Fill Out Your 40D Form

The 40D form is an important document for agents associated with North American Company for Life and Health Insurance. It serves a specific purpose by allowing you to designate a beneficiary who will receive any vested commissions that might remain unpaid at the time of your death. This includes vital information, such as the full name and social security number of both the agent and the designated beneficiary. Notably, the form must be notarized to be valid. Upon your passing, you will need to ensure that your beneficiary provides a certified copy of your death certificate alongside the Deceased Agent Beneficiary Form to facilitate the commission payout. It's essential to understand that any outstanding debts you may have with North American will be settled from the commissions before any payments are made to the beneficiary. If you ever want to change your designated beneficiary, it's a simple process, but it's crucial to know that doing so will revoke the rights of any previous beneficiaries. By filling out the 40D form, you can take this proactive step in securing your financial legacy and ensuring that your intentions regarding your commissions are honored.

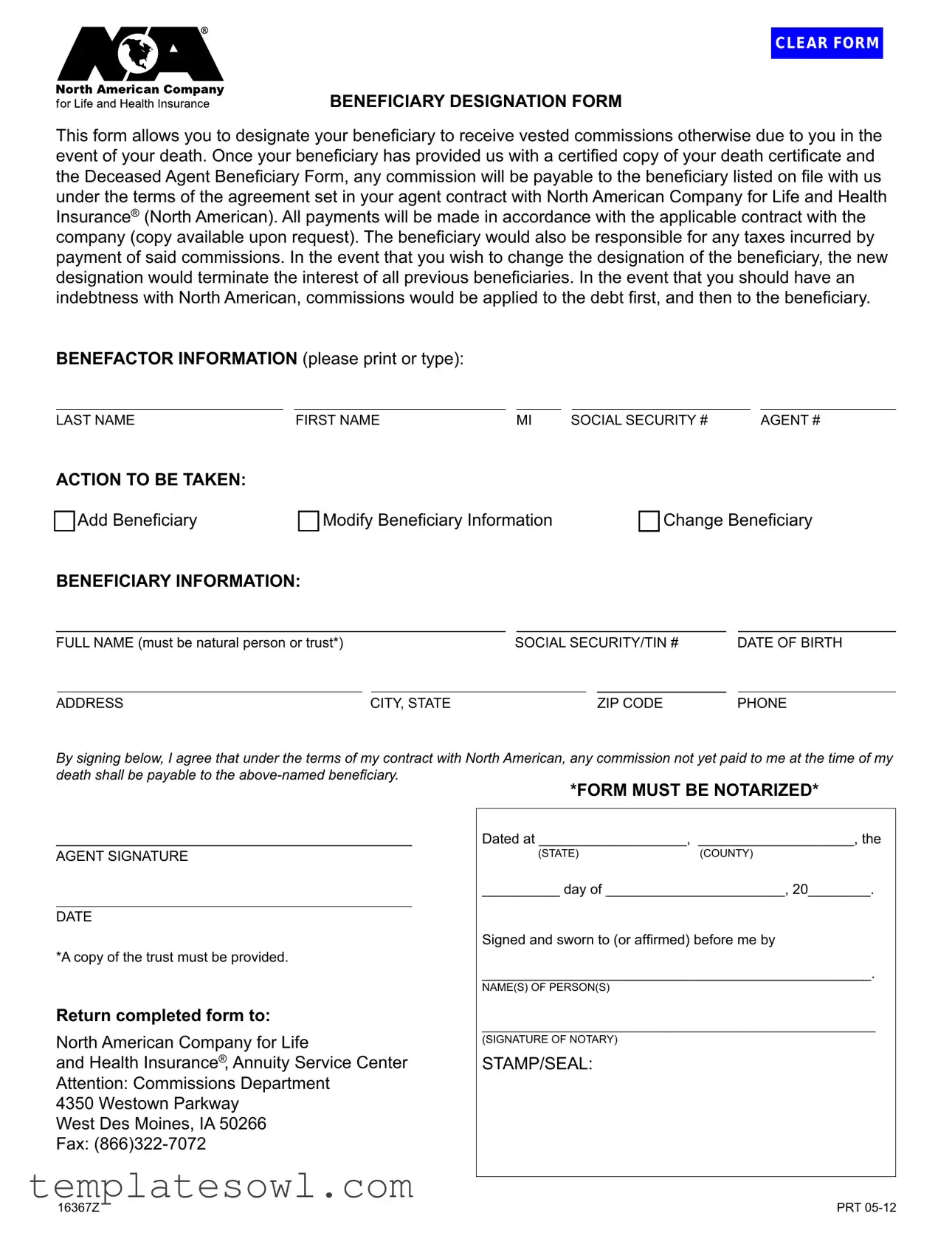

40D Example

CLEAR FORM

BENEFICIARY DESIGNATION FORM

This form allows you to designate your beneficiary to receive vested commissions otherwise due to you in the event of your death. Once your beneficiary has provided us with a certified copy of your death certificate and the Deceased Agent Beneficiary Form, any commission will be payable to the beneficiary listed on file with us under the terms of the agreement set in your agent contract with North American Company for Life and Health Insurance® (North American). All payments will be made in accordance with the applicable contract with the company (copy available upon request). The beneficiary would also be responsible for any taxes incurred by payment of said commissions. In the event that you wish to change the designation of the beneficiary, the new designation would terminate the interest of all previous beneficiaries. In the event that you should have an indebtness with North American, commissions would be applied to the debt first, and then to the beneficiary.

BENEFACTOR INFORMATION (please print or type):

LAST NAMEFIRST NAMEMI SOCIAL SECURITY # AGENT #

ACTION TO BE TAKEN: |

|

|

|

|

|

|

|

|

|

r Add Beneficiary |

r Modify Beneficiary Information |

|

r Change Beneficiary |

||||||

BENEFICIARY INFORMATION: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

FULL NAME (must be natural person or trust*) |

|

|

SOCIAL SECURITY/TIN # |

DATE OF BIRTH |

|||||

|

|

|

|

|

|

|

|

||

ADDRESS |

|

CITY, STATE |

|

ZIP CODE |

PHONE |

||||

AGENT SIGNATURE

DATE

*A copy of the trust must be provided.

Return completed form to:

North American Company for Life

and Health Insurance®, Annuity Service Center Attention: Commissions Department

4350 Westown Parkway West Des Moines, IA 50266 Fax:

(state)(county)

