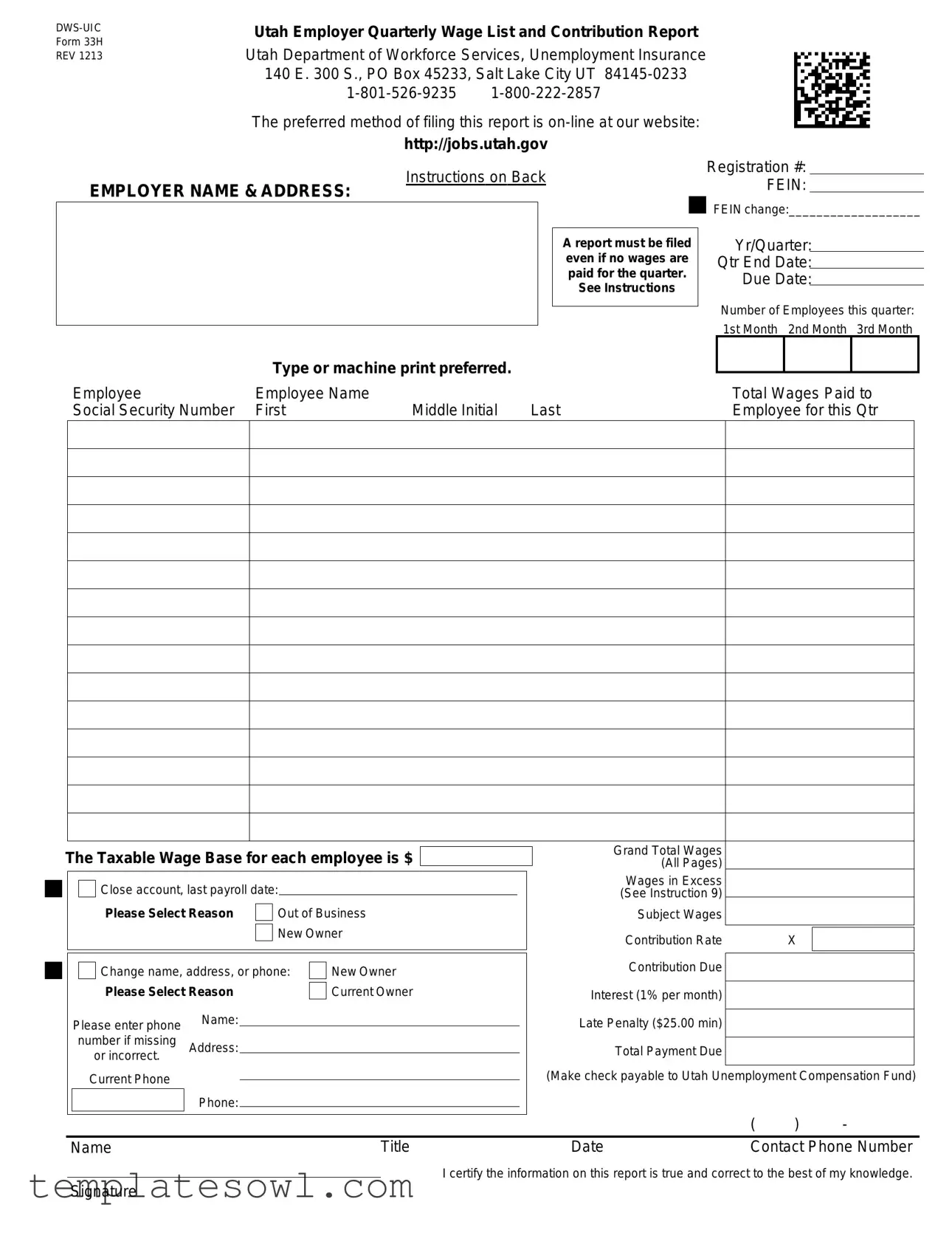

Fill Out Your 33H Form

The 33H form, officially known as the Utah Employer Quarterly Wage List and Contribution Report, plays a vital role in the state’s unemployment insurance system. Employers must file this report even if no wages were paid during the quarter, emphasizing the form's requirements for compliance. When submitting the 33H, you'll need to provide essential details such as the employer's name, address, and unique registration number, alongside the quarter's end date, due date, and total number of employees. It's crucial to report total wages paid to each employee. This ensures that the appropriate unemployment insurance contributions can be assessed based on taxable wages. Furthermore, the form outlines processes for updating information if there’s a change in ownership or contact details. The state encourages online filing, which can streamline the process, making it cost-effective and efficient. Overall, understanding the specifics of the 33H form is essential for every Utah employer to avoid penalties and contribute to a system that supports workers in times of need.

