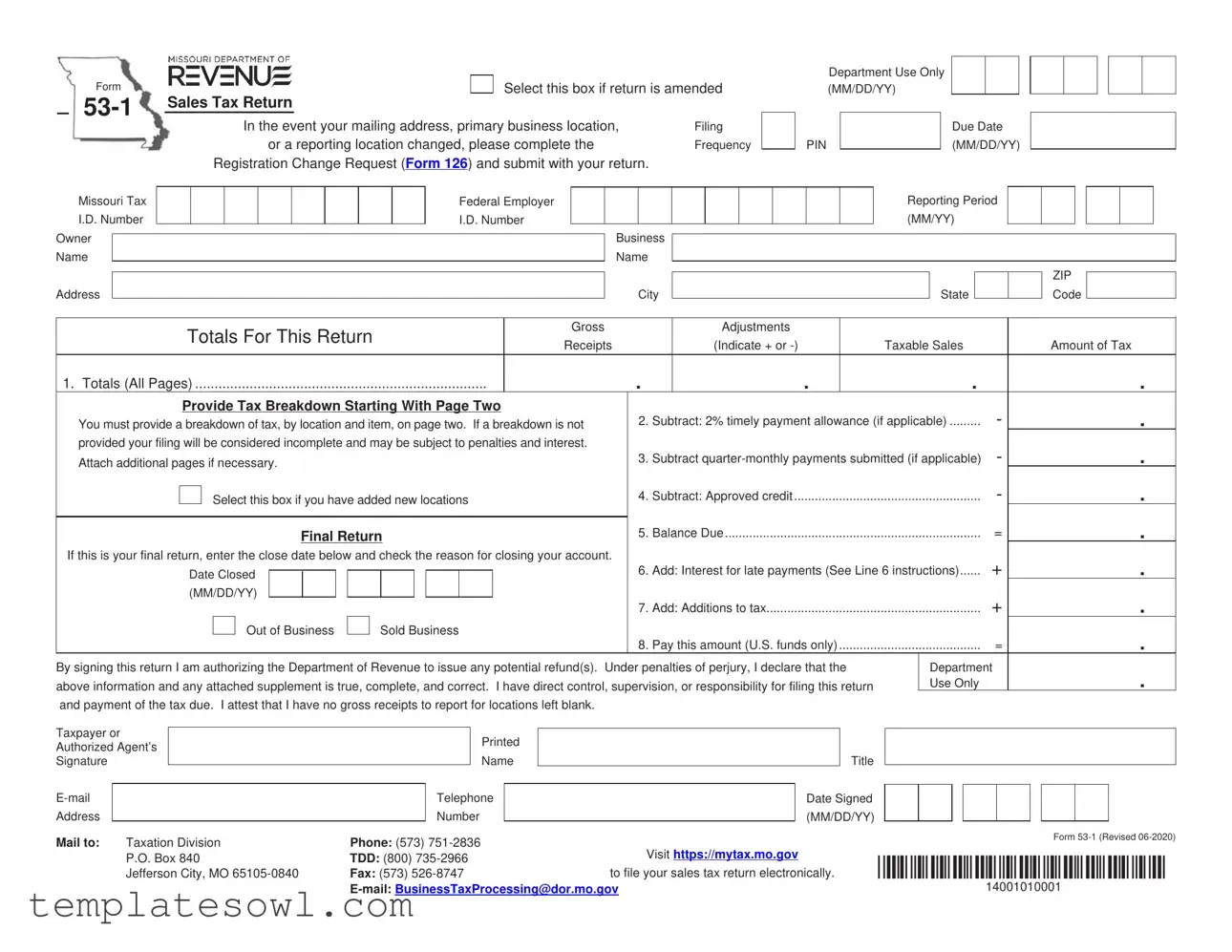

Fill Out Your 53 1 Form

Navigating the world of sales tax can be daunting for business owners, particularly when it comes to fulfilling obligations set by state regulations. Among the essential documents in Missouri is the Form 53-1, a sales tax return template that serves a critical purpose for those conducting business within the state. This form requests pertinent details including your Missouri Tax I.D. Number, Federal Employer I.D. Number, and specific business information such as owner name and address. Additionally, it covers the reporting period and due date, ensuring timely submissions. The form not only requires the total amount of gross receipts and taxable sales but also demands a thorough breakdown of these figures by location and item. If adjustments are necessary due to changes in reporting or if new business locations have been added, this form accommodates those needs as well. Completing the Form 53-1 properly is crucial; an incomplete submission can lead to penalties and interest. Whether you are filing for the first time or making amendments, understanding the nuances of this form will facilitate compliance and help avoid costly mistakes.

