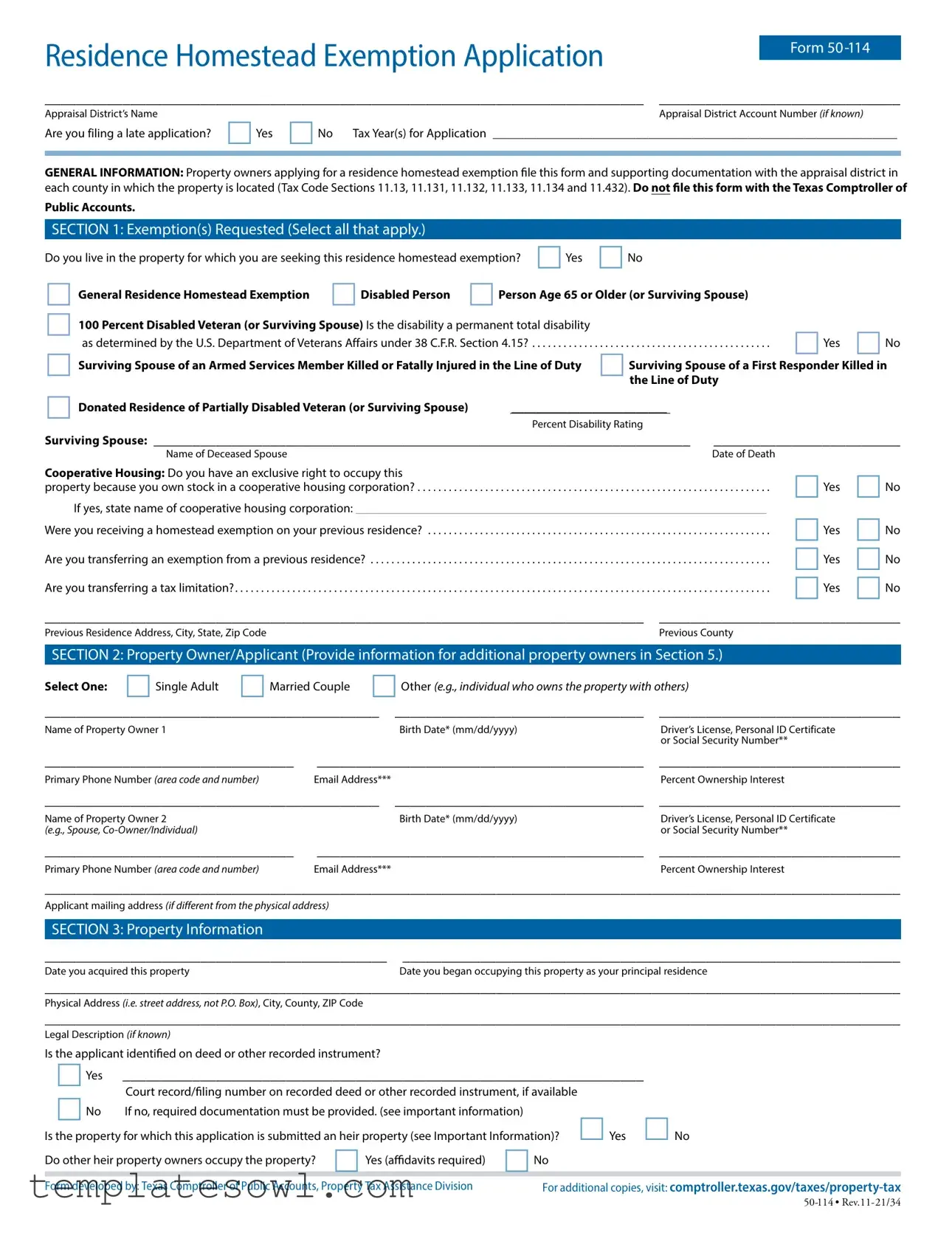

Fill Out Your 50 114 Form

The Residence Homestead Exemption Application Form 50-114 serves as an essential resource for property owners in Texas seeking to reduce their property tax burden. This form is necessary for those applying for various exemptions, such as the general residence homestead exemption, exemptions for persons aged 65 or older, disabled individuals, and disabled veterans. In completing this form, applicants must delve into personal and property information, including the appraisal district's name and account number, and whether they are submitting a late application. Drawing on specific key sections, the form prompts applicants to provide details about their residency status, ownership, and any previous exemptions claimed, ensuring thorough documentation to support their claims. Important deadlines for submission also emphasize timely filing to qualify for the necessary tax benefits, as they must generally be submitted between January 1 and April 30 of the applicable tax year. Additionally, for those with special circumstances such as survivor benefits, the form outlines unique requirements for documentation. Filing this form correctly and on time is critical in ensuring homeowners can maximize their property tax exemptions, ultimately assisting in safeguarding their financial well-being.

50 114 Example

Residence Homestead Exemption Application |

|

Form |

|

|

|

_____________________________________________________________________________ |

_______________________________ |

|

Appraisal District’s Name |

Appraisal District Account Number (if known) |

|

Are you filing a late application? Yes No |

Tax Year(s) for Application _________________________________________________________________ |

GENERAL INFORMATION: Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in each county in which the property is located (Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432). Do not file this form with the Texas Comptroller of

Public Accounts.

SECTION 1: Exemption(s) Requested (Select all that apply.)

Do you live in the property for which you are seeking this residence homestead exemption? Yes |

No |

|

|

|

General Residence Homestead Exemption Disabled Person Person Age 65 or Older (or Surviving Spouse) |

|

|||

100 Percent Disabled Veteran (or Surviving Spouse) Is the disability a permanent total disability |

|

|

Yes No |

|

as determined by the U.S. Department of Veterans Affairs under 38 C.F.R. Section 4.15? |

||||

Surviving Spouse of an Armed Services Member Killed or Fatally Injured in the Line of Duty |

