Fill Out Your 4180 Pdf Form

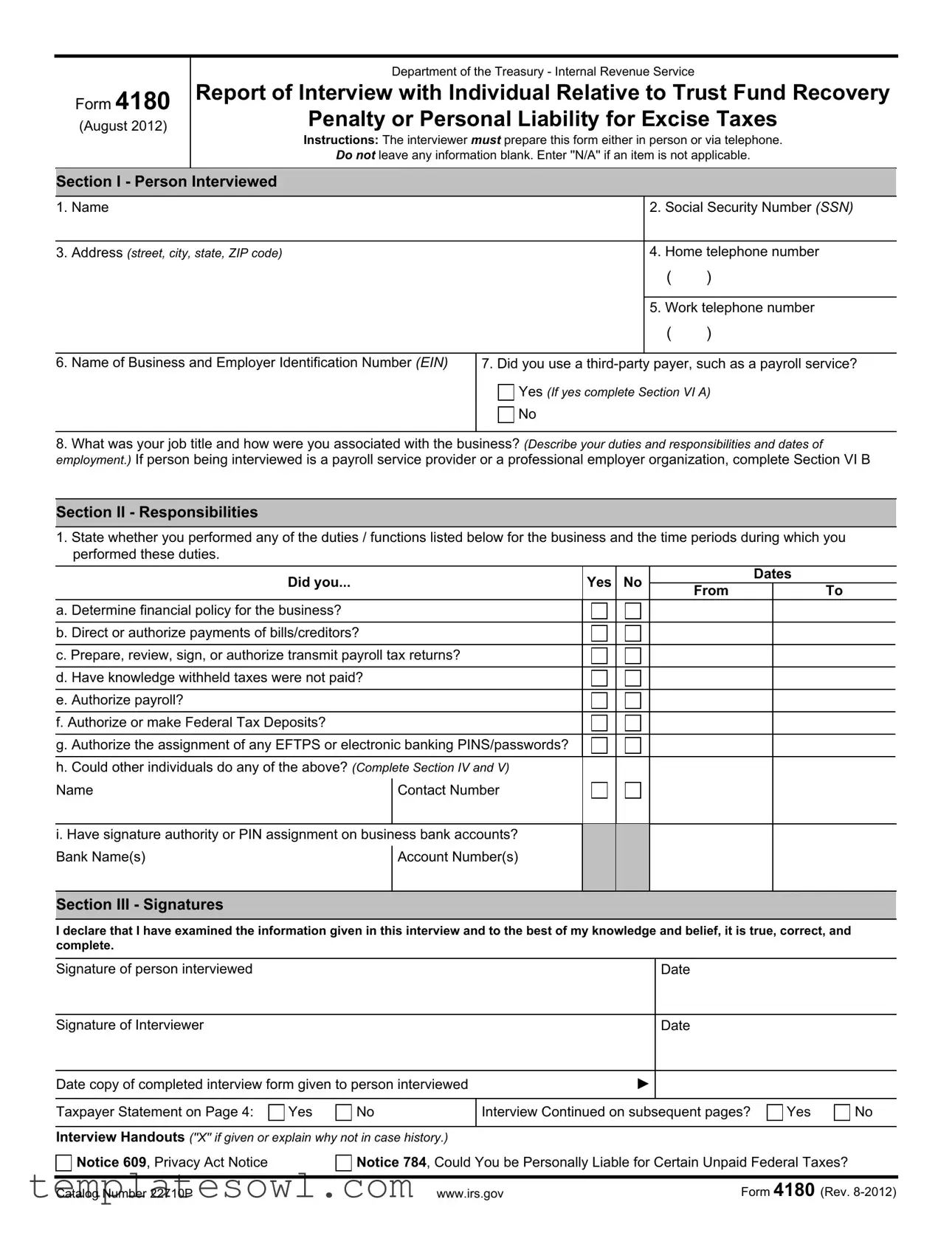

The 4180 PDF form, officially titled "Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes," serves a critical function for the Internal Revenue Service (IRS) in assessing individual liability for unpaid employment taxes. Designed for use by the interviewer, the form requires comprehensive information, ensuring that no crucial detail is overlooked. Sections of the form prompt the respondent to provide personal details, including their name, Social Security Number, and contact information. Additionally, it queries their role within the business and their specific responsibilities related to tax payments. Critical sections seek clarity on financial policy decisions, payment authorizations, and any prior knowledge of unpaid taxes. These insights are vital for the IRS to determine accountability in cases where the Trust Fund Recovery Penalty may apply. The form also includes sections relevant to businesses using third-party payroll services, thus making it adaptable for various employment structures. Overall, Form 4180 is an essential tool for assessing personal liability concerning tax obligations, reflecting the IRS’s mission to enforce tax laws fairly and effectively.

4180 Pdf Example

Form 4180

(August 2012)

Department of the Treasury - Internal Revenue Service

Report of Interview with Individual Relative to Trust Fund Recovery

Penalty or Personal Liability for Excise Taxes

Instructions: The interviewer must prepare this form either in person or via telephone.

Do not leave any information blank. Enter ''N/A'' if an item is not applicable.

Section I - Person Interviewed

1. |

Name |

2. |

Social Security Number (SSN) |

|

|

|

|

|

|

3. |

Address (street, city, state, ZIP code) |

4. |

Home telephone number |

|

|

|

|

( |

) |

|

|

|

|

|

|

|

5. |

Work telephone number |

|

|

|

|

( |

) |

|

|

|

|

|

6. Name of Business and Employer Identification Number (EIN)

7. Did you use a

Yes (If yes complete Section VI A)

No

