Fill Out Your 240A Form

The Form 240A is an essential document in the bankruptcy process that facilitates the reaffirmation of debts. It serves as an agreement between a debtor and a creditor, allowing the debtor to maintain specific debts that might otherwise be discharged in bankruptcy. This form consists of several parts, each designed to guide the debtor through the reaffirmation process while ensuring that they understand their financial responsibilities. Key sections include disclosures and instructions that highlight the implications of reaffirmation, such as the legal obligations the debtor retains, the amounts they are reaffirming, and the conditions under which the agreement is valid. Notably, the debtor must indicate whether a presumption of undue hardship applies, which can impact the agreement's enforceability. Furthermore, Form 240A requires detailed information about the creditor, including their business type and contact information, while also outlining the debtor's right to rescind the agreement within a specified timeframe. Completing this form accurately and comprehensively is crucial for protecting the debtor's interests and ensuring future financial stability.

240A Example

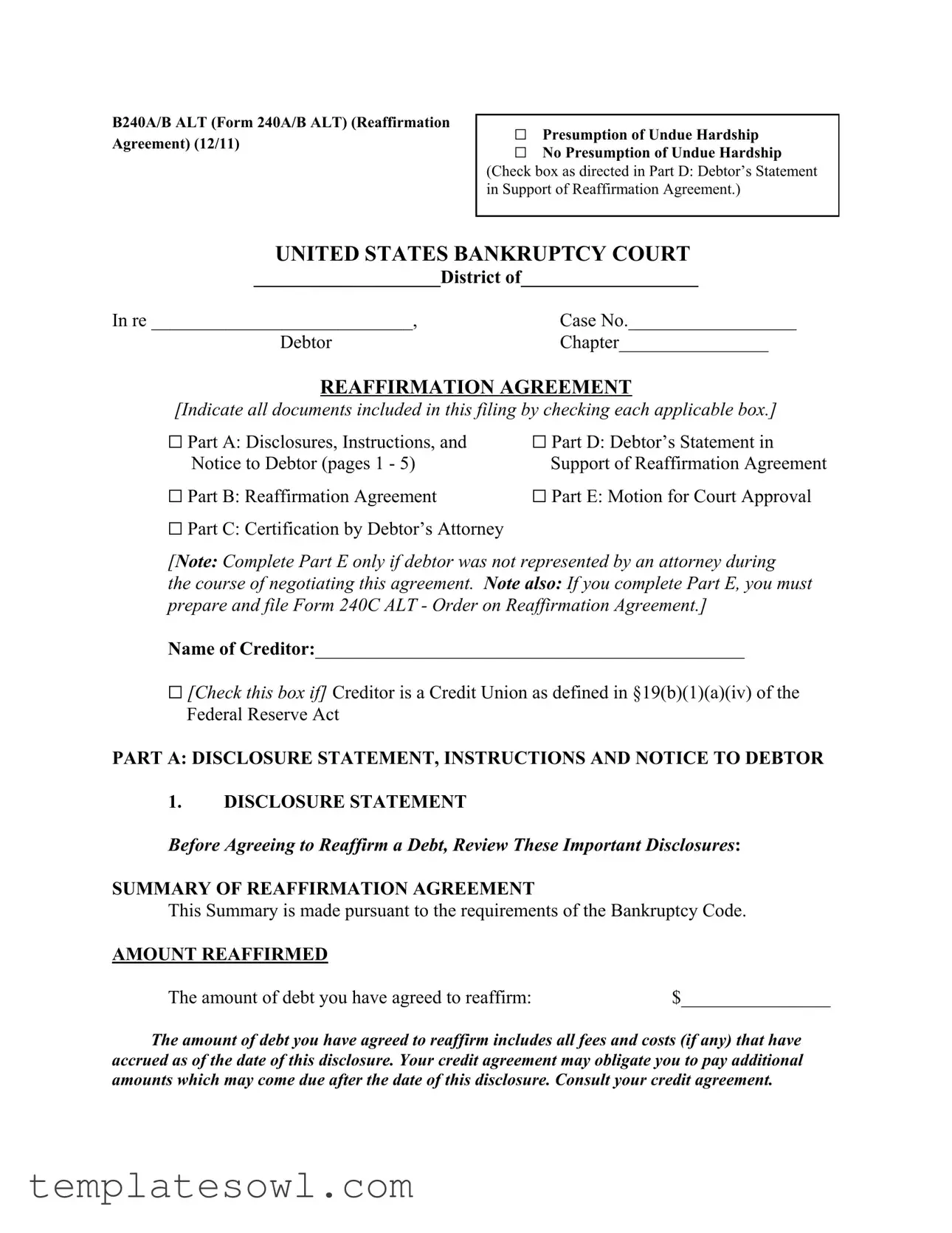

B240A/B ALT (Form 240A/B ALT) (Reaffirmation Agreement) (12/11)

GPresumption of Undue Hardship

GNo Presumption of Undue Hardship (Check box as directed in Part D: Debtor’s Statement in Support of Reaffirmation Agreement.)

UNITED STATES BANKRUPTCY COURT

____________________District of___________________

In re ____________________________, |

Case No.__________________ |

Debtor |

Chapter________________ |

REAFFIRMATION AGREEMENT

[Indicate all documents included in this filing by checking each applicable box.]

G Part A: Disclosures, Instructions, and |

G Part D: Debtor’s Statement in |

Notice to Debtor (pages 1 - 5) |

Support of Reaffirmation Agreement |

G Part B: Reaffirmation Agreement |

G Part E: Motion for Court Approval |

G Part C: Certification by Debtor’s Attorney |

|

[Note: Complete Part E only if debtor was not represented by an attorney during

the course of negotiating this agreement. Note also: If you complete Part E, you must prepare and file Form 240C ALT - Order on Reaffirmation Agreement.]

Name of Creditor:______________________________________________

G [Check this box if] Creditor is a Credit Union as defined in §19(b)(1)(a)(iv) of the Federal Reserve Act

PART A: DISCLOSURE STATEMENT, INSTRUCTIONS AND NOTICE TO DEBTOR

1.DISCLOSURE STATEMENT

