Fill Out Your 355 7004 Form

The Massachusetts Department of Revenue Form 355-7004 is essential for corporate excise taxpayers who need to manage their extension payment obligations. This form includes a worksheet that helps calculate the estimated tax due for the taxable year, requiring taxpayers to provide an estimated tax amount and any advance or estimated payments made. It is crucial to pay the full tax amount reported on the worksheet by the return due date; otherwise, penalties and interest may apply. The extension process is automated, granting corporations a seven-month extension to file if they meet certain payment criteria. Taxpayers must ensure they have paid at least 50% of their total tax liability or the minimum corporate excise tax by the original due date. Specific deadlines differ for business corporations, S corporations in combined groups, and those not included in combined filings. Additionally, while the form allows for the payment of taxes due, it is important to note that an extension to file does not equate to an extension to pay. Late payments incur interest and penalties, which can significantly affect the total owed. By understanding the components and requirements of Form 355-7004, taxpayers can navigate their corporate tax responsibilities more effectively.

355 7004 Example

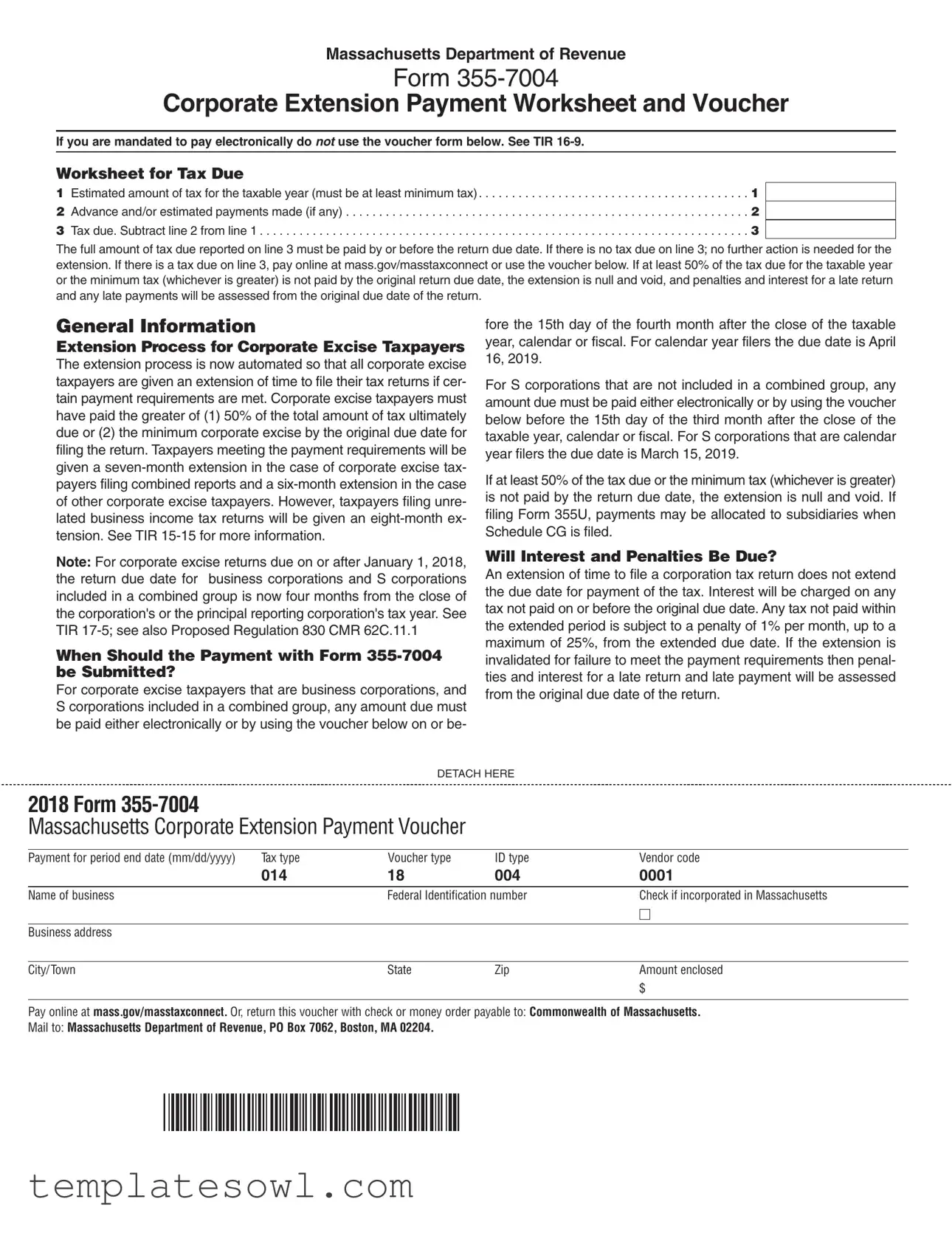

Massachusetts Department of Revenue

Form

CorporateExtensionPaymentWorksheetandVoucher

If you are mandated to pay electronically do NOT use the voucher form below. See TIR

Worksheet for Tax Due

1 Estimated amount of tax for the taxable year (must be at least minimum tax) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 2 Advance and/or estimated payments made (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2 3 Tax due. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

The full amount of tax due reported on line 3 must be paid by or before the return due date. If there is no tax due on line 3; no further action is needed for the extension. If there is a tax due on line 3, pay online at mass.gov/masstaxconnect or use the voucher below. If at least 50% of the tax due for the taxable year or the minimum tax (whichever is greater) is not paid by the original return due date, the extension is null and void, and penalties and interest for a late return and any late payments will be assessed from the original due date of the return.

General Information

Extension Process for Corporate Excise Taxpayers

