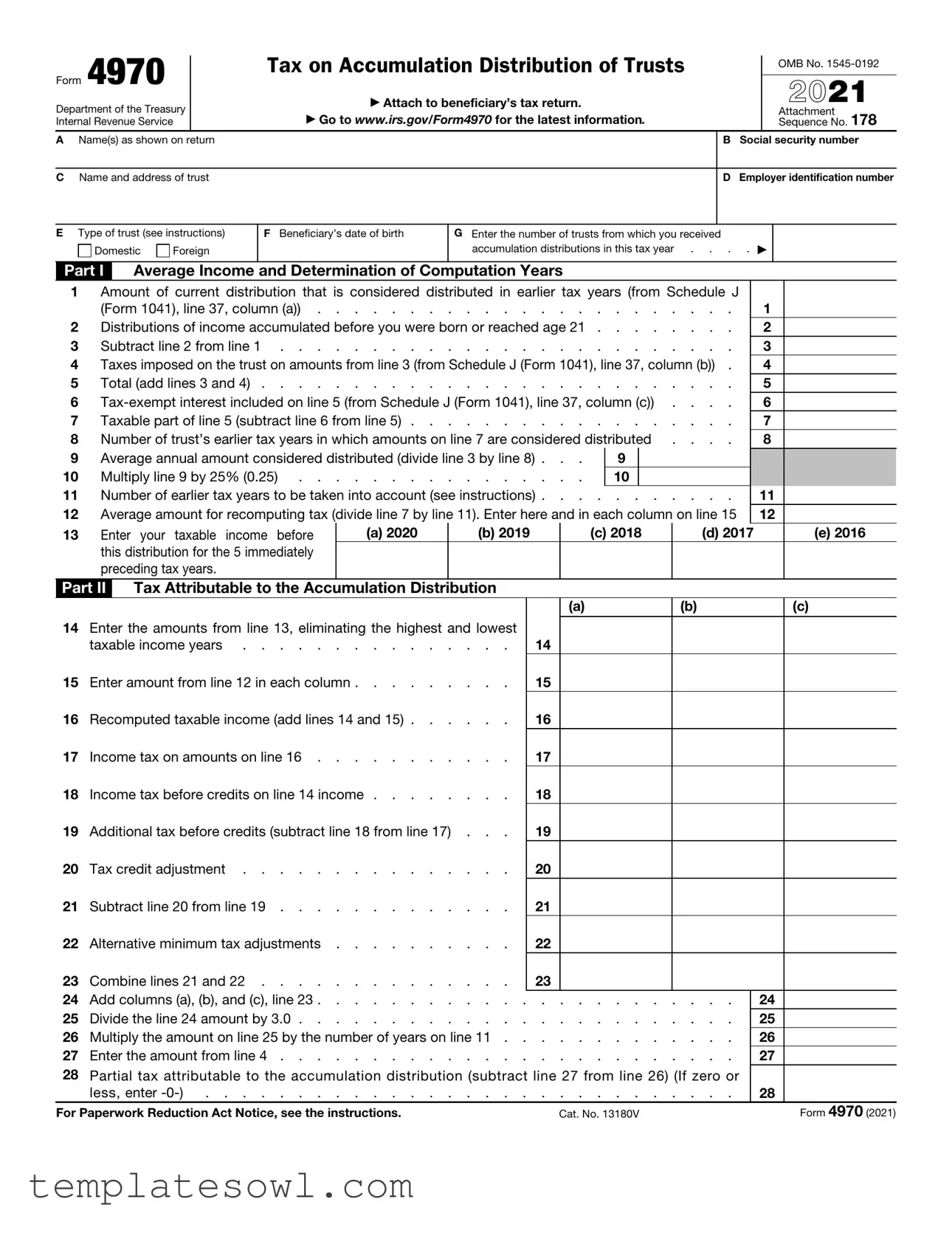

Fill Out Your 4970 Form

Form 4970, officially known as the Tax on Accumulation Distribution of Trusts, plays a crucial role for beneficiaries of certain trusts in the United States. This form is required for individuals who receive what is termed an "accumulation distribution" from a domestic trust and need to calculate any additional tax that may apply. An accumulation distribution occurs when a trust retains its income rather than distributing it to beneficiaries, resulting in potential tax implications for those beneficiaries when they ultimately receive a payout. To complete Form 4970 accurately, beneficiaries must gather specific details about the trust, including the trust's name, address, and employer identification number, along with personal information such as their Social Security number and date of birth. This form serves not just to report the distribution, but also to determine taxes owed on the accumulated income, taking into account various factors such as prior taxable income and tax-exempt interest. Additionally, those who have received distributions from multiple trusts in a given tax year must file a separate Form 4970 for each trust. It's important to note that this form specifically pertains to trusts created prior to March 1, 1984, as distributions from foreign trusts are reported differently. Understanding the nuances of Form 4970 is essential for beneficiaries to comply with IRS regulations and accurately assess their tax responsibilities.

