Fill Out Your 472 Form

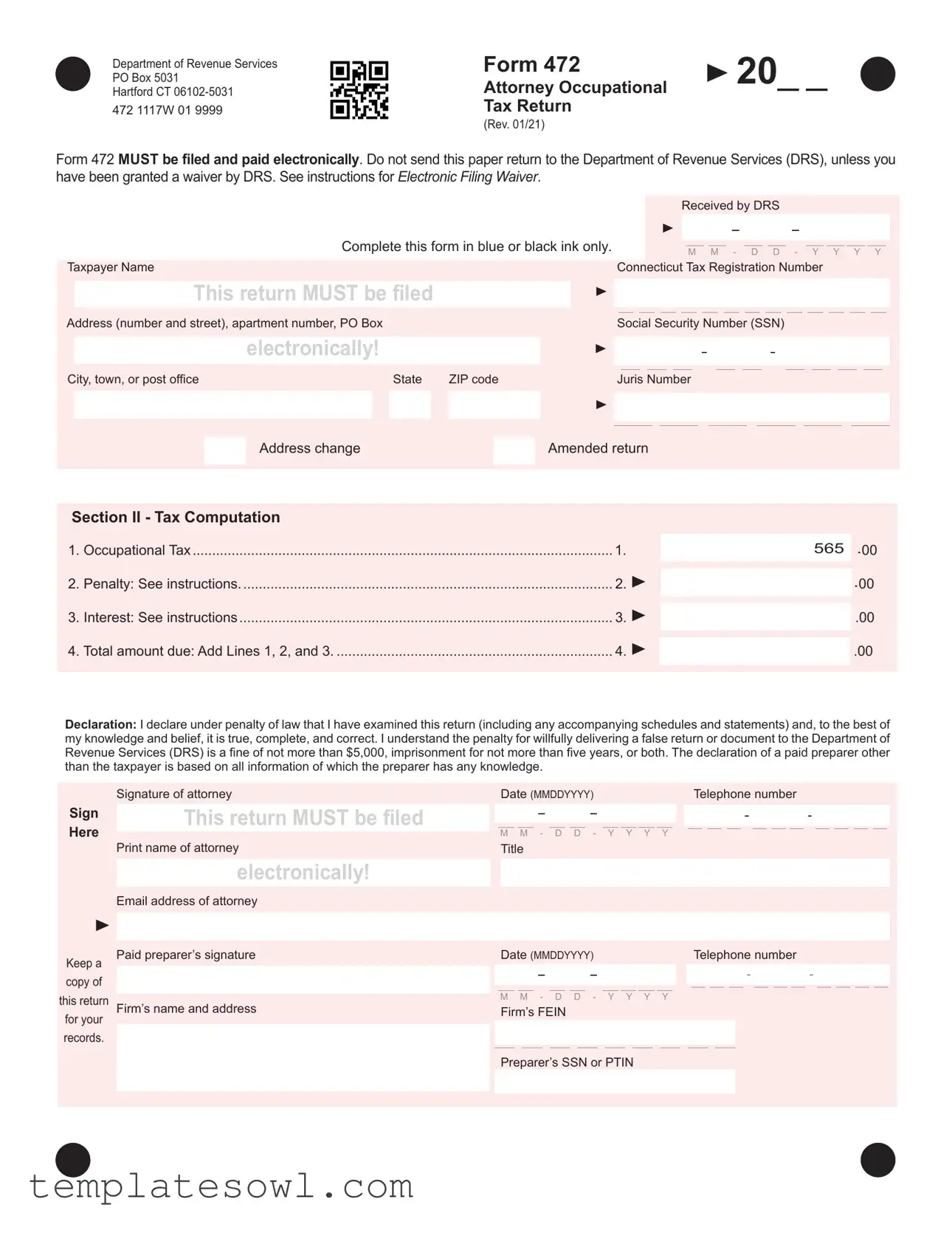

The 472 form, known as the Attorney Occupational Tax Return, is an essential document for attorneys practicing in Connecticut. It is required to be filed electronically with the Department of Revenue Services (DRS) by January 15 following the close of the calendar year, regardless of whether the attorney is claiming an exemption. This form collects information such as the taxpayer's name, Connecticut Tax Registration Number, and Juris Number. It also includes sections for tax computation, allowing for penalties and interest if payments are late. Notably, those who qualify for an exemption—such as judges or attorneys who engaged in legal practice without compensation—must indicate their status on the form. It is important to remember that the 472 form should not be mailed unless a specific waiver from the DRS has been granted. Furthermore, attorneys must sign and complete the form accurately, as any discrepancies can lead to penalties for false declarations. Overall, understanding the purpose and requirements of Form 472 is vital for compliance with Connecticut's taxation regulations for legal professionals.

