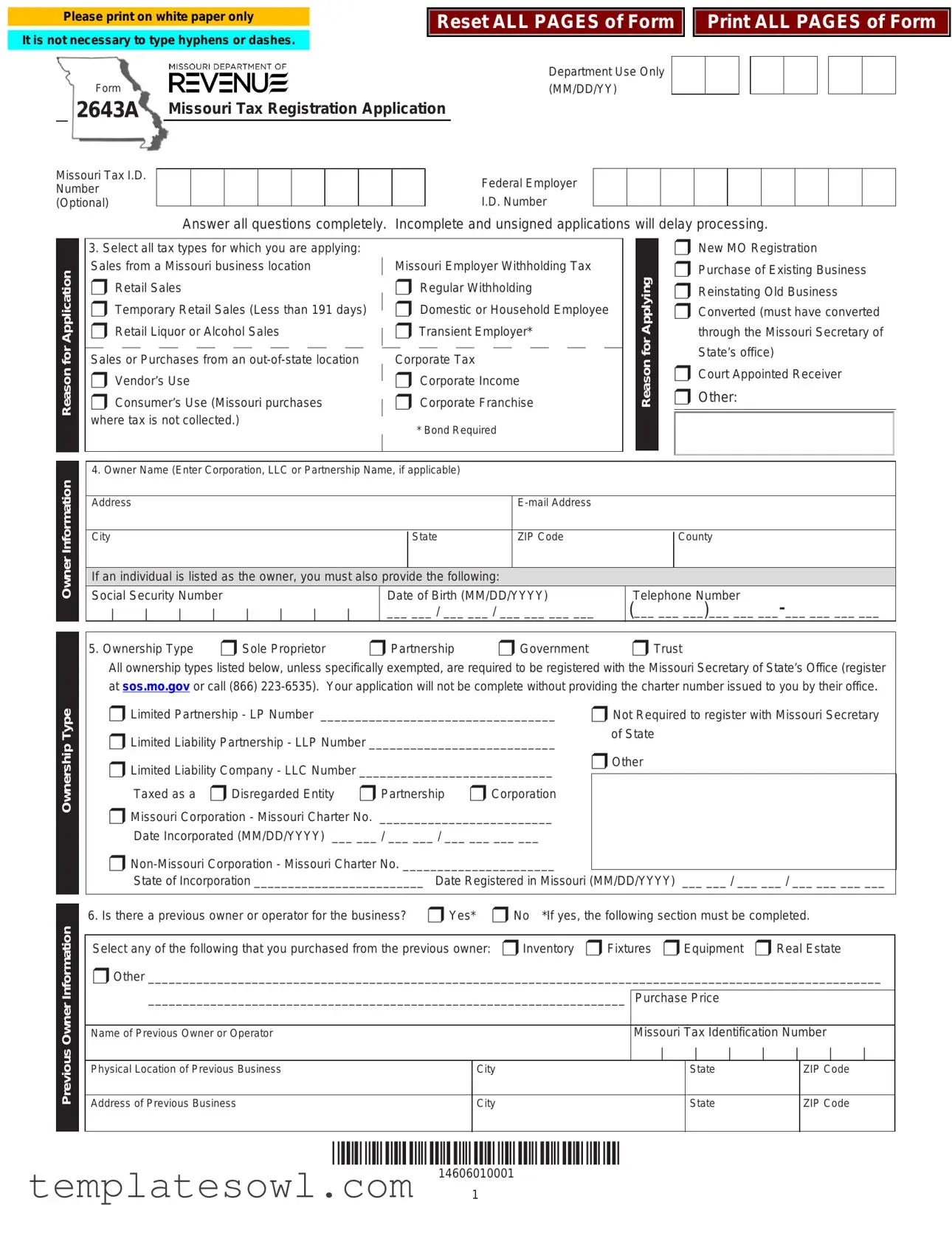

Fill Out Your 2643A Form

The 2643A form serves as a crucial tool for individuals or entities looking to establish or update their tax registration in Missouri. This form is utilized to apply for various tax types, including sales tax, employer withholding tax, and corporate income tax. Upon filling out the form, applicants must provide thorough information about their ownership structure, such as whether they are a sole proprietor, partnership, or corporation. Additionally, the form requests details about the business's physical location and any previous owners. Applicants need to select the reason for their application, which could range from establishing a new business to reinstating an old one. Specific sections require the disclosure of business activities and estimated tax liabilities, ensuring that the appropriate tax codes apply. To maintain compliance, all involved parties, including partners and responsible officers, must also be identified. Failure to complete the form accurately may lead to delays in processing, making attention to detail imperative. By ensuring all information is submitted in accordance with state requirements, businesses can facilitate a smoother registration process and stay informed of their tax obligations.

