Fill Out Your 3567 Form

The 3567 form, issued by the California Franchise Tax Board, is crucial for taxpayers who find themselves unable to pay their tax liabilities in full. This form facilitates a structured installment agreement, allowing individuals to make monthly payments towards their tax debts instead of paying the total amount upfront. Taxpayers may qualify for this arrangement if their tax obligation does not exceed $25,000, the payment period is limited to 60 months, and certain filing requirements are met. It is paramount that all personal income tax returns are filed and that applicants are not currently enrolled in another installment agreement. Several conditions accompany the approval process, including a commitment to timely payments and maintenance of sufficient funds in the taxpayer's bank account. A fee of $34 is applicable, with potential adjustments based on current policies. Furthermore, the Franchise Tax Board retains the right to file a lien against the taxpayer's property, which can impact credit ratings until the liability is fully satisfied. Ensuring compliance with these terms is essential, as non-adherence can lead to the termination of the agreement. The process for submitting a request can be conducted online, via phone, or by mail, and applicants must be prepared to navigate the associated requirements carefully to avoid delays or complications.

3567 Example

Form Characteristics

| Fact Name | Description |

|---|---|

| Eligibility Requirements | To qualify for an installment agreement, the taxpayer must owe no more than $25,000, have filed all necessary tax returns, and not currently be in an installment agreement. |

| Payment Conditions | Taxpayers must make timely monthly payments and maintain sufficient funds in their bank account to cover these payments until the tax liability is fully paid. |

| Installment Agreement Fee | A fee of $34 applies to the installment agreement, which will be added to the total tax liability. This fee is subject to change without notice. |

| State Tax Liens | The Franchise Tax Board may file a lien until the tax liability is fulfilled, protecting the state’s interest and potentially affecting the taxpayer's credit report. Governed by Government Code Sections 7170-7173. |

| Electronic Funds Transfer | Taxpayers must authorize automatic monthly withdrawals from their bank account for payments. A date must be selected that is no later than the 28th of each month to avoid processing delays. |

Guidelines on Utilizing 3567

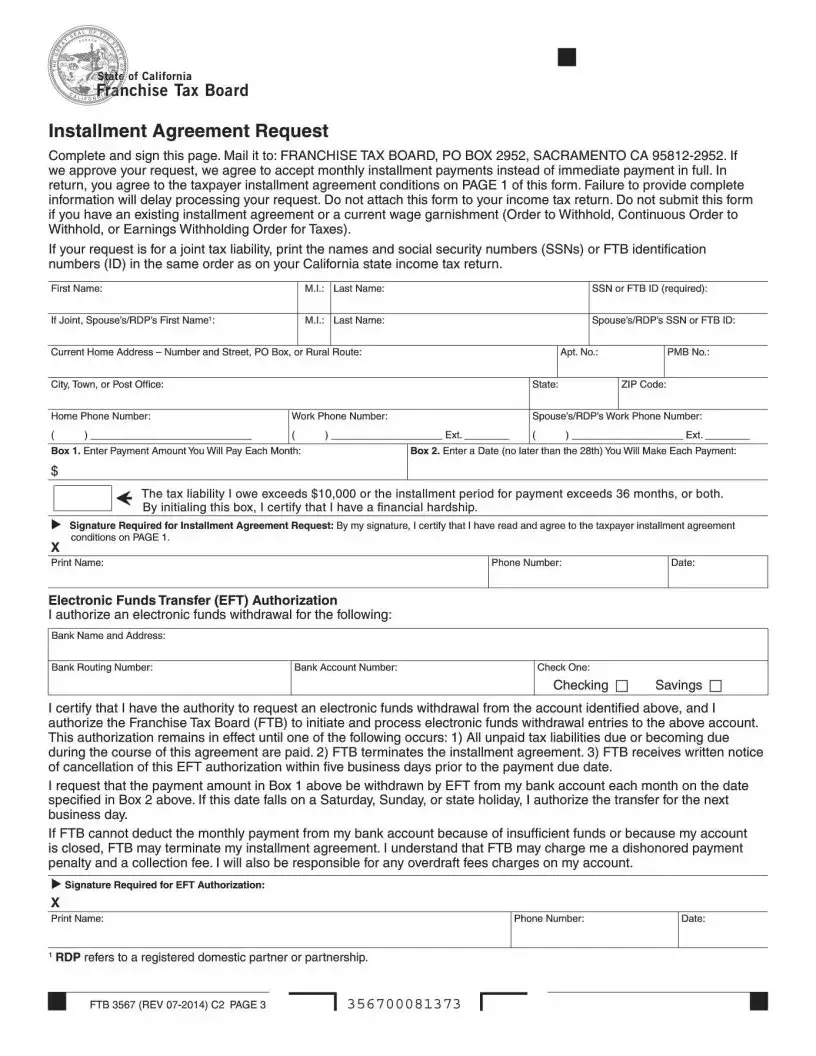

Completing the 3567 form is essential for requesting an installment agreement with the Franchise Tax Board. Once you submit the form, they will review your request and inform you of any required actions based on your financial situation and payment history. Follow these steps to fill out the form correctly.