__________ day of _______________________, 20________.

Signed and sworn to (or affirmed) before me by

__________________________________________________.

NAME(S) OF PERSON(S)

_________________________________________________________________

(sIGNATURE OF NOTARY)

STAMP/SEAL:

16367Z |

PRT |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | This form allows individuals to designate a beneficiary for their unpaid commissions upon death. |

| Notarization Requirement | The form must be notarized to be valid. |

| Company | North American Company for Life and Health Insurance® governs this form. |

| Beneficiary Eligibility | Beneficiaries can be natural persons or trusts, but a copy of the trust must be included if applicable. |

| Tax Responsibility | The designated beneficiary is responsible for any taxes incurred from the commission payment. |

| Debt Application | If there is any debt owed to North American, commissions will first apply to the debt before reaching the beneficiary. |

| State-Specific Law | This form may be subject to the specific laws of the state of Iowa, where North American is headquartered. |

Guidelines on Utilizing 40D

Before you start filling out the 40D form, ensure that you have all the necessary information on hand. This form is important for designating a beneficiary for your commissions in case of your passing. Once completed, you will need to have the form notarized, and then submit it to the designated address.

- Gather Required Information: Collect your personal details, including your last name, first name, middle initial, social security number, and agent number. Have your beneficiary's information ready as well.

- Choose an Action: Indicate whether you want to add, modify, or change a beneficiary by checking the appropriate box.

- Fill Out Beneficiary Information: Enter the full name, social security number or TIN, date of birth, address, city, state, ZIP code, and phone number of your beneficiary. Ensure that the beneficiary is a natural person or a trust, and remember to attach a copy of the trust if applicable.

- Agent Signature: Sign and date the form to affirm the information you have provided is accurate.

- Notarization: Leave space for a notary public to sign. The notary will indicate the date and location of notarization, as well as their seal. Arrange for the notarization to be completed as required.

- Submission: Finally, return the completed form either by mail or fax to the North American Company for Life and Health Insurance, ensuring it reaches the Commissions Department at the specified address.

What You Should Know About This Form

What is the purpose of the 40D form?

The 40D form is used to designate a beneficiary for the vested commissions that are due to you under your contract with North American Company for Life and Health Insurance. If you pass away, the commissions that have not yet been paid will go to the beneficiary you designate on this form. This ensures that your financial intentions are honored even after your death.