8.What was your job title and how were you associated with the business? (Describe your duties and responsibilities and dates of employment.) If person being interviewed is a payroll service provider or a professional employer organization, complete Section VI B

Section II - Responsibilities

1.State whether you performed any of the duties / functions listed below for the business and the time periods during which you performed these duties.

Did you... |

|

|

Yes |

No |

|

Dates |

|

|

|

From |

|

To |

|||

|

|

|

|

|

|

||

a. Determine financial policy for the business? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

b. Direct or authorize payments of bills/creditors? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

c. Prepare, review, sign, or authorize transmit payroll tax returns? |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

d. Have knowledge withheld taxes were not paid? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

e. Authorize payroll? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

f. Authorize or make Federal Tax Deposits? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

g. Authorize the assignment of any EFTPS or electronic banking PINS/passwords? |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

h. Could other individuals do any of the above? (Complete Section IV and V) |

|

|

|

|

|

||

Name |

|

Contact Number |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

i. Have signature authority or PIN assignment on business bank accounts? |

|

|

|

|

|

||

Bank Name(s) |

|

Account Number(s) |

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

Section III - Signatures

I declare that I have examined the information given in this interview and to the best of my knowledge and belief, it is true, correct, and complete.

Signature of person interviewed

Signature of Interviewer

Date

Date

Date copy of completed interview form given to person interviewed |

► |

Taxpayer Statement on Page 4:

Yes

No

Interview Continued on subsequent pages?

Yes

No

Interview Handouts (''X'' if given or explain why not in case history.)

Notice 609, Privacy Act Notice

Notice 784, Could You be Personally Liable for Certain Unpaid Federal Taxes?

