Fill Out Your 543A Form

The 543A form is an important document used for filing amendments or restatements for domestic limited liability companies in Ohio. It helps businesses communicate changes such as alterations to the company name, its duration, or other significant information set forth in their articles of organization. This form also includes options for expedited processing, allowing applicants to receive quicker approvals depending on their needs. Importantly, the 543A form provides clear choices regarding the type of service requested, ranging from standard processing to expedited options that can ensure swift handling of submitted documents. Additionally, it includes sections for essential details like the name and contact information of the individual or business submitting the form. By signing the form, the authorized representative affirms their authority to execute the document, paving the way for necessary updates to be recognized officially. This form must be completed accurately and submitted to the Ohio Secretary of State's office to keep business records current and compliant with state requirements.

543A Example

Toll Free: 877.767.3453 | Central Ohio: 614.466.3910

OhioSoS.gov | business@OhioSoS.gov

File online or for more information: OhioBusinessCentral.gov

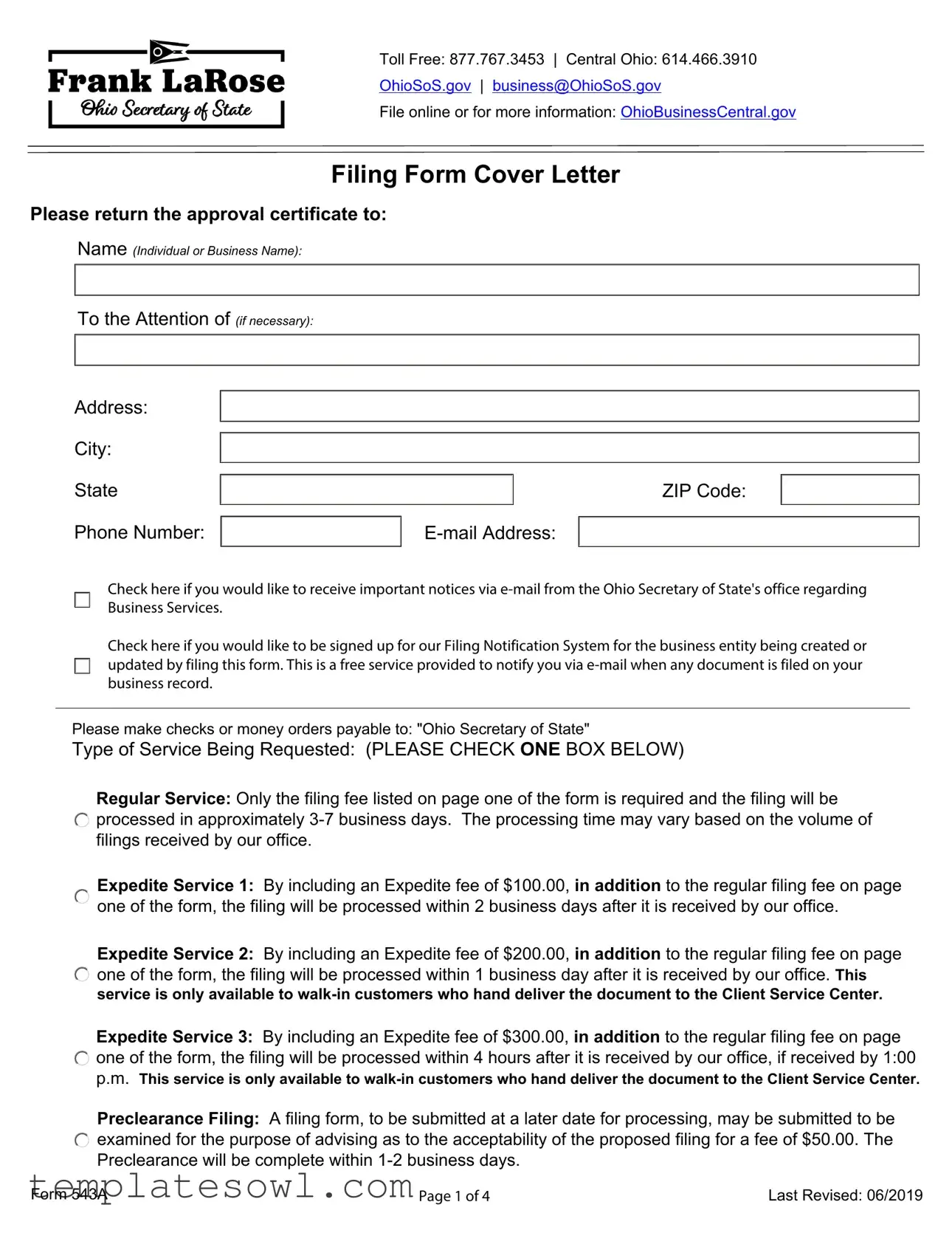

Filing Form Cover Letter

Please return the approval certificate to:

Name (Individual or Business Name):

To the Attention of (if necessary):

Address: |

|

City: |

|

State |

ZIP Code: |

Phone Number: |

Check here if you would like to receive important notices via

Check here if you would like to be signed up for our Filing Notification System for the business entity being created or updated by filing this form. This is a free service provided to notify you via

Please make checks or money orders payable to: "Ohio Secretary of State"