The extension process is now automated so that all corporate excise taxpayers are given an extension of time to file their tax returns if cer- tain payment requirements are met. Corporate excise taxpayers must have paid the greater of (1) 50% of the total amount of tax ultimately due or (2) the minimum corporate excise by the original due date for filing the return. Taxpayers meeting the payment requirements will be given a

Note: For corporate excise returns due on or after January 1, 2018, the return due date for business corporations and S corporations included in a combined group is now four months from the close of the corporation's or the principal reporting corporation's tax year. See TIR

When Should the Payment with Form

For corporate excise taxpayers that are business corporations, and S corporations included in a combined group, any amount due must be paid either electronically or by using the voucher below on or be-

fore the 15th day of the fourth month after the close of the taxable year, calendar or fiscal. For calendar year filers the due date is April 16, 2019.

For S corporations that are not included in a combined group, any amount due must be paid either electronically or by using the voucher below before the 15th day of the third month after the close of the taxable year, calendar or fiscal. For S corporations that are calendar year filers the due date is March 15, 2019.

If at least 50% of the tax due or the minimum tax (whichever is greater) is not paid by the return due date, the extension is null and void. If filing Form 355U, payments may be allocated to subsidiaries when Schedule CG is filed.

Will Interest and Penalties Be Due?

An extension of time to file a corporation tax return does not extend the due date for payment of the tax. Interest will be charged on any tax not paid on or before the original due date. Any tax not paid within the extended period is subject to a penalty of 1% per month, up to a maximum of 25%, from the extended due date. If the extension is invalidated for failure to meet the payment requirements then penal- ties and interest for a late return and late payment will be assessed from the original due date of the return.

DETACH HERE

2018 Form

Massachusetts Corporate Extension Payment Voucher

Payment for period end date (mm/dd/yyyy) |

Tax type |

Voucher type |

ID type |

Vendor code |

|

014 |

18 |

004 |

0001 |

|

|

|

|

|

Name of business |

|

Federal Identification number |

Check if incorporated in Massachusetts |

|

|

|

|

|

|

Business address |

|

|

|

|

|

|

|

|

|

City/ Town |

|

State |

Zip |

Amount enclosed |

|

|

|

|

$ |

|

|

|

|

|

Pay online at mass.gov/masstaxconnect. Or, return this voucher with check or money order payable to: Commonwealth of Massachusetts.

