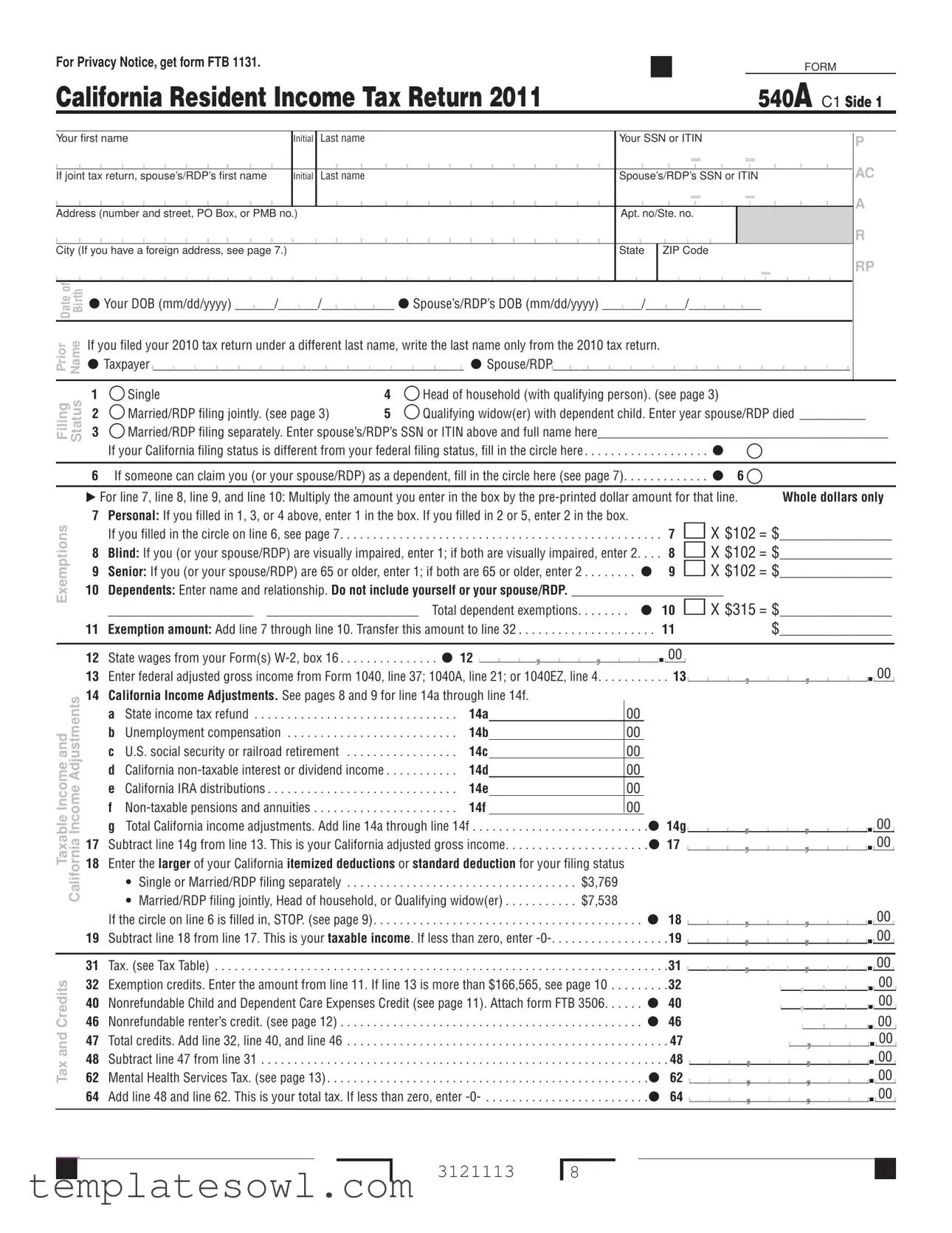

Fill Out Your 540A Form

The California Form 540A serves as an essential document for residents filing their income tax returns, particularly for those with straightforward tax situations. This form is designed for individuals and couples who do not have complex deductions or credits that necessitate additional schedules. Primarily, it gathers vital personal information, including names, Social Security numbers, and filing status, to ensure accurate processing. The 540A also facilitates the calculation of exemptions based on personal circumstances, such as age and disability status, impacting the overall taxable income. Moreover, it integrates adjustments specific to California law, allowing taxpayers to align their federal adjusted gross income with state-specific considerations. Understanding the structure of this form, including sections for income, deductions, and various tax credits, is crucial for effective tax filing. Taxpayers will find instructions throughout the form guiding them step-by-step in their calculations, making it accessible to those seeking compliance without the need for professional assistance. If you wish to maximize your refund or minimize your tax liability, attention to detail on Form 540A is indispensable.

540A Example

For Privacy Notice, get form FTB 1131. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FORM |

||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

CALIFORNIA RESIDENT INCOME TAX RETURN 2011 |

|

|

540A C1 SIDE 1 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your first name |

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Your SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

P |

||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AC |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

If joint tax return, spouse’s/RDP’s first name |

Initial |

Last name |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s/RDP’s SSN or ITIN |

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

A |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address (number and street, PO Box, or PMB no.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Apt. no/Ste. no. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

R |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City (If you have a foreign address, see page 7.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

State |

ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RP |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dateof |

Birth |

Your DOB (mm/dd/yyyy) ______/______/ |

___________ Spouse’s/RDP’s DOB (mm/dd/yyyy) ______/______/ |

|

___________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior |

Name |