Type of Service Being Requested: (PLEASE CHECK ONE BOX BELOW)

Regular Service: Only the filing fee listed on page one of the form is required and the filing will be  processed in approximately

processed in approximately

Expedite Service 1: By including an Expedite fee of $100.00, in addition to the regular filing fee on page one of the form, the filing will be processed within 2 business days after it is received by our office.

Expedite Service 2: By including an Expedite fee of $200.00, in addition to the regular filing fee on page  one of the form, the filing will be processed within 1 business day after it is received by our office. This

one of the form, the filing will be processed within 1 business day after it is received by our office. This

service is only available to

Expedite Service 3: By including an Expedite fee of $300.00, in addition to the regular filing fee on page  one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00

one of the form, the filing will be processed within 4 hours after it is received by our office, if received by 1:00

p.m. This service is only available to

Preclearance Filing: A filing form, to be submitted at a later date for processing, may be submitted to be  examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The

examined for the purpose of advising as to the acceptability of the proposed filing for a fee of $50.00. The

Preclearance will be complete within

Form 543A |

Page 1 of 4 |

Last Revised: 06/2019 |

Form 543A Prescribed by:

Toll Free: 877.767.3453

Central Ohio: 614.466.3910

OhioSoS.gov

business@OhioSoS.gov

File online or for more information: OhioBusinessCentral.gov

For screen readers, follow instructions located at this path.

Mail this form to one of the following:

Regular Filing (non expedite)

P.O. Box 1329

Columbus, OH 43216

Expedite Filing (Two business day processing time. Requires an additional $100.00)

