Fill Out Your 2407 Pa Form

The 2407 Pa form is a crucial document for individuals who are contemplating the replacement of their existing life insurance or annuity coverage. Issued by the Baltimore Life Insurance Company, this form serves as an important notice that underscores the responsibilities both of the applicant and the insurer in such a transition. When someone expresses the intention to switch their coverage, the form provides essential guidance for making an informed decision. It emphasizes the importance of understanding the current insurance scenario in comparison to the proposed policy, including potential benefits and drawbacks.

One major aspect detailed within the form is the recommendation for applicants to gather comprehensive information from their existing insurance provider before moving forward with a new policy. This may include considerations such as possible advantages of the current policy, including established cash values and dividend accruals, as opposed to the immediate costs and conditions associated with a new policy. The document also brings attention to the possibility of higher premiums in a new policy due to the age of the applicant; these elements can significantly impact long-term financial planning.

Furthermore, the 2407 Pa form addresses the implications of existing policies that may contain certain guarantees or options not available in the proposed coverage. Another critical element is the 20-day review period that allows applicants to assess the newly issued policy. During this time, they have the option to cancel the new policy should it not meet their expectations or financial needs. This ensures that individuals can make choices that protect their interests without rushing into a decision.

As part of the overall process, the form must be shared with the applicant, their existing insurer, and the Baltimore Life Insurance Company's home office, ensuring transparency and clarity. The importance of this form lies in its ability to equip individuals with the necessary information to navigate the often complex landscape of life insurance replacement, ultimately guiding them toward informed choices regarding their financial security and peace of mind.

