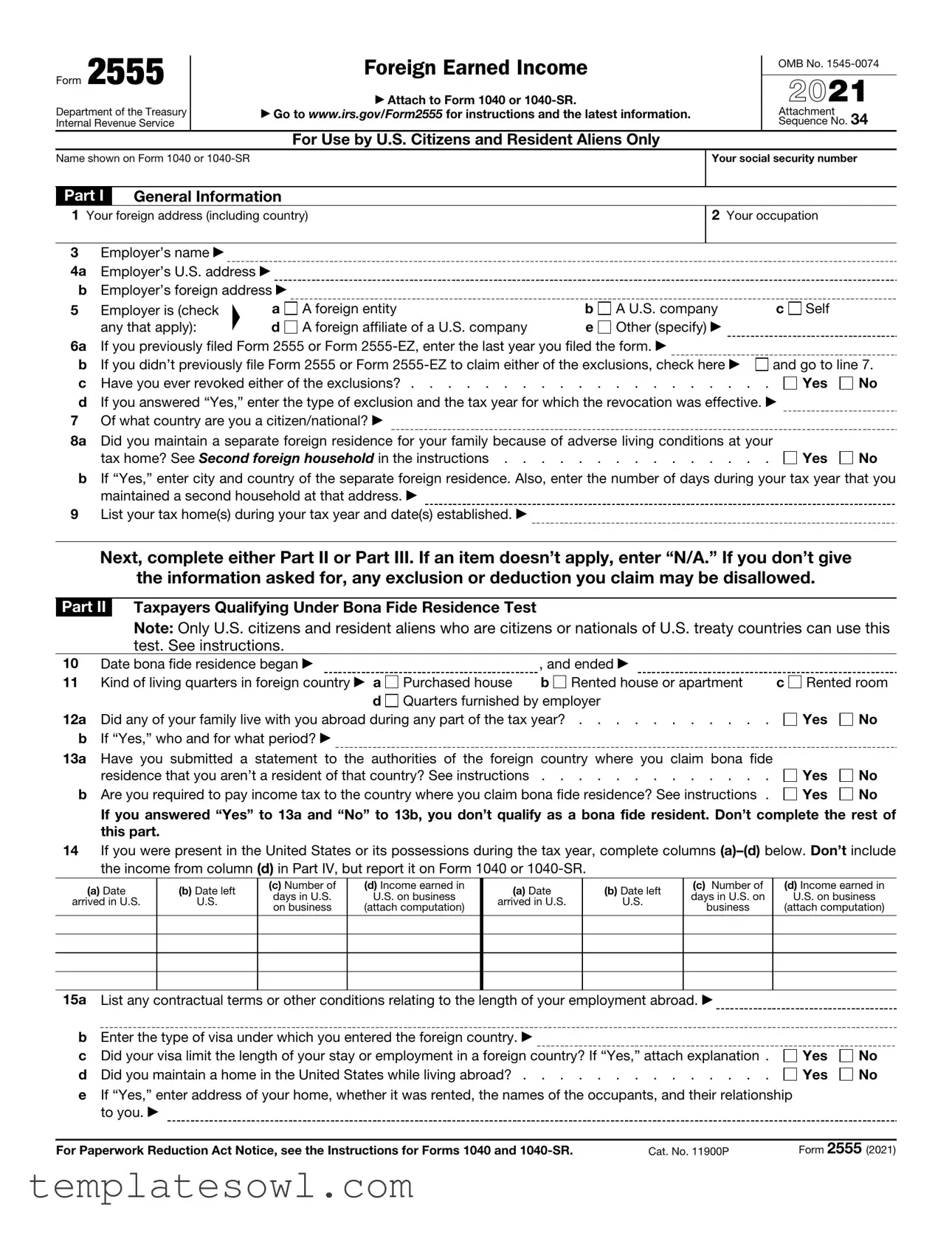

Fill Out Your 2155 Form

The Form 2555 is an essential document for U.S. citizens and resident aliens earning income abroad. This form allows eligible taxpayers to claim foreign earned income exclusions, which can significantly reduce taxable income. Understanding the details of this form is crucial for those who live and work outside the United States, as it encompasses various aspects of their foreign residency and employment. The form is organized into specific sections, requiring information about personal details, foreign addresses, and the nature of one’s employment. Taxpayers must also provide information about their residency status—whether they qualify under the bona fide residence test or the physical presence test. Additionally, income earned while working abroad, along with any allowable housing deductions, must be meticulously reported on Form 2555. By properly completing this form, individuals can take advantage of substantial tax benefits, enabling them to manage their finances more effectively while living overseas. Navigating the requirements can seem daunting, but with the right information and guidance, taxpayers can ensure compliance while maximizing their benefits.

