Fill Out Your 50 244 Form

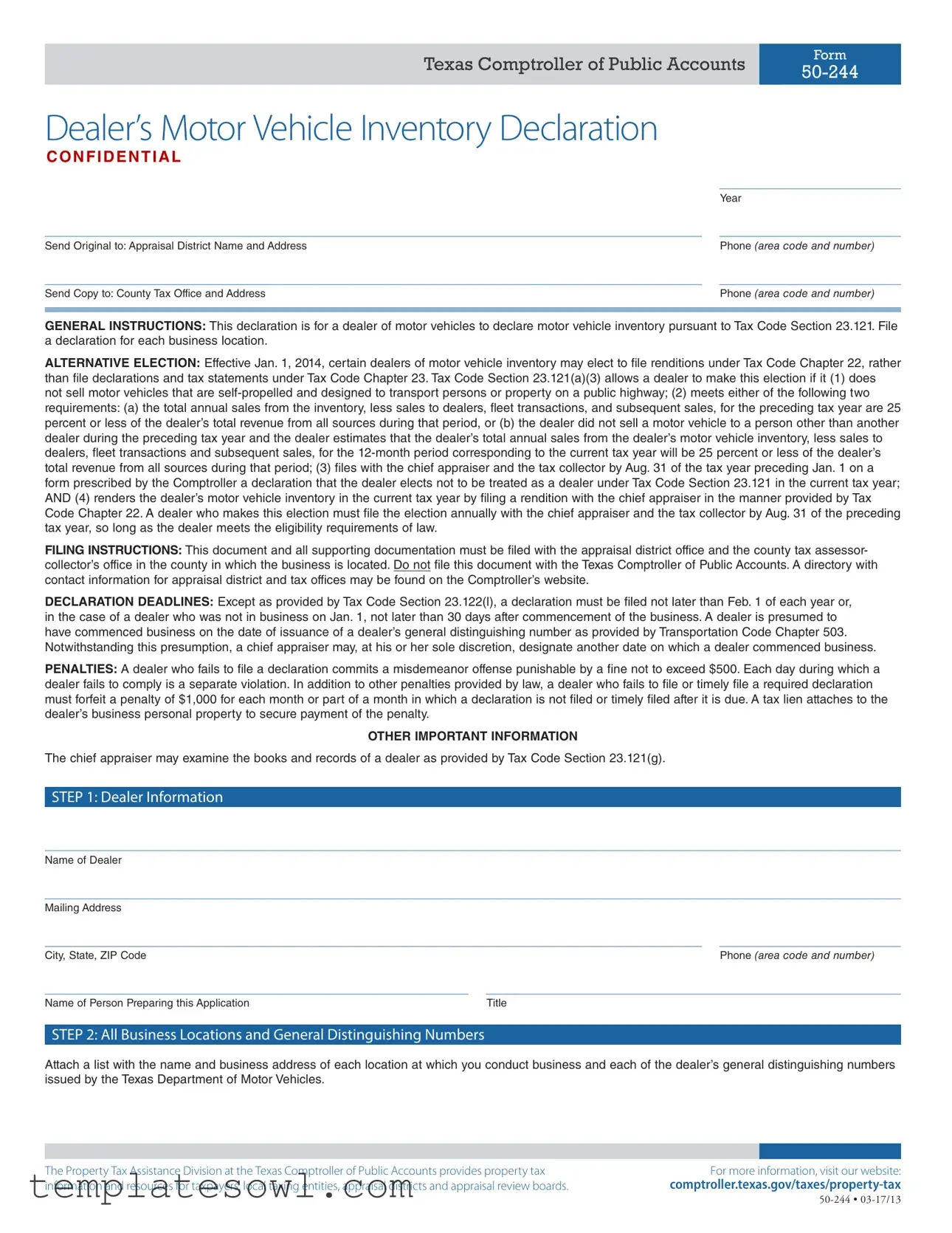

The Texas Comptroller of Public Accounts Form 50-244, known as the Dealer’s Motor Vehicle Inventory Declaration, serves a crucial function for motor vehicle dealers in Texas. This form is designed to help dealers declare their motor vehicle inventory in accordance with specific provisions outlined in the Texas Tax Code. Each dealer must submit a declaration for every location where business is conducted. The form captures essential details such as the dealer's name, business address, general distinguishing numbers, and sales information from the previous tax year. Dealers have the option, under certain conditions, to elect to file an alternative declaration under a different tax code chapter. The filing process involves submitting the completed form, along with supporting documentation, to both the local appraisal district and the county tax office. It’s important to note that the declaration is subject to strict deadlines, typically due by February 1 each year, with penalties imposed for late submissions. Properly filling out this form not only ensures compliance with state regulations but also helps in accurately assessing the market value of the dealer’s inventory, which can significantly affect tax responsibilities.

