Fill Out Your 401 H R Block Bank Form

The 401 H&R Block Bank form plays a significant role in managing your finances if you have an H&R Block Emerald Prepaid MasterCard. This form is primarily a transfer request, allowing you to move funds from your Emerald Card to another Emerald Card or to a different financial institution. To initiate the transfer, individuals must fill out key details, including personal information such as name, social security number, and contact details. You'll also need to provide the 16-digit Emerald Card number and specify the amount to be transferred. It’s important to note that any pending transactions will prevent fund transfers. The form offers various transfer methods, including ACH transfers to a linked bank account or mailing a check to a specified address. Clear instructions outline the requirements for each method, emphasizing the necessity of accurate information to avoid delays. Completing the form accurately ensures a smooth transfer process and maintains clear communication with H&R Block Bank, which may reach out for confirmation if needed. Overall, the 401 form is a straightforward yet essential tool for managing fund transfers effectively and efficiently.

401 H R Block Bank Example

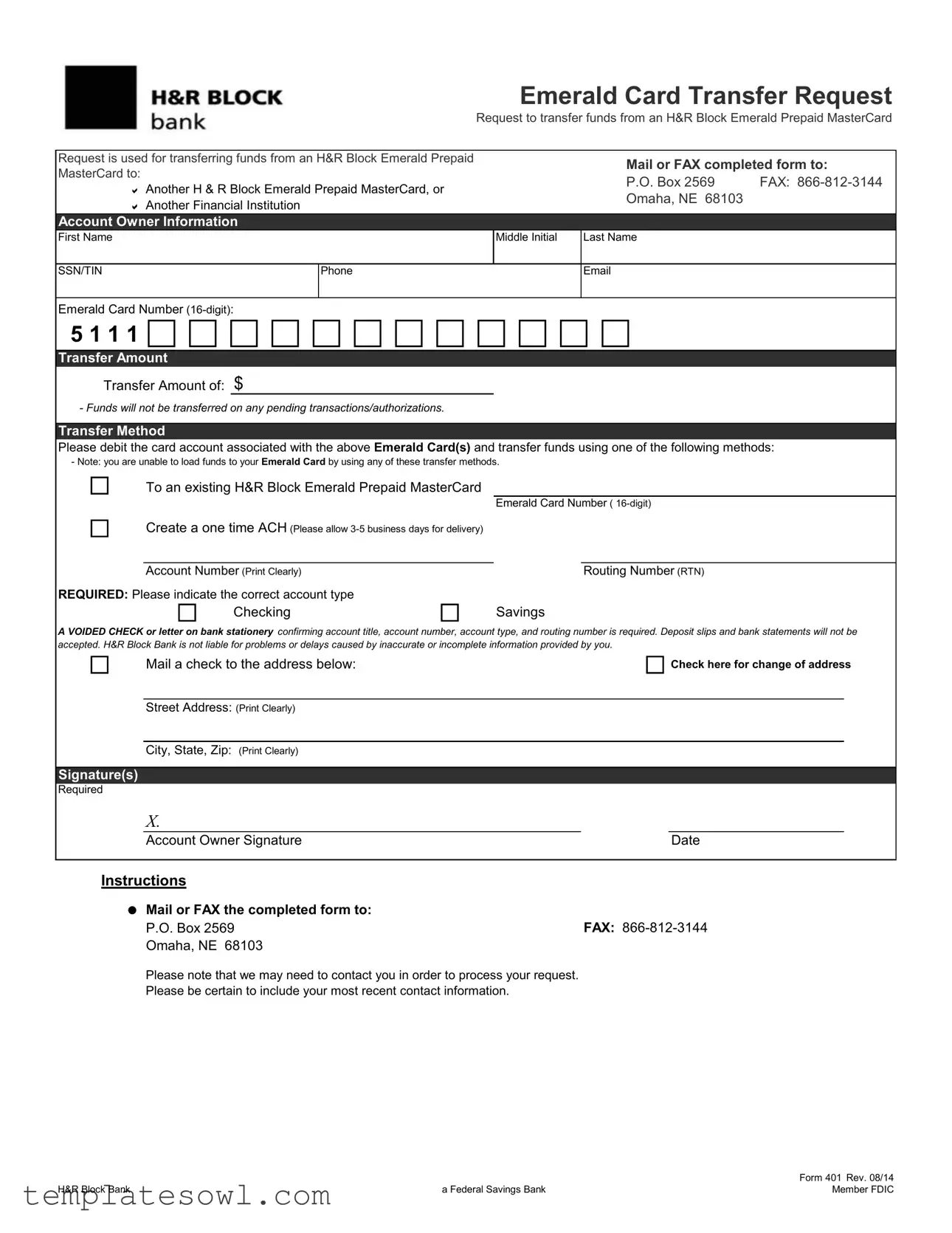

Emerald Card Transfer Request

Request to transfer funds from an H&R Block Emerald Prepaid MasterCard

Request is used for transferring funds from an H&R Block Emerald Prepaid |

Mail or FAX completed form to: |

|||||

MasterCard to: |

|

|

|

|||

|

|

|

P.O. Box 2569 |

FAX: |

||

|

Another H & R Block Emerald Prepaid MasterCard, or |

|||||

Omaha, NE 68103 |

|

|||||

Another Financial Institution |

|

|||||

|

|

|||||

Account Owner Information |

|

|

||||

First Name |

|

|

Middle Initial |

Last Name |

|

|

|

|

|

|

|

|

|

SSN/TIN |

|

Phone |

|

|||

|

|

|

|

|

|

|

Emerald Card Number

5 1 1 1

Transfer Amount

Transfer Amount of: $

- Funds will not be transferred on any pending transactions/authorizations.

Transfer Method

Please debit the card account associated with the above Emerald Card(s) and transfer funds using one of the following methods:

- Note: you are unable to load funds to your Emerald Card by using any of these transfer methods.

