Fill Out Your 5020 California Form

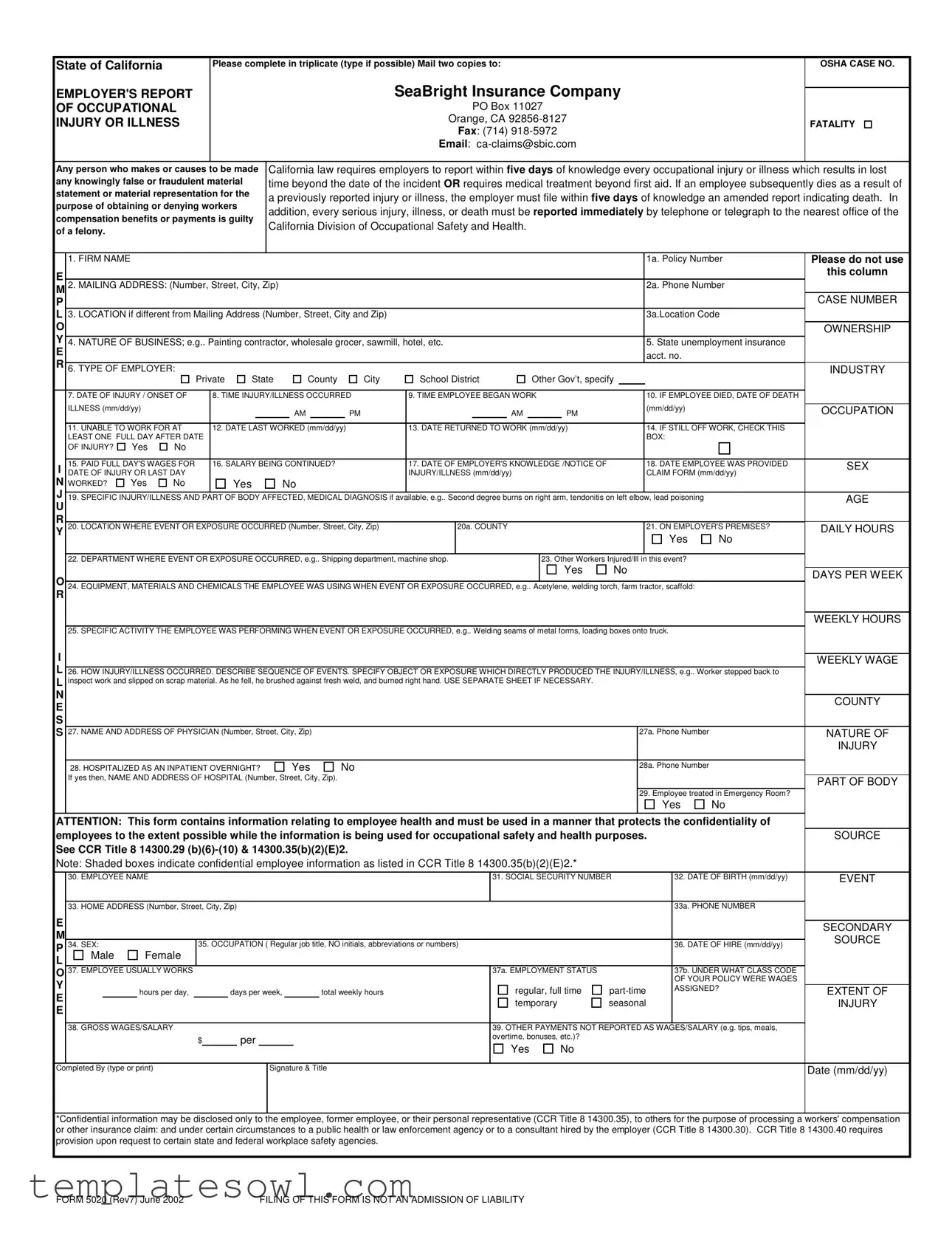

The 5020 California form serves as a crucial tool for employers in the state, facilitating the reporting of occupational injuries or illnesses. Designed to be straightforward, the form must be completed in triplicate by the employer, with two copies sent to SeaBright Insurance Company. It is essential to be aware that California law mandates this report be filed within five days of the employer’s knowledge about any work-related injury or illness that leads to an employee's absence from work or necessitates more than first aid medical treatment. Additionally, if an employee dies as a result of such an injury or illness, an amended report must be submitted within the same timeframe. Major sections of the form require information about the employer, including the nature of the business and ownership details, as well as specifics regarding the injured employee like their occupation, date of injury, and any medical information available. Information on how the injury occurred, including context about equipment involved or other contributing factors, is also critically required. To maintain the confidentiality of worker information, this form must be handled carefully, reflecting the seriousness of its purpose. Understanding the proper use of the 5020 form equips employers to comply with legal obligations, enhance workplace safety, and support their employees in times of need.