Before Agreeing to Reaffirm a Debt, Review These Important Disclosures:

SUMMARY OF REAFFIRMATION AGREEMENT

This Summary is made pursuant to the requirements of the Bankruptcy Code.

AMOUNT REAFFIRMED

The amount of debt you have agreed to reaffirm: |

$________________ |

The amount of debt you have agreed to reaffirm includes all fees and costs (if any) that have accrued as of the date of this disclosure. Your credit agreement may obligate you to pay additional amounts which may come due after the date of this disclosure. Consult your credit agreement.

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

2 |

ANNUAL PERCENTAGE RATE

[The annual percentage rate can be disclosed in different ways, depending on the type of debt.]

a.If the debt is an extension of “credit” under an “open end credit plan,” as those terms are defined in § 103 of the Truth in Lending Act, such as a credit card, the creditor may disclose the annual percentage rate shown in (i) below or, to the extent this rate is not readily available or not applicable, the simple interest rate shown in (ii) below, or both.

(i)The Annual Percentage Rate disclosed, or that would have been disclosed, to the debtor in the most recent periodic statement prior to entering into the reaffirmation agreement described in Part B below or, if no such periodic statement was given to the debtor during the prior six months, the annual percentage rate as it would have been so disclosed at the time of the disclosure statement: ______%.

---And/Or

(ii)The simple interest rate applicable to the amount reaffirmed as of the date this disclosure statement is given to the debtor: __________%. If different simple interest rates apply to different balances included in the amount reaffirmed, the amount of each balance and the rate applicable to it are:

$_________@ _________%; $_________ @ _________%; $_________ @ _________%.

b.If the debt is an extension of credit other than under than an open end credit plan, the creditor may disclose the annual percentage rate shown in (I) below, or, to the extent this rate is not readily available or not applicable, the simple interest rate shown in (ii) below, or both.

(i)The Annual Percentage Rate under §128(a)(4) of the Truth in Lending Act, as disclosed to the debtor in the most recent disclosure statement given to the debtor prior to entering into the reaffirmation agreement with respect to the debt or, if no such disclosure statement was given to the debtor, the annual percentage rate as it would have been so disclosed: _________%.

