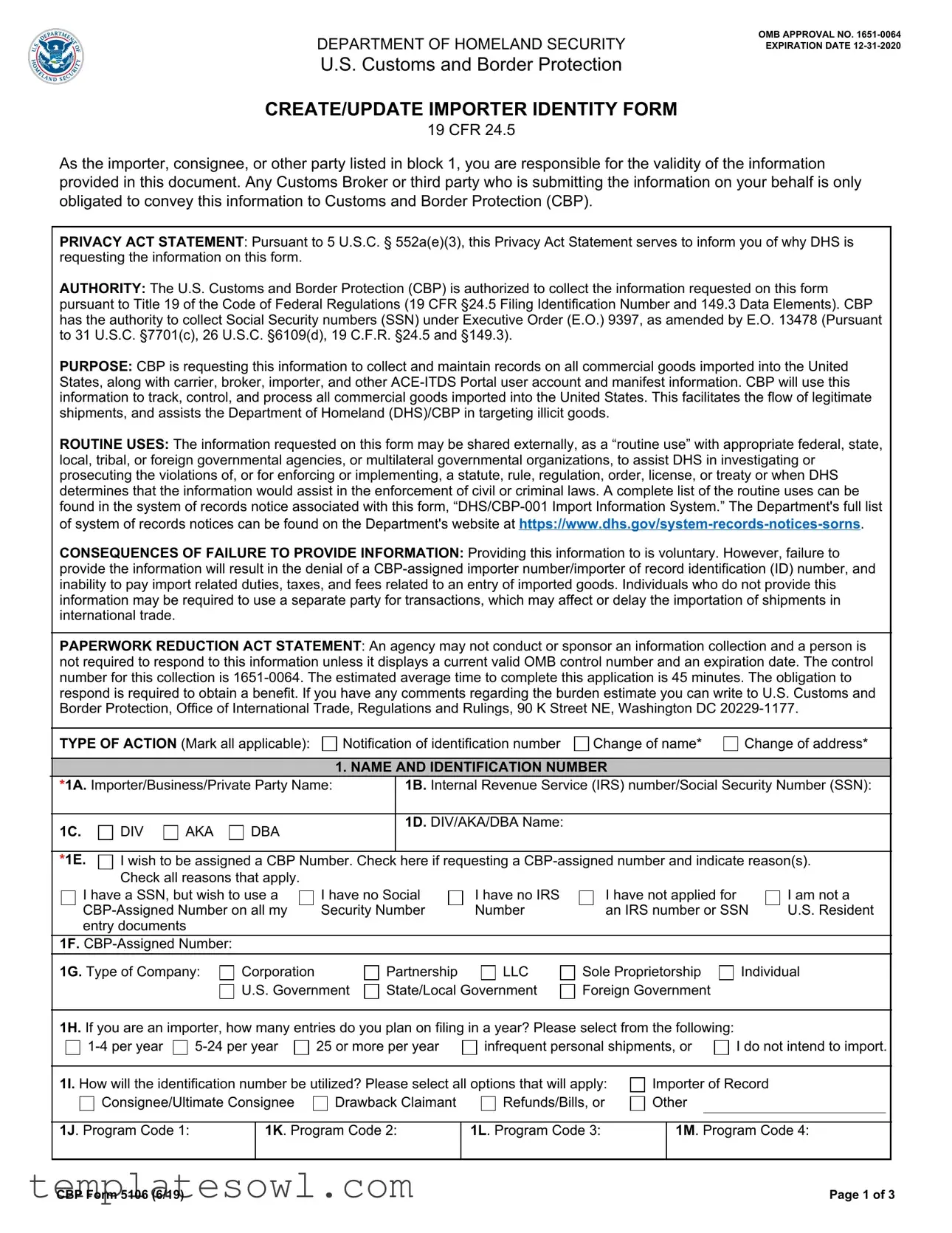

Fill Out Your 5106 Form

The 5106 form, officially known as the Create/Update Importer Identity Form, is a crucial document for anyone involved in the importation of goods into the United States. This form must be completed by importers, consignees, or any party indicated in Block 1, detailing information about businesses and individuals seeking to gain or modify their CBP (U.S. Customs and Border Protection) assigned importer number. The 5106 form plays an essential role in maintaining the integrity of the import process. It ensures that accurate records are preserved for all commercial goods entering the U.S., tracking vital details about carriers, brokers, and other parties involved. Additionally, importing parties must be aware of their legal responsibilities regarding the information provided. Failure to complete or submit this form correctly can result in severe consequences, such as denial of entry or delays in shipments. Importers are required to offer personal identification details, including an IRS number or Social Security Number, along with their business structure and operation specifics. Privacy protocols are adhered to, ensuring that the collected information is safeguarded and only shared when necessary for enforcement of trade regulations. The urgency to complete the 5106 form correctly cannot be overstated, as it directly impacts the overall efficiency and legality of importing activities.