Surviving Spouse of a First Responder Killed in |

|||

|

|

the Line of Duty |

|

|

Donated Residence of Partially Disabled Veteran (or Surviving Spouse) |

_________________________ |

|

|

|

|

Percent Disability Rating |

|

|

|

Surviving Spouse: _____________________________________________________________________ |

________________________ |

|||

Name of Deceased Spouse |

|

|

Date of Death |

|

Cooperative Housing: Do you have an exclusive right to occupy this

property because you own stock in a cooperative housing corporation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If yes, state name of cooperative housing corporation: __________________________________________________________________

Were you receiving a homestead exemption on your previous residence? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Are you transferring an exemption from a previous residence? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Are you transferring a tax limitation?. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes No

Yes No

Yes No

Yes No

_____________________________________________________________________________ |

_______________________________ |

Previous Residence Address, City, State, Zip Code |

Previous County |

SECTION 2: Property Owner/Applicant (Provide information for additional property owners in Section 5.)

Select One: Single Adult Married Couple Other (e.g., individual who owns the property with others)

___________________________________________ |

________________________________ |

_______________________________ |

|

Name of Property Owner 1 |

|

Birth Date* (mm/dd/yyyy) |

Driver’s License, Personal ID Certificate |

|

|

|

or Social Security Number** |

________________________________ |

__________________________________________ |

_______________________________ |

|

Primary Phone Number (area code and number) |

Email Address*** |

|

Percent Ownership Interest |

___________________________________________ |

________________________________ |

_______________________________ |

|

Name of Property Owner 2 |

|

Birth Date* (mm/dd/yyyy) |

Driver’s License, Personal ID Certificate |

(e.g., Spouse, |

|

|

or Social Security Number** |

________________________________ |

__________________________________________ |

_______________________________ |

|

Primary Phone Number (area code and number) |

Email Address*** |

|

Percent Ownership Interest |

______________________________________________________________________________________________________________

Applicant mailing address (if different from the physical address)