472 Example

PO Box 5031 |

Form 472 |

u |

20_ _ |

Department of Revenue Services |

|

|

|

Hartford CT |

Attorney Occupational |

|

|

472 1117W 01 9999 |

Tax Return |

|

|

(Rev. 01/21)

Form 472 MUST be filed and paid electronically. Do not send this paper return to the Department of Revenue Services (DRS), unless you have been granted a waiver by DRS. See instructions for Electronic Filing Waiver.

Received by DRS

u

Complete this form in blue or black ink only.

M M - D D - Y Y Y Y

Taxpayer Name |

Connecticut Tax Registration Number |

This return MUST be filed

u

Address (number and street), apartment number, PO Box |

|

|

|

|

|

|

|

Social Security Number (SSN) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

electronically! |

|

|

|

|

|

u |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

City, town, or post office |

State |

|

ZIP code |

|

|

Juris Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

u |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address change |

|

|

|

|

|

Amended return |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Section II - Tax Computation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

1. |

Occupational Tax |

|

|

|

|

1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

565 |

.00 |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2. |

Penalty: See instructions |

|

|

|

|

|

|

2. u |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

3. |

Interest: See instructions |

|

|

|

|

|

|

3. u |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

4. Total amount due: Add Lines 1, 2, and 3 |

|

|

|

|

|

|

4. u |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration: I declare under penalty of law that I have examined this return (including any accompanying schedules and statements) and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return or document to the Department of Revenue Services (DRS) is a fine of not more than $5,000, imprisonment for not more than five years, or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

|

Signature of attorney |

|

|

|

Date (MMDDYYYY) |

|

|

|

|

|

Telephone number |

||||||||||||||||||||||||||||||||||||

Sign |

This return MUST be filed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Here |

|

|

|

|

|

|

|

- |

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

M |

M |

D |

D |

Y |

Y |

Y |

Y |

||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

Print name of attorney |

|||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Email address of attorney |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

u |

This return MUST be filed electronically! |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

Keep a copy of this return for your records.

Paid preparer’s signature |

|

|

Date (MMDDYYYY) |

|

|

|

|

|

|

|

|

Telephone number |

||||||||||||||||||||||||||||||||||||||||||

DO NOT MAIL paper return to DRS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

- |

|

|

|

|

|

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Firm’s name and address |

|

M |

M |

D |

|

D |

|

Y |

|

Y |

Y |

|

Y |

|||||||||||||||||||||||||||||||||||||||||

|

|

Firm’s FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preparer’s SSN or PTIN

Form 472, Page 2 of 2 |

CT Tax Registration Number |

(Rev. 01/21)

472 1117W 01 9999

Section I - Exemptions

If you claim exemption from the occupational tax for the calendar year for which you are filing, check one of the following boxes. If more than one statement is true, check the primary reason you are exempt from the tax. If you are not exempt from the tax, skip to Section II, Line 1.

Check one:

u |

|

The attorney named above died during the calendar year. Enter date of death: u |

M M - D D - Y Y Y Y

u  My name was removed from the roll of attorneys maintained by the Clerk of the Superior Court for the Judicial District of Hartford.

My name was removed from the roll of attorneys maintained by the Clerk of the Superior Court for the Judicial District of Hartford.

u |

|

I engaged in the practice of law, but not as an occupation, and I received less than $1000 in compensation from engaging |

|

|

in the practice of law. |

|

|

|

u |

|

I was a judge, senior judge, or referee. (Probate judges who otherwise engage in the practice of law cannot claim this |

|

||

|

|

exemption.) |

|

|

|

u |

|

I was a Connecticut state employee employed as an attorney and I did not otherwise engage in the practice of law. |

|

||

u |

|

I was a federal government employee employed as an attorney and I did not otherwise engage in the practice of law. |

|

||

|

||

u |

|

I was a Connecticut political subdivision employee employed as an attorney and did not otherwise engage in the practice |

|

||

|

||

|

|

of law. |

|

|

|

u |

|

I was a Connecticut probate court employee employed as an attorney and did not otherwise engage in the practice of law. |

|

||

u |

|

I engaged in the practice of law exclusively outside of Connecticut. |

|

||

|

||

u |

|

I did not work or was not employed as an attorney. |

|

||

|

||

u |

|

I was on active duty with the United States Armed Forces for more than six months. |

|

||

|

||

u |

|

I retired from the practice of law and filed written notice of retirement with the Clerk of the Superior Court for the Judicial District |

|

||

|

||

|

|

of Hartford. |

|

|

Form 472 - Instructions

General Instructions

File Electronically

This return must be filed electronically through the Department of Revenue Services (DRS) Taxpayer Service Center (TSC). The TSC allows taxpayers to electronically file, pay, and manage state tax responsibilities. To make electronic transactions or administer your tax account online, visit portal.ct.gov/TSC.

