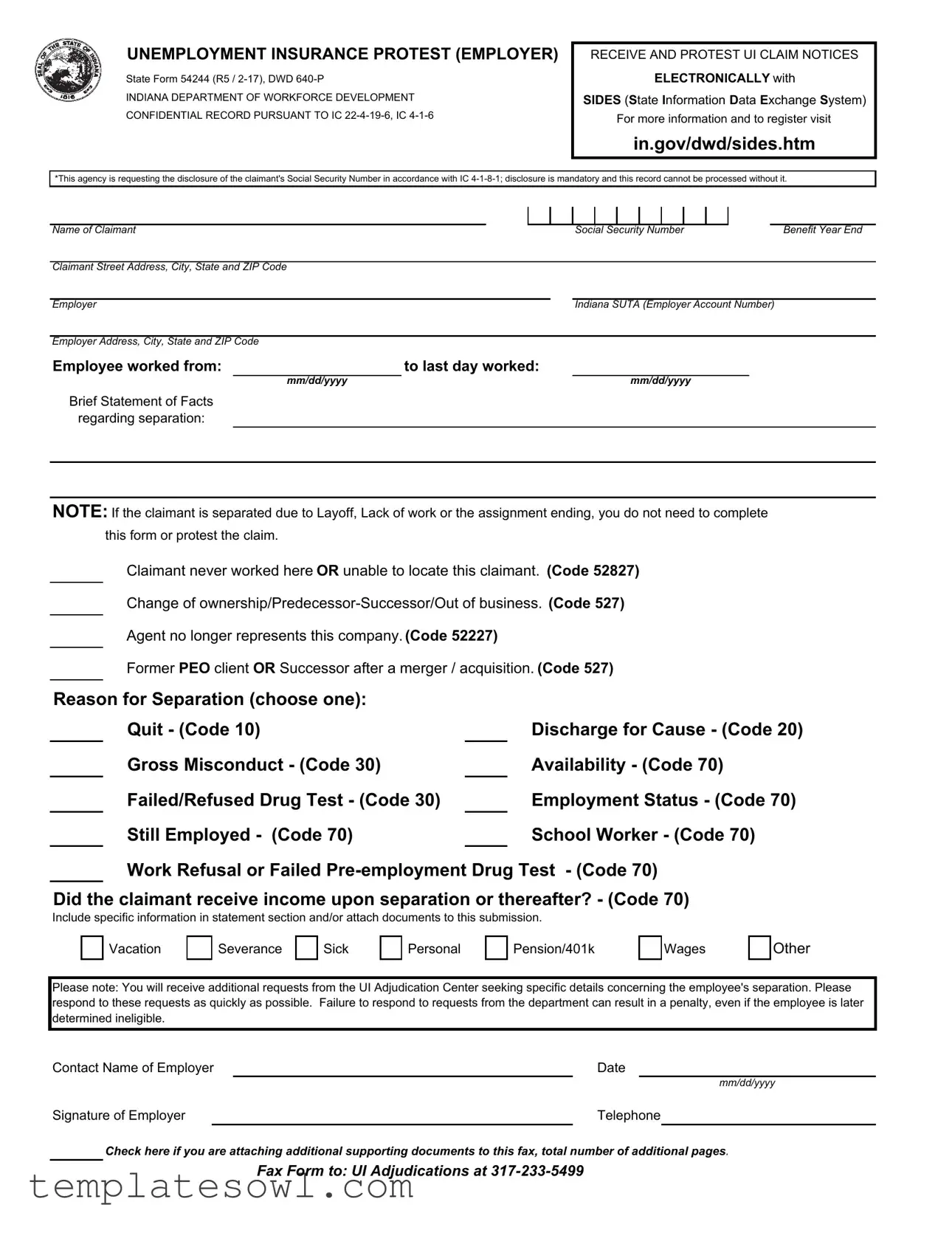

Fill Out Your 54244 Form

The 54244 form is a crucial tool for employers in Indiana who wish to address unemployment insurance claims. This form serves as a vehicle for employers to officially protest unemployment insurance claims made by former employees, providing a structured process to present reasons for contesting a claim. Key elements include the claimant's information, such as their Social Security number and work history, as well as the employer's details. Employers must select a reason for separation from a specific list, allowing them to clearly articulate the basis for the protest. Important to note is that if a claim is based on a layoff or lack of work, the form is not necessary. The Indiana Department of Workforce Development emphasizes the importance of timely responses to requests for information regarding the claim, underscoring that neglecting these communications could lead to penalties. Additionally, employers have the option to attach supporting documents to bolster their case. By navigating this form correctly, employers can protect their interests while ensuring compliance with state regulations.

