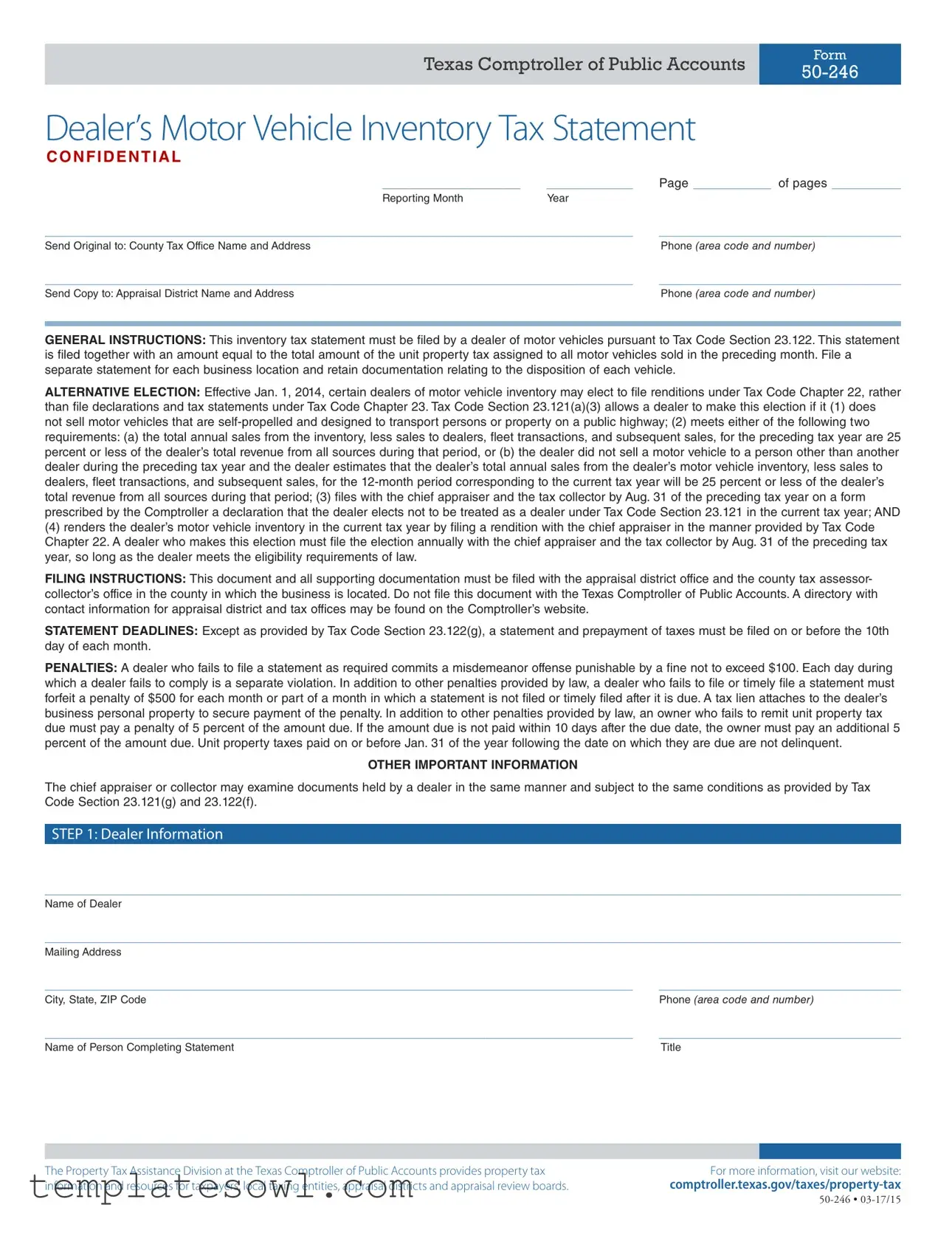

Fill Out Your 50 246 Form

The Texas Comptroller of Public Accounts Form 50-246, also known as the Dealer’s Motor Vehicle Inventory Tax Statement, plays a pivotal role for motor vehicle dealers in the state. This form serves as an inventory tax statement that must be filed monthly to report the sales of motor vehicles and ensures compliance with Texas Tax Code Section 23.122. Dealers are required to submit this statement along with payments that reflect the total amount of unit property tax owed on vehicles sold during the previous month. Filing is necessary for each business location, and maintaining documentation about vehicle transactions is strongly advised. For certain dealers, there exists an alternative election that allows them to file under Tax Code Chapter 22, provided they meet specific criteria. Timely submission is crucial; the form and accompanying taxes must be filed on or before the 10th day of each month to avoid penalties. The penalties for late or failed submissions can be significant, including potential fines and the risk of a tax lien on the dealer’s business personal property. By understanding the importance of the Form 50-246 and adhering to its requirements, motor vehicle dealers can successfully navigate their tax obligations and maintain compliance within the Texas regulatory framework.

50 246 Example

Texas Comptroller of Public Accounts |

Form |

|

|

Dealer’s Motor Vehicle Inventory Tax Statement

CONFIDENT IAL

________________ |

__________ |

Page _________ of pages ________ |

Reporting Month |

Year |

|

____________________________________________________________________ |

____________________________ |

|

Send Original to: County Tax Office Name and Address |

|

Phone (area code and number) |

____________________________________________________________________ |

____________________________ |

|

Send Copy to: Appraisal District Name and Address |

|

Phone (area code and number) |

GENERAL INSTRUCTIONS: This inventory tax statement must be filed by a dealer of motor vehicles pursuant to Tax Code Section 23.122. This statement is filed together with an amount equal to the total amount of the unit property tax assigned to all motor vehicles sold in the preceding month. File a separate statement for each business location and retain documentation relating to the disposition of each vehicle.