5020 California Example

State of California

EMPLOYER'S REPORT OF OCCUPATIONAL INJURY OR ILLNESS

Please complete in triplicate (type if possible) Mail two copies to:

SeaBright Insurance Company

PO Box 11027

Orange, CA

Fax: (714)

Email:

OSHA CASE NO.

FATALITY

Any person who makes or causes to be made any knowingly false or fraudulent material statement or material representation for the purpose of obtaining or denying workers compensation benefits or payments is guilty of a felony.

California law requires employers to report within five days of knowledge every occupational injury or illness which results in lost time beyond the date of the incident OR requires medical treatment beyond first aid. If an employee subsequently dies as a result of a previously reported injury or illness, the employer must file within five days of knowledge an amended report indicating death. In addition, every serious injury, illness, or death must be reported immediately by telephone or telegraph to the nearest office of the California Division of Occupational Safety and Health.

|

|

1. FIRM NAME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1a. Policy Number |

Please do not use |

||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

this column |

|

2. MAILING ADDRESS: (Number, Street, City, Zip) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2a. Phone Number |

|

|||||||||

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

P |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASE NUMBER |

L |

3. LOCATION if different from Mailing Address (Number, Street, City and Zip) |

|

|

|

|

|

|

|

|

|

3a.Location Code |

|

||||||||||||||

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OWNERSHIP |

|

Y |

|

4. NATURE OF BUSINESS; e.g.. Painting contractor, wholesale grocer, sawmill, hotel, etc. |

|

|

|

|

|

5. State unemployment insurance |

|

|||||||||||||||||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

acct. no. |

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6. TYPE OF EMPLOYER: |

Private |

State |

|

County |

City |

School District |

Other Gov’t, specify |

|

|

INDUSTRY |

|||||||||||||||

|

|

|

|

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

7. DATE OF INJURY / ONSET OF |

|

8. TIME INJURY/ILLNESS OCCURRED |

9. TIME EMPLOYEE BEGAN WORK |

|

|

10. IF EMPLOYEE DIED, DATE OF DEATH |

|

|||||||||||||||||

|

|

ILLNESS (mm/dd/yy) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(mm/dd/yy) |

|

|

|

|

|

|

|

|

|

|

|

|

AM |

|

|

PM |

|

|

|

AM |

|

|

PM |

|

|

|

|

OCCUPATION |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

|

|

11. UNABLE TO WORK FOR AT |

|

12. DATE LAST WORKED (mm/dd/yy) |

|

13. DATE RETURNED TO WORK (mm/dd/yy) |

|

|

14. IF STILL OFF WORK, CHECK THIS |

|

||||||||||||||||

|

|

LEAST ONE FULL DAY AFTER DATE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BOX: |

|

|

|

|||

|

|

OF INJURY? |

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

I |

15. PAID FULL DAY'S WAGES FOR |

|

16. SALARY BEING CONTINUED? |

|

17. DATE OF EMPLOYER'S KNOWLEDGE /NOTICE OF |

|

|

18. DATE EMPLOYEE WAS PROVIDED |

SEX |

|||||||||||||||||

DATE OF INJURY OR LAST DAY |

|

|

|

|

|

|

|

|

|

INJURY/ILLNESS (mm/dd/yy) |

|

|

|

|

|

CLAIM FORM (mm/dd/yy) |

|

|||||||||

N |

WORKED? |

Yes |

No |

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

J |

|

19. SPECIFIC INJURY/ILLNESS AND PART OF BODY AFFECTED, MEDICAL DIAGNOSIS if available, e.g.. Second degree burns on right arm, tendonitis on left elbow, lead poisoning |