---And/Or

(ii)The simple interest rate applicable to the amount reaffirmed as of the date this disclosure statement is given to the debtor: __________%. If different simple interest rates apply to different balances included in the amount reaffirmed, the amount of each balance and the rate applicable to it are:

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

3 |

$_________@ _________%; $_________ @ _________%; $_________ @ _________%.

c.If the underlying debt transaction was disclosed as a variable rate transaction on the most recent disclosure given under the Truth in Lending Act:

The interest rate on your loan may be a variable interest rate which changes from time to time, so that the annual percentage rate disclosed here may be higher or lower.

d.If the reaffirmed debt is secured by a security interest or lien, which has not been waived or determined to be void by a final order of the court, the following items or types of items of the debtor’s goods or property remain subject to such security interest or lien in connection with the debt or debts being reaffirmed in the reaffirmation agreement described in Part B.

Item or Type of Item |

Original Purchase Price or Original Amount of Loan |

Repayment Schedule:

Your first payment in the amount of $___________ is due on _________(date), but the future

payment amount may be different. Consult your reaffirmation agreement or credit agreement, as applicable.

— Or —

Your payment schedule will be: _________(number) payments in the amount of $___________

each, payable (monthly, annually, weekly, etc.) on the __________ (day) of each ____________

(week, month, etc.), unless altered later by mutual agreement in writing.

—Or —

A reasonably specific description of the debtor’s repayment obligations to the extent known by the creditor or creditor’s representative.

2. INSTRUCTIONS AND NOTICE TO DEBTOR

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

4 |

Reaffirming a debt is a serious financial decision. The law requires you to take certain steps to make sure the decision is in your best interest. If these steps are not completed, the reaffirmation agreement is not effective, even though you have signed it.

1.Read the disclosures in this Part A carefully. Consider the decision to reaffirm carefully. Then, if you want to reaffirm, sign the reaffirmation agreement in Part B (or you may use a separate agreement you and your creditor agree on).

2.Complete and sign Part D and be sure you can afford to make the payments you are agreeing to make and have received a copy of the disclosure statement and a completed and signed reaffirmation agreement.

3.If you were represented by an attorney during the negotiation of your reaffirmation agreement, the attorney must have signed the certification in Part C.

4.If you were not represented by an attorney during the negotiation of your reaffirmation agreement, you must have completed and signed Part E.

5.The original of this disclosure must be filed with the court by you or your creditor. If a separate reaffirmation agreement (other than the one in Part B) has been signed, it must be attached.

6.If the creditor is not a Credit Union and you were represented by an attorney during the negotiation of your reaffirmation agreement, your reaffirmation agreement becomes effective upon filing with the court unless the reaffirmation is presumed to be an undue hardship as explained in Part D. If the creditor is a Credit Union and you were represented by an attorney during the negotiation of your reaffirmation agreement, your reaffirmation agreement becomes effective upon filing with the court.

7.If you were not represented by an attorney during the negotiation of your reaffirmation agreement, it will not be effective unless the court approves it. The court will notify you and the creditor of the hearing on your reaffirmation agreement. You must attend this hearing in bankruptcy court where the judge will review your reaffirmation agreement. The bankruptcy court must approve your reaffirmation agreement as consistent with your best interests, except that no court approval is required if your reaffirmation agreement is for a consumer debt secured by a mortgage, deed of trust, security deed, or other lien on your real property, like your home.

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

5 |

YOUR RIGHT TO RESCIND (CANCEL) YOUR REAFFIRMATION AGREEMENT

You may rescind (cancel) your reaffirmation agreement at any time before the bankruptcy court enters a discharge order, or before the expiration of the

Frequently Asked Questions:

What are your obligations if you reaffirm the debt? A reaffirmed debt remains your personal legal obligation. It is not discharged in your bankruptcy case. That means that if you default on your reaffirmed debt after your bankruptcy case is over, your creditor may be able to take your property or your wages. Otherwise, your obligations will be determined by the reaffirmation agreement which may have changed the terms of the original agreement. For example, if you are reaffirming an open end credit agreement, the creditor may be permitted by that agreement or applicable law to change the terms of that agreement in the future under certain conditions.