Mail to: Massachusetts Department of Revenue, PO Box 7062, Boston, MA 02204.

FORM

How Do I Use This Worksheet and Voucher?

Use this worksheet to calculate the tax due that must be paid by or before the original due date of the return. Pay online with MassTax- Connect at mass.gov/masstaxconnect or use the Form

Note: Corporations with $100,000 or more in receipts or sales must submit their extension payment, electronically. Also, any corporation making an extension payment of $5,000 or more must make the pay- ment using electronic means. For further information on electronic fil- ing and payment requirements, see TIR

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Title | Massachusetts Department of Revenue Form 355-7004 Corporate Extension Payment Worksheet and Voucher |

| Governing Laws | TIR 16-9, TIR 15-15, TIR 17-5 |

| Payment Deadline | The tax due must be paid by the original return due date, specifically the 15th day of the fourth month after the close of the taxable year. |

| Extension Duration | Qualified corporate excise taxpayers receive a six-to-eight month extension to file, depending on their classification and payment amounts. |

| Payment Method | Taxpayers may pay online at mass.gov/masstaxconnect or use the voucher provided on the form. |

| Consequences of Non-Payment | If required payments are not made by the due date, penalties and interest will be applied to the unpaid tax from the original due date. |

Guidelines on Utilizing 355 7004

Filling out Form 355-7004 involves several straightforward steps. Ensure all information is accurate and up-to-date to avoid penalties. After completing the form, submit it along with any required payment before the specified due date.

- Begin by entering the estimated amount of tax for the taxable year in line 1.

- In line 2, list any advance or estimated payments you have already made.

- Subtract the amount in line 2 from the amount in line 1. Record the result in line 3 as the tax due.

- If there is no tax due, no further steps are needed for the extension. If there is a tax due, prepare to make your payment.

- Choose your payment method: pay online at mass.gov/masstaxconnect or use the provided voucher.

- If using the voucher, fill in the payment period end date, tax type, and other required information.

- Provide your business name and Federal Identification number. Check the box if incorporated in Massachusetts.

- Complete the business address, including city, state, and zip code.

- Enter the amount enclosed in the designated area.

- Detach the voucher from the worksheet and mail it with your payment to: Massachusetts Department of Revenue, PO Box 7062, Boston, MA 02204.

What You Should Know About This Form

What is Form 355-7004?

Form 355-7004 is a worksheet and voucher used by corporate excise taxpayers in Massachusetts. The form is specifically designed for businesses to calculate and submit their estimated corporate excise tax payments. When certain payment requirements are met, this form allows businesses to request an extension for filing their tax returns.

Who needs to file Form 355-7004?

Corporate excise taxpayers, including business corporations and S corporations, are required to file Form 355-7004 when they wish to extend their filing deadline. This applies particularly to those who need to calculate estimated taxes due and pay the required amounts on time to avoid penalties.

When should Form 355-7004 be submitted?

The form must be submitted on or before the 15th day of the fourth month following the end of the taxable year for business corporations and combined group S corporations. For S corporations that are not included in a combined group, the deadline is the 15th day of the third month after the close of the taxable year.

What happens if I don't pay the tax due by the deadline?

If at least 50% of the tax due or the minimum tax is not paid by the original due date, the extension becomes null and void. This means that penalties and interest for failing to file and pay on time will be assessed from the original due date of the return.

Will I incur interest and penalties if I file an extension?

Yes, an extension to file does not extend the due date for tax payment. If any tax remains unpaid after the original due date, interest will be charged. Additionally, any tax not paid within the extended filing period might incur a penalty of 1% per month, up to a maximum of 25% starting from the extended due date.

How do I use the voucher portion of Form 355-7004?