2643A Example

Please print on white paper only |

|

Reset ALL PAGES of Form |

|

|

|

|

|

|

It is not necessary to type hyphens or dashes. |

|

|

|

|

|

|

|

|

Print ALL PAGES of Form

Form

2643A

Missouri Tax I.D. Number (Optional)

Department Use Only (MM/DD/YY)

Missouri Tax Registration Application

Federal Employer

I.D. Number

Answer all questions completely. Incomplete and unsigned applications will delay processing.

Reason for Application

3. Select all tax types for which you are applying: |

|

|

Sales from a Missouri business location |

|

|

Missouri Employer Withholding Tax |

||

r Retail Sales |

r Regular Withholding |

|

r Temporary Retail Sales (Less than 191 days) |

r Domestic or Household Employee |

|

r Retail Liquor or Alcohol Sales |

r Transient Employer* |

|

Sales or Purchases from an |

Corporate Tax |

|

r Vendor’s Use |

r Corporate Income |

|

r Consumer’s Use (Missouri purchases |

r Corporate Franchise |

|

where tax is not collected.) |

|

|

* Bond Required |

||

|

Reason for Applying

rNew MO Registration

rPurchase of Existing Business

rReinstating Old Business

rConverted (must have converted through the Missouri Secretary of State’s office)

rCourt Appointed Receiver

rOther:

|

Information |

|

|

4. Owner Name (Enter Corporation, LLC or Partnership Name, if applicable) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Owner |

|

|

City |

|

|

|

|

|

|

|

|

State |

|

ZIP Code |

|

|

|

|

|

County |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If an individual is listed as the owner, you must also provide the following: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

Social Security Number |

|

|

|

|

Date of Birth (MM/DD/YYYY) |

|

|

|

Telephone Number |

|

|

|

|

|

|||||||||||

|

|

|

|

| |

| |

| |

| |

| |

| |

| |

| |

___ ___ / ___ ___ / ___ ___ ___ ___ |

(___ ___ ___)___ ___ |

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5. Ownership Type |

r Sole Proprietor r Partnership r Government r Trust |

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

All ownership types listed below, unless specifically exempted, are required to be registered with the Missouri Secretary of State’s Office (register |

|

||||||||||||||||||||||||

|

|

|

|

at sos.mo.gov or call (866) |

|

||||||||||||||||||||||||

|

Type |

|

|

r Limited Partnership - LP Number __________________________________ |

|

r Not Required to register with Missouri Secretary |

|

||||||||||||||||||||||

|

|

|

r Limited Liability Partnership - LLP Number ___________________________ |

|

of State |

|

|

|

|

|

|

|

|

||||||||||||||||

|

Ownership |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

r Limited Liability Company - LLC Number ____________________________ |

|

r Other |

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

Taxed as a r Disregarded Entity r Partnership r Corporation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

r Missouri Corporation - Missouri Charter No. _________________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

Date Incorporated (MM/DD/YYYY) |

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

r |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

State of Incorporation _________________________ Date Registered in Missouri (MM/DD/YYYY) |

___ ___ / ___ ___ / ___ ___ ___ ___ |

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. Is there a previous owner or operator for the business? r Yes* r No *If yes, the following section must be completed. |

|

|

|||||||||||||||||||||||

|

Information |

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Select any of the following that you purchased from the previous owner: |

r Inventory |

r Fixtures r Equipment |

r Real Estate |

|

|

|||||||||||||||||||||

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

r Other __________________________________________________________________________________________________________ |

|

||||||||||||||||||||||||

|

|

|

|

|

|

_____________________________________________________________________ |

|

|

|

|

|

|

|

|

|||||||||||||||

|

Owner |

|

|

|

|

|

Purchase Price |

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Previous Owner or Operator |

|

|

|

|

|

|

|

|

|

|

|

Missouri Tax Identification Number |

|

|

|||||||||||

|

Previous |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| |

| |

| |

| |

| |

| |

|

|

|

|

|

Physical Location of Previous Business |

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

|

|

ZIP Code |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Address of Previous Business |

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

State |

|

|

|

ZIP Code |

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*14606010001*

14606010001

1

Mailing and Storage Address

Officers, Partners, or Members

Retail Sales, Consumer’s or Vendor’s Use Tax Representatives

Reporting forms and notices will be mailed to this address.