2407 Pa Example

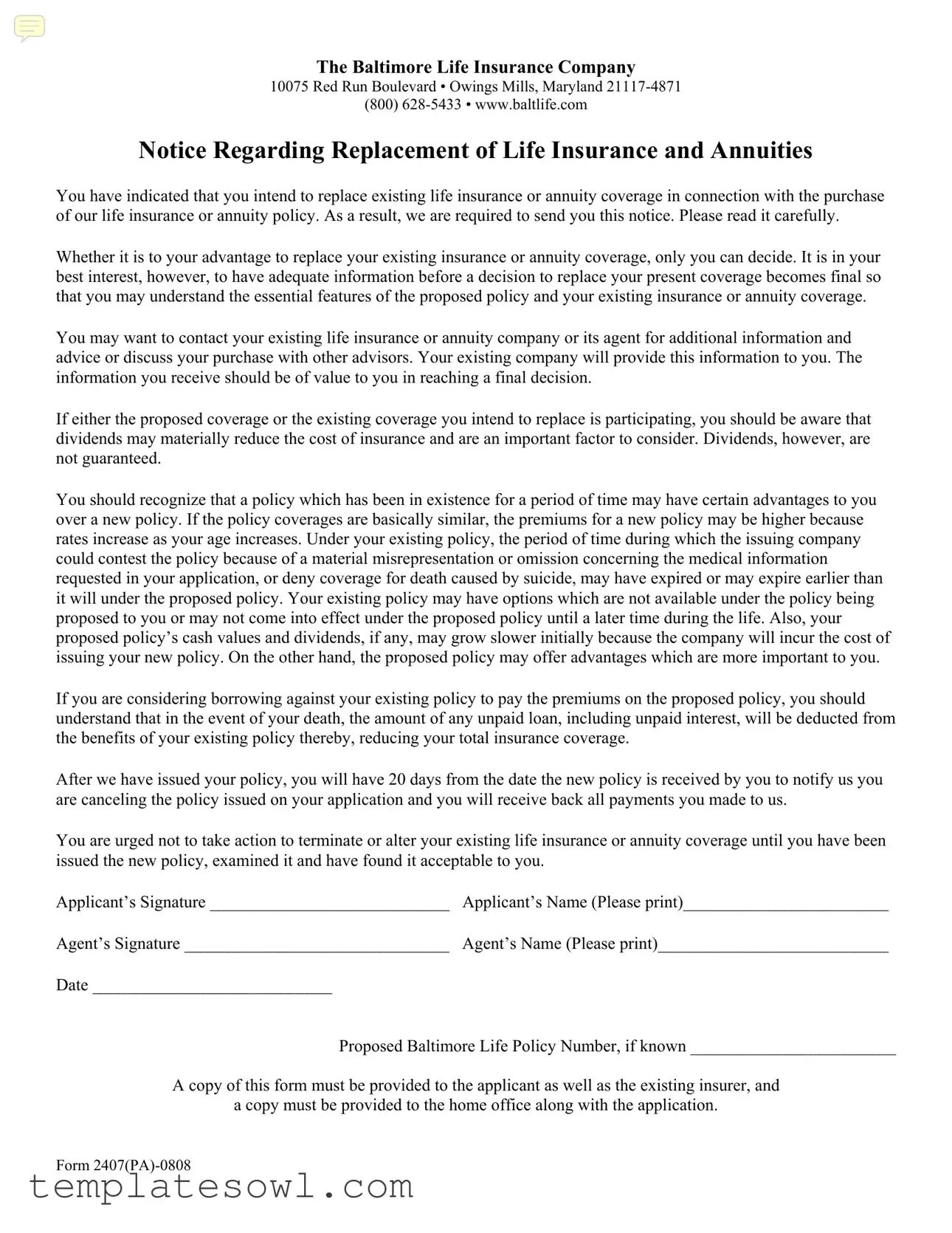

The Baltimore Life Insurance Company

10075 Red Run Boulevard • Owings Mills, Maryland

(800)

Notice Regarding Replacement of Life Insurance and Annuities

You have indicated that you intend to replace existing life insurance or annuity coverage in connection with the purchase of our life insurance or annuity policy. As a result, we are required to send you this notice. Please read it carefully.

Whether it is to your advantage to replace your existing insurance or annuity coverage, only you can decide. It is in your best interest, however, to have adequate information before a decision to replace your present coverage becomes final so that you may understand the essential features of the proposed policy and your existing insurance or annuity coverage.

You may want to contact your existing life insurance or annuity company or its agent for additional information and advice or discuss your purchase with other advisors. Your existing company will provide this information to you. The information you receive should be of value to you in reaching a final decision.

If either the proposed coverage or the existing coverage you intend to replace is participating, you should be aware that dividends may materially reduce the cost of insurance and are an important factor to consider. Dividends, however, are not guaranteed.

You should recognize that a policy which has been in existence for a period of time may have certain advantages to you over a new policy. If the policy coverages are basically similar, the premiums for a new policy may be higher because rates increase as your age increases. Under your existing policy, the period of time during which the issuing company could contest the policy because of a material misrepresentation or omission concerning the medical information requested in your application, or deny coverage for death caused by suicide, may have expired or may expire earlier than it will under the proposed policy. Your existing policy may have options which are not available under the policy being proposed to you or may not come into effect under the proposed policy until a later time during the life. Also, your proposed policy’s cash values and dividends, if any, may grow slower initially because the company will incur the cost of issuing your new policy. On the other hand, the proposed policy may offer advantages which are more important to you.

If you are considering borrowing against your existing policy to pay the premiums on the proposed policy, you should understand that in the event of your death, the amount of any unpaid loan, including unpaid interest, will be deducted from the benefits of your existing policy thereby, reducing your total insurance coverage.

After we have issued your policy, you will have 20 days from the date the new policy is received by you to notify us you are canceling the policy issued on your application and you will receive back all payments you made to us.

You are urged not to take action to terminate or alter your existing life insurance or annuity coverage until you have been issued the new policy, examined it and have found it acceptable to you.

Applicant’s Signature ____________________________ Applicant’s Name (Please print)________________________

Agent’s Signature _______________________________ Agent’s Name (Please print)___________________________

Date ____________________________

Proposed Baltimore Life Policy Number, if known ________________________

A copy of this form must be provided to the applicant as well as the existing insurer, and

a copy must be provided to the home office along with the application.