The voucher should be used to submit your payment along with the completed form. It is essential to detach the voucher from the worksheet when sending in your payment. Submission of the entire worksheet may lead to payment delays.

Can I pay my taxes electronically instead of using the voucher?

Yes, taxpayers are encouraged to pay online through MassTaxConnect at mass.gov/masstaxconnect. This option is available for those who prefer a more efficient payment method. Businesses with significant receipts or sales are required to pay electronically.

What if I'm filing Form 355U?

If you are filing Form 355U, you may allocate your payments to subsidiaries, provided you also file Schedule CG. This may help streamline the reporting and payment process for businesses with multiple entities.

Common mistakes

When completing the Massachusetts Form 355-7004, taxpayers often make several common mistakes that can lead to complications. One of the most frequent errors is failing to report the estimated tax amount correctly. Line 1 requires the estimated amount of tax for the taxable year, which must be at least the minimum tax. Missing this line or entering an incorrect amount can result in penalties.

Another common mistake involves neglecting to account for advance and estimated payments already made. Line 2 must accurately reflect any payments; otherwise, the calculated tax due on Line 3 will be inaccurate. This error could delay processing and affect the taxpayer's standing with the Massachusetts Department of Revenue.

Taxpayers also misunderstand the importance of timely payments. If the tax due on Line 3 is not paid by the specified due date, the extension becomes null and void. This situation is often overlooked, leading to late fees and interest charges.

Providing incorrect business identification information presents another issue. Taxpayers must ensure that the business name and Federal Identification Number match records precisely. Discrepancies can cause unnecessary confusion during processing.

Many taxpayers mistakenly assume that submitting the entire worksheet with the payment voucher is acceptable. Instead, only the voucher needs to be submitted. Not following this guideline may delay processing and result in extended waiting periods for confirmation.

Inadequate electronic payment compliance is another area where mistakes occur. Corporations with $100,000 or more in receipts must submit their extension payments electronically. Failure to adhere to this rule could lead to penalties and invalidation of the extension.

Additionally, some taxpayers may not be aware that the due dates for S corporations differ from other corporations. Failing to recognize this distinction can lead to missed deadlines and subsequent penalties for late payment.

Misunderstanding the extension’s impact on the payment due date is crucial. An extension to file does not extend the payment deadline. Failing to pay on time incurs interest and potential penalties, which can escalate significantly if overlooked.

Finally, taxpayers often overlook the specific mailing instructions. Payments should be sent to the designated address with the voucher. Misaddressed payments or those sent without a voucher may result in further delays.

Documents used along the form

When filing Form 355-7004, there are several other documents you may encounter that are essential for the process. Each of these forms serves a specific purpose, helping to ensure that your corporate tax obligations are met in compliance with Massachusetts regulations. Below is a concise overview of these forms.

- Form 355: This is the Massachusetts corporate excise tax return. Corporations must file this form to report their total income and calculate the tax due. It serves as the main document for annual tax reporting.

- Form 355-UX: This form is for corporate excise tax returns filed by certain organizations exempt from federal taxes. It allows eligible entities to declare their tax-exempt status and report specific income details instead.

- Form 355-7004 Voucher: This is the payment voucher used in conjunction with Form 355-7004. Corporations must submit this voucher along with their payment, detailing the tax amount being paid.

- Schedule C: This schedule is included with Form 355 and is used to report net income from business activities. It helps to clarify the source of income and deductions, contributing to the overall tax calculation.

- Schedule CG: This schedule applies when filing Form 355U. It allows corporations to allocate payments to subsidiaries, helping to distribute tax responsibilities fairly among related entities.

Understanding these additional forms and documents can streamline the tax filing process and minimize potential issues. Staying organized and informed about each requirement will facilitate a smoother experience as you navigate your corporate tax obligations in Massachusetts.

Similar forms

- Form 1120: This is the standard corporate tax return for U.S. corporations. Like the 355-7004, it requires detailed reporting of income, deductions, and tax liability, forming a key part of corporate taxation.