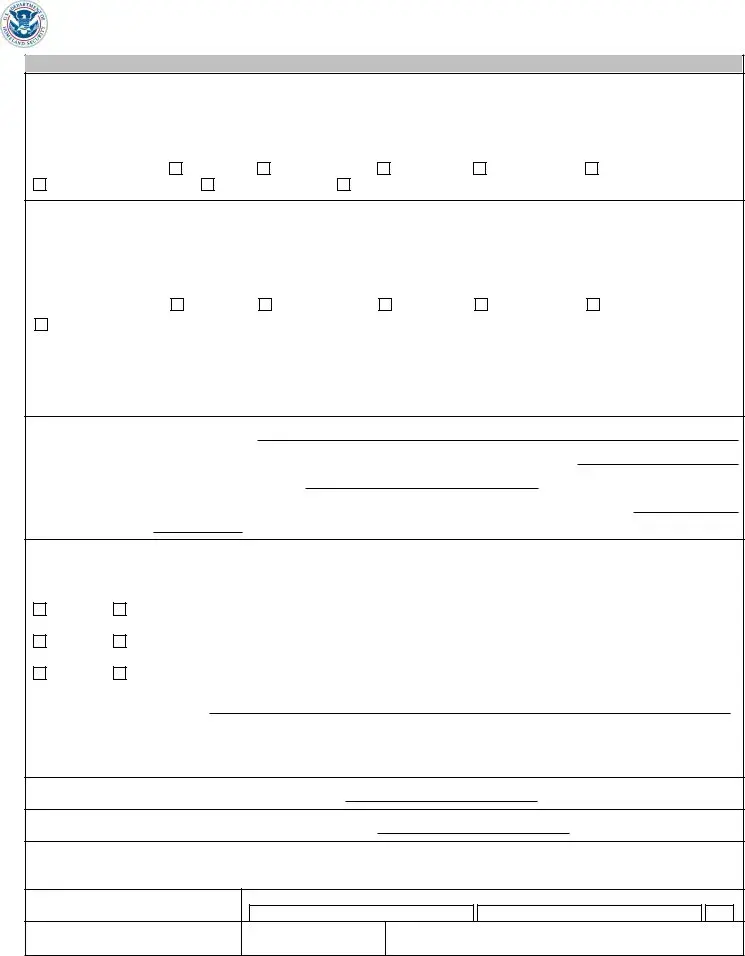

5106 Example

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

CREATE/UPDATE IMPORTER IDENTITY FORM

19 CFR 24.5

OMB APPROVAL NO.

As the importer, consignee, or other party listed in block 1, you are responsible for the validity of the information provided in this document. Any Customs Broker or third party who is submitting the information on your behalf is only obligated to convey this information to Customs and Border Protection (CBP).

PRIVACY ACT STATEMENT: Pursuant to 5 U.S.C. § 552a(e)(3), this Privacy Act Statement serves to inform you of why DHS is requesting the information on this form.

AUTHORITY: The U.S. Customs and Border Protection (CBP) is authorized to collect the information requested on this form pursuant to Title 19 of the Code of Federal Regulations (19 CFR §24.5 Filing Identification Number and 149.3 Data Elements). CBP has the authority to collect Social Security numbers (SSN) under Executive Order (E.O.) 9397, as amended by E.O. 13478 (Pursuant to 31 U.S.C. §7701(c), 26 U.S.C. §6109(d), 19 C.F.R. §24.5 and §149.3).

PURPOSE: CBP is requesting this information to collect and maintain records on all commercial goods imported into the United States, along with carrier, broker, importer, and other

ROUTINE USES: The information requested on this form may be shared externally, as a “routine use” with appropriate federal, state, local, tribal, or foreign governmental agencies, or multilateral governmental organizations, to assist DHS in investigating or prosecuting the violations of, or for enforcing or implementing, a statute, rule, regulation, order, license, or treaty or when DHS determines that the information would assist in the enforcement of civil or criminal laws. A complete list of the routine uses can be found in the system of records notice associated with this form,

CONSEQUENCES OF FAILURE TO PROVIDE INFORMATION: Providing this information to is voluntary. However, failure to provide the information will result in the denial of a

PAPERWORK REDUCTION ACT STATEMENT: An agency may not conduct or sponsor an information collection and a person is not required to respond to this information unless it displays a current valid OMB control number and an expiration date. The control number for this collection is

TYPE OF ACTION (Mark all applicable): |

Notification of identification number |

Change of name* |

Change of address* |

1. NAME AND IDENTIFICATION NUMBER

*1A. Importer/Business/Private Party Name: 1B. Internal Revenue Service (IRS) number/Social Security Number (SSN):

