment for ministers and members of religious orders, several important forms and documents are necessary to ensure compliance with IRS regulations. The Form 2031 is specifically designed for revoking an exemption from self-employment tax, but it isn't the only document you might encounter in this process. Understanding these related forms can help clarify the requirements and responsibilities associated with this decision.

- Form 4361: This form serves as the initial application for exemption from self-employment tax for ministers, members of religious orders, and Christian Science practitioners. It's crucial for individuals seeking to exempt their earnings from self-employment tax to first file and receive approval for Form 4361 before subsequently considering a revocation.

- Form 1040: The U.S. Individual Income Tax Return, more commonly known as Form 1040, must be filed annually by individuals to report their income, claim deductions, and calculate the tax owed. For those who revoke their exemption status via Form 2031, this form becomes essential to report and pay the applicable self-employment tax.

- Schedule SE: This document is attached to Form 1040 for calculating self-employment tax. Individuals who have revoked their exemption will need to complete Schedule SE to determine their self-employment tax obligations arising from their earnings.

- Form 1040X: Known as the Amended U.S. Individual Income Tax Return, Form 1040X is used to correct previously filed tax returns. If someone has revoked their exemption and must pay additional self-employment tax for a past tax year, this form will allow them to report changes to their income and tax liabilities accordingly.

In summary, while Form 2031 is vital for revoking an exemption from self-employment tax, the other forms mentioned support the necessary reporting and payment processes. By familiarizing yourself with these documents, you can navigate the complexities of tax obligations with greater ease and accuracy.

Similar forms

- Form 4361: This is the Application for Exemption From Self-Employment Tax for Use by Ministers, Members of Religious Orders, and Christian Science Practitioners. Both forms deal with the self-employment tax exemption for religious individuals. Form 4361 grants the initial exemption, while Form 2031 serves to revoke it.

- Form 1040: This is the U.S. Individual Income Tax Return. While Form 2031 is used to revoke the exemption status, Form 1040 is where individuals report their overall income and associated taxes, including any self-employment taxes arising from the revocation.

- Schedule SE (Form 1040): This schedule is used to calculate Self-Employment Tax. After revoking the exemption, individuals must use Schedule SE to determine their tax liability based on self-employment income, much like the purpose of Form 2031 which initiates that process.

- Form 1040X: This is the Amended U.S. Individual Income Tax Return. If someone has already filed their tax return but needs to adjust it because of the revocation under Form 2031, they would file Form 1040X to reflect the new tax obligations.

- Form SS-4: This is the Application for Employer Identification Number. For individuals who may need a new EIN after revoking their exemption, Form SS-4 serves as the means to obtain it, similar to how Form 2031 involves important identification elements related to tax status.

Dos and Don'ts

Things to Do:

- Type or print your information clearly to avoid processing delays.

- Double-check your social security number for accuracy.

- Enter the correct date of your ordination or licensing as specified in the prompt.

- Provide the legal name and EIN of your ordaining body without missing any details.

- Sign and date the form where required to ensure it is valid.

- File the form by the deadline to ensure timely processing.

- Keep a copy of the submitted form for your records.

Things Not to Do:

- Do not leave any fields blank; all requested information is necessary.

- Do not submit the form with your tax return; file it separately.

- Do not use a different name format than what is on Form 1040.

- Do not assume the form is filed unless you receive confirmation from the IRS.

- Do not provide false information; this could lead to penalties.

- Do not miss the filing deadline, as this can lead to complications.

- Do not send the form to addresses other than those specified for filing.

Misconceptions

- Filing Form 2031 means you can change your mind later. Once you file Form 2031, the election to revoke your exemption from self-employment tax is irrevocable. This means you cannot revert back to your previous status.

- All ministers can use Form 2031. Not every minister is eligible. Specifically, members of religious orders who have taken a vow of poverty cannot file this form.

- Form 2031 is filed with your tax return. This is incorrect. You must file Form 2031 separately and not with your tax return. Be sure to follow the instructions to avoid processing issues.

- The effective date is always the same for everyone. You have the option to choose the effective date for your revocation. It can be for the first or second tax year beginning after 1999.

- By revoking your exemption, you lose all Medicare and Social Security benefits. While revoking the exemption requires you to pay self-employment tax, it allows you to gain Medicare and Social Security coverage for your earnings as a minister or practitioner.

- Filing does not require personal information. You are required to provide your social security number and other identifying details to process the form. This information ensures compliance with tax laws.

- Once filed, there are no further tax responsibilities. After revoking your exemption, you are responsible for any self-employment tax related to your income in the tax year that the revocation takes effect.

Key takeaways

Form 2031 is used to revoke your exemption from self-employment tax if you are a duly ordained minister, a member of a religious order not under a vow of poverty, or a Christian Science practitioner. Submit the form only if you previously filed Form 4361 and received IRS approval for the exemption.

Understand that once you file Form 2031, you will be liable for self-employment tax moving forward. This decision will subject your earnings from relevant services to social security and Medicare coverage.

File Form 2031 by the deadline, which typically falls on April 15, 2002, for most individuals. Ensure it is submitted no later than the due date of your Federal income tax return for the second year beginning after 1999.

When filling out the form, indicate the first tax year you want the revocation to be effective. This decision is crucial as it affects your tax obligations for that period.

You may file the form either by faxing it to the specified IRS number or mailing it to the designated address in Covington, KY. Do not include this form with your tax return.

If you have already filed your tax return for the year in which the revocation takes effect, you must submit an amended return, Form 1040X, along with any necessary schedules and additional self-employment tax due.

The IRS requires your social security number to process Form 2031. Enter it exactly as it appears on your social security card to avoid complications.

Lastly, remember that this revocation is irrevocable. Once you make this choice, you cannot go back to your previous exempt status. Carefully consider all implications prior to proceeding.

Browse Other Templates

H and R Block Brampton - Report any gambling winnings or losses relevant to your tax return.

Fsbp - Include your full name and date of birth clearly on the form.

Vehicle Maintenance Record Template - Record essential maintenance details for your vehicle.