Catalog Number 22710P |

www.irs.gov |

Form 4180 (Rev. |

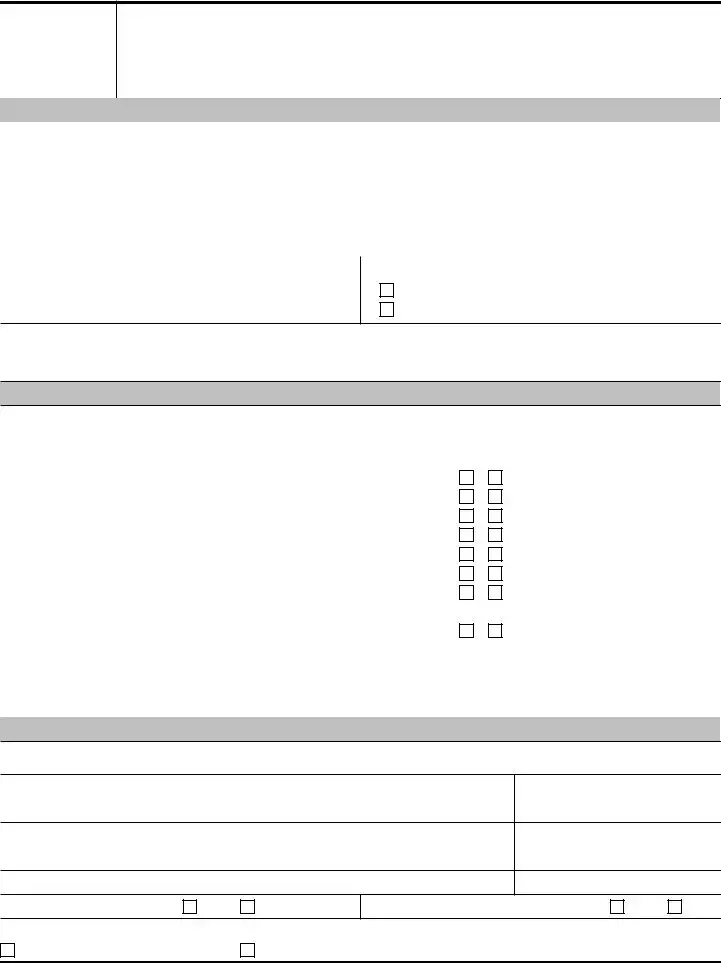

Page 2

Section IV - Business Information

1. List corporate positions below, identifying the persons who occupied them and their dates of service.

Position (e.g. president, director) |

Name |

Address |

Dates |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. Did/does the business use the Electronic Federal Tax Payment |

3. Other than the EFTPS, does the business do any other banking |

|

System (EFTPS) to make Federal Tax Deposits (FTD's) or |

electronically? |

|

payments? |

No |

|

|

||

No |

Yes Where |

|

Yes If yes, to whom are the PINS or passwords assigned |

|

|

To whom are the PINs/passwords assigned |

||

4. Does the business file Form 941 electronically?

No |

Who is authorized to sign Form 941 |

Yes |

Who files the returns electronically |

Section V - Knowledge / Willfulness

1.During the time the delinquent taxes were increasing, or at any time thereafter, were any financial obligations of the business paid?

(such as rent, mortgage, utilities, vehicle or equipment loans, or payments to vendors)

No

Yes Which obligations were paid?

Who authorized them to be paid?

2. Were all or a portion of the payrolls met?

No

Yes

Who authorized

3.Did any person or organization provide funds to pay net corporate payroll?

No

No

Yes (explain in detail and provide name)

4. When and how did you first become aware of the unpaid taxes? 5. What actions did you attempt to see that the taxes were paid?