33H Example

Utah Employer Quarterly Wage List and Contribution Report

Form 33H |

Utah Department of Workforce Services, Unemployment Insurance |

||||||

REV 1213 |

|||||||

|

140 E. 300 S., PO Box 45233, Salt Lake City UT |

||||||

|

|

|

|||||

|

The preferred method of filing this report is |

||||||

|

http://jobs.utah.gov |

||||||

|

Instructions on Back |

||||||

EMPLOYER NAME & ADDRESS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A report must be filed |

|

|

|

|

|

|

|

even if no wages are |

|

|

|

|

|

|

|

paid for the quarter. |

|

|

|

|

|

|

|

See Instructions |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Registration #:

FEIN:

FEIN change:___________________

Yr/Quarter:

Qtr End Date:

Due Date:

Number of Employees this quarter: 1st Month 2nd Month 3rd Month

Type or machine print preferred.

Employee |

Employee Name |

|

|

Total Wages Paid to |

Social Security Number |

First |

Middle Initial |

Last |

Employee for this Qtr |

|

|

|

|

|

|

|

|

|

|

The Taxable Wage Base for each employee is $

Close account, last payroll date:

Close account, last payroll date:

|

|

Please Select Reason |

|

Out of Business |

||

|

|

|

|

New Owner |

||

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Change name, address, or phone: |

|

New Owner |

||

|

|

|

||||

|

|

Please Select Reason |

|

|

|

Current Owner |

|

|

|

|

|

||

Please enter phone |

Name: |

|

|

||

number if missing |

Address: |

|

or incorrect. |

||

|

||

Current Phone |

|

|

|

Phone: |

Grand Total Wages

(All Pages)

Wages in Excess

(See Instruction 9)

Subject Wages

Contribution RateX

Contribution Due

Interest (1% per month)

Late Penalty ($25.00 min)

Total Payment Due  (Make check payable to Utah Unemployment Compensation Fund)

(Make check payable to Utah Unemployment Compensation Fund)

|

|

|

( |

) |

- |

Name |

Title |

Date |

Contact Phone Number |

||

I certify the information on this report is true and correct to the best of my knowledge.