- Obtain the FTB 3567, Installment Agreement Request form.

- Fill in your personal information at the top of the form, including your name, address, and Social Security number or FTB ID.

- If applicable, provide your spouse’s or registered domestic partner’s personal information in the designated area.

- In Box 1, enter the amount you plan to pay each month.

- In Box 2, select a payment date that is no later than the 28th of each month.

- If your tax liability exceeds $10,000 or the payment period exceeds 36 months, initial the box to certify financial hardship.

- Sign and date the form to confirm that you agree to the taxpayer installment agreement conditions.

- Complete the Electronic Funds Transfer (EFT) Authorization section if you wish to have payments automatically withdrawn from your bank account.

- List your bank details, including the bank name, routing number, and account number.

- Choose whether your account is checking or savings, and then sign and date the EFT Authorization section.

- Review the form for accuracy and completeness before mailing.

- Mail the completed form to the address provided: STATE OF CALIFORNIA, FRANCHISE TAX BOARD, PO BOX 2952, SACRAMENTO CA 95812-2952.

What You Should Know About This Form

What is the FTB 3567 form used for?

The FTB 3567 form is used to request an installment agreement with the California Franchise Tax Board (FTB). If you're unable to pay your tax liability in full, this form allows you to propose a plan to make monthly payments over time, making it easier to manage your financial obligations.

Who is eligible to use the FTB 3567 form?

You may be eligible for an installment agreement if you owe no more than $25,000, can complete payments within 60 months, have filed all required income tax returns, and are not currently under an existing installment agreement. Meeting these criteria is essential for your request to be considered.

What are the responsibilities I have if my installment agreement is accepted?

Once your installment agreement is approved, you must make timely monthly payments until your tax liability is fully paid. It’s important to maintain enough funds in your bank account to cover these payments and to file all required tax returns on time. Additionally, you need to pay a $34 fee, which is added to your tax liability.

What happens if I miss a payment?

If you fail to make a monthly payment, the FTB may terminate your installment agreement. Before taking this step, they will send you a notice of intent to terminate, providing 30 days for you to address the situation. It’s crucial to stay on top of your payments to avoid this outcome.

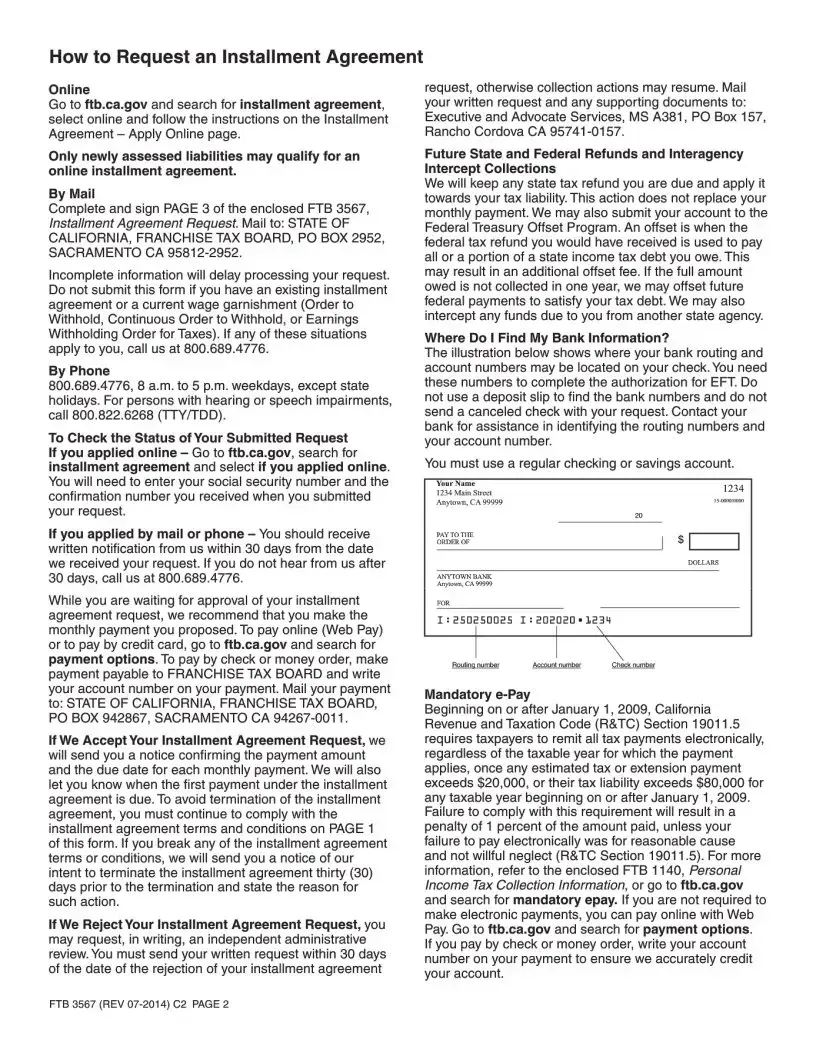

How do I authorize electronic payments for my installment agreement?