50 244 Example

Texas Comptroller of Public Accounts |

Form |

|

|

||

|

|

Dealer’s Motor Vehicle Inventory Declaration

C O N F I D E N T I A L

|

_____________________ |

|

Year |

____________________________________________________________________________ |

_____________________ |

Send Original to: Appraisal District Name and Address |

Phone (AREA CODE AND NUMBER) |

____________________________________________________________________________ |

_____________________ |

Send Copy to: County Tax Office and Address |

Phone (AREA CODE AND NUMBER) |

|

|

GENERAL INSTRUCTIONS: This declaration is for a dealer of motor vehicles to declare motor vehicle inventory pursuant to Tax Code Section 23.121. File a declaration for each business location.

ALTERNATIVE ELECTION: Effective Jan. 1, 2014, certain dealers of motor vehicle inventory may elect to ile renditions under Tax Code Chapter 22, rather than ile declarations and tax statements under Tax Code Chapter 23. Tax Code Section 23.121(a)(3) allows a dealer to make this election if it (1) does not sell motor vehicles that are

FILING INSTRUCTIONS: This document and all supporting documentation must be iled with the appraisal district office and the county tax assessor- collector’s office in the county in which the business is located. Do not ile this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district and tax offices may be found on the Comptroller’s website.

DECLARATION DEADLINES: Except as provided by Tax Code Section 23.122(l), a declaration must be iled not later than Feb. 1 of each year or, in the case of a dealer who was not in business on Jan. 1, not later than 30 days after commencement of the business. A dealer is presumed to have commenced business on the date of issuance of a dealer’s general distinguishing number as provided by Transportation Code Chapter 503. Notwithstanding this presumption, a chief appraiser may, at his or her sole discretion, designate another date on which a dealer commenced business.

PENALTIES: A dealer who fails to ile a declaration commits a misdemeanor offense punishable by a ine not to exceed $500. Each day during which a dealer fails to comply is a separate violation. In addition to other penalties provided by law, a dealer who fails to ile or timely ile a required declaration must forfeit a penalty of $1,000 for each month or part of a month in which a declaration is not iled or timely iled after it is due. A tax lien attaches to the dealer’s business personal property to secure payment of the penalty.

OTHER IMPORTANT INFORMATION

The chief appraiser may examine the books and records of a dealer as provided by Tax Code Section 23.121(g).

STEP 1: Dealer Information

___________________________________________________________________________________________________

Name of Dealer

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________________ _____________________

City, State, ZIP CodePhone (AREA CODE AND NUMBER)

_________________________________________________ |

________________________________________________ |

Name of Person Preparing this Application |

Title |

STEP 2: All Business Locations and General Distinguishing Numbers

Attach a list with the name and business address of each location at which you conduct business and each of the dealer’s general distinguishing numbers issued by the Texas Department of Motor Vehicles.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax |

For more information, visit our website: |

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards. |

Texas Comptroller of Public Accounts |

Form |

|

|

||

|

|

STEP 3: Business Location Information

Provide the business name, general distinguishing number, physical address of the business location and account number for the inventory being declared or you may attach a tax bill or a copy of appraisal or tax office correspondence concerning your account.

_____________________________________________________________________ |

____________________________ |

Name of Business |

General Distinguishing Number of Location |

___________________________________________________________________________________________________

Address, Street, City, State, ZIP Code

_____________________________________________________________________ |

____________________________ |

Account Number (IF KNOWN) |

Business Start Date, if Not in Business on Jan. 1 |

STEP 4: Number of Units Sold and Sale Totals

Number of units sold for the previous

_______________________ |

________________________ |

_______________________ |

_______________________ |

Motor Vehicle Inventory |

Fleet Transactions |

Dealer Sales |

Subsequent Sales |

Sales amounts for the previous

$ |

$ |

$ |

$ |

Motor Vehicle Inventory |

Fleet Transactions |

Dealer Sales |

Subsequent Sales |

STEP 5: Market Value of Motor Vehicle Inventory

State the market value of the motor vehicle inventory for the current tax year, as computed under Tax Code Section 23.121. Market value is total annual sales less sales to dealers, leet transactions and subsequent sales, from the dealer’s motor vehicle inventory for the previous

$ |

÷ 12 = ______________________________ |

Dealer’s Motor Vehicle Inventory Sales for Prior Year |

Market Value for Current Tax Year |

STEP 6: Signature and Date

By signing this declaration, you certify that the dealer identiied in Step 1 is the owner of a dealer’s motor vehicle inventory.

