Fill Out Your 3561 Bklt Form

The 3561 BKLT form is an essential tool for individuals facing financial hardships in California who are unable to pay their tax obligations in full. This booklet outlines the process for requesting an installment agreement with the California Franchise Tax Board, allowing taxpayers to make manageable monthly payments instead of a lump sum. The form also emphasizes the requirement of making payments through electronic funds transfer (EFT), which simplifies the payment process by automatically taking funds from a bank account. It's important to note that taxpayers must remain compliant with future tax liabilities, ensuring timely filing and adequate withholding or estimated payments for subsequent years. If payments are not made on time or if there's an outstanding balance in the future, the taxpayer risks defaulting on their agreement, which may lead to collection actions by the tax board. Additionally, this booklet contains a financial statement section where taxpayers must provide personal details, information about income and expenses, and any dependents living with them. By understanding the key features of the 3561 BKLT form, individuals can navigate their responsibilities effectively while managing their tax burdens with greater ease.

3561 Bklt Example

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | The 3561 BKLT form allows individuals in California to set up an installment agreement for tax payments if they face financial hardship. |

| Eligibility | Taxpayers may qualify for this agreement if they are unable to pay their tax debt in full. |

| Payment Method | Payments must be made electronically through an electronic funds transfer (EFT) directly from a bank account. |

| Future Obligations | Once approved, individuals must continue to meet all future tax liabilities and file returns timely. |

| Default Conditions | Failure to make timely payments or having unpaid future taxes results in default. |

| Interest and Penalties | Interest and some penalties continue to accrue while the installment payments are being made. |

| State Tax Refunds | The Franchise Tax Board may offset any state tax refunds against the outstanding tax balance. |

| Credit Impact | If necessary, the Franchise Tax Board may file a lien, which can affect an individual’s credit record. |

| Governing Law | This form and its agreements are governed by the laws of the State of California, specifically under Government Code Sections 7170-7173. |

Guidelines on Utilizing 3561 Bklt

Filling out the 3561 BKLT form can feel like a daunting task, but with a step-by-step approach, you’ll find it manageable. This form is designed for individuals who want to set up an installment agreement with the California Franchise Tax Board to pay off their tax liabilities over time. Be sure you have all your information handy before starting, as this will help streamline the process.