ALTERNATIVE ELECTION: Effective Jan. 1, 2014, certain dealers of motor vehicle inventory may elect to file renditions under Tax Code Chapter 22, rather than file declarations and tax statements under Tax Code Chapter 23. Tax Code Section 23.121(a)(3) allows a dealer to make this election if it (1) does not sell motor vehicles that are

(4)renders the dealer’s motor vehicle inventory in the current tax year by filing a rendition with the chief appraiser in the manner provided by Tax Code Chapter 22. A dealer who makes this election must file the election annually with the chief appraiser and the tax collector by Aug. 31 of the preceding tax year, so long as the dealer meets the eligibility requirements of law.

FILING INSTRUCTIONS: This document and all supporting documentation must be filed with the appraisal district office and the county tax assessor- collector’s office in the county in which the business is located. Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district and tax offices may be found on the Comptroller’s website.

STATEMENT DEADLINES: Except as provided by Tax Code Section 23.122(g), a statement and prepayment of taxes must be filed on or before the 10th day of each month.

PENALTIES: A dealer who fails to file a statement as required commits a misdemeanor offense punishable by a fine not to exceed $100. Each day during which a dealer fails to comply is a separate violation. In addition to other penalties provided by law, a dealer who fails to file or timely file a statement must forfeit a penalty of $500 for each month or part of a month in which a statement is not filed or timely filed after it is due. A tax lien attaches to the dealer’s business personal property to secure payment of the penalty. In addition to other penalties provided by law, an owner who fails to remit unit property tax due must pay a penalty of 5 percent of the amount due. If the amount due is not paid within 10 days after the due date, the owner must pay an additional 5 percent of the amount due. Unit property taxes paid on or before Jan. 31 of the year following the date on which they are due are not delinquent.

OTHER IMPORTANT INFORMATION

The chief appraiser or collector may examine documents held by a dealer in the same manner and subject to the same conditions as provided by Tax Code Section 23.121(g) and 23.122(f).