Payment Options

Pay Electronically

Use the TSC to make a direct tax payment. After logging into the TSC, select the Make Payment Only option and choose a tax type from the drop down box. Using this option authorizes DRS to electronically withdraw a payment from your bank account (checking or savings) on a date you select up to the due date. As a reminder, even if you pay electronically you must still file your return by the due date. Tax not paid on or before the due date will be subject to penalty and interest.

Pay by Credit Card or Debit Card

You may elect to pay your Attorney Occupational Tax liability using your American Express® card, Discover® card, MasterCard® card, VISA® card, or comparable debit card. A convenience fee based on the total tax payment will be charged to your account by the credit card service provider. You will be informed of the amount of the fee and you may elect to cancel the transaction.

At the end of the transaction you will be given a confirmation number for your records. There are two ways to pay by credit card:

•Login to your account in the TSC and select Make Payment by Credit Card; or

•Visit www.officialpayments.com and select State Payments.

Your payment will be effective on the date you make the charge.

Who Must File This Return

Any attorney listed on the roll of attorneys maintained by the Superior Court at any time during the calendar year for which this return is filed, must file a return for the calendar year even if the attorney is claiming an exemption from tax.

Who is Liable for the Tax

Any person who:

•Is admitted as an attorney by the judges of the Superior Court, Appellate Court, or Supreme Court;

•Engaged in the practice of law in Connecticut during the calendar year for which this return is filed; and

•Is not exempt from this tax.

Who is Exempt From the Tax

See Section I of this return for a complete list of exemptions.

Where Can I Find my Juris Number

If you are unsure of your Juris Number, refer to a copy of your Attorney Registration form completed in compliance with Practice Book §

Employers Paying on Behalf of Employees

Employers paying the tax on behalf of employees may use the Bulk filing option to file their Attorney Occupational Tax returns. The bulk filing option allows for multiple returns to either be “keyed in” or uploaded using the Dynamic Web Import; a file upload process that allows you to define your file type and layout.

For more information on this process please visit:

portal.ct.gov/TSC and click on Tax Preparer (Bulk Filers).

When do I File

File Form 472 on or before January 15, following the close of the calendar year. If the due date falls on a Saturday, Sunday, or legal holiday, the return will be considered timely if filed by the next business day.

Penalty and Interest for Late Filing or Payment

If you are subject to the tax and pay late, the late payment penalty is $50.

To be considered timely, an electronic funds transfer (EFT) payment must be initiated on or before the due date of such payment.

If you fail to remit payment electronically, DRS will impose a

Interest is computed at 1% per month or fraction of a month on the underpayment of tax from the original due date of the return through the date of payment.

If you are exempt from the tax but file Form 472 late, a late filing penalty of $50 may be imposed.

If you receive a waiver from electronic filing, your paper return will meet the timely filed and timely payment rules if the U.S. Postal Service cancellation date, or the date recorded or marked by a designated private delivery service (PDS) using a designated type of service, is on or before the due date. Not all services provided by these designated PDSs qualify. See Policy Statement 2016(4), Designated Private Delivery Services and Designated Types of Service.

Form 472 Instructions (Rev 01/21) |

Page 1 of 2 |

Rounding Off to Whole Dollars

You must round off cents to the nearest whole dollar on your return and schedules. If you do not round, DRS will disregard the cents.

Round down to the next lowest dollar all amounts that include 1 through 49 cents. Round up to the next highest dollar all amounts that include 50 through 99 cents. However, if you need to add two or more amounts to compute the amount to enter on a line, include cents and round off only the total.

Example: Add two amounts ($1.29 + $3.21) to compute the total ($4.50), then round the total to $5.00 and enter it on a line.

What if My Address Changes

If your address changes, you should notify both DRS and the Statewide Grievance Committee.