If you filed your 2010 tax return under a different last name, write the last name only from the 2010 tax return. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Taxpayer |

|

|

|

|

|

|

|

_______________________________________________ |

|

|

|

|

|

|

|

Spouse/RDP |

|

|

|

|

|

|

|

_____________________________________________ |

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

Status |

1 |

Single |

|

|

|

|

4 |

Head of household (with qualifying person). (see page 3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Filing |

2 |

Married/RDP filing jointly. (see page 3) |

5 |

Qualifying widow(er) with dependent child. Enter year spouse/RDP died __________ |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

3 |

Married/RDP filing separately. Enter spouse’s/RDP’s SSN or ITIN above and full name here____________________________________________ |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

If your California filing status is different from your federal filing status, fill in the circle here . . . . . . . . . . . . . . . . . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

6 |

If someone can claim you (or your spouse/RDP) as a dependent, fill in the circle here (see page 7). . . . . . . . . . . . . 6 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

For line 7, line 8, line 9, and line 10: Multiply the amount you enter in the box by the |

|

|

|

|

|

|

|

Whole dollars only |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

7Personal: If you filled in 1, 3, or 4 above, enter 1 in the box. If you filled in 2 or 5, enter 2 in the box.

Exemptions |

|

If you filled in the circle on line 6, see page 7 |

. . . . 7 |

X $102 = $_________________ |

|

8 |

Blind: If you (or your spouse/RDP) are visually impaired, enter 1; if both are visually impaired, enter 2 |

. . . . 8 |

X $102 = $_________________ |

|

9 |

Senior: If you (or your spouse/RDP) are 65 or older, enter 1; if both are 65 or older, enter 2 |

9 |

X $102 = $_________________ |

|

10 |

Dependents: Enter name and relationship. Do not include yourself or your spouse/RDP. _______________________ |

||

|

|

______________________ _______________________ Total dependent exemptions |

10 |

X $315 = $_________________ |

|

11 |

Exemption amount: Add line 7 through line 10. Transfer this amount to line 32 |

. . . 11 |

$_________________ |

Taxable Income and California Income Adjustments

Tax and Credits

12 |

State wages from your Form(s) |

12 |

, |

, |

|

. |

00 |

|

|

|

|

|

|||||

13 |

Enter federal adjusted gross income from Form 1040, line 37; 1040A, line 21; or 1040EZ, line 4 |

. 13. |

||||||

14California Income Adjustments. See pages 8 and 9 for line 14a through line 14f.