SECTION 3: Property Information |

|

____________________________________________ |

________________________________________________________________ |

Date you acquired this property |

Date you began occupying this property as your principal residence |

______________________________________________________________________________________________________________

Physical Address (i.e. street address, not P.O. Box), City, County, ZIP Code

______________________________________________________________________________________________________________

Legal Description (if known)

Is the applicant identified on deed or other recorded instrument? |

|

|

|

|

Yes |

___________________________________________________________________ |

|||

No |

Court record/filing number on recorded deed or other recorded instrument, if available |

|

||

If no, required documentation must be provided. (see important information) |

Yes |

No |

||

Is the property for which this application is submitted an heir property (see Important Information)? |

||||

Do other heir property owners occupy the property? Yes (affidavits required) |

No |

|

|

|

|

|

|||

Form developed by: Texas Comptroller of Public Accounts, Property Tax Assistance Division |

For additional copies, visit: |

|||

Residence Homestead Exemption Application |

|

Form |

|

|

|

SECTION 3: Property Information (Continued) |

|

|

_____________________________________ |

_____________________________________ |

______________________________ |

Manufactured Home Make |

Model |

ID Number |

Is any portion of the property for which you are claiming a residence homestead exemption income producing? |

. . . . . . . . . . . . . . . . . . . . . . Yes No |

|

If yes, indicate the percentage of the property that is income producing: _________ percent

Number of acres (or fraction of an acre, not to exceed 20 acres) you own and occupy as your principal residence:

SECTION 4: Waiver of Required Documentation

Indicate if you are exempt from the requirement to provide a copy of your driver’s license or

I am a resident of a facility that provides services related to health, infirmity or aging.

_________________________________________________________________________________________________________

Facility Name and Address

I am certified for participation in the address confidentiality program administered by the Office of the Texas Attorney General under Code of Criminal Procedure Chapter 58, Subchapter B.

Indicate if you request that the chief appraiser waive the requirement that the property address for exemption corresponds to your driver’s license or

I am an active duty U.S. armed services member or the spouse of an active duty member.

I hold a driver’s license issued under Transportation Code Section 521.121(c) or 521.1211. Attached is a copy of the application for that license.

SECTION 5: Provide Additional Information Here (If any)

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

If you own other residential property in Texas, please list the county(ies) of location.

______________________________________________________________________________________________________________

______________________________________________________________________________________________________________

SECTION 6: Affirmation and Signature

I understand if I make a false statement on this form, I could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37.10.

I, _____________________________________________________ , |

_____________________________ , swear or affirm the following: |

Property Owner/Authorized Representative Name |

Title/Authorization |

1.that each fact contained in this application is true and correct;

2.that I/the property owner meet(s) the qualifications under Texas law for the residence homestead exemption for which I am applying; and

3.that I/the property owner do(es) not claim an exemption on another residence homestead or claim a residence homestead exemption on a residence homestead outside Texas.

_________________________________________________________

Signature of Property Owner/Applicant or Authorized Representative |

Date |

*May be used by appraisal district to determine eligibility for persons age 65 or older exemption or surviving spouse exemptions (Tax Code §11.43(m))

**Social security number disclosure may be required for tax administration and identification. (42 U.S.C. §405(c)(2)(C)(i); Tax Code §11.43(f)). A driver’s license number, personal identification number or social security number disclosed in an exemption application is confidential and not open to public inspection, except as authorized by Tax Code §11.48(b).

***May be confidential under Government Code §552.137; however, by including the email address on this form, you are affirmatively consenting to its release under the Public Information Act.

For additional copies, visit: |

Page 2 |

Residence Homestead Exemption Application |

Form |

Important Information

GENERAL INSTRUCTIONS

This application is for claiming residence homestead exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134 and 11.432. Certain exemptions may also require Form

FILING INSTRUCTIONS

File this form and all supporting documentation with the appraisal district office in each county in which the property is located generally between Jan. 1 and April 30 of the year for which the exemption is requested. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the Comptroller’s website.