|

|

AGE |

|||||||||||||||||||||

U |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Y |

20. LOCATION WHERE EVENT OR EXPOSURE OCCURRED (Number, Street, City, Zip) |

|

20a. COUNTY |

|

|

|

|

|

21. ON EMPLOYER'S PREMISES? |

DAILY HOURS |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

22. DEPARTMENT WHERE EVENT OR EXPOSURE OCCURRED, e.g.. Shipping department, machine shop. |

|

23. Other Workers Injured/Ill in this event? |

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

||

O |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAYS PER WEEK |

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

24. EQUIPMENT, MATERIALS AND CHEMICALS THE EMPLOYEE WAS USING WHEN EVENT OR EXPOSURE OCCURRED, e.g.. Acetylene, welding torch, farm tractor, scaffold: |

|

|

|

||||||||||||||||||||||

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEEKLY HOURS

25. SPECIFIC ACTIVITY THE EMPLOYEE WAS PERFORMING WHEN EVENT OR EXPOSURE OCCURRED, e.g.. Welding seams of metal forms, loading boxes onto truck.

I |

WEEKLY WAGE |

|

L26. HOW INJURY/ILLNESS OCCURRED. DESCRIBE SEQUENCE OF EVENTS. SPECIFY OBJECT OR EXPOSURE WHICH DIRECTLY PRODUCED THE INJURY/ILLNESS, e.g.. Worker stepped back to L inspect work and slipped on scrap material. As he fell, he brushed against fresh weld, and burned right hand. USE SEPARATE SHEET IF NECESSARY.

N |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COUNTY |

|

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

S 27. NAME AND ADDRESS OF PHYSICIAN (Number, Street, City, Zip) |

|

|

|

|

|

|

|

|

27a. Phone Number |

|

|

|

NATURE OF |

||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INJURY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

28. HOSPITALIZED AS AN INPATIENT OVERNIGHT? |

|

|

Yes |

|

|

No |

|

|

|

|

|

28a. Phone Number |

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

If yes then, NAME AND ADDRESS OF HOSPITAL (Number, Street, City, Zip). |

|

|

|

|

|

|

|

|

|

|

|

PART OF BODY |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

29. Employee treated in Emergency Room? |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

ATTENTION: This form contains information relating to employee health and must be used in a manner that protects the confidentiality of |

|

|

|||||||||||||||||||||||||||

employees to the extent possible while the information is being used for occupational safety and health purposes. |

|

|

|

|

|

SOURCE |

|||||||||||||||||||||||

See CCR Title 8 14300.29 |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||

Note: Shaded boxes indicate confidential employee information as listed in CCR Title 8 14300.35(b)(2)(E)2.* |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

30. EMPLOYEE NAME |

|

|

|

|

|

|

|

|

|

|

|

|

31. SOCIAL SECURITY NUMBER |

|

|

32. DATE OF BIRTH (mm/dd/yy) |

|

EVENT |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

33. HOME ADDRESS (Number, Street, City, Zip) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

33a. PHONE NUMBER |

|

|

|||||||||||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SECONDARY |

|

M |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SOURCE |

|

P |

34. SEX: |

Female |

35. OCCUPATION ( Regular job title, NO initials, abbreviations or numbers) |

|

|

|

|

|

|

|

36. DATE OF HIRE (mm/dd/yy) |

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

L |

|

Male |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

O |

37. EMPLOYEE USUALLY WORKS |

|

|

|

|

|

|

|

|

|

|

|

|

37a. EMPLOYMENT STATUS |

|

|

|

|

|

37b. UNDER WHAT CLASS CODE |

|

|

|||||||

Y |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OF YOUR POLICY WERE WAGES |

|

|

||

|

|

|

hours per day, |

|

|

days per week, |

total weekly hours |

regular, full time |

|

ASSIGNED? |

|

EXTENT OF |

|||||||||||||||||

E |

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

temporary |

|

seasonal |

|

|

|

|

|

INJURY |

||||

E |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

38. GROSS WAGES/SALARY |

|

|

|

|

|

|

|

|

|

|

|

|

39. OTHER PAYMENTS NOT REPORTED AS WAGES/SALARY (e.g. tips, meals, |

|

|

|||||||||||||

|

|

|

|

|

|

$ |

|

per |

|

|

|

|

|

|

|

overtime, bonuses, etc.)? |

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Completed By (type or print) |

|

|

|

|

|

Signature & Title |

|

|

|

|

|

|

|

|

|

|

|

Date (mm/dd/yy) |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Confidential information may be disclosed only to the employee, former employee, or their personal representative (CCR Title 8 14300.35), to others for the purpose of processing a workers' compensation or other insurance claim: and under certain circumstances to a public health or law enforcement agency or to a consultant hired by the employer (CCR Title 8 14300.30). CCR Title 8 14300.40 requires provision upon request to certain state and federal workplace safety agencies.