- Form 7004: This form is for automatic extensions of time to file certain business tax returns, similar to the 355-7004. Both forms deal with tax extension requests, but 7004 is used for various business types beyond just Massachusetts corporations.

- Form 990: Nonprofit organizations use this form to report their income, expenditures, and compliance with federal tax laws. It shares the 355-7004's purpose of informing tax authorities about financial activity.

- Form 1065: Partnerships use this for reporting income and losses. Both forms require estimates of tax owed and involve timely submissions to avoid penalties.

- Massachusetts Form 355: This is the actual corporate excise tax return in Massachusetts. While 355-7004 is an extension form, Form 355 is where you ultimately report the tax due.

- Form 941: Employers use this to report payroll taxes. Similar to the 355-7004, it has strict deadlines that must be met to avoid penalties.

- Form 1065-B: This applies to electing large partnerships. Like the 355-7004, it also involves payment-related issues and timing considerations for tax liabilities.

- Form CT-3: This New York corporate tax return is similar in that it serves to report corporate tax obligations and require estimated payments, similar to the need for a timely Form 355-7004 submission.

- Form 1120S: Used by S Corporations to report income, deductions, and credits. Like the 355-7004, certain payments and filings must be made on time to avoid penalties and interest.

Dos and Don'ts

When filling out the 355-7004 form, keep these important dos and don'ts in mind:

- Do ensure you calculate the estimated tax for the taxable year accurately.

- Do submit your payment online or with the voucher on or before the original due date.

- Don't assume you can skip the payment; the extension only covers the filing date.

- Don't use the voucher form if you are required to pay electronically.

Misconceptions

- Misconception 1: Anyone can use the Form 355-7004 voucher.

- Misconception 2: Filing the Form 355-7004 automatically extends the tax payment deadline.

- Misconception 3: Any amount can be paid with the Form 355-7004 voucher.

- Misconception 4: Filing Form 355-7004 guarantees a tax extension.

- Misconception 5: The entire Form 355-7004 needs to be submitted with the payment voucher.

This form is specifically for corporate excise taxpayers who are either business corporations or S corporations in a combined group. If you are mandated to pay electronically, you should not use the voucher at all.

Submitting the form does not extend the deadline to pay any taxes due. Taxes must be paid by the original due date to avoid interest and penalties.

Only the estimated tax amount due can be paid using this voucher. If at least 50% of the tax due or the minimum tax is not paid by the original deadline, the extension is null and void.

A valid tax extension is granted only if the payment requirements are met. If the required payment is not made, the extension will not be honored.

Only the payment voucher should be submitted. Make sure to cut it where indicated. Sending the full worksheet can delay your payment processing.

Key takeaways

When it comes to using the Massachusetts Department of Revenue Form 355-7004, there are several important points to keep in mind. Here's a concise list of key takeaways:

- Understand the payment requirements: To receive an extension, you must pay at least 50% of the total tax owed or the minimum corporate excise tax by the original due date.

- Deadlines matter: Ensure that payments are made by the 15th day of the fourth month after the end of your taxable year. For calendar year filers, this often means April 15 for corporations, and March 15 for S corporations not in a combined group.

- Use the right payment method: If your corporation has $100,000 or more in receipts, or if your payment is $5,000 or more, you must pay electronically. Otherwise, you can use the voucher form.

- Know the consequences: If you fail to pay the required amount by the due date, your extension becomes void, and penalties or interest may be applied retroactively.

- Keep forms separate: When mailing the payment voucher, do not send the entire worksheet. Only include the completed voucher to avoid delays in processing your payment.

By staying informed and organized, you can navigate the process of filling out and submitting Form 355-7004 with greater ease.

Browse Other Templates

Child Care Licensing Michigan - Record-keeping is essential for accountability and a clear line of communication between caregivers and guardians.

Form 4549 Instructions - This form must be signed by both taxpayers if a joint return was submitted.