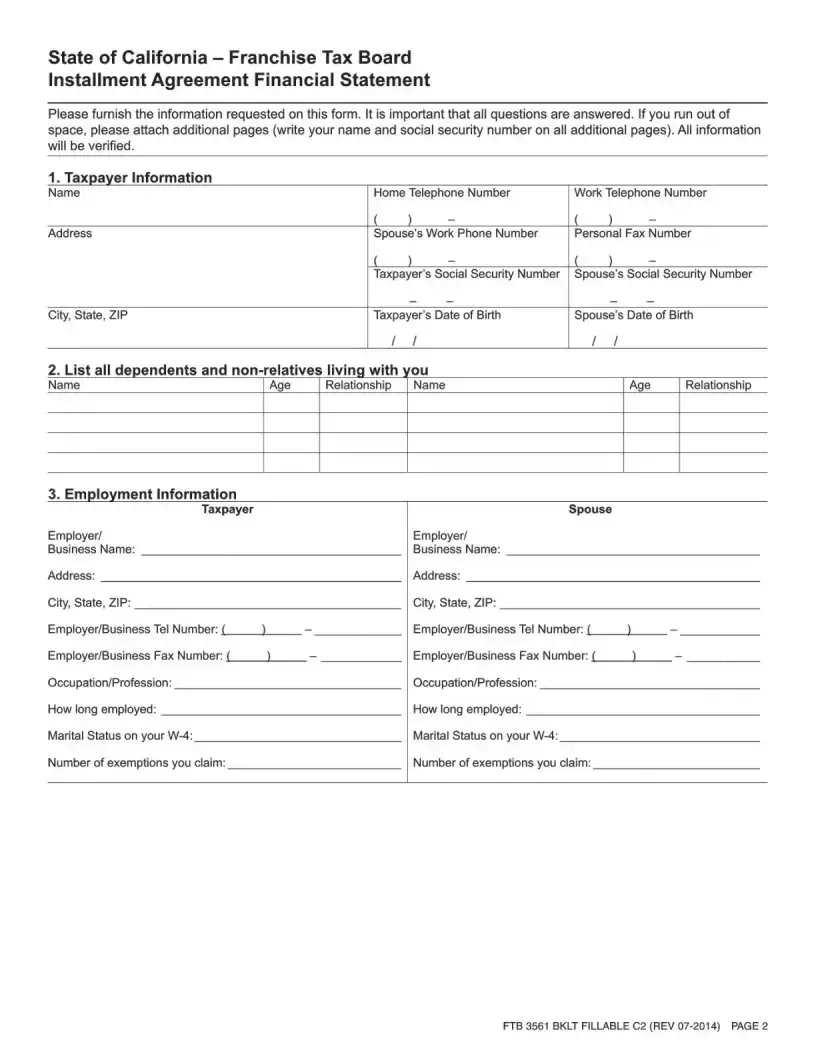

- Start with the Taxpayer Information section. Fill in your name, address, and contact numbers as requested.

- Provide your Social Security Number and date of birth, along with your spouse’s information if applicable.

- Next, in the Dependents Section, list all dependents and any non-relatives living with you, including their names and ages.

- For the Employment Information section, enter the details of your and your spouse’s employers, including business names, addresses, and phone numbers. Make sure to indicate your occupations and how long you've been employed.

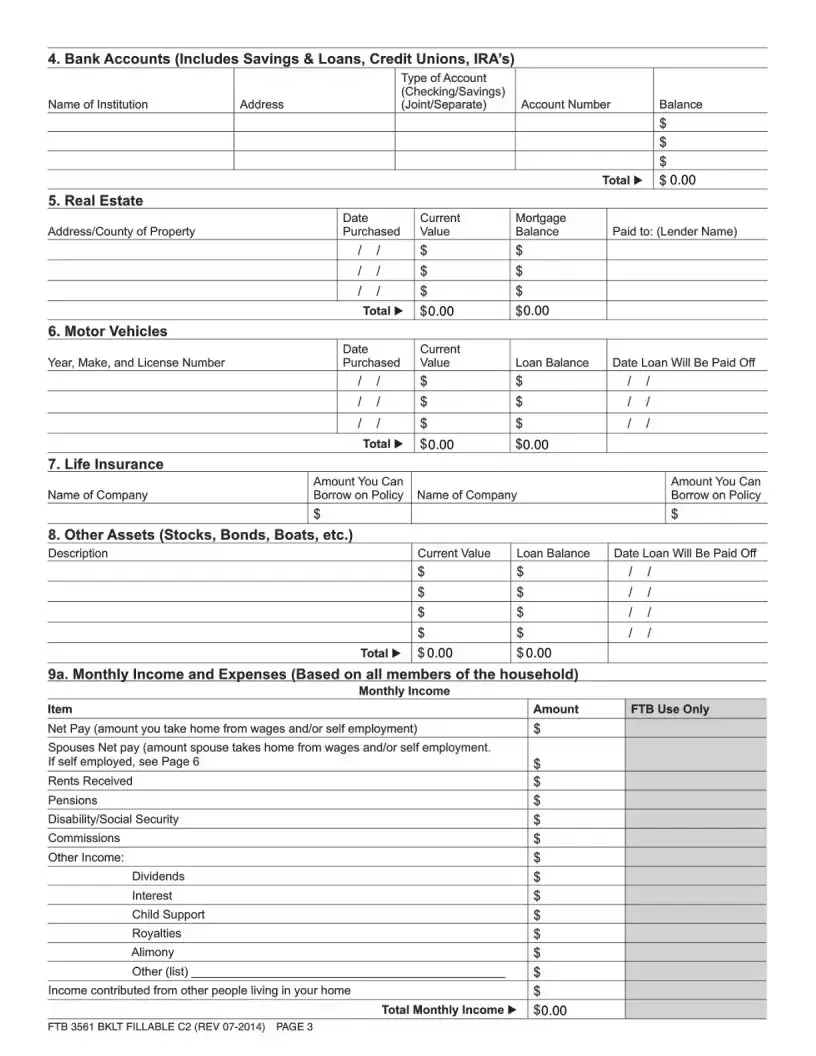

- Go to the Bank Accounts section and specify the details for each account you have, including the type of account (checking or savings) and the current balance.

