Fill Out Your 26 6393 Form

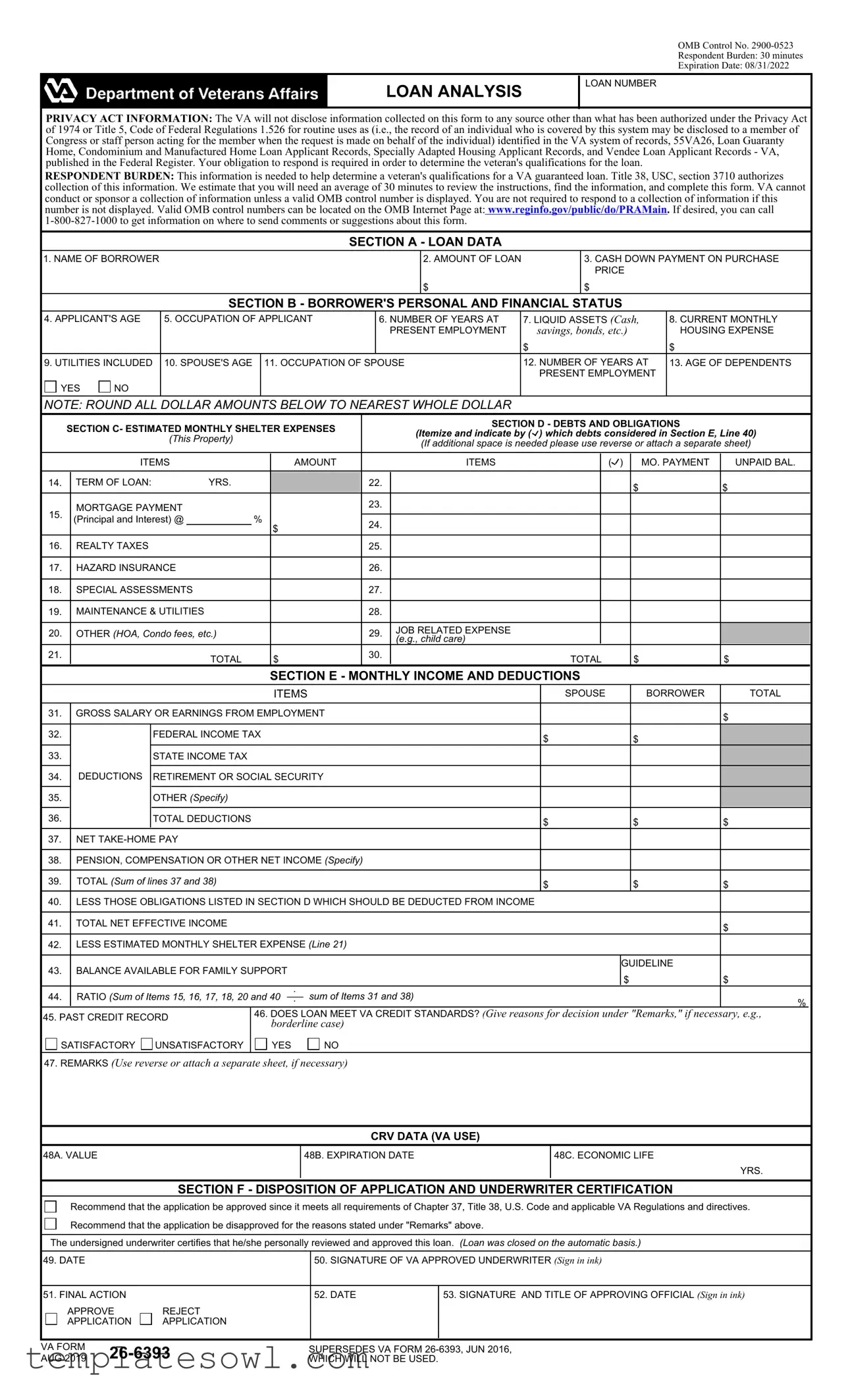

The VA Form 26-6393 plays a pivotal role in the process of obtaining a VA-guaranteed loan, aiming to assess the financial stability and qualifications of veterans seeking home financing. Designed to gather essential information, this form facilitates a thorough loan analysis by requiring the borrower to provide details about their personal and financial status, such as income, debts, and current housing expenses. It includes sections that focus on loan data, estimated monthly shelter expenses, and the applicant's obligations. Furthermore, it emphasizes the importance of adhering to privacy regulations, assuring respondents that their information is protected and used only for authorized purposes. Each section of the form not only captures necessary figures but also assesses the veteran's ability to repay the loan, thereby ensuring a responsible lending process that benefits all parties involved. Additionally, clarity concerning respondent obligations and the average time required to fill out the form aids in making the process smooth and efficient, ultimately guiding veterans toward securing their homes with the support of VA resources.