4970 Example

Form 4970 |

Tax on Accumulation Distribution of Trusts |

|

OMB No. |

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Department of the Treasury |

|

▶ Attach to beneficiary’s tax return. |

2021 |

|

|

▶ Go to www.irs.gov/Form4970 for the latest information. |

|

Attachment |

|

Internal Revenue Service |

|

|

Sequence No. 178 |

|

A Name(s) as shown on return |

|

B Social security number |

||

CName and address of trust

D Employer identification number

E Type of trust (see instructions) |

F Beneficiary’s date of birth |

G Enter the number of trusts from which you received |

|

Domestic |

Foreign |

|

accumulation distributions in this tax year . . . . ▶ |

Part I Average Income and Determination of Computation Years

1Amount of current distribution that is considered distributed in earlier tax years (from Schedule J

|

(Form 1041), line 37, column (a)) |

|

1 |

|

||||||

2 |

Distributions of income accumulated before you were born or reached age 21 |

|

2 |

|

||||||

3 |

Subtract line 2 from line 1 |

|

3 |

|

||||||

4 |

Taxes imposed on the trust on amounts from line 3 (from Schedule J (Form 1041), line 37, column (b)) . |

|

4 |

|

||||||

5 |

Total (add lines 3 and 4) |

|

5 |

|

||||||

6 |

|

6 |

|

|||||||

7 |

Taxable part of line 5 (subtract line 6 from line 5) |

|

7 |

|

||||||

8 |

Number of trust’s earlier tax years in which amounts on line 7 are considered distributed . . . . |

8 |

|

|||||||

9 |

Average annual amount considered distributed (divide line 3 by line 8) . . . |

|

9 |

|

|

|

|

|

||

10 |

Multiply line 9 by 25% (0.25) |

|

10 |

|

|

|

|

|

||

11 |

Number of earlier tax years to be taken into account (see instructions) |

|

11 |

|

||||||

12 |

Average amount for recomputing tax (divide line 7 by line 11). Enter here and in each column on line 15 |

|

12 |

|

||||||

13 |

Enter your taxable income before |

(a) 2020 |

(b) 2019 |

(c) 2018 |

(d) 2017 |

|

(e) 2016 |

|||

|

this distribution for the 5 immediately |

|

|

|

|

|

|

|

|

|

|

preceding tax years. |

|

|

|

|

|

|

|

|

|

Part II |

Tax Attributable to the Accumulation Distribution |

|

|

|

(a) |

(b) |

(c) |

14Enter the amounts from line 13, eliminating the highest and lowest

|

taxable income years |

|

14 |

|

15 |

Enter amount from line 12 in each column |

|

15 |

|

16 |

Recomputed taxable income (add lines 14 and 15) |

|

16 |

|

17 |

Income tax on amounts on line 16 |

|

17 |

|

18 |

Income tax before credits on line 14 income |

|

18 |

|

19 |

Additional tax before credits (subtract line 18 from line 17) . . . |

|

19 |

|

20 |

Tax credit adjustment |

|

20 |

|

21 |

Subtract line 20 from line 19 |

|

21 |

|

22 |

Alternative minimum tax adjustments |

|

22 |

|

23 |

Combine lines 21 and 22 |

|

23 |

|

24 |

Add columns (a), (b), and (c), line 23 |

. . . . . . . . . . . |

24 |

|

25 |

Divide the line 24 amount by 3.0 |

. . . . . . . . . . . |

25 |

|

26 |

Multiply the amount on line 25 by the number of years on line 11 . . |

. . . . . . . . . . . |

26 |

|

27 |

Enter the amount from line 4 |

. . . . . . . . . . . |

27 |

|

28Partial tax attributable to the accumulation distribution (subtract line 27 from line 26) (If zero or

less, enter |

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

28 |

|

For Paperwork Reduction Act Notice, see the instructions. |

Cat. No. 13180V |

Form 4970 (2021) |

|

Form 4970 (2021) |

Page 2 |

|

|

General Instructions

Section references are to the Internal Revenue Code unless otherwise noted.