STEP 1: Dealer Information

___________________________________________________________________________________________________

Name of Dealer

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________ |

____________________________ |

City, State, ZIP Code |

Phone (area code and number) |

____________________________________________________________________ |

____________________________ |

Name of Person Completing Statement |

Title |

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax |

For more information, visit our website: |

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards. |

Texas Comptroller of Public Accounts |

Form |

|

|

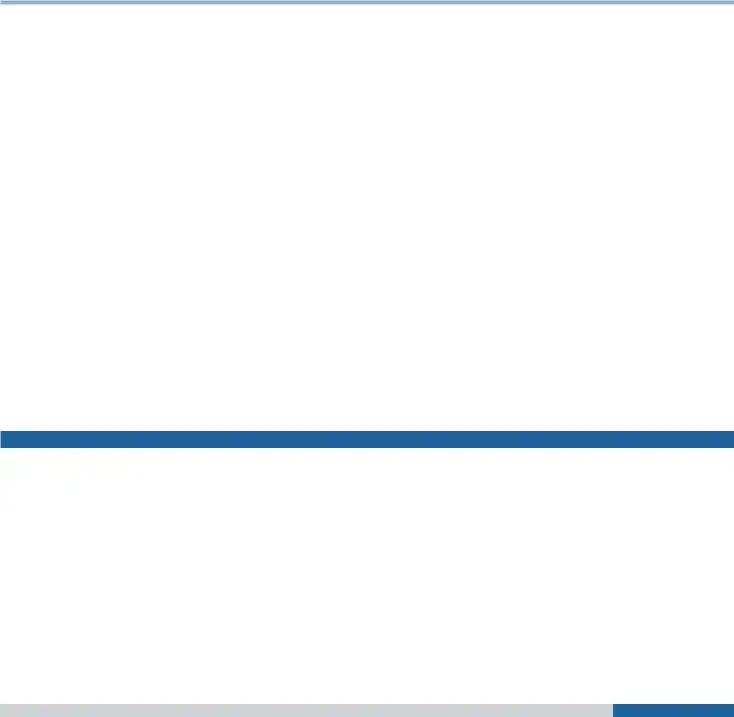

STEP 2: Business’ Name and Physical Address of Business Location

Provide the appraisal district account number if available or attach tax bill or copy of appraisal or tax office correspondence concerning your account.

___________________________________________________________________________________________________

Name of Business

___________________________________________________________________________________________________

Address, City, State, ZIP Code

____________________________________________________________________ |

____________________________ |

Account Number |

Business Start Date, if Not in Business on Jan. 1 |

____________________________________________________________________ |

|

General Distinguishing Number (GDN) |

|

STEP 3: Vehicle Inventory Information

Provide the following information about each motor vehicle sale during the reporting month. Continue on additional sheets if necessary. In lieu of filling out the information in this step, you may attach separate documentation setting forth the information required. All such information must be separately identified in a manner that conforms to the column headers used in the table below. See last page for additional instructions and footnotes.