- In the Real Estate section, provide information about any properties you own, including addresses and current values.

- Complete the Motor Vehicles section by listing any vehicles you own, including their year, make, license numbers, and current values.

- Fill out the Life Insurance details, mentioning the companies and how much you can borrow against your policies.

- In the Other Assets section, outline any stocks, bonds, or additional assets along with their values.

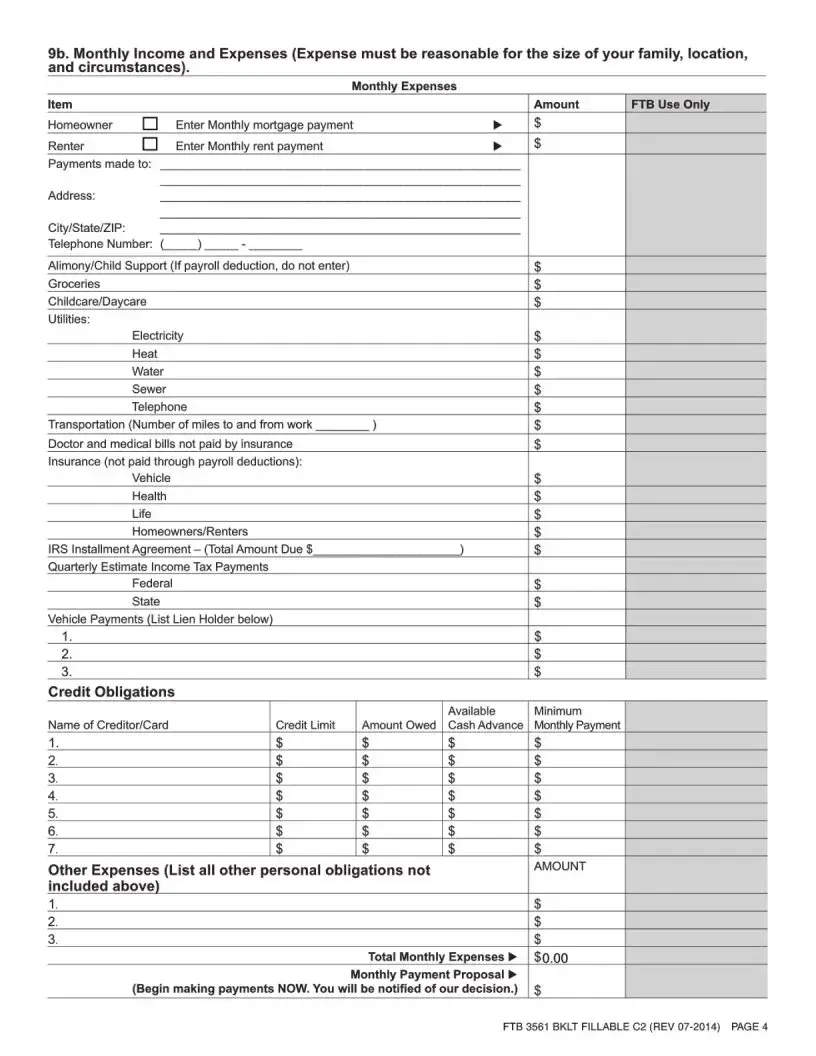

- Lastly, detail your Monthly Income and Expenses, providing a summary of all sources of income, including net pay, rents, pensions, and any contributions from others living with you.

Once you've filled out the form, double-check your entries for accuracy. If you need extra space for some answers, attach additional pages where necessary, ensuring you include your name and Social Security Number on them. Submitting a thorough and complete application can help pave the way for your installment agreement to be approved smoothly.

What You Should Know About This Form

What is the purpose of the 3561 Bklt form?

The 3561 Bklt form is used to apply for an installment agreement with the California Franchise Tax Board (FTB). This agreement allows taxpayers who experience financial hardship to pay their tax liability in monthly installments rather than in one lump sum.

Who is eligible to use the 3561 Bklt form?

To be eligible, you must show that you cannot pay your tax amount in full due to financial hardship. Additionally, you must agree to meet all future tax liabilities and file your future returns on time.

How do I make payments if my installment agreement is approved?