7. Address (street, rural route or P.O. Box) |

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

Company Name if different than owner |

|

|

|

|

|

|

|

|

|

|

|

|

|

Which forms do you want mailed to this address? |

|

|

|

|

|

|

r All Tax Types |

r Sales and Use Tax |

r Corporate Income Tax |

r Employer Withholding Tax |

|

||

|

|

|

|

|||

Address where you will store your tax records (do not use a P.O. Box for record storage). |

|

|||||

|

|

|

|

|

|

|

8. Physical Address |

|

|

City |

|

State |

ZIP Code |

|

|

|

|

|

|

|

9.Provide the officers, partners, or members (L.L.C.) of your business who are responsible for the collection and remittance of tax. Listing individuals or entities here indicates they have direct supervision or control over tax matters. Attach list if needed.

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

Title |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Social Security Number |

|

|

|

|

Federal Employer ID Number (FEIN) |

|

|

|

Date of Birth (MM/DD/YYYY) |

||||||||

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

___ ___/___ ___/___ ___ ___ ___ |

Home Address |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

County |

|

|

|

|

|

|

Title Begin Date (MM/DD/YYYY) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___/___ ___/___ ___ ___ ___ |

|

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

Title |

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|||||||

Social Security Number |

|

|

|

|

Federal Employer ID Number (FEIN) |

|

|

|

Date of Birth (MM/DD/YYYY) |

||||||||

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

|

___ ___/___ ___/___ ___ ___ ___ |

Home Address |

|

|

|

|

|

|

|

|

|

|

City |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

|

|

|

|

|

ZIP Code |

|

County |

|

|

|

|

|

|

Title Begin Date (MM/DD/YYYY) |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___/___ ___/___ ___ ___ ___ |

|

10.Business Tax Accounts: Identify all persons who are not a partner, member (L.L.C), or officer of the business that have direct supervision or control over tax matters whom you authorize the Department to discuss your tax matters. Attach list if needed.

Title Begin or End Date (MM/DD/YYYY) |

Name (Last, First, Middle Initial) |

|

|

|

|

|

|

|

|

|||

__ __ / __ __ / __ __ __ __ |

|

|

|

|

|

|

|

|

|

|

|

|

Title |

|

|

Social Security Number |

|

|

|

|

Birthdate (MM/DD/YYYY) |

||||

|

|

| |

| |

| |

| |

| |

| |

| |

| |

__ __ / __ __ / __ __ __ __ |

||

Home Address |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City |

|

State |

|

|

ZIP Code |

|

|

|

|

County |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

11.Taxable Sales or Purchases Begin Date (MM/DD/YYYY) ___ ___/___ ___/___ ___ ___ ___

12.Temporary License (Less than 191 days) (MM/DD/YYYY)

(Example: fireworks, temporary event, etc.) Begins ___ ___/___ ___/___ ___ ___ ___ Ends ___ ___/___ ___/___ ___ ___ ___

13. Seasonal Business: If you do not make taxable sales year round, please check the months that you do.

rJanuary r February r March r April r May r June r July r August r September r October r November r December

14.Estimated sales and use tax liability (select one). Your selection will determine your return filing frequency.

r Monthly (Over $500 a month) |

r Quarterly ($500 or less a month) |

r Annual (Less than $200 a quarter) |

*14606020001*

14606020001

2

Business Name and Physical Location

Business Activity

15. Business Name (DBA name: attach list if necessary for additional locations)

Street, Highway (Do not use P.O. Box Number or Rural Route Number) |

City |

|

|

|

|

|

|

County |

State |

ZIP Code |

Business Telephone Number |

|

|

|

(___ ___ ___)___ ___ |

16.Will sales be made at various temporary locations in Missouri?

r No r

17.Is this business located inside the city limits of any city or municipality in Missouri?