Description of Vehicle Sold

Date of |

Model |

|

Vehicle |

Sale |

Year |

Make |

Identification Number |

|

|

|

|

Purchaser’s

Name

Type of

Sale1

Sales Price2

Unit Property

Tax3

Total Unit Property Tax4

________________________________________________

Unit Property Tax Factor

For more information, visit our website: |

Page 2 |

|

|

Texas Comptroller of Public Accounts |

Form |

|

|

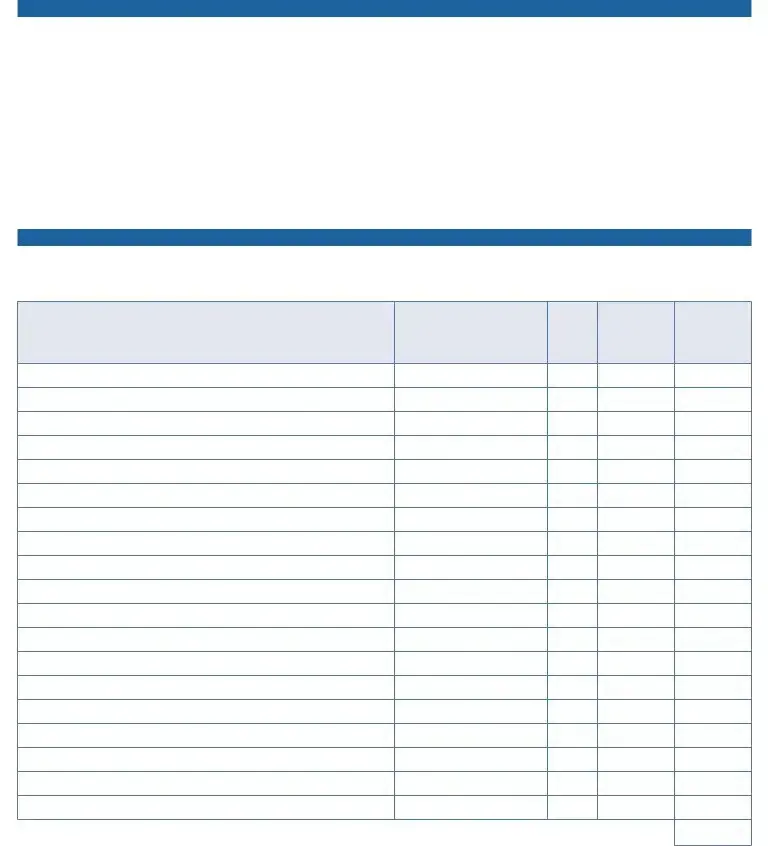

STEP 4: Total Units Sold and Total Sales

Number of units sold for reporting month:

______________________ |

______________________ |

______________________ |

_____________________ |

|||

Motor Vehicle Inventory |

Fleet Transactions |

Dealer Sales |

|

Subsequent Sales |

||

Sales amounts for reporting month: |

|

|

|

|

||

$_____________________ |

$_____________________ |

$_____________________ |

$ ____________________ |

|||

Motor Vehicle Inventory |

Fleet Transactions |

Dealer Sales |

|

Subsequent Sales |

||

|

|

|

|

|

|

|

STEP 5: Signature and Date |

|

|

|

|

||

Signature required on last page only. |

|

|

|

|

||

|

________________________________ |

|||||

|

|

__________________________________________________________ |

||||

|

||||||

|

|

Print Name |

|

|

Title |

|

|

________________________________ |

|||||

|

|

_________________________________________________________ |

||||

|

||||||

|

|

Authorized Signature |

|

|

Date |

|

If you make a false statement on this report, you could be found guilty of a Class A misdemeanor or a state jail felony under Penal Code Section 37.10

For more information, visit our website: |

Page 3 |

|

|

Texas Comptroller of Public Accounts |

Form |

|

|

Additional Instructions

Step 3: Information on each vehicle sold during the reporting month. Complete the information on each motor vehicle sold, including the date of sale, model year, model make, vehicle identification number, purchaser’s name, type of sale, sales price and unit property tax. The footnotes include:

1Type of Sale: Place one of the following codes by each sale reported:

MV – motor vehicle inventory – sales of motor vehi- cles. A motor vehicle is a fully

FL – fleet transactions – motor vehicles included in the sale of five or more motor vehicles from inventory to the same person within one calendar year.

DL – dealer sales – sales of vehicles to another Texas dealer or dealer who is legally recognized in another state as a motor vehicle dealer.

SS – subsequent sales –

2Sales Price: Total amount of money paid or to be paid for the purchase of a motor vehicle as set forth as sales price in the form entitled Application for Texas Certificate of Title promulgated by the Texas Department of Motor Vehicles. In a transaction that does not involve the use of that form, the term means an amount of money that is equivalent, or substantially equivalent, to the amount that would appear as sales price on the Application for Texas Certificate of Title if that form were involved.

3Unit Property Tax: To compute, multiply the sales price by the unit property tax factor. Contact either the county tax

4Total unit property tax for reporting month: Enter the total amount of unit property tax from the “Total for this page only” box on previous page(s). This is the total amount of unit property tax that will be submitted with the statement to the collector.

For more information, visit our website: |

Page 4 |

|

|

Form Characteristics

| Fact Name | Details |

|---|---|

| Form Purpose | The 50-246 form is the Dealer’s Motor Vehicle Inventory Tax Statement required for motor vehicle dealers in Texas. |

| Governing Law | This form is filed in accordance with Texas Tax Code Section 23.122. |

| Filing Frequency | Dealers must submit this form on or before the 10th day of each month, reporting sales from the previous month. |

| Alternative Election | Dealers may choose to file under Tax Code Chapter 22 if certain criteria are met, as outlined in Tax Code Section 23.121(a)(3). |

| Penalties for Non-Compliance | Failure to file can result in a misdemeanor offense and monthly penalties up to $500, in addition to a fine for late payment of unit property tax. |

| Send Locations | The original form must be sent to the County Tax Office, while a copy goes to the Appraisal District. |

| Documentation Retention | Dealers are required to keep documentation for the disposition of each vehicle sold for filing and auditing purposes. |

| Importance of Accurate Reporting | Providing accurate information is crucial, as false statements can lead to criminal charges under Penal Code Section 37.10. |

Guidelines on Utilizing 50 246

Filling out the Texas Comptroller of Public Accounts Form 50-246 is essential for motor vehicle dealers. The form gathers critical information for reporting vehicle inventory and taxes. After preparing all required information, it's important to file this statement with both the county tax office and the appraisal district.