2155 Example

Form 2555

Department of the Treasury Internal Revenue Service

Foreign Earned Income

▶Attach to Form 1040 or

▶Go to www.irs.gov/Form2555 for instructions and the latest information.

For Use by U.S. Citizens and Resident Aliens Only

OMB No.

2021

Attachment 34 Sequence No.

Name shown on Form 1040 or

Part I General Information

1Your foreign address (including country)

Your social security number

2Your occupation

3

4a b 5

6a b c d 7 8a

b

9

Employer’s name ▶ |

|

|

|

|

|

|

|

Employer’s U.S. address ▶ |

|

|

|

|

|

|

|

Employer’s foreign address ▶ |

|

|

|

|

|

||

Employer is (check |

▲ |

a |

A foreign entity |

b |

A U.S. company |

c Self |

|

any that apply): |

d |

A foreign affiliate of a U.S. company |

e |

Other (specify) ▶ |

|

|

|

If you previously filed Form 2555 or Form |

|

|

|||||

If you didn’t previously file Form 2555 or Form |

and go to line 7. |

||||||

Have you ever revoked either of the exclusions? |

Yes |

No |

|||||

If you answered “Yes,” enter the type of exclusion and the tax year for which the revocation was effective. ▶ |

|

||||||

Of what country are you a citizen/national? ▶ |

|

|

|

|

|||

Did you maintain a separate foreign residence for your family because of adverse living conditions at your |

|

|

|||||

tax home? See Second foreign household in the instructions |

Yes |

No |

|||||

If “Yes,” enter city and country of the separate foreign residence. Also, enter the number of days during your tax year that you maintained a second household at that address. ▶

List your tax home(s) during your tax year and date(s) established. ▶

Next, complete either Part II or Part III. If an item doesn’t apply, enter “N/A.” If you don’t give

the information asked for, any exclusion or deduction you claim may be disallowed.

Part II Taxpayers Qualifying Under Bona Fide Residence Test

Note: Only U.S. citizens and resident aliens who are citizens or nationals of U.S. treaty countries can use this test. See instructions.

10 |

Date bona fide residence began ▶ |

, and ended ▶ |

|

|

|

11 |

Kind of living quarters in foreign country ▶ a Purchased house |

b Rented house or apartment |

c |

Rented room |

|

|

d Quarters furnished by employer |

|

|

|

|

12a |

Did any of your family live with you abroad during any part of the tax year? |

|

Yes |

No |

|

bIf “Yes,” who and for what period? ▶

13a Have you submitted a statement to the authorities of the foreign country where you claim bona fide |

|

|

residence that you aren’t a resident of that country? See instructions |

Yes |

No |

b Are you required to pay income tax to the country where you claim bona fide residence? See instructions . |

Yes |

No |

If you answered “Yes” to 13a and “No” to 13b, you don’t qualify as a bona fide resident. Don’t complete the rest of this part.

14If you were present in the United States or its possessions during the tax year, complete columns

(a)Date

arrived in U.S.

(b)Date left U.S.

(c)Number of days in U.S. on business

(d)Income earned in U.S. on business

(attach computation)

(a)Date

arrived in U.S.

(b)Date left U.S.

(c)Number of days in U.S. on

business

(d)Income earned in U.S. on business

(attach computation)

15a |

List any contractual terms or other conditions relating to the length of your employment abroad. ▶ |

|

|

b Enter the type of visa under which you entered the foreign country. ▶ |

|

|

|

c |

Did your visa limit the length of your stay or employment in a foreign country? If “Yes,” attach explanation . |

Yes |

No |

d |

Did you maintain a home in the United States while living abroad? |

Yes |

No |

eIf “Yes,” enter address of your home, whether it was rented, the names of the occupants, and their relationship to you. ▶