To verify go to mytax.mo.gov/rptp/portal/home/business/salesUseTaxRateInformation

r No r Yes — Specify the city: _________________________________________________________________________

18.Is this business located inside a district(s)? For example, ambulance, fire, tourism, community or transportation development.

rNo r Yes — Specify the district name(s): ________________________________________________________________

19.Describe the business activity, stating the major products sold and services provided.____________________________________________

________________________________________________________________________________________________________________

r Retail _____% r Wholesale _____% |

r Service _____% r Manufacturer r Contractor r Other _______________ |

||||

|

|

|

|

|

|

|

|

|

|

|

|

20. |

Do you make retail sales of the following items? |

Select all that apply. |

|

|

|

|

r Alcoholic Beverages |

r Alternative Nicotine r Cigarettes or Other Tobacco Products r Domestic Utilities |

|

|

|

|

r |

||||

|

r Items Qualifying for |

r |

|||

|

r New Tires r |

|

|

||

|

.r Qualifying Utilities or Items Used or Consumed in Manufacturing or Mining, Research and Development, or Processing Recovered Materials. |

||||

21. |

Do you make retail sales of aviation jet fuel to Missouri customers? |

r Yes |

r No |

||

|

If yes, are your sales made at: |

|

|

|

|

|

r A Missouri airport? |

r A location outside Missouri and the fuel is transported into Missouri? |

|

|

|

|

If yes, is the airport located in Missouri and identified on the National Plan of Integrated Airport Systems (NPIAS)? |

r Yes |

r No |

||

|

If yes, provide a list of applicable locations._ _____________________________________________________________________________ |

||||

22. |

Do you use, store, or consume aviation jet fuel in Missouri where the seller does not collect tax? |

r Yes |

r No |

||

|

If yes, is the fuel stored, used, or consumed in an airport that is identified on the NPIAS? |

r Yes |

r No |

||

|

If yes, provide a list of applicable locations: ______________________________________________________________________________ |

||||

23. |

Do you lease or rent motor vehicles that were purchased sales tax exempt, to Missouri customers? |

r Yes |

r No |

||

|

If you are an |

r Yes |

r No |

||

|

outside Missouri and the motor vehicle is delivered outside Missouri? |

||||

If you are an

24. |

Do you have a location or job site in Missouri? |

r Yes |

r No |

|

If yes, attach a list of your locations including address, city, state, zip code and indicate if the location is inside or outside |

|

|

|

the city limits._ ____________________________________________________________________________________________________ |

||

25. |

Are orders taken from your Missouri customers by telephone, |

r Yes |

r No |

|

a list where they live and indicate if they are inside or outside the city limits |

||

26. |

Do your representatives who reside in Missouri: |

r Yes |

r No |

|

A. Approve customer orders? |

||

|

B. Make on the spot sales? |

r Yes |

r No |

|

C. Maintain an inventory? |

r Yes |

r No |

|

D. Deliver merchandise to the customer? |

r Yes |

r No |

27. |

Do you have |

r Yes |

r No |

|

If yes, define the activities performed while in Missouri._ ___________________________________________________________________ |

||

|

____________________________________________________________________________________________________ |

||

28. |

Do you have real or tangible personal property in Missouri? |

r Yes |

r No |

|

If yes, please describe: ___________________________________________________________________________________ |

||

*14606030001*

14606030001

3

|

Tax |

|

|

29. Is this corporation registered with the Internal Revenue Service as a |

r Regular or Close Corporation |

r Sub Chapter S Corporation |

||||||||||||||||

|

Income |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

30. Corporation Tax Begin Date in Missouri (MM/DD/YYYY) |

Corporation Taxable Year End (MM/DD) |

|

|

||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||

|

Corporate |

|

|

|

___ ___/___ ___/___ ___ ___ ___ |

|

___ ___/___ ___ |

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

tax is expected to be at least $250, or 6.25% of the Missouri taxable income, check the “Yes” box |

|

|

r Yes |

r No |

||||||||||||||

|

|

|

|

31. Will the corporation be required to make quarterly estimated Missouri income tax payments? If the Missouri estimated |