Are you required to enter into a reaffirmation agreement by any law? No, you are not required to reaffirm a debt by any law. Only agree to reaffirm a debt if it is in your best interest. Be sure you can afford the payments you agree to make.

What if your creditor has a security interest or lien? Your bankruptcy discharge does not eliminate any lien on your property. A ‘‘lien’’ is often referred to as a security interest, deed of trust, mortgage or security deed. Even if you do not reaffirm and your personal liability on the debt is discharged, because of the lien your creditor may still have the right to take the property securing the lien if you do not pay the debt or default on it. If the lien is on an item of personal property that is exempt under your State’s law or that the trustee has abandoned, you may be able to redeem the item rather than reaffirm the debt. To redeem, you must make a single payment to the creditor equal to the amount of the allowed secured claim, as agreed by the parties or determined by the court.

NOTE: When this disclosure refers to what a creditor ‘‘may’’ do, it does not use the word “may’’ to give the creditor specific permission. The word ‘‘may’’ is used to tell you what might occur if the law permits the creditor to take the action. If you have questions about your reaffirming a debt or what the law requires, consult with the attorney who helped you negotiate this agreement reaffirming a debt. If you don’t have an attorney helping you, the judge will explain the effect of your reaffirming a debt when the hearing on the reaffirmation agreement is held.

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

6 |

PART B: REAFFIRMATION AGREEMENT.

I (we) agree to reaffirm the debts arising under the credit agreement described below.

1.Brief description of credit agreement:

2.Description of any changes to the credit agreement made as part of this reaffirmation agreement:

SIGNATURE(S):

Borrower:

______________________________

(Print Name)

______________________________

(Signature)

Date: ________________

____________________________

(Print Name)

____________________________

(Signature)

Date: ________________

Accepted by creditor:

______________________________

(Printed Name of Creditor)

______________________________

(Address of Creditor)

______________________________

(Signature)

______________________________

(Printed Name and Title of Individual Signing for Creditor)

Date of creditor acceptance:

_______________________

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

7 |

PART C: CERTIFICATION BY DEBTOR’S ATTORNEY (IF ANY).

[To be filed only if the attorney represented the debtor during the course of negotiating this agreement.]

I hereby certify that (1) this agreement represents a fully informed and voluntary agreement by the debtor; (2) this agreement does not impose an undue hardship on the debtor or any dependent of the debtor; and (3) I have fully advised the debtor of the legal effect and consequences of this agreement and any default under this agreement.

G [Check box, if applicable and the creditor is not a Credit Union.] A presumption of undue hardship has been established with respect to this agreement. In my opinion, however, the debtor is able to make the required payment.

Printed Name of Debtor’s Attorney: _______________________________

Signature of Debtor’s Attorney: ___________________________________

Date: ______________

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

8 |

PART D: DEBTOR’S STATEMENT IN SUPPORT OF REAFFIRMATION AGREEMENT

[Read and complete sections 1 and 2, OR, if the creditor is a Credit Union and the debtor is represented by an attorney, read section 3. Sign the appropriate signature line(s) and date your signature. If you complete sections 1 and 2 and your income less monthly expenses does not leave enough to make the payments under this reaffirmation agreement, check the box at the top of page 1 indicating “Presumption of Undue Hardship.” Otherwise, check the box at the top of page 1 indicating “No Presumption of Undue Hardship”]

1.I believe this reaffirmation agreement will not impose an undue hardship on my dependents or me. I can afford to make the payments on the reaffirmed debt because my monthly income (take home pay plus any other income received) is $________, and my actual current monthly expenses including monthly payments on

I understand that if my income less my monthly expenses does not leave enough to make the payments, this reaffirmation agreement is presumed to be an undue hardship on me and must be reviewed by the court. However, this presumption may be overcome if I explain to the satisfaction of the court how I can afford to make the payments here:

.

(Use an additional page if needed for a full explanation.)

2.I received a copy of the Reaffirmation Disclosure Statement in Part A and a completed and signed reaffirmation agreement.