53 1 Example

Form

|

Department Use Only |

Select this box if return is amended |

(MM/DD/YY) |

Sales Tax Return

Missouri Tax

I.D. Number Owner

Name

|

|

In the event your mailing address, primary business location, |

Filing |

|

|

|

|

||||||||||||

|

|

|

or a reporting location changed, please complete the |

Frequency |

|

|

|

PIN |

|||||||||||

|

Registration Change Request (Form 126) and submit with your return. |

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

Federal Employer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

I.D. Number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

Name |

|

|

|

|

|

|

|

|

|

Due Date (MM/DD/YY)

Reporting Period (MM/YY)

Address

ZIP

City |

|

State |

|

Code |

|

Totals For This Return |

|

|

|

|

|

Gross |

|

|

Adjustments |

|

|

|

|

|

||||||||

|

|

|

|

|

|

Receipts |

|

|

(Indicate + or |

|

Taxable Sales |

|

Amount of Tax |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Totals (All Pages) |

|

|

|

|

|

|

. |

|

. |

|

. |

|

. |

||||||||||

|

Provide Tax Breakdown Starting With Page Two |

|

|

|

|

|

|

- |

. |

||||||||||||||

You must provide a breakdown of tax, by location and item, on page two. If a breakdown is not |

2. |

Subtract: 2% timely payment allowance (if applicable) |

|||||||||||||||||||||

provided your filing will be considered incomplete and may be subject to penalties and interest. |

|

|

|

|

|

|

- |

. |

|||||||||||||||

Attach additional pages if necessary. |

|

|

|

|

|

|

3. |

Subtract |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

. |

|||||||||||

|

|

|

Select this box if you have added new locations |

4. |

Subtract: Approved credit |

|

|

- |

|||||||||||||||

|

|

|

|

||||||||||||||||||||

|

|

|

|

|

|

|

5. Balance Due |

|

|

= |

. |

||||||||||||

|

|

|

|

|

Final Return |

|

|||||||||||||||||

If this is your final return, enter the close date below and check the reason for closing your account. |

|

|

|

|

|

|

+ |

. |

|||||||||||||||

|

Date Closed |

|

|

|

|

|

|

|

|

|

|

|

6. |

Add: Interest for late payments (See Line 6 instructions) |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

7. |

Add: Additions to tax |

|

|

+ |

. |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

Out of Business |

|

|

Sold Business |

8. |

Pay this amount (U.S. funds only) |

|

|

= |

. |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

By signing this return I am authorizing the Department of Revenue to issue any potential refund(s). Under penalties of perjury, I declare that the |

|

Department |

. |

||||||||||||||||||||

above information and any attached supplement is true, complete, and correct. I have direct control, supervision, or responsibility for filing this return |

|

Use Only |

|

||||||||||||||||||||

and payment of the tax due. I attest that I have no gross receipts to report for locations left blank.

Taxpayer or |

|

|

|

|

Printed |

||

Authorized Agent’s |

|

|

|

||||

|

|

|

|

|

|||

Signature |

|

|

|

|

Name |

||

|

|

|

|

|

Telephone |

|

|

|

|

|

|

|

|||

Address |

|

|

|

|

Number |

|

|

Mail to: |

Taxation Division |

Phone: (573) |

|||||

|

|

P.O. Box 840 |

TDD: (800) |

||||

|

|

Jefferson City, MO |

Fax: (573) |

||||

|

|

Title |

|

|

|

|

|

|

|

|

|

|

|

Date Signed |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

(MM/DD/YY) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Form |

||

Visit https://mytax.mo.gov |

*14001010001* |

|||||||||||

to file your sales tax return electronically. |

||||||||||||

14001010001 |

Missouri Tax I.D.

Number

Reporting Period

(MM/YY)

*14001020001*

14001020001 |

Page |

of

|

Business Location |

Jurisdiction Code |

|

Item |

|

Site |

Gross |

Adjustments |

|

Tax Rate (Do not |

|

|||||

Close |

(Street Address and City) |

(City, County, and District) |

|

Code |

|

Code |

Receipts |

(Indicate + or |

Taxable Sales |

include % symbol) |

Amount of Tax |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

- |

- |

|

|

|

|

|

|

|

|

. |

. |

. |

. |

. |

Page

.

.

.

.

Sales Tax Return (Form

Important: This return must be filed for the reporting period even though you have no tax to report.