Future Developments

For the latest information about developments related to Form 4970 and its instructions, such as legislation enacted after they were published, go to www.irs.gov/Form4970.

Purpose of Form

A beneficiary of certain domestic trusts (see Who Must File below) uses Form 4970 to figure the partial tax on accumulation distributions under section 667. The fiduciary notifies the beneficiary of an “accumulation distribution” by completing Part IV of Schedule J (Form 1041).

If you received a distribution for this tax year from a trust that accumulated its income instead of distributing it each year (and the trust paid taxes on that income), you must complete Form 4970 to compute any additional tax liability. The trustee must give you a completed Part IV of Schedule J (Form 1041) so you can complete this form.

If you received accumulation distributions from more than one trust during the current tax year, prepare a separate Form 4970 for each trust from which you received an accumulation distribution. You can arrange the distributions in any order you want them considered to have been made.

Who Must File

Beneficiaries who received an accumulation distribution from certain domestic trusts that were created before March 1, 1984, must file Form 4970. For details, see section 665(c).

Foreign trust beneficiaries. If you received an accumulation distribution from a foreign trust, you must report the distribution and the partial tax on a 2021 Form 3520, Annual Return To Report Transactions With Foreign Trusts and Receipt of Certain Foreign Gifts.

Don’t file Form 4970 for distributions from any foreign trusts, except to attach it as a worksheet to Form 3520 if those instructions direct you to.

Note: If the accumulation distributions are from a domestic trust that used to be a foreign trust, see Rev. Rul.

Definitions

Undistributed net income (UNI). UNI is the distributable net income (DNI) of the trust for any tax year less (1) the amount of income required to be distributed currently and any other amounts properly paid or credited or required to be distributed to beneficiaries in the tax year and

(2)the taxes imposed on the trust attributable to such DNI.

Accumulation distribution. An accumulation distribution is the excess of amounts properly paid, credited, or required to be distributed (other than income required to be distributed currently) over the DNI of the trust reduced by income required to be distributed currently.

Generally, except for

Specific Instructions

Item

Line 1. For a nonresident alien or foreign corporation, include only the part of the accumulation distribution that is attributable to U.S. sources or is effectively connected with a trade or business carried on in the United States.

Line 2. Enter any amount from line 1 that represents UNI of a domestic trust accumulated before you were born or reached age 21. However, if the multiple trust rule applies, see the instructions for line 4.

Line 4. Multiple trust rule. If you received accumulation distributions from two or more other trusts that were considered to have been made in any of the earlier tax years in which the current accumulation distribution is considered to have been made, don’t include on line 4 the taxes attributable to the current accumulation distribution considered to have been distributed in the same earlier tax year(s).

For this special rule, only count as trusts those trusts for which the sum of this accumulation distribution and any earlier accumulation distributions from the trust, which are considered under section 666(a) to have been distributed in the same earlier tax year(s), is $1,000 or more.

Foreign trust. If the trust is a foreign trust, see section 665(d)(2).

Line 8. You can determine the number of years in which the UNI is deemed to have been distributed by counting the “throwback years” for which there are entries on lines 32 through 36 of Part IV of Schedule J (Form 1041). These throwback rules apply even if you wouldn’t have been entitled to receive a distribution in the earlier tax year if the distribution had actually been made then. There can be more than 5 “throwback years.”

Line 11. From the number of years entered on line 8, subtract any year in which the distribution from column (a), Part IV of Schedule J (Form 1041) is less than the amount on line 10 of Form 4970. If the distribution for each throwback year is more than line 10, then enter the same number on line 11 as you entered on line 8.

Line 13. Enter your taxable incomes for years

If your taxable income as adjusted is less than zero, enter zero.

Line 17. Figure the income tax (excluding any alternative minimum tax (AMT)) on the income on line 16 using the tax rates in effect for your particular earlier tax year shown in each of the three columns. Use the Tax Rate Schedules, etc., as applicable. You can get the Tax Rate Schedules and prior year forms by downloading them at www.irs.gov.