Signed: ____________________________________

(Debtor)

_____________________________________

(Joint Debtor, if any) Date: ___________________

— Or —

[If the creditor is a Credit Union and the debtor is represented by an attorney]

3.I believe this reaffirmation agreement is in my financial interest. I can afford to make the payments on the reaffirmed debt. I received a copy of the Reaffirmation Disclosure Statement in Part A and a completed and signed reaffirmation agreement.

Signed: ____________________________________

(Debtor)

_____________________________________

(Joint Debtor, if any) Date: ___________________

Form 240A/B ALT - Reaffirmation Agreement (Cont.) |

9 |

PART E: MOTION FOR COURT APPROVAL

[To be completed and filed only if the debtor is not represented by an attorney during the course of negotiating this agreement.]

MOTION FOR COURT APPROVAL OF REAFFIRMATION AGREEMENT

I (we), the debtor(s), affirm the following to be true and correct:

I am not represented by an attorney in connection with this reaffirmation agreement.

I believe this reaffirmation agreement is in my best interest based on the income and expenses I have disclosed in my Statement in Support of this reaffirmation agreement, and because (provide any additional relevant reasons the court should consider):

Therefore, I ask the court for an order approving this reaffirmation agreement under the following provisions (check all applicable boxes):

G 11 U.S.C. § 524(c)(6) (debtor is not represented by an attorney during the course of the negotiation of the reaffirmation agreement)

G11 U.S.C. § 524(m) (presumption of undue hardship has arisen because monthly expenses exceed monthly income)

Signed:_______________________________

(Debtor)

_______________________________

(Joint Debtor, if any) Date: __________________

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | The form is known as the B240A/B ALT (Reaffirmation Agreement). |

| Purpose | This form is used to reaffirm a debt in U.S. bankruptcy cases, ensuring the debtor remains liable for the debt. |

| Governing Law | The reaffirmation agreement falls under the Bankruptcy Code, specifically sections dealing with reaffirmation. |

| Required Signatures | Debtors must sign the form, and if represented, their attorney should also sign the certification. |

| Rescission Period | Debtors can cancel their reaffirmation agreement anytime before the bankruptcy discharge order or within 60 days of filing. |

| Secured vs Unsecured Debts | Reaffirmation may be required for secured debts, such as mortgages, while it’s optional for unsecured debts. |

| Filing Requirements | The original form must be filed with the bankruptcy court, either by the debtor or the creditor. |

| Undue Hardship | If there's a presumption of undue hardship, court approval is necessary for the reaffirmation agreement to be effective. |

| Creditor Type | Special provisions apply if the creditor is a credit union under the Federal Reserve Act. |

| Payment Terms | The agreement should specify payment amounts and schedules, including any changes in terms. |

Guidelines on Utilizing 240A

After you have reviewed the necessary information regarding Form 240A, the next step involves filling out the form accurately. This guide provides straightforward, step-by-step instructions to assist you in completing the Reaffirmation Agreement.

- Begin by entering the relevant court information at the top of the form: the District and the Debtor's name along with the Case Number and Chapter.

- Check the appropriate box in Part D to indicate if there is a Presumption of Undue Hardship or No Presumption of Undue Hardship.

- In Part A, provide the amount of debt you have agreed to reaffirm along with any applicable fees or costs.

- Input the Annual Percentage Rate (APR) that applies to the reaffirmed debt; choose the appropriate options based on the type of debt.

- If applicable, list the various balances and rates associated with the reaffirmed debt.

- Indicate whether the reaffirmed debt is secured and, if so, describe the collateral.

- If a repayment schedule is available, complete that section with the necessary details, including the due dates and amounts of future payments.

- Proceed to Part D and complete the Debtor’s Statement, ensuring you can afford the payments.

- If an attorney represented you during the agreement negotiations, have them sign Part C. If not, complete and sign Part E.

- Ensure that the original disclosure, along with any additional reaffirmation agreements, is filed with the bankruptcy court.

- Monitor the status of your reaffirmation agreement. Understand that if you were not represented by an attorney, a court hearing will be necessary for approval.

By following these steps diligently, you can complete Form 240A accurately. It is essential to understand the responsibilities that accompany reaffirmation, so approach this process with careful consideration.