___________________________________________________________________________________________________

On Behalf of (NAME OF DEALER)

_________________________________________________________ |

________________________________ |

Print Name |

Title |

_________________________________________________________ |

________________________________ |

Authorized Signature |

Date |

If you make a false statement on this report, you could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37.10.

For more information, visit our website: |

Page 2 |

|

|

Texas Comptroller of Public Accounts |

Form |

|

|

||

|

|

Additional Instructions

Step 4. Number of units sold and sale totals. The top row of boxes is the number of units sold for the preceding year in each category. The bottom row of boxes is the dollar amount sold for the previous year in each category. The categories include:

Motor vehicle inventory – sales of motor vehicles. A motor vehicle is a fully

Fleet transaction – motor vehicles included in the sale of ive or more motor vehicles from your inventory to the same person within one calendar year.

Dealer sales – sales of vehicles to another Texas dealer or a dealer who is legally recognized in another state as a motor vehicle dealer.

Subsequent sale –

For more information, visit our website: |

Page 3 |

|

|

Form Characteristics

| Fact Name | Detail |

|---|---|

| Purpose | Form 50-244 is a declaration for motor vehicle dealers to report their inventory as required by Tax Code Section 23.121. |

| Filing Requirements | A declaration must be filed every year by February 1, or within 30 days if starting a new business after January 1. |

| Penalties | Failure to file can result in a maximum fine of $500. Each day of non-compliance counts as a separate violation. |

| Alternative Election | Dealers can choose to file renditions under Tax Code Chapter 22 instead of this declaration if certain criteria are met. |

| Governing Law | This form is governed by the Texas Tax Code, specifically Sections 23.121 and 22. |

Guidelines on Utilizing 50 244

Completing the 50-244 form requires careful attention to detail. This form serves as a declaration for motor vehicle inventory, which must be accurately filed with the appropriate authorities by the specified deadlines. Ensure that all necessary information is collected before starting the process of filling out the form.

- Step 1: Dealer Information

Fill in the name of the dealer and the mailing address. Provide the city, state, ZIP code, and phone number. Also, include the name and title of the person preparing the application. - Step 2: Business Locations

Attach a list that includes the name and business address of each location where business is conducted. Include all general distinguishing numbers issued by the Texas Department of Motor Vehicles. - Step 3: Business Location Information

Provide details for each business location, including the name, general distinguishing number, and physical address. If known, include the account number for the inventory being declared. - Step 4: Number of Units Sold and Sale Totals

Report the number of units sold over the previous 12-month period. Specify the totals for motor vehicle inventory, fleet transactions, dealer sales, and subsequent sales. Enter the corresponding dollar amounts as well. - Step 5: Market Value of Motor Vehicle Inventory

State the market value of the current year's motor vehicle inventory. Calculate this value by dividing total annual sales by 12, based on the previous year's sales data. - Step 6: Signature and Date

Sign and date the declaration. Include the name of the dealer, the title of the signatory, and authorized signature.

What You Should Know About This Form

What is the purpose of Form 50-244?

Form 50-244 serves as a Dealer’s Motor Vehicle Inventory Declaration. It is required for dealers of motor vehicles to formally declare their motor vehicle inventory as mandated by Texas Tax Code Section 23.121. Each business location owned by the dealer must file a separate declaration.

Who must file this form?

Any motor vehicle dealer operating in Texas must file Form 50-244. This includes dealers who sell vehicles that are designed to be driven on public roads. If a dealer operates multiple locations, a separate declaration must be submitted for each site.

What are the filing deadlines for Form 50-244?

The declaration must be filed annually by February 1. If the dealer was not in business on January 1, they have 30 days from the start of their business to file the form. The date a dealer commences business is typically the date they receive their general distinguishing number from the Texas Department of Motor Vehicles.

What happens if a dealer fails to file the declaration?

A dealer who does not file or files late may face serious penalties, including a fine of up to $500 for each day of non-compliance. There is also a monthly penalty of $1,000 for each month the declaration is not filed or is untimely filed. Additionally, a tax lien may be placed on the dealer’s business personal property to secure payment of any penalties.

Can a dealer elect to file under a different section of the tax code?

Yes, on January 1, 2014, changes were made allowing certain dealers not to be classified under Section 23.121. To qualify, a dealer must meet specific sales criteria and file an election statement with the chief appraiser and the county tax collector by August 31 of the preceding tax year.

What information is required to complete Form 50-244?