54244 Example

UNEMPLOYMENT INSURANCE PROTEST (EMPLOYER)

State Form 54244 (R5 /

INDIANA DEPARTMENT OF WORKFORCE DEVELOPMENT

CONFIDENTIAL RECORD PURSUANT TO IC

RECEIVE AND PROTEST UI CLAIM NOTICES

ELECTRONICALLY with

SIDES (State Information Data Exchange System)

For more information and to register visit

in.gov/dwd/sides.htm

*This agency is requesting the disclosure of the claimant's Social Security Number in accordance with IC

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Claimant |

|

|

|

|

Social Security Number |

Benefit Year End |

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Claimant Street Address, City, State and ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer |

|

|

|

|

Indiana SUTA (Employer Account Number) |

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employer Address, City, State and ZIP Code |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Employee worked from: |

|

to last day worked: |

|

|

|

|||||||||||

|

mm/dd/yyyy |

|

|

|

|

|

|

mm/dd/yyyy |

|

|||||||

Brief Statement of Facts

regarding separation:

NOTE: If the claimant is separated due to Layoff, Lack of work or the assignment ending, you do not need to complete

this form or protest the claim.

Claimant never worked here OR unable to locate this claimant. (Code 52827)

Change of

Agent no longer represents this company. (Code 52227)

Former PEO client OR Successor after a merger / acquisition. (Code 527)

Reason for Separation (choose one): |

|

|

|

|

Quit - (Code 10) |

|

Discharge for Cause - (Code 20) |

|

Gross Misconduct - (Code 30) |

|

Availability - (Code 70) |

|

Failed/Refused Drug Test - (Code 30) |

|

Employment Status - (Code 70) |

|

Still Employed - (Code 70) |

|

School Worker - (Code 70) |

Work Refusal or Failed

Include specific information in statement section and/or attach documents to this submission.

Vacation

Severance

Sick

Personal

Pension/401k

Wages

Other

Please note: You will receive additional requests from the UI Adjudication Center seeking specific details concerning the employee's separation. Please respond to these requests as quickly as possible. Failure to respond to requests from the department can result in a penalty, even if the employee is later determined ineligible.

Contact Name of Employer |

|

Date |

|||

|

|

|

|

|

mm/dd/yyyy |

Signature of Employer |

|

|

Telephone |

|

|

Check here if you are attaching additional supporting documents to this fax, total number of additional pages:

Fax Form to: UI Adjudications at

Form Characteristics

| Fact Name | Details |

|---|---|

| Purpose of Form | The 54244 form is used by employers to protest unemployment insurance claims made by former employees in Indiana. |

| Governing Law | This form is governed by Indiana Code IC 22-4-19-6 and IC 4-1-6. |

| Confidentiality Requirement | The form requires disclosure of the claimant's Social Security Number to process the record, as mandated by IC 4-1-8-1. |

| Submission Instructions | Employers must fax the completed form to the UI Adjudications at 317-233-5499 and may attach additional supporting documents if necessary. |

Guidelines on Utilizing 54244

Filling out the Indiana Department of Workforce Development’s 54244 form is an important step for employers who wish to protest a claim for unemployment insurance. Once the form is completed, it needs to be faxed to the designated office. Make sure you have all necessary information handy, as accuracy is crucial.

- Claimant Information: Enter the name of the claimant in the designated field.

- Social Security Number: Provide the claimant's Social Security Number. Remember, this number is mandatory for processing.

- Benefit Year End: Fill in the benefit year end date.

- Claimant’s Address: Write the claimant’s street address, city, state, and ZIP code.

- Employer Information: Input your employer name and Indiana SUTA (Employer Account Number).

- Employer Address: Enter your company address, including the city, state, and ZIP code.

- Employment Dates: Specify the dates the employee worked, including the last day worked.

- Statement of Facts: Provide a brief statement concerning the separation of the claimant.

- Reason for Separation: Choose the appropriate reason from the provided options.

- Income Upon Separation: Indicate whether the claimant received any income upon separation and provide details as necessary.

- Contact Information: Provide the contact name of the employer, the date of completion, and the employer’s signature.

- Telephone Number: Include a contact telephone number.

- Additional Documents: Check the box if you are attaching extra supporting documents and list the total number of pages.

- Fax Submission: Fax the completed form to UI Adjudications at the number provided: 317-233-5499.

What You Should Know About This Form

What is Form 54244, and when should it be used?

Form 54244 is the Unemployment Insurance Protest form specifically for employers in Indiana. Employers need to use this form when they want to protest a claim for unemployment insurance made by a former employee. The form allows the employer to provide information about the employee’s separation from the company, including the reasons why they believe the claim should not be granted. However, it is important to note that if the employee was separated due to layoff or lack of work, the employer does not need to complete this form or protest the claim.

What information is required on Form 54244?