26 6393 Example

OMB Control No.

LOAN ANALYSIS

LOAN NUMBER

PRIVACY ACT INFORMATION: The VA will not disclose information collected on this form to any source other than what has been authorized under the Privacy Act of 1974 or Title 5, Code of Federal Regulations 1.526 for routine uses as (i.e., the record of an individual who is covered by this system may be disclosed to a member of Congress or staff person acting for the member when the request is made on behalf of the individual) identified in the VA system of records, 55VA26, Loan Guaranty Home, Condominium and Manufactured Home Loan Applicant Records, Specially Adapted Housing Applicant Records, and Vendee Loan Applicant Records - VA, published in the Federal Register. Your obligation to respond is required in order to determine the veteran's qualifications for the loan.

RESPONDENT BURDEN: This information is needed to help determine a veteran's qualifications for a VA guaranteed loan. Title 38, USC, section 3710 authorizes collection of this information. We estimate that you will need an average of 30 minutes to review the instructions, find the information, and complete this form. VA cannot conduct or sponsor a collection of information unless a valid OMB control number is displayed. You are not required to respond to a collection of information if this number is not displayed. Valid OMB control numbers can be located on the OMB Internet Page at: www.reginfo.gov/public/do/PRAMain. If desired, you can call

SECTION A - LOAN DATA

1. NAME OF BORROWER |

|

|

|

|

|

|

|

2. AMOUNT OF LOAN |

|

3. CASH DOWN PAYMENT ON PURCHASE |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRICE |

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|

SECTION B - BORROWER'S PERSONAL AND FINANCIAL STATUS |

|

|

|

|

||||||||||||||

4. APPLICANT'S AGE |

|

5. OCCUPATION OF APPLICANT |

|

6. NUMBER OF YEARS AT |

7. LIQUID ASSETS (Cash, |

|

8. CURRENT MONTHLY |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

PRESENT EMPLOYMENT |

savings, bonds, etc.) |

|

HOUSING EXPENSE |

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

|

|

|

|

$ |

|

|

9. UTILITIES INCLUDED |

|

10. SPOUSE'S AGE |

|

11. OCCUPATION OF SPOUSE |

12. NUMBER OF YEARS AT |

13. AGE OF DEPENDENTS |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PRESENT EMPLOYMENT |

|

|

|

|||||

YES |

NO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

NOTE: ROUND ALL DOLLAR AMOUNTS BELOW TO NEAREST WHOLE DOLLAR |

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

SECTION C- ESTIMATED MONTHLY SHELTER EXPENSES |

|

|

|

|

SECTION D - DEBTS AND OBLIGATIONS |

|

|

||||||||||||||||

|

|

|

|

(Itemize and indicate by ( ) which debts considered in Section E, Line 40) |

|

|||||||||||||||||||

|

|

|

|

|

(This Property) |

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(If additional space is needed please use reverse or attach a separate sheet) |