To complete the form, dealers need to provide their business name, mailing address, and general distinguishing numbers. They must report the number of units sold in the previous 12-month period, sales totals, and the current market value of the inventory. Additionally, the signature of the dealer or an authorized representative is required.

Are there limitations on which vehicles are included in the inventory declaration?

Yes, motor vehicles eligible for declaration include fully self-propelled vehicles with at least two wheels. However, vehicles with salvage titles and equipment not intended for transportation do not qualify as motor vehicle inventory and should not be included in this declaration.

What should a dealer do if they need assistance with this form?

Dealers can consult the Texas Comptroller of Public Accounts’ website for resources and guidance. Moreover, contacting the local appraisal district or county tax office directly can provide personalized assistance regarding completing and filing Form 50-244.

Common mistakes

Filling out the Form 50-244 can be a straightforward task, but many people can make mistakes that lead to delays or penalties. One common mistake is not reading the instructions thoroughly. This form has several steps and detailed requirements. Rushing through the process can lead to missing key pieces of information, such as the specific definitions of what constitutes a motor vehicle or how to categorize sales.

Another frequent error involves providing inaccurate contact information. When entering the dealer’s name, address, and phone number, it’s crucial to ensure the details are correct. Mistakes in contact information can cause significant challenges later, especially when the appraisal district attempts to reach out for clarification or additional documentation.

Incomplete sections of the form present another serious issue. Each step of the form requires specific information. In particular, the section that asks for the number of units sold and their totals needs careful attention. Failure to fill out this section entirely or accurately can lead to complications in the inventory assessment.

Many dealers forget to include all of their business locations and general distinguishing numbers. This oversight can impact the overall assessment of the motor vehicle inventory. It’s essential to attach a complete list of each location where business is conducted along with the corresponding general distinguishing numbers issued by the Texas Department of Motor Vehicles.

Additionally, using the wrong deadlines can result in penalties. The declaration must be filed by the appropriate dates outlined in the instructions. Missing these deadlines, particularly the February 1 deadline, could lead to serious financial penalties, including fines or additional fees.

Some dealers inadvertently miscalculate their market value of the motor vehicle inventory. It’s vital to correctly compute this value based on the sales data from the previous year divided by twelve. Any errors in this calculation can lead to inaccurate reporting, which may have tax implications.

Failing to sign and date the form is another common oversight. This step might seem minor, but without a signature and date, the declaration cannot be considered valid. This mistake could inadvertently push the filing into non-compliance.

Finally, not keeping a copy of the submitted form can be detrimental. It is advisable to maintain a record for future reference. This documentation could be invaluable in case of questions or disputes arising later with the appraisal district or tax office.

Documents used along the form

The Texas Comptroller of Public Accounts Form 50-244, known as the Dealer’s Motor Vehicle Inventory Declaration, is an important document for motor vehicle dealers in Texas. In addition to this form, there are several other forms and documents that dealers may need to use in conjunction with the Form 50-244 to ensure compliance with state tax laws and regulations.

- Form 50-247: This form is used for the Rendition of Personal Property, which allows certain dealers to report their motor vehicle inventory under different provisions of the tax code, party to an election made by the dealer.

- Dealer's General Distinguishing Number: This document is required for establishing and maintaining a dealer's identity within the Texas Department of Motor Vehicles. It must accompany the 50-244 form for each business location.

- Tax Bill: A tax bill summarizes the amount of tax owed based on the market value of the motor vehicle inventory and must be attached to the declaration for verification purposes.

- Proof of Sales: Documentation of past sales is essential. Dealers may need to provide records or reports detailing the number of units sold and total sales figures for the previous year.

- Property Appraisal Report: A document detailing the appraisal of the dealer’s property, including vehicles, may be required to establish the market value for tax purposes.

- Affidavit of Ownership: This affidavit serves as a sworn statement confirming the ownership of the motor vehicle inventory declared and can help in substantiating the claims made in the 50-244 form.

- Election Form for Tax Code Chapter 22: If a dealer opts to elect not to follow the traditional inventory declaration process, this form must be submitted to establish the alternative election under Chapter 22.

- Inspection Records: Documentation showing regular inspections of the inventory can assist in verifying that the dealer complies with all state regulations, which may be reviewed by the chief appraiser.

Properly completing and filing these additional documents alongside Form 50-244 can help ensure that motor vehicle dealers remain compliant with Texas tax regulations. Neglecting any of these forms may result in penalties or complications in processing the declaration.

Similar forms

Form 50-241: Dealer's Motor Vehicle Tax Statement - Similar to the 50-244, this form is used by motor vehicle dealers to report the tax owed based on their inventory. Both documents require details about the dealer's inventory and sales, as well as deadlines for submission to local tax authorities.