6. Were discussions ever held by stockholders, officers, or other |

7. Who handled IRS contacts such as phone calls, |

interested parties regarding nonpayment of the taxes? |

correspondence, or visits by IRS personnel? |

No |

|

Yes |

|

Identify who attended, dates, any decisions reached, and |

When did these contacts take place, and what were the results |

whether any documentation is available. |

of these contacts? |

Catalog Number 22710P |

www.irs.gov |

Form 4180 (Rev. |

Page 3

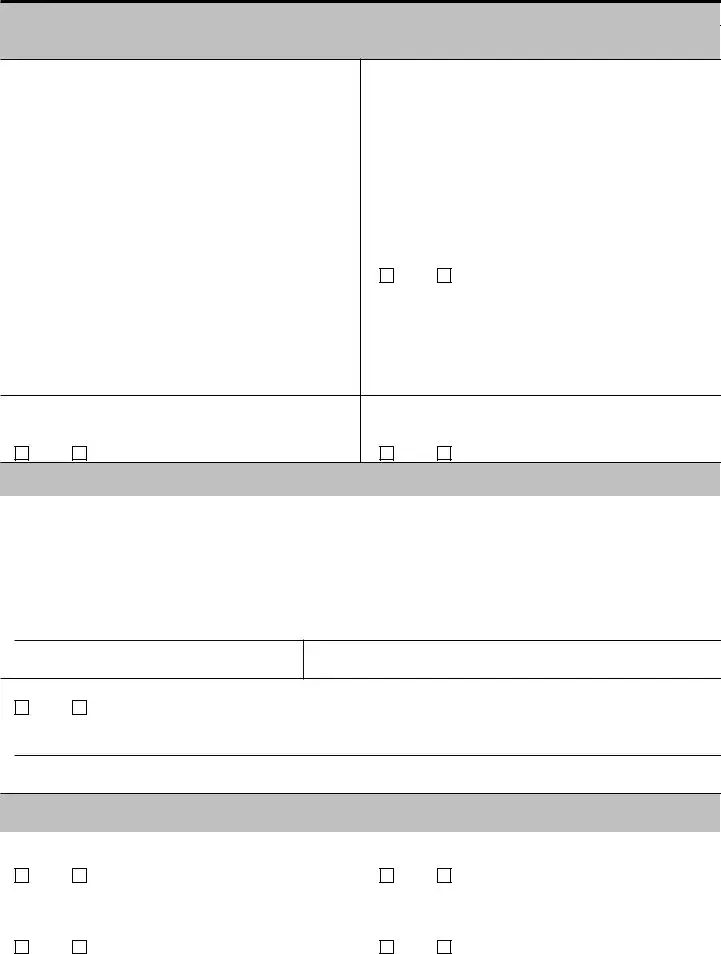

Section VI - Payroll Service Provider (PSP) or Professional Employer Organization (PEO)

A -

(complete this section only if you are interviewing a taxpayer who used a

1. |

Who signed the service contract or entered into the agreement |

2. Who in the business handled the contacts with the |

||

|

for services with the |

|

payer? |

|

|

|

|

|

|

3. |

Who was your contact at the |

4. How were funds to be made available for the |

||

|

|

pay the taxes? |

||

|

|

|

|

|

|

|

|

Name of Bank(s) and Account number(s) from which funds |

|

|

|

|

were to be transferred. |

|

|

|

|

||

5. |

What actions did you take to verify the |

6. Were funds available for the |

||

|

filing returns, or making required payments? |

|

payment of the taxes? |

|

|

|

|

Yes |

No |

|

|

|

If yes, explain in detail how and when the money was |

|

|

|

|

transferred to the |

|

7. Were you aware that the |

8. Did you receive IRS notices indicating that the employment tax |

||

required payments? |

returns were not filed, or that the employment taxes were not |

||

|

|

paid? |

|

Yes |

No |

Yes |

No |

B -

(complete this section only if you are interviewing a

1. |

Who in your organization handled the contacts with the client? |

2. |

Who was your contact at the client business? |

|

|

|

|

3. |

Who at the client business signed the service contract or |

4. |

Who had control over the payments of the client's employment |

|

entered into the agreement for services? |

|

taxes? |

|

|

|

|

5. How were funds to be made available from the client business to pay the taxes?

Bank Name(s)

Account Number(s)

6. Were there funds actually available for you to make the tax payments?

Yes

No

If yes, explain in detail how and when the money was transferred to the

If no, what actions did you take to attempt to collect the funds from the client?