FORM 5020 (Rev7) June 2002 |

FILING OF THIS FORM IS NOT AN ADMISSION OF LIABILITY |

Form Characteristics

| Fact Title | Details |

|---|---|

| Form Purpose | The 5020 California form serves as the Employer's Report of Occupational Injury or Illness. |

| Filing Deadline | Employers must report occupational injuries or illnesses within five days of knowledge if they result in lost time or require medical treatment beyond first aid. |

| Death Reporting Requirement | If an employee dies as a result of a previously reported injury, an amended report must be filed within five days of knowledge of the death. |

| Serious Injury Reporting | California law mandates immediate reporting by phone or telegraph to the California Division of Occupational Safety and Health for serious injuries, illnesses, or deaths. |

| Governing Laws | California Code of Regulations (CCR) Title 8, sections 14300.29 and 14300.35 govern the reporting requirements for occupational injuries and illnesses. |

| Submission Copies | The form must be completed in triplicate. Two copies should be mailed to SeaBright Insurance Company. |

| Confidentiality Notice | The form contains sensitive employee health information and must be managed to protect confidentiality. |

| Employer's Liability | Filing this form is not considered an admission of liability for the employer. |

Guidelines on Utilizing 5020 California

Once you have completed the 5020 California form, you will need to send two copies to the SeaBright Insurance Company. Make sure to keep a copy for your records. This form is essential in reporting an employee’s occupational injury or illness. Fill it out completely and accurately to ensure the claims process can proceed smoothly.

- In the first section, fill out the firm name and policy number.

- Provide the mailing address, including the number, street, city, and zip code.

- List the phone number of the firm.

- If the location of the incident is different from the mailing address, fill this out as well.

- State the nature of your business, such as "painting contractor" or "hotel."

- Enter the state unemployment insurance account number.

- Select the type of employer from the given options.

- Specify the date of injury or the onset of illness.

- Note the time the injury or illness occurred.

- Fill in the time employee began work.

- If applicable, enter the date of death.

- Indicate how long the employee will be unable to work.

- Provide the date the employee last worked.

- Fill out the date the employee returned to work, if applicable.

- Check the box if the employee was off work for at least one full day after the incident.

- Indicate if the employee was paid full day’s wages.

- State if the salary is being continued.

- Enter the date of employer’s knowledge of the injury.

- Provide the date the employee was given the claim form.

- List the specific injury or illness and the part of the body affected.

- Fill out the location where the event or exposure occurred.

- Specify the county where the event took place.

- Indicate whether the event occurred on employer’s premises.

- Provide information about the department where the event occurred.

- State whether other workers were injured or ill in the same event.

- List any equipment or materials used during the event.

- Describe the specific activity the employee was doing at the time of the injury.

- Detail how the injury or illness occurred.

- Include the name and address of the physician or medical provider.

- Indicate whether the employee was hospitalized overnight.

- State if the employee was treated in the emergency room.

- Fill out the employee's personal details, including name, social security number, and date of birth.

- Provide the home address of the employee.

- Note the employee’s phone number.

- State the employee's sex and occupation.

- Enter the date of hire.

- Detail the employee’s work schedule in terms of hours per day and days per week.

- Indicate the employment status of the employee.

- Mention the class code of your policy related to the wages.

- Provide the gross wages or salary.

- State if there are other payments not reported as wages or salary.

- Complete the section for who completed the form by typing or printing the name, signature, title, and date.

What You Should Know About This Form

What is the purpose of the 5020 California form?

The 5020 California form serves as an Employer's Report of Occupational Injury or Illness. It is required when an employee suffers an injury or illness that results in lost time beyond the date of the incident or requires medical treatment beyond first aid. Employers must submit this report to document the incident officially. Additionally, if an employee dies as a result of a previously reported injury or illness, this form must be amended to reflect the fatality.

What are the consequences of providing false information on the form?

Providing knowingly false or fraudulent information on the form can lead to severe consequences. Under California law, anyone who makes false statements for the purpose of obtaining or denying workers’ compensation benefits may be prosecuted as a felony. This underscores the importance of accuracy when completing the form, as any discrepancies could lead to legal ramifications for the employer.

How soon must employers report an injury or illness?

Employers are required to report an occupational injury or illness within five days of becoming aware of it. This reporting must occur if the injury results in lost time beyond the initial incident or necessitates medical treatment. Furthermore, serious injuries, illnesses, or fatalities must be reported immediately to the California Division of Occupational Safety and Health by phone or telegraph.