For Paperwork Reduction Act Notice, see the Instructions for Forms 1040 and |

Cat. No. 11900P |

Form 2555 (2021) |

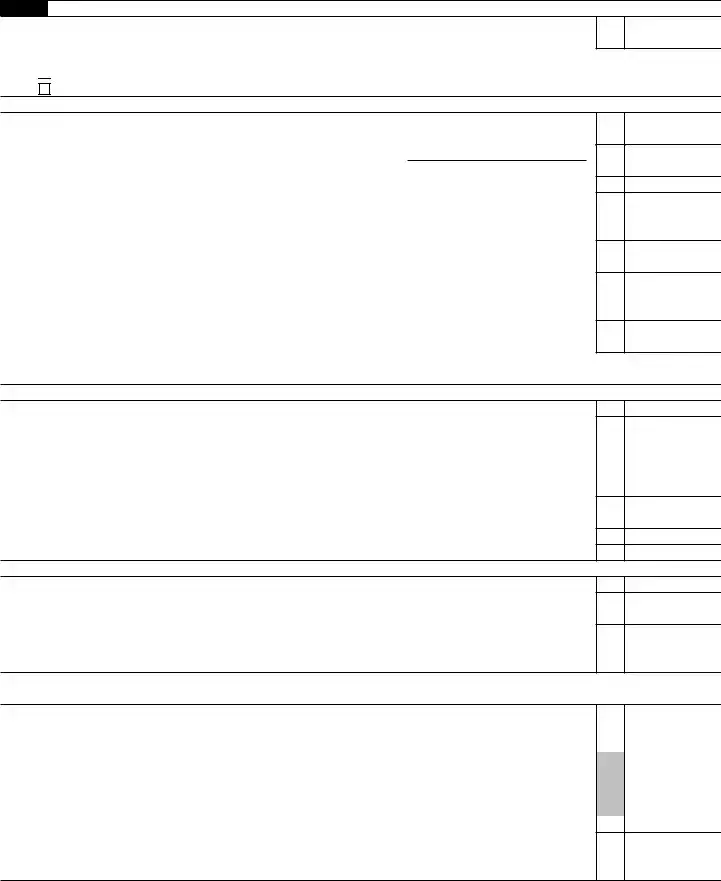

Form 2555 (2021) |

Page 2 |

|

Part III |

Taxpayers Qualifying Under Physical Presence Test |

|

|

Note: U.S. citizens and all resident aliens can use this test. See instructions. |

|

16 The physical presence test is based on the |

through ▶ |

|

17Enter your principal country of employment during your tax year. ▶

18If you traveled abroad during the

(a) Name of country |

(b) Date arrived |

(c) Date left |

(d) Full days |

(e) Number of |

(f) Income earned in U.S. |

|

present in |

days in U.S. |

on business (attach |

||||

(including U.S.) |

||||||

|

|

country |

on business |

computation) |

||

|

|

|

Part IV All Taxpayers

Note: Enter on lines 19 through 23 all income, including noncash income, you earned and actually or constructively received during your 2021 tax year for services you performed in a foreign country. If any of the foreign earned income received this tax year was earned in a prior tax year, or will be earned in a later tax year (such as a bonus), see the instructions. Don’t include income from line 14, column (d), or line 18, column (f). Report amounts in U.S. dollars, using the exchange rates in effect when you actually or constructively received the income.

If you are a cash basis taxpayer, report on Form 1040 or

|

2021 Foreign Earned Income |

Amount |

|

(in U.S. dollars) |

|

|

|

|

|

|

|

19 |

Total wages, salaries, bonuses, commissions, etc |

19 |

20 |

Allowable share of income for personal services performed (see instructions): |

|

a |

In a business (including farming) or profession |

20a |

b In a partnership. List partnership’s name and address and type of income. ▶ |

|

|

|

|

20b |

21Noncash income (market value of property or facilities furnished by

a |

Home (lodging) |

21a |

b |

Meals |

21b |

c |

Car |

21c |

dOther property or facilities. List type and amount. ▶

21d

22Allowances, reimbursements, or expenses paid on your behalf for services you performed:

a |

Cost of living and overseas differential |

22a |

b |

Family |

22b |

c |

Education |

22c |

d |

Home leave |

22d |

e |

Quarters |

22e |

fFor any other purpose. List type and amount. ▶

22f

g Add lines 22a through 22f . . . . . . . . . . . . . . . . . . . . . . . . . 22g

23Other foreign earned income. List type and amount. ▶

23

24 |

Add lines 19 through 21d, line 22g, and line 23 |

24 |

25 |

Total amount of meals and lodging included on line 24 that is excludable (see instructions) . . . . |

25 |

26 |

Subtract line 25 from line 24. Enter the result here and on line 27 on page 3. This is your 2021 foreign |

|

|

earned income . . . . . . . . . . . . . . . . . . . . . . . . . . . . ▶ |

26 |

Form 2555 (2021)