Form

Form Characteristics

| Fact Title | Description |

|---|---|

| Purpose | The 2407 Pa form serves as a notification regarding the replacement of life insurance and annuities. |

| Issuing Company | This form is issued by The Baltimore Life Insurance Company, located in Owings Mills, Maryland. |

| Contact Information | For inquiries, individuals can reach the company at (800) 628-5433 or visit their website at www.baltlife.com. |

| Importance of Decision | It emphasizes that the decision to replace existing coverage lies solely with the individual, highlighting the importance of informed choices. |

| Dividends | The form notes that dividends may affect insurance costs but are not guaranteed, urging careful consideration. |

| Policy Contestability | It outlines that existing policies may have a contestability period that is shorter than that of the new policy. |

| Cash Values | The new policy's cash values might take longer to grow due to initial costs of issuance. |

| Borrowing Against Policy | In case of borrowing against the existing policy, any unpaid loans will reduce the death benefits payable. |

| Cancellation Period | Once the new policy is received, there is a 20-day period to cancel it for a full refund. |

| Distribution Requirement | A copy of the 2407 Pa form must be provided to the applicant, existing insurer, and the home office with the application. |

Guidelines on Utilizing 2407 Pa

Completing the 2407 PA form is a straightforward process. This form is necessary when replacing existing life insurance or annuity coverage with a new policy. Follow these steps carefully to ensure all required information is accurately provided.

- Download and print the 2407 PA form from the Baltimore Life Insurance Company's website or obtain a physical copy from your agent.

- Begin by filling out the "Applicant's Signature" section. Sign your name to confirm that you are the applicant.

- In the "Applicant's Name" field, clearly print your full name as it appears on your identification documents.

- Have your insurance agent complete the "Agent's Signature" section by signing their name.

- Your agent should print their full name in the "Agent's Name" field.

- Fill in the "Date" field with the date when you are completing the form.

- If you know it, write the proposed policy number in the designated field.

- Make sure to provide copies of the completed form to the applicant, the existing insurer, and the home office along with the application.

Review your completed form to ensure all sections are correctly filled out. Accuracy is important to avoid any delays in your application process.

What You Should Know About This Form

What is the purpose of the 2407 PA form?

The 2407 PA form is a notice regarding the replacement of life insurance and annuities. It is issued by The Baltimore Life Insurance Company when an individual indicates an intention to replace existing insurance or annuity coverage with a new policy. The purpose of this form is to ensure that individuals are fully informed about the implications of replacing their current insurance, including the potential benefits and drawbacks. It encourages individuals to thoroughly evaluate both the existing and proposed policies before making a final decision.

What information should be considered before replacing existing life insurance?

When contemplating the replacement of existing life insurance, individuals should carefully analyze several factors. First, understanding the specific features of both the existing and proposed policies is crucial. This includes evaluating premium amounts, coverage limits, and any potential dividends. Consulting with the existing insurance company is advisable, as they can provide pertinent details related to the current policy. Additionally, one should assess the longevity of the existing policy, as longer-held policies may have benefits that new policies do not, such as lower contestability periods and possibly lower premiums due to age-related rate increases.

What happens if I decide to proceed with the new policy?

If you choose to move forward with the new policy after applying for it, you will have a 20-day review period once the new policy is received. During this time, you may examine the new policy and, if it does not meet your expectations, you can cancel it. Should you decide to cancel, all payments made will be refunded. This provision is significant in allowing individuals to ensure that they are comfortable with the new coverage before fully transitioning from their existing policy.

Are there any risks associated with borrowing against an existing policy to fund a new one?