P.O. Box 1390

Columbus, OH 43216

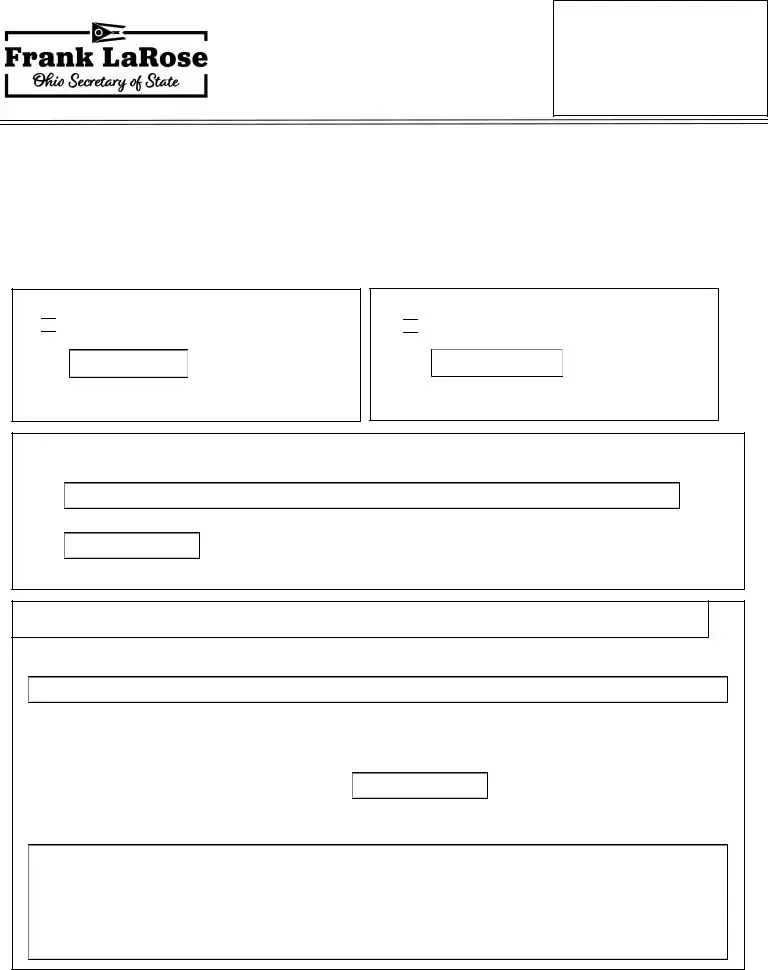

Domestic Limited Liability Company Certificate of

Amendment or Restatement

Filing Fee: $50

Form Must Be Typed

(CHECK ONLY ONE (1) BOX)

(1)Domestic Limited Liability Company

Amendment

Amendment

Date of Formation

(MM/DD/YYYY)

(2)Domestic Limited Liability Company

Restatement

Restatement

Date of Formation

(MM/DD/YYYY)

The undersigned authorized representative of:

Name of Limited Liability Company

Registration Number

If box (1) Amendment is checked, only complete sections that apply. If box (2) Restatement is checked, all sections below must be completed.

The name of said limited liability company shall be:

Name must include one of the following words or abbreviations: "limited liability company," "limited," "LLC," "L.L.C.," "ltd." or "ltd"

This limited liability company shall exist for a period of:

Purpose

Form 543A |

Page 2 of 4 |

Last Revised: 06/2019 |

By signing and submitting this form to the Ohio Secretary of State, the undersigned hereby certifies that he or she has the requisite authority to execute this document.

Required

Must be signed by a member, manager or other representative.

If authorized representative is an individual, then they must sign in the "signature" box and print their name in the "Print Name" box.

If authorized representative is a business entity, not an individual, then please print the business name in the "signature" box, an authorized representative of the business entity must sign in the "By" box and print their name in the "Print Name" box.

Signature

By (if applicable)

Print Name

Signature

By (if applicable)

Print Name

Signature

By (if applicable)

Print Name

Form 543A |

Page 3 of 4 |

Last Revised: 06/2019 |

Instructions for Limited Liability Company Certificate of Amendment or

Restatement

This form should be used if you wish to file an amendment or restatement to the articles of organization for a domestic limited liability company.

Pursuant to Ohio Revised Code §1705.08, the articles of organization of a limited liability company may be amended at any time, but a certificate of amendment amending the articles of organization shall be filed within thirty days after the occurrence of any of the following: (1) the name of the limited liability company is changed; (2) the period of the limited liability company's duration is changed; or (3) any other information that is set forth in the articles of organization is changed. An authorized representative of the limited liability company must file an amendment upon discovering that a statement in the articles of organization was materially false when made or that any other information set forth in the articles of organization has changed making the articles materially inaccurate.

The articles of organization of a limited liability company may be restated at any time by filing a restatement of the articles of organization.

If you wish to file an amendment, please select box 1. If you wish to file a restatement, please select box 2. As required by Ohio Revised Code §1705.08 (C)(1)(b), indicate the date of the filing of the limited liability company's articles of organization that are being amended.

Name of Limited Liability Company

Indicate the name of the limited liability company and the registration number. If you choose to change the name of the limited liability company, the name must include one of the following: “limited liability company,” “limited,” “LLC,” “L.L.C.,” “ltd.” or “ltd”, pursuant to Ohio Revised Code §1705.05.

Period of Existence

A period of existence may be provided but is not required. Pursuant to Ohio Revised Code §1705.04 (B), if a period of existence is not provided in the articles the limited liability company's period of existence is perpetual.