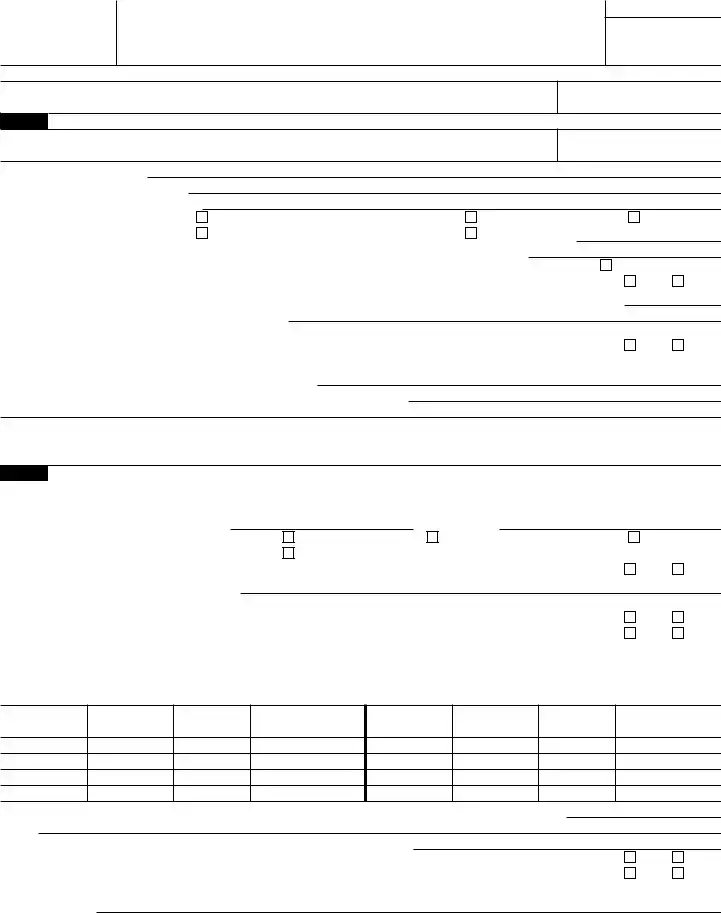

Form 2555 (2021) |

Page 3 |

Part V All Taxpayers

27 Enter the amount from line 26 . . . . . . . . . . . . . . . . . . . . . . . .

Are you claiming the housing exclusion or housing deduction?

Yes. Complete Part VI.

Yes. Complete Part VI.

No. Go to Part VII.

Part VI Taxpayers Claiming the Housing Exclusion and/or Deduction

27

28 |

Qualified housing expenses for the tax year (see instructions) |

28 |

||

29a |

Enter location where housing expenses incurred. See instructions. ▶ |

|

|

|

b |

Enter limit on housing expenses. See instructions |

29b |

||

30 |

Enter the smaller of line 28 or line 29b |

30 |

||

31 |

Number of days in your qualifying period that fall within your 2021 tax year |

|

|

|

|

(see instructions) |

31 |

days |

|

32 |

Multiply $47.65 by the number of days on line 31. If 365 is entered on line 31, enter $17,392 here . . |

32 |

||

33Subtract line 32 from line 30. If the result is zero or less, don’t complete the rest of this part or any of

|

Part IX |

. . . . . . . |

33 |

|

34 |

Enter |

34 |

|

|

35Divide line 34 by line 27. Enter the result as a decimal (rounded to at least three places), but don’t

enter more than “1.000” |

35 |

36Housing exclusion. Multiply line 33 by line 35. Enter the result but don’t enter more than the amount

on line 34. Also, complete Part VIII . . . . . . . . . . . . . . . . . . . . . ▶ |

36 |

Note: The housing deduction is figured in Part IX. If you choose to claim the foreign earned income exclusion, complete Parts VII and VIII before Part IX.

.

Part VII Taxpayers Claiming the Foreign Earned Income Exclusion

37 |

Maximum foreign earned income exclusion. Enter $108,700 |

. |

37 |

|||

38 |

• If you completed Part VI, enter the number from line 31. |

} |

|

|

|

|

|

• All others, enter the number of days in your qualifying period that fall |

38 |

days |

|

||

|

within your 2021 tax year. See the instructions for line 31. |

|

|

|

|

|

39 |

• If line 38 and the number of days in your 2021 tax year (usually 365) are the same, enter “1.000.” |

} |

|

|||

|

• Otherwise, divide line 38 by the number of days in your 2021 tax year and enter the result as a |

39 |

||||

|

decimal (rounded to at least three places). |

|

|

|

|

|

40 |

Multiply line 37 by line 39 |

. |

40 |

|||

41 |

Subtract line 36 from line 27 |

. |

41 |

|||

42 |

Foreign earned income exclusion. Enter the smaller of line 40 or line 41. Also, complete Part VIII . . |

▶ |

42 |

|||

Part VIII Taxpayers Claiming the Housing Exclusion, Foreign Earned Income Exclusion, or Both

.