Yes, borrowing against an existing policy can present certain risks. If you choose to take out a loan against your current policy to pay premiums on a new policy, it is essential to be aware that any outstanding loan balance will reduce the benefits of the existing policy upon your death. This means that the total death benefit available to your beneficiaries could be significantly decreased due to unpaid loans and interest. Consequently, this decision should be approached with caution, and it may be beneficial to consult with an insurance advisor for further guidance on managing existing policy loans effectively.

Common mistakes

Filling out the 2407 PA form accurately is crucial for a smooth insurance application process. However, there are common mistakes that applicants often make. Recognizing these pitfalls can help ensure a more straightforward experience.

One frequent error is not providing complete and accurate information. Many applicants skip sections or provide vague answers, which can delay processing or lead to unexpected complications. Each question must be answered thoroughly to avoid misunderstandings.

Another common mistake involves the signature section. Applicants sometimes forget to sign the form or fail to print their names clearly. This oversight can create confusion about the identity of the applicant and may require additional communications to resolve.

Failing to review the document carefully before submission is a significant misstep. Some individuals do not read through their entries, leading to typos or incorrect details that could affect coverage. It is important to double-check all information for accuracy.

Many people also overlook the importance of providing the proposed policy number if it is known. Leaving this blank can hinder the processing of the application and create delays in coverage activation.

Another mistake is not sending a copy of the completed form to all required parties. Applicants sometimes fail to provide copies to both the existing insurer and the home office. Ensuring that all parties receive a copy helps maintain clear communication and accountability.

It's essential for applicants to fully understand the implications of replacing existing insurance or annuities. Many individuals do not seek prior advice from their current insurance provider before making decisions. This lack of research can lead to regrettable choices regarding coverage.

People sometimes ignore the notice regarding the potential costs associated with replacing one policy with another. They may not realize that premiums can be higher for new policies due to age and risk factors, leading to unexpected financial burdens down the line.

Moreover, another key area where mistakes may occur is not considering existing policy advantages. Some applicants fail to appreciate the benefits that their current policy may offer, such as lower premiums or unique options that may not be available in the new coverage.

Finally, timing can be an issue. Applicants may rush to terminate their existing insurance before receiving the new policy. It is vital to wait until the new policy is in hand and meets their satisfaction, as this protects them from lapses in coverage.

Documents used along the form

When dealing with life insurance replacements, several documents are commonly required alongside the 2407 PA form. Each of these is designed to ensure that the policyholder has all necessary information before making a decision. Below is a list of these important documents.

- Replacement Notice: This document informs the applicant about the implications of replacing existing insurance. It outlines the risks and benefits, ensuring the applicant understands what they may be giving up.

- Application for Life Insurance: This form is the formal application for the new policy. It requires personal and health information that underwriters use to assess risk and determine premiums.

- Disclosure Statement: This statement contains detailed information about the policy being purchased. It typically includes features, costs, and any limitations or exclusions that might apply.

- Authorization to Release Information: This document allows the new insurer to obtain medical records and other relevant details from the applicant's existing insurance company, facilitating a smooth transition.

- Policy Illustration: An illustration provides a visual representation of how the proposed policy works over time, including potential cash values and death benefits. It helps applicants understand what they can expect.

- Existing Policy Evaluation: This is a comparative document that details the features and values of existing policies. It aids the applicant in evaluating whether to switch or maintain their current coverage.

- Notice of Information Practices: This document outlines how the insurance company will use any personal information collected during the application process and reassures applicants of their privacy rights.

Understanding these documents can empower policyholders to make informed decisions regarding their life insurance coverage. It is essential to review each document thoroughly to grasp the benefits and drawbacks before proceeding with any changes.

Similar forms

- Form 2406 - Notice of Replacement of Insurance: This form serves a similar purpose in informing applicants about the consequences of replacing insurance policies. It aims to ensure that the client is fully aware of potential drawbacks associated with switching coverage.

- Form 6400 - Life Insurance Policy Application: This document is utilized during the application process for life insurance policies. Like the 2407 PA form, it emphasizes the importance of understanding both existing and proposed policy details.