Completing Form 54244 requires several key pieces of information. The employer must provide the claimant's name, Social Security Number, and their Indiana SUTA account number. Additionally, the employer needs to detail the dates of employment and the last day worked. A brief statement explaining the circumstances surrounding the employee’s separation is crucial. The form also asks the employer to select the reason for separation from a predetermined list, such as "quit," "discharge for cause," or "gross misconduct." Supporting documentation regarding any income received after separation should also be attached if applicable.

What happens after submitting Form 54244?

Once Form 54244 is submitted, it will be reviewed by the Indiana Department of Workforce Development. Employers should be prepared to receive further requests from the UI Adjudication Center regarding additional details related to the employee's separation. Promptness in responding to these requests is essential. Failure to provide the requested information can lead to penalties, even if the employee is later found ineligible for benefits.

How can employers submit Form 54244?

Employers can submit Form 54244 via fax. The completed form should be sent to the UI Adjudications at the number provided on the form, which is 317-233-5499. If the employer has supporting documents to attach, they should include the total number of additional pages when submitting. It is advisable to keep a copy of the fax confirmation as proof of submission, in case any issues arise later.

Common mistakes

Filling out the 54244 form correctly is crucial for employers who wish to protest an unemployment insurance claim. However, several common mistakes can lead to complications or delays in the process. Understanding these pitfalls can help ensure a smoother submission process.

One major mistake is neglecting to include the claimant's Social Security Number. This number is not just a formality; it's mandatory for processing. Without it, the entire submission can be invalidated, causing unnecessary delays. Always double-check that this sensitive information is entered accurately and completely.

Another frequent error occurs when employers do not provide a complete statement of facts regarding the separation of the employee. This section is vital for explaining the circumstances surrounding the claim. Incomplete or vague descriptions may result in further inquiries from the UI Adjudication Center. Make sure to include clear and detailed information to avoid back-and-forth communications.

People sometimes forget to check the appropriate reason for separation. Selecting the wrong code can lead to confusion and may even result in penalties. It's important to carefully review the available options and choose the one that accurately reflects the situation. If more than one reason applies, each should be clearly articulated to avoid misinterpretation.

Additionally, some employers fail to indicate whether the claimant received any income upon separation. This information is crucial for determining the eligibility of the employee for benefits. Be sure to specify any wages, severance, or other forms of compensation the claimant may have received to give a comprehensive view of the circumstances.

Not attaching supporting documents when necessary is another common oversight. If additional paperwork is required, employers should ensure they check the box indicating extra documents are attached. This helps streamline the review process and ensures that all relevant information is considered by the adjudicators.

Lastly, a mistake that can be easily overlooked is not responding promptly to subsequent requests from the UI Adjudication Center. Failing to act quickly can lead to penalties or a negative outcome for the protest. Establish a system to track requests and ensure timely responses to avoid any penalties.

Documents used along the form

The 54244 form is a crucial document for employers in Indiana who wish to protest unemployment insurance claims. Employers often need to accompany this form with additional documentation to support their claims or clarify situations involving former employees. Here’s a list of other commonly used forms and documents that can be relevant when filing the protest.

- Employee Separation Notice: This document outlines the circumstances surrounding an employee's separation from the company. It provides details that may be necessary for reviewing the merits of the protest.

- Wage Records: Comprehensive records detailing the employee’s wages leading up to separation. This helps establish the employee’s earnings and eligibility for benefits.

- Payroll Documentation: A series of payroll records that verify the employee's hours worked and compensation. This documentation is essential to substantiate any claims related to wages.

- Termination Letter: A formal letter sent to the employee at the time of termination. It should clearly state the reasons for termination, which can support the employer's position in protest hearings.

- Disciplinary Records: These records detail any prior disciplinary actions taken against the claimant. They can help establish a pattern of behavior relevant to the protest claim.

- Witness Statements: Affidavits from other employees or individuals who may have witnessed interactions between the employer and the former employee. These can provide context and support employer claims.

- Incident Reports: Documentation of any specific incidents that led to the employee's separation, such as breaches of conduct or policy. This evidence can be vital in a protest situation.

- Proof of Notifications: Documentation showing that the employee was informed of policies or the reasons for termination. This helps ensure that due process was followed.

- Company Policy Manuals: Relevant excerpts from policies that relate to the employee's separation. This can clarify whether the actions taken were aligned with company standards.

It is important to gather as much relevant information as possible when submitting the 54244 form and any accompanying documents. Aligning all supporting materials aids in a more favorable review process and mitigates potential penalties for non-compliance or failure to provide adequate information. Keep thorough records, and ensure all submissions are complete and accurate.

Similar forms

The Form 54244 is an important document used by employers to protest unemployment insurance claims. Several other forms serve similar purposes in different contexts, each helping to manage employment-related disputes or information. Here are nine documents that bear similarities to the Form 54244:

- Form 940: This is the Employer’s Annual Federal Unemployment Tax Return. Like the 54244, it deals with unemployment taxes, ensuring accurate reporting and compliance with regulations.