43 Add lines 36 and 42 . . . . . . . . . . . . . . . . . . . . . . . . . . .

44Deductions allowed in figuring your adjusted gross income (Form 1040 or

45Subtract line 44 from line 43. Enter the result here and in parentheses on Schedule 1 (Form 1040), line 8d. Complete the Foreign Earned Income Tax Worksheet in the Instructions for Forms 1040 and

43

44

45

Part IX Taxpayers Claiming the Housing

(b)line 27 is more than line 43.

46 |

Subtract line 36 from line 33 |

46 |

47 |

Subtract line 43 from line 27 |

47 |

48 |

Enter the smaller of line 46 or line 47 |

48 |

|

Note: If line 47 is more than line 48 and you couldn’t deduct all of your 2020 housing deduction |

|

|

because of the 2020 limit, use the Housing Deduction Carryover Worksheet in the instructions to |

|

|

figure the amount to enter on line 49. Otherwise, go to line 50. |

|

49Housing deduction carryover from 2020 (from the Housing Deduction Carryover Worksheet in the

instructions) |

49 |

50Housing deduction. Add lines 48 and 49. Enter the total here and on Schedule 1 (Form 1040), line 24j. Complete the Foreign Earned Income Tax Worksheet in the Instructions for Forms 1040 and

50 |

Form 2555 (2021)

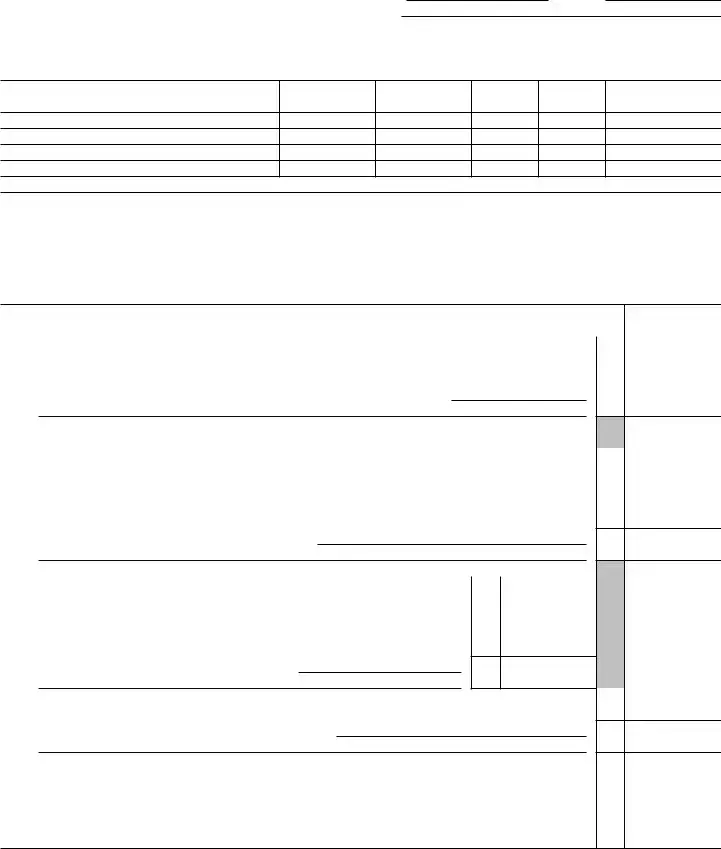

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | Form 2555 is used by U.S. citizens and resident aliens to report foreign earned income and to claim the foreign earned income exclusion. |

| Governing IRS Regulations | This form is governed by federal tax laws outlined by the Internal Revenue Service (IRS), specifically under Title 26 of the U.S. Code. |

| Eligibility Criteria | Eligible individuals include U.S. citizens and resident aliens living abroad who meet specific conditions related to their foreign earnings. |

| Filing Requirement | Form 2555 must be attached to either Form 1040 or Form 1040-SR when filing for the tax year. |

| Physical Presence Test | The form allows taxpayers to qualify for the foreign earned income exclusion based on either the Bona Fide Residence Test or the Physical Presence Test. |

| Foreign Address | Taxpayers must provide their foreign address, including the country, which is crucial for determining eligibility and exclusions. |

| Claim Limits | For the year 2021, the maximum foreign earned income exclusion amount is $108,700, which may be adjusted in future tax years. |

Guidelines on Utilizing 2155

Completing the Form 2555 is an essential step for U.S. citizens and resident aliens who earn income abroad. This form is attached to your tax return, and it helps in claiming certain exclusions related to foreign earned income. To begin, gather the necessary information about your foreign employment, living arrangements, and any income earned during the tax year. Moreover, ensure your details on Form 1040 or 1040-SR are accurate and prepared for attachment.