a |

. . . . . . . . . . .State income tax refund |

14a |

|

00 |

|

|

b |

Unemployment compensation |

14b |

|

00 |

|

|

c |

U.S. social security or railroad retirement |

14c |

|

00 |

|

|

d |

California |

14d |

|

00 |

|

|

e |

California IRA distributions |

14e |

|

00 |

|

|

f |

14f |

|

00 |

14g |

||

g Total California income adjustments. Add line 14a through line 14f |

. . . |

|||||

17 Subtract line 14g from line 13. This is your California adjusted gross income |

. . . |

. |

17 |

|||

18Enter the larger of your California itemized deductions or standard deduction for your filing status

• Single or Married/RDP filing separately . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $3,769

• Married/RDP filing jointly, Head of household, or Qualifying widow(er) . . . . . . . . . . . $7,538

If the circle on line 6 is filled in, STOP. (see page 9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Subtract line 18 from line 17. This is your taxable income. If less than zero, enter

31 |

Tax. (see Tax Table) |

. . . . |

31 |

32 |

Exemption credits. Enter the amount from line 11. If line 13 is more than $166,565, see page 10 |

. . . . |

32 |

40 |

Nonrefundable Child and Dependent Care Expenses Credit (see page 11). Attach form FTB 3506 |

40 |

|

46 |

Nonrefundable renter’s credit. (see page 12) |

46 |

|

47 |

Total credits. Add line 32, line 40, and line 46 |

. . . . |

47 |

48 |

Subtract line 47 from line 31 |

. . . . |

48 |

62 |

Mental Health Services Tax. (see page 13) |

. |

62 |

64 |

Add line 48 and line 62. This is your total tax. If less than zero, enter |

. |

64 |

,

,

,

. 00

. 00

, |

, |

. 00 |

, |

, |

. 00 |

, |

, |

. 00 |

, |

, |

. 00 |

, |

, |

. 00 |

|

, |

. 00 |

|

, |

. 00 |

|

|

. 00 |

|

, |

. 00 |

, |

, |

. 00 |

, |

, |

. 00 |

, |

, |

. 00 |

3121113

8

Your name: ______________________________________Your SSN or ITIN: ______________________________ |

|

|

|

|

|

|

|

|

|||||||||

|

70 Enter the amount from Side 1, line 64 |

. . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . . . . . |

70 |

|

, |

, |

|

. |

00 |

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Payments |

71 |

California income tax withheld (see page 13) |

. . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . |

. . 71 |

|

, |

. |

00 |

|||||||

75 |

Add line 71, line 72, and line 74. These are your total payments |

|

|

.. |

.. .. . |

75 |

|

, |

|

|

|

|

|||||

. . . . . . . . . . |

|

, |

. 00 |

||||||||||||||

|

72 |

2011 CA estimated tax and other payments (see page 13) . |

. . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . |

72 |

|

|

, |

. |

00 |

||||||

|

74 |

Excess SDI (or VPDI) withheld (see page 13) |

. . . . . . . . . . . . . |

. . . . . . . . . |

. . . . . . . . . . . |

. . |

74 |

|

|

|

, |

. |

00 |

||||

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OverpaidTax/ TaxDue |

91 |

Overpaid tax. If line 75 is more than line 70, subtract line 70 from line 75 |

|

|

. |

. . . |

91 |

|

, |

, |

. |

00 |

|||||

|

. . . . . . . . . |

. . . . . . . . . . |

|

||||||||||||||

|

92 |

Amount of line 91 you want applied to your 2012 estimated tax |

. . . . . . . . . . . . . |

92 |

|

, |

, |

. |

00 |

||||||||

|

93 |

Overpaid tax available this year. Subtract line 92 from line 91 |

. . . . . . . . . . . . . |

93 |

|

, |

, |

. |

00 |

||||||||

|

|

|

|

|

00 |

||||||||||||

|

94 |

Tax due. If line 75 is less than line 70, subtract line 75 from line 70. (see page 14) |