APPLICATION DEADLINES

Generally, the completed application and required documentation is due no later than April 30 of the year for which the exemption is requested.

The due date for persons age 65 or older; disabled; or partially disabled veterans with donated homesteads to apply for the exemption is no later than the first anniversary of the qualification date.

A late application for a residence homestead exemption may be filed up to two years after the deadline for filing has passed. (Tax Code Section 11.431). A late application for residence homestead exemption filed for a disabled veteran (not a surviving spouse) under Tax Code sections 11.131 or 11.132 may be filed up to 5 years after the delinquency date. Surviving spouse of a disabled veteran, who files under Tax Code sections 11.131 or 11.132, may file up to two years after the delinquency date, for a late application for residence homestead exemption.

If the chief appraiser grants the exemption(s), property owner does not need to reapply annually, but must reapply if the chief appraiser requires it, unless seeking to apply the exemption to property not listed in this application.

Property owners already receiving a general residence homestead exemption who turn age 65 in that next year are not required to apply for age 65 or older exemption if accurate birthdate information is included in the appraisal district records or in the information the Texas Department of Public Safety provided to the appraisal district under Transportation Code Section 521.049. (Tax Code Section 11.43(m))

REQUIRED DOCUMENTATION

Attach a copy of property owner’s driver’s license or

Heir property is property owned by one or more individuals, where at least one owner claims the property as a residence homestead, and the property was acquired by will, transfer on death deed, or intestacy. An heir property owner not specifically identified as the residence homestead owner on a deed or other recorded instrument in the county where the property is located must provide:

•an affidavit establishing ownership of interest in the property (See Form

•a copy of the prior property owner’s death certificate;

•a copy of the property’s most recent utility bill; and

•A citation of any court record relating to the applicant’s ownership of the property, if available.

Each heir property owner who occupies the property as a principal residence, other than the applicant, must provide an affidavit that authorizes the submission of this application (See Form

Manufactured homeowners must provide:

•a copy of the Texas Department of Housing and Community Affairs statement of ownership showing that the applicant is the owner of the manufactured home;

•a copy of the sales purchase agreement, other applicable contract or agreement or payment receipt showing that the applicant is the purchaser of the manufactured home; or

•a sworn affidavit (see Form

1.the applicant is the owner of the manufactured home;

2.the seller of the manufactured home did not provide the applicant with the applicable contract or agreement; and

3.the applicant could not locate the seller after making a good faith effort.

ADDITIONAL INFORMATION REQUEST

The chief appraiser may request additional information to evaluate this application. Property owner must comply within 30 days of the request or the application will be denied. The chief appraiser may extend this deadline for a single period not to

exceed 15 days for good cause shown. (Tax Code Section 11.45)

DUTY TO NOTIFY

Property owner must notify the chief appraiser in writing before May 1 of the year after his or her right to this exemption ends.

EXEMPTION QUALIFICATIONS

General Residence Homestead Exemption (Tax Code Section 11.13(a) and (b))

Property was owned and occupied as owner’s principal residence on Jan. 1. No residence homestead exemption can be claimed by the property owner on any other property.

Disabled Person Exemption (Tax Code Section 11.13(c) and (d))

Persons under a disability for purposes of payment of disability insurance benefits under Federal

Age 65 or Older Exemption (Tax Code Section 11.13(c) and (d))

This exemption is effective Jan. 1 of the tax year in which the property owner becomes age 65. Property owners not identified on a deed or other instrument recorded in the applicable real property records as an owner of the residence homestead must provide an affidavit or other compelling evidence establishing the applicant’s ownership interest in the homestead. (See Form

Surviving Spouse of an Individual Who Qualified for Age 65 or Older Exemption (Tax Code Section 11.13(q)):

Surviving spouse of person who qualified for the age 65 or older exemption may receive this exemption if the surviving spouse was 55 years of age or older when the qualifying spouse died. The property must have been the surviving spouse’s residence homestead at the time of death and remain the surviving spouse’s residence homestead. This exemption cannot be combined with an exemption under 11.13(d).