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

32. Missouri Withholding Begin Date (MM/DD/YYYY) |

|

How many of your employees will work in Missouri? |

|

|

||||||||||||||

|

|

|

|

|

___ ___/___ ___/___ ___ ___ ___ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33. Estimated employer withholding tax liability (select one). Your selection will determine your return filing frequency. |

|

|

||||||||||||||||

|

|

|

|

|

Estimated monthly gross wages _____________________ X 5.4% = __________________________ |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

r Annually (less than $100 withholding tax per quarter) |

r Monthly ($500 to $9,000 withholding tax per month) |

|

|

||||||||||||||

|

|

|

|

|

r Quarterly ($100 withholding tax per quarter to $499 |

r |

||||||||||||||||

|

|

|

|

|

per month) |

|

|

|

to pay electronically) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

34. Does a parent company file withholding tax reports and receive full compensation for timely filed returns? |

|

|

r Yes |

r No |

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

35. If you do not pay wages year round, please check the months that you do pay wages. |

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

r January r February r March r April r May r June r July r August r September r October r November r December |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Withholding Tax Courtesy Mailing Address (a copy of all withholding tax delinquent notices will be mailed to this address) |

|

|

||||||||||||||||

Tax |

|

36. Business Name (DBA name) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Withholding |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

Street, Route or P.O. Box |

|

|

|

|

City |

(___ ___ ___)___ ___ |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

County |

|

State |

|

|

ZIP Code |

Business Telephone Number |

|

|

||||||||||

Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Transient Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

37. |

Are you a transient employer? |

|

|

|

|

|

|

|

|

|

|

|

r Yes |

r No |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

An employer not domiciled in Missouri and temporarily transacting business in Missouri for less than 24 consecutive months is defined as a transient employer. |

|||||||||||||||||

|

|

|

|

|

(Example: contractor, temporary staffing agency, etc.). For additional information, contact the Department at businesstaxregister@dor.mo.gov or call |

|

|

|||||||||||||||

|

|

|

|

|

(573) |

|

|

|||||||||||||||

|

|

|

|

|

A transient employer must submit the following with this application: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

Missouri Employment Security Account Number |

|||||||||||||

|

|

|

|

|

• A completed insurance certification slip indicating Missouri as a covered state for worker’s compensation |

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

• Missouri Employment Security Account number, if hiring a Missouri resident: (first seven digits required) |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

• Your Missouri Certificate of Authority Number issued by the corporate division of the Missouri Secretary of State’s Office |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

• A Transient Employer Bond not less than $5,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Calculate your transient employer bond: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

A. Missouri withholding tax |

Monthly gross wages _______________________ |

X 5.4% = _____________________ X 3 = ____________________________ (a) |

||||||||||||||||

|

|

|

|

B. Missouri unemployment tax |

Average # of workers __________ X $7,000 = __________________ X 3.38% __________________ / 4 = ___________________ (b) |

|||||||||||||||||

|

|

|

|

(a) ___________________________ + (b) ___________________ = ______________________________ (amount of bond - minimum $5,000) |

|

|

||||||||||||||||

|

|

|

|

Visit dor.mo.gov/forms/?formName=&category=13&year=99 for bond forms. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

Type of bond r Cash Bond (Form 332) r Certificate of Deposit (Form 4172) r Irrevocable Letter of Credit (Form 2879) r Surety Bond (Form 331) |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct. This application must be signed by the owner, if the business |

||||||||||||||||||

|

|

|

|

is a sole proprietorship, or by an individual listed in the Officer, Partners, or Members section of this application. The signing party is acknowledging that they have direct supervision or |

||||||||||||||||||

|

|

|

|

control over tax matters. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signature |

|

|

Signature |

|

|

Title |

|

|

|

|

|

|

Date (MM/DD/YYYY) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

___ ___ / ___ ___ / ___ ___ |

___ ___ |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Typed or Printed Name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

Confidentiality of Tax Records |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

Missouri Statute 32.057, RSMo, states that all tax records and information maintained by the Missouri Department of Revenue are confidential. The tax information can |

||||||||||||||||||

|

|

|

|

only be given to the owner, partner, member, or officer who is listed with us as such. If you wish to give an employee, attorney, or accountant access to your tax information, |

||||||||||||||||||

|

|

|

|

you must supply the Department with a power of attorney to grant the authority to release confidential information to them. Visit dor.mo.gov/forms to obtain a Power of |

||||||||||||||||||

|

|

|

|

Attorney (Form 2827). |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mail to: Taxation Division |