1C. |

DIV |

AKA |

DBA |

1D. DIV/AKA/DBA Name: |

|

||||

|

|

|||

*1E. |

I wish to be assigned a CBP Number. Check here if requesting a |

|||

|

Check all reasons that apply. |

|

||

I have a SSN, but wish to use a |

I have no Social |

I have no IRS |

I have not applied for |

|

I am not a |

||

Security Number |

Number |

an IRS number or SSN |

U.S. Resident |

||||

entry documents |

|

|

|

|

|

|

|

1F. |

|

|

|

|

|

|

|

1G. Type of Company: |

Corporation |

|

Partnership |

LLC |

Sole Proprietorship |

Individual |

|

|

U.S. Government |

State/Local Government |

Foreign Government |

|

|

||

1H. If you are an importer, how many entries do you plan on filing in a year? Please select from the following:

25 or more per year |

infrequent personal shipments, or |

I do not intend to import. |

||||||

|

|

|

||||||

1I. How will the identification number be utilized? Please select all options that will apply: |

Importer of Record |

|||||||

Consignee/Ultimate Consignee |

Drawback Claimant |

Refunds/Bills, or |

Other |

|

|

|||

|

|

|

|

|

|

|

|

|

1J. Program Code 1: |

|

1K. Program Code 2: |

1L. Program Code 3: |

|

1M. Program Code 4: |

|||

|

|

|

|

|

|

|

|

|

CBP Form 5106 (6/19) |

Page 1 of 3 |

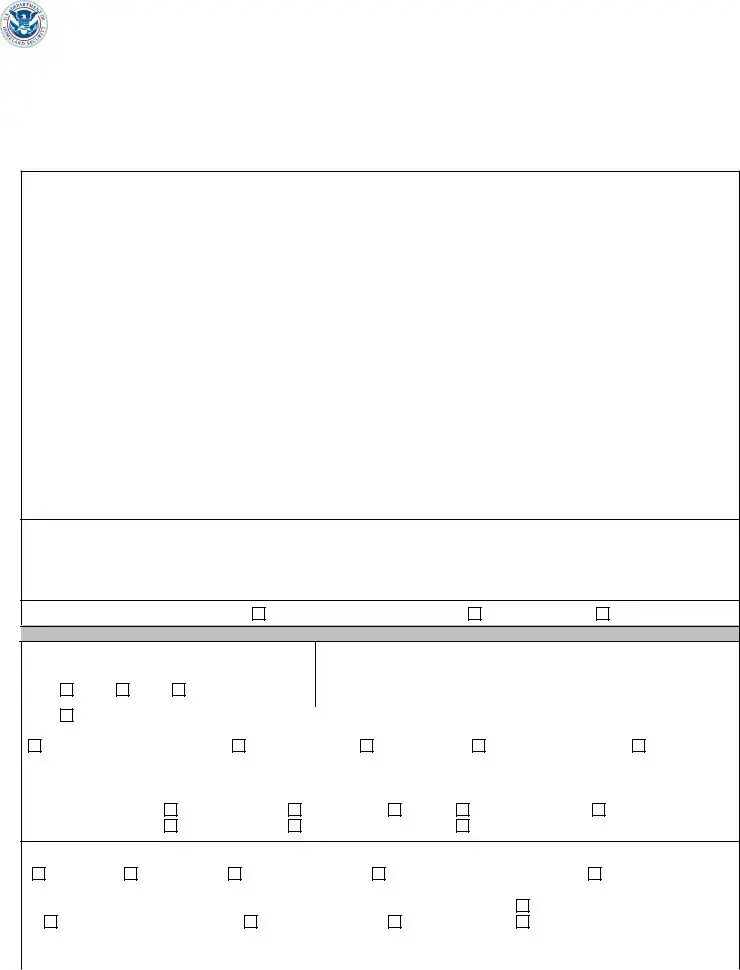

2.ADDRESS INFORMATION 2A. MAILING ADDRESS (Each street address line can be no more than 32 characters)

*Street Address 1: |

|

|

*City: |

|

|

|

|

*State/Province: |

||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

Street Address 2: |

|

|

Zip Code: |

|

|

Country ISO Code: |

||||

|

|

|

|

|

|

|

|

|

|

|

*Is the address in 2A, a |

Residence |

Corporate Office |

Warehouse |

Retail Location |

|

Office Building |

||||

Business Service Center |

Post Office Box or |

Other - Explain: |

|

|

|

|

|

|

||

2B. PHYSICAL LOCATION ADDRESS (Required only if different than mailing address. 32 character limit applies to street address line)

|

*Street Address 1: |

|

|

|

*City: |

|

|

|

|

*State/Province: |

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

Street Address 2: |

|

|

|

Zip Code: |

|

|

Country ISO Code: |

|||||

|

|

|

|

|

|

|

|

|

|||||

|

*Is the address in 2B, a |

Residence |

Corporate Office |

Warehouse |

Retail Location |

|

Office Building or |

||||||

|

Other - Explain: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

2C. *Phone number: |

|

Extension: |

|

2D. Fax number: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|||

|

2E. *Email address: |

|

|

|

2F. Website: |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

3. COMPANY INFORMATION |

|

|

|

|

|

|||

3A. Provide a brief business description:

3B. Provide the

3C. Provide the

3D. If you are also a

3E. Year established:

3F. List the names and Internal Revenue Service (IRS) employer identification, Social Security or

Related Business |

Name of Business Entities |

||

Current |

Previous |

|

|

|

|

|

|

Current |

Previous |

|

|

|

|

|

|

Current |

Previous |

|

|

|

|

|

|

3G. Primary Banking Institution:

(Name)

|

|

|

|

|

|

|

(Bank Routing Number) |

|

(City) |

|

(State) |

|

(Country ISO Code) |

3H. Certificate or Articles of Incorporation - (Locater I.D.)

3I. Certificate or Articles of Incorporation – (Reference Number)

3J. Business Structure/Beneficial Owner/Company Officers - The officers listed in this section must have importing and financial business knowledge of the company listed in section 1 of this form and must have legal authority to make decisions on behalf of the company listed in section 1. Elements designated below with an asterisk are optional data fields.

Company Position Title:

Direct Phone Number:

Name (Last, First, Middle Initial):

Extension: |

Direct Email: |

CBP Form 5106 (6/19) |

Page 2 of 3 |

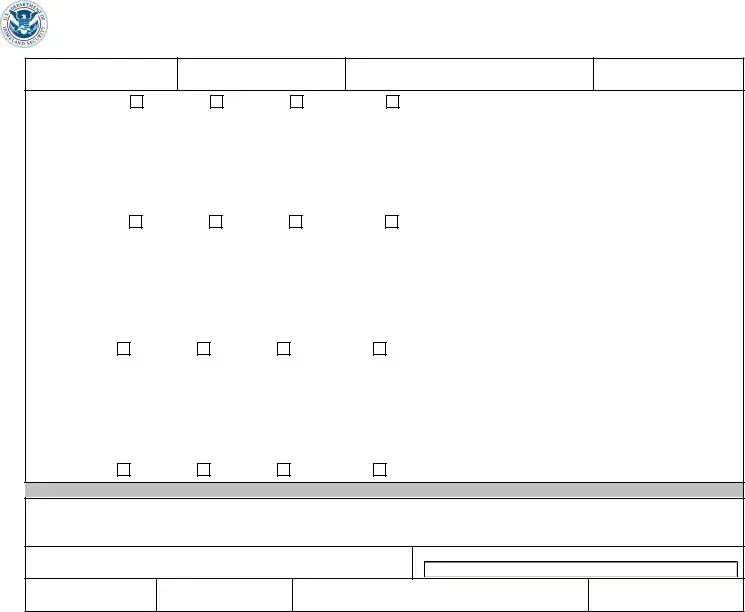

Social Security Number:

Passport Number:

Country of Issuance:

Passport Expiration Date:

Passport Type: |

Regular |

|

Official |

Diplomatic |

|

Passport Card |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Company Position Title: |

|

|

|

|

|

|

|

Name (Last, First, Middle Initial): |

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Phone Number: |

|

|

|

|

|

|

|

Extension: |

|

Direct Email: |

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Social Security Number: |

|

Passport |

Number: |

|

|

Country |

of Issuance: |

|

Passport Expiration Date: |

||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

*Passport Type: |

Regular |

|

Official |

Diplomatic |

|

Passport Card |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Company Position Title: |

|

|

|

|

|

Name (Last, First, Middle Initial): |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct Phone Number: |

|

|

|

|

|

Extension: |

|

|

|

Direct Email: |

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||

Social Security Number: |

|

Passport Number: |

|

Country of Issuance: |

Passport Expiration Date: |

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Passport Type: |

Regular |

Official |

Diplomatic |

|

Passport Card |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Company Position Title: |

|

|

|

|

|

Name (Last, First, Middle Initial): |

|

|

|

|

|

|

|

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Direct Phone Number: |

|

|

|

|

|

Extension: |

|

|

|

Direct Email: |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

Social Security Number: |

|

Passport Number: |

|

Country |

of Issuance: |

Passport Expiration Date: |

|||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

Passport Type: |

Regular |

Official |

Diplomatic |

|

Passport Card |

|

|

|

|

|

|

|

|

||||||||||||||

4. CERTIFICATION

By my signature below, I certify that, to the best of my knowledge and belief, all of the information included in this document is true, correct, and provided in good faith. I understand that if I make an intentional false statement, or commit deception or fraud in this 5106 document, I may be fined or imprisoned (18 U.S.C. § 1001).