Line 18. Enter your income tax (excluding any AMT) as originally reported, corrected, or amended, before reduction for any credits for your particular earlier year shown in each of the three columns.

Line 20. Nonrefundable credits that are limited to tax liability, such as the general business credit, may be changed because of an accumulation distribution. If the total allowable credits for any of the 3 computation years increase, enter the increase on line 20. However, don’t treat as an increase the part of the credit that was allowable as a carryback or carryforward credit in the current or any preceding year other than the computation year.

To refigure these credits, you must consider changes to the tax before credits for each of the 3 computation years due to previous accumulation distributions.

If the accumulation distribution is from a domestic trust that paid foreign income taxes, the limitation on the foreign tax credit under section 904 is applied separately to the

accumulation distribution. If the distribution is from a foreign trust, see sections 667(d) and 904(f)(4) for special rules.

Attach the proper form for any credit you refigure. The amount determined for items on this line is limited to tax law provisions in effect for those years involved.

Line 22. For each year entered in Part II, columns

Line 28. If estate taxes or

Individuals. Include the amount from this line on Schedule 2 (Form 1040), line 8c. Write “ADT” on the line 8c entry space.

Trusts and decedents’ estates. Include the amount on Form 1041, Schedule G, line 8. Write “From Form 4970” and the amount of the tax to the left of the line 8 entry space.

Other filers. Add the result to the total tax liability before the refundable credits on your income tax return for the year of the accumulation distribution. Attach this form to that return.

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required to give us the information. We need it to ensure that you are complying with these laws and to allow us to figure and collect the right amount of tax.

You aren’t required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for individual taxpayers filing this form is approved under OMB control number

Learning about the

law or the form . . . . . . . . 13 min. Preparing the form . . . . . . 52 min.

Copying, assembling,

and sending the form to the IRS . . 20 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from you. See the instructions for the tax return with which this form is filed.

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | Form 4970 is used to calculate the tax on accumulation distributions from trusts. |

| Who Must File | Beneficiaries receiving accumulation distributions from certain domestic trusts created before March 1, 1984, must file this form. |

| Trust Types | The form is applicable for domestic trusts only; foreign trust distributions are reported differently. |

| Related IRS Form | Attach Form 4970 to the beneficiary's income tax return for the year of the distribution. |

| Filing Instructions | Trustees must provide beneficiaries with completed parts of Schedule J (Form 1041) to assist in filling out Form 4970. |

| OMB Approval | This form is assigned OMB No. 1545-0192 and reflects the IRS's commitment to data collection compliance. |

| Time to Complete | On average, it takes approximately 52 minutes to prepare this form, translating to time management for taxpayers. |

| Tax Trends | Accumulation distributions can change tax liability, and it’s crucial to report all previous taxable incomes accurately. |

| Paperwork Reduction Act | Taxpayers are not required to complete this form unless it includes a valid OMB control number, protecting their effort. |

Guidelines on Utilizing 4970

Proceeding with Form 4970 involves accurately reporting accumulation distributions from trusts. Each step must be followed carefully to ensure that calculations are correct and all necessary information is provided.

- Begin by entering your name(s) as shown on your tax return in Box A.

- Provide your Social Security number in Box B.

- Fill in the name and address of the trust in Box C.

- Enter the employer identification number (EIN) of the trust in Box D.

- Specify the type of trust in Box E.

- Input your date of birth in Box F.

- Indicate the number of trusts from which you received domestic or foreign accumulation distributions in Box G.

Next, proceed to Part I. Start determining the average income and computation years.

- On line 1, record the amount of distribution considered distributed in earlier tax years as shown on Schedule J (Form 1041), line 37, column (a).

- Input any distributions of income accumulated before your birth or age 21 on line 2.

- Perform the calculation by subtracting line 2 from line 1 and enter the result on line 3.

- From Schedule J (Form 1041), line 37, column (b), report taxes imposed on the trust on amounts from line 3 in line 4.

- Add lines 3 and 4, recording the total on line 5.

- Enter any tax-exempt interest from Schedule J (Form 1041), line 37, column (c) on line 6.

- Calculate the taxable part of line 5 by subtracting line 6 from line 5 and place this on line 7.

- Determine the number of earlier tax years in which amounts on line 7 are distributed and enter the total on line 8.

- Divide line 3 by line 8 and put the average annual amount considered distributed on line 9.

- Multiply line 9 by 25% (0.25) and record the result on line 10.