Form 2643A (Revised |

|

|

||

P.O. Box 357 |

Visit |

|

Jefferson City, MO |

Ever served on active duty in the United States Armed Forces? |

|

|

||

Phone: (573) |

If yes, visit dor.mo.gov/military/ to see the services and benefits we offer to all eligible |

|

military individuals. A list of all state agency resources and benefits can be found at |

||

Fax: (573) |

||

4 |

14606040001 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 2643A form is the Missouri Tax Registration Application. It helps businesses register for tax identification in Missouri. |

| Mandatory Information | All questions must be answered completely. Incomplete or unsigned applications may delay processing. |

| Tax Types | Applicants can choose multiple tax types, including Sales, Withholding, and Corporate Taxes. |

| Governing Law | This form is governed by Missouri state law, particularly related to business taxation. |

| Confidentiality | Tax records filed under this form are confidential, per Missouri Statute 32.057, RSMo. |

Guidelines on Utilizing 2643A

Completing Form 2643A requires careful attention to detail. Ensure that you provide all necessary information and check your entries for accuracy. This will help expedite the processing of your application.

- Print the form on white paper.

- Fill in the Missouri Tax Registration Application section at the top of the form.

- Enter your Missouri Tax I.D. Number, if applicable.

- Provide your Federal Employer I.D. Number.

- Indicate the reason for application by selecting the appropriate option.

- Select all applicable tax types for which you are applying.

- Enter the owner's name, which may include a corporation, LLC, or partnership name.

- Provide the owner's address, email address, city, state, ZIP code, and county.

- If the owner is an individual, include their Social Security Number, date of birth, and telephone number.

- Select the type of ownership and provide the charter number, if necessary.

- Answer whether there is a previous owner or operator for the business.

- If applicable, detail the purchase price, previous owner's name, and their Missouri Tax Identification Number.

- Provide the mailing address and specify which tax forms should be sent there.

- Outline the physical address where tax records will be stored.

- List the names, titles, and other requested details for responsible officers, partners, or members.

- Identify any other persons with direct control over tax matters.

- Fill in the taxable sales or purchases start date.

- If applicable, complete the temporary license section.

- Check the seasonal business months applicable to your operations.

- Select your estimated sales and use tax liability frequency.

- Provide the business name and physical location.

- Describe your business activity and products/services offered.

- Indicate whether retail sales of specific items apply to your business.

- Answer questions regarding aviation fuel sales and any related activities.

- Complete questions about leasing motor vehicles and having a business presence in Missouri.

- For corporations, answer tax-related questions about income tax expectations and quarters.

- Provide information on estimated employer withholding taxes and payment frequency.

- Indicate transient employer status and include necessary information.

- Sign and date the form, ensuring that all entries are accurate.

- If needed, provide a power of attorney to grant access to your tax information.

- Mail the completed form to the address specified at the bottom.

What You Should Know About This Form

What is the 2643A form used for?

The 2643A form, officially known as the Missouri Tax Registration Application, is used by businesses to register for various tax types in Missouri. This includes sales tax, employer withholding tax, corporate income tax, and more. Completing this form is essential for compliance with Missouri tax laws and ensures you can legally conduct business in the state.

Who needs to fill out the 2643A form?

Any business operating in Missouri or planning to operate there needs to fill out the 2643A form. This applies to new business establishments, those purchasing existing businesses, or those reinstating an old business. It is also necessary for transient employers conducting temporary work in Missouri.

What information is required on the 2643A form?

The form requires various pieces of information, including the owner's name and contact details, the federal employer identification number (FEIN), and details about the type of business and its location. It also requires information about officers or partners in the business, previous owners, and anticipated sales and tax liabilities. Complete and accurate responses are necessary to avoid processing delays.

Is the Missouri Tax I.D. Number mandatory on the 2643A form?

Providing a Missouri Tax I.D. Number on the 2643A form is optional. However, if you have one, entering it can help streamline the registration process and ensure your records are properly maintained by the state.

What happens if the application is incomplete?

If the 2643A form is incomplete or unsigned, it will result in delays in processing your application. All required fields must be filled out accurately to avoid setbacks in your business registration and tax obligations.

How long does it take to process the 2643A form?