Signature

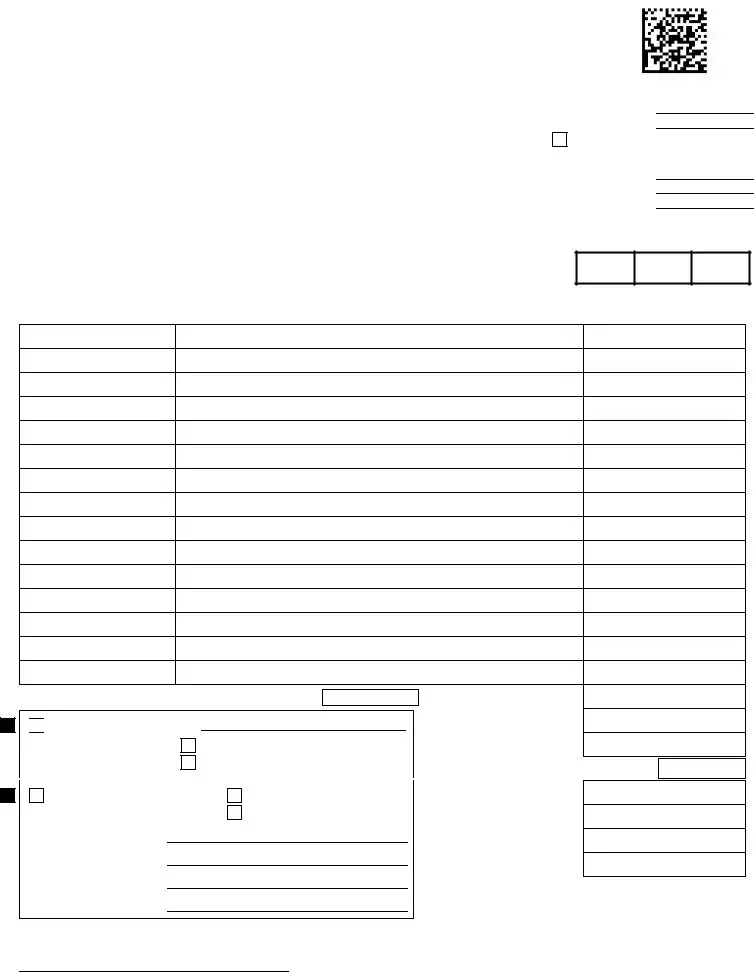

Form 33HA

REV 0813

Utah Employer Quarterly Wage List Continuation Sheet

Utah Department of Workforce Services, Unemployment Insurance

140 E. 300 S., PO Box 45233, Salt Lake City UT

The preferred method of filing this report is

http://jobs.utah.gov

Registration #:

EMPLOYER NAME & ADDRESS:

Yr/Quarter:

Qtr End Date:

Due Date:

|

|

Type or machine print this report. |

|

|

Employee |

Employee Name |

|

Total Wages Paid to |

|

Social Security Number |

First |

Middle Initial |

Last |

Employee for this Qtr |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Form Purpose | The 33H form is used by Utah employers to report quarterly wages and contributions to the state’s Unemployment Insurance program. |

| Filing Requirement | Employers must file this report every quarter, even if no wages were paid during that period. |

| Submission Method | The preferred method of filing the report is online through the Utah Department of Workforce Services website. |

| Governing Laws | This form is governed by the Utah Unemployment Insurance Act and relevant state employment laws. |

Guidelines on Utilizing 33H

Completing the 33H form is essential for employers to report wages and contributions accurately. After filling out this form, you will submit it to the Utah Department of Workforce Services to fulfill your obligation for the quarter. It is vital to ensure all information is correct before submission to avoid delays or penalties. Below are the steps to guide you through the process.

- Gather Your Information: Collect necessary details like your employer name, address, registration number, and Federal Employer Identification Number (FEIN).

- Determine the Reporting Period: Identify the year and quarter for which you are filing the report, including the quarter end date and due date.

- Count the Employees: Record the number of employees for this quarter.

- Complete Employee Details: For each employee, write their name (first, middle initial, last), Social Security number, and total wages paid for the quarter.

- Calculate Wages: Determine the grand total of wages paid and any taxable wages over the base amount, as necessary.

- Fill in Contribution Details: Indicate your contribution rate, calculate the contribution due, and add any interest or late penalties if applicable.

- Input Contact Information: Provide your name, title, and contact phone number.

- Certification: Sign and date the form, certifying that the information is accurate to the best of your knowledge.

- Submit Your Form: Choose your filing method. While online submission is preferred, you can also mail the completed form to the address provided.

What You Should Know About This Form

What is the purpose of the 33H form?

The 33H form, also known as the Utah Employer Quarterly Wage List and Contribution Report, is used by employers to report wages paid to employees and to calculate contributions owed to the Utah Unemployment Compensation Fund. This form must be submitted quarterly, even if no wages were paid during that period.

Who needs to file the 33H form?

All employers in Utah who have employees must file the 33H form. This includes businesses that did not pay wages in a particular quarter. Failure to file can result in penalties.

When is the due date for filing the 33H form?

The due date for filing the 33H form is based on the end of each quarter. Employers need to submit the form within 30 days after the quarter ends. For example, for the quarter ending on March 31, the form is due by April 30.

What information is required on the 33H form?

The form requires details such as the employer's name and address, registration number, Federal Employer Identification Number (FEIN), quarter end date, number of employees, and total wages paid to each employee. It may also ask for information regarding any changes, such as closing a business or changing ownership.

Can the 33H form be filed online?

Yes, the preferred method of filing the 33H form is online through the Utah Department of Workforce Services website. This is often quicker and may help avoid some common filing errors.

Is there a penalty for late filing of the 33H form?

Yes, there is a penalty for late filing. Employers may incur a minimum late penalty of $25. Additionally, interest is charged at a rate of 1% per month on overdue amounts, which can add to the total payment due.

What if there are no wages to report for a quarter?

Even if no wages were paid in a quarter, a 33H form must still be filed. It is important for employers to maintain compliance by submitting a report indicating that no wages were paid.

What should an employer do if they change ownership or close the business?