- Fill in your personal information: Write your name exactly as it appears on Form 1040 or 1040-SR. Provide your foreign address, social security number, and occupation.

- Employer information: Include your employer’s name, both U.S. and foreign addresses. Check the box that corresponds to the type of employer you have (foreign entity, U.S. company, self-employed, etc.).

- Prior filings: If you previously filed Form 2555 or 2555-EZ, indicate the last year you submitted it. If not, check the appropriate box and move to the next question about exclusions.

- Citizenship: Enter the country of which you are a citizen or national. Confirm if you maintained a separate foreign residence for your family and provide the relevant city, country, and number of days spent there.

- Tax homes: List any tax homes you had during the tax year along with the dates you established them.

- Complete either Part II or Part III: Depending on which residency test applies to you—bona fide residence or physical presence—fill out the relevant section. Ensure you answer all questions accurately and mark “N/A” for items that don't apply.

- Gather foreign income details: In Part IV, report all income earned in foreign countries, ensuring it’s in U.S. dollars. List wages, salaries, and any noncash income received.

- Calculate earnings: Add up all income from Part IV, and then determine any excludable amounts related to meals and lodging.

- Complete the housing exclusion or deduction portion: If applicable, fill out Part VI regarding housing expenses, and provide the necessary calculations.

- Claiming foreign earned income exclusion: Following completion of Part VII, enter the calculated amounts for either housing or foreign earned income exclusion as required.

- Final review and attachments: Double-check all entered information for accuracy. Make certain to attach Form 2555 to your Form 1040 or 1040-SR before submission.

What You Should Know About This Form

What is Form 2555 and who needs to file it?

Form 2555, titled Foreign Earned Income, is used by U.S. citizens and resident aliens to report income earned while working abroad. This form allows you to claim either a foreign earned income exclusion or a housing exclusion or deduction. If you reside and work in a foreign country and earn income there, you will likely need to file this form along with your annual income tax return (Form 1040 or 1040-SR).

What information do I need to provide when filling out Form 2555?

To successfully complete Form 2555, you will need various personal and financial details. This includes your foreign address, occupation, social security number, and the specifics of your employment abroad. You will also need to indicate whether your employer is a foreign entity, a U.S. company, or if you are self-employed. Additionally, information about your residence, family status while living abroad, and your foreign income must be disclosed. Failure to provide all required information could jeopardize your eligibility for the exclusions or deductions.

How do I qualify for the foreign earned income exclusion?

Qualification for the foreign earned income exclusion can be achieved through one of two tests: the bona fide residence test or the physical presence test. The bona fide residence test is for U.S. citizens who are residents of a foreign country and should show that you have established a permanent home there. Alternatively, the physical presence test is based on being physically present in a foreign country for at least 330 full days during any 12-month period. Understanding your eligibility is crucial, as it determines the benefits you may claim on your tax return.

What should I do if I am not sure whether to file Form 2555?

If you are uncertain about whether to file Form 2555, consider the nature of your residency and income situation. If you have lived and earned income abroad during the tax year, it may be beneficial to consult with a tax professional who understands international tax laws. They can provide guidance specific to your circumstances and help ensure that you comply with U.S. tax obligations while maximizing any potential benefits available to you for foreign earned income.

Common mistakes

Completing IRS Form 2555 can be a complex process, and many individuals make common mistakes that can lead to delays or even disallowance of claims. Recognizing these pitfalls can help ensure a smoother filing experience.

One frequent mistake is not providing complete and accurate information about the foreign address. Leaving out important details, like the country, can lead to confusion. It's essential to double-check that all addresses are correct, as errors can impede the IRS's ability to process your form effectively.

Another common error is failing to complete the right part of the form. Taxpayers must choose between the Bona Fide Residence Test and the Physical Presence Test, depending on their situation. Skipping this determination can result in filing the incorrect sections, often leading to potential denial of any exclusions claimed.

Some people neglect to document their income correctly. When reporting income on Form 2555, all earnings must be expressed in U.S. dollars. If you're unaware of the exchange rates in effect at the time the income was received, you could misreport your earnings. This mistake not only affects the accuracy of your form but may also raise flags with the IRS.

Furthermore, failing to check boxes associated with previous exclusions is another critical error. If applying for exclusions that were previously revoked, you must clearly indicate this on the form. Incomplete or unclear responses can lead to misunderstanding and possibly deny your claims.