*Printed or Typed Full Name and Title:

Telephone Number: *Date:

Broker Name:

*Signature:

Telephone Number:

CBP Form 5106 (6/19) |

Page 3 of 3 |

INSTRUCTIONS

TYPE OF ACTION

Notification of Identification Number - Check this box if this is your first request for services with CBP, or if your current Importer Number is inactive and you wish to activate this number.

Change Name - Check this box if the Importer Number is on file but there is a change in the name.

Change of Address - Check this box if the Importer Number is on file but there is a change in the address.

For updates involving changes to an existing IOR other than a “Change of Name” and “Change of Address”, the “TYPE OF ACTION” should be left blank.

NOTE - If a “Change of Address” and/or “Change of Name” is requested for an importer or other party that has an active bond on file with CBP, then a name and/or address rider must accompany this change document, unless the rider is otherwise not required for the bond pursuant to a CBP test announced in the Federal Register, such as CBP's eBond Test Program, or otherwise not required by CBP's regulations.

SECTION 1 - NAME AND IDENTIFICATION NUMBER

1A - Importer/Business/Private Name - Please indicate the name of the company or individual who will be importing or seeking service or payment. If you are submitting this document as a consignee to the import transaction, sections 1 and 2 must be filled out completely.

1B - IRS/SSN - Complete this block if you are assigned an Internal Revenue Service (IRS) employer identification number or Social Security Number (SSN). If neither an IRS employer identification number nor a Social Security Number (SSN) has been assigned, the word “NONE” shall be written in 1B. The SSN should belong to the principal or owner of the company.

1C - DIV/AKA/DBA - Complete this block if an importer is a division of another company (DIV), is also known under another name (AKA), or conducts business under another name (DBA).

1D - Complete this block only if Block 1C is used.

1E - Request

PLEASE NOTE: A

3J of this form. If you have elected to request a CBP Assigned Number in lieu of your SSN, you must provide your SSN in section 3J of this form. In general, a CBP- assigned number will be issued to foreign businesses or individuals, provided no IRS employer identification number or SSN exists for the requester. A requester can choose to keep using the

1F -

1G - Type of Company- Please select the description that accurately describes your company. A Limited Liability Company (LLC) is not a corporation; it is a legal form of company that provides limited liability to its owners.

1H - Provide an estimate of the number of entries that will be imported into the U.S. in one year, if you are an importer of record.

1I - Check the boxes which will indicate how the name and identification number will be utilized. If the role of the party is not listed, you can select “Other” and then list the specific role for the party. (ex., Transportation carrier, Licensed Customs Brokerage Firm, Container Freight Station, Commercial Warehouse/Foreign Trade Zone Operator, Container Examination Station or Deliver to Party).

1J thru 1M - If you are currently an active participant in a CBP Partnership Program(s), please provide the program code in Block 1J thru Block 1M of the revised CBP Form 5106 and the information that is contained in Section 3 of the revised CBP Form will not be required. (ex., Customs Trade Partnership Against Terrorism - CTPAT, Importer

SECTION 2 - ADDRESS INFORMATION

2A - MAILING ADDRESS (Mailing Address for the named business entity or individual referenced in section 1)

Street Address 1 - This block must always be completed. It may or may not be the physical location. Insert a post office box number or a street number representing the first line of the mailing address. For a U.S. or Canadian mailing address, additional mailing address information may be inserted. If a P.O. Box number is given for the mailing address, a second address (physical location) must be provided in 2B. This line can be no more

than 32 characters long.

Street Address 2 - If applicable, this block must always be completed with the apartment, suite, floor, and/or room number. This line can be no more than 32 characters long.

City - Insert the city name of the importer's mailing address.

State/Province - - For a U.S., Canadian, or Mexican mailing address, a

Zip Code - For a U.S. mailing address, insert a 5 or

CBP Form 5106 (6/19) |

Instructions Page 1 of 2 |

Country ISO Code - For a U.S. mailing address, leave blank. For any foreign mailing address, including Canada and Mexico, insert a

Type of Address - Check the box that describes this address.

2B - PHYSICAL LOCATION ADDRESS - Please provide the address that is associated with the business or the individual. This address cannot be a P.O. Box, Business Service Center, etc. The address associated with the business can be the principal's home address. The Physical Location Address does not need to be provided on the form if it is the same as the mailing address.

Street Address 1- If the place of business is the same as the mailing address, leave blank. If different from the mailing address, insert the company's business address in this space. A second address representing the company's place of business is to be provided if the mailing address is a post office box or drawer. This line can be no more than 32 characters long.

Street Address 2 - If applicable, this block must always be completed with the apartment, suite, floor, and/or room number. This line can be no more than 32 characters long.

City - Insert the city name for the business address.