- Complete line 11 by noting the number of earlier tax years to account for, following the instructions.

- Divide line 7 by line 11, entering your average amount for recomputing tax on line 12.

- Input your taxable income for years 2016 through 2020, before the current distribution, in line 13.

Now, proceed to Part II to compute the tax attributable to the accumulation distribution.

- On line 14, enter the amounts from line 13, eliminating the highest and lowest taxable income years.

- Fill in the amount from line 12 in each column on line 15.

- Add lines 14 and 15 for the recomputed taxable income and place that amount on line 16.

- Calculate the income tax on line 16 and record it on line 17.

- Report the income tax before credits from line 14 on line 18.

- Subtract line 18 from line 17 to determine the additional tax before credits; enter this on line 19.

- Identify your tax credit adjustment and place that amount on line 20.

- Subtract line 20 from line 19 and record the result on line 21.

- Account for any alternative minimum tax adjustments on line 22.

- Combine lines 21 and 22, placing the total on line 23.

- Add all three columns from line 23 for total line 24.

- Divide the amount on line 24 by 3.0 and record that on line 25.

- Multiply the amount on line 25 by the number of years entered on line 11 for line 26.

- Enter the amount from line 4 on line 27.

- Finally, subtract line 27 from line 26 to find the partial tax attributable to the accumulation distribution. Enter this value on line 28. If the result is zero or less, write -0-.

Once completed, ensure this form is attached to the beneficiary’s tax return for that year. Prior to sending, review for accuracy and completeness. Each form should accurately reflect an understanding of the trust distributions involved.

What You Should Know About This Form

What is Form 4970 and why is it used?

Form 4970 is used by beneficiaries of certain domestic trusts to calculate the tax due on accumulation distributions. An accumulation distribution refers to amounts that the trust accumulated instead of distributing its income each year. When a trust pays taxes on its income, beneficiaries may need to complete this form to determine their additional tax liabilities on distributions received in a given tax year. It is essential to attach this form to the beneficiary's tax return.

Who needs to file Form 4970?

Any beneficiary who has received an accumulation distribution from a domestic trust created before March 1, 1984, is required to file Form 4970. If accumulation distributions were received from a foreign trust, then Form 4970 is not applicable. Instead, beneficiaries should report such distributions using Form 3520. It is crucial that beneficiaries receive a completed Part IV of Schedule J from the trust's fiduciary to accurately fill out Form 4970.

What information is required to complete Form 4970?

To complete Form 4970, various information must be gathered, including the beneficiary's name, Social Security number, details about the trust, and the amounts received as accumulation distributions. Beneficiaries must also include information from the trust's Schedule J (Form 1041), such as income figures and past tax returns spanning the last five years. For accurate calculations, beneficiaries should consult the trust documents and may require assistance from tax professionals to navigate the complexities.

What steps are involved in calculating the tax on the accumulation distribution?

Calculating tax on the accumulation distribution involves determining the average income from previous tax years, computing taxable income, and comparing it to the amounts received. Beneficiaries will need to account for any taxes already paid by the trust as well as any exemptions or credits that may apply. The instructions on the form provide detailed guidance on how to perform these calculations, which can include multiple steps and require careful attention to prior tax returns.

What happens if a beneficiary fails to file Form 4970?

If a beneficiary fails to file Form 4970 when required, it may lead to inaccuracies in reporting income and potential tax liabilities. The IRS may assess penalties or interest on any unpaid taxes. Additionally, without properly reporting accumulation distributions, beneficiaries risk the possibility of future audits or disputes with the IRS. It is advisable to consult a tax professional when navigating this form to ensure compliance and avoid complications.

Common mistakes

Filling out Form 4970 can be tricky, and mistakes are common. One major error occurs when beneficiaries do not accurately report their information. Always double-check the Name(s) and Social Security number on the form to ensure they match what is on your tax return. Any discrepancies can lead to delays or extra scrutiny from the IRS.

Another common pitfall is misunderstanding how to report distributions. Some individuals fail to include the correct amounts from Schedule J (Form 1041). It’s important to provide the amounts accurately from the previous year, especially on line 1 and line 4. Mistakes here can significantly alter your tax liability.

Beneficiaries often overlook the specifics of the trust type as well. There are different rules for domestic versus foreign trusts. Misclassifying the trust can result in incorrectly filling out the form altogether. This mistake can lead to missed tax requirements or incorrect forms being filed.