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

ITEMS |

|

|

AMOUNT |

|

|

|

|

ITEMS |

|

( |

) |

|

MO. PAYMENT |

UNPAID BAL. |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

|

TERM OF LOAN: |

|

|

YRS. |

|

|

|

22. |

|

|

|

|

|

|

|

$ |

|

|

$ |

|

|||

15. |

|

MORTGAGE PAYMENT |

|

|

|

23. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

(Principal and Interest) @ |

$ |

24. |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

16. |

|

REALTY TAXES |

|

|

|

|

|

|

|

25. |

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

17. |

|

HAZARD INSURANCE |

|

|

|

26. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

18. |

|

SPECIAL ASSESSMENTS |

|

|

|

27. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

19. |

|

MAINTENANCE & UTILITIES |

|

|

|

28. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

20. |

|

OTHER (HOA, Condo fees, etc.) |

|

|

|

29. |

|

JOB RELATED EXPENSE |

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(e.g., child care) |

|

|

|

|

|

|

|

|

|

|

21. |

|

|

|

|

|

TOTAL |

|

|

$ |

30. |

|

|

|

TOTAL |

|

$ |

|

|

$ |

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

SECTION E - MONTHLY INCOME AND DEDUCTIONS |

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

ITEMS |

|

|

|

|

|

SPOUSE |

|

|

BORROWER |

TOTAL |

|

|||

31. |

|

GROSS SALARY OR EARNINGS FROM EMPLOYMENT |

|

|

|

|

|

|

|

|

|

|

|

|

$ |

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32. |

|

|

|

FEDERAL INCOME TAX |

|

|

|

|

|

$ |

|

|

$ |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

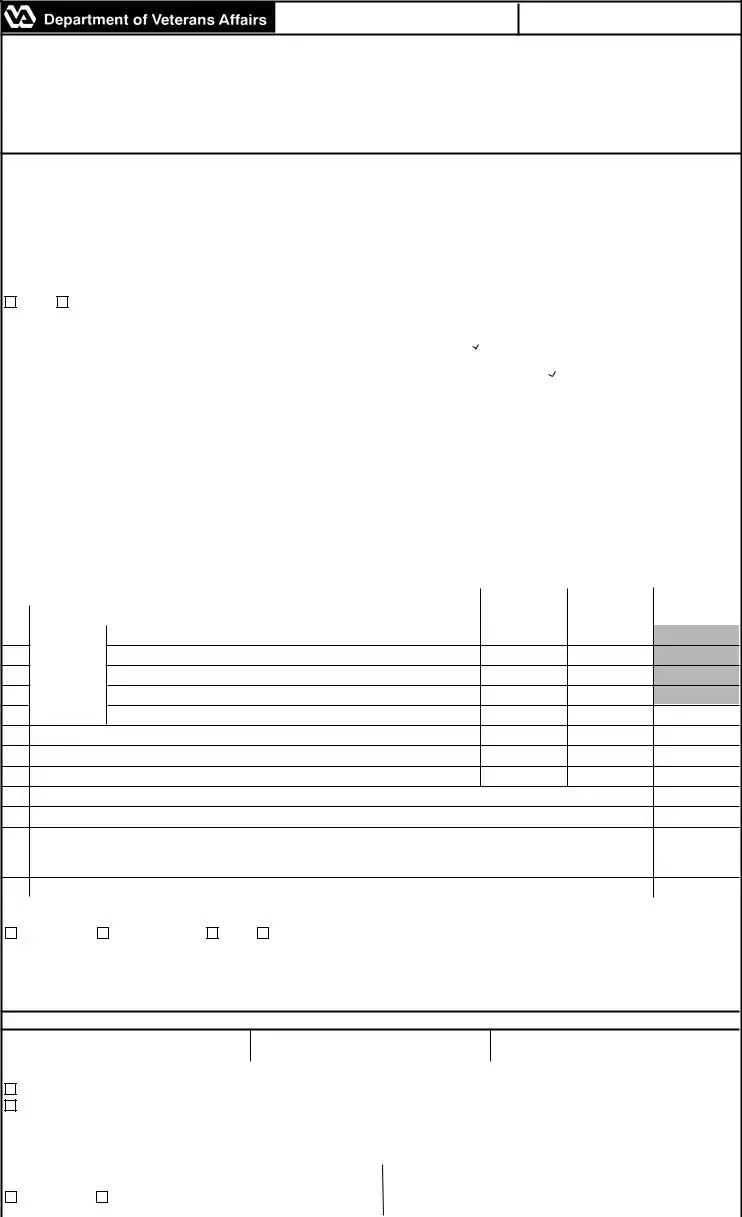

33.STATE INCOME TAX

34. DEDUCTIONS RETIREMENT OR SOCIAL SECURITY

35.OTHER (Specify)

36. |

TOTAL DEDUCTIONS |

$ |

$ |

$ |

|

|

37.NET

38.PENSION, COMPENSATION OR OTHER NET INCOME (Specify)

39. TOTAL (Sum of lines 37 and 38) |

$ |

$ |

$ |

40.LESS THOSE OBLIGATIONS LISTED IN SECTION D WHICH SHOULD BE DEDUCTED FROM INCOME

41. TOTAL NET EFFECTIVE INCOME |

$ |

|

42.LESS ESTIMATED MONTHLY SHELTER EXPENSE (Line 21)

43. |

BALANCE AVAILABLE FOR FAMILY SUPPORT |

|

GUIDELINE |

|

|

|

|

$ |

$ |

|

|||

|

|

. |

|

|

||

|

|

|

|

|

|

|

44. |

|

___ |

sum of Items 31 and 38) |

|

|

|

RATIO (Sum of Items 15, 16, 17, 18, 20 and 40 . |

% |

|

||||

45. PAST CREDIT RECORD |

46. DOES LOAN MEET VA CREDIT STANDARDS? (Give reasons for decision under "Remarks," if necessary, e.g., |

|

||||

|

|

borderline case) |

|

|

||

SATISFACTORY UNSATISFACTORY |

YES |

NO |

|

|

||

47.REMARKS (Use reverse or attach a separate sheet, if necessary)