State/Province - For a U.S. address, insert a

Zip Code - For a U.S. business address, insert a 5 or

Country ISO Code - For a U.S. address, leave blank. For any foreign address, including Canada and Mexico, insert a

Type of Address - Check the box which describes this address. |

|

2C - Phone Number - The phone number and extension. |

2D - Fax Number - The fax number. |

2E - |

2F - Website - The website. |

SECTION 3 - COMPANY INFORMATION In most cases the data elements in this section are optional. However, if the "I have an SSN, but wish to use a

The absence of this information will affect CBP's ability to fully understand the level of risk on subsequent transactions and could result in the delay of cargo release or the processing of a refund.

3A - Provide a brief description of your business.

3B - Complete this field if you know the North American Industry Classification System (NAICS) code as defined by the Department of Commerce. Provide your

3C - If available, provide the Dun & Bradstreet Number for the name that was presented in section 1.

3D - If you are an importer who is a

3E - Indicate the year in which your company was established.

3F - Related Businesses Information - List the name and IRS employer identification number, Social Security Number or

3G - Indicate the primary banking information for the company that is listed in 1B.

3H - Certificate or Articles of Incorporation - Provide the

3I - Certificate or Articles of Incorporation - Provide the file, reference, entity, issuance or unique identifying number for the certificate or articles of incorporation or the foreign articles of incorporation. (as applicable)

3J - Business Structure/Beneficial Owner/Company Officer - The Beneficial Owner is any individual or group of individuals that, either directly or indirectly, has the power to vote or influence the transaction decisions regarding a specific security or one who has the benefits of ownership of a Security (finance) or property and yet does not nominally own the asset itself. Beneficial Owner/ Company Officers must have importing and financial business knowledge of the company listed in section 1 and the legal authority to make decisions on behalf of the company listed in section 1 with respect to that knowledge. Please note that in most instances the SSN or “Passport Number”, “Country of Issuance”, “Passport Expiration Date”, and “Passport Type”, in the absence of an SSN, are optional in this block. However, if the "I have an SSN, but wish to use a

CBP Form 5106 (6/19) |

Instructions Page 2 of 2 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Title | U.S. Customs and Border Protection Create/Update Importer Identity Form. |

| Authority | Authorized under Title 19 of the Code of Federal Regulations, specifically 19 CFR §24.5 and §149.3. |

| Privacy Act Statement | Information is collected under 5 U.S.C. § 552a(e)(3) for specific purposes and is subject to privacy protections. |

| Purpose | This form is used to collect information for tracking, controlling, and processing imported goods. |

| Consequences of Non-Compliance | Failure to provide information may result in denial of a CBP-assigned importer number, affecting importation. |

| OMB Approval | Form has OMB approval number 1651-0064, with expiration date of December 31, 2020. |

| Time to Complete | Estimated time to fill out the form is 45 minutes. |

| Routine Uses | Information may be shared with governmental agencies for enforcement and investigative purposes. |

| Type of Action | Options include notification of identification number, change of name, or change of address. |

Guidelines on Utilizing 5106

Filling out the 5106 Form can feel daunting, but with the right approach, it can be straightforward. This form is essential for importing goods into the United States. After completing it, you'll submit it to U.S. Customs and Border Protection (CBP). If all information is accurate and complete, you should receive your CBP-assigned importer number, which will be vital for your future transactions.

- Determine the Type of Action: Circle the applicable option: Notification of Identification Number, Change of Name, or Change of Address.

- Enter Your Name and Identification Number:

- Provide your Importer/Business/Private Party Name.

- Include your IRS number or SSN.

- If applicable, fill in the DIV AKA DBA and the DIV/AKA/DBA Name.

- Request a CBP Number if needed by checking the appropriate box.

- If you already have a CBP-assigned number, fill that in as well.

- Select the Type of Company: Corporation, Partnership, LLC, Sole Proprietorship, etc.

- Indicate how many entries you plan on filing each year.

- Specify how the identification number will be used.

- Provide Your Address Information:

- Fill in your Mailing Address completely.

- If your Physical Location Address differs, provide that too.

- Include your phone number, fax number, email address, and website.

- Include Company Information:

- Write a brief description of your business.

- Enter the 6-digit NAICS code for your business.

- If applicable, provide the D-U-N-S Number.

- Add your year established and relevant banking institution information.

- If there are any related businesses, list their names and numbers.

- Complete the Certification Section:

- Print or type your full name and title.

- Provide a date.

- Sign the form and include your telephone number.

What You Should Know About This Form

What is the purpose of the 5106 form?

The 5106 form, also known as the Create/Update Importer Identity Form, is primarily used by importers, consignees, or other parties involved in importing goods into the United States. Its main purpose is to collect and maintain records regarding commercial goods entering the country. The U.S. Customs and Border Protection (CBP) utilizes this information to track shipments, facilitate the flow of legitimate trade, and assist in targeting illegal goods. By providing accurate details, importers can ensure smoother transactions and compliance with U.S. regulations.

Who is required to file the 5106 form?