Who can be designated as a beneficiary?

You can designate a natural person or a trust as your beneficiary. It is essential that you provide the full name, Social Security number, date of birth, and contact information for the beneficiary you choose. If you opt to designate a trust, a copy of the trust must accompany the form.

What happens if I want to change my beneficiary?

If you wish to change your beneficiary, you can do so by submitting a new 40D form. It is important to note that changing the designation of your beneficiary will automatically terminate the interest of all previous beneficiaries listed on the old form.

Are there any tax responsibilities for the beneficiary?

Yes, the beneficiary named on the 40D form will be responsible for any taxes associated with the payment of the commissions they receive upon your death. This means it's important for the beneficiary to understand these potential tax implications.

What documents are required when submitting the form?

When you submit the 40D form, it must be notarized to be considered valid. In the event of your death, the beneficiary will need to provide a certified copy of your death certificate along with the Deceased Agent Beneficiary Form to claim the commissions.

What if there are unpaid debts owed to North American?

If you have any unpaid debts to North American at the time of your passing, the commissions that would have been payable to your beneficiary will first be applied to settle those debts. Only after the debt has been cleared will any remaining commissions be distributed to your designated beneficiary.

Where should I send the completed 40D form?

The completed form should be sent to the North American Company for Life and Health Insurance, specifically to the Annuity Service Center, Commissions Department. The mailing address is 4350 Westown Parkway, West Des Moines, IA 50266. Alternatively, you can fax the completed form to (866) 322-7072.

What should I do if I have more questions about the 40D form?

If you have further questions, it is advisable to contact North American directly. They can provide more detailed information regarding the 40D form, its processes, and any other concerns you may have. Contacting them directly will ensure you receive accurate and specific guidance tailored to your situation.

Common mistakes

Filling out the 40D form can seem straightforward, but there are common mistakes that can lead to complications. One frequent error is failing to properly notarize the form. Notarization is explicitly required, and without it, the form becomes invalid. It's crucial to include a notary's signature and seal to ensure your form meets the legal requirements.

Another mistake people often make is leaving fields incomplete. Each section of the form is important, especially the beneficiary information. Omitting details like the beneficiary’s Social Security number, date of birth, or address can delay the process or cause confusion later on.

Diligence in specifying the beneficiary is essential. Some individuals may incorrectly assume they can list multiple beneficiaries without clear instructions in the form. Confusion arises if the form does not indicate how shares should be divided, which can lead to disputes after the agent's death.

Many also overlook the impact of debt on commission disbursement. Commissions may first be applied to any outstanding debts owed to North American before being paid to the designated beneficiary. Awareness of this policy helps set realistic expectations for the beneficiaries.

Another common pitfall is neglecting to submit a trust copy when a trust is designated as the beneficiary. If a trust is the named beneficiary, the required documentation must accompany the form. Failure to provide this can result in automatic delays in processing the claim.

People sometimes modify beneficiary information without understanding the implications. Changing a beneficiary nullifies all prior designations, which can unintentionally disenfranchise previous beneficiaries. Communication with all parties involved is critical if changes are made.

Beyond errors in beneficiary details, individuals might misinterpret the need for a certified copy of the death certificate. This document is necessary for beneficiaries to receive the commissions owed. Ensuring someone knows how to obtain and present this certificate is vital for a smooth claims process.

Lastly, incorrect submission of the form can be an issue. Once completed, individuals must make sure to send the form to the correct address. Misdelivery can result in lost paperwork, causing unnecessary delays and stress for loved ones.

Documents used along the form

When dealing with the 40D form, there are several other important documents often used. Each of these plays a role in managing commissions and ensuring the proper handling of beneficiary designations.

- Certified Copy of Death Certificate: This document serves as proof of the agent's passing. Without it, the commission payments cannot be processed to the designated beneficiary.

- Deceased Agent Beneficiary Form: Beneficiaries must complete this form to formally claim their commission payments. It includes necessary information about the deceased agent and their designated beneficiary.

- Beneficiary Change Form: This form is used to modify or change the existing beneficiary designation. Submitting it effectively updates the records and replaces any previous beneficiaries that were on file.

- Trust Documentation: If a trust is named as a beneficiary, documentation must be presented. This ensures that the trust is recognized legally, allowing for proper distribution of commissions.

Understanding these documents can ease the process for both agents and beneficiaries. If you have any questions about these forms or the next steps, support is available to assist you.