Purpose Clause

A purpose clause may be provided but is not required. As stated in Ohio Revised Code §1705.02, a limited liability company may generally “be formed for any purpose or purposes for which individuals lawfully may associate themselves.”

Additional Provisions

If the information you wish to provide for the record does not fit on the form, please attach additional provisions on a

Signature(s)

After completing all information on the filing form, please make sure that page 2 is signed by at least one authorized representative of the limited liability company.

**Note: Our office cannot file or record a document that contains a social security number or tax identification number. Please do not enter a social security number or tax identification number, in any format, on this form.

Form 543A |

Page 4 of 4 |

Last Revised: 06/2019 |

Form Characteristics

| Fact Name | Description |

|---|---|

| Purpose | The 543A form is used to amend or restate the articles of organization for domestic limited liability companies in Ohio. |

| Filing Fee | The standard filing fee for using the 543A form is $50. |

| Processing Times | Regular filings are processed within approximately 3-7 business days. Expedited options are available for faster processing. |

| Expedited Service Options | Filers can choose expedite services with varying fees: $100 for 2 business days, $200 for 1 business day, and $300 for 4 hours processing. |

| Preclearance Filing | For $50, preclearance can be requested, which provides feedback on the proposed filing's acceptability, typically completed within 1-2 business days. |

| Governing Law | This form is prescribed under Ohio Revised Code §1705, which governs limited liability companies in the state. |

| Email Notifications | Filers can opt to receive important notices via email from the Ohio Secretary of State's office regarding business services. |

| Mailing Addresses | The form must be mailed to different addresses depending on the type of filing: regular or expedite. |

Guidelines on Utilizing 543A

Once you have gathered the necessary information, you are ready to fill out the Form 543A. This form is an important step for your business in Ohio, especially if you are seeking to amend or restate your articles of organization for a limited liability company. Follow these steps to ensure the form is completed correctly.

- Obtain the Form 543A either online or from the Ohio Secretary of State's office.

- Type the form, as it must be submitted in typed format.

- Check one box to indicate whether you are filing for an Amendment or Restatement of your limited liability company.

- If you checked Amendment, only complete the sections that are relevant. If you checked Restatement, fill out all sections below.

- In the "Name of Limited Liability Company" section, provide the current name of your company. Ensure that the name includes one of the required words or abbreviations such as “limited liability company,” “LLC,” or “ltd.”

- Indicate the Date of Formation in MM/DD/YYYY format.

- If applicable, specify the Period of Existence of the company.

- Provide a Purpose Clause if desired. This is not mandatory.

- Make sure that the form is signed by an authorized representative of the company.

- Provide contact information, including name, address, phone number, and e-mail address.

- Choose the type of service requested—regular or expedite service—and include the appropriate fees.

- Make checks or money orders payable to "Ohio Secretary of State" and attach them to the form.

- Mail the completed form to the appropriate address based on your chosen service type.

What You Should Know About This Form

1. What is the purpose of the 543A form?

The 543A form is used to file an amendment or restatement to the articles of organization for a domestic limited liability company (LLC) in Ohio. It allows you to make changes such as updating the company’s name, altering its duration, or correcting any inaccuracies in the articles of organization.

2. How do I file the 543A form?

You can file the 543A form by mailing it to the appropriate address based on the type of service you choose. For regular filings, send it to P.O. Box 1329, Columbus, OH 43216. For expedited service, mail it to P.O. Box 1390, Columbus, OH 43216. Make sure to include the required fees and any necessary information in the form.

3. What are the different service options available when filing the 543A form?

You have several options:

- Regular Service: Processed in 3-7 business days.

- Expedite Service 1: Costs an additional $100 and is processed within 2 business days.

- Expedite Service 2: Costs an additional $200 and is processed within 1 business day, but is available only for walk-in customers.

- Expedite Service 3: Costs $300 and is processed within 4 hours if received by 1:00 p.m., available only for walk-in customers.

4. How do I pay the filing fee?

Make checks or money orders payable to "Ohio Secretary of State." Be sure to include this payment along with your completed form when filing.