Any individual or business planning to import goods into the United States is required to complete the 5106 form. This includes companies, partnerships, sole proprietorships, and government entities. Importers must provide information about themselves, their business structure, and the nature of their importing activities. If a Customs Broker or another third party is submitting this form on behalf of the importer, they are responsible for accurately conveying the necessary information, but the ultimate responsibility lies with the importer.

What happens if I do not provide the information requested on the 5106 form?

Failure to complete and submit the 5106 form may result in significant complications. Specifically, individuals who do not provide the required information may be denied a CBP-assigned importer number or identification number. Without this number, it becomes impossible to pay import-related duties, taxes, and fees, which can delay or hinder the importation process. Importers may need to resort to using a different party for transactions, creating additional challenges and potential delays in international trade.

What information should I include on the 5106 form?

When filling out the 5106 form, it is crucial to provide accurate and comprehensive information. This includes the name of the business or individual importing goods, the Internal Revenue Service (IRS) number or Social Security Number (SSN), and the physical and mailing addresses. Additionally, details about the company type, the number of import entries anticipated in a year, and how the identification number will be utilized must be included. Providing related business information and banking details may also be necessary, depending on the unique circumstances of the importing entity. Ensuring all sections are completed accurately can help prevent processing delays.

Common mistakes

Filling out the CBP Form 5106 is a critical step for importers and businesses engaging in international trade. However, many make common errors that can delay processing or cause complications. Here are nine frequent mistakes individuals make when completing this form.

One notable error involves leaving out necessary information, especially in Section 1. This section requires detailed information about the importer, including the Name and IRS or Social Security Number (SSN). Failing to provide the required identifiers can result in denial of the importer number and related duties, taxes, and fees.

Another mistake occurs when individuals check incorrect boxes regarding the Type of Action. Whether they are applying for a notification of identification number, a name change, or an address change, choosing the wrong option can lead to unnecessary processing delays.

Additionally, many people forget to indicate the Type of Company accurately. This omission or incorrect selection can create confusion and affect how the company is categorized and treated under customs regulations. It’s essential to ensure that the selected option truly reflects the business structure.

In Section 2, errors related to the Address Information occur frequently. Individuals often provide incomplete mailing or physical addresses, or they might use a post office box where a physical address is required. This mistake can significantly hinder CBP's ability to process the application correctly.

Providing inaccurate or outdated contact information, such as phone numbers or email addresses, is another common issue. Ensuring that this information is accurate allows CBP to reach out for any clarifications or updates if necessary.

Understanding Section 3 is also crucial. Some individuals neglect to provide a business description or fail to include their NAICS code. This information is vital for CBP to assess the nature of the business properly, and leaving it blank can lead to unnecessary follow-ups.

Individuals sometimes overlook the importance of beneficial owner information. If the Company Officer section isn’t filled out completely, delays may occur as CBP seeks additional information. This section directly relates to accountability within the importing process.

Furthermore, those who are self-filing might forget to enter their Filer Code in Section 3D, which can be critical for those handling their own transactions with CBP. Its absence can lead to a lack of proper identification in processing.

Finally, individuals often ignore the importance of signing the certification section. Without a proper signature, the form remains incomplete, and the corresponding application is unlikely to be processed. Thus, every detail matters when submitting the 5106 form.

By avoiding these common mistakes, individuals can ensure a smoother process when filling out the CBP Form 5106, ultimately facilitating their engagement in international trade more effectively.

Documents used along the form

The 5106 Form, officially known as the Create/Update Importer Identity Form, is essential for individuals or businesses engaged in importing goods into the United States. Along with this form, several other documents are often necessary to ensure compliance with U.S. Customs and Border Protection (CBP) requirements. Below is a list of commonly associated forms and documents that may be required during the importation process.

- Customs Bond: This document acts as a guarantee to CBP that duties, taxes, and penalties owed will be paid. Importers usually need this bond to ensure compliance, and it is often required for entry of certain goods.

- Commercial Invoice: This is a vital document that details the transaction between the seller and buyer. It includes information such as the value of the goods being imported, a description of the items, and terms of sale. Customs uses this to assess duties and taxes.

- Packing List: This document provides information about the contents of a shipment, including the number of items and how they are packed. While not always mandatory, it can facilitate a smoother inspection process by CBP.

- Bill of Lading: This is a legal document issued by a carrier to acknowledge receipt of cargo for shipment. It serves as a contract between the owner of the goods and the carrier and may be required for the import process.

- Import License: Certain goods may require specific licenses or permits before they can be imported. This document varies depending on the type of merchandise and the regulations governing it.

- Pro Forma Invoice: This is a preliminary bill of sale that outlines the terms of sale but is not yet finalized. It can be used for customs purposes to estimate duties and taxes, especially when actual invoices are not available at the time of entry.

Each of these documents plays an important role in the importation process, ensuring that goods are legally and properly brought into the U.S. By preparing and submitting the necessary forms along with the 5106 Form, importers can help streamline their interactions with customs officials.

Similar forms

- Form W-9: Similar to the 5106 form, the W-9 is used to collect taxpayer identification information, including the name and Taxpayer Identification Number (TIN), ensuring compliance with IRS regulations.

- Form 1040: This is the individual income tax return, where individuals report income, deductions, and other tax-related information. It requires accurate personal and business details, much like the importer details on the 5106.

- Form SS-4: This form requests an Employer Identification Number (EIN) from the IRS. It shares the necessity for identification numbers to correctly associate entities for tax purposes, similar to the importer number in the 5106.

- Customs Form 7501: The Entry Summary form details imported goods, the parties involved, and duties owed, paralleling the 5106’s focus on commercial import records and party identification.

- Form I-94: Issued by the Department of Homeland Security, it tracks arrivals and departures of non-U.S. citizens entering the country, similar in its purpose of maintaining accurate records of individuals associated with importing activities.

- CBP Form 3461: This is the entry/entry summary form for importing goods to the U.S. It also captures crucial details about the importer, akin to the data required in the 5106.

- Form 8842: The Election to Foreign Trust Beneficiaries focuses on identifying and reporting sensitive beneficiary information, demonstrating the importance of complete and accurate identification processes, like the 5106.

- Form 1042: This is the Annual Withholding Tax Return for U.S. Source Income of Foreign Persons, similarly emphasizing the need for identification and compliance for accurate reporting of entities receiving payments.

- Form 8300: Required for reporting cash payments over $10,000, this form is used to identify parties involved in larger transactions, mirroring the 5106's emphasis on valid identification and data collection for importing identification.

Dos and Don'ts

- Do provide accurate and complete information in every section to avoid delays.

- Don't leave any required fields blank; if a section doesn’t apply, state "N/A" instead.

- Do double-check your IRS number or Social Security Number for accuracy.

- Don't use a P.O. Box as your physical address unless specified; ensure the physical location is correct.

- Do keep a copy of the completed form for your records.

- Don't forget to sign and date the form before submission; an unsigned form may be rejected.

Misconceptions

- Misconception 1: The 5106 form is only for U.S. residents. Many believe that only U.S. residents must fill out the form. In fact, non-resident individuals and foreign businesses may also need to complete it to obtain an importer identification number.

- Misconception 2: A Customs Broker is responsible for the information on the 5106 form. It's a common misconception that if a Customs Broker submits the form, they bear the responsibility for accuracy. The importer or consignee listed is ultimately responsible for the validity of the information provided.

- Misconception 3: The information on the form is strictly confidential. While information might be shared with certain governmental agencies for enforcement purposes, it often gets disclosed under routine uses as indicated in the Privacy Act Statement.

- Misconception 4: Filing the 5106 form guarantees rapid processing of imports. Although this form is crucial for obtaining an importer identification number, timely processing of goods depends on various factors, including regulatory compliance and additional documentation.

- Misconception 5: Providing a Social Security Number (SSN) is mandatory for everyone. While SSNs may be collected, businesses without an SSN can still request a CBP-assigned number if they do not have an IRS number.

- Misconception 6: The 5106 form is only for new importers. Current importers must also use the form to update their information, such as changes to their name or address. Regular updates help maintain accurate records with U.S. Customs and Border Protection.

Key takeaways

Understanding the form 5106 is essential for anyone involved in the importation of goods into the United States. Here are some key takeaways:

- Purpose of the Form: The 5106 form is used to create or update an Importer Identification Number, which is necessary for importing commercial goods.

- Who is Responsible? The person listed as the importer or consignee is responsible for the truthfulness of the information on the form, even if a third party, like a customs broker, fills it out.

- Privacy Matters: Information provided on this form may be shared with other government entities for law enforcement and regulatory enforcement purposes.

- Voluntary, but Important: While filling out the form is voluntary, failing to do so may result in the inability to receive an assigned importer number, which can severely delay imports.

- Types of Actions: Users must indicate the type of action they are taking, such as requesting a CBP identification number, changing a name, or updating an address.

- Detailed Information: Be prepared to provide various forms of detailed information, including mailing and physical addresses, contact details, and business structure.

- Time Commitment: Completing this form takes approximately 45 minutes, so it’s wise to set aside ample time to gather the necessary information.

- Consequences of Inaccuracy: Misrepresentation or false statements on the form can lead to serious legal repercussions, including fines or imprisonment.

By keeping these points in mind, individuals and businesses can navigate the importation process with confidence and reduce the likelihood of delays or complications.

Browse Other Templates

1099 Agreement - All Associates must maintain the necessary licenses for their business activities.

Mri Mean - Only eligible veterinarians may apply for or renew their accreditation.

Painters Union Insurance Fund Provider Portal - Benefits incurred prior to any plan termination remain the responsibility of the Trust.