CRV DATA (VA USE)

48A. VALUE

48B. EXPIRATION DATE

48C. ECONOMIC LIFE

YRS.

|

|

SECTION F - DISPOSITION OF APPLICATION AND UNDERWRITER CERTIFICATION |

|

||

Recommend that the application be approved since it meets all requirements of Chapter 37, Title 38, U.S. Code and applicable VA Regulations and directives. |

|||||

Recommend that the application be disapproved for the reasons stated under "Remarks" above. |

|

||||

The undersigned underwriter certifies that he/she personally reviewed and approved this loan. (Loan was closed on the automatic basis.) |

|

||||

49. DATE |

|

|

50. SIGNATURE OF VA APPROVED UNDERWRITER (Sign in ink) |

||

|

|

|

|

|

|

51. FINAL ACTION |

|

52. DATE |

53. SIGNATURE AND TITLE OF APPROVING OFFICIAL (Sign in ink) |

||

APPROVE |

REJECT |

|

|

|

|

APPLICATION |

APPLICATION |

|

|

|

|

|

|

|

|

|

|

AUG 2019 |

WHICH WILL NOT BE USED. |

|

|

||

VA FORM |

|

|

SUPERSEDES VA FORM |

||

Form Characteristics

| Fact Name | Detail |

|---|---|

| OMB Control Number | 2900-0523 |

| Respondent Burden | Estimated to be 30 minutes. |

| Expiration Date | 08/31/2022 |

| Governing Law | Title 38, USC, section 3710 |

| Use of Personal Information | Information is protected under the Privacy Act of 1974. |

| Loan Amount | Details required for specific loan number. |

| Monthly Housing Expense | Calculated total includes utilities and other costs. |

| Underwriter Certification | Loan underwriter certifies compliance with all regulations. |

Guidelines on Utilizing 26 6393

Filling out the 26-6393 form is an important step in determining loan qualification. Accurate completion of this form is essential for processing your application smoothly. Follow the steps below for guidance.

- Section A - Loan Data:

- Provide the name of the borrower in the first field.

- Enter the amount of the loan you are applying for.

- Specify the cash down payment on the purchase price.

- Section B - Borrower's Personal and Financial Status:

- Input the applicant's age and occupation.

- Indicate how many years the applicant has been at their current job.

- List liquid assets such as cash, savings, and bonds.

- Fill in the current monthly housing expense.

- Note whether utilities are included in the expense.

- Provide the spouse's age and occupation.

- Record how many years the spouse has been at their current job.

- Enter the ages of any dependents.

- Section C - Estimated Monthly Shelter Expenses:

- Outline expected monthly shelter expenses.

- Section D - Debts and Obligations:

- Itemize current debts and their amounts.

- Clearly mark which debts are considered in Section E, Line 40.

- Section E - Monthly Income and Deductions:

- List gross salary or earnings from employment for both borrower and spouse.

- Fill in deductions such as federal and state income tax.

- Indicate any retirement or social security deductions.

- Enter other deductions, if applicable.

- Calculate and show total deductions.

- Determine net take-home pay for both parties.

- Include pension, compensation, or other net income, if any.

- Compute the total from net take-home pay and other incomes.

- Deduct obligations listed in Section D from total income.

- Calculate the total net effective income.

- Deduct estimated monthly shelter expenses from total income.

- Later, record the balance available for family support guidelines.

- Complete the ratio and past credit record sections appropriately.

- Assess whether the loan meets VA credit standards.

- Provide reasons in the remarks section if necessary.

- Section F - Disposition of Application and Underwriter Certification:

- Indicate whether to approve or reject the application and document reasons.

- The underwriter must date and sign the form in the designated section.

- Final action on the application must be recorded with the sign-off of the approving official.

Ensure all sections are accurately completed to avoid delays. After filling out the form, it should be submitted to the appropriate authority for review and processing.

What You Should Know About This Form

What is the 26-6393 form used for?

The 26-6393 form is a Loan Analysis form used to assess a veteran's qualifications for a VA guaranteed loan. It collects necessary personal and financial information to evaluate the applicant's ability to repay the loan.

Who needs to fill out the 26-6393 form?