5. Can I receive notifications regarding my business filing?

Yes, you can opt to receive important notices via e-mail from the Ohio Secretary of State’s office. You can also sign up for the Filing Notification System, which will notify you via e-mail when any document is filed on your business record. Check the appropriate boxes on the form to enroll in these services.

6. What happens if I discover an error in my articles of organization?

If you find that any statement in your articles of organization was materially false or that any information has changed, you are required to file an amendment using the 543A form within thirty days. It is essential to keep the information accurate to maintain your LLC's compliance with state regulations.

Common mistakes

Filling out Form 543A can be a straightforward process, yet many individuals make common mistakes that can delay processing or lead to the rejection of the application. One frequent mistake is failing to type the form. The instructions clearly specify that the form must be completed in typed format. Handwritten submissions may not be accepted and could result in rejection or delays.

Another common error involves leaving out essential information. Incomplete submissions, particularly regarding the name of the limited liability company and its registration number, can cause significant issues. Ensure that every required field is filled out completely. Check the form twice to verify that all necessary information is present before submitting it.

Incorrectly selecting the type of service needed can also create problems. There are multiple options for processing the form, each with different fees and timelines. It is imperative to check only one box, as selecting multiple may confuse the processing team and lead to unintended consequences.

Many individuals overlook the signature requirement. The form must be signed by an authorized representative, such as a member or manager of the limited liability company. Ensure that the appropriate individual signs in the specified area, as failure to do so will result in the form being unfiled.

Another mistake comes from misunderstanding the purpose clause. Although it is not mandatory to include a purpose clause, many people either skip this section entirely or provide vague information. Taking the time to clarify the business purpose can aid in processing and provide useful insights into the business's objectives.

Finally, some applicants mistakenly provide personal social security numbers or tax identification numbers. The instructions are explicit: these numbers must not be included on the form. Including such sensitive information can lead to the form being rejected and potential privacy concerns. Always double-check to ensure that sensitive data is omitted.

Documents used along the form

The 543A form is often filed alongside various other documents that help establish or update business entities in Ohio. Each of these documents serves a specific purpose and can be essential for ensuring compliance and effective communication with the Ohio Secretary of State's office. Below is a list of other common forms and documents that frequently accompany the 543A form.

- Certificate of Amendment: This document is filed when a limited liability company (LLC) wishes to change its articles of organization. Amendments might relate to changes in the name, duration, or other significant details of the LLC.

- Certificate of Restatement: A restatement consolidates all amendments and modifications made to the articles of organization into a single document. This is beneficial for clarity and provides an updated overview of the LLC's official information.

- Filing Cover Letter: This letter accompanies the 543A form and outlines the details of the filing. It typically includes essential information such as the name of the business, the type of service requested, and the contact information of the individual handling the filing.

- Preclearance Filing Form: This form asks for an initial review of proposed changes before the formal filing is submitted. It helps business owners understand if their intended amendments align with state regulations.

- Consent of Members: If there are changes that require approval from other members or managers of the LLC, this document serves as confirmation that all necessary parties agree to the new filings or amendments. Obtaining this consent ensures transparency and complies with LLC operating agreements.

In summary, when filing the 543A form, it’s crucial to consider these additional documents. They enhance the clarity and legality of your business changes, ensuring that you meet the necessary standards set by the Ohio Secretary of State's office. Proper documentation can help streamline the process and minimize challenges as your business evolves.

Similar forms

Articles of Organization: Like the 543A form, the Articles of Organization is essential for establishing a limited liability company (LLC). Both documents outline key organizational details, such as the LLC name and purpose.

LLC Operating Agreement: This document complements the 543A form by detailing the management structure and operational guidelines for the LLC. It provides internal governance rules, while the 543A is more administrative.

Certificate of Good Standing: Similar to the 543A form, this document verifies that a business is authorized to operate and is compliant with state regulations. Both documents confirm business legitimacy, but for different purposes.

Certificate of Amendment: If changes are made to an LLC's structure or details, a Certificate of Amendment is filed. This is akin to the 543A, as both serve to formally document changes regarding the LLC.

Statement of Information: Found in certain states, this document is similar to the 543A form, as it provides essential business information and updates to the state, typically filed annually or biannually.