What information is required on the 5020 form?

The 5020 form requires detailed information about the injured employee and the incident. Employers must provide the firm name, contact information, specifics about the nature of the injury, and the circumstances under which it occurred. This includes the type of injury, where it happened, and the equipment or materials involved. Gathering all this information promptly is crucial for compliance and for processing any workers' compensation claims effectively.

Common mistakes

Filling out the 5020 California form can be a straightforward process, but common mistakes can lead to complications down the road. One of the most frequent errors is failing to report the occurrence within the required timeline. California law mandates that employers must submit the form within five days of becoming aware of the occupational injury or illness. Neglecting this could result in penalties or delays in the claims process.

Another common mistake is providing incorrect or incomplete information about the employee. Filling in the employee's name, social security number, and date of birth should be done with care. Mistakes in these sections can cause significant issues, including delays in payments or denials of claims. It's crucial to double-check these details before submission.

Many people also struggle with accurately describing the nature of the injury or illness. It’s not enough to simply state that the employee got hurt; providing a detailed description, including specific injuries and the part of the body affected, is essential. A lack of detail can make it harder for claims to be processed correctly.

Missing the location of the incident is another frequent oversight. Employers must specify where the injury occurred; this includes the exact address and county. If the injury took place off-site, it’s critical to indicate that clearly to avoid confusion with the claims process.

Another area for mistakes involves reporting on the wages of the employee. Make sure to accurately record their gross wages and any other payments that might not be reported as wages. Incorrect figures can lead to issues such as under-compensation, which can harm the employee's recovery experience.

Failure to check the appropriate box regarding the employee's current status off work is equally important. When filling out whether the employee is still off work, be clear and accurate. If this section is overlooked or answered incorrectly, the processing of benefits may be delayed.

Lastly, forgetting to complete all required fields can derail the entire filing process. Each section of the form, from the firm's name down to the details about the injury, must be filled out comprehensively. Before submitting, it’s wise to review the entire form to ensure all necessary information is included.

Documents used along the form

When filing a 5020 California form, certain additional forms and documents are often required to ensure thorough reporting and compliance. Below is a list of these documents, each essential in the claims process regarding workplace injuries.

- Employee Claim Form (DWC 1): This form is filled out by the injured employee to report their claim for benefits. It provides information about the injury or illness, including details about the incident and the medical treatment received. This document initiates the claims process for workers' compensation.

- First Report of Injury (FROI): The FROI captures initial information about the injury as soon as it is reported. It includes details about the employee, the nature and cause of the injury, and the treatment provided. This document serves as the foundation for formalizing a claim with the insurance carrier.

- Subsequent Report of Injury (SROI): If the employee's condition changes, the SROI must be completed. This form updates the insurance company on the employee's medical status, further treatments, and any changes in the claim. Accurate continuation of information is vital for ongoing claims management.

- Medical Reports: Medical records from healthcare providers who treated the employee are crucial. These reports confirm the diagnosis, treatment received, and prognosis. Comprehensive medical documentation assists in validating the claim and ensuring appropriate benefits are provided.

Collecting and submitting these forms alongside the 5020 California form plays a critical role in managing workers' compensation claims effectively. Timely and accurate reporting will help facilitate the claims process for both employers and employees.

Similar forms

- Form 5021 - Employee's Claim for Workers' Compensation Benefits: Like the Form 5020, Form 5021 requires detailed information about the injury, including the nature of the incident and specifics about the employee's condition. Both forms serve the purpose of initiating the claims process, ensuring employers meet their reporting obligations under California law.

- Form 5022 - Claim for Compensation: This form is similar in that it details the employee's claim for various workers’ compensation benefits. Both documents seek comprehensive information relating to the injured party's employment status and medical care needed as a result of the injury or illness.

- OSHA Form 300 - Log of Work-Related Injuries and Illnesses: While Form 5020 focuses on immediate reporting following an injury, OSHA Form 300 documents injuries over a calendar year. Both forms aim to track workplace safety and employee health, thereby increasing awareness and facilitating compliance with regulations.

- Form DWC-1 - Workers' Compensation Claim Form: This form is akin to Form 5020 because it is filed to initiate a workers' compensation claim. It collects information about the employee’s injury and requirements for medical treatment, emphasizing timely reporting.