Amended Return Check Box - This box should be checked to correct a previously filed return to show an increase or decrease in the amount of tax liability. A separate return must be filed for each period being amended. If the return and payment are being submitted after the period(s) due date, interest and penalty will apply to the additional amount being reported.

Please note if an overpayment has been authorized, the overpayment is subject to be used as an offset towards any debt. In addition, to receive a refund of the overpayment attach a Seller’s Claim for Sales or Use Tax Refund or Credit (Form 472S).

Filing Frequency – This is the frequency in which you are required to file your returns. Not a required field. If unknown leave blank.

PIN – This is a unique four digit number that is issued to you by the Department of Revenue. Not a required field. If unknown leave blank.

Due Date – Visit http://dor.mo.gov/taxcalendar/ for a list of due dates.

Missouri Tax I.D. Number – This is an eight digit number issued by the Missouri Department of Revenue to identify your business. If you have not registered with the Department, complete the Missouri Tax Registration Application (Form 2643) or complete your registration online by going to https://dors.mo.gov/tax/coreg/index.jsp. If you have misplaced your Missouri Tax I.D Number, you can call (573)

Federal Employer I.D. Number – This is a nine digit identification number issued by the Internal Revenue Service to identify your business.

Reporting Period – This is the tax period you are required to file based on your filing frequency.

Owner and Business Name, Address, City, State and ZIP Code – Enter the name, address, city, state and ZIP code. Note: In the event your mailing address, primary business location, or a reporting location has changed you will need to complete the Missouri Registration Change Request (Form 126) and submit it with your return.

Line 1- Totals (All Pages) – Enter the total gross receipts, adjustments, taxable sales, and tax due for all pages.

Each page must have a breakdown per business location identifying the item code, site code, gross receipts, adjustment, taxable sales, and amount of tax. See the page two instructions for more information. If a breakdown is not provided, your filing will be considered incomplete and may be subject to penalties and interest. Attach additional pages if

necessary.

Adding New Locations – This box should be checked when adding a new business location(s). The location information (street address and city) on page two or subsequent pages must be completed when this box is checked. A breakdown per location which identifies the item code, gross receipts, adjustments, taxable sales, and amount of tax must also be

provided. See page two instructions for more information.

Final Return – If this is your final return, enter the close date and check the reason for closing your account. Missouri law requires any person selling or discontinuing business to make a final sales tax return within 15 days of the sale or closing.

Line 2 – Subtract: 2% Timely Payment Allowance – Multiply total amount of tax by 2% and enter the amount on this line. If the return is late the discount is not allowed.

Line 3 – Subtract:

Line 4 – Subtract: Approved Credit – This is a credit that has been approved by the Department of Revenue.

Line 5 – Balance Due – Amount of Tax from line 1 minus line 2, 3 and 4 (if applicable).

Line 6 – Add Interest for Late Payments – If tax is not paid by the due date, (A) multiply Line 5 by the daily interest rate*. Then (B) multiply this amount by the number of days late. See example below. Note: The number of days late is counted from the due date to the postmark date.

For example, if the due date is March 20, and the postmark date is April 9, the payment is 20 days late. The example below is based on an annual interest rate of 4% and a daily rate of .0001096.

Example: Line 5 is $480

(A)$480 x .0001096 = .05261

(B). 05261 x 20 days late = 1.05 1.05 is the interest for late payment

*14000000001*

14000000001

Sales Tax Return (Form

*The annual interest rate is subject to change each year. Visit http://dor.mo.gov/intrates.php to access the annual interest rate. Visit http://dor.mo.gov/calculators/interest/ for assistance calculating the appropriate interest.

Lines 7 – Add Additions to Tax – For failure to pay sales tax on or before the due date, calculate 5% of Line 5. For failure to file a sales tax return on or before the due date, calculate 5% of Line 5 for each month late up to a maximum of 25% (5 months late in filing = 25%). Note: If additions to tax for failure to file apply, do not pay additions to tax for failure to pay.

For example, if a return due March 20 is filed any time between March

Example: Return is due March 20, but is filed (postmarked) April 10 |

Example: Return is due March 20, but is filed (postmarked) April 21 |

Line 5 is $480 |

Line 5 is $480 |

$480 x 5% = $24 |

$480 x 10% = $48 |

$24 is the additions to tax |

$48 is the additions to tax |

Access http://dor.mo.gov/calculators/interest/ for assistance calculating the appropriate additions.