If a business changes ownership or closes, the employer should indicate this on the 33H form. They will need to select the appropriate reason for closing the account or changing ownership and provide contact information to ensure proper processing.

How can employers ensure the information on the 33H form is accurate?

Employers should carefully review all entries to ensure accuracy before submitting the form. It may be helpful to maintain payroll records throughout the quarter for reference. Certifications of accuracy are required when submitting the report.

Where can additional information about the 33H form be found?

Additional information regarding the 33H form can be found on the Utah Department of Workforce Services website. Employers may also contact the department directly using the provided phone numbers for further assistance.

Common mistakes

Completing the 33H form accurately is essential to ensure compliance with state requirements. One common mistake involves failing to file a report even when no wages have been paid during the quarter. In such cases, a report is still necessary, which can lead to unnecessary penalties if overlooked.

Another frequent error is incorrect registration numbers. Employers might misplace their registration number or federal employer identification number (FEIN), leading to delays in processing. Always verify these numbers and ensure they are entered correctly.

Some individuals forget to enter the year and quarter for which the report is being filed. This oversight can cause confusion and may result in the report being deemed invalid or returned for clarification.

Providing inaccurate data for employee information constitutes a significant mistake. Employers should double-check the names, Social Security numbers, and total wages paid for each employee. Even minor discrepancies can lead to issues down the line.

Another issue arises with the "Grand Total Wages" section. Employers may fail to sum the wages accurately from all employees. An incorrect total can lead to miscalculations of unemployment contributions.

Late submissions of the form are common, often due to misunderstanding the due dates. Being aware of deadlines helps avoid late penalties, which can be financially burdensome.

Furthermore, some people neglect to sign the form. A missing signature can render the submission incomplete, causing additional delays in processing.

Another mistake involves omitting the contact phone number. This information is vital, as it allows the state to reach the employer in case there are questions regarding the submission.

Employers sometimes ignore the necessity to indicate changes in ownership or address details. Failing to report such changes can lead to complications in communication and processing.

Lastly, errors may occur in calculating the total payment due. Employers need to pay careful attention to the contribution rates and any applicable interest or penalties. Accurate calculations prevent issues with payment processing and ensure compliance with regulations.

Documents used along the form

The DWS-UIC Utah Employer Quarterly Wage List and Contribution Report Form 33H is an essential tool for employers in Utah. It allows businesses to report wages paid to employees and to calculate unemployment insurance contributions. However, several other forms and documents are frequently used in conjunction with this report. Understanding these additional documents can help ensure compliance and foster accurate reporting.

- DWS-UIC Form 33HA: This is the continuation sheet for the 33H form, used when there are more employees than can be listed on the primary form. It captures employee names and wages, thus providing a complete payroll record.

- Form W-2: Employers use this form to report annual wages and taxes withheld for each employee. It's crucial for employees to file their income taxes correctly.

- Form 940: This is an annual report filed by employers to report unemployment taxes. It's important for assessing contribution levels and ensuring compliance with federal regulations.

- Form 941: This quarterly tax form reports payroll taxes withheld from employee paychecks, including federal income tax and Social Security tax. It's vital for maintaining accurate payroll records.

- Form DUA: In some cases, employers may need to submit this form to apply for a determination of unemployment insurance benefits for employees. It is particularly relevant in situations involving layoffs or business closures.

- IRS Form 1099: If a business hires independent contractors, this form is used to report payments made to them. It's important for tax purposes and record-keeping.

- Claim for Unemployment Benefits Form: This form is completed by employees to claim unemployment benefits. Employers may need to respond to these claims, making understanding the process essential.

- Employee Time Sheets: While not a formal government form, maintaining accurate time sheets is necessary for reporting wages properly on the 33H and related documents, demonstrating hours worked.

These forms and documents complement the DWS-UIC Utah Employer Quarterly Wage List and Contribution Report Form 33H, helping employers navigate their responsibilities. By being aware of these essentials, businesses can ensure compliance while also aiding their employees in fulfilling their own obligations.

Similar forms

- Form W-2: Similar to the 33H form, the W-2 reports annual wages and taxes withheld for employees to the IRS, providing a summary of an employee's earnings and tax contributions.

- Form 940: This form is used for reporting annual Federal Unemployment Taxes. Like the 33H, it helps track contributions, although it covers a different time frame and scope.