. . . . . . . . . . . . . . . . |

94 |

|

, |

, |

|

. |

||||||||

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Use Tax |

95 |

Use Tax. This is not a total line. (see page 14) |

95 |

|

, |

, |

. |

00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Code |

Amount |

|

|

Code |

Amount |

||

|

. . .California Seniors Special Fund (see page 23) |

. 400 |

|

|

00 |

. . . . . .California Sea Otter Fund |

. 410 |

|

00 |

|

|

. 401 |

|

|

|

Municipal Shelter |

412 |

|

00 |

|

Alzheimer’s Disease/Related Disorders Fund . . . . |

|

|

00 |

|

||||

|

|

. 402 |

|

|

|

California Cancer Research Fund |

413 |

|

00 |

|

California Fund for Senior Citizens |

|

|

00 |

|

||||

Contributions |

Rare and Endangered Species |

|

|

|

|

ALS/Lou Gehrig’s Disease Research Fund. |

414 |

|

00 |

|

|

|

|

|

|||||

Preservation Program |

. 403 |

|

|

00 |

Arts Council Fund |

. 415 |

|

00 |

|

|

State Children’s Trust Fund for the Prevention |

|

|

|

|

California Police Activities League |

. 416 |

|

|

|

|

|

|

|

|

|

|||

|

of Child Abuse |

. 404 |

|

|

00 |

(CALPAL) Fund |

|

00 |

|

|

|

. 405 |

|

|

|

California Veterans Homes Fund |

417 |

|

00 |

|

California Breast Cancer Research Fund |

|

|

00 |

|

||||

|

|

. 406 |

|

|

|

Safely Surrendered Baby Fund |

418 |

|

00 |

|

California Firefighters’ Memorial Fund |

|

|

00 |

|

||||

|

|

. 407 |

|

|

|

Child Victims of Human Trafficking Fund . |

419 |

|

00 |

|

Emergency Food for Families Fund |

|

|

00 |

|

||||

|

California Peace Officer Memorial |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foundation Fund |

. 408 |

|

|

00 |

|

|

|

|

Amount You Owe

110 |

Add code 400 through code 419. This is your total contribution |

110 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|||||||||||||

111 |

AMOUNT YOU OWE. Add line 94, line 95, and line 110 (see page 15). Do not send cash. |

. . . . |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

|

Mail to: FRANCHISE TAX BOARD, PO BOX 942867, SACRAMENTO CA |

111 |

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Pay Online – Go to ftb.ca.gov and search for web pay. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

00 |

|

|

113 |

Underpayment of estimated tax. If form FTB 5805 is attached, fill in this circle |

113 |

|

|

|

|

|

, |

|

|

|

, |

|

|

|

|

|

|

|

. |

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

Deposit

115 REFUND or NO AMOUNT DUE. Subtract line 95 and line 110 from line 93 (see page 16). |

|

|

|

Mail to: FRANCHISE TAX BOARD, PO BOX 942840, SACRAMENTO CA |

, |

, |

. 00 |

Fill in the information to authorize direct deposit of your refund into one or two accounts. Do not attach a voided check or a deposit slip (see page 17). Have you veriied the routing and account numbers? Use whole dollars only.

Refund and Direct

All or the following amount of my refund (line 115) is authorized for direct deposit into the account shown below:

|

|

|

|

|

|

|

|

|

|

Checking |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Routing number |

Type |

Account number |

||||||||||||||||||||||||||

The remaining amount of my refund (line 115) is authorized for direct deposit into the account shown below:

|

Checking |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

Savings |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Routing number |

Type |

Account number |

||||||||||||||||||||||||||

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|

116 Direct deposit amount |

|

|

|

|

|

||||||||||

|

|

|

, |

|

|

|

, |

|

|

|

|

|

. |

|

00 |

|

|

117 Direct deposit amount |

|

|

|

|

|

||||||||||

Under penalties of perjury, I declare that I have examined this tax return, including accompanying schedules and statements, and to the best of my knowledge and belief, it is true, correct, and complete.

SIGN

HERE

It is unlawful to

forge a spouse’s/RDP’s signature.