Line 8 – Pay This Amount – Enter total amount due (Line 5 “plus” Line 6 “plus” Line 7). Send a check for the total amount. Make check, draft, or money order payable to Director of Revenue (U.S. funds only). Do not send cash or stamps. Visit http://dor.mo.gov/business/payonline.php to pay your sales tax online using a credit card or

Page 2 Instructions

Missouri Tax I.D. Number – Enter your Missouri I.D. Number from page 1.

Reporting Period – Enter reporting period from page 1

Page _ of __ – The front page acts as page 1. Any sequent pages start with page 2. Please indicate total to ensure all pages are received.

Business Locations – List each of your business locations in this column. If you have discontinued operation of a business location, check the close box in front of the location.

Jurisdiction Code – Enter the jurisdiction code of each location from which you made sales. This is a numeric code that is assigned by the Missouri Department of Revenue to each city, county, and district. If unknown, leave blank.

Item Code – Enter the four digit item code that is assigned by the Department. Item taxes, such as the food tax, are reported on a separate line for each business location. If unknown, clearly indicate what the item tax is. For example, if you are reporting food sales at the lower food tax rate, write “Food”.

Site Code – Enter the one to four digit site code that is assigned by the Department. If unknown, leave blank.

Gross Receipts – Enter gross receipts from all sales of tangible personal property and taxable services made during the reporting period for each business location. If none, enter “zero” (0).

Adjustments – Make any adjustments for each location for which you are reporting. Indicate “plus” or “minus” for the total adjustment claimed for each location. A negative figure may be exempt sales or nontaxable receipts. Positive adjustments are items that were purchased exempt, but subsequently used by the seller.

Taxable Sales – Enter the amount of taxable sales for each business location. Gross Receipts (+) or

Rate: The rate percentage must include the combined state, conservation, parks and soils, and any applicable local or transportation sales tax rate percentages. Enter the sales tax rate for each location. If you are unsure of the correct tax rate, access the Department’s website at http://dor.mo.gov/business/sales/rates or contact the Taxation Division at (573)

Amount of Tax – Multiply your taxable sales for each location by the applicable tax rate percent and enter the amount of tax.

Page Totals – Enter the total gross receipts, adjustments, taxable sales and tax due for each page.

*14000000001* |

Form |

14000000001

Form Characteristics

| Fact Name | Description |

|---|---|

| Form Purpose | The 53-1 form is used to file sales tax returns in Missouri. |

| Governing Law | This form is governed by Missouri sales tax laws. |

| Filing Frequency | Businesses must file per their assigned filing frequency, which may vary. |

| Late Fees | Filing late may result in penalties and interest charges. |

| Amended Returns | Selecting the amended return box corrects previous filings. |

| Final Return | Marking this return as final requires listing the closure date. |

| Interest Calculation | Interest for late payments is calculated based on daily rates from the due date. |

| Tax Breakdown Requirement | A detailed breakdown of sales tax by location must be provided. |

| Contact Information | For questions, contact the Missouri Taxation Division at (573) 751-2836. |

Guidelines on Utilizing 53 1

Completing the Form 53-1 is a crucial step in ensuring compliance with Missouri sales tax requirements. Accurate completion will facilitate the timely submission of your tax return and any potential refunds. Following these steps will help ensure that the form is properly filled out.

- Select the appropriate box if the return is amended.

- Fill in the following information:

- Sales Tax Return

- Missouri Tax I.D. Number

- Owner Name

- Federal Employer I.D. Number

- Business Name

- Due Date (MM/DD/YY)

- Reporting Period (MM/YY)

- Address, City, State, and ZIP Code

- In the section labeled "Totals For This Return":

- Enter your gross receipts, adjustments, and taxable sales.

- Calculate the amount of tax due.

- Provide a tax breakdown on page two as instructed. Ensure it includes item and location details.

- Complete the subtraction calculations for timely payment allowance, quarter-monthly payments, and approved credits.

- Calculate the Balance Due by deducting relevant amounts from the totals.

- If applicable, calculate and add interest for late payments.

- Add any additions to tax for late filings, if required.

- Determine the final amount due and write your payment details.

- Sign and date the return, affirming the authenticity of the information provided.

- Mail the completed form to the appropriate address provided in the instructions.

What You Should Know About This Form

What is Form 53-1?

Form 53-1 is a sales tax return used in Missouri for reporting the sales tax collected by businesses. This form is mandatory for all businesses that conduct sales in the state, regardless of whether they have tax to report for a given period. Completing and submitting this form ensures compliance with state tax laws.