What You Should Know About This Form

What is Form 240A?

Form 240A is the Reaffirmation Agreement used in bankruptcy proceedings. When you reaffirm a debt, you agree to remain personally liable for that debt even after your bankruptcy discharge. This form outlines the terms of reaffirmation, ensuring you understand the implications of your decision.

Why would someone want to reaffirm a debt?

Reaffirming a debt may protect essential items such as your home or car. If you want to continue making payments on these secured debts and avoid repossession, reaffirmation can be a strategic choice. Additionally, reaffirming a debt may help maintain your credit history with that creditor.

Are you required to reaffirm a debt by any law?

No, you are not legally obligated to reaffirm a debt. It's entirely your choice. You should only do so if it benefits you financially and if you can afford the payments. Evaluate your situation carefully before making this decision.

What happens if I default on a reaffirmed debt?

If you default after reaffirming a debt, the creditor can pursue collection actions against you, which may include repossessing property or garnishing wages. Your reaffirmed debt remains your personal responsibility, and failure to pay could result in significant financial consequences.

What is a lien, and how does it affect reaffirmation?

A lien is a legal claim on your property. When you reaffirm a debt secured by a lien, your bankruptcy discharge does not eliminate that lien. Even if you discharge your personal liability, the creditor can still take the property if you fail to make payments. Understanding liens is crucial when deciding to reaffirm.

Do I need an attorney to reaffirm a debt?

While it's not mandatory to have an attorney to reaffirm a debt, having one is strongly advised. If you were represented by an attorney during the negotiation of the reaffirmation agreement, they must sign the relevant certification. Without an attorney, additional steps may be required for court approval.

How can I rescind my reaffirmation agreement?

You can cancel your reaffirmation agreement at any time before the bankruptcy court issues a discharge order or within 60 days after your agreement is filed, whichever is later. To rescind, notify your creditor in writing that you wish to cancel the agreement.

What should I do if I have more questions about reaffirmation?

If you have questions about your reaffirmation agreement or its consequences, consult the attorney who helped you with your bankruptcy case. If you don’t have an attorney, the judge can explain the implications during the hearing on the reaffirmation agreement.

Common mistakes

Completing Form 240A can be a meticulous process, and it's easy to make mistakes. Here are five common errors that individuals encounter when filling out this significant reaffirmation agreement.

First, many people overlook the importance of **accurately documenting the amount to be reaffirmed**. The form requires you to specify the exact amount of the debt, inclusive of any fees and costs up to the date of the disclosure. Failing to provide this information correctly can lead to disputes later. Without precise figures, you risk reaffirming an incorrect amount, which may not align with what you expect to pay.

Second, individuals often neglect to check the appropriate box regarding whether the creditor is a credit union. This seemingly small oversight can have serious implications. The form differentiates between credit unions and other creditors because they follow different rules under the law. Not indicating the correct status can complicate matters, especially during legal proceedings.

Another frequent mistake is related to the **annual percentage rate (APR)**. Many rush through the financial disclosures, forgetting to enter the correct APR or any applicable simple interest rates. Since this information is crucial to understanding repayment obligations, it’s vital to take the time to clarify and accurately convey these details. A misrepresented rate could lead to unexpected financial burdens in the future.

Additionally, some filers miss the required signatures. They may forget to obtain the necessary signatures from themselves, their creditors, or their attorney. All signatures must be in place for the reaffirmation agreement to be valid. Missing a signature can invalidate the entire document, leading to potential complications in your financial arrangements.

Lastly, failing to understand the **consequences of reaffirmation** is a common pitfall. Many individuals fill out the form without fully grasping the commitment they are making. Once reaffirmed, the debt remains yours even if your bankruptcy case discharges this obligation. Consequently, if you default post-bankruptcy, creditors can pursue you for the debt. Understanding this risk is essential before proceeding with execution of the agreement.

In conclusion, the process of filling out Form 240A requires careful attention to detail. By avoiding these common mistakes—accurate documentation of the amount, checking the appropriate creditor status, providing correct APR information, ensuring all required signatures are obtained, and understanding the implications of reaffirmation—you can navigate this process more effectively and make informed financial decisions.