Joint tax return? (see page 17)

Your signature |

Spouse’s/RDP’s signature (if a joint tax return, both must sign) Daytime phone number (optional) |

||||||||||||||||||||||||||||||||||||||||||||

X |

X |

( |

|

|

|

|

|

|

|

|

|

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

Date |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

Your email address (optional). Enter only one email address. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Paid preparer’s signature (declaration of preparer is based on all information of which preparer has any knowledge) |

|

PTIN |

|||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||

Firm’s name (or yours, if |

Firm’s address |

|

|

|

|

|

|

|

FEIN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do you want to allow another person to discuss this tax return with us? (see page 17) . . . . . . . . . Yes No |

||||||||||||||||||||||||||||||||||||||||||||

__________________________________________________________________ |

( |

|

|

|

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Print Third Party Designee’s Name |

|

Telephone Number |

|||||||||||||||||||||||||||||||||||||||||||

Side 2 Form 540A C1 2011

3122113

7

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 540A form is designed for California residents to file their state income tax returns. |

| Eligibility | This form is ideal for individuals with uncomplicated tax situations, particularly those who do not itemize deductions. |

| Tax Year | The version referenced pertains to the tax year 2011 and must be filed for that specific year’s income. |

| Filing Status | It accommodates different filing statuses including Single, Married/RDP filing jointly, and more. |

| Exemptions | Taxpayers can claim various exemptions, including personal and dependent exemptions, which can reduce taxable income. |

| Privacy Notice | For information regarding privacy, taxpayers should refer to form FTB 1131. |

| Governing Law | This form follows the laws governing California income taxes, primarily the California Revenue and Taxation Code. |

Guidelines on Utilizing 540A

Completing the 540A form is an important step in filing your California state income taxes. This process requires careful attention to detail to ensure all information is accurate. Follow the steps below to fill out the form correctly.

- Start with your personal information. Fill in your first name, initial, last name, and your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) at the top of the form.

- If you are filing jointly, include your spouse’s or Registered Domestic Partner’s (RDP) first name, initial, last name, and their SSN or ITIN.

- Provide your address. Include your street number and name, apartment number if applicable, city, state, and ZIP code.

- Enter your and your spouse/RDP’s dates of birth in the format mm/dd/yyyy.

- If you used a different last name when filing your 2010 tax return, include that last name here.

- Indicate your filing status by filling in the appropriate circle: Single, Married/RDP filing jointly, Married/RDP filing separately, Head of household (with qualifying person), or Qualifying widow(er) with dependent child.

- If someone can claim you or your spouse/RDP as a dependent, fill in the circle provided.

- Skip to lines 7 through 10. Fill in the number of exemptions based on the criteria specified, such as personal status, blindness, age (65 or older), and dependents.

- Add the amounts from lines 7 to 10 and transfer this total to line 11 as your exemption amount.

- On line 12, enter your state wages from your W-2 form, specifically box 16.

- For line 13, input your federal adjusted gross income from your 1040, 1040A, or 1040EZ forms.

- Line 14 covers California income adjustments. Fill in any relevant amounts from state tax refunds, unemployment compensation, or any non-taxable income. Add these amounts to get the total on line 14g.

- Subtract line 14g from line 13. This will give you your California adjusted gross income, which you report on line 17.

- Check the deduction amounts for your filing status. Enter the standard or itemized deduction amount on line 18.

- Line 19 requires you to subtract line 18 from line 17, yielding your taxable income.

- On line 31, refer to the tax table to find and enter the appropriate tax amount corresponding to your taxable income.

- For line 32, enter the exemption credits amount from line 11.

- Add any applicable credits to arrive at the total credits amount on line 47.

- Calculate your total tax by subtracting line 47 from line 31 and report this result on line 48.

- On line 70, enter the tax amount from line 64.

- Report total payments on line 75, which includes things like California income tax withheld and estimated tax payments.

- If you have overpaid, complete lines 91 to 94 to determine your refund or tax due.

- Fill out the direct deposit information for your refund if applicable, including bank details.

- Finally, sign and date the form, ensuring both you and your spouse/RDP sign if it's a joint return.

Once completed, review all the entries for accuracy. After confirming everything is correct, submit the form according to the mailing instructions provided. Keeping a copy for your records is strongly recommended. Make sure to stay informed about any additional steps you may need to take based on your financial situation or changes in tax laws.