Section VII - Personal Liability for Excise Tax Cases (Complete only if Business is required to file Excise Tax Returns)

1. |

Are you aware of any required excise tax returns which have not |

2. With respect to excise taxes, were the patrons or customers |

||

|

been filed? |

|

informed that the tax was included in the sales price? |

|

|

No |

Yes (list periods) |

No |

Yes |

|

|

|

||

3. |

If the liability is one of the ''collected'' taxes (transportation of |

4. Were you aware, during the period tax accrued, that the law |

||

|

persons or property and communications), was the tax |

required collection of the tax? |

||

|

collected? |

|

|

|

|

No |

Yes |

No |

Yes |

|

|

|

|

|

Catalog Number 22710P |

www.irs.gov |

Form 4180 (Rev. |

Page 4

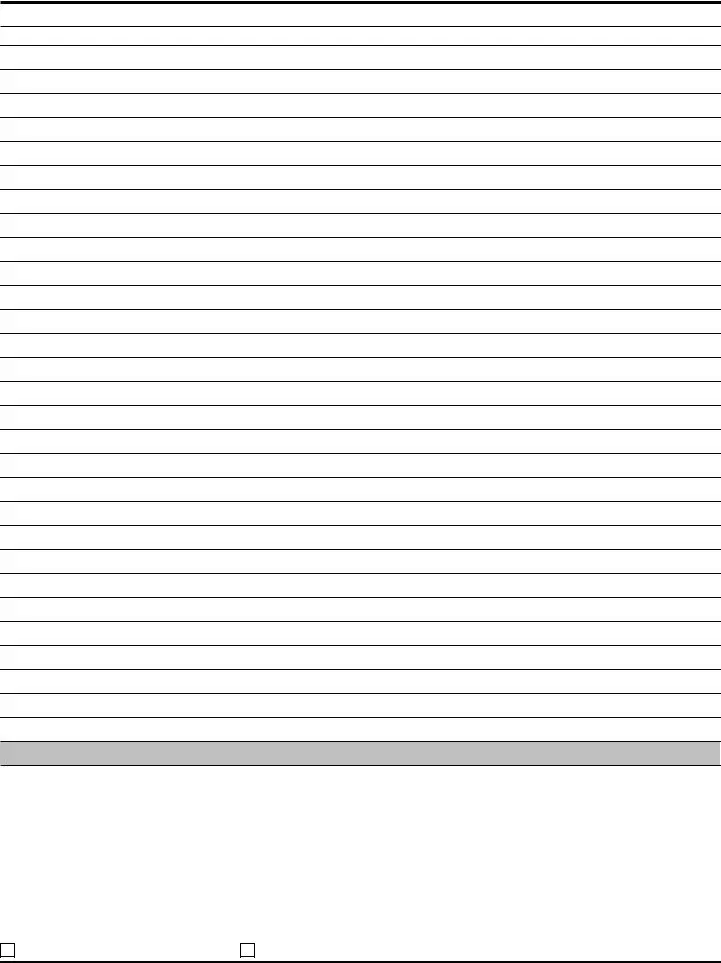

Additional Information

Section VIII - Signatures

I declare that I have examined the information given in this interview and to the best of my knowledge and belief, it is true, correct, and complete.

Signature of person interviewed |

|

Date |

|

|

|

Signature of Interviewer |

|

Date |

|

|

|

Date copy of completed interview form given to person interviewed |

► |

|

|

|

|

Interview Handouts (''X'' if given or explain why not in case history.)

Notice 609, Privacy Act Notice

Notice 784, Could You be Personally Liable for Certain Unpaid Federal Taxes?

Catalog Number 22710P |

www.irs.gov |

Form 4180 (Rev. |

Form Characteristics

| Fact Name | Description |

|---|---|

| Title and Purpose | The 4180 PDF form is titled "Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes" and is used to document interviews related to potential penalties for unpaid employment taxes. |

| Governing Authority | This form is governed by the Internal Revenue Code, specifically concerning the collection of trust fund recovery penalties under Section 6672. |

| Interview Method | Interviews can be conducted either in person or via telephone, as specified in the form’s instructions. Interviewers must ensure all fields are filled, marking 'N/A' where necessary. |

| Signature Requirement | A declaration is required at the end of the form, where the interviewed individual and the interviewer must sign, confirming the accuracy and completeness of the information provided. |

| Business Information | The form collects detailed business information, including names, positions, and responsibilities of individuals involved in managing business finances during the time of tax delinquency. |

| Payroll Service Provider Section | If applicable, the form includes a section specifically for interviews with payroll service providers, gathering information on their roles and interactions with the client’s tax obligations. |

| Excise Tax Filing | In cases involving excise taxes, the interviewee must disclose whether required excise tax returns have been filed and provide information on the collection of these taxes. |