100 Percent Disabled Veterans Exemption (Tax Code Section 11.131(b))

Property owner who has been awarded a 100 percent disability compensation due to a

Documentation must be provided to support this exemption request.

Surviving Spouse of a Disabled Veteran Who Qualified or Would Have Qualified for the 100 Percent Disabled Veteran’s Exemption (Tax Code Section 11.131(c) and (d))

Surviving spouse of a disabled veteran (who qualified for an exemption under Tax Code Section 11.131(b) at the time of his or her death or would have qualified for the exemption if the exemption had been in effect on the date the disabled veteran died) who has not remarried since the death of the veteran. The property must have been the surviving spouse’s residence homestead at the time of the veteran’s death and remain the surviving spouse’s residence homestead.

Donated Residence Homestead of Partially Disabled Veteran (Tax Code Section 11.132(b))

A disabled veteran with a disability rating of less than 100 percent with a residence homestead donated by a charitable organization at no cost or at some cost that is not more than 50 percent of the good faith estimate of the market value of the residence homestead as of the date the donation is made. Documentation must be provided to support this exemption request.

Surviving Spouse of a Disabled Veteran Who Qualified for the Donated Residence Homestead Exemption (Tax Code Section 11.132(c) and (d)):

Surviving spouse of a disabled veteran (who qualified for an exemption under Tax Code Section 11.132(b) at the time of his or her death) who has not remarried since the death of the disabled veteran and maintains the property as his or her residence homestead.

Surviving Spouse of a Member of Armed Services Killed in Line of Duty (Tax Code Section 11.133(b) and (c))

Surviving spouse of a U.S. armed services member who is killed or fatally injured in the line of duty who has not remarried since the death of the service member. Documentation must be provided to support this exemption request.

Surviving Spouse of a First Responder Killed in the Line of Duty (Tax Code Section 11.134)

Surviving spouse of a first responder who is killed or fatally injured in the line of duty who has not remarried since the death of the first responder. Documentation must be provided to support this exemption request.

For additional copies, visit: |

Page 3 |

Form Characteristics

| Fact Name | Fact Description |

|---|---|

| Purpose of Form | The 50-114 form is used to apply for residence homestead exemptions in Texas. |

| Filing Deadline | Applications are generally due by April 30 of the year for which the exemption is requested. |

| Governing Law | This form operates under Texas Tax Code Sections 11.13, 11.131, 11.132, 11.133, 11.134, and 11.432. |

| Late Applications | Late applications may be submitted within two years of the original deadline; up to five years for certain disabled veterans. |

| Required Documentation | A copy of the property owner's driver's license or state ID is generally required, unless specifically exempted. |

| Ownership Requirement | The property must be owned and occupied by the applicant as their principal residence. |

| Eligibility | Eligibility includes categories like disabled persons, elderly homeowners, and surviving spouses of veterans. |

| Exemption Types | Various exemptions can be requested, including those for disabled veterans and persons aged 65 or older. |

| Impact on Taxes | Receiving a homestead exemption can significantly lower property tax liability for eligible homeowners. |

| Submission Instructions | Forms must be submitted directly to the county appraisal district, not the Texas Comptroller of Public Accounts. |

Guidelines on Utilizing 50 114

To complete the form for the Residence Homestead Exemption Application (Form 50-114), you will need to gather several pieces of information and follow the steps outlined below. This process is essential for property owners who want to apply for various exemptions on their property taxes. Make sure you have all necessary documentation ready before starting to fill out the form.

- Obtain the Form: Download or pick up the Residence Homestead Exemption Application Form 50-114 from your local appraisal district’s office or the Texas Comptroller's website.