|

To an existing H&R Block Emerald Prepaid MasterCard |

|

|

|||

|

|

|

|

|

Emerald Card Number ( |

|

|

Create a one time ACH (Please allow |

|

|

|||

|

|

|

|

|

|

|

|

Account Number (Print Clearly) |

|

|

|

Routing Number (RTN) |

|

REQUIRED: Please indicate the correct account type |

|

|

|

|

||

|

|

Checking |

|

Savings |

||

A VOIDED CHECK or letter on bank stationery confirming account title, account number, account type, and routing number is required. Deposit slips and bank statements will not be accepted. H&R Block Bank is not liable for problems or delays caused by inaccurate or incomplete information provided by you.

|

Mail a check to the address below: |

Check here for change of address |

||

|

|

|

|

|

|

Street Address: (Print Clearly) |

|

|

|

|

|

|

|

|

|

City, State, Zip: (Print Clearly) |

|

|

|

|

|

|

|

|

Signature(s) |

|

|

|

|

Required |

|

|

|

|

|

X. |

|

|

|

|

|

|

|

|

|

Account Owner Signature |

|

Date |

|

Instructions

Mail or FAX the completed form to:

P.O. Box 2569 |

FAX: |

Omaha, NE 68103 |

|

Please note that we may need to contact you in order to process your request.

Please be certain to include your most recent contact information.

|

|

Form 401 Rev. 08/14 |

H&R Block Bank |

a Federal Savings Bank |

Member FDIC |

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose of the Form | The form is used to transfer funds from an H&R Block Emerald Prepaid MasterCard. |

| Transfer Methods | Funds can be transferred to another Emerald Card or to a bank account via ACH. |

| Required Information | First and last name, SSN/TIN, phone, email, and Emerald Card number are necessary. |

| Transfer Timeline | Allow 3-5 business days for delivery of ACH transfers. |

| Pending Transactions | Funds will not transfer if there are any pending transactions or authorizations. |

| Documentation for ACH | A voided check or a bank letter confirming account details is required. |

| Mailing Address | Requests must be mailed to P.O. Box 2569, Omaha, NE 68103. |

| Who Can Submit | The account owner must sign the form for the request to be valid. |

| Liability for Errors | H&R Block Bank is not liable for errors from incomplete information. |