Guidelines on Utilizing 4180 Pdf

When preparing to fill out Form 4180, it's essential to gather the necessary information beforehand. This form is often used to document interviews related to tax responsibilities and obligations. Having all required details handy will streamline the process and ensure accuracy.

- Begin with **Section I - Person Interviewed**. Fill in the following:

- Name

- Social Security Number (SSN)

- Address (street, city, state, ZIP code)

- Home telephone number

- Work telephone number

- Name of Business and Employer Identification Number (EIN)

- Indicate if you used a third-party payer and proceed accordingly.

- Describe job title, duties, and employment dates.

- Next, move to **Section II - Responsibilities**. For each duty listed:

- Indicate whether you performed these functions and the relevant dates.

- Examples include determining financial policy, authorizing payments, and having knowledge of unpaid taxes.

- In **Section III - Signatures**, both the person interviewed and the interviewer must sign and date the form, certifying the provided information is accurate. Ensure that a copy of the completed form is given to the person interviewed.

- Proceed to **Section IV - Business Information**. Here, record information about corporate positions, use of electronic tax payment systems, and who is authorized for signing tax-related documents.

- In **Section V - Knowledge / Willfulness**, respond to questions regarding the payment of financial obligations and payrolls during the tax delinquency periods. Provide details on the actions taken to address unpaid taxes.

- If applicable, complete **Section VI - Payroll Service Provider (PSP) or Professional Employer Organization (PEO)**. Document who handled third-party communications and how funds were managed.

- For **Section VII - Personal Liability for Excise Tax Cases**, indicate knowledge of any unfiled excise tax returns and any necessary customer notifications regarding included taxes.

- Finally, confirm all information is accurate, then complete **Section VIII - Signatures** with signatures and dates for both the interviewed person and the interviewer.

What You Should Know About This Form

What is Form 4180 used for?

Form 4180, officially titled the "Report of Interview with Individual Relative to Trust Fund Recovery Penalty or Personal Liability for Excise Taxes," is used by the Internal Revenue Service (IRS) to document interviews related to unpaid federal taxes. When there is a failure to pay certain taxes—such as payroll taxes or excise taxes—this form helps establish whether individuals were responsible for the payment of those taxes. It collects information on the individual's roles, responsibilities, and any financial information relevant to the case.

Who is required to fill out Form 4180?

This form must be filled out by an interviewer conducting an interview with an individual who may be liable for unpaid trust fund taxes or excise taxes. The individual being interviewed is typically someone who had a managerial role within a business that failed to pay taxes. Their duties and decisions about financial matters can indicate their responsibility and potential liability for the owed amount.

How should the form be completed?

Completing Form 4180 requires attention to detail. The interviewer needs to gather specific information, including the person's name, contact details, job title, and the company's financial practices. Every section of the form must be filled out; if a question does not apply, the interviewer should indicate "N/A" instead of leaving it blank. This completeness ensures that the IRS receives accurate information for their review.

What happens if an individual does not complete Form 4180?

If an individual fails to complete or provide accurate information on Form 4180, it may lead to implications regarding their liability for unpaid taxes. The IRS may interpret the incomplete information as a lack of cooperation, which could result in further investigation or even penalties. It is crucial to provide thorough and truthful responses to avoid complications.

Are there penalties associated with filing misleading information on Form 4180?

Yes, providing false information or omitting required details can lead to serious consequences. This includes potential civil penalties and, in some cases, criminal charges for fraud. The IRS heavily scrutinizes the information on this form, and inaccuracies can affect not only the individual’s tax situation but also potentially lead to legal action against them.

How does Form 4180 relate to the Trust Fund Recovery Penalty?