- Fill in the Appraisal District Information: Write the name of the appraisal district and your appraisal district account number, if known.

- Indicate Late Application Status: Circle “Yes” or “No” if you are filing a late application.

- Input Tax Year: Fill in the tax year or years for which you are applying for the exemption.

- Select Exemption(s) Requested: Indicate whether you live in the property and check all applicable exemptions.

- Provide Property Owner Information: Fill out personal details for all property owners, including names, birth dates, social security numbers, phone numbers, and email addresses.

- Fill in Mailing Address: If your mailing address is different from your physical property address, include it here.

- Detail Property Information: Provide the date you acquired the property, when you began occupying it, the physical address, and the legal description if available.

- State Manufactured Home Details: If applicable, include information about your manufactured home, including make, model, and ID number.

- Identify Income Status: Specify if any part of the property is income-producing and indicate the percentage.

- Provide Additional Information: If needed, use this section to include any other information that may support your application.

- Sign and Date: Confirm that all information is true and correct, then provide your signature and date to affirm the application.

- Attach Supporting Documentation: Include copies of required documents, such as your driver’s license or state ID.

- Submit the Form: Turn in your completed application to the appraisal district office in the county where your property is located. Ensure it’s filed by the deadline, typically between January 1 and April 30 of the year in question.

Once you have submitted the form along with any necessary documentation, the chief appraiser will review your application. Be mindful of any requests for additional information or documentation, as a timely response will prevent delays in the exemption approval process. After the review, you will be notified about the status of your exemption application.

What You Should Know About This Form

What is the purpose of Form 50-114?

Form 50-114, officially known as the Residence Homestead Exemption Application, is utilized by property owners in Texas who wish to claim homestead exemptions for their residence. This form allows homeowners to apply for various exemptions that reduce their property tax burden, specifically targeting those who occupy the property as their primary residence. Some exemptions relate to specific circumstances, such as being a disabled person or a senior citizen aged 65 or older. It's important to note that this form must be submitted to the appropriate appraisal district in each county where the property is located.

When should I file Form 50-114?

The completed Form 50-114, along with any necessary supporting documentation, should be filed with the local appraisal district office by April 30 of the tax year for which you're seeking the exemption. However, there are some exceptions. For instance, individuals who are age 65 or older, disabled, or partially disabled veterans can apply for the exemption within one year of the qualification date. If you miss the regular deadline, you may still file a late application within two years from the original deadline, providing you can demonstrate eligibility.

What information do I need to provide on Form 50-114?

Form 50-114 requires various pieces of information including the property owner's name, contact details, and the address of the property. Additionally, you must indicate the specific exemptions you're requesting, such as a general residence exemption or those for qualifying individuals like disabled veterans or surviving spouses. Documentation may also need to be attached. This could include a driver's license showing the property address or proof of your disability status, depending on which exemptions you are applying for. Always ensure the information provided is accurate, as any false statements could lead to penalties.

Can I receive multiple exemptions on the same property?

Yes, it's possible to qualify for more than one exemption on your residence homestead. For instance, if you are age 65 or older and also have a disability, you can apply for both exemptions in the same year. However, you cannot receive both exemptions from the same tax units. Always check with your local appraisal district to confirm eligibility and specific requirements related to multiple exemptions.

Common mistakes

Completing the Form 50-114 for the Residence Homestead Exemption can be straightforward; however, applicants often encounter common mistakes that may lead to delays or denials. One such mistake involves not selecting the correct exemption(s) requested in Section 1. Qualified applicants should ensure they check all relevant boxes, as failure to do so can result in missing out on available benefits.

Another frequent error is not providing complete or up-to-date personal information in Section 2. This includes names, birthdates, and contact details. Accuracy is essential to avoid complications in processing the application. Missing or incorrect information can delay the approval process significantly.