If approved, your monthly payments will be automatically deducted through an electronic funds transfer (EFT) from your checking or savings account. This ensures timely payment without the need for additional action on your part.

What happens if I miss a payment?

If you fail to make your payments on time or if you have any outstanding amounts in future years, you will be in default of your agreement. This can lead to collection actions from the FTB to recover the entire tax amount owed.

Will interest and penalties continue to accrue while I am making payments?

Yes, additional interest and some penalties will continue to accrue while you make your scheduled payments. It’s important to have accurate future withholding or estimated tax payments to mitigate any future liabilities.

Can my state tax refund be used to pay down my installment agreement?

Yes, the FTB will offset any state tax refund you are due and apply it towards your total tax liability. However, this offset will not replace your regular monthly payment amount.

How does the FTB verify the information I provide on the 3561 Bklt form?

The FTB verifies the information you provide on your 3561 Bklt form through various means, including cross-referencing with previous tax filings, bank accounts, and financial institutions. Accurate and complete information is critical.

Will applying for an installment agreement impact my credit score?

Yes, if the FTB files a state tax lien to secure the repayment of your tax debt, it may appear on your credit record. This could potentially affect your credit score negatively.

How can I ensure that future tax liabilities are met while on an installment agreement?

To meet future tax liabilities, make sure your withholding rates are correct by checking your W-4. If necessary, adjust your withholding with your employer to ensure you are covering your tax obligations for subsequent years.

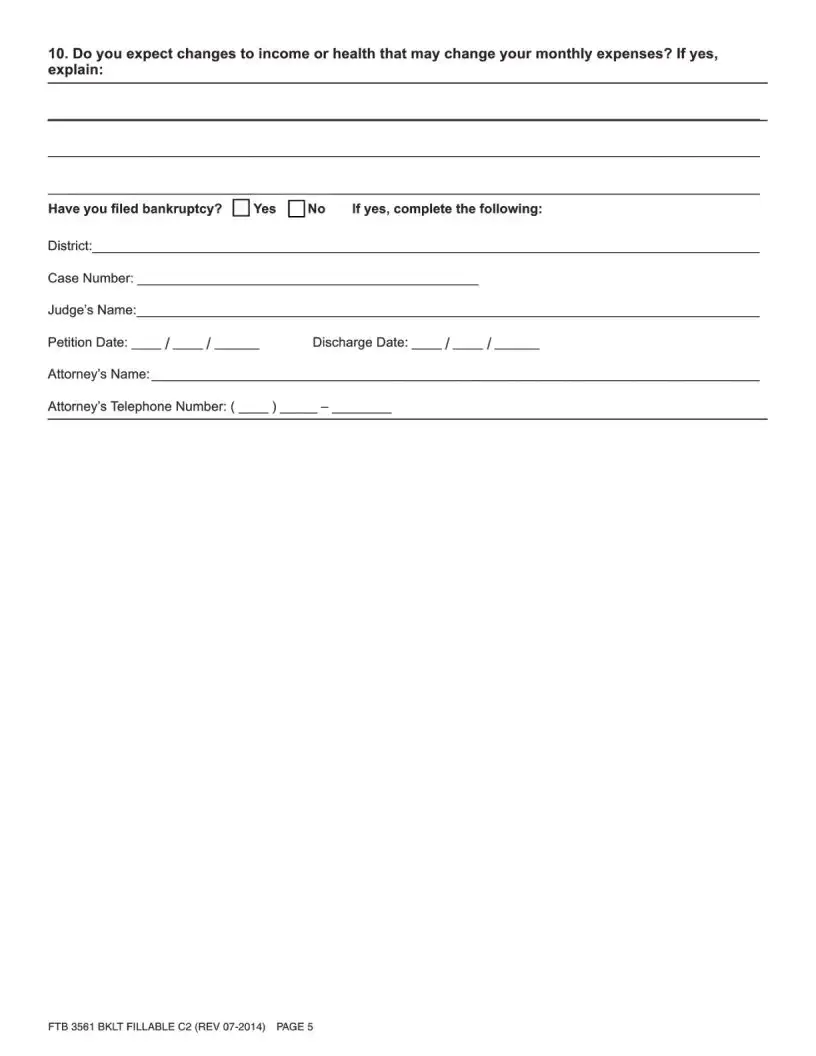

What kind of information do I need to provide in the financial statement section?