The Trust Fund Recovery Penalty (TFRP) is a penalty imposed on individuals responsible for collecting, accounting for, or paying over certain taxes, such as payroll taxes, who willfully fail to do so. Form 4180 is a critical tool in determining whether an individual can be held liable for the TFRP. The information collected during the interview aids the IRS in making this determination.

What resources are available for individuals completing Form 4180?

Individuals filling out Form 4180 can refer to the IRS website, which provides guidance and relevant publications about the form. Additionally, consulting with a tax professional can be beneficial. These experts can offer advice tailored to specific situations and help ensure that all information is complete and accurate.

Common mistakes

Filling out Form 4180 can be challenging. One common mistake is leaving sections blank. It is crucial to ensure that every question is addressed, even if some information does not apply. In such cases, the form should indicate “N/A” instead of leaving it empty. This omission can lead to delays or complications during processing.

Another error people often make is providing incorrect or outdated contact information. When listing their name, social security number, and addresses, it is essential to double-check all entries for accuracy. Bugs in personal information can create confusion and may affect the timely processing of the interview.

Many individuals fail to fully understand the responsibilities they held within the business. Section II prompts interviewees to specify their duties. Not providing clear descriptions can result in a misunderstanding of one's role and presence when taxes were due. These details are significant in establishing accountability.

In Section IV, errors frequently occur with the business information provided. Interviewees sometimes neglect to mention the electronic payment methods their business utilized. This is important for verifying compliance with tax obligations. Failure to report discrepancies here may lead investigators to assume false assumptions about the business's financial practices.

People often overlook the importance of signatures and dates at the end of the form. The interviewee and interviewer must sign and date the document to affirm the information's accuracy. Without these signatures, the form may be considered incomplete, even if all other sections are populated correctly.

Lastly, many individuals do not adequately explain third-party payment arrangements or fail to provide complete information regarding contacts with payroll service providers in Section VI. It is vital to ensure that all relevant details regarding third-party interactions and funds available for tax payments are thoroughly addressed. Without this context, it may be challenging to understand the flow of funds and responsibilities, increasing the likelihood of fines or penalties.

Documents used along the form

The IRS Form 4180 is used to document interviews regarding potential personal liability for trust fund recovery penalties. This form often accompanies several other forms and documents that help to clarify the responsibilities and financial practices of an individual or business in relation to unpaid taxes. Below is a list of documents commonly used in conjunction with the Form 4180.

- Form 941: This form is the Employer's Quarterly Federal Tax Return. It reports income taxes, Social Security tax, or Medicare tax withheld from employee's paychecks and also calculates the employer's portion of Social Security and Medicare tax.

- Form 945: This is the Annual Return of Withheld Federal Income Tax. It reports income tax withheld for non-payroll payments. This form is relevant when the business has made payments that require withholding, such as payments to independent contractors.

- Form 940: The Employer's Annual Federal Unemployment (FUTA) Tax Return is submitted to report the employer's federal unemployment tax. This form helps determine whether the employer owes any unemployment taxes at the federal level.

- Form W-2: This form is used to report wages paid to employees and the taxes withheld from them. Employers must provide a W-2 to each employee by the end of January following the tax year.

- Form W-3: This is the Transmittal of Wage and Tax Statements and is used to summarize the information provided on all W-2 forms submitted by an employer. It is filed with the Social Security Administration.

- Form 8821: The Tax Information Authorization Form allows an individual to authorize a third party to receive or inspect tax information from the IRS on their behalf.

- Form 2848: This is the Power of Attorney and Declaration of Representative form, permitting an individual to act on behalf of the taxpayer in all dealings with the IRS.

- IRS Notice 609: This is a Privacy Act Notice that outlines how the IRS will use the taxpayer's information. It is generally provided alongside Form 4180.

- IRS Notice 784: This notice informs individuals about personal liability for certain unpaid federal taxes, emphasizing the importance of understanding one’s responsibilities regarding tax payments.