To change your address with DRS:

•Fax a written notice of the change. Include your Juris Number and Connecticut Tax Registration Number as it appears on the front of this return and fax to

Attn.: Operations Bureau/Registration; or

•Submit a written notice of the change, include your Juris Number or Connecticut Tax Registration Number as it appears on the front of this return and mail to:

Department of Revenue Services

Operations Bureau/Registration PO Box 2937

Hartford CT

To change your address with the Statewide Grievance Committee:

•Visit the Connecticut Judicial Branch website at www.jud.ct.gov to download form

Registration, Change of Information;

•Return form

Committee at the address shown on the form; and

•Indicate your change of address on Form

Attorney Registration, which is sent to you annually by the Statewide Grievance Committee.

Waiver of Penalty

To request a penalty waiver, taxpayers must complete and submit Form

Department of Revenue Services

Operations Bureau/Penalty Waiver PO Box 5089

Hartford CT

DRS will not consider a penalty waiver request unless it is accompanied by a fully completed and properly executed Form

Who Must Sign the Return

The attorney must sign and date Form 472. If the attorney becomes legally incompetent or dies before filing the attorney occupational tax return, the attorney’s guardian, conservator, executor, or administrator, as the case may be, may sign the return on the attorney’s behalf.

Paid Preparer Information

A paid preparer must sign and date Form 472. Paid preparers must also enter their SSN or Preparer Tax Identification number (PTIN) and their firm’s name, address, and Federal Employer Identification Number (FEIN) in the spaces provided.

File a Paper Return

Only taxpayers that must file an amended return or receive a waiver from electronic filing from the DRS may file Form 472 on paper.

If the return is mailed, the return must be postmarked on or before the due date.

Mail paper returns to:

Department of Revenue Services State of Connecticut

PO Box 5031

Hartford CT

Electronic Filing Waiver

To request a waiver from the electronic filing requirement visit portal.ct.gov/DRS and complete Form

Filing an Amended Return

If you make an error(s) on your return, you must correct the error(s) by filing an amended return using a new Form 472.

Enter your Social Security Number (SSN) and Juris Number in the spaces provided. Check the box to indicate this is an amended return and complete the form using the correct figures and information for the reporting period.

You must file an amended return within three years of the original due date of the return to claim a refund of taxes already paid. An explanation of the claim for refund must accompany the amended return.

Make your check payable to: Commissioner of Revenue Services. To ensure payment is applied to your account, write the calendar year of the return, “Form 472” and your Connecticut Tax Registration Number or Juris Number on the front of your check. Sign your check and paper clip it to the front of your return. Do not send cash. DRS may submit your check to your bank electronically.

Additional Information

See Informational Publication 2020(15), Attorney Occupational Tax and Client Security Fund Fee.

Form 472 Instructions (Rev 01/21) |

Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Filing Requirement | Form 472 must be filed electronically through the DRS Taxpayer Service Center. |

| Governing Law | This form is governed by the Connecticut General Statutes, specifically in relation to attorney occupational tax obligations. |

| Exemption Criteria | Several exemptions exist. For example, attorneys who earn less than $1,000 or those serving in specific governmental roles may not owe the tax. |

| Deadline | Form 472 must be filed by January 15, following the close of the calendar year. |

| Penalty for Late Filing | If filed late, a $50 penalty applies. Interest accrues at 1% per month on unpaid taxes. |

| Address Change Notification | Taxpayers must inform both DRS and the Statewide Grievance Committee of any address changes to ensure proper record keeping. |

Guidelines on Utilizing 472

Filling out Form 472 is an important process for attorneys in Connecticut. Once you have completed this form, you'll need to file it electronically with the Department of Revenue Services (DRS). Make sure all information is accurate to avoid penalties and ensure timely processing.

- Gather your information: Collect your Connecticut Tax Registration Number, Juris Number, and Social Security Number (SSN).

- Complete Section I: If applicable, indicate your exemption from the occupational tax by checking the appropriate box.

- Move to Section II: Fill in the Occupational Tax amount. If you owe a penalty or interest, include those amounts as well.

- Add up the amounts: Calculate the total amount due by adding lines 1, 2, and 3.

- Sign your declaration: Confirm the accuracy of your return by signing and dating the form.

- Fill in preparer details: If someone else prepared your form, enter their information in the designated area.

- File electronically: Access the DRS Taxpayer Service Center online to submit your completed form.

- Keep a copy: Print or save a copy of the completed form for your records.

By following these steps carefully, you can ensure your Form 472 is completed accurately and filed on time. It’s essential to adhere to the electronic filing requirements to avoid any penalties.