- Form 2408 - Statement of Policy Changes: This form outlines changes made to an existing insurance policy. It parallels the 2407 PA by ensuring clients are aware of modifications that might affect their coverage.

- Form 2409 - Policy Summary: The policy summary provides an overview of the terms and conditions of an insurance policy. It is similar in that it helps clients grasp important aspects of their insurance options, like the 2407 PA form does.

- Form 2410 - Disclosure Statement: This document discloses information regarding insurance policy features. It aims to inform clients about their rights, similar to how the 2407 PA emphasizes the need for careful consideration before making changes.

- Form 2411 - Notice of Insurer's Rights: This form details the rights insurers have concerning policy management. It aligns with the 2407 PA form's goal of communicating responsibilities and rights between clients and insurance providers.

- Form 2420 - Premium Payment Agreement: This agreement discusses the terms of premium payments for a new insurance policy. It is akin to the 2407 PA in that it highlights financial considerations tied to policy changes.

Dos and Don'ts

When filling out the 2407 PA form, there are certain actions that can help ensure completeness and accuracy. Below is a list outlining what to do and what to avoid.

- Do provide accurate personal information. Ensure that your name, address, and contact details are correct.

- Do read the instructions carefully. Understanding the requirements of the form will help prevent errors.

- Do double-check all entries. Review the information you’ve entered before submission to catch any mistakes.

- Do consult with your current insurance provider. This can offer insights into your existing coverage and any implications of switching.

- Do not rush the process. Taking your time can lead to more accurate and thoughtful entries.

- Do not disregard the replacement notice. This notice contains essential information that can affect your decision.

- Do not omit signatures. Ensure all required signatures are present to validate your application.

- Do not cancel your existing policy immediately. Wait until you have received and reviewed the new policy to make any changes.

Misconceptions

Misconceptions can often lead to confusion, especially when it comes to forms such as the 2407 PA form. Here are nine common misconceptions clarified:

- Only insurance agents can fill out the 2407 PA form. Any applicant has the right to complete this form, although agents may assist in the process.

- The 2407 PA form guarantees approval of the new policy. Filling out the form does not guarantee that the proposed policy will be issued.

- You must cancel your existing policy before receiving the new one. It is highly recommended to wait for the new policy before making any changes to your current coverage.

- Replacing insurance always leads to better coverage. Not all replacements result in better terms. It's important to evaluate both policies thoroughly.

- Dividends are guaranteed with the new policy. While dividends can benefit a policyholder, they are not guaranteed under the proposed coverage.

- Your old policy is worthless once you apply for a new one. Existing policies may offer benefits not available under a new policy, and their value should not be underestimated.

- The 2407 PA form is only for life insurance policies. This form can also pertain to annuity coverage and needs careful consideration.

- Once I sign the form, I cannot change my mind. Applicants have a 20-day review period to assess the new policy before making any definitive decisions.

- The proposed policy will always have lower premiums. Premiums can vary based on several factors, including the applicant's age and health at the time of application.

Understanding these misconceptions can help you make informed decisions about your insurance and annuity options.

Key takeaways

Here are some key takeaways regarding the 2407 Pa form related to replacing life insurance or annuity coverage:

- The form serves as a notice about the implications of replacing existing life insurance or annuity policies. It's essential to read and understand its content thoroughly.

- Before making a decision to replace coverage, gather information from both your current insurance provider and the new policy provider to compare features and benefits.

- Consider the implications of dividends and cash value growth. A new policy might not accumulate cash value as quickly initially, while an older policy could offer other benefits that are no longer available under new policies.

- Once you receive the new policy, you have 20 days to cancel it if needed. It’s wise to avoid canceling your existing coverage until you are satisfied with the new policy.

Browse Other Templates

Vacant Land Appraisal Form - The form prompts reviewers to confirm property details, including location and ownership information.

How Old Do You Have to Be to Get a Ged in Michigan - Filling out the form correctly helps expedite the process.