Guidelines on Utilizing 401 H R Block Bank

Completing the 401 H&R Block Bank form requires careful attention to detail. Follow these straightforward steps to ensure your transfer request is processed efficiently. Once you have provided all necessary information, you can submit the form by either mailing or faxing it to the designated address.

- Owner Information: Fill in your first name, middle initial, last name, and Social Security number (SSN) or Tax Identification Number (TIN). Include your phone number and email address.

- Emerald Card Number: Enter your 16-digit Emerald Card number in the designated space.

- Transfer Amount: Specify the amount you wish to transfer.

- Transfer Method: Choose how you want to transfer funds. You can select either:

- To another H&R Block Emerald Prepaid MasterCard (enter the 16-digit card number).

- Create a one-time ACH transfer (provide the account number and routing number. Don’t forget to indicate the account type: checking or savings).

- Voided Check: Attach a voided check or a letter from your bank that includes the account title, number, type, and routing number. Note that deposit slips or bank statements are not accepted.

- Mailing Address: If applicable, provide your new street address, city, state, and zip code. Check the box if this is a change of address.

- Signature: Sign and date the form to confirm your request.

- Submission: Mail the completed form to P.O. Box 2569, Omaha, NE 68103, or fax it to 866-812-3144.

Make sure to double-check your information for accuracy before submitting. Incorrect or incomplete information might delay the processing of your request. After sending, monitor your contact information for any follow-up inquiries from H&R Block Bank regarding your transfer.

What You Should Know About This Form

What is the purpose of the 401 H&R Block Bank form?

The 401 H&R Block Bank form is primarily used to request a transfer of funds from an H&R Block Emerald Prepaid MasterCard. This form allows you to move money either to another H&R Block Emerald Prepaid MasterCard or to a different financial institution's account. It is essential for managing your funds efficiently and ensures that your money reaches the desired account securely.

How do I fill out the account owner information on the form?

Completing the account owner information section is straightforward. You will need to provide your first name, middle initial, last name, Social Security Number or Tax Identification Number, phone number, email address, and your 16-digit Emerald Card number. Ensure all information is accurate to avoid delays, as any inaccuracies may lead to processing problems.

What methods can I use to transfer my funds?

You have a few options for transferring funds, including transferring to another H&R Block Emerald Prepaid MasterCard or creating a one-time ACH transfer to an existing bank account. If you select the ACH method, make sure to provide the correct account number, routing number, and indicate whether it’s a checking or savings account. Remember, a voided check or a letter from your bank confirming your account details is required to complete this process. Unfortunately, you cannot load funds to your Emerald Card using these transfer methods.

What should I do if I need to change my address?

If you would like to change your address while submitting the transfer request, you simply need to check the designated box for a change of address on the form. Provide your new street address, city, state, and zip code clearly. Keeping your address updated is crucial, as any correspondence or checks related to your transfer will be sent to this address.

How long will it take for my funds to transfer?

The time it takes for your funds to transfer largely depends on the method you select. If you choose the ACH option, expect a delivery timeframe of 3 to 5 business days. Transfers to another H&R Block Emerald Prepaid MasterCard may occur more swiftly, but they will not process if there are any pending transactions or authorizations on the card. Always keep an eye on your account activity to ensure smooth transactions.

Common mistakes

Filling out the 401 H&R Block Bank form is a critical step in ensuring your funds are transferred without issues. However, many individuals make several common mistakes that can complicate the process. Understanding these pitfalls can help you avoid unnecessary delays and contribute to a smoother transaction experience.