You can authorize electronic funds transfers by completing the EFT Authorization section on page 3 of the FTB 3567 form. Specify a payment date no later than the 28th of each month. If the selected date is after the 28th, the FTB will withdraw the payment on the 28th instead.

Can I apply for an installment agreement online?

Yes, you can apply for an installment agreement online. Visit the FTB website and search for “installment agreement.” Follow the instructions provided on the Apply Online page. Note that only newly assessed tax liabilities may qualify for online requests.

What are the consequences of not maintaining sufficient funds for payments?

If there aren’t enough funds in your account to cover the monthly payment, it could lead to dishonored payment penalties, potential additional fees, and ultimately the termination of your installment agreement. Managing your account balance carefully is vital to prevent these issues.

How can I check the status of my installment agreement request?

If you applied online, you can check the status on the FTB website by entering your Social Security number and confirmation number. For requests made by mail or phone, you should receive a written notification within 30 days of your application. If you don't hear from the FTB by then, give them a call.

What should I do if my installment agreement request is denied?

If your request is denied, you can request an independent administrative review in writing. You must send this request within 30 days of the rejection notice. Include any supporting documents when mailing your appeal to the designated address to ensure your case is reviewed properly.

Common mistakes

Filling out the 3567 form, which is your request for an installment agreement with the California Franchise Tax Board, demands attention to detail. However, many individuals trip over common mistakes that can leave their applications delayed or even rejected. One frequent error is not providing complete information. Incomplete submissions can lead to a significant hold-up in the processing of your request. Ensure that every section of the form is filled out accurately, including your financial details and contact information, to avoid unnecessary delays.

Another mistake revolves around the payment amount and schedule. Some applicants do not specify a realistic monthly payment or fail to choose an appropriate date for automatic withdrawals. Remember, your tax liability continues to accrue interest until it is paid in full. Set a payment amount that you can consistently maintain without risking the termination of your agreement. Additionally, if your chosen date is questionable, the Franchise Tax Board has rules about when payments can be processed. Always select a date between the 1st and 28th to ensure timely deductions.

Furthermore, failing to maintain sufficient funds is a considerable blunder. It’s crucial to have adequate funds in your account to cover the monthly payments. If the funds are insufficient when a withdrawal attempt occurs, the FTB might impose fees or terminate your installment agreement altogether. Keep a close eye on your bank balance each month to avoid overdrafts or penalties that could jeopardize your financial plan.

Finally, many overlook the requirement for a financial hardship certification when certain thresholds are met. If your owed tax liability exceeds $10,000 or the payment period exceeds 36 months, you are required to demonstrate a financial hardship. Failing to include this certification form can result in rejection of your application. Be proactive in providing all necessary documentation to support your request, especially if you find yourself in a challenging financial situation.

Documents used along the form

The **FTB 3567 Form** is an essential part of the process for requesting an installment agreement for tax liabilities with the California Franchise Tax Board. However, this form often works in conjunction with other documents that aid in managing your taxes effectively. Below is a brief overview of some of the other forms and documents you might encounter when dealing with your tax situation.

- FTB 1140 - Personal Income Tax Collection Information: This document provides important information on personal income tax collection processes, including details regarding electronic payment and guidelines for taxpayers to understand their rights and responsibilities.

- Form W-4: The Employee's Withholding Certificate helps taxpayers adjust the amount withheld from their paychecks for federal income tax. Ensuring correct withholding is vital for meeting future tax obligations.

- Form DE 4: Similar to the W-4, this form pertains to state taxes and mandates that individuals provide accurate information on their state income withholding. This can prevent future tax liabilities from increasing unexpectedly.

- Financial Statement - FTB Form 3570: When financial hardship is claimed, taxpayers may need to complete this financial statement. This document outlines your financial situation and helps the FTB evaluate your ability to pay the tax due.

- Tax Payment Plan: This is not a formal document but rather a structured repayment arrangement detailing the proposed payment schedule and amounts. It’s essential when requesting an installment agreement.

- Notice of State Tax Lien: If a tax liability remains unpaid, the Franchise Tax Board may file a lien. This notice can affect your credit report and will detail the amount owed and the terms of the lien.