Documents used along the form

The 240A form, formally known as the Reaffirmation Agreement, is a crucial document used in the bankruptcy process, particularly by individuals seeking to reaffirm debts. Alongside this form, various other documents may be utilized to support the reaffirmation agreement and ensure compliance with legal requirements. Each document plays a vital role in maintaining transparency and protecting the interests of both debtors and creditors.

- Disclosure Statement: This document provides essential information about the terms of the reaffirmation agreement, including the amount being reaffirmed and the annual percentage rate. It serves to inform the debtor about their financial obligations before they decide to reaffirm a debt.

- Debtor's Statement in Support of Reaffirmation Agreement: Found in Part D, this statement allows the debtor to assert that reaffirming the debt does not impose an undue hardship on their financial situation. It emphasizes the importance of the debtor’s financial assessment.

- Certification by Debtor’s Attorney: In Part C, if an attorney represented the debtor during negotiations, this certification confirms that the attorney believes the reaffirmation agreement is in the debtor's best interest, thus ensuring that legal counsel was provided correctly.

- Motion for Court Approval: This file is necessary if the debtor was not represented by an attorney when negotiating the reaffirmation agreement. It requests the court’s approval, ensuring that the agreement meets legal standards and protecting the debtor's rights.

- Order on Reaffirmation Agreement: Form 240C ALT is prepared if a motion for court approval is needed. It outlines the court’s decision regarding the reaffirmation agreement, which is crucial for validating the process when no attorney representation was involved.

- Creditor’s Verification: This document serves as proof from the creditor regarding the accuracy of the financial details presented in the reaffirmation agreement. It affirms the debt amount and any relevant terms, ensuring both parties are on the same page.

- Repayment Schedule: While detailed information about repayment options may be included within the reaffirmation agreement, a separate repayment schedule may clarify payment amounts, due dates, and methods. This helps set clear expectations for the debtor’s financial obligations.

- Notice of Right to Rescind: This important notice informs the debtor of their right to rescind the reaffirmation agreement before the court enters a discharge order or within a specific timeframe. It provides an essential safety net for debtors reconsidering their decision.

- Creditor's Consent: This document captures the creditor's agreement to the terms of reaffirmation and confirms their willingness to proceed with the arrangement. It solidifies the deal made between the debtor and creditor, ensuring clarity and reducing potential disputes.

Understanding these accompanying documents can empower individuals navigating the complexities of bankruptcy. Each piece not only assists in the reaffirmation process but also protects the rights and interests of all parties involved. It’s advisable for debtors to review these documents carefully and seek guidance when necessary to make informed financial decisions.

Similar forms

The Form 240A is primarily used for reaffirmation agreements in bankruptcy proceedings. It involves disclosing important financial information and reaffirming debts. Similarly, there are other important documents within bankruptcy and credit management that serve related purposes. Here are five documents that share similarities with Form 240A:

- Form 240B: Reaffirmation Agreement - Like Form 240A, this document is utilized to formalize the reaffirmation of a debt. It outlines the terms and conditions between the debtor and creditor, ensuring clarity on payment obligations and the amounts reaffirmed.

- Disclosure Statement - This document provides essential information regarding general legal rights and obligations in a bankruptcy context. It, too, emphasizes the importance of fully understanding the financial impact before making decisions similar to those in the reaffirmation process.

- Form 240C: Order on Reaffirmation Agreement - This form garners the court’s approval for a reaffirmation agreement. Just like the agreements associated with Form 240A, this is crucial in confirming that reaffirming a debt aligns with the debtor’s best interests.

- Chapter 13 Plan - A Chapter 13 repayment plan lays out how debtors will repay their creditors over time. Much like Form 240A, it requires careful consideration of finances and repayment obligations, ensuring that debtors fully understand their commitments moving forward.

- Form 4010: Notice of Chapter 7 Bankruptcy Case - This notice informs creditors that the debtor has filed for bankruptcy. Similar to the disclosure processes in Form 240A, it communicates vital information to involved parties about the bankruptcy proceedings, setting the stage for potential reaffirmations or changes in repayment strategies.