- Form 300A - Summary of Work-Related Injuries and Illnesses: This document serves as a summary of the injuries recorded throughout the year and is similar to Form 5020 in its goal of promoting workplace safety. Both documents are foundational in maintaining effective health and safety reporting within the workplace.

- California C-120 - Report of Occupational Injury or Illness: This form is comparable to Form 5020 as it also requires reporting of workplace injuries, detailing specifics like treatment, date of occurrence, and how the event transpired. Timely submission is key in both.

- Form DWC-7 - Notice of Claim Rejection: This is similar because it relates to the workers' compensation process. While it addresses claim rejections, both forms play a crucial role in the broader context of injury reporting and understanding employer responsibilities.

- Form 7 - Workers' Compensation Claim Receipt: This document provides acknowledgment of workers' compensation claims and aligns with the reporting requirements outlined in Form 5020. Both ensure clear communication between employee and employer regarding injury claims.

- Employer's First Report of Injury or Illness (FROI): This is another critical document in the reporting process. Like Form 5020, it captures essential details about workplace injuries, emphasizing the employer's obligation to report incidents promptly to the relevant authorities.

Each of these forms plays a pivotal role in documenting workplace incidents and ensuring compliance with California's strict safety regulations. Understanding their similarities helps clarify the responsibilities of employers when handling occupational injuries.

Dos and Don'ts

When filling out the 5020 California form, it is crucial to adhere to proper guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do complete the form in triplicate. This ensures that multiple copies are available for distribution.

- Do provide accurate and complete information about the employer, employee, and the incident itself.

- Do submit the completed form within five days of your knowledge of the injury or illness.

- Do describe the sequence of events leading to the injury in detail.

- Don't include false or misleading information on the form, as this can be considered a felony.

- Don't assume all injuries only need to be reported for serious cases; any injury requiring lost time or medical treatment must be reported.

- Don't forget to check the boxes indicating whether an employee is still off work or if wages are being continued.

- Don't overlook providing the name and address of the physician who treated the employee, if applicable.

Misconceptions

Here are five common misconceptions about the 5020 California form, the Employer's Report of Occupational Injury or Illness:

- This form is optional for employers. Many employers believe that filing the 5020 form is optional. In reality, California law mandates that employers report occupational injuries and illnesses that result in lost time or require medical treatment beyond first aid.

- Filing the form means admitting liability. Some employers worry that submitting this form will be seen as an admission of liability for the incident. However, filing the 5020 does not constitute an admission of liability; it serves as a necessary report for compliance with state regulations.

- The deadline for filing is flexible. It is a misconception that employers have time to delay the filing of this report. California law requires that the report be submitted within five days of the employer becoming aware of the injury or illness.

- Only serious injuries need to be reported. Some believe only serious injuries warrant a report on the 5020 form. In fact, any injury or illness that results in lost time or requires medical treatment beyond first aid must be reported.

- All injuries can be reported later. There is a misunderstanding that injuries can be reported at any time after the incident. Employers must report injuries promptly. If an employee dies from a previously reported injury, an amended report must also be filed within five days.

Key takeaways

When filling out the California Form 5020, it's important to follow several guidelines to ensure proper compliance and reporting.

- Complete in Triplicate: Ensure you have three copies of the form ready before submission.

- Timely Reporting: Submit the form within five days of knowing about any occupational injury or illness that results in lost time or requires medical treatment.

- Contact the Relevant Authorities: For serious injuries or fatalities, immediately contact the California Division of Occupational Safety and Health.

- Accurate Information: Fill in all required fields, including the policy number and mailing address, to avoid delays.

- Clearly Describe the Incident: Include a detailed account of how the injury or illness occurred, specifying any objects or exposures involved.

- Medical Information: If available, provide a medical diagnosis and the treating physician's name and contact details.

- Confidentiality Matters: Handle all employee health information with care to protect confidentiality as mandated by law.

- Type of Employer: Identify the type of employer accurately, as this can affect reporting requirements.

- No Admission of Liability: Keep in mind that submitting this form does not imply liability for the injury or illness.

- Use Correct Contact Information: Make sure to send copies to the correct address and provide any necessary phone numbers for follow-up.

By taking these steps and ensuring accurate reporting, employers can fulfill their legal obligations while also supporting employee welfare.

Browse Other Templates

Free Rabbit Pedigree Template - The form aids in promoting and sustaining rabbit breeding heritage.

Texas Certificate of Conversion Foreign Entity - Failure to complete required sections may delay the processing of document filings.