- Demand for Payment: This communication from the FTB outlines the tax amount due and serves as a reminder that payment is required. Ignoring this notice can lead to further collection actions.

Understanding these forms and documents can facilitate a smoother process when applying for an installment agreement and ensure you remain on track with your tax responsibilities. Always consider consulting a tax professional if you're unsure about handling these documents.

Similar forms

- Form 9465 - Installment Agreement Request (IRS): Like the California FTB 3567, Form 9465 allows taxpayers to request a monthly payment plan for their federal tax liabilities. Both forms require that taxpayers agree to make timely payments and comply with specific terms while their debt is paid down over time.

- Form 433-F - Collection Information Statement: This document is similar in that it provides detailed financial information, allowing tax authorities to assess an individual's ability to comply with payment arrangements. It helps validate claims of financial hardship, much like the FTB's requirement to certify financial hardship under certain conditions.

- Form 2848 - Power of Attorney and Declaration of Representative: Although different in purpose, this form can accompany installment agreement requests when involving representatives. Both documents necessitate disclosures and agreements related to financial obligations to the respective tax authorities.

- Payment Plan Information Sheet: Some states provide a separate document with information specific to local installment agreements. This sheet often outlines terms and requirements, similar to elements found in the FTB 3567, aiding taxpayers in understanding their payment options and responsibilities.

Dos and Don'ts

When filling out the 3567 form, there are essential actions to take and avoid to ensure a smooth process. Here’s a helpful list:

- DO: Ensure all required personal income tax returns are filed before submitting the form.

- DO: Provide accurate and complete information to avoid delays in processing your request.

- DO: Choose a withdrawal date for your payments that is no later than the 28th of each month.

- DO: Maintain sufficient funds in your bank account to cover monthly payments to avoid penalties.

- DON'T: Submit the form if you have an existing installment agreement or a wage garnishment pending.

- DON'T: Use a deposit slip to find your bank routing and account numbers; refer to your checks instead.

- DON'T: Forget to initial the box if you certify financial hardship when applicable.

- DON'T: Include the form with your income tax return; send it separately.

Misconceptions

- Installment agreements are only for those who cannot pay immediately. This is a common misconception. While installment agreements are designed for individuals who cannot pay their tax liability in full, the Franchise Tax Board encourages immediate payment. It is often advised to borrow funds if needed to avoid incurring interest and penalties.

- You are eligible for an installment agreement regardless of your tax liability amount. In reality, there are specific eligibility requirements. Your tax liability must not exceed $25,000, and the payment period cannot exceed 60 months.

- Once an installment agreement is approved, you do not have to worry about payments. This is misleading. You must make timely payments to maintain the agreement. If you miss payments, the Franchise Tax Board may take action to terminate the agreement.

- All past tax liabilities can be included in one agreement. This is incorrect. Only newly assessed tax liabilities can qualify for an online installment agreement, and if you have other existing agreements or wage garnishments, you cannot submit a new request.

- The installment agreement fee is always fixed and will not change. This is not true. The $34 fee for the installment agreement can change without notice, so it’s important to be prepared for potential changes.

- Your financial condition will never be reviewed after approval. This is false. If your tax liability exceeds certain amounts or if you claim financial hardship, your agreement may be subject to periodic review, ensuring compliance with the terms of the installment agreement.

Key takeaways

When filling out and using the FTB 3567 form for an installment agreement with the California Franchise Tax Board, consider the following key takeaways:

- Eligibility Requirements: To qualify for an installment agreement, ensure your tax liability does not exceed $25,000, you have filed all necessary tax returns, and you're not already under an installment agreement.

- Timely Payments: Commit to making monthly payments on time. Lack of timely payments may lead to penalties or termination of the agreement.

- Financial Hardship Disclosure: If your tax liability exceeds $10,000 or if your payment period exceeds 36 months, you must certify financial hardship for your installment request to be approved.

- Electronic Funds Transfer (EFT): Completing the EFT Authorization section allows automatic withdrawals from your bank account. Select a withdrawal date no later than the 28th of each month to avoid processing delays.

- State Tax Liens: Be aware that the Franchise Tax Board can file a state tax lien to protect its interests, which may impact your credit report.

Browse Other Templates

Boiler Engineer Affidavit,Minnesota Boiler License Declaration,License Experience Verification Form,Boiler Operation Certification,Engineer Operating Experience Affidavit,Steam Engineer Affidavit,Boiler Qualification Statement,Thermal Systems Experie - Military or maritime service experience does not require an affidavit submission.

Disposition Letter From Landlord - Tenancy dates are required to establish the duration of the lease.

Georgia Adoption Petition Form - Filing this form is part of the overall adoption process in Georgia.