Business License Application: This document is necessary for operating legally within a specific jurisdiction. Like the 543A, it contains key details about the business entity but focuses on regulatory compliance.

Tax Registration Form: Similar to the 543A form, this registration is essential for tax purposes. It ensures that the business is recognized by tax authorities, enabling it to fulfill its tax obligations.

Foreign LLC Registration: For businesses operating in different states, this document is required for recognition outside the home state. Like the 543A form, it formalizes the business's presence in a new jurisdiction.

Annual Report: Businesses often file annual reports to maintain their good standing. This is somewhat similar to the 543A form, as both serve to keep the state informed about business operations and structure.

Business Name Registration: This document is crucial for ensuring that a chosen name for a business does not conflict with existing entities. It shares similarities with the 543A in that both deal with the official recognition of a business name.

Dos and Don'ts

Filling out the 543A form can be a straightforward process if you keep a few key points in mind. To help ensure a smooth experience, here are eight essential dos and don'ts for completing the form.

- Do double-check that the form is typed and not handwritten. Clarity is crucial.

- Do select the correct type of service being requested. Be clear on your needs.

- Do provide accurate and complete contact information. This will help facilitate communication.

- Do sign the form as required. Your signature confirms that you have the authority to submit the document.

- Don't forget to review all sections applicable to your request. Missing details can lead to delays.

- Don't include a social security number or tax identification number. This information should remain confidential.

- Don't ignore instructions for additional provisions. If your information exceeds the form's space, use a separate sheet as instructed.

- Don't assume processing times are the same for all submissions. Choose the service that best suits your needs and timeline.

By keeping these simple guidelines in mind, you can help ensure that your 543A form is filled out correctly and processed in a timely manner. Accurate submissions reduce stress and enhance efficiency for everyone involved.

Misconceptions

Below is a list of misconceptions regarding the 543A form:

- It is only for new businesses. The 543A form can be utilized by existing limited liability companies looking to amend or restate their articles of organization, not just for newly formed entities.

- Filing the form guarantees immediate processing. While expedited services are available, regular filings typically take 3-7 business days, and there are precise procedures to follow for faster processing.

- Any representative can sign the form. Only authorized representatives such as members or managers of the limited liability company have the authority to sign and submit the 543A form.

- Changes to the company name have no time limit for filing. Amendments, including name changes, must be filed within thirty days of the change occurring.

- The form does not require a fee. There is a mandatory filing fee of $50, along with additional fees for expedited processing options, which must be included with the submission.

- You can submit the form with incomplete information. All relevant sections of the form must be filled out correctly; incomplete submissions can lead to delays or rejection.

- Social security or tax identification numbers can be included in the form. This form must not contain any social security numbers or tax identification numbers, as submissions of this nature cannot be processed.

By addressing these misconceptions, individuals will better understand the requirements and processes involved with the 543A form. Immediate action is necessary to ensure compliance and timely processing.

Key takeaways

- Ensure all information is filled out correctly. Incomplete or incorrect forms can lead to delays or rejections.

- Use a typewriter or computer for clarity. Handwritten forms may be harder to read and could cause issues in processing.

- Decide on your service speed before submission. You have options from regular processing to expedited services, which vary in cost and delivery time.

- Check the appropriate box for either Amendment or Restatement. This delineation impacts what information you’ll need to provide.

- Be mindful of your company's name requirements. It must include certain language, such as "LLC" or "limited."

- Consider including a purpose clause. While it’s not required, it adds clarity about your business’s goals and activities.

- Attach any additional provisions necessary. If you need to provide more details than the form allows, include them on a single-sided piece of paper.

- Sign the form correctly. Make sure an authorized person signs and prints their name as required to validate your submission.

- Be aware that sensitive information like Social Security or tax identification numbers should not be included. This will prevent delays in processing.

Browse Other Templates

Partial Disclaimer of Inheritance - Before filing, conduct a thorough review of all sections to ensure there are no omissions.

Insurance Quote Form - State the above-ground square footage of your home.

Tennessee Llc Formation - Applicants can choose a delayed effective date for the LLC’s existence if desired.