Form 50-245: Dealer's Fleet Inventory Declaration - This form is intended for dealers who maintain a fleet of vehicles for rental or lease. Like Form 50-244, it captures inventory details but is specifically tailored for businesses that operate under a fleet model, highlighting differences in reporting exempt vehicles.

Form 50-246: Motor Vehicle Inventory Workbook - This workbook assists dealers in calculating their inventory value. It helps organize sales data and market values in a manner consistent with Form 50-244. Both are crucial for accurate annual reporting, ensuring compliance with inventory tax laws.

Form 50-247: Application for Dealer’s Tax Exemption - Similar in intent, this form allows dealers to apply for tax exemptions based on various criteria. While it serves a different purpose, both forms require thorough documentation and offer a pathway for dealers to manage their tax responsibilities effectively.

Dos and Don'ts

Filling out the Texas Comptroller of Public Accounts Form 50-244 requires careful attention to detail. To avoid common pitfalls, here are several things you should and shouldn't do.

- Do read the entire form and associated instructions before starting.

- Don't rush through the form; take your time to ensure accuracy.

- Do provide complete and correct information in all fields.

- Don't leave any required sections blank; this can lead to delays or penalties.

- Do double-check the deadlines for filing to avoid late penalties.

- Don't misunderstand the definitions of motor vehicle inventory, fleet transactions, dealer sales, and subsequent sales.

- Do keep copies of the completed form and any supporting documents for your records.

Following these guidelines will help ensure your declaration is processed smoothly and correctly.

Misconceptions

The following list addresses common misconceptions about the Texas Comptroller of Public Accounts Form 50-244. Understanding these points can clarify the purpose and requirements of this form.

- Form 50-244 is only for car dealerships. This form is used by any dealer of motor vehicles, including those who deal in trucks, motorcycles, and recreational vehicles.

- You can file Form 50-244 whenever you want. Deadlines are crucial. This declaration must be filed by February 1 each year, or within 30 days of starting your business if you were not operational on January 1.

- Only one form is needed for multiple locations. You must file a separate Form 50-244 for each business location where you deal in motor vehicles.

- Filing Form 50-244 is optional. Filing this declaration is required by law if you are a dealer of motor vehicles and do not choose to elect under Tax Code Chapter 22.

- There are no penalties for late submissions. Failing to file on time can lead to fines up to $500 and an additional $1,000 penalty for each month you remain non-compliant.

- You can file this form with the Texas Comptroller. This form should be filed with your local appraisal district office and the county tax assessor-collector’s office, not the Texas Comptroller’s office.

- It’s just a simple checklist. The form requires detailed information about your inventory, sales, and business operations and must be prepared carefully to avoid errors.

- All vehicles qualify as motor vehicle inventory. Only fully self-propelled vehicles designed to transport people or property qualify. Certain vehicles, like salvage titles or specialized machinery, do not count.

- Once filed, you don’t need to worry about the form again. You are required to file this form annually, and your eligibility for exemptions or elections can change each year.

- This form is the same every year. Always check for any changes in the form or instructions, as regulations and requirements may update, affecting how you complete it.

Understanding these misconceptions will help ensure compliance and avoid unnecessary penalties. Always refer to the official guidelines or consult an expert if you have questions about the filing process.

Key takeaways

Filing the Texas Comptroller of Public Accounts Form 50-244 is essential for motor vehicle dealers. Understanding the key points can streamline the process.

- Purpose: This form allows motor vehicle dealers to declare their inventory as required by law.

- Filing Requirement: A separate declaration is needed for each business location.

- Deadline: Declarations must be filed by February 1 each year, or within 30 days if the business started after January 1.

- Eligibility for Alternative Election: Certain dealers may choose to file under Chapter 22 instead of Chapter 23 if they meet specific criteria.

- Multiple Locations: Include all business addresses and general distinguishing numbers on the form.

- Market Value Calculation: Report the market value of the inventory for the current year, based on previous year's sales data.

- Penalties: Failure to file on time may result in a fine of up to $500, plus additional monthly penalties.

- Signature Requirement: An authorized person's signature is necessary to validate the submission.

- Documentation: Supporting documents should be attached as required, and ensure they are accurate.

- Record Keeping: The chief appraiser may examine dealer records; maintain thorough documentation for compliance.

Browse Other Templates

Owcp - Completing the CA-20 is a collaborative process between physicians and patients.

Kmart Donations - Kmart invites community organizations to apply for support through the Community Request Application Form.

Can an Llc Be Taxed as an S Corp - The submission must be accurate and complete, as errors can lead to rejection of the application.