What You Should Know About This Form

What is the 540A form used for?

The 540A form is the California Resident Income Tax Return specifically designed for use by individual taxpayers. It is primarily used to report income earned in California, calculate taxes owed, and claim any available credits or deductions. This form helps ensure that residents comply with state tax laws while providing essential information for tax evaluation.

Who should file the 540A form?

The 540A form is suitable for individuals or couples whose total income meets specific criteria and who can accurately file using a simpler form. Generally, if your federal adjusted gross income is below certain thresholds and you do not have complex tax situations such as itemizing deductions, you should consider filing this form. Individuals filing as single, married filing jointly, or head of household are typically eligible.

What information do I need to complete the 540A form?

To fill out the 540A form, you will need various pieces of information. This includes your personal identification details such as name, Social Security Number, and date of birth. Additionally, you should have your income details from W-2 forms, any applicable deductions, and information regarding your dependents. It is vital to have any documentation related to tax credits you plan to claim as well.

Can I file the 540A form electronically?

Yes, many taxpayers choose to file the 540A form electronically. The California Franchise Tax Board (FTB) allows e-filing through approved tax software, making the process more accessible and efficient. Electronic filing often leads to quicker processing times and may facilitate faster refunds when applicable.

What are the exemptions available on the 540A form?

The 540A form allows you to claim several exemptions. These include personal exemptions based on your filing status, as well as exemptions for being blind or over the age of 65. Moreover, you can claim exemptions for dependents. Each exemption reduces your taxable income, which may lead to a lower overall tax bill.

What happens if I cannot pay the tax owed?

If tax owed is beyond your current ability to pay, it is important to communicate with the California Franchise Tax Board. They offer payment plans and options that may assist in managing your tax obligations without incurring severe penalties. Taking proactive steps is crucial for maintaining compliance and minimizing financial repercussions.

How can I check the status of my 540A form after filing?

You can check the status of your filed 540A form by visiting the California Franchise Tax Board website. Using their online services, you will need to provide your personal information like your Social Security number and the amount of your expected refund or payment. This will allow you to obtain up-to-date information regarding the processing of your tax return.

What should I do if I made a mistake on my 540A form?

If you discover an error on your 540A form after submission, you can correct it by filing an amended return using Form 540X. It is essential to provide a clear explanation for the changes made. Filing an amended return ensures that your tax records are accurate and minimizes potential issues with the tax authority.

Where do I send my completed 540A form?

Your completed 540A form can be mailed to the Franchise Tax Board at the address listed on the form. For residents filing with a refund, the mailing address is P.O. Box 942840, Sacramento, CA 94240-0002. If you owe taxes, use the address provided in the instructions for payments. Ensure that you send your form in a timely manner to avoid unnecessary delays or penalties.

Common mistakes

When filling out the 540A form for California state income tax returns, individuals often overlook critical details that can lead to complications, delays, or even penalties. Here are nine common mistakes that people make during this process.

One prominent mistake involves incorrectly entering personal information. This includes names, Social Security numbers (SSNs), and dates of birth. Each piece of information must be precise; even a minor typo can cause the IRS to misidentify your return or, worse, reject it entirely. For instance, entering "1/13/1980" instead of "01/13/1980" can be enough to create discrepancies that may complicate the filing process.

People frequently forget to double-check the filing status they select. Misclassifying yourself as "single" when you actually should file as "married/RDP filing jointly" can have significant financial repercussions, affecting everything from tax rates to deductions. Carefully review the definitions and requirements for each filing status to ensure compliance.

Another critical area often mishandled is the calculation of exemptions. Many forms require filers to indicate personal exemptions accurately. The instructions on the form specify dollar amounts that need to be multiplied by the number of exemptions claimed. Mistakes here could lead to an incorrect total, which then affects your overall tax liability.

In a similar vein, underreporting income is a common error. Taxpayers sometimes fail to include wages from their W-2 forms, overlooking sources of income that are critical for calculating adjusted gross income (AGI). Ensure that all income is reported accurately, as failing to do so constitutes a violation of tax law.