This form must be filled out by veterans seeking a VA guaranteed loan. Both the borrower and their spouse, if applicable, may need to provide information to complete the form.

What type of information is required on the 26-6393 form?

The form requires various types of information, including the loan amount, cash down payment, personal details about the borrower and their spouse, monthly shelter expenses, debts and obligations, and estimates of income and deductions.

Is there an estimated time to complete the 26-6393 form?

The estimated time to complete the 26-6393 form is about 30 minutes. This allows enough time for applicants to review the instructions, gather necessary information, and fill out the form accurately.

What should I do if I have questions about the form?

If you have questions regarding the form, you can call the VA at 1-800-827-1000. They can provide clarification on any section of the form or assist you with the submission process.

Where can I submit the completed 26-6393 form?

The completed form should be submitted to the appropriate VA regional loan center. The specific address may vary based on your location, so it’s important to check the VA’s website or contact the help number for guidance.

What happens if I don’t fill out the 26-6393 form?

Failing to complete the 26-6393 form may delay the processing of your loan application. The VA requires this form to determine your eligibility for a guaranteed loan, so it is essential to submit it promptly.

Is the information provided on the 26-6393 form kept confidential?

Yes, the information provided on the 26-6393 form is protected under the Privacy Act of 1974. The VA cannot disclose your information without your authorization, except for specific uses allowed by law.

What if I need to make corrections to the form after submission?

If you need to make corrections to the 26-6393 form after submission, it is best to contact the VA as soon as possible. They will provide instructions on how to amend your application and any necessary steps you should take.

What should I do if the OMB Control Number is not displayed on the form?

You are not required to respond to the collection of information on the 26-6393 form if the OMB Control Number (2900-0523) is not displayed. In such cases, you should contact the VA for guidance before proceeding with the application.

Common mistakes

Filling out the VA Form 26-6393 can seem straightforward, but many make crucial errors that can delay the loan process. One common mistake is not providing accurate information in the Loan Data section. This section requires precise details, such as the amount of the loan and cash down payment. Failing to input the correct amounts can lead to confusion and unnecessary delays.

Another frequent error occurs in Section B, where applicants list their personal and financial status. People often underestimate their liquid assets or provide outdated employment information. It's essential to round all dollar amounts accurately as per the instructions, as this detail can affect the overall assessment of qualifications.

In Section D, concerning debts and obligations, applicants sometimes neglect to itemize all debts completely. This includes failing to specify which debts are included when calculating monthly income. It's vital to be thorough in this section because incomplete information could jeopardize the approval of the loan.

Documentation errors are also an issue. Missing signatures or dates can halt the processing of the form. Each required signature should be carefully checked. In addition, make sure that the OMB control number is visible. Without it, responses cannot be collected, and the application may be deemed invalid.

Furthermore, applicants sometimes don’t review their calculations, leading to inaccurate net income figures. Careful math is crucial as it impacts the entire financial picture. Double-checking total deductions and monthly expenses can prevent costly mistakes.

Lastly, neglecting to provide necessary remarks in Section E can be a significant oversight. If there are any issues or borderline cases, detailing those in the remarks section can clarify the situation. This insight can aid in processing the application more efficiently.

Documents used along the form

The VA Form 26-6393 is used primarily for loan analysis for veterans seeking guaranteed loans. Several other forms and documents are commonly used in conjunction with this form to facilitate the loan application process. Each document plays a critical role in ensuring that the loan analysis is comprehensive and accurate.

- VA Form 26-1880: This form is the Request for a Certificate of Eligibility. It is necessary for veterans to submit this document to verify their eligibility for VA loan benefits and to determine the amount of entitlement available.

- VA Form 26-4555: Known as the Request for Determination of Loan Guaranty Eligibility, this form is used to assess the borrower’s qualifications for a VA loan by collecting relevant information about their military service and financial background.

- VA Form 26-0286: This is the Initial VA Loan Application. It serves as the first step in the loan process, gathering essential information about the borrower and the potential loan terms.

- VA Form 26-8320: The Loan Analysis form provides a detailed breakdown of the borrower’s financial situation, including income, debt, and asset levels. This document is crucial for determining the borrower's ability to repay the loan.

- FHA Form 92900-A: This is the HUD/VA Addendum to the Uniform Residential Loan Application. It ensures that all necessary data specific to the VA loan process is captured and provides additional documentation needed for loan processing.

- Credit Report: A credit report reflects the borrower’s credit history and current credit status. It is reviewed to assess creditworthiness, which is a significant factor in the loan approval process.