- Employment Records: These records include documentation relating to employee wages, tax withholding, and hours worked. They support claims made in tax forms and can be crucial during IRS inquiries.

These documents work together to provide a clear picture of an individual’s or business’s tax obligations and financial practices. Each form carries significant weight in determining liability and compliance with federal tax law. Accurate and comprehensive record-keeping is essential in these matters to avoid penalties and ensure proper adherence to tax responsibilities.

Similar forms

Form 4180 is essential for understanding relationships and responsibilities concerning Trust Fund Recovery Penalty issues. Several other forms serve similar purposes in providing information about responsibilities and actions regarding tax matters. Here are four such forms:

- Form 941: This form is used by employers to report payroll taxes. Like Form 4180, it collects essential details about employment tax liabilities, including wages paid and taxes withheld. Both forms assist the IRS in determining compliance with tax obligations.

- Form 843: This form is known as the "Claim for Refund and Request for Abatement." It lets taxpayers request relief from tax penalties or seek refunds for overpaid taxes. Similar to Form 4180, Form 843 requires detailed information about responsibilities related to tax payments.

- Form 1120: This form is for corporations to file corporate income taxes. It requires detailed financial reporting, similar to the detailed responsibilities listed in Form 4180. Both forms help the IRS assess taxpayer liabilities accurately.

- Form 1040: This is the individual income tax return. While targeted toward individual taxpayers, it also gathers information on income sources and tax liabilities. Like Form 4180, it provides insight into the taxpayer's financial responsibilities and compliance.

Dos and Don'ts

- Do: Fill out all sections completely. Do not leave any information blank. Use "N/A" for items that do not apply.

- Do: Provide accurate and honest information throughout the form.

- Do: Sign and date the form after reviewing all the information for correctness.

- Do: Use clear and legible handwriting, or consider typing the form if possible.

- Don't: Forget to include contact numbers for any relevant individuals mentioned in the form.

- Don't: Use vague descriptions. Be specific when describing duties and responsibilities.

Misconceptions

-

Misconception: Form 4180 is only for businesses with large payrolls.

This form is applicable to all businesses that have employees and may be subject to the Trust Fund Recovery Penalty or personal liability for excise taxes, regardless of their size.

-

Misconception: The interview conducted for Form 4180 can be informal.

The interviewer must prepare the form in a structured manner, either in person or via telephone, ensuring all information is accurately captured.

-

Misconception: It is acceptable to leave sections of the form blank.

No section should be left blank; if an item is not applicable, respondents should enter "N/A" to indicate that the question does not apply to their situation.

-

Misconception: Only the owner of the business can complete Form 4180.

Individuals who have had significant roles in the business or who hold relevant responsibilities can also be interviewed and asked to complete the form.

-

Misconception: This form is not important and can be completed haphazardly.

Completing Form 4180 accurately is vital, as the information collected is used by the IRS to determine personal liability for unpaid employment taxes.

Key takeaways

When filling out and using the 4180 PDF form, here are some critical points to keep in mind:

- Completeness is essential. Every section must be filled out. If a question does not apply, write "N/A" instead of leaving it blank.

- Accurate information is crucial. Ensure all details, especially regarding responsibilities and financial obligations, are truthful and precise. This affects liability assessments.

- Document verification actions. Clearly state any steps taken to verify tax payments or communications with the IRS. This information plays a role in determining potential liability.

- Signature confirmation is necessary. Both the interviewer and the interviewed must sign to validate the interview, confirming that the stated information is complete and accurate.

Browse Other Templates

Baseball Game Tracker,Diamond Stats Sheet,Game Performance Record,Inning Summary Chart,Scorekeeper's Log,Baseball Play-by-Play Sheet,Matchup Scoreboard,Game Day Record,Athletic Score Synopsis,Player Performance Index - Guide discussions about player rotations and line-up changes.

What Is a Form 3 - Form used to record cash and check contributions.

Ssa Representative Payee - Once submitted, you will receive a Representative Identification (Rep ID) within 2 to 3 weeks.