People also make the mistake of overlooking the need for an accurate calculation of deductions. The form asks whether to use itemized deductions or the standard deduction. Some filers are tempted to guess rather than calculate which option is more beneficial. This oversight can result in a higher tax burden than necessary. It’s essential to take the time to review receipts and tax documents thoroughly.

Another frequent hiccup involves failing to sign and date the return. An unsigned return is treated as if it were never filed, meaning the taxpayer could face penalties or additional interest on taxes owed. Make it a point to sign and date your return before mailing it in; this simple step can save you from future headaches.

A lesser-known mistake occurs when individuals do not consider partnerships or joint income. If married or in a Registered Domestic Partnership (RDP), it’s vital to account accurately for spousal income and potentially fabricating deductions. Both partners should coordinate to provide a complete picture of combined finances.

Lastly, many people forget to attach any necessary forms or support required by the FTB. If you are claiming special credits or deductions, supporting documents must be included; otherwise, your claim could go unrecognized. Always review the filing instructions to identify any required attachments.

Avoiding these common mistakes can lead to a smoother filing experience and potentially save you time and money. Ensure that you double-check each detail, consult with a tax professional if uncertain, and stay informed about the tax codes and regulations that apply to your situation.

Documents used along the form

The California 540A form is a straightforward way for residents to file their income tax returns. Along with this form, several other documents are commonly used to ensure that taxpayers provide all necessary information and claim any eligible benefits or deductions. Here’s a list of key forms often required in conjunction with the 540A:

- Form 1040: This is the federal income tax return form that taxpayers file with the IRS. It provides a comprehensive overview of the taxpayer's total income, deductions, and credits, which is crucial for completing the state income tax return.

- Form W-2: Employers issue this form to employees to report wages, tips, and other compensation. It also shows the amount of income tax that has been withheld, which is necessary for tax calculations.

- Form 1099: This form is used to report various types of income received by a taxpayer that are not wages. Common 1099 forms include 1099-INT for interest income and 1099-MISC for miscellaneous income. It is essential for reporting all sources of income accurately.

- Form FTB 3506: This form is used to claim the nonrefundable Child and Dependent Care Expenses Credit. Taxpayers can benefit from this credit if they pay for childcare in order to work or look for work.

- Form 540A Schedule CA: Taxpayers use this schedule to make adjustments to their federal income to reflect California tax laws. It helps in calculating California adjusted gross income correctly.

- Form FTB 5805: This form is for figuring out any underpayment of estimated tax. It assesses whether a taxpayer owes any penalties for not paying enough tax throughout the year.

- Form FTB 1131: This is the Privacy Notice. It's important for informing taxpayers about how their personal information will be handled in the context of their tax returns.

Using the correct combination of these forms can make the tax filing process smoother and help ensure that all relevant income is reported accurately and all potential credits and deductions are claimed. Keeping all forms organized and referring to them as you complete your tax return can significantly reduce any stress related to tax season.

Similar forms

The Form 540A is a specific California income tax return for residents. It might have similarities with other important tax documents. Below are seven forms that share features with the 540A, detailing how they are alike:

- Form 1040: This is the federal individual income tax return. Like the 540A, it requires personal information, income details, and deduction claims. Both forms aim to calculate the total taxable income of individuals.

- Form 1040A: A simplified version of the federal income tax return, this form is similar to the 540A in that it is designed for individuals with simpler tax situations, allowing for limited deductions and credits.

- Form 1040EZ: Another basic federal return, the 1040EZ is for individuals with no dependents and limited income. Its straightforward nature is akin to how the 540A simplifies the California tax process for eligible filers.

- Form FTB 3506: This form is used to claim the California Child and Dependent Care Expenses Credit. The 540A allows taxpayers to report similar credits. Both forms require information about eligible expenses.

- Form W-2: A wage and tax statement provided by employers, this form reports annual wages and withholdings. The 540A utilizes data from W-2s to help determine total income for tax calculation.

- Form 540: This is the standard California income tax return that applies to more complex tax situations. It is similar to the 540A in structure and purpose but is used by those who do not meet 540A requirements.