The processing time for the 2643A form can vary based on the volume of applications received by the Missouri Department of Revenue. Generally, you can expect a processing time of several weeks, so it’s wise to submit your application well in advance of when you plan to begin operations.

Can I authorize someone else to discuss my tax matters with the Department of Revenue?

Yes, you can authorize an employee, attorney, or accountant to discuss tax matters on your behalf. To do so, you must provide a power of attorney form (Form 2827) to the Missouri Department of Revenue, granting them the authority to release tax information to that individual.

What should I do if I have further questions about filling out the 2643A form?

If you have more questions or need assistance, it's best to contact the Missouri Department of Revenue directly. You can reach them via email at businesstaxregister@dor.mo.gov or by phone at (573) 751-5860. They will provide guidance and support for completing the form correctly.

Common mistakes

Filling out Form 2643A can seem simple, but many people encounter stumbling blocks that delay their application processing. One common mistake is failing to answer all questions completely. Incomplete applications will not only slow down processing but might also require additional correspondence that could have been avoided.

Another frequent error is not signing the application. An unsigned application will be deemed invalid. It’s essential to ensure that the owner or an authorized party signs the form to confirm that the information provided is accurate and intentional.

Many applicants overlook the importance of selecting the correct tax types for which they are applying. Form 2643A requires specific selections, and choosing incorrectly can complicate matters later. Make sure to carefully review each tax type listed and mark all that apply correctly.

Another serious mistake happens when applicants neglect to provide the Missouri Tax ID or federal Employer ID number. While the Missouri Tax ID is optional, it can help expedite the review process. Therefore, it’s wise to provide it if applicable. Conversely, an incorrect federal ID can lead to significant delays.

People often forget to include the previous business owner’s details when applicable. If the business being registered has had a previous owner, that information must be filled in. Neglecting to provide this can raise questions and result in processing delays.

A lack of detail in describing the business activity can also be problematic. The form asks for a clear description of what your business entails. Failure to provide enough detail can lead to confusion or a misclassification of your business type.

It's crucial to check the box indicating whether your business will operate seasonally. This oversight can affect your tax liability and reporting frequency. Therefore, if your business operates during specific months, be honest about it.

Lastly, one should not ignore the mailing address for tax forms and notices. Using a P.O. Box for record storage is prohibited. Instead, ensure a physical address is provided to guarantee all correspondence from the Department arrives without issue.

Documents used along the form

The 2643A form is commonly used in Missouri for tax registration purposes. Alongside this essential form, several other documents may be required to ensure proper compliance and processing. Below is a list of nine key forms that are frequently used in conjunction with the 2643A.

- Power of Attorney (Form 2827): This document allows an employee, attorney, or accountant to access confidential tax information on behalf of the business owner.

- Transient Employer Bond: Required for transient employers, this bond serves as a financial guarantee that the employer will comply with tax obligations. Various bond types, including cash and surety bonds, can be used.

- Missouri Employment Security Account Number: This number is essential for businesses that hire employees in Missouri. It registers the business for unemployment insurance purposes.

- Missouri Certificate of Authority: If a business is incorporated outside of Missouri, this certificate is necessary to legally conduct business within the state.

- Insurance Certification Slip: This document confirms that the transient employer has Missouri as a covered state for worker’s compensation, necessary for compliance.

- Missouri Tax Registration Application (Form 2643): In addition to the 2643A form, this form is often utilized by businesses to register for various tax types and establish their tax account.

- Corporate Tax Registration Form: Necessary for corporations, this form registers the company for corporate income taxes and lays the groundwork for compliance.

- Employer Withholding Tax Registration Form: This form registers businesses that withhold taxes from employee wages, ensuring compliance with state withholding tax obligations.

- Business Location Documentation: If applicable, businesses must provide documentation proving their physical business location, especially for licensing and tax purposes.

It is crucial to complete the 2643A form along with any required supplementary documents correctly and completely. This ensures a smooth registration process and helps avoid delays in obtaining the necessary permits and tax accounts.

Similar forms

- Form 2643B: Missouri Business Registration Application - Similar to Form 2643A, this document collects comprehensive details about businesses registering with the state, including ownership, tax type, and contact information, ensuring compliance with Missouri business regulations.