You will need to provide comprehensive details about your financial situation, including personal information, household income, expenses, assets, liabilities, and employment information. This allows the FTB to assess your eligibility accurately.

Common mistakes

Filling out the 3561 Bklt form can be a vital step in managing your tax obligations, especially during financial hardship. However, mistakes can lead to delays or even disapproval of your installment agreement request. Understanding common errors can help you submit a complete and accurate application.

One frequent mistake is failing to provide complete taxpayer information. Ensure you include your full name, address, and social security number, along with your spouse’s details if applicable. Omitting any of this essential information can hinder the processing of your form.

Another issue arises from inaccurately listing dependents. It’s crucial to list all dependents and their correct ages. If you underestimate or misidentify relationships, you risk complications in your financial evaluation.

In the employment section, some individuals neglect to keep their job information updated. It’s important to accurately state your current employer, job title, and length of employment. Missing or outdated details can signal to the Franchise Tax Board that you might not have stable financial circumstances.

Bank account information is often another area where errors occur. Ensure that all account details, including balances and account numbers are correct. A mismatch or an incorrect account number could delay your setup of electronic funds transfer.

In the asset declaration section, some people inaccurately report the value of their real estate or vehicles. Providing inflated values can misrepresent your financial situation. Ensure that you report current market values to maintain transparency.

Individuals sometimes misreport monthly income and expenses, incorrectly estimating their monthly financial situation. Your total monthly income should include all sources, and accurate expense detailing is equally important. This ensures that the Franchise Tax Board can assess your financial hardship appropriately.

Taxpayers occasionally overlook the importance of reviewing their future tax liabilities, which can lead to non-compliance issues. It is essential to agree to meet future tax obligations, or else your installment agreement might be at risk of default.

Finally, not checking for pending liens on credit records can be a serious mistake. Familiarize yourself with any existing tax liens, as they may impact your ability to secure an installment agreement. Taking proactive steps to understand your financial obligations can prevent future roadblocks.