Each of these forms and documents complements the VA Form 26-6393 by providing vital information necessary for a thorough evaluation of the applicant's qualifications for a VA guaranteed loan. Proper completion and submission of these forms can facilitate a smoother loan application process.

Similar forms

- VA Form 26-1880: This form is used to apply for a Certificate of Eligibility for VA home loan benefits. Like the 26-6393, it collects personal and financial information to assess eligibility, ensuring veterans can access the benefits they deserve.

- VA Form 26-6850: This form requests information about income and expenses for those seeking a VA loan. Its purpose is similar to the 26-6393 in evaluating a borrower's financial status to determine qualifications for loans.

- VA Form 26-4555: Known as the "Request for Determination of Loan Guaranty Eligibility," this document helps assess a veteran's eligibility for loan reimbursement. It shares similarities with the 26-6393 in terms of financial assessment.

- VA Form 26-1820: This is a report of the loan closing, which documents transaction details and ensures compliance with VA loan requirements. The focus on detailed financial information connects this form to the 26-6393's financial evaluations.

- VA Form 26-4212: This form indicates a veteran's need for special assistance regarding their loan application eligibility. It, too, gathers personal and financial details, emphasizing the importance of thorough information for approval processes like the 26-6393.

- VA Form 26-0781: This document serves as a statement of the veteran's claim for a loan, focusing on the debts and obligations that impact loan approval. Its function parallels that of the 26-6393 in assessing financial readiness for home loans.

Dos and Don'ts

- Do: Carefully read the instructions provided with the 26-6393 form to ensure you understand each section before filling it out.

- Do: Gather all necessary financial documents beforehand so you can provide accurate information about your income and debts.

- Do: Double-check your entries for accuracy, particularly with numeric figures such as loan amounts and monthly expenses.

- Do: Sign and date the form before submission, as missing this step can delay processing.

- Don't: Rush through the form; taking your time can prevent mistakes that may affect your loan approval.

- Don't: Leave any required fields blank; if a question does not apply, indicate that it’s not applicable rather than skipping it.

- Don't: Provide outdated information or documents. Ensure everything reflects your current financial status accurately.

- Don't: Forget to keep a copy of the completed form for your records after submission.

Misconceptions

Many individuals encounter misunderstandings when it comes to the VA Form 26-6393. Here are six common misconceptions and clarifications for each:

- This form is only for veterans. While the form is primarily designed for veterans, it can also apply to qualifying spouses and other eligible beneficiaries seeking VA guaranteed loans.

- Completing the form takes hours. In reality, most respondents can fill it out in about 30 minutes, as indicated by the VA. This includes reviewing the instructions and gathering necessary information.

- The information on this form is publicly available. This is not true. The VA safeguards the information collected on this form, adhering to the Privacy Act of 1974 to protect applicant confidentiality.

- You can apply for a loan without submitting this form. Not quite. This form is essential for determining eligibility for VA guaranteed loans. Skipping it could delay or hinder the loan process.

- The OMB control number is not important. On the contrary, a valid OMB control number must be displayed for the form. If it’s not visible, you are not obligated to fill it out, so it's crucial to check for it.

- This form is the same as previous versions. The 26-6393 has undergone changes and updates. Always ensure you are using the most current version to avoid confusion and potential issues with your application.

Understanding these points can help clarify the purpose and requirements of the 26-6393 form, ensuring a smoother loan application process.

Key takeaways

- Understand the Purpose: The 26-6393 form is essential for determining a veteran's qualifications for a VA guaranteed loan. Filling it out accurately is crucial.

- Time Commitment: Expect to spend about 30 minutes completing the form. This accounts for reviewing instructions and gathering necessary information.

- Personal Information Required: Prepare to provide detailed personal and financial information. Key sections include the borrower’s age, occupation, and monthly housing expenses.

- Accuracy is Key: Round all dollar amounts to the nearest whole dollar. Ensure all entries are precise to avoid delays in processing.

- Privacy Protection: Information collected will comply with the Privacy Act of 1974, meaning it will only be shared as authorized by law.

- Underwriter Certification: An underwriter must review and certify the application. Ensure all necessary signatures are obtained before submission.

Browse Other Templates

Detroit Tigers Donation Request - The organization should describe the distribution plan for the tickets in the letter.

Braums Hiring - The application emphasizes honesty, highlighting the consequences of providing false information.

Car Title Sent to Wrong Address - The disclosure aids in establishing the vehicle's history and value.