- Form 1040: U.S. Individual Income Tax Return - Like 2643A, this form requires personal and financial information from individuals, ensuring that the government has accurate taxpayer data to calculate tax liabilities.

- Form W-9: Request for Taxpayer Identification Number - Both forms confirm taxpayer identity and require accurate completion to avoid delays in tax processing, ensuring government and individual records match.

- Form SS-4: Application for Employer Identification Number - This form shares similarities in purpose, gathering essential business information to assign a unique identification number necessary for tax purposes.

- Form 941: Employer's Quarterly Federal Tax Return - This form requires tax information similar to that collected in 2643A, helping businesses report payroll taxes and maintain compliance with federal tax obligations.

- Form 1065: U.S. Return of Partnership Income - Like the 2643A, this form requests detailed ownership information and business activities, ensuring transparency and compliance for partnerships managing taxes.

- Form 1120: U.S. Corporation Income Tax Return - This document parallels Form 2643A in collecting crucial corporate details and determining income tax liabilities for corporations dealing with federal taxes.

- Form 4852: Substitute for Form W-2 - Both forms function similarly by capturing necessary taxpayer and business details when standard documents are unavailable, facilitating timely tax reporting.

Dos and Don'ts

Filling out the Form 2643A can be straightforward if you follow the right guidelines. Here’s a helpful list of what to do and what to avoid:

- Do use white paper only to print the form.

- Do answer all questions completely. Incomplete forms can delay processing.

- Do provide your Missouri Tax I.D. Number, even though it is optional.

- Do ensure that the form is signed by the appropriate individual responsible for tax matters.

- Do indicate the correct ownership type, as this impacts registration requirements.

- Don’t type hyphens or dashes when filling out the form.

- Don’t leave any sections blank—every applicable question must have an answer.

- Don’t provide a P.O. Box for record storage; a physical address is required.

- Don’t forget to reset all pages of the form if you need to make any changes.

By keeping these points in mind, you can simplify the process and help ensure that your application is processed efficiently.

Misconceptions

- Misconception 1: The Missouri Tax I.D. number is mandatory on the 2643A form.

- Misconception 2: You must type hyphens or dashes on the form.

- Misconception 3: Signing the 2643A form is not essential.

- Misconception 4: You can submit the form without answering all questions.

- Misconception 5: Once submitted, the form cannot be modified.

- Misconception 6: The form only applies to new businesses.

- Misconception 7: All tax types must be selected regardless of your business.

- Misconception 8: Your business does not need to report income if it has no taxable sales.

- Misconception 9: You don’t need to provide details about previous owners.

- Misconception 10: The form can be submitted electronically.

In fact, the Missouri Tax I.D. number is optional. It is not required for the application to be processed.

It is not necessary to type hyphens or dashes. Filling in the required boxes clearly is more important.

Incomplete and unsigned applications will lead to delays in processing. Be sure to sign the form to avoid any issues.

All questions must be answered completely. Incomplete submissions will cause delays.

While it is best to submit accurate information from the start, you can contact the Department if changes are needed after submission.

The 2643A form can also be used for purchasing existing businesses, reinstating old businesses, or converting through the Missouri Secretary of State’s office.

You should only select the tax types relevant to your business operations. This ensures you are filing for the correct taxes.

Even if your business has no taxable sales, you still need to report your business activity to the state.

If your business involves a previous owner, you must complete the section related to past ownership, including necessary details about the purchase.

The form must be printed and mailed. Electronic submission is not an option at this time.

Key takeaways

Complete All Sections: Ensure that every question on the 2643A form is answered fully. An incomplete application may lead to delays in processing, which could affect your business operations.

Signature Requirement: The form must be signed by the owner or an authorized individual listed in the officer or partner section. This signature indicates acknowledgment and responsibility for the reported information.

Choose Tax Types Wisely: Select all applicable tax types that your business will be involved with. This choice impacts how your taxes are managed and reported, so careful consideration is essential.

Confidentiality of Records: Be aware that tax records are treated as confidential under Missouri law. Access to this information is limited to authorized individuals. If you need to grant access to another party, a power of attorney must be submitted to the Department of Revenue.

Browse Other Templates

Ss Forms - Instructions for photocopying underline the importance of record-keeping.

Hazmat Bol - The revision of outdated practices helps to modernize hazardous materials transport standards.