Documents used along the form

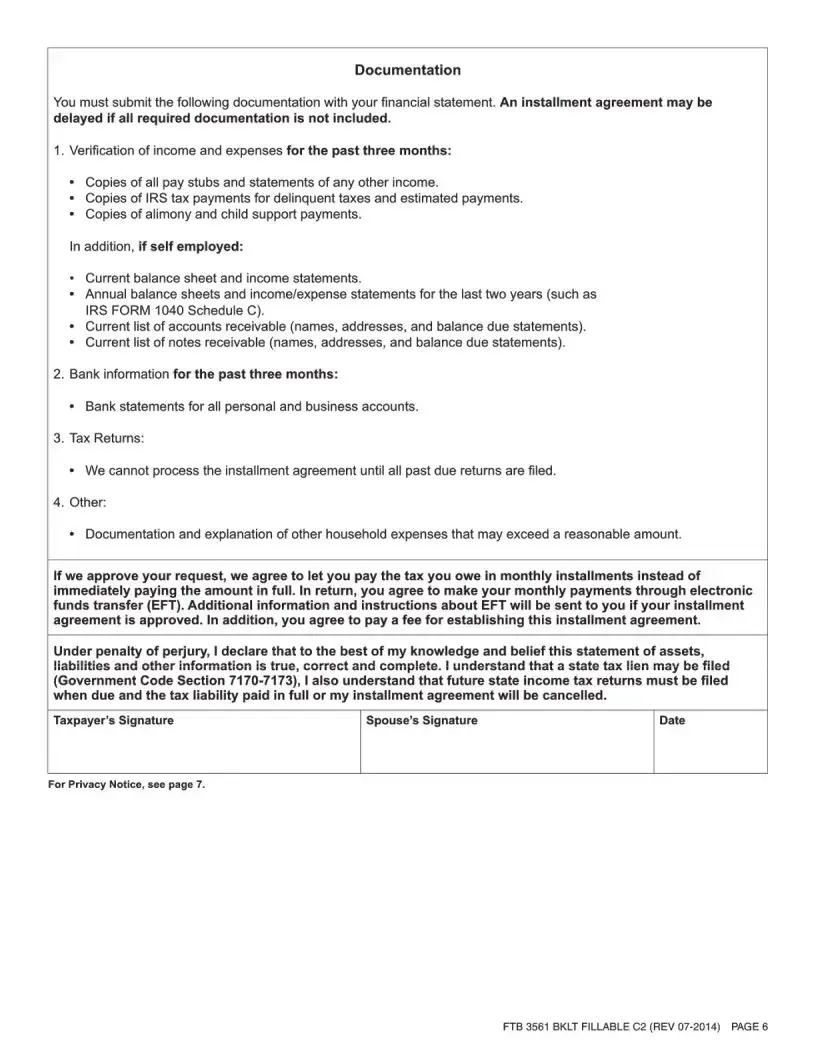

The California Franchise Tax Board Form 3561 Bklt is an essential document for individuals seeking an installment agreement due to financial hardship. Alongside this form, several other documents often play a critical role in the process. Here is a list of some common forms and documents used in conjunction with the 3561 Bklt.

- Form FTB 540: This is the California Resident Income Tax Return. It provides crucial information about your income and tax liabilities for the previous year. Completing this form is necessary to determine your overall financial situation.

- FTB 2319: The Installment Agreement Request form allows taxpayers to propose a specific monthly payment amount. It is crucial for those who do not owe a substantial amount and wish to negotiate terms based on their financial capacity.

- Form FTB 3520: This form is used for reporting a California tax lien. If approved for an installment agreement, a lien may be placed on your property to safeguard the state's interest in collecting taxes owed.

- W-4 Form: The Federal Employee’s Withholding Certificate is essential for adjusting the amount of federal income tax withheld from paychecks. Modifying this form ensures enough tax is withheld to cover future liabilities.

- DE 4: This form is California's equivalent of the W-4, adjusting state withholding rates. Properly managing this can prevent future tax liabilities from accumulating.

- Financial Statement: An essential document that comprehensively outlines your financial situation, including income, expenses, assets, and liabilities. It's often required to gain approval for any payment arrangement.

- Payment History Record: This document tracks previous payments made towards tax obligations. It may be necessary to show a consistent payment pattern if you are seeking approval for an installment strategy.

- Tax Return Transcripts: Requesting transcripts from prior tax returns provides a comprehensive overview of your tax filing history to the California Franchise Tax Board, assisting them in making determinations about your financial position.

These documents work together to provide a complete picture of an individual's financial circumstances during the installment agreement process. Ensuring that all relevant forms are accurately completed and submitted is key to navigating this system effectively.

Similar forms

Form 1040: This is the individual income tax return form used by U.S. citizens and residents. Like the 3561 Bklt form, it collects personal financial data to determine tax liability for the year.

Form 9465: This form allows taxpayers to request an installment agreement with the IRS. Much like the 3561 Bklt form, it requires financial information to establish eligibility for reduced payment options.

Form 433-F: This form is the Collection Information Statement used by the IRS to assess a taxpayer's financial conditions. Both forms aim to gain insights into financial hardships to tailor repayment options.

Form W-4: Employees use this form to indicate their withholding preferences on their taxes. Similar to the 3561 Bklt form, it plays a crucial role in determining future tax liabilities based on current income.

Form DE-4: This is the California Employee's Withholding Allowance Certificate, akin to the W-4 but specific to California, guiding tax withholding based on financial needs. It correlates with the need to adjust future withholding as outlined in the 3561 Bklt.

Form 5495: This form is used for requesting an installment payment agreement with certain tax debts. It has similarities with the 3561 Bklt form, as both are designed for financial alleviation through structured payments.

Form 133-A: Used by taxpayers to verify their financial circumstances with the IRS when requesting a payment plan. Like the 3561 Bklt, it requires comprehensive financial disclosure to assess repayment ability.

CA Form 540: This is a California resident income tax return used to report personal income. It provides essential personal and financial information, similar to the requirements in the 3561 Bklt.

Schedule C: This form is used by sole proprietors to report income or loss from their business. The information required parallels the detailed financial disclosure needed on the 3561 Bklt form.

Installment Agreement Request: While not a formal form, the informal process for requesting installment agreements in various jurisdictions shares the purpose of providing relief through manageable payments, aligning well with the intent of the 3561 Bklt.