When is Form 53-1 due?

The due date for Form 53-1 varies based on your assigned filing frequency. You can visit the Missouri Department of Revenue’s tax calendar online to find specific due dates. If a due date is missed, late fees and interest may be applied to any taxes owed.

What should I do if I need to amend my Form 53-1?

If you need to amend a previously filed return, check the appropriate box on Form 53-1. Complete a new return for the period being amended, indicating any increases or decreases in tax liability. Be aware that submitting an amendment after the due date may result in additional penalties and interest.

How do I report multiple business locations on Form 53-1?

To report multiple business locations, complete the required information for each location on subsequent pages of Form 53-1. You must include details such as gross receipts, adjustments, and taxable sales for each site. Each location must have its own breakdown to ensure accuracy.

What happens if I fail to file Form 53-1 on time?

Failure to file Form 53-1 by the due date can result in penalties and interest on any amount owed. The penalty may be based on the amount of tax due or calculated at a rate of 5% for each month the return is late, up to a maximum of 25%. It's crucial to file on time to avoid these additional fees.

How can I pay the amount due on Form 53-1?

You can pay the amount due using a check or money order made payable to the Director of Revenue. Ensure the payment is in U.S. funds only. Alternatively, you can pay online via credit card or e-check through the Missouri Department of Revenue’s website. Make sure to keep a copy of your payment confirmation for your records.

Common mistakes

Filling out Form 53-1 can be a straightforward process, but there are common pitfalls that can lead to mistakes. One major error is failing to provide a complete tax breakdown on page two of the form. It’s crucial to include a detailed breakdown that identifies the item code, site code, gross receipts, adjustments, taxable sales, and tax amount for each business location. Omitting this information may result in your filing being considered incomplete, which could lead to penalties and interest.

Another frequent mistake occurs when taxpayers overlook the timely payment allowance. If applicable, you need to subtract 2% from your total tax due. However, if your return is submitted late, that discount is not available. Forgetting to take this into account can inflate your balance due, causing unnecessary payment concerns.

Failure to accurately report and subtract quarter-monthly payments is also a common issue. If you have made such payments during the reporting period, it’s essential to reflect those on Line 3. Neglecting to do so can result in an overestimation of what you owe, leading to potential complications.

Moreover, many individuals mistakenly treat their return as a final return without fully understanding the implications. If this is indeed your final return, you must enter the closing date and select the appropriate reason for terminating your business. Not doing so can lead to delays and confusion in properly closing your tax account.

People often miscalculate their additions to tax for late payments as well. If your payment is not submitted by the due date, calculate 5% of the balance due for each month late, up to a maximum of 25%. It's easy to underestimate this figure, resulting in an unexpected total that you'll owe when it comes time to pay.

Lastly, sending cash or stamps along with your return is a mistake many make. The form specifically requests U.S. funds only, so ensure that checks, drafts, or money orders are used instead. Using cash or stamps may not only lead to rejection by the Department of Revenue but can also delay your filing process unnecessarily.

Documents used along the form

The Form 53-1 is essential for businesses in Missouri to report their sales tax accurately. Along with this form, other documents may be required to ensure compliance with tax regulations. Here are several forms that are commonly used in conjunction with the Form 53-1.

- Form 126: Frequency PIN Registration Change Request

This form is used to notify the Missouri Department of Revenue about any changes in the business's mailing address, primary business location, or reporting location. It is necessary to submit this form along with the 53-1 when such changes occur.

- Form 2643: Missouri Tax Registration Application

This application is essential for businesses that are registering for a Missouri Tax I.D. Number for the first time. It can be completed either on paper or electronically through the Missouri Department of Revenue's portal.

- Form 472S: Seller’s Claim for Sales or Use Tax Refund or Credit

If a business has overpaid sales tax and seeks a refund, this form must be submitted. It serves to formally claim any refunds or credits due from the Department of Revenue.

- Electronic Payment Options

By using these forms in conjunction with the Form 53-1, businesses can maintain compliance with Missouri's sales tax regulations, reduce the risk of penalties, and streamline the tax reporting process.

Similar forms

- Form 472S - Seller's Claim for Sales or Use Tax Refund or Credit: This form allows a business to claim a refund for overpaid sales tax. Similar to the 53-1, it involves the reporting of sales data, though it specifically focuses on refund requests.

- Form 2643 - Missouri Tax Registration Application: This document is used to register a business with the Missouri Department of Revenue. Like the 53-1, it identifies the business and provides essential information necessary for tax reporting.