Inaccurate reporting of travel days within the U.S. can also be problematic. Under Part IV, taxpayers need to accurately list their days spent in the U.S., including any business days. An incorrect count can lead to complications or challenges when the IRS reviews your eligibility for the foreign earned income exclusion.

Lastly, many overlook the importance of strictly following instructions for each section of the form. The IRS provides detailed guidelines for completing Form 2555, and not adhering closely to these can result in omissions or incorrect claims. Following the instructions accurately can help reduce errors and improve your chances of obtaining the exclusions you are entitled to.

Awareness of these common mistakes can greatly assist individuals in filling out Form 2555 correctly. Taking the time to be thorough, double-check your entries, and ensure that every section is complete may prevent issues down the road. This diligence can facilitate a smoother filing process and contribute to the overall accuracy of your tax return.

Documents used along the form

The completion of Form 2555 is often accompanied by a variety of other documents that support the taxpayer's claims regarding foreign earned income. Each of these documents serves a distinct purpose and provides necessary information for the IRS to assess eligibility for exclusions or deductions. Below is a list of commonly used forms and documents that may accompany Form 2555.

- Form 1040: This is the standard individual income tax return form. Taxpayers report their total income, claim tax deductions, and determine their overall tax liability.

- Form 1040-SR: Similar to Form 1040 but designed for seniors aged 65 and older. It features a larger font and simplified instructions.

- Form 2555-EZ: This simplified version of Form 2555 can be used by qualified taxpayers who meet specific criteria. It streamlines the process and minimizes the required information.

- Form 8938: The Statement of Specified Foreign Financial Assets is required for certain taxpayers with foreign bank accounts or investments above specific thresholds.

- Form 4868: This form requests an automatic extension of time to file a U.S. individual income tax return, allowing taxpayers more time to finalize their financial details.

- Foreign Tax Credit Documentation: Taxpayers may need to attach information on taxes paid to foreign governments to apply for a foreign tax credit, mitigating double taxation.

- Housing Exclusion Spreadsheets: These detail qualifying housing expenses claimed by taxpayers who qualify for a housing exclusion or deduction. They provide specific amounts and locations incurred.

- Visa/Residency Documentation: Documents proving legal residency or visa status in a foreign country help establish eligibility for specific exclusions under the foreign earned income provisions.

- Employment Verification Letters: Letters from employers confirming the taxpayer’s employment abroad can assist in corroborating the details reported on Form 2555.

It is crucial to prepare these documents accurately and timely, as they play an essential role in substantiating claims made on Form 2555. Ensuring all required documentation is in order may expedite the processing of the tax return and reduce the likelihood of inquiries from the IRS.

Similar forms

Form 2555-EZ: This form is a simpler alternative for U.S. citizens or resident aliens who meet specific criteria to claim the foreign earned income exclusion. Like Form 2555, it requires information about foreign earned income but has fewer lines and less complex reporting requirements.

Form 1040: This is the main individual income tax return form for U.S. taxpayers. Both Form 2555 and Form 1040 need to be filed together for those claiming foreign earned income exclusions, as 2555 is attached to 1040.

Form 1040-SR: Designed for seniors, this form serves as another version for filing individual income tax returns. Similar to Form 1040, it allows the attachment of Form 2555 for reporting foreign income.

Form 8938: This form is used to report specified foreign financial assets. Just like Form 2555, it is intended for U.S. citizens and resident aliens and emphasizes the requirement to report income and assets abroad.

Schedule A (Form 1040): Used to itemize deductions, this schedule can be used by individuals, including those filing Form 2555, to report various deductions for tax purposes, enhancing the overall tax return.

Form 4868: This form allows taxpayers to request an extension of time to file their tax returns. Even those filing Form 2555 can benefit from this extension, ensuring they have ample time to gather necessary documentation.

Form 8889: This form is for reporting Health Savings Accounts (HSAs). It parallels Form 2555 in that both address financial reporting but cater to different aspects of tax liabilities and benefits.

Form 1116: This form is used to claim the foreign tax credit, which can also relate to Form 2555 when dealing with foreign earned income. Both forms serve to avoid double taxation on income earned abroad.

Form 8938 (FATCA): This form is a requirement under the Foreign Account Tax Compliance Act (FATCA). Similar to Form 2555, it focuses on U.S. taxpayers with foreign financial interests, helping to disclose required information to the IRS.

Dos and Don'ts

When filling out Form 2555, careful attention to detail is essential. Here’s a practical guide on what you should and shouldn’t do:

- Do ensure that your name matches exactly as shown on Form 1040 or 1040-SR.