Similar forms

- Beneficiary Designation Form: Similar to the 40D form, this document allows individuals to specify a beneficiary who will receive benefits upon their death. It also typically requires notarization and follows certain company protocols.

- Last Will and Testament: This legal document outlines how a person wants their assets to be distributed after their death. Like the 40D form, it serves to clarify beneficiary designations but covers a broader range of assets.

- Trust Document: A trust outlines who receives assets and when. This document is also important for establishing the management of assets after death and can be modified, similar to changing a beneficiary on the 40D form.

- Power of Attorney: This document allows someone to act on another person's behalf in various matters, including managing finances. While it does not directly deal with beneficiary designations, it shares the ability to affect financial matters after one’s passing.

- Retirement Account Beneficiary Designation: Just like the 40D form, this document allows account holders to name beneficiaries for their retirement accounts. It usually requires the beneficiary to provide proof of identity after the account holder's death.

- Healthcare Proxy: Though primarily concerned with medical decisions, this document can influence financial matters regarding healthcare. It shares the need for a clear designation of someone to act on behalf of an individual.

- Insurance Policy Beneficiary Designation: This is similar to the 40D form as it allows individuals to name a beneficiary for life insurance benefits. The insurance policy will outline how benefits are paid out upon the insured's death.

Dos and Don'ts

When filling out the 40D form, it is important to follow certain guidelines to ensure it's completed correctly.

- Do: Make sure to print or type the information clearly for easy reading.

- Do: Include all required information about yourself and your beneficiary.

- Do: Sign the form in the designated spot before a notary public.

- Do: Submit a copy of the trust if you are naming a trust as the beneficiary.

- Don't: Skip notarizing the form, as it is a mandatory requirement.

- Don't: Forget to provide a certified copy of the death certificate when needed.

- Don't: Use incorrect or outdated beneficiary information.

- Don't: Leave any required fields blank when completing the form.

Misconceptions

This list addresses common misconceptions about the 40D form and offers clarity on its purpose and usage.

- The 40D form is only for life insurance beneficiaries. This form is actually meant for designating beneficiaries for commissions due to an agent, not strictly for life insurance purposes.

- A beneficiary can be anyone. The beneficiary must be a natural person or trust designated on the form. This means you cannot choose a business or organization.

- The form does not need to be notarized. In fact, notarization is required for the form to be valid. You must sign it in front of a notary public.

- Changing a beneficiary is a simple verbal process. To modify or change a beneficiary, a new completed 40D form must be submitted, and any previous designations will be terminated.

- Your beneficiary cannot receive benefits if you owe money. While it is true that any existing debts to North American will be deducted from your commissions first, the remaining amount will then be paid to your beneficiary.

- All beneficiaries receive equal shares automatically. The distribution of commissions depends on how you designate the beneficiaries. You can specify percentages if you choose more than one.

- The form is only necessary for active agents. Even if you are no longer an active agent, it can still be important to complete this form to ensure your commissions go to the right person upon your passing.

- The 40D form does not require personal information from the beneficiary. In fact, you must provide specific personal details about the beneficiary, including their full name, Social Security number, and date of birth.

- Submitting the form guarantees immediate payment to the beneficiary. Payment is contingent upon the beneficiary providing a certified death certificate and the completion of additional required forms.

Key takeaways

When filling out and using the 40D form, consider the following key takeaways:

- Purpose: This form allows you to designate a beneficiary who will receive any vested commissions due to you upon your death.

- Notarization is Required: It is essential for the form to be notarized to ensure its validity.

- Beneficiary Information: You must provide complete information about your chosen beneficiary, including their full name, date of birth, and Social Security number.

- Commission Payments: Commissions will be paid to the designated beneficiary after they provide a certified copy of your death certificate.

- Changing Beneficiaries: If you choose to change your designated beneficiary, the new designation automatically voids all previous beneficiaries.

- Debt Considerations: Any outstanding debt with North American will be settled with your commission payments before any funds are paid to the beneficiary.

- Submission Instructions: Completed forms should be returned to the specific address provided by North American to ensure proper processing.

Browse Other Templates

Parent Sample Letter to Judge for Child Custody - It helps clarify the facts presented in a case for the legal record.

Erm 6 - This document captures important statistics for up to three years of experience, not including the previous year's data.

What Is a Form 8862 - Eligibility includes spending on construction, operation, and enhancement of childcare facilities.