One prevalent mistake involves leaving out essential personal information. The Account Owner Information section requires your full name, Social Security Number, and contact details. Omitting any part of this information can lead to processing complications. The more complete and accurate your information is, the less likely it is that you will encounter delays.

People often mismanage their Emerald Card numbers, too. It’s vital to input the full 16-digit Emerald Card number correctly. A simple transposition of digits can lead to significant bumps in the transfer process. Furthermore, ensure you check the number against the card itself to confirm its accuracy.

Another common error occurs in the section regarding the transfer method. Individuals frequently click on the wrong options accidentally or neglect to mark a method entirely. Whether you choose to transfer funds to another H&R Block card or set up a one-time ACH transfer, double-check your selections to confirm they align with your intentions.

When transferring to another bank account, many forget to include necessary banking details. Providing an account number and routing number is essential, yet some people mistakenly think this information can be bypassed. AVOIDED CHECK or official bank letter verification is mandatory. Incomplete or inaccurate banking information can delay your transaction and result in bounced transfers.

Next, address verification is often overlooked. When updating your address in the Change of Address section, it’s crucial to ensure that the information provided is accurate and clearly printed. Mistakes in your address can send critical correspondence to the wrong location, further complicating your transfer request.

Finally, signatures can be a stumbling block. Many fail to remember to sign the form completely, or sometimes they sign but forget to include the date. Both signature and date are necessary for processing, so skipping this action seems minor but can have significant repercussions. Always review your form before sending it off.

Being mindful of these seven common mistakes can greatly increase your chances of a successful and timely transfer on the 401 H&R Block Bank form. Take your time, double-check your entries, and ensure every section is fully and accurately completed. This attention to detail pays off in a smoother transaction experience.

Documents used along the form

The 401 H&R Block Bank form is used primarily for transferring funds from an H&R Block Emerald Prepaid MasterCard. When dealing with such financial transactions, several other forms and documents might also come into play. Understanding these can improve your experience and ensure everything goes smoothly.

- Bank Account Verification Letter: This document confirms your account information, including account title, account number, and routing number. It's crucial for ACH transfers, ensuring the funds are sent to the correct account.

- Voided Check: A voided check provides proof of your bank account details. It must be submitted with the transfer request to ensure accuracy.

- Emerald Card Statement: This statement outlines your recent transactions and balance on the Emerald Card. It can help clarify funds available for transfer.

- Direct Deposit Authorization Form: If you plan to set up direct deposit for your Emerald Card, this form authorizes your employer or other entities to deposit funds directly. It requires your account information.

- Identification Documents: These include a government-issued ID or Social Security card, which verify your identity during the transfer process.

- IRS Form W-9: This form certifies your taxpayer information. It's often needed for tax purposes when dealing with financial institutions.

- Change of Address Form: If you’ve recently moved, this form ensures that all communications and transactions are sent to your new address, preventing any potential delays.

Pairs of documents, such as the bank account verification letter with the voided check, ensure your requests are processed without issues. Always keep your information accurate and up to date to avoid complications when transferring funds.

Similar forms

The 401 H&R Block Bank form serves a specific purpose, allowing users to transfer funds from their H&R Block Emerald Prepaid MasterCard. However, it shares similarities with various financial documents that facilitate similar transactions or provide important instructions regarding banking processes. Below are four documents that are comparable to the 401 form:

- ACH Transfer Form: Like the 401 form, an ACH (Automated Clearing House) Transfer Form is used to authorize the transfer of funds electronically between bank accounts. Both forms require account owner information, including account numbers and routing numbers, ensuring a seamless transaction process.

- Wire Transfer Request Form: This form is essential for initiating wire transfers. Similar to the 401 form, it requires detailed information about the sender’s and receiver’s bank accounts. Both documents aim to facilitate quick transfers of money, though wire transfers typically occur faster than ACH transfers.

- Direct Deposit Authorization Form: This document allows employees to authorize their employers to deposit their paychecks directly into their bank accounts. Much like the 401 form, it involves providing account details and proves essential in ensuring the recipient receives their funds without delay.