- Form 941: Businesses use this form to report quarterly federal payroll taxes. Both 33H and 941 require information on employee wages and taxes owed, emphasizing accurate reporting.

- Form 1099-MISC: This form reports payments made to independent contractors. The 1099-MISC and 33H capture financial information related to wage payments, albeit for different employment classifications.

- State Quarterly Tax Returns: Various states require similar quarterly reports for unemployment insurance. These documents parallel the 33H in their aim to account for employee contributions at the state level.

- Form I-9: This form verifies the identity and employment authorization of individuals hired for employment. While not strictly a wage report, it is a crucial part of the employment documentation process, similar to the employment context of the 33H.

- Payroll Register: The payroll register is an internal document that summarizes all employee wages and deductions for a given pay period. It serves a function akin to the 33H, focusing on detailed employee compensation data.

- Form 8862: This form allows individuals to claim the Earned Income Tax Credit after it has been previously denied. Both forms are linked to reporting financial information but target different tax benefits and eligibility criteria.

Dos and Don'ts

When completing the 33H form for reporting wages and contributions to the Utah Department of Workforce Services, it is essential to follow specific practices to ensure the process goes smoothly. The following is a list of dos and don’ts to guide you through the completion of this important document.

- Do file your report online for efficiency and accuracy.

- Do include the employer name and address clearly at the top of the form.

- Do report the total wages paid for each employee accurately.

- Do verify that the Social Security Numbers for employees are correct.

- Do submit the report even if no wages were paid during the quarter.

- Don’t leave any mandatory fields blank; all information is required.

- Don’t forget to calculate and include any interest or penalties due.

- Don’t wait until the last minute to file; aim to complete the form well before the due date.

- Don’t assume that previous information is still correct; recheck all data for accuracy.

Adhering to these guidelines will help avoid errors that could lead to complications in reporting wages and contributions. Accurate and timely submissions are crucial for compliance with state regulations.

Misconceptions

There are many misconceptions surrounding the Utah Employer Quarterly Wage List and Contribution Report Form 33H. Understanding the facts can help employers better navigate their responsibilities. Here are seven common misconceptions:

-

Form 33H is only for reporting employee wages.

While the primary purpose is to report wages, employers must also include certain contribution details. This ensures compliance with unemployment insurance requirements.

-

You don’t need to file if no wages were paid.

This is false. A report must be filed even if no wages are paid during the quarter. It is essential to maintain accurate records with the Utah Department of Workforce Services.

-

Filing late won't incur penalties.

Contrary to this belief, late filings can result in penalties, including a minimum fee of $25. Staying aware of due dates can save employers from unnecessary costs.

-

All employees' wages are considered taxable without exception.

This is not entirely accurate. There are specific exemptions for certain types of payments. Employers should review these details to ensure accurate reporting.

-

You can file the form in any format.

Employers are encouraged to file online through the designated website. This method is preferred and may streamline the process significantly.

-

Only the owner is responsible for ensuring the form is accurate.

This misconception overlooks that all employees involved in payroll and reporting share the responsibility for accurate information. Collaboration is key.

-

The information on the form does not need to be certified.

In fact, the form requires a certification statement from the employer. This ensures that the information provided is truthful and complete to the best of their knowledge.

By addressing these misconceptions, employers can better comply with their obligations and avoid potential pitfalls in the reporting process.

Key takeaways

Filling out the 33H form, which is the Utah Employer Quarterly Wage List and Contribution Report, requires careful attention to detail. Here are some key takeaways to consider:

- The 33H form must be submitted quarterly, even if no wages were paid during that period.

- It is recommended to file the report online through the Utah Department of Workforce Services website for convenience.

- Inclusion of accurate employer information is essential. This includes official name, address, and registration number.

- Each employee's name, Social Security number, and total wages paid for the quarter should be listed clearly.

- The reported taxable wage base must be accurate, as it affects the contribution calculation.

- Any changes to the business status, such as being out of business or a change of ownership, must be noted.

- Late submissions may incur penalties; be aware of the due date to avoid additional charges.

- The form requires a certification that the reported information is true and accurate, which must be signed by an authorized individual.

Browse Other Templates

Sc 107 - Potential legal consequences of ignoring the SC 107 add weight to its importance in court proceedings.

Post Office Forms - Protected status violations may lead to reportable incidents if unwanted mail is received after 30 days.