Dos and Don'ts

When filling out the 3561 Bklt form, it's essential to follow the guidelines carefully. Here are the things you should and shouldn't do:

- DO: Provide accurate information for all requested fields.

- DO: Make sure your bank account information is correct for electronic funds transfer.

- DO: Include all dependents and relevant household members in your application.

- DO: Review your W-4 or DE-4 form to ensure your tax withholding is appropriate.

- DO: Attach additional pages if necessary, clearly identifying your name and social security number.

- DON'T: Leave any required fields blank, as incomplete forms may delay your request.

- DON'T: Submit outdated or incorrect information about your employment.

- DON'T: Forget to include the details of all your assets and liabilities.

- DON'T: Assume future tax liabilities will be covered without adjustments; monitor your financial status.

Misconceptions

Understanding the 3561 Bklt form can be tricky, and there are several misconceptions that often lead to confusion. Here’s a list of nine common misunderstandings:

- Installing payment plans is only for large debts. Many believe that only significant tax debts qualify for an installment agreement. In reality, individuals can request installment plans for smaller amounts if they are experiencing financial hardship.

- Once approved, you never need to worry about your taxes again. Many people think that once they secure an installment agreement, their tax worries are over. However, it’s essential to stay compliant by timely filing future returns and ensuring enough withholding or estimated payments.

- You can make payments however you want. Some assume they can pay their tax debts in cash or through checks. In fact, you must use electronic funds transfer (EFT) for your monthly installments.

- All penalties and interest stop when you enter an agreement. While an installment agreement provides some relief, additional interest and penalties may still accrue during the payment period.

- Your tax refund will not be affected. It’s a common belief that any refund will go directly to the taxpayer. Instead, the Franchise Tax Board may offset your state tax refund against the amount owed under the installment agreement.

- Only individuals with low income can get a payment plan. Many think that only low-income earners qualify for installment agreements. However, anyone facing financial hardship, regardless of income, can apply.

- Missing a payment means you lose your agreement entirely. While it's true that failing to make timely payments can put you in default, there may be options to resolve the issue without losing the agreement altogether.

- You won't face collection actions once you enroll. This is misleading; collection actions may still occur if you have outstanding debts or fail to comply with the terms of the agreement.

- All forms need to be completed at once. Some feel overwhelmed thinking they must fill out the entire form in one go. In reality, they can attach additional pages and provide information over time as needed.

By recognizing and understanding these misconceptions, taxpayers can better navigate their responsibilities and options when dealing with tax payments in California.

Key takeaways

When considering the California Franchise Tax Board 3561 Booklet form for an Installment Agreement, here are key takeaways to keep in mind:

- Understand Your Eligibility: You may qualify for monthly installment payments due to financial hardship if you cannot pay your taxes in full.

- Monthly Payments Required: Approved requests allow you to pay the tax owed in monthly installments rather than a lump sum.

- Electronic Payments: Your monthly payments must be made through electronic funds transfer (EFT) from your bank account.

- Future Tax Compliance: Once enrolled in an installment agreement, you must file future tax returns on time and ensure your withholdings and estimated payments cover upcoming tax liabilities.

- Default Conditions: Missing payments or accruing new tax liabilities could put you in default on your agreement, leading to potential collection actions.

- W-4 Adjustments: Regularly check and adjust your W-4 or DE-4 with your employer to accurately reflect the correct withholding rate.

- Refund Offsets: Any state tax refunds you may be eligible for can be deducted from your total owed tax amount as part of the agreement.

- Lien Potential: Be aware that a tax lien may be filed against your property to secure the state’s interest until your balance is settled.

- Detailed Financial Information: Complete all sections of the financial statement accurately, as the Franchise Tax Board will verify this information.

Being prepared and informed will help you navigate the process smoothly. Understanding these points ensures you meet your obligations and avoid complications with your installment agreement.

Browse Other Templates

Vehicle Sale Agreement Word Format - Provides options for different payment methods accepted by the seller.

ATRRS Modification Request,ATRRS Update Form,ATRRS Change Application,ATRRS Adjustment Form,ATRRS Information Change Request,ATRRS Change Submission,ATRRS Request for Change,ATRRS Enrollment Modification Form,ATRRS Course Change Form,ATRRS Data Revis - Request the necessary changes to an ATRRS record.