Applicants sometimes forget to check if they are eligible for an exemption under different categories, such as age or disability. Section 1 requires specific details, such as whether the reported disability is a permanent total one according to the U.S. Department of Veterans Affairs. Incomplete or inaccurate responses may hinder proper verification.

A common oversight is related to the documentation needed to substantiate claims. Applicants must attach a copy of their driver’s license or state-issued ID. Neglecting to include this critical documentation will result in an automatic denial of the application.

Another mistake occurs when applicants fail to specify if they have been receiving a homestead exemption on another property. Providing this information is crucial for the appraisal district to assess eligibility correctly. Omitting this detail may lead to confusion during the review process.

In Section 3, applicants sometimes misunderstand the requirement to identify the legal description of the property. Ensuring that this section is fully and accurately filled out is paramount. This may require referencing property deeds or previous documentation to obtain the necessary details.

Additionally, Section 4 allows for a waiver of documentation in specific circumstances. Applicants can overlook the possibility of waivers based on residency in a facility or military status, which may exempt them from certain requirements. Understanding these provisions can help streamline the process.

It is crucial to check the affirmation and signature section before submission. Incomplete affirmations can lead to the automatic rejection of the application. Verifying that the signature aligns with the information presented is essential for the integrity of the application.

Finally, applicants sometimes miscalculate deadlines. The application must be submitted by April 30 of the year for which the exemption is requested. Lack of awareness regarding deadlines can result in missed opportunities for obtaining property tax relief. Marking these dates on a calendar can help prevent this mistake.

Documents used along the form

The Form 50-114 is essential for property owners in Texas seeking a homestead exemption on their primary residence. However, several other forms and documents often accompany this application to ensure eligibility and compliance with the law. Understanding these additional requirements can help streamline the exemption process.

- Form 50-114-A: This form is used to provide additional information for applicants who are not named on a deed or recorded instrument. Individuals must attach an affidavit establishing their ownership interest in the property.

- Affidavit for Heir Property: Heir property requires specific documentation to establish ownership claims. An affidavit is needed that showcases the relationship to the deceased owner and confirms the heir's residency.

- Death Certificate: If the property was inherited, a death certificate of the previous owner must be included. This confirms the legal transfer of property ownership due to inheritance.

- Utility Bill: A recent utility bill can serve as proof of residency. It should show the applicant’s name and the property address to verify occupation of the homestead.

- Certificate of Disability: Those applying for the Disabled Person Exemption must provide this certificate from the U.S. Department of Veterans Affairs or another qualified agency to validate their eligibility.

- Statement of Ownership for Manufactured Homes: For applicants claiming an exemption on a manufactured home, the Texas Department of Housing and Community Affairs provides a statement verifying ownership.

- Documentation for Service Members: Active duty members or their spouses may need to submit specific documentation to prove eligibility for exemptions based on military service.

Being aware of these forms and documents can greatly enhance the likelihood of a successful exemption application. Each piece is designed to ensure that property owners receive the benefits they're entitled to while maintaining compliance with Texas tax laws.

Similar forms

-

Form 50-115: Application for 100% Disabled Veteran’s Exemption - This document is specifically for veterans with a 100 percent disability rating. Similar to Form 50-114, it requires details about the property owner’s eligibility and documentation to support their claim for exemption based on disability due to military service.

-

Form 50-116: Application for the Surviving Spouse of a Disabled Veteran’s Exemption - This form allows the surviving spouse of a disabled veteran to apply for an exemption. Like Form 50-114, it requests information to verify occupancy and eligibility criteria for the exemption intended for spouses of veterans who have passed away.

-

Form 50-117: Application for the Donated Residence Homestead Exemption - This form is used by partially disabled veterans who receive a donated home. Similar in nature to Form 50-114, applicants must show proof of their disability and the donation to secure their homestead exemption.

-

Form 50-118: Application for Surviving Spouse of an Armed Service Member Killed in Action - This document allows the spouse of a deceased service member who died in the line of duty to seek exemption. It parallels Form 50-114 as it collects similar personal and property information to assess eligibility for the exemption.