- Step 1: Dealer Information

- Enter the name of the dealer.

- Provide the mailing address.

- Include city, state, and ZIP code.

- Add the phone number of the dealer.

- List the name of the person completing the statement and their title.

- Step 2: Business Name and Physical Address

- Fill in the name of the business.

- Provide the address, city, state, and ZIP code of the business location.

- If available, include the appraisal district account number.

- Indicate the business start date if it was not in operation on January 1.

- Enter the General Distinguishing Number (GDN).

- Step 3: Vehicle Inventory Information

- List each motor vehicle sold during the reporting month, including:

- Vehicle description, date of sale, model year, make, and identification number.

- Purchaser's name and type of sale.

- Sales price and unit property tax.

- Use additional sheets if necessary, or attach separate documentation for this information.

- Step 4: Total Units Sold and Total Sales

- Record the number of units sold for the reporting month in appropriate categories:

- Motor Vehicle Inventory.

- Fleet Transactions.

- Dealer Sales.

- Subsequent Sales.

- Sum the sales amounts for each category in the reporting month.

- Step 5: Signature and Date

- Sign the last page.

- Print your name and title.

- Provide the authorized signature and date of signing.

Once the form is completed, ensure all information is accurate. Submit the original to the county tax office and a copy to the appraisal district. Meeting the filing deadline each month will help you avoid penalties.

What You Should Know About This Form

1. What is the purpose of the 50-246 form?

The 50-246 form, also known as the Dealer’s Motor Vehicle Inventory Tax Statement, is a document required by the Texas Comptroller of Public Accounts. It is used by motor vehicle dealers to report the inventory of vehicles sold in the preceding month and to remit any related property taxes. This ensures compliance with Texas tax regulations related to motor vehicle sales.

2. Who is required to file the 50-246 form?

Any dealer of motor vehicles in Texas must file this form. This includes those who sell, lease, or otherwise transfer ownership of motor vehicles. Dealers are required to file separate forms for each business location they operate.

3. What are the filing instructions for the 50-246 form?

Dealers must submit the completed form and all supporting documents to both the appraisal district office and the county tax assessor-collector’s office in the county where their business is located. It is important to note that the form should not be sent to the Texas Comptroller of Public Accounts.

4. What is the deadline for filing the 50-246 form?

The form, along with any prepayment of taxes, must be filed no later than the 10th day of each month. It's essential for dealers to adhere to this timeline to avoid penalties.

5. What are the penalties for failing to file the 50-246 form?

If a dealer fails to file the 50-246 form, they may face a misdemeanor offense with a fine of up to $100. Additionally, a $500 penalty is incurred for each month the filing is late. Tax liens may also be imposed on business property to secure payment of these penalties.

6. What is the process for dealers opting for an alternative election?

Starting in 2014, certain dealers have the option to file renditions instead of the 50-246 form if they meet specific criteria. These criteria include limitations on the types of vehicles sold and the percentage of total revenue derived from those sales. Eligible dealers must file a declaration of this election with the appraisal district and the tax collector by August 31 of the preceding tax year.

7. What information is required about vehicle sales on the 50-246 form?

Dealers must provide detailed information about each vehicle sold during the reporting month. This includes the sale date, model year, make, vehicle identification number, purchaser's name, type of sale, sales price, and unit property tax. Accurate reporting is crucial for calculating tax obligations.

8. How is unit property tax calculated?

Unit property tax is calculated by multiplying the sales price of the vehicle by the unit property tax factor. This factor can be obtained from the county tax assessor-collector or appraisal district and is derived from the previous year’s aggregate tax rate divided by 12. The total unit property tax from sold vehicles should be submitted with the statement.