What You Should Know About This Form

What is Form 472 and who needs to file it?

Form 472 is the Attorney Occupational Tax Return required for attorneys practicing in Connecticut. Any attorney who is listed on the roll of attorneys maintained by the Superior Court at any time during the calendar year must file this return. Even if an attorney claims an exemption, they still need to file the form. The filing deadline is on or before January 15 following the close of the calendar year.

How should I file Form 472?

Form 472 must be filed electronically through the Department of Revenue Services (DRS) Taxpayer Service Center (TSC). You cannot send a paper return unless you’ve received a waiver from DRS. To file electronically, visit portal.ct.gov/TSC, where you can file, pay, and manage your state tax responsibilities.

What should I do if my address changes?

It's important to update your address with the DRS and the Statewide Grievance Committee promptly. To notify DRS, fax or mail a written notice including your Juris Number and Connecticut Tax Registration Number. For the Grievance Committee, download form JD-GC-10 from the Connecticut Judicial Branch website and return it with your updated information.

What happens if I file Form 472 late?

If you fail to file or pay on time, a $50 late payment penalty applies. Additionally, interest will accrue at 1% per month from the original due date. If you are exempt from the tax but file late, you will also face a late filing penalty of $50. To avoid these issues, ensure that your payment is initiated electronically by the due date.

Common mistakes

When filling out Form 472, attorneys often make several critical mistakes that can lead to penalties or delays. One common error is failing to file the return electronically, despite clear instructions mandating electronic filing. Paper returns are not accepted unless a specific waiver is granted by the Department of Revenue Services (DRS). Ignoring this requirement can lead to automatic penalties.

Another frequent mistake involves not rounding off amounts to whole dollars. The instructions clearly state that cents should be disregarded unless they are part of a total calculation. If amounts are not rounded properly, DRS will not process those entries, potentially leading to inaccuracies in tax liability and complications in payment.

Inaccurate personal information is also a common pitfall. Many individuals overlook the necessity to verify their personal details, such as the Connecticut Tax Registration Number and Social Security Number. Any inconsistency can result in confusion and processing errors, leading to further complications down the line.

Failure to sign the return is another oversight that can invalidate the submission. Both the attorney and any paid preparer must sign the form. Without this signature, the return is considered incomplete. Additionally, not including the correct preparer’s information, such as the PTIN or firm’s FEIN, can lead to unnecessary delays in processing.

Lastly, some attorneys mistakenly believe they can submit their return after the due date without repercussions. Late filings incur penalties, as outlined in the instructions. It is crucial for attorneys to be aware of the January 15 deadline to avoid financial consequences due to late payments.

Documents used along the form

When filing your Attorney Occupational Tax Return using Form 472, several related documents might be required to ensure compliance and accuracy. Understanding these forms can streamline the process and help avoid potential issues. Here’s a concise overview of these essential documents.

- Form DRS-PW: Request for Waiver of Civil Penalty - This form is used to request a waiver if you believe you have a valid reason for late filing or payment of your tax obligations. Providing thorough justification with this form can alleviate penalties that may have accrued.

- Form DRS-EWVR: Electronic Filing and Payment Waiver Request - If you are unable to file electronically due to specific circumstances, complete this form to formally request an exemption from the electronic filing requirement. It's crucial to submit this request before the due date.

- Form JD-GC-10: Attorney Registration, Change of Information - Use this form if you need to update your personal information, such as a change of address, with the Statewide Grievance Committee. Keeping your records current is essential for compliance.

- Form 472Amended Return - Mistakes happen. If you discover an error in your original tax return, file an amended Form 472 as soon as possible. Include all necessary corrections and any explanations to ensure the process is seamless.

- Payment Options Documentation - Your chosen payment method (credit card, debit card, or electronic funds transfer) may require additional documentation. Keep records of these transactions to prevent issues during audits or inquiries.

- Informational Publication 2020(15) - This publication provides detailed guidance on the Attorney Occupational Tax and related fees. It’s a useful reference for understanding your obligations and rights.

Being informed about the related documents and forms when filing Form 472 can aid in a smooth and efficient filing experience. It's crucial to act promptly to meet all requirements and avoid unnecessary complications. Stay organized, and don’t hesitate to seek assistance if needed!