These documents play key roles in ensuring that debtors navigate their financial responsibilities thoughtfully, paralleling the intentions found within Form 240A. Understanding these similarities can aid in managing one's financial situation more effectively.

Dos and Don'ts

When it comes to filling out the Form 240A, which concerns a Reaffirmation Agreement, there are important guidelines to follow. Here’s a comprehensive list of ten dos and don’ts to help you through the process smoothly.

- Do read the instructions carefully before starting.

- Don't skip any sections, as each part is crucial for your reaffirmation agreement.

- Do ensure you fully understand the financial implications of reaffirming a debt.

- Don't rush through filling out the form; take your time to avoid mistakes.

- Do seek legal advice if you're unsure about any terms or implications.

- Don't assume everything is fine just because the creditor agrees; double-check all your entries.

- Do sign the form only when you are ready and certain of your decision.

- Don't forget to keep a copy of the completed form for your records.

- Do file the form with the court as required.

- Don't neglect to attend any required hearings related to your reaffirmation agreement.

Following these guidelines can help navigate the complexities of the reaffirmation process and ensure that your rights and interests are adequately protected.

Misconceptions

Misconceptions about the 240A form can lead to misunderstandings regarding reaffirmation agreements. Below is a list of ten common misconceptions, along with brief explanations.

- The 240A form is optional in all cases. The use of the 240A form is required when reaffirming a debt in bankruptcy unless specific exemptions apply.

- Signing the 240A form guarantees approval of the reaffirmation agreement. While signing the form is an important step, final approval from the bankruptcy court is necessary for the agreement to take effect.

- You must reaffirm a debt to avoid losing the collateral. This is not true. A debtor can choose not to reaffirm, but may lose the property if payments are not made.

- Reaffirmation agreements are binding without court approval. Most reaffirmation agreements require court approval to be enforceable, especially if the debtor was unrepresented by an attorney.

- You cannot change your mind after signing the 240A form. Debtors have the right to rescind their reaffirmation agreements within a set timeframe after filing the form.

- All creditors must use the 240A form. Only creditors seeking reaffirmation agreements are required to file this form. Other processes may apply to different types of debts.

- Completing the 240A form guarantees that the debt is discharged in bankruptcy. Reaffirmation means the debt will not be discharged, and the debtor remains liable even after bankruptcy concludes.

- The 240A form is the only document needed for reaffirmation. Additional documentation, including the statement of disclosure and potentially a motion for court approval, may also be required.

- A reaffirmed debt cannot be modified. The terms of a reaffirmed debt can be different from the initial agreement. Terms may include altered interest rates or repayment schedules.

- The 240A form has no implications for my credit report. Reaffirming a debt can affect credit, as it remains a legal obligation and can impact future borrowing potential.

Key takeaways

When completing and utilizing the 240A form, it is essential to understand the following key points:

- Read All Instructions: Carefully review the instructions provided in Part A. Understanding each section helps ensure the reaffirmation agreement is appropriate for your situation.

- Debt Amount: Clearly state the total debt amount you agree to reaffirm. This figure should include all fees and costs accrued up to the date of the disclosure.

- Consult Credit Agreement: Your original credit agreement may contain terms that affect your rights and obligations post-reaffirmation. Consult it for details.

- Attorney Representation: If you had legal representation during the process, your attorney must complete and sign Part C. If not, you must complete Part E for the agreement to remain valid.

- Filing Requirements: Ensure that the original reaffirmation agreement and any necessary documents are filed with the court. This is critical for the agreement to take effect.

- Right to Rescind: You have the right to cancel the reaffirmation agreement at any time before discharge or within 60 days of filing, whichever is later. Notify the creditor in writing if you decide to rescind.

Browse Other Templates

Apply for Champva - It’s crucial to review all instructions before filling out the application.

Mobile Food Vendor Application,MFDV Licensing Form,Food Truck Permit Application,Mobile Food Business Registration,Street Food License Application,Food Cart Operation Permit,Mobile Food Service License,Food Dispensing Vehicle Application,Mobile Cater - Clarification on any aspect of the DBPR HR-7031 can be sought from the department.

Watoga State Park Riverside Campground - You must submit the form with a payment to secure your campsite reservation.