9. Where can I find additional resources on the 50-246 form?

Dealers looking for more information can visit the Texas Comptroller of Public Accounts website. They provide resources about property tax, including guidance on filling out the 50-246 form and compliance requirements for motor vehicle dealers.

Common mistakes

Completing the Texas Comptroller of Public Accounts Form 50-246 can be a straightforward process, but several common mistakes can complicate matters for dealers of motor vehicles. One frequent error is failing to submit the form by the deadline. The statement and prepayment of taxes must be filed by the 10th day of each month. Missing this deadline can result in penalties, which can accumulate quickly and lead to significant financial implications for the dealer.

Another common mistake is not filing a separate statement for each business location. It's essential for dealers operating multiple locations to ensure that they submit individual forms for each site. Failing to do so may result in inaccurate reporting and can trigger compliance issues with tax authorities.

Many dealers also overlook the importance of keeping detailed documentation. The form requires that supporting documentation related to the disposition of each vehicle be retained. Not having accurate records can cause challenges during audits or when clarifying the dealer's inventory tax obligations.

Inaccurate record-keeping regarding vehicle sales can further complicate the filing process. When detailing sales on the form, dealers must provide specific information such as the date of sale, make, model year, and vehicle identification number. Omitting any of this information, or providing inaccurate details, can lead to errors in tax calculations and potential fines.

Another mistake is neglecting to include the correct unit property tax factor. Dealers must compute the unit property tax by multiplying the sales price by the unit property tax factor. Not consulting with the county tax assessor-collector to obtain the current unit property tax factor may lead to incorrect tax calculations and reporting errors.

Lastly, many dealers fail to sign the form correctly. While this requirement may seem simple, an unsigned document can lead to delays or rejection of the filing. It is necessary for the form to be signed by an authorized person with their title clearly stated to validate the accuracy and legitimacy of the submission. Paying careful attention to these details can prevent complications during the filer's interactions with tax authorities.

Documents used along the form

The Form 50-246, Dealer’s Motor Vehicle Inventory Tax Statement, is an essential document for motor vehicle dealers in Texas. It is often filed alongside various other forms and documents to ensure compliance with state tax regulations. Below is a list of related documents that may accompany Form 50-246.

- Form 50-100: This is the Texas Property Tax Rendition form, which allows businesses to report property that may be taxable. It provides an overview of the property owned, which may be relevant for dealers who elect to file renditions instead of the inventory tax statement.

- Form 50-143: Dealers may use this form to report their personal property. It is utilized to detail the types of vehicles in inventory that may be subject to different tax regulations.

- Proof of Sale Documents: These documents, including bills of sale or receipts, serve as evidence of each sale conducted during the reporting month. They support the information provided in Form 50-246.

- Unit Property Tax Calculation Worksheet: This worksheet aids dealers in accurately calculating the unit property tax for each vehicle sold. It may include the tax factor and sales prices that need to be reflected in Form 50-246.

- Tax Payment Receipts: These receipts demonstrate payment of taxes owed based on the reported inventory. They affirm compliance with tax obligations and should be retained for recordkeeping.

- Completed IRS Forms: If applicable, dealers may need to include completed IRS forms, such as Form 940 or Form 941, which report payroll taxes. These forms may offer additional insights into the dealer's overall financial activities.

- Sales and Use Tax Report: This report details the sales tax collected from vehicle sales. It supports compliance with state tax laws and provides a complete picture of the dealer's financial filings.

These documents work together to ensure that all necessary information is accurately provided and reported to the appropriate authorities. Properly maintaining and submitting them is crucial for compliance and the continuity of business operations in the automotive industry.

Similar forms

- Form 50-244 - This form is a Texas Dealer’s Motor Vehicle Tax Statement. Like Form 50-246, it is used to report the inventory of motor vehicles by dealers and must be filed monthly.

- Form 50-247 - This form is related to the Texas Dealer’s Inventory Tax Agent Designation. Both forms are linked to inventory tax reporting and compliance, but 50-247 specifically designates a tax agent.

- Form 50-148 - This is the Texas Application for Exemption from Property Tax for Pollution Control Property. Similar to Form 50-246, it is used for tax filings, although it pertains specifically to pollution control assets.