Similar forms

The Form 472 is an important document for attorneys in Connecticut. Several other tax forms have similarities to this form, especially in terms of purpose, filing requirements, and structure. Here are nine such documents:

- Form W-2: Similar to Form 472, Form W-2 reports wages paid to employees and the taxes withheld. Both forms require electronic filing with the IRS and represent tax obligations for specific roles.

- Form 1040: This is the standard individual income tax return. Like Form 472, it demands a declaration of accuracy and is a critical document for tax compliance in the U.S.

- Form 1065: Used for partnership tax reporting, Form 1065, like Form 472, includes tax computation and must be filed electronically, emphasizing the shared principle of accountability in tax matters.

- Form 1099: This form reports income received by freelancers or self-employed individuals. Both Form 472 and Form 1099 require accurate record-keeping and timely electronic submission to avoid penalties.

- Form 941: The Employer's Quarterly Federal Tax Return, Form 941, reports employee wages and taxes withheld. Similar to Form 472, this form also emphasizes the importance of accuracy and deadlines.

- Form 990: Nonprofit organizations use this form to report their financial data. Like Form 472, Form 990 requires precise calculations and must be filed electronically with the IRS.

- Form 1120: This is the corporate income tax return. Both Form 472 and Form 1120 require the disclosure of financial information, emphasizing fiscal responsibility.

- Form 4506-T: This form allows individuals to request a transcript of their tax return. Like Form 472, it plays a role in maintaining accurate tax records and compliance.

- Form 8862: This is used to claim the Earned Income Credit after it has been denied. Similar to Form 472, it includes sections for exemptions and necessitates a signature certifying its accuracy.

These forms, while serving distinct purposes, emphasize the necessity for accurate reporting, electronic submission, and accountability in tax matters.

Dos and Don'ts

- Do file Form 472 electronically through the Department of Revenue Services (DRS) Taxpayer Service Center.

- Do complete the form using blue or black ink only if filing by paper with an approved waiver.

- Do keep a copy of the completed form for your records.

- Do ensure all figures are rounded to the nearest whole dollar.

- Don't send a paper return to the DRS unless you have received an official waiver.

- Don't forget to sign and date the form before submission.

- Don't neglect to notify the DRS of any address changes promptly.

- Don't ignore the requirement to file an amended return if an error is discovered.

Misconceptions

- Misconception 1: Filing Form 472 can be done on paper without exceptions.

- Misconception 2: All attorneys are exempt from the occupational tax.

- Misconception 3: The penalties for late filing or payment are negligible.

- Misconception 4: Filing for a waiver means penalties will be waived automatically.

Many people believe they can file Form 472 in paper format as they would other tax forms. However, this is incorrect. The Connecticut Department of Revenue Services requires that Form 472 be filed electronically. Only individuals granted a special waiver can submit a paper return. This policy is designed to streamline processing and ensure timely payments.

Another common misunderstanding is that all attorneys can avoid the occupational tax. In reality, any attorney listed on the roll maintained by the Superior Court must file the form, even if they claim an exemption. It is crucial to review the specific exemption criteria and ensure compliance to avoid penalties.

Some individuals underestimate the consequences of late filing or payment. This is a mistake, as the penalties can add up quickly. For example, failing to pay on time incurs a $50 late payment penalty. Interest also accrues at a rate of 1% per month on unpaid taxes, which can lead to significant costs over time.

Lastly, many believe that requesting a waiver from electronic filing automatically negates any penalties. That is not true. While a waiver can exempt someone from electronic filing requirements, it does not eliminate penalties for late filing or non-payment. Taxpayers must still meet specific conditions for a waiver request to be valid.

Key takeaways

- Form 472 must be filed electronically. Paper returns are not acceptable unless a waiver is granted by the Department of Revenue Services (DRS).

- Only blue or black ink is permitted when filling out the form.

- The deadline for filing Form 472 is January 15 of the year following the calendar year for which you are filing.

- Attorneys need to provide accurate information, including Juris Number, tax registration number, and social security number.

- If claiming an exemption from the occupational tax, the primary reason must be indicated.

- Failure to pay the tax by the due date results in a $50 late payment penalty.

- You can pay the tax electronically or by credit/debit card, but a convenience fee may apply.

- Keep a copy of the completed Form 472 for your records after filing.

- Changes in personal information, such as an address, require notification to both DRS and the Statewide Grievance Committee.

Browse Other Templates

866-873-8279 - Requests for coverage can include a variety of chronic conditions.

Can We Open Bank Account Without Pan Card in Sbi - Limit thresholds for transaction purposes may be established.

Nvar Rental Application - Specify any additional income sources in the application.