- Form 941: Employers use this form to report income taxes withheld from employee wages. It assists in confirming employment status, similar to how the 54244 verifies claims against employer records.

- Form I-9: This form verifies employee identity and eligibility to work in the U.S. While different in focus, both require accurate documentation about employment status.

- Form W-2: Issued to employees at year-end, this form summarizes their earnings and withholdings. It identifies important employment information, paralleling the role of the 54244 in documenting employment separation.

- Form 1099: For independent contractors, this form details payments made. While not for unemployment, it also addresses reporting of worker status, similar to the employment data in the 54244.

- Claim for Unemployment Benefits: This form is used by employees to claim benefits. It initiates the unemployment process, prompting the need for a response from the employer, as seen in the 54244.

- UI Appeals Form: Employees may file this if they wish to contest an unemployment decision. Employers often respond to these appeals, mirroring the protest function of the 54244.

- Employee Separation Notice: Often required by state law, this document notifies relevant parties of an employee’s separation. It helps employers track employee status, like the 54244.

- Request for Additional Information: Sometimes sent during unemployment hearings, this document seeks clarification from employers on pending claims, akin to the inquiries outlined in the 54244.

These forms and documents help maintain clear communication regarding employment and unemployment matters. Each serves a distinct purpose, but all contribute to the overarching framework of workforce management and support related to unemployment insurance.

Dos and Don'ts

When filling out the 54244 form for unemployment insurance protest, it is essential to approach the task carefully. Here’s a list of things you should and shouldn’t do:

- Do include the claimant's Social Security Number. Failure to do so will prevent processing.

- Do provide accurate dates for employment. The last day worked is crucial.

- Do submit specific reasons for separation. Be clear and concise.

- Do respond quickly to any follow-up requests from the UI Adjudication Center.

- Do check if you are required to protest. If the separation is due to a layoff or lack of work, you might not need to fill out this form.

- Don’t provide vague statements. Detailed facts are necessary for a clear understanding.

- Don’t omit any additional documents that support your protest. Attach all relevant paperwork.

- Don’t forget to sign and date the form. An unsigned form may not be valid.

- Don’t ignore requests for information after submission. Delays can lead to penalties.

- Don’t assume that submitting incomplete information is acceptable. Every detail matters.

Misconceptions

Misconceptions about the 54244 form often lead to confusion among employers navigating unemployment insurance claims. Here are nine common misconceptions clarified:

- Employers must always complete the form. Not true. If the claimant was laid off, there is no need to protest, and thus the form does not need to be filled out.

- This form can be submitted without a Social Security Number. Incorrect. The Social Security Number is mandatory for processing the claim.

- Filing the form guarantees a favorable outcome for the employer. Misleading. While the form allows for a protest, outcomes depend on various factors evaluated by the adjudication center.

- Any protest will result in a hearing. Not necessarily. Only specific cases may advance to a hearing based on the provided information.

- Employers should wait to respond to requests for more information. Wrong. Quick responses are crucial to avoid penalties.

- The form is only for employers with previous claims. False. New claims require attention as well, especially for potential disputes.

- Only large businesses need to worry about this form. Untrue. Any employer in Indiana with a claim against them should be aware of the form.

- The form can be submitted via email. Incorrect. Instead, it must be faxed to the designated UI Adjudications number.

- Protesting a claim means admitting fault. This is not the case. Protesting simply means that the employer questions the validity of the claim based on specific circumstances.

Understanding these misconceptions is vital for proper handling of unemployment insurance claims and can prevent unnecessary issues down the line.

Key takeaways

This document outlines key points regarding the filling out and use of the 54244 form for unemployment insurance protest.

- Mandatory Information: The form requires the claimant's Social Security Number for processing. This information is mandatory under state law.

- Claimant Identification: Record the name, Social Security Number, and address of the claimant accurately to ensure the protest is associated with the correct individual.

- Employer Details: Employers must provide their Indiana SUTA account number along with their complete address to identify the protest's origin.

- Employment Dates: It’s crucial to document the exact dates of employment, including the last day worked.

- Separation Reasons: Clearly indicate the reason for separation by selecting from the provided categories. Be specific about the circumstances of the claimant’s departure.

- Documentation: Attach any relevant documents which can help support the claims made in the protest. Specific details enhance the credibility of the submission.

- Timeliness: Respond promptly to any additional information requests from the UI Adjudication Center to avoid penalties.

- Electronic Filing: Employers can submit this form electronically through the State Information Data Exchange System (SIDES), simplifying the process.

By keeping these points in mind, you can effectively manage the completion and submission of the 54244 form for unemployment insurance protests.

Browse Other Templates

How to Get Scholarship for International Students in Usa - Careful consideration of all application requirements is essential for a successful submission.

Cput Online Application - If under 18, ensure you have a guardian's signature on the application form.