- Do provide your complete foreign address, including the country.

- Do disclose all foreign earned income accurately, reporting it in U.S. dollars.

- Do check your eligibility for exclusivity on foreign earned income, either under bona fide residence or physical presence tests.

- Do indicate whether you have maintained a separate foreign residence for your family, especially under adverse conditions.

- Don't leave any sections blank. If something doesn’t apply, write “N/A”.

- Don't forget to sign and date the form before submission, as an unsigned form is invalid.

- Don't report income from U.S. sources on this form; focus only on foreign income.

- Don't use different currency conversions for the same income figures; stick to the exchange rates effective at the time you received the income.

- Don't underestimate the importance of documentation; keep copies of your submitted form and any supporting materials for your records.

Being meticulous while completing Form 2555 can help facilitate your claims for exclusions and deductions. Double-check your information to minimize the risk of errors.

Misconceptions

When navigating forms and tax regulations, misunderstandings are common. Here are nine misconceptions regarding Form 2555, often referred to as the Foreign Earned Income form:

- Only expatriates need to file the 2555. Many believe that only those who permanently live abroad can or should file this form. In reality, U.S. citizens and resident aliens can file it even if they are temporarily working overseas.

- Form 2555 guarantees a tax refund. While filing this form may allow taxpayers to exclude certain foreign earned income from U.S. taxation, it does not guarantee a refund. The amount of tax owed or refunded relies on various factors including total income and deductions.

- The only eligibility requirement is overseas residency. Some assume that simply living abroad qualifies them for the benefits of Form 2555. In fact, individuals must also meet either the bona fide residence test or the physical presence test to be eligible.

- Income earned while traveling on business is always excluded. This misconception arises from a misunderstanding of how income is categorized. Income earned during international business travel may not qualify for exclusion; it depends on the specifics of the situation.

- The form is unnecessary if earning below a certain income threshold. Even if your income is below the exclusion threshold, filing could still be advantageous for claiming other deductions or credits. Therefore, it's crucial to assess individual circumstances.

- Residents of U.S. territories do not need to file the form. People often think that residency in U.S. territories like Puerto Rico exempts them from needing to file. However, U.S. territories have different tax rules, and details should be reviewed accordingly.

- Once the form is filed, it does not need to be updated. This notion is misleading. If circumstances change, such as a change in residency status or income changes, taxpayers are required to update, amend, or file accordingly.

- All foreign income is automatically exempt. It’s a common belief that all income earned outside of the U.S. is exempt simply by filing Form 2555. However, only qualifying foreign earned income can be excluded, and this is defined precisely within the instructions.

- Adverse living conditions guarantee approval. While certain adverse living situations can impact the ability to claim exclusions, they alone do not guarantee approval. Approval depends on meticulously meeting all criteria set forth by the IRS.

Understanding these misconceptions is vital for ensuring compliance and optimizing eligible benefits. It’s advisable to keep informed and seek guidance if uncertainties arise regarding the form and its requirements.

Key takeaways

Filling out the 2155 Form can be an essential step for U.S. citizens and resident aliens working abroad. Understanding its components will streamline the process and help ensure compliance with tax regulations. Here are key takeaways for effectively completing and utilizing this form:

- Identify Eligibility: Only U.S. citizens and resident aliens can use the Form 2555. Additionally, there are specific criteria depending on whether you use the bona fide residence or physical presence tests.

- Gather Required Information: Have your foreign address, social security number, and details about your employment handy. Failure to provide complete information may lead to disallowance of exclusions or deductions.

- Understand the Parts: Form 2555 has multiple sections, including those for general information, exclusions, and deductions. Carefully complete each relevant portion.

- Convert Foreign Income: Report foreign earned income in U.S. dollars, using the exchange rates applicable when you received the income. This is crucial for accurate reporting and compliance.

- Claim Exclusions Wisely: If you qualify, consider claiming the foreign earned income exclusion and the housing exclusion. Make sure to fill out the corresponding sections correctly to maximize your benefits.

- Consult Official Resources: Refer to the IRS website for the latest guidance related to Form 2555. Staying informed about changes can help avoid potential pitfalls.

Using these insights will assist in navigating the requirements of Form 2555 smoothly. Pay attention to details, as accurate completion can lead to significant tax benefits for expatriates.

Browse Other Templates

Green Card Affidavit of Support - Submitting the I-864A is part of a broader strategy in seeking immigration benefits.

Publix Scholarships - Your reimbursement will be subject to federal and state taxes.