- Bank Account Change Form: When a customer wants to update their bank account information, this form ensures that the bank has the correct details. Similar to the 401 form, it requires personal information and account specifics, thus maintaining accurate records for fund transfers and operations.

Each of these documents plays a crucial role in managing and transferring funds, underscoring the importance of clear communication and accurate information in financial transactions.

Dos and Don'ts

When filling out the 401 H&R Block Bank form, following the right steps can ensure a smooth transfer process. Here's a list of things to do and avoid.

- Do include accurate personal information. Make sure that your name, Social Security Number, and contact details are correct.

- Do clearly state the transfer amount. Write the exact amount you want to transfer to avoid delays.

- Do choose the correct transfer method. Indicate whether you want to transfer funds to another Emerald Card or a financial institution.

- Do provide required documentation. A voided check or a signed letter from your bank must accompany the form.

- Don't forget to sign the form. An unsigned form will lead to processing delays.

- Don't use deposit slips or bank statements. Only the specified voided check or letter will be accepted.

By following these guidelines, you'll help ensure your fund transfer request goes smoothly and without any unnecessary complications.

Misconceptions

Understanding the 401 H&R Block Bank form can be complicated, and several misconceptions often arise. Here’s a rundown to clarify these misunderstandings:

- This form is only for transferring funds between H&R Block accounts. Many believe this is true; however, the form can also transfer funds to other financial institutions.

- You can load money onto your Emerald Card using this form. Some think that this form allows them to load money. In reality, it does not support loading funds onto the Emerald Card.

- A voided check is optional. It is a common belief that you can submit this form without a voided check. However, you must include one to confirm your bank account details.

- Pendings transactions will be considered for the transfer. Many users mistakenly think that pending transactions can delay their funds transfer. Instead, the transfer won't take place if there are any pending transactions on the card.

- This form can be submitted electronically. Some may assume they can send this form via email or another electronic method. The only accepted methods are mail or fax.

- You need to have a specific type of account to use the form. While certain account types are mentioned, individuals can use either checking or savings accounts for transfers.

- You don’t need to provide a signature. It's often misunderstood that a signature isn't necessary. In fact, a signature is required for processing the transfer.

- Delay in receiving funds only results from bank processing time. While banks do indeed take time, problems in completing the form or providing inaccurate information can also lead to delays.

- Any identity verification leapfrogs the need for additional information. There is a belief that if an identity is verified, no further information is required. However, clarity in your contact details and complete information can expedite the process.

- The contact information you provide is unimportant. People sometimes think that as long as they submit the form, their contact details don’t matter. On the contrary, accurate and up-to-date contact information is essential for processing and any follow-up needed.

By dispelling these misconceptions, individuals can navigate the 401 H&R Block Bank form with greater ease and confidence. It's essential to read the form carefully and understand the requirements to ensure a smooth process.

Key takeaways

Here are some key takeaways regarding the H&R Block Bank 401 form:

- Purpose: The form is specifically for transferring funds from your H&R Block Emerald Prepaid MasterCard to another account.

- Submission: You can submit the completed form by mailing it or faxing it to H&R Block Bank.

- Transfer Options: Funds can be transferred to another Emerald Card or a bank account via ACH.

- Information Required: Provide your full name, Social Security Number, phone number, email, and Emerald Card number.

- Transfer Amount: Specify the amount you wish to transfer, remembering that pending transactions cannot be included.

- Account Details: For ACH transfers, you must provide the account number, routing number, and specify the type of account.

- Documentation: A voided check or a bank letter is needed to confirm your account details; deposit slips are not accepted.

Be diligent in providing accurate information on the form. This will help avoid delays in processing your request.

Browse Other Templates

Home Sepot - Attach a current resume if available to support your application.

Police Vehicle Inspection Form Template - Ensure brake lights are functioning, including the third light.