- Form FTB 5805: This form is for calculating the underpayment of estimated tax. It shares the thematic purpose of the 540A by addressing tax liabilities, albeit in a different context of estimated tax payments owed throughout the year.

Dos and Don'ts

When filling out the California Form 540A, it is crucial to adhere to certain guidelines to ensure accuracy and compliance. Here’s a concise list of what you should and shouldn’t do:

- Do double-check personal information such as your name, address, and Social Security Number (SSN) for accuracy.

- Do ensure that all required signatures are included, especially if filing a joint tax return.

- Do utilize whole numbers only when entering amounts; decimals may lead to complications or delays.

- Do carefully read and follow all instructions provided with the form to avoid mistakes.

- Don’t forget to report all sources of income, as failure to disclose can result in penalties.

- Don’t skip the review of your prior year's tax return if applicable; it may provide useful context and information.

- Don’t assume that your income adjustments are straightforward; consult the guidelines to ensure you’re making appropriate calculations.

- Don’t leave any sections blank unless specifically instructed to do so; all relevant sections must be completed.

Following these recommendations can help reduce errors and lead to a smoother filing process. Take the time to understand the form and its requirements thoroughly.

Misconceptions

- Form 540A is only for single filers. This form is used by various filing statuses, including married couples filing jointly and heads of household.

- Filing Form 540A guarantees a tax refund. A refund depends on your total income, tax withheld, credits, and deductions, not merely the form used.

- You must complete Form 540A if you have income from sources outside of California. Only residents use this form. Non-residents use different forms, like the 540NR.

- Form 540A is less thorough than Form 540. Form 540A is designed for simpler tax situations. It addresses many relevant tax credits and deductions.

- All dependents must live with you to claim them. You can claim dependents who are your relatives or are legally recognized, even if they do not live in your household.

- If you file Form 540A, you don't need to report federally taxed income. All income, regardless of where it was taxed, must be reported on your California tax return.

- Filing extensions with Form 540A will increase my refund. Extensions allow more time to file but do not affect the refund or taxes owed.

- Fill in all boxes for them to be valid. Only fill in the boxes relevant to your situation; not everything needs to be completed.

- Tax credits do not affect your taxable income. Credits directly reduce the amount of tax owed, impacting the final tax liability.

- Completing Form 540A is optional if you have a high income. If you meet the income threshold requiring a tax return, filing Form 540A is necessary.

Key takeaways

When it comes to navigating tax season, filling out the California Form 540A is an essential step for residents. Here are some key points to keep in mind as you complete this important document:

- Correct Personal Information: Ensure that all names, Social Security Numbers (SSN), and addresses are entered accurately. Mistakes can lead to delays or complications with your tax return.

- Filing Status Matters: Select the appropriate filing status that reflects your situation—whether you are single, married, or head of household. This choice can impact your tax rate and available deductions.

- Exemption Claims: Don’t forget to count your exemptions. You can claim exemptions for yourself, your spouse, and any dependents. This can decrease your taxable income, which may lead to a lower tax bill.

- Income Reporting: Accurately report all sources of income. This includes wages from W-2 forms, adjustments, and any non-taxable income sources. Report this in the appropriate sections to ensure accurate calculations.

- Credits and Deductions: Identify any tax credits or deductions you may qualify for, such as child care or renter’s credit. These can significantly reduce your overall tax liability.

- Review Before Sending: Double-check your completed form for accuracy. Look for any missing signatures or numbers. Submitting an incomplete or incorrect form can result in processing delays or additional scrutiny from the tax authorities.

Taking a moment to thoroughly understand these key aspects can ease the process and help ensure you are filing correctly. Every detail counts in the realm of taxes, and being diligent pays off in the end.

Browse Other Templates

Milburn Printing - It includes shipment details like pick-up and delivery dates.

Irs Form 211 - Contact the OTC Compliance Unit for any questions regarding the form's process.

How to Report Someone Putting Something in Your Mailbox - Mail theft is a federal crime and can lead to severe legal consequences.