- Form 50-135 - The Tax Statement for Retailer’s Inventory. Deals with tax reporting for retailers and shares common requirements with Form 50-246 regarding inventory reporting.

- Form 50-114 - This form serves as the Innkeeper's Hotel Occupancy Tax Report. Like the 50-246, it requires monthly submission and relates to tax obligations for specific property types.

- Form 50-062 - The Texas Property Tax Report for Franchised Motor Vehicle Dealers is similar in function and purpose but is tailored for franchised dealers instead of independent ones.

- Form 50-120 - The Application for Property Tax Exemptions must be submitted annually and bears resemblance to the 50-246 in terms of reporting exemptions relevant to property ownership.

- Form 50-100 - The Texas Inventory Certification for Appraisers. It shares the inventory reporting theme seen in Form 50-246, assisting in the appraisal and tax assessment process.

- Form 50-367 - This is the Texas Dealer's Monthly Sales Tax Report. It requires reporting on sales, which directly ties into the inventory tax filings seen in Form 50-246.

Dos and Don'ts

Filling out the Texas Comptroller of Public Accounts Form 50-246 can be a straightforward process if you keep the following guidelines in mind. Here's a critical list to help ensure that your submission is accurate and compliant.

- DO fill out the form completely and accurately. Include all required information for each vehicle sold during the reporting month.

- DON'T neglect to retain copies of all supporting documentation. This includes details about vehicle sales that may be requested later.

- DO submit the original form to the County Tax Office and a copy to the Appraisal District. Ensure that both offices receive the documents promptly.

- DON'T miss the deadline. Statements and tax payments must be filed on or before the 10th day of each month to avoid penalties.

- DO consult with the local appraisal district if you’re uncertain about any aspect of the form or the requirements.

- DON'T fail to double-check that your calculations for unit property tax are correct before submission. Errors can lead to penalties and fees.

Following these directives will help in filing the form correctly and in a timely manner, avoiding unnecessary complications down the road.

Misconceptions

Understanding the Texas Comptroller of Public Accounts Form 50-246 is essential for motor vehicle dealers. However, there are several misconceptions surrounding this form that can lead to confusion. Here are six common myths:

- Only large dealers need to file Form 50-246. This is not true. Any dealer of motor vehicles, regardless of size, must file this form if they are engaged in selling motor vehicles.

- Form 50-246 only needs to be filed once a year. In fact, this form must be filed monthly, specifically by the 10th day of each month. Missing this deadline can result in penalties.

- All motor vehicle sales are subject to inventory tax. Some distributions, such as sales to other dealers or fleet transactions, may not incur inventory tax. It's important to classify sales correctly on the form.

- Filing Form 50-246 is optional. Filing this form is a legal requirement for dealers. Failure to do so can result in severe penalties, including fines and additional charges.

- Form 50-246 is filed with the Texas Comptroller. This is a common misconception. The form and its accompanying documents must be submitted to the local county tax assessor-collector and appraisal district office, not the state Comptroller's office.

- There are no penalties for filing late for Form 50-246. Unfortunately, this is incorrect. A dealer who fails to file on time can incur penalties of up to $500 for each month the form is late, along with other potential fines.

Clarifying these misconceptions helps ensure compliance with Texas tax laws and promotes a smoother filing process for motor vehicle dealers.

Key takeaways

- The 50-246 form is essential for motor vehicle dealers in Texas to report their inventory tax.

- This form must be filed by the 10th day of each month, along with payment for the prior month's taxes.

- A separate form is needed for each business location, ensuring accurate reporting for each site.

- Dealers can choose to file under Tax Code Chapter 22 if they meet certain criteria outlined in the instructions.

- Failing to file the form on time can lead to penalties, including a $100 fine and further financial repercussions.

- It is important to include complete and accurate information about each vehicle sale to avoid complications.

- The form is not to be filed with the Texas Comptroller; instead, it should be submitted to the local appraisal district and county tax office.

Browse Other Templates

Pa Tint Exemption Form - This form is required for individuals or businesses seeking to exempt window tints from state regulations.

Mn State Tax Payment - Check for any updates or changes in tax law that may affect your payment.

24 Pet Watch Canada - Understanding the medical history requirements can help you gather necessary information.