The calculation of taxable income is another area prone to errors. Many people do not fully account for all years when entering their taxable income for the five immediately preceding tax years. This oversight can affect how the tax attributable to accumulation distributions is calculated.

Sometimes, beneficiaries misunderstand the concept of "throwback years." When counting the number of prior years in which the income is considered distributed, it’s crucial to follow the correct guidelines. Miscounting these years can lead to incorrect tax computations.

A frequent mistake includes failing to attach necessary documentation. Attach the completed Part IV of Schedule J (Form 1041) as it provides crucial information for the IRS to process your Form 4970 correctly. Not including the right documents can create complications in the processing of your return.

Additionally, some filers neglect to carefully compute their Alternative Minimum Tax adjustments. This adjustment can be complex, and not accounting for it correctly may result in an underpayment or overpayment of taxes.

Beneficiaries also sometimes ignore the implications of tax credits. If any credits change as a result of the accumulation distribution, they need to be recalibrated on the form. Neglecting this can lead to mistakes in the final tax amount owed.

Finally, waiting until the last minute to complete the form can result in rushed work and errors. It’s always best to start early and take the time to review each section carefully. This approach will help to ensure that all information is accurate and complete before submitting.

Documents used along the form

The Form 4970 is a critical document related to the tax obligations of beneficiaries who have received accumulation distributions from certain trusts. When completing Form 4970, there are various other forms and documents that may be necessary to accurately report and calculate tax liabilities. Below are examples of such documents that often accompany Form 4970.

- Form 3520: Used by U.S. persons who receive distributions from foreign trusts or large gifts from foreign individuals. This form reports transactions involving foreign trusts and receipts of certain foreign gifts.

- Schedule J (Form 1041): Provides detailed information on the income of a trust and any distributions made to beneficiaries. This serves as a support document for Form 4970.

- Form 1041: The U.S. Income Tax Return for Estates and Trusts. Trusts are required to file this form to report income, deductions, gains, and losses.

- Form 1040: The individual income tax return form that can include the tax owed reported on Form 4970. Beneficiaries must file their personal tax returns in conjunction with any trust distributions.

- Schedule K-1 (Form 1041): Reports the income, deductions, and credits from a trust to the beneficiaries. Beneficiaries should keep this form for their records and for accurately reporting income on their returns.

- Form 4626: For corporations, this form calculates the Alternative Minimum Tax (AMT). Individuals must use Form 6251 instead for their AMT calculations when applicable.

- Form 6251: This form helps individuals calculate their Alternative Minimum Tax, which may be impacted by the distributions noted on Form 4970.

- Schedule I (Form 1041): Specifically for estates and trusts, this schedule helps calculate any Alternative Minimum Tax adjustments and may be attached to Form 1041.

- Form 8862: If the beneficiary is claiming the Earned Income Credit after having it denied in the prior year, this form must be filled out to re-establish eligibility.

- Form 8889: If health savings accounts are involved, this form is used to report contributions to, and distributions from, the account when applicable to distributions from trusts.

Understanding and preparing the necessary forms is essential for compliance with tax regulations associated with trust distributions. It ensures accurate reporting and avoids potential penalties or issues with the IRS. If each of these documents is completed correctly, it will provide clarity and maintain proper adherence to tax obligations.

Similar forms

- Form 3520: Similar to Form 4970, Form 3520 is used to report transactions with foreign trusts and the receipt of certain foreign gifts. It covers distributions from foreign trusts whereas Form 4970 focuses on domestic trusts and their accumulation distributions.

- Form 1041: This form is for estates and trusts to report their income, deductions, and credits. While Form 4970 determines taxes on accumulation distributions from trusts, Form 1041 is used to report the overall income of the trust before any distributions.

- Schedule J (Form 1041): This schedule is part of Form 1041 and helps calculate the income distribution deduction for trusts. Part IV of Schedule J acts as a step in determining the accumulation distribution reported on Form 4970.

- Form 4626: This form is used for corporations to determine their alternative minimum tax. Similar to how Form 4970 may require adjustments based on AMT, Form 4626 focuses on calculating the tax based on alternative income.

- Form 6251: This form is used by individuals to figure their alternative minimum tax. It is similar to Form 4970 in that both require calculating additional taxes based on specific sets of rules about income, thereby ensuring compliance with tax laws.

Dos and Don'ts

When filling out Form 4970, it's important to follow certain guidelines to ensure accuracy and compliance with IRS regulations. Below is a list of things you should and shouldn't do.

- Do read the instructions carefully before starting.

- Do gather all necessary information from the trust before filling out the form.

- Do double-check that you are using the correct version of Form 4970 for the relevant tax year.

- Do prepare a separate Form 4970 for each trust from which you received an accumulation distribution.

- Do include only U.S. source amounts if you are a nonresident alien or foreign corporation.

- Don't skip complex lines; each entry is significant to the final calculation.

- Don't assume that distributions from foreign trusts can be reported on this form. Use Form 3520 instead.

- Don't rush through the computations; accuracy is crucial to avoid penalties.

- Don't leave any fields blank, as this may lead to errors or delays.

- Don't forget to attach any required schedules or additional forms as specified in the instructions.

Misconceptions

1. Anyone can file Form 4970. This is incorrect. Only beneficiaries of certain domestic trusts that created accumulation distributions must file this form. If your trust was established before March 1, 1984, then you likely need to file.

2. Form 4970 is for distributions from foreign trusts. This is a misconception. Form 4970 should not be used for distributions from foreign trusts. Those distributions should be reported on Form 3520, not Form 4970.

3. Filing Form 4970 is optional. In reality, if you have received an accumulation distribution from a qualifying trust, you are required to file Form 4970 to determine your tax liability. This isn't a choice; it's a requirement.

4. You don’t need to report taxable income from prior years. This is misleading. You must report your taxable income for the five years preceding the distribution to calculate tax liability accurately. This is an essential step in the process.

5. The trustee always provides accurate information. While trustees are responsible for supplying details, mistakes can happen. Beneficiaries should verify the information provided on Part IV of Schedule J (Form 1041) before filling out Form 4970.

6. You can combine distributions from multiple trusts on one form. This is incorrect. Each trust from which you received an accumulation distribution requires a separate Form 4970. You must prepare individual forms for each trust to ensure accurate reporting.

7. Accumulation distributions don't incur additional tax. This misunderstanding can lead to issues. Accumulation distributions often result in a tax liability, and Form 4970 is specifically designed to help calculate any additional taxes owed as a consequence of these distributions.

Key takeaways

Filling out Form 4970, which is the Tax on Accumulation Distribution of Trusts, requires attention to detail. Here are some key takeaways to consider:

- Purpose: The form is used by beneficiaries of certain domestic trusts to determine their tax liability on accumulation distributions, which are amounts accumulated by the trust instead of being distributed to beneficiaries each year.

- Filing Requirement: Beneficiaries must file this form if they received an accumulation distribution from a domestic trust established before March 1, 1984. It's important to check trust eligibility first.

- Separate Forms: If you received accumulation distributions from multiple trusts, complete a separate Form 4970 for each trust to accurately reflect the distribution amounts.

- Trustee's Role: The trustee is responsible for informing beneficiaries about accumulation distributions. They must complete a specific part of Schedule J (Form 1041) to facilitate this process.

- Tax Year Information: Ensure you have your taxable income for the five preceding tax years ready. This is crucial for calculating tax liabilities accurately.

- Throwback Rules: Know that accumulation distributions may be subject to throwback rules, meaning you need to track prior related distributions to compute current obligations properly.

- Multiple Trust Rule: Applying the multiple trust rule is necessary if distributions from multiple trusts have implications for the same prior tax years. This aligns with specific IRS instructions.

- Line-by-Line Entries: Pay careful attention to each line on the form. Misplacing an entry on any line can lead to erroneous tax calculations which may complicate your tax return.

- Credits and Adjustments: Be aware that any nonrefundable credits may need adjustment due to the accumulation distribution. This influences the overall tax computation for the filing year.

- Form Attachment: Always remember to attach Form 4970 to the relevant tax return (e.g., Form 1040 or Form 1041) as this ensures the IRS processes your return correctly.

By paying close attention to these takeaways, beneficiaries can navigate the complexities of Form 4970 and ensure compliance with tax regulations.

Browse Other Templates

Indefinite Suspension Drivers License Pa - Intended for drivers facing license issues, this form is essential for legal documentation.

G4 Form - Education history must be completed, including high school graduation status and college details.

Guard/Reserve Position Form - The NGB 34-1 must be submitted alongside other required documentation.