-

Form 50-119: Application for a Residence Homestead Exemption for Persons Aged 65 or Older - This form applies to those aged 65 and above seeking a homestead exemption. Like Form 50-114, it focuses on confirming residency and age along with submitting relevant identification and property documentation.

-

Form 50-120: Application for an Exemption for Individuals with Disabilities - This form caters to individuals classified as disabled but not necessarily veterans. It mirrors Form 50-114 by requiring information about both the applicant and property while also demanding proof of disability and residence status.

Dos and Don'ts

- Do provide accurate and truthful information on the form to avoid penalties.

- Do ensure your driver’s license or ID number and property address match.

- Do attach all required documentation, such as death certificates when applicable.

- Do submit the form to the correct appraisal district before the deadline.

- Don't file this form with the Texas Comptroller of Public Accounts.

- Don't leave any sections blank; ensure all questions are answered.

- Don't delay in submitting your application beyond April 30 without checking eligibility for late filing.

- Don't forget to notify the chief appraiser if your eligibility status changes.

Misconceptions

- Form 50-114 is only for first-time applicants. Many believe that the 50-114 form is exclusively for those applying for the residence homestead exemption for the first time. In reality, this form can also be used for late applications and exemptions transfer from a previous residence.

- Filing late results in automatic denial. There's a misconception that filing a late application for a homestead exemption will lead to rejection. However, Texas law permits applications to be submitted up to two years after the regular deadline, with some exceptions allowing up to five years.

- The application must be filed with the Texas Comptroller. Many are under the impression that they should submit Form 50-114 to the Texas Comptroller of Public Accounts. In fact, it should only be filed with the local appraisal district.

- You need to reapply every year. Some property owners think they have to file the exemption application annually. This is not the case. Once granted, an exemption typically remains in effect unless there is a change in ownership or property use.

- Only homeowners can apply for this exemption. There's a belief that only traditional homeowners can qualify. However, residents in cooperative housing may also apply, provided they have exclusive rights to occupy their unit.

- All types of properties qualify for the exemption. It's a common mistake to assume that any property can be claimed. The exemption strictly applies only to your principal residence and does not extend to properties used for investment or income-generating purposes.

- Anyone can apply without documentation. Some applicants forget that supporting documentation is vital. The form requires proof of identity, ownership, and sometimes additional evidence depending on the exemption type being claimed.

- Only certain age groups can apply. While it's true that specific exemptions target seniors and disabled individuals, many people think only these demographics can qualify. Exemptions exist for veterans and their surviving spouses, including those affected by certain disabilities or line-of-duty deaths.

Key takeaways

Understanding the 50-114 form, or Residence Homestead Exemption Application Form, is crucial for property owners seeking exemptions in Texas. Here are some key takeaways to keep in mind while filling out this form:

- Submit Locally: The form must be filed with the appraisal district in each county where the property is located, not with the Texas Comptroller of Public Accounts.

- Application Deadlines: Typically, applications are due by April 30 of the tax year for which the exemption is requested, although some exceptions may apply for individuals over 65 or with certain disabilities.

- Required Documentation: You’ll need to provide proof of identity, such as a driver’s license or state ID, and this must match the property address you’re claiming.

- Types of Exemptions: The form allows you to apply for various exemptions, including those for disabled individuals and those over the age of 65, as well as exemptions for surviving spouses.

- Late Applications: You can file a late application under specific circumstances, such as for disabled veterans, which may extend up to five years after deadlines.

By ensuring you follow these guidelines, you can navigate the process more smoothly and increase your chances of receiving valuable exemptions on your property taxes.

Browse Other Templates

Virginia Accident Reports - This procedure helps streamline the documentation process for non-injury accidents.

Nj Certificate of Amendment Online - The business registration details form is vital for maintaining good standing with the state.

How to Set Up Direct Deposit - Direct deposit saves time and enhances financial convenience.