- Form 126 - Registration Change Request: Businesses use this form to notify the Department of Revenue about changes in their filing details. Similar to the 53-1, it requires careful attention to current business information and updates.

- Form 940 - Employer's Annual Federal Unemployment (FUTA) Tax Return: This federal form calculates unemployment tax owed by businesses, providing a comprehensive overview of taxable payroll. Like the 53-1, it requires the reporting of financial figures within specific periods.

- Form 941 - Employer's Quarterly Federal Tax Return: Employers file this form quarterly to report income taxes, Social Security tax, and Medicare tax withheld from employee paychecks. It shares similarities with the 53-1 in terms of due dates and periodic filing requirements.

- Form 1099 - Miscellaneous Income: Businesses use this form to report payments made to independent contractors. Like the 53-1, it is an essential tax reporting document that requires careful record-keeping and adherence to timelines.

- Form W-2 - Wage and Tax Statement: Employers must provide this form to employees, detailing their earnings and taxes withheld during the year. Similar to the 53-1, it serves as a key reporting tool for tax purposes.

Dos and Don'ts

10 Things You Should and Shouldn't Do When Filling Out Form 53-1

- Do read the instructions thoroughly before starting.

- Don't leave any fields blank unless specified as optional.

- Do double-check your Missouri Tax I.D. Number for accuracy.

- Don't forget to include a breakdown of tax on page two.

- Do indicate if this is an amended return by checking the appropriate box.

- Don't neglect to attach any additional pages if necessary.

- Do ensure that you sign the return; an unsigned return is invalid.

- Don't forget to calculate any interest or additions to tax if applicable.

- Do make your check or money order payable to the Director of Revenue.

- Don't send cash or stamps; only U.S. funds are accepted.

Misconceptions

Form 53-1 is essential for businesses in Missouri to report sales tax. However, several misconceptions may lead to confusion. Here are nine common misconceptions regarding the form:

- 1. It's only for businesses with large sales. The Form 53-1 must be filed regardless of the business's sales volume. Even if there are no tax liabilities, filing is necessary.

- 2. You can skip filing if you have no tax to report. This is incorrect. The form must be submitted for each reporting period, even with no tax due.

- 3. The timely payment allowance applies to all submissions. This allowance is only granted if the return is filed on time. Late submissions forfeit this discount.

- 4. You don’t need to provide a breakdown if you are only submitting one page. A breakdown of sales, including item codes and amounts, is required on each page, irrespective of the quantity.

- 5. The final return is optional if closing the business. When discontinuing business, a final return is mandatory to avoid penalties.

- 6. You can calculate interest and penalties arbitrarily. There are specific formulas provided in the instructions for determining allowable interest and penalties for late payments.

- 7. The form can be filed electronically only. While electronic filing is encouraged, businesses still have the option of submitting a paper form.

- 8. You can use personal checks for payment. All payments must be made in U.S. funds, and personal checks are not allowed. Payments must be made directly to the Director of Revenue.

- 9. The Missouri Tax I.D. Number is the same as the Federal Employer I.D. Number. These are two different identification numbers. Each serves distinct purposes and must be accurately reported.

Awareness of these misconceptions can facilitate accurate and timely filing of the Form 53-1, ultimately aiding in compliance with Missouri tax regulations.

Key takeaways

Here are key takeaways for filling out and using the Form 53-1 for sales tax in Missouri:

- Amended Returns: If you are correcting a previously filed return, check the box marked "Amended Return." Each amended period requires a separate return.

- Reporting All Periods: This return must be submitted for each reporting period, even if you have no tax to report.

- Tax Identification: Enter your Missouri Tax I.D. Number and Federal Employer I.D. Number accurately to prevent delays.

- Breakdowns Required: A detailed tax breakdown by location and item on page two is necessary. If not provided, your return may be deemed incomplete.

- Timely Payment Allowance: Calculate and subtract the 2% timely payment allowance only if the return is filed on time.

- Interest and Penalties: Be aware that late payments incur interest and potential penalties, calculated based on the outstanding tax amount.

- Final Returns: If this is your last sales tax return, include your closing date and reason for closure; law mandates this within 15 days of closing.

- Payment Instructions: Send your payment via check made out to the Director of Revenue. Consider online payment options for convenience.

Browse Other Templates

Certification Application for Administrators - Renewal applicants must maintain compliance with criminal record clearances and provide ongoing education proof.

Steer Clear Program State Farm